MICAT Total Requirements for FTHBI Mortgages - Advisory (2019)

Information

Table of contents

I. Introduction

This Advisory defines the total requirements for First-Time Home Buyer Incentive insured mortgages (FTHBI mortgages) and complements OSFI's Mortgage Insurer Capital Adequacy Test (MICAT) Guideline.

The requirements included in this Advisory are effective November 1, 2019.

II. Total Requirements for FTHBI Mortgages

The base total requirements and supplementary capital requirements for FTHBI mortgages are calculated using the general method specified in MICAT section 3.1 and the following specifications for defining the loan-to-value ratio, in lieu of MICAT section 3.1.1.5.

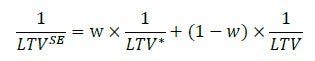

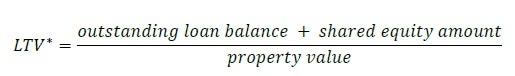

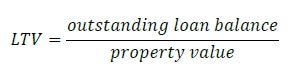

- The reciprocal of loan-to-value for a FTHBI mortgage (LTVSE) is the weighted average of the reciprocal of loan-to-value as calculated according to MICAT section 3.1.1.5 and the reciprocal of a loan-to-value calculated using, as the loan amount, the sum of the outstanding loan balance as of the reporting date and the shared equity amount (LTV*). The property value is as of the origination date or the date of the most recent appraisal, if the appraisal was commissioned by an independent third party entity other than an insurer. The shared equity amount is as of the origination date, unless the property value is updated to the most recent appraisal, in which case the shared equity amount should be updated as well.

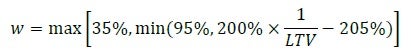

- The weights for the loan-to-value average are determined based on the mortgage loan-to-value.

The reciprocal of loan-to-value input for FTHBI mortgages is represented formulaically below:

Where

And

And

If a borrower pays back the shared equity amount while the mortgage is still in-force, then the shared equity amount component above is equal to zero and the total requirements for the mortgage should be the same as if it were calculated as specified in the MICAT without regard for this advisory.