Mortgage Insurance Financial Return Instructions – Section II – Filing Requirements

General

The MI financial returns are considered to be generally self-explanatory, and accordingly, the text on each page of the Return is considered to be part of the instructions. Below are additional points to assist in the preparation of the MI Financial Quarterly and Annual Supplement Returns.

-

The filing deadlines found in "Section V - Jurisdictional Requirements" are the dates by which the regulators must receive the Quarterly and Annual Supplement Financial Returns. A February 28 deadline refers to the last day of February.

-

Sample MI financial returns can be found on OSFI's website.

Some jurisdictions require the MI financial returns to be submitted electronically through an approved software provider. Some jurisdictions also require a supplementary file to be included with the MI financial returns. Please refer to "Section V - Jurisdictional Requirements" for details.

-

The full name of the insurer and the year must be shown on the cover page and on page 10.10. The insurer is required to be identified on every page; an abbreviated form of the name is acceptable on the inside pages.

The code number assigned to each insurer by its primary regulator must also be indicated in the lower right-hand corner of the cover.

-

The MI financial returns must be properly verified by affidavit(s) (pages 99.10 and 99.16). Please refer to "Section V - Jurisdictional Requirements" for details.

All filed copies of the MI financial returns must bear the original signatures of the appropriate officers (Chief Executive Officer), directors, commissioner and/or notary public. If the MI financial returns are filed electronically, the original signature pages must be retained on file for regulatory review as required.

-

Pages containing no data are to be included with the filed MI financial returns.

-

All dollar amounts reported in the MI financial returns are to be reported in Canadian dollars.

-

Dollar amounts must be rounded to the nearest thousand dollars, except for certain figures such as per-share data. Individual items must be adjusted so that the total is not affected by rounding to the nearest thousand dollars.

-

Information or descriptions within the MI financial returns must not be changed. Write-in information is not permitted except where explicitly noted. For most schedules, adequate blank lines are provided for additional information. Any permitted write-in information must be self-explanatory. If additional pages are required for detailed information, the information should be provided in an electronic format, such as embedded within the special Excel file.

-

All subtotals and totals must be calculated and reported on the form, since regulators use these amounts as reference points. Where supplementary listings are filed (e.g. investments), the totals must be carried forward to the actual exhibits in the MI financial returns.

-

To indicate a number contrary to normal expectation, insurers must use brackets rather than a minus sign, for example "(649)" rather than "-649."

-

An Appointed Actuary's Report on the adequacy of the provision for unearned premiums and unpaid claims must be filed with the MI Financial returns; failure to include one would render the filing incomplete for most jurisdictions.

Please refer to "Section V- Jurisdictional Requirements" for more information.

Also note that a certificate of opinion, in lieu of a full report, is not acceptable.

-

External Auditor Reports must be filed with the MI financial returns; failure to include both would render the filing incomplete.

The External Auditor Reports should be addressed to the primary regulator (OSFI / Autorité des marchés financiers (AMF)), and (other) provincial superintendents, where applicable. For example:

"To the Superintendent of Financial Institutions Canada, and the provincial superintendents of financial institutions / insurance."Please refer to "Section V" for specific jurisdictional requirements. The Reports and opinion must be based on the total business of the insurer regardless of the division of business between in-Canada and out-of-Canada operations. The Report must cover pages 20.10 to 20.60 of the MI quarterly financial return.

The External Auditor Report to the shareholders/policyholders, together with the annual Financial Statement, must be filed with the MI financial returns where required; (refer to "Section V"). If there are material differences in classification between the annual Financial Statement and the financial statements included in the MI financial, a reconciliation should be completed and filed with the MI financial returns, and the Auditor Report to the regulator(s) on the MI financial returns should include a comment indicating that the auditor has reviewed the reconciliation and that it appropriately reflects the reconciliation of items between the annual Financial Statement and the financial statements included in the MI financial returns.

Mortgage insurers are required to provide an annual External Auditor Report for the Mortgage Insurers Capital Adequacy Test (MICAT), confirm this requirement with your primary regulator or refer to "Section V – Jurisdictional Requirements." The annual audit of the MICAT is required to be a separate audit report from the one provided for the audited financial statements. For further details, please refer to OSFI's MICAT Guideline.

-

Financial statements of subsidiaries: refer to "Section V" for specific jurisdictional requirements, where applicable.

-

For amended return filing, see Amendments to the MI Financial Return in this section.

-

If the filed information is inaccurate or incomplete, the MI financial returns will not be considered filed.

-

Dates are to be reported using the convention DD/MM/YYYY, and names are to be reported with the surname first (e.g. ABLE, Ingrid M.).

-

Please refer to OSFI's website for a list of all current validation rules.

Filing Requirements – MI Financial Return documents

For the specific list of filing requirements for each jurisdiction, please refer to "Section V - Jurisdictional Requirements."

Mailing Addresses

See "Section V - Jurisdictional Requirements" for the mailing addresses of all regulators.

Penalties for Late Filing

The MI financial returns must be received at the regulator's office on the applicable due date. There are penalties for late filing in all jurisdictions. In some jurisdictions, late filing is an offence that may result in prosecution and fines.

Electronic Filing

Please refer to the schedules in "Section V – Jurisdictional Requirements".

Amendments to the MI Financial Returns

If amendments are made to the MI financial returns, the amended return must be filed immediately with every jurisdiction where the insurer had filed the original version. A validation report, transmittal form and updated affidavit (pages 99.10or 99.16) may be required by some jurisdictions. An updated Auditor Report may also be required if there are material changes affecting pages 20.10 to 20.60 of the MI financial return.

Annual Return Filing Specifications

Currently, the only approved software vendor for this return is PricewaterhouseCoopers (PwC).

Quarterly Return Filing Specifications

Submission to the primary regulatory, OSFI, using this convention:

Refer to the file naming instructions included in the Regulatory Reporting System (RRS) – Manage Financial Returns User Guide, on the OSFI website.

Submission to AMF:

Please refer to the file naming conventions set out in the document entitled Guide – Specific File Transfer Service (FTS) Requirements, which is available on the AMF's website.

Submission to other regulators:

Please contact the jurisdiction in question for further details.

Embedding Objects Within the Special Excel File

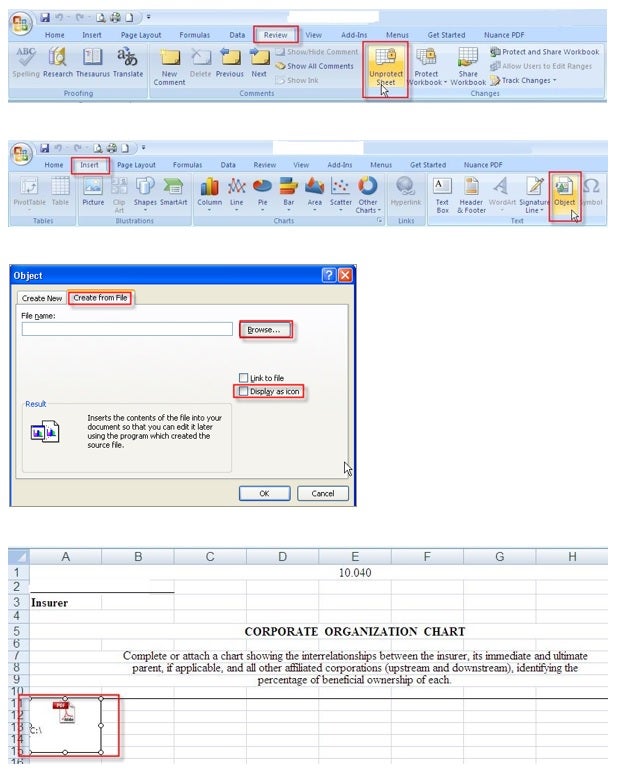

The following instructions are based on Excel 2007 and 2010:

- Unprotect the page by clicking on Review > Unprotect

- Place mouse in the location where you would like to insert the file

- Go to Insert > Object

- Select the second tab Create from File

- Browse to your selected file

- Check off the Display as icon check box and select OK

- The file will be displayed on the page and when double clicked, it will open up the embedded file

Example:

Embedding files is only permitted within the following pages of the MI financial returns:

10.16 – Chief Representative in Quebec

10.30 – Corporate Organization Chart

10.40 – Other Information

10.41 – Other Information

10.42 – Other Information

20.52 – Statement of Cash Flows

20.60 – Notes to Financial Statements

40.12 – Short Term Investments

40.22 – Bonds and Debentures

40.32 – Mortgage Loans

40.42 – Preferred Shares

40.52 – Common Shares

40.70 – Investment Properties, Own Use Property and Equipment

40.80 – Other Loans and Invested Assets

50.20 – Receivable from/Payable to Non-Associated Agents and Brokers

50.40 –Receivable from/Payable to Subsidiaries, Associates & Joint Ventures

70.10 – Premiums and Claims – Reinsurance Ceded

70.21 – Summary of Reinsurance

95.10 – Premiums and Claims – Reinsurance Ceded (Quebec)

99.10 –Affidavit Verifying Annual Return

99.16 – Affidavit Verifying Quarterly Return

All totals must be included within each schedule of the Quarterly or Annual Supplement returns.