Financial Highlights for the period ended June 30, 2020

Introduction

Raison d'être

The Office of the Superintendent of Financial Institutions (OSFI) was established in 1987 by an Act of Parliament: the Office of the Superintendent of Financial Institutions Act (OSFI Act). It is an independent agency of the Government of Canada and reports to Parliament through the Minister of Finance.

OSFI supervises and regulates all banks in Canada and federal credit unions in Canada and all federally incorporated or registered trust and loan companies, insurance companies, fraternal benefit societies and private pension plans. Under the OSFI Act, the Superintendent is solely responsible for exercising OSFI's authorities and is required to report to the Minister of Finance from time to time on the administration of the financial institutions legislation.

The Office of the Chief Actuary, which is an independent unit within OSFI, provides actuarial valuation and advisory services for the Canada Pension Plan, the Old Age Security program, the Canada Student Loans and Employment Insurance Programs and other public sector pension and benefit plans.

Responsibilities

OSFI's legislated mandate was implemented in 1996 and consists in the following:

Fostering sound risk management and governance practices

OSFI advances a regulatory framework designed to control and manage risk.

Supervision and early intervention

OSFI supervises federally regulated financial institutions and pension plans to determine whether they are in sound financial condition and meeting regulatory and supervisory requirements.

OSFI promptly advises financial institutions and pension plans if there are material deficiencies, and takes corrective measures or requires that they be taken to expeditiously address the situation.

Environmental scanning linked to safety and soundness of financial institutions

OSFI monitors and evaluates system-wide or sectoral developments that may have a negative impact on the financial condition of federally regulated financial institutions.

Taking a balanced approach

OSFI acts to protect the rights and interests of depositors, policyholders, financial institution creditors and pension plan beneficiaries while having due regard for the need to allow financial institutions to compete effectively and take reasonable risks.

OSFI recognizes that management, boards of directors and pension plan administrators are ultimately responsible for risk decisions and that financial institutions can fail and pension plans can experience financial difficulties resulting in the loss of benefits.

In fulfilling its mandate, OSFI supports the government's objective of contributing to public confidence in the Canadian financial system.

OSFI also provides supervision services to the Canada Mortgage and Housing Corporation in accordance with the National Housing Act.

The OCA is an independent unit within OSFI that provides a range of actuarial valuation and advisory services to the Government of Canada.

Basis of Presentation

These quarterly financial statements have been prepared by management as required by Section 65.1 of the Financial Administration Act and in accordance with Public Sector Accounting Standards (PSAS), using the accrual basis of accounting.

These quarterly financial statements have not been subject to an external audit or review

OSFI's Funding Model

OSFI recovers its costs from several revenue sources. It is mainly funded through assessments on the financial institutions and private pension plans that it regulates and supervises, as well as through a user-pay program for legislative approvals and other selected services. OSFI also receives revenues for cost-recovered services. These include revenues from provinces on behalf of which OSFI supervises institutions on contract, and revenues from other federal organizations to which OSFI provides administrative support, and other services.

The accompanying quarterly financial statements reflect OSFI's legislated authority to spend revenues from assessments and other sources as per Section 17(2) of the OSFI Act as well as any authorities granted by Parliament and used by OSFI. OSFI receives an annual parliamentary appropriation pursuant to Section 16 of the OSFI Act to support the operations of the Office of the Chief Actuary. Such funding is presented as Government Funding in the Statement of Operations and the amount is consistent with the Main and Supplementary Estimates per the Appropriation Act in effect for the reporting period.

Financial Review and Highlights - Fiscal Year to Date

Statement of Financial Position and Statement of Cash Flows

The majority of OSFI's revenue is derived from base assessments on federally regulated financial institutions. Assessments are billed annually, usually in the second quarter of the fiscal year. As a result of this annual cycle, some accounts in OSFI's Statement of Financial Position can vary significantly throughout the year. In between base assessment billings, OSFI's cash entitlement balance decreases gradually as payments pertaining to operational costs and asset acquisitions are issued. Similarly, OSFI's accrued base assessments balance increases, to reflect expenses incurred but not yet billed. After the base assessments are billed and collected, cash and accounts receivable increase, as do unearned base assessments. OSFI last invoiced its base assessments in August 2019.

During the three months ended June 30, 2020, OSFI's cash entitlement balance decreased by $44.8 million, its trade and other receivables increased by $2.1 million and its accrued base assessments increased by $42.8 million.

As explained in Note 2 (a) to the financial statements, OSFI has a revolving expenditure authority from the Treasury Board Secretariat to draw upon the Consolidated Revenue Fund to ensure the availability of funds prior to receipt of revenue. Additional information on OSFI's sources and uses of cash can be found in its Statement of Cash Flows.

Statement of Operations

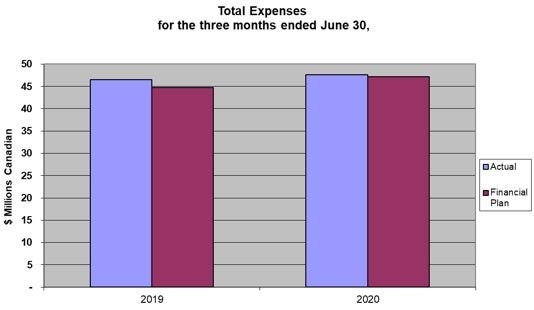

OSFI operates on a cost recovery model. Assessment revenue is recorded at an amount necessary to balance revenue and expenses after all other sources of revenue are taken into account. OSFI's total expenses for the three months ended June 30, 2020 were $47.6 million, a $1.1 million or 2.5% increase from the same period last year.

- Personnel costs rose by $1.1 million or 3.0% due to the staffing of vacant positions, and normal escalation / merit increases.

- Rental costs increased by $0.5 million or 16.0% because of additional space / premises, normal escalation, and an increase in software licencing costs related to growth in headcount.

- Professional services costs increased by $0.4 million or 12.0% in support of ongoing information technology projects including a multi-year project to renew OSFI's supervisory tools.

- Travel costs decreased by $0.9 million or 99.2% as a result of Covid-19 related travel restrictions.

OSFI's total expenses of $47.6 million for the period were $0.4 million or 0.9% above plan (versus $1.8 million or 4.0% above plan for the same period last year). OSFI monitors its performance via monthly variance analysis and quarterly forecast exercises. The variance this year is due to intra-year timing differences (i.e., when certain expenses were planned and when they incurred). Management actions are taken if / when required.

Text version - Chart 1

| 2019 | 2020 | |

|---|---|---|

| Actual ($millions Canadian) |

46.5M | 47.6M |

| Financial Plan ($millions Canadian) |

$44.7M | 47.2M |

Government Funding

In addition to its assessment and cost-recovered services revenues, OSFI was granted a parliamentary appropriation of $1.2 million for the fiscal year ending March 31, 2021 (2020- $1.5 million). During the three months ended June 30, 2020, OSFI recognized $0.3 million (2019 - $0.3 million) of this annual amount.

Risks and Uncertainties

OSFI operates in a constantly changing environment reflected in uncertain economic and financial conditions and an industry that can undergo periods of rapid change and that is becoming increasingly complex. The risks that exist in such circumstances can have financial consequences, thereby affecting financial statements.

Enterprise Risks

Through Enterprise Risk Management (ERM), OSFI identifies its key external and internal risksFootnote 1on a yearly basis. While OSFI continues to actively address the suite of risks covered by its framework, it also identified new ones during this reporting period.

External Risks

Macroeconomic and geopolitical uncertainty / COVID-19 Pandemic

This risk relates to the possibility that OSFI may not promptly identify the causes and/or consequences of financial contagion stemming from macroeconomic, geopolitical or pandemic events and may not proactively respond to them. To address this risk OSFI actively monitors changes in portfolios and investigates the reasons for such changes in order to assess the implications for financial institutions.

Financial institution (FI) cyber-security vulnerability

There is a risk that OSFI may not respond effectively to cyber threats to Canadian FIs or a major FI cyber-security incident. OSFI continues to actively monitor this risk and the mitigation measures being applied by FIs given the rapid evolution of cyber-attacks, their increasing number, and system interdependencies that could create multiple points of vulnerability for institutions. Issues regarding cyber breaches or service disruption threats are discussed with FIs, including with their Board and Risk Committee.

Financial industry advancement

Given the scale and pace of change in the financial industry, there is a risk that OSFI may not keep pace with advancements/developments (e.g., FinTech, shadow banking, insurance companies alternative investments, use of non-regulated retrocession reinsurers). OSFI monitors FIs for the impact of such industry changes and addresses issues, as appropriate.

Climate change

Weather and climate threats are among the top risks that will have the biggest global impact over the next ten years according to the 2018 Global Risks Report from the World Economic Forum. There is a risk that OSFI may not keep pace with the impacts this could have on financial industry. OSFI monitors the impact of such climate changes and addresses issues, as appropriate.

Internal Risks

OSFI manages a suite of internal risks that can also affect resources, given the investments needed to mitigate them appropriately. Areas of focus pertain to:

Internal change agenda and organizational change management maturity

OSFI has undergone several significant business changes and adaptations in the areas of technology renewal, organizational re-structuring and supervisory process reviews. There is a risk that development and delivery of OSFI's internal change agenda may be detrimental to the effective delivery of its core mandate or its workforce due to change fatigue and diminishing morale. To mitigate this risk, extensive efforts are being deployed in the area of change management, including training and advisory services as well as the establishment of an Enterprise Change Management Lead Network comprised of representatives from all OSFI's sectors.

Human resources capacity and capability

OSFI's success is dependent upon having employees with highly specialized knowledge, skills and experience to regulate and supervise FIs. There is a risk that OSFI's human capital may be inadequate to deliver on its mandate due to soft and transferable skill gaps, experience gaps, a lack of technical knowledge to keep pace with FIs' evolving business models (FinTech), turnover, succession planning/ key person risk, or poor performers. In response to this risk, OSFI continues the implementation of its comprehensive Human Capital Strategy over the next three years.

Financial institution information and data

There is a risk that OSFI may over-rely on information provided by FIs' management to assess the quality of portfolios or that the FI data collected and OSFI's management of it are inadequate to effectively deliver on OSFI's mandate. OSFI is in the process of developing an Enterprise Data Management Strategy to respond to this risk.

Protection of Information

OSFI's information holdings include sensitive and personal information. As such, there is a risk that OSFI's systems may be inappropriately accessed by external parties or inappropriately used by its employees. To address this risk OSFI is implementing a Cyber Security Strategy and Action Plan while also optimizing the use of existing security technologies.

Remote work

The vast majority of OSFI's employees are currently working remotely because of the Covid-19 Pandemic. As such, there is a risk that OSFI may not be as efficient as it otherwise would be. To address the additional risks created by having most employees working remotely, OSFI is investing in its work-from-anywhere capabilities, including increasing remote communication capacity and integrating new tools to allow additional secure communication channels and capacity.

Financial Risks

Financial risks, primarily liquidity risk and credit risk, are closely managed and continue to be rated low. Please refer to Note 10 to the financial statements for a full analysis of the financial risks that OSFI is exposed to.

Significant Changes in Relation to Operations, Personnel and Programs

As a result of the current Covid-19 Pandemic, the vast majority of OSFI's employees have worked remotely throughout the last quarter and will most likely continue to do so for the remainder of this fiscal year.

There have been no other significant changes in relation to Operations, Personnel and Programs during the quarter ended June 30, 2020.

Approval by Senior Officials

Approved by,

Marc Desautels

Chief Financial Officer

Jeremy Rudin,

Superintendent

Footnotes

- Footnote 1

-

External risks are those driven by external factors that can directly impact the organization's ability to deliver on its expected results. Internal risks, while sometimes resulting from external pressures, are mainly driven by internal decisions and investments.