Actuarial Report on the Benefit Plan Financed through the RCMP (Dependants) Pension Fund as at 31 March 2019

Accessibility statement

The Web Content Accessibility Guidelines (WCAG) defines requirements for designers and developers to improve accessibility for people with disabilities. It defines three levels of conformance: Level A, Level AA, and Level AAA. This report is partially conformant with WCAG 2.0 level AA. If you require a compliant version, please contact webmaster@osfi-bsif.gc.ca.

The Honourable Chrystia Freeland, P.C., M.P.

Minister of Finance

House of Commons

Ottawa, Canada

K1A 0G5

Dear Minister:

Pursuant to section 56 of the Royal Canadian Mounted Police Pension Continuation Act (RCMPPCA), I am pleased to submit the report on the actuarial review as at 31 March 2019 of the benefit plan established under Part IV of the RCMPPCA.

Yours sincerely,

Assia Billig, FCIA, FSA, PhD

Chief Actuary

Table of contents

List of tables

- Table 1 Balance Sheet

- Table 2 Reconciliation of Financial Position

- Table 3 Experience Gains and (Losses)

- Table 4 Change in Actuarial Assumptions

- Table 5 Fund Balance

- Table 6 Recommended Benefit Improvements

- Table 7 Members Data

- Table 8 Widows Data

- Table 9 Reconciliation of Membership

- Table 10 Economic Assumptions

- Table 11 Plan Year 2020 Mortality Rates

- Table 12 Future Annual Longevity Improvement Factors

- Table 13 Assumptions for Prospective Widows

1. Executive Summary

1.1 Purpose of this Actuarial Report

This actuarial review of the benefit plan (Plan) governed by Part IV of the Royal Canadian Mounted Police Pension Continuation Act (RCMPPCA) was made as at 31 March 2019 pursuant to section 56 of the RCMPPCA. The previous review was made as at 31 March 2016.

In accordance with accepted actuarial practice and the RCMPPCA, the main purposes of this actuarial report are:

- to show an estimate of the balance sheet as at the valuation date,

- to compare the actual and expected experience under the Plan during the intervaluation period and to reconcile the change in the financial position of the Plan since the last actuarial report, and

- to recommend measures to deal with the actuarial excess.

Although the RCMPPCA requires that an actuarial review be undertaken every five years, we recommend, as it has been the previous practice, that the next actuarial review be no later than three years from this review, namely 31 March 2022.

1.2 Future of the Plan

The Plan's membership has been declining steadily since 1948. The recorded balance of the RCMP (Dependants) Pension Fund (the Fund) is estimated to decline steadily until the last dollar is paid to the last widow, which is projected to occur in the plan year 2049, based on the best-estimate mortality assumptions of this report.

A best-estimate mortality assumption is developed in the way that it projects a smooth long-term mortality experience of a sufficiently large group. However, as the group size diminishes, random fluctuations play a larger role in mortality experience. This is demonstrated in the experience gains and losses analysis section of this report which shows significant deviation between actual and expected mortality results. It is expected that these significant gains or losses will arise more frequently with each passing year as the number of members and widows continues to fall. In this context, keeping the same procedure of preparing actuarial valuations and reviewing the rate of benefit increases every three years may result in significant changes in the rate of benefit increases from one actuarial valuation to the next. In addition, as the number of survivors is decreasing, there is a possibility that a future potential surplus be distributed to a small number of remaining survivors in the future.

As a result, we recommend that a plan review be undertaken before the next scheduled actuarial review at 31 March 2022 to address these possible issues.

1.3 Changes since the Last Valuation

During the intervaluation period there were no changes to the plan provisions, which are summarized in Appendix A. However, the Governor in Council made benefit improvements in accordance with the excess distribution recommendations in the 2016 actuarial report on the benefit plan. The major improvements were effective pension increases of 1.9% as at 1 April 2017, 1 April 2018 and 1 April 2019. There were also increases in the lump sum death benefit payable on the death of a member and in the residual amount payable on the early death of a widow.

The Fund yield and mortality assumptions were revised for this valuation. These changes are discussed respectively in Appendix C and Appendix D.

1.4 Main Findings and Recommendation

-

As at 31 March 2019 (i.e. the end of the 2019 plan yearFootnote 1), the Plan had an actuarial excess of $0.9 million ($1.35 million as at 31 March 2016), being the excess of the recorded balance of the Fund of $12.8 million over the actuarial liabilities of $11.9 million.

-

It is recommended that annual benefit increases of 2.0% be applied until the next actuarial review as at 31 March 2022. Benefit improvements for subsequent years will be determined in the actuarial review as at 31 March 2022 and will reflect actual mortality experience, which could be significantly different than expected. The recommended benefit improvements until the next actuarial review as at 31 March 2022 are detailed as follows:

-

a pension increase for current and prospective widows of 2.0% as at 1 April 2020, 1 April 2021 and 1 April 2022;

-

an increase in the lump sum benefit payable upon the death of a member of 2.0% as at 1 April 2020, 1 April 2021 and 1 April 2022; and

-

an increase in residual amount payable on the death of a widow of a member who dies in the 2021, 2022 or 2023 plan years, obtained by increasing the member's deemed contributions as at 1 April 2019 by 2.0% on 1 April 2020, 1 April 2021 and 1 April 2022. Increases by year of death may be found in Table 6.

-

-

It is recommended that a plan review be undertaken before the next scheduled actuarial valuation at 31 March 2022 to address the potential variability in future benefit improvements and the potential distribution of a future surplus to a small number of survivors.

2. Financial Position of the Plan

2.1 Balance Sheet

The following balance sheet is based on the plan provisions described in Appendix A, the cumulative dividends in effect as at 1 April 2019, and the data and actuarial assumptions described in following sections. Previous valuation results as at 31 March 2016 are shown for comparison.

| As at 31 March 2019 | As at 31 March 2016 | |

|---|---|---|

| Recorded Fund Balance | ||

| Fund balance | 12,778,000 | 17,673,000 |

| Actuarial value of instalments in pay by members | 7,000 | 12,000 |

| Total Recorded Fund Balance | 12,785,000 | 17,685,000 |

| Actuarial Liabilities | ||

| Benefits accrued by members | ||

| · widow pensions | 942,000 | 1,932,000 |

| · lump sums on death without a widow | 1,747,000 | 2,829,000 |

| Widow pensions in pay | 8,926,000 | 11,242,000 |

| Outstanding paymentsTable 1 Footnote * | 269,000 | 334,000 |

| Total Actuarial Liabilities | 11,884,000 | 16,337,000 |

| Actuarial Excess | 901,000 | 1,348,000 |

Table 1 Footnote

|

||

The actuarial excess of $0.9 million represents 7.6% of the actuarial liabilities of $11.9 million.

2.2 Reconciliation of Financial Position with Previous Report

Table 2 presents the reconciliation of the changes in actuarial excess of the Plan. Figures in brackets indicate negative amounts. Explanations of the elements largely responsible for the changes follow the table.

| Actuarial excess as at 31 March 2016 | 1,348,000 |

|---|---|

| Cost of 2017, 2018 and 2019 benefit increases | (662,000) |

| Updated actuarial excess as at 31 March 2016 | 686,000 |

| Interest on excess | 90,000 |

| Expected actuarial excess as at 31 March 2019 | 776,000 |

| Experience gains and (losses) | 277,000 |

| Change in actuarial assumptions | (152,000) |

| Actuarial excess as at 31 March 2019 | 901,000 |

2.2.1 Cost of 2017, 2018 and 2019 Benefits Increases

Benefit improvements in accordance with the excess distribution recommendations of the previous report were approved and the excess as at 31 March 2016 decreased by $662,000.

2.2.2 Interest on Excess

The expected interest to 31 March 2019 on the updated excess as at 31 March 2016 amounts to $90,000.

2.2.3 Experience Gains and Losses

Since the previous valuation, the actuarial excess increased by $277,000 due to actuarial gains and losses as described in the following table.

| Mortality of widows | 366,000 |

|---|---|

| Age of new widows | 121,000 |

| Mortality of members | (127,000) |

| Proportion married | (107,000) |

| Interest rates | 30,000 |

| Miscellaneous | (6,000) |

| Net experience gains | 277,000 |

-

Mortality of Widows

During the three years ended 31 March 2019, the 30 reported widow deaths amounted to 137% of the 21.9 deaths expected in accordance with the assumption in the previous valuation. The Plan recorded an experience gain of $366,000.

-

Age of New Widows

The 11 new widows during the three-year period were on average 1.7 years older than expected. The Plan recorded an experience gain of $121,000.

-

Mortality of Members

During the three years ended 31 March 2019, the 21 reported member deaths amounted to 116% of the 18.1 deaths expected in accordance with the assumption in the previous valuation. The Plan recorded an experience loss of $127,000.

-

Proportion Married

During the three years ended 31 March 2019, the 11 new widows were 141% of the 7.8 expected; the Plan recorded an experience loss of $107,000.

-

Interest Rates

In the previous valuation, the Fund was assumed to be credited with interest at an average annual rate of 4.20% during the three years ended 31 March 2019. The actual interest rates were above the expected rates (average 4.26%), causing an experience gain of $30,000.

2.2.4 Change in Actuarial Assumptions

Actuarial assumptions were revised as described in Appendix D and Appendix E. The actuarial excess decreased by $152,000, due to the following revisions.

| Mortality of widows | (3,000) |

|---|---|

| Mortality of members | 2,000 |

| Interest rates | (151,000) |

| Net impact of revision | (152,000) |

-

Mortality of Widows

Both components of the mortality basis for widows, namely the rates assumed for the 2020 plan year and the annual reduction factors applying to those rates in subsequent years, were revised for this valuation. As a result, the actuarial excess decreased by $3,000.

-

Interest Rates

The interest rates for this valuation are shown in Appendix D and were developed by the procedure described in Appendix C, in particular, the long-term new money rate decreased from 4.6% to 4.5%, and the Fund yield on average was 0.2% lower than in the previous valuation over the next 5 years and 0.5% lower over the next 15 years. The adoption of the revised interest assumption caused the actuarial excess to decrease by $151,000.

-

Mortality of Members

Both components of the mortality basis for members, namely the rates assumed for the 2020 plan year and the annual reduction factors applying to those rates in subsequent years, were revised. As a result, the actuarial excess increased by $2,000.

2.3 Sensitivity Analysis of Actuarial Liabilities to Variations in Key Assumptions

The supplementary estimates shown below indicate the degree to which the actuarial liabilities as at 31 March 2019 of $11,615,000 (before taking into consideration the outstanding payments) shown in the balance sheet depend on some key assumptions. The actuarial liability changes can also serve to approximate the effect of other numerical variations in each key assumption, to the extent that such effects are linear.

2.3.1 Fund Yield

If the fund yield assumption would increase by 1% in each future year, the actuarial liabilities would decrease by $481,000 (i.e. by 4.1%).

If the interest rates assumption would decrease by 1% in each future year, the actuarial liabilities would increase by $523,000 (i.e. by 4.5%).

2.3.2 Mortality of Widows

If the mortality rates assumed for widows in each future year were reduced by 10%, the actuarial liabilities would increase by $618,000 (i.e. by 5.3%).

If the assumed improvements in longevity for widows after the 2020 plan year (see Appendix E) were not realized, the actuarial liabilities would decrease by $173,000 (i.e. by 1.5%).

2.3.3 Mortality of Members

If the mortality rates assumed for members in each future year were increased by 10%, the actuarial liabilities would increase by $37,000 (i.e. by 0.3%).

If the assumed improvements in longevity for members after the 2020 plan year (see Appendix E) were not realized, the actuarial liabilities would increase by $6,000 (i.e. by 0.1%).

2.3.4 Proportion of Married Members

If the proportion of members married at death were increased by 10%, then the actuarial liabilities would increase by $25,000 (i.e. by 0.2%).

2.3.5 Widow Age Difference

If the age of each future new widow were reduced by one year, then the actuarial liabilities would increase by $44,000 (i.e. by 0.4%).

2.4 Fund Balance

2.4.1 RCMP (Dependants) Pension Fund

Member contributions and benefits earned under Part IV of the RCMPPCA are tracked entirely through the RCMP (Dependants) Pension Fund, which forms part of the Public Accounts of Canada. The Fund is:

- credited with all contributions made by members;

- charged with the benefit payments made; and,

- credited with interest, as though net cash flows were invested with other public pension plans' cash flows in 20-year Government of Canada bonds issued at prescribed interest rates and held to maturity. Interest is credited every three months to the Fund on the basis of the actual average yield for the same period on the combined Superannuation Accounts of the Public Service, Canadian Forces – Regular Forces and RCMP pension plans.

No formal debt instrument is issued to the Fund by the Government in recognition of the amounts therein.

2.4.2 Reconciliation

The following table shows the reconciliation of the Fund balance from the previous valuation date to the current valuation date. The Fund entries shown below were provided and certified by the RCMP Pension Accounting Unit. During the intervaluation period, the Fund balance decreased by $4,895,000 (i.e. 28%) to $12,778,000 as at 31 March 2019.

| Plan year | |||

|---|---|---|---|

| 2017 | 2018 | 2019 | |

| Opening Balance | 17,672,931 | 15,791,975 | 14,055,572 |

| Receipts and other credits | |||

| Contributions | 2,856 | 2,049 | 1,771 |

| Interest | 738,468 | 620,658 | 530,155 |

| Total | 741,324 | 622,707 | 531,926 |

| Payments and other charges | |||

| Annuities | 2,020,404 | 1,932,785 | 1,734,804 |

| Lump sum payments | 601,876 | 426,325 | 343,691 |

| Return of Contributions | - | - | - |

| Total | 2,622,280 | 2,359,110 | 2,078,495 |

| Net Assets Available for Benefits | 15,791,975 | 14,055,572 | 12,509,003 |

| Accounts PayableTable 5 Footnote * | 268,672 | ||

| Closing balance | 15,791,975 | 14,055,572 | 12,777,676Table 5 Footnote ** |

Table 5 Footnotes

|

|||

2.4.3 Interest Earnings

The interest earnings on the Fund in plan years 2017, 2018 and 2019 were 4.5%, 4.2% and 4.0% respectively. They were calculated based on the assumption that instalment payments, survivor pension benefits and lump sum benefits were made in the middle of the year.

2.5 Disposition of Actuarial Excess

As in past actuarial reports where an actuarial excess was identified, a portion of this excess was applied to provide benefit improvements for the three years following the actuarial valuation while the remaining excess was retained for future potential benefit increases. For this valuation, it is recommended that benefit improvementsFootnote 2 of 2.0% be applied on 1 April 2020, 1 April 2021 and 1 April 2022 for pensions and residual amounts payable to current and prospective widows as well as for lump sums payable upon the death of a member.

The annual level of improvements was determined such that the actuarial excess would be used over the expected remaining life of the Plan assuming the experience of the Plan would develop according to the best-estimate assumptions established in this report. However, actual economic and demographic experience could be significantly different than expected, which could result in large fluctuations in the rate of benefit increases in the future and therefore should be re-assessed in the next actuarial review.

It is recommended that a plan review be undertaken before the next scheduled actuarial review at 31 March 2022 to address the potential variability in future benefit improvements and the potential distribution of a future surplus to a small number of survivors.

The following table presents the recommended benefit improvements until the next actuarial review.

| Pension and residual amount increase for current and prospective widows | |||

|---|---|---|---|

| Effective Date |

Additional Dividend |

Cumulative Dividend |

Effective Increase |

| 1 April 2020 | 29% | 1,381% | 2.0% |

| 1 April 2021 | 30% | 1,411% | 2.0% |

| 1 April 2022 | 30% | 1,441% | 2.0% |

| Increase in lump sum payable upon death of a member | |||

| Effective Date |

Additional Dividend |

Cumulative Dividend |

Effective Increase |

| 1 April 2020 | 17% | 769% | 2.0% |

| 1 April 2021 | 17% | 786% | 2.0% |

| 1 April 2022 | 18% | 804% | 2.0% |

3. Demographic and Financial Projections

3.1 Membership Projections

On the basis of the demographic assumptions described in Appendix E, the member and widow populations were projected over the expected remaining lifetime of the Plan.

| As at 31 March |

Members | Widows |

|---|---|---|

| Historical | ||

| 2001 | 193 | 176 |

| 2004 | 165 | 171 |

| 2007 | 125 | 149 |

| 2010 | 97 | 144 |

| 2013 | 65 | 132 |

| 2016 | 44 | 97 |

| 2019 | 23 | 78 |

| 2020Table Footnote * | 12 | 73 |

| Projected | ||

| 2022 | 7 | 56 |

| 2025 | 3 | 34 |

| 2028 | 1 | 18 |

| 2031 | 0 | 9 |

| 2037 | 0 | 2 |

| 2041 | 0 | 1 |

| 2049 | 0 | 0 |

Table Footnote

|

||

Over the last decade, the number of members has fallen steadily so that only 23 remain at 31 March 2019 and 12 at 31 March 2020 (44 at 31 March 2016); this trend is projected to continue until the death of the last member, which is expected in the plan year 2031. The number of widows was 78 as at 31 March 2019 and 73 as at 31 March 2020 (97 as at 31 March 2016). A steady decline is expected thereafter, with the last widow expected to survive to the plan year 2049 (2046 in the 2016 valuation).

Emerging mortality experience will be subject to statistical fluctuations. Consequently the actual membership statistics will deviate, perhaps materially, due to the relatively small number of participants.

3.2 Projection of Recorded Fund Balance

Using the assumptions described in Appendix D and E, the recorded balance of the Fund was projected assuming annual benefits improvements of 2.0% for the remaining lifetime of the Plan. The total outstanding payments of $269,000 shown in the balance sheet were assumed to be made on 1 April 2019.

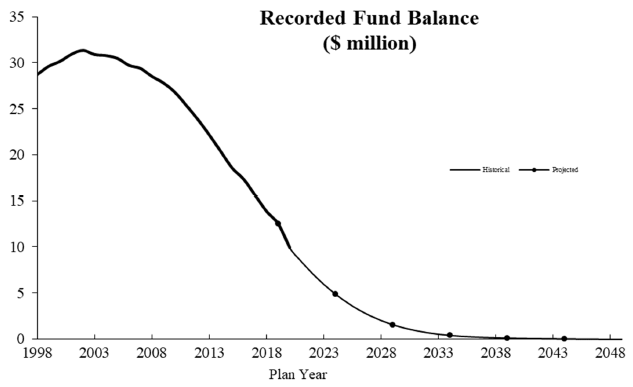

Chart - Recorded Fund Balance

Line chart showing the historical and projected recorded Fund balance over time. Y axis represents the recorded balance of the Fund in millions of dollars. X axis represents the plan year, starting at 31 March 1998 and ending at 31 March 2048.

The thick line represents the historical actual amounts up to 31 March 2020 of the recorded balance of the Fund. The thin line represents the projected amounts beyond 31 March 2020.

The recorded balance of the Fund was approximately $28.7 million as at 31 March 1998 and reached its maximum of $31.4 million as at 31 March 2002. Thereafter, the recorded balance of the Fund declined. If the experience of the Plan develops in accordance with the assumptions and benefit improvements of 2.0% are granted annually, the recorded balance of the Fund is expected to decline steadily until it reaches $0 in plan year 2048.

The recorded balance of the Fund reached its maximum of $31.4 million on 31 March 2002. If the experience of the Plan develops according to the assumptions and benefit improvements of 2.0% are granted annually, the recorded balance of the Fund assets is expected to decline steadily until it reaches $0 in plan year 2048. It is projected that the Plan would be in a shortfall position less than $0.1 million when the last expected payment is made under the Plan in plan year 2049. This projected shortfall would be at the charge of the Government.

The actual evolution of the recorded balance of the Fund will be influenced by several variables, most notably the statistical mortality fluctuations affecting the membership projections.

4. Actuarial Opinion

In our opinion, considering that this report was prepared pursuant to the Royal Canadian Mounted Police Pension Continuation Act,

- the valuation data on which the valuation is based are sufficient and reliable for the purposes of the valuation;

- the assumptions used are individually reasonable and appropriate in the aggregate for the purposes of the valuation; and

- the methods employed are appropriate for the purposes of the valuation.

This report has been prepared, and our opinions given, in accordance with accepted actuarial practice in Canada. In particular, this report was prepared in accordance with the Standards of Practice (General Standards and Practice – Specific Standards for Pension Plans) published by the Canadian Institute of Actuaries.

We have reflected the impacts of the COVID-19 pandemic on the economic assumptions used in this report. It is important to note that the pandemic is a very fluid situation that will likely continue to evolve for some time. We have estimated the impacts based on the information known at the time the report was prepared. The final impacts of this health and economic crisis will likely generate some differences in the future.

To the best of our knowledge, after discussions with the Royal Canadian Mounted Police, there were no other events between the valuation date and the date of this report that would materially impact the results of the actuarial valuation report.

Assia Billig, FCIA, FSA

Chief Actuary

François Lemire, FCIA, FSA

Ottawa, Canada

16 March 2021

Appendix A ― Summary of Plan Provisions

The provisions of the benefit plan governed by Part IV of the Royal Canadian Mounted Police Pension Continuation Act (RCMPPCA) are summarized in this appendix. However, the RCMPPCA shall prevail if there is any discrepancy between the RCMPPCA and this summary.

A.1 History of the Plan

The benefit plan associated with the Royal Canadian Mounted Police (Dependants) Pension Fund was established in 1934 when Part IV was added to the Royal Canadian Mounted Police Act (RCMP Act). Plan membership was optional for constables on active duty on 1 October 1934; however, it was mandatory for constables appointed to the Force thereafter.

In 1948, Part V (a new pension arrangement) was added to the RCMP Act. Plan members who elected to become contributors under Part V were required to either suspend or terminate their participation in the Plan. Moreover, the Plan was then closed to any new entrants except certain constables whose continuous service dated back to 1 October 1934 or earlier. Lastly, the Plan was amended so that the government assumed responsibility for any shortfall in the Fund.

In 1959, the Royal Canadian Mounted Police Superannuation Act and the Royal Canadian Mounted Police Pension Continuation Act were enacted to provide for all RCMP pension arrangements. The Plan was transferred to the RCMPPCA, where it remains.

In 1975, the age at which the eligibility of a son for survivor benefits expires was raised from 18 years to 21 years, which already applied to a daughter. In addition, survivor benefits were extended to age 25 for unmarried sons and daughters still in school, subject to certain conditions. Lastly, the 4% annual interest rate that had always been applied to the Fund balance was replaced by the rate applied to the three major Superannuation Accounts (Public Service, Canadian Forces – Regular Forces, and Royal Canadian Mounted Police), which is derived from the yield on a notional long term bond portfolio (see Appendix C). The resulting higher interest credits have flowed through to members and survivors in the form of more generous benefit increases from 1975 onward.

In 1989, marital status was eliminated as a criterion to determine the eligibility for survivor benefits of a son or daughter between ages 21 and 25. Also eliminated was the provision for reducing the pension of a widow more than 20 years younger than her husband at the date of his death.

In 1993, the Plan was amended to allow the payment of pension to a widow cohabiting with a man to whom she is not married.

A.2 Membership

As mentioned above, Plan membership was compulsory for constables appointed to the Force from 1934 to 1948. Thereafter, the Plan was essentially closed to new entrants. The last plan member retired from active duty in 1987.

A.3 Contributions

A.3.1 Member Contributions

A.3.1.1 Current Service

To purchase current service benefits, a member on active duty contributed 5% of pay together with any supplementary amounts in accordance with the scale set out in the RCMPPCA.

A.3.1.2 Past Service

A member on active duty could elect to contribute, either in a lump sum or by equivalentFootnote 3 instalments, to purchase benefits in respect of any period of eligible past service, based on his rate of pay at the date of election. Similarly, on promotion to or within the ranks of non commissioned officers, he could elect to partially or fully upgrade the accrued benefits.

A.3.2 Government Contributions

The RCMPPCA requires the Government of Canada to make contributions only to re-establish the solvency of the Fund. Every valuation to date has revealed an actuarial excess and therefore no government contribution has ever been credited to the Fund.

A.4 Interest Earnings

Interest is credited every three months to the Fund on the basis of the yield in the preceding quarter on the notional bond portfolio underlying the combined Superannuation Accounts of the Public Service, Canadian Forces – Regular Forces, and Royal Canadian Mounted Police pension plans.

A.5 Basic Death Benefits

The amount of basic benefit is determined solely in accordance with the terms of the RCMPPCA, without reference to any cumulative dividend (see subsection A.6 below) that may be payable. A lump sum or pension benefits, as applicable, are payable on the death of a member who has made the scheduled contributions and had left them in the Fund.

A.5.1 Widow Pensions

A widow is entitled to the pension purchased by the member's contributions at the rates specified in Table II of the Schedule to the RCMPPCA. In many cases, the pension is approximately equal to 1.5% of the member's final pay multiplied by his years of credited service. The pension is payable for life. If a widow dies before receiving payments at least equal to the member's contributions, then a residual amount is payable.

A.5.2 Lump Sum Benefits

If a member is not survived by a widow, a lump sum payment is made to the dependants and relatives of the member who are, in the opinion of the Minister having control and management of the Force, best entitled to share the benefit. The lump sum amount is equal to the present valueFootnote 4 of a hypothetical pension payable to a 75 year old widow.

A.5.3 Benefit Limitation

The basic pension payable to the widow of a member who married after age 60 is reduced to ensure that the present valueFootnote 4 of her pension does not exceed the lump sum otherwise payable on his death.

A.6 Cumulative Dividends on Basic Death Benefits

If the Fund balance is substantially in excess of the amount required to make adequate provision for the prospective payments to be made out of it, the Governor in Council may by order increase all the plan benefits, or any of them, in such manner as may appear equitable and expedient.

Until 31 March 1991, the benefit increases took the form of cumulative dividend percentages applied equally to all basic death benefits except the residual amount payable on the early death of a widow. Effective 1 April 1991, separate cumulative dividend percentages for lump sum benefits and for pensions to widows were introduced. At the same time, cumulative dividends first became applicable to the residual amount payable on the early death of a widow. Dividend rates as at 31 March 2019 are 1,352% for pension and residual benefits, and 752% for lump sums payable on member deaths.

The cumulative dividends that may be declared are not subject to the limitations on the basic death benefits described in subsection A.5.3 above.

A.7 Withdrawal Benefits

A member can elect at any time to withdraw his contributions from the Fund, without interest; neither he nor any of his dependants has any entitlement under the Plan thereafter.

A.8 Instalment Payments

A member can elect at any time to discontinue instalment payments being made in respect of a past service election. The present valueFootnote 5 of the discontinued payments is thereupon converted into an equivalentFootnote 6 amount of basic death benefit and his accrued basic death benefit is reduced accordingly. In turn, this causes a reduction in the amount of the cumulative dividend.

If a member dies while making instalment payments, his entitlement under the Plan remains unchanged because all required payments are deemed to have been made.

Appendix B ― Membership Data

B.1 Source

The individual data in respect of members and widows as at 31 March 2019 are shown in the summaries of data in this appendix. Data on widows were supplied by the Department of Public Service and Procurement Canada (PSPC), which is responsible for the payment of benefits.

B.2 Validation

We performed certain tests of internal consistency, as well as tests of consistency with the data used in the previous valuation, with respect to membership reconciliation, basic information (date of birth, sex, etc.) and pensions to survivors.

Based on the omissions and discrepancies identified by these and other tests, appropriate adjustments were made to the basic data after consulting with the data provider.

B.3 Data Summary

In this report, member means a former contributor whose contributions are still credited to the Fund and widow means a widow whose pension is charged against the Fund. All members are males and all surviving spouses are widows. There is no child annuity in course of payment as at 31 March 2019.

The membership data is summarized in the following tables.

| Age Last Birthday |

NumberTable 7 Footnote ** | Spouse's Accrued Annual PensionTable 7 Footnote * | |

|---|---|---|---|

| Average ($) | Total ($) | ||

| 85-89 | 3 | 15,278 | 45,835 |

| 90-94 | 15 | 30,541 | 458,117 |

| 95+ | 5 | 17,429 | 87,144 |

| All ages | 23 | 25,700 | 591,096 |

| Average age: 93.3 years | |||

Table 7 Footnotes

|

|||

| Age Last Birthday |

Number | Spouse's Accrued Annual PensionTable 8 Footnote * | |

|---|---|---|---|

| Average ($) | Total ($) | ||

| Less than 79 | 2 | 21,310 | 42,620 |

| 80-84 | 6 | 21,688 | 130,129 |

| 85-89 | 26 | 25,364 | 659,470 |

| 90-94 | 29 | 22,602 | 655,465 |

| 95+ | 15 | 19,110 | 286,653 |

| All ages | 78 | 22,748 | 1,774,337 |

| Average age: 90.6 years | |||

Table 8 Footnote

|

|||

B.4 Reconciliation

The following table derived from the basic data reconciles the numbers of members and widows as at 31 March 2019 with the numbers shown in the previous report.

| Members | Widows | |

|---|---|---|

| As at 31 March 2016 | 44 | 97 |

| Data correction | - | - |

| New survivors | - | 11 |

| Deaths | (21) | (30) |

| As at 31 March 2019 | 23 | 78 |

Appendix C ― Methodology

C.1 Royal Canadian Mounted Police (Dependants) Pension Fund

The balance in the Royal Canadian Mounted Police (Dependants) Pension Fund forms part of the Public Accounts of Canada. The underlying notional bond portfolio described in Section 2.4 is shown at the book value.

The only other Fund-related amount consists of the value, discounted in accordance with the projected Fund yields described in Section C.3 below and shown in Appendix D, of all future instalment payments by members in respect of past service elections made by 31 March 1987, which is when the last plan member retired from active duty.

C.2 Actuarial Liabilities

C.2.1 Members

The actuarial liabilities in respect of the members as at the valuation date correspond to the value, discounted in accordance with the actuarial assumptions, of all future benefits accrued as at that date in respect of service as an active member of the Force. The last benefit improvements approved by the Governor in Council were assumed to be fixed at 1,352% for pensions and 752% for lump sums payable on member deaths.

C.2.2 Widows

The actuarial liabilities in respect of the widows as at the valuation date correspond to the value, discounted in accordance with the actuarial assumptions, of all future benefits as at that date to which those widows are entitled. The last benefit improvements approved by the Governor in Council were assumed to be fixed at 1,352%.

C.3 Projected Yields on the Fund

The government applies the same quarterly interest credits to the Fund as it does to the three major Superannuation Accounts (Public Service, Canadian Forces – Regular Forces, and Royal Canadian Mounted Police). The projected yields (shown in Appendix D) assumed in computing the liabilities are the projected annual yields on the combined book value of the three major Superannuation Accounts.

The projected yields were determined by an iterative process involving the interest credits on the notional bond portfolio of the three accounts as at the valuation date, the assumed future new money interest rates (also shown in Appendix D), and the assumed future combined cash flows for the three accounts. This approach is in accordance with legislation, common to the three foregoing pension plans, stipulating that the average yield on the combined accounts is to be used in allocating aggregate interest earnings to each of the three accounts.

C.4 Utilization of Actuarial Excess

For this valuation, it is recommended that benefit improvementsFootnote 7 of 2.0% be applied on 1 April 2020, 1 April 2021 and 1 April 2022 for pensions and residual amounts payable to current and prospective widows as well as for lump sums payable upon the death of a member.

The annual level of improvements was determined such that the actuarial excess would be used over the expected remaining life of the Plan assuming the experience of the Plan would develop according to the best-estimate assumptions established in this report.

Appendix D ― Economic Assumptions

D.1 Interest Assumptions

The interest assumptions were changed for this valuation. Recognizing recent experience, the rate of return on long-term government of Canada bonds (new money rate) is assumed to be 1.6% for plan year 2020. The rate decreases to 1.3% for plan year 2021 then increases gradually and reaches its ultimate rate of 4.5% per annum in plan year 2036. This ultimate rate is 0.1% lower than in the previous valuation and is reached in plan year 2036 (2025 in previous valuation). The Fund yield assumption, derived as described in Appendix C, are lower than those used in the previous valuation throughout the future period of benefit payments. They are as follows.

| Plan Year |

Interest Rates (%) | |

|---|---|---|

| New Money |

Fund Yield |

|

| 2020 | 1.6 | 3.7 |

| 2021 | 1.3 | 3.5 |

| 2022 | 1.6 | 3.3 |

| 2023 | 1.7 | 3.2 |

| 2024 | 2.0 | 3.1 |

| 2025 | 2.4 | 3.0 |

| 2026 | 2.7 | 2.9 |

| 2027 | 2.9 | 2.8 |

| 2028 | 3.1 | 2.7 |

| 2029 | 3.3 | 2.6 |

| 2030 | 3.5 | 2.6 |

| 2031 | 3.7 | 2.5 |

| 2032 | 3.9 | 2.4 |

| 2033 | 4.1 | 2.5 |

| 2034 | 4.3 | 2.5 |

| 2035 | 4.4 | 2.5 |

| 2040 | 4.5 | 3.0 |

| 2045 | 4.5 | 3.9 |

| 2050 | 4.5 | 4.1 |

| 2053+ | 4.5 | 4.5 |

D.2 Administrative Expenses

As in the previous valuation, the expenses incurred for the administration of the Plan are assumed to be nil. These expenses, which are not charged against the Fund, are borne entirely by the government and are commingled with all other government expenses.

Appendix E ― Demographic Assumptions

The demographic assumptions are presented below.

E.1 New Entrants

As in the previous valuation, because the Plan is closed to new entrants, it is assumed that there would be no future new entrants.

E.2 Withdrawal Rates

As in the previous valuation, no members are assumed to withdraw from the Plan.

E.3 Mortality

Assumed rates of mortality applicable to members were changed for this valuation. They correspond to the plan year 2020 mortality rates for male Regular Members from the actuarial report on the pension plan for the Royal Canadian Mounted Police as at 31 March 2018.

Assumed rates of mortality applicable to widows correspond to the plan year 2020 mortality rates for female Regular Members from the actuarial report on the pension plan for the Royal Canadian Mounted Police as at 31 March 2018Footnote 8.

| Age Last Birthday |

Plan Year 2020 Mortality Rates | |

|---|---|---|

| Members | Widows | |

| 55 | 2.0 | 2.1 |

| 65 | 6.8 | 5.4 |

| 75 | 20.2 | 14.3 |

| 85 | 80.0 | 53.0 |

| 95 | 196.1 | 197.0 |

| 105 | 498.6 | 423.7 |

| 115 | 1,000.0 | 1,000.0 |

Mortality rates are reduced in the future in accordance with the same longevity improvement assumption used in the actuarial report on the pension plan for the Royal Canadian Mounted Police as at 31 March 2018. These longevity improvement factors are the same as used in the 27th Actuarial Report on the Canada Pension Plan.

Assumed future annual reductions in mortality rates are shown in the following table.

| Age Last birthday |

Members | Widows | ||

|---|---|---|---|---|

| 2021 | 2033+ | 2021 | 2033+ | |

| 55 | 1.37 | 0.80 | 1.04 | 0.80 |

| 65 | 1.86 | 0.80 | 1.48 | 0.80 |

| 75 | 2.02 | 0.74 | 1.52 | 0.74 |

| 85 | 1.70 | 0.58 | 1.45 | 0.58 |

| 95 | 0.83 | 0.42 | 0.84 | 0.42 |

| 105 | 0.27 | 0.14 | 0.28 | 0.14 |

| 115 | - | - | - | - |

Table 12 Footnote

|

||||

E.4 Prospective Widows and Eligible Children

Table 13 shows the proportion of members assumed to leave, upon death, a widow eligible for a pension from the Plan. Also shown is the assumed age difference between spouses. Both assumptions are unchanged from the previous valuation.

| Age Last Birthday of Member at Death |

Proportion of Members Married |

AgeFootnote * Difference |

|---|---|---|

| 80 | 0.77 | (4) |

| 85 | 0.66 | (5) |

| 90 | 0.49 | (5) |

| 95 | 0.31 | (6) |

| 100 | 0.16 | (8) |

| 105 | 0.07 | (11) |

| 110 | 0.03 | (14) |

| 115 | 0.01 | (18) |

Table 13 Footnote

|

||

Taking into account the advanced ages of the current members, the assumption that no member would be survived by a child or student eligible to receive an annuity was retained from the previous valuation.

Appendix F ― Acknowledgements

The RCMP Pension Accounting Unit provided and certified the financial statements as at 31 March 2019 upon which the income statement and Fund balance were based.

The Department of PSPC, responsible for the payment of benefits, provided relevant valuation input data in respect of members and widows.

The co-operation and able assistance received from the above-mentioned information providers deserve to be acknowledged.

The following individuals assisted in the preparation of this report:

Hao Chen, FCIA, FSA

Ayoub Ezzahouri

Laurence Frappier, FCIA, FSA

Steve McCleave

Kelly Moore

Natalija Rajic

Footnotes

- Footnote 1

-

Any reference to a given plan year in this report should be taken as the 12-month period ending 31 March of the given year.

- Footnote 2

-

Experience gains/losses incurred during plan year 2020, which were available at the time of preparing this actuarial valuation report, were taken into account when estimating the benefit improvements.

- Footnote 3

-

Based on the mortality rates of the CM(5) Table with interest at 4% per annum.

- Footnote 4

-

Based on the mortality rates of the a(f) Ultimate Table with interest at 4% per annum.

- Footnote 5

-

Based on the mortality rates of the CM(5) Table with interest at 4% per annum.

- Footnote 6

-

Based on the rates in Table II of the RCMPPCA.

- Footnote 7

-

Experience gains/losses incurred during plan year 2020, which were available at the time of preparing this actuarial valuation report, were taken into account when estimating the benefit improvements.

- Footnote 8

-

Based on the 2014 Canadian Pensioners Mortality Table (CPM2014) published by the Canadian Institute of Actuaries, projected with longevity improvement factors from scale CPM Improvement Scale B (CPM-B) to plan year 2019 and longevity improvement factors used in the 27th Actuarial Report on the Canada Pension Plan to plan year 2020.