Financial highlights for the period ended June 30, 2025

Introduction

Raison d'être

The Office of the Superintendent of Financial Institutions (OSFI) was established in 1987 by an Act of Parliament: the Office of the Superintendent of Financial Institutions Act (OSFI Act). It is an independent agency of the Government of Canada and reports to Parliament through the Minister of Finance.

OSFI supervises and regulates all banks in Canada and federal credit unions in Canada and all federally incorporated or registered trust and loan companies, insurance companies, fraternal benefit societies and private pension plans. Under the OSFI Act, the Superintendent is solely responsible for exercising OSFI's authorities and is required to report to the Minister of Finance from time to time on the administration of the financial institutions' legislation.

The Office of the Chief Actuary (OCA), which is an independent unit within OSFI, provides actuarial valuation and advisory services for the Canada Pension Plan, the Old Age Security program, the Canada Student Loans and Employment Insurance Programs and other public sector pension and benefit plans.

Responsibilities

OSFI's purpose is to contribute to public confidence in the Canadian financial system by regulating and supervising approximately 400 federally regulated financial institutions (FRFIs) and 1200 federally regulated pension plans (FRPPs).

OSFI's mandate is to:

- ensure FRFIs and FRPPs remain in sound financial condition

- ensure FRFIs protect themselves against threats to their integrity and security, including foreign interference

- act early when issues arise and require FRFIs and FRPPs to take necessary corrective measures without delay

- monitor and evaluate risks and promote sound risk-management by FRFIs and FRPPs

In exercising its mandate:

- for FRFIs, OSFI strives to protect the rights and interests of depositors and creditors while having due regard for the need to allow FRFIs to compete effectively and take reasonable risks

- for FRPPs, OSFI strives to protect the rights and interests of pension plan members, former members and entitled beneficiaries

OSFI also provides supervision services to the Canada Mortgage and Housing Corporation in accordance with the National Housing Act.

The OCA is an independent unit within OSFI that provides a range of actuarial valuation and advisory services to the Government of Canada.

Basis of presentation

These quarterly financial statements have been prepared by management as required by Section 65.1 of the Financial Administration Act and in accordance with Public Sector Accounting Standards (PSAS), using the accrual basis of accounting.

These quarterly financial statements have not been subject to an external audit or review.

OSFI's funding model

OSFI recovers its costs from several revenue sources. It is mainly funded through assessments on the financial institutions and private pension plans that it regulates and supervises, as well as through a user-pay program for legislative approvals and other selected services. OSFI also receives revenues for cost-recovered services. These include revenues from provinces on behalf of which OSFI supervises institutions on contract, and revenues from other federal organizations to which OSFI provides administrative support.

The accompanying quarterly financial statements reflect OSFI's legislated authority to spend revenues from assessments and other sources as per Section 17(2) of the OSFI Act as well as any authorities granted by Parliament and used by OSFI. OSFI receives an annual parliamentary appropriation pursuant to Section 16 of the OSFI Act to support the operations of the OCA. Such funding is presented as Government Funding in the Statement of Operations and the amount is consistent with the Main and Supplementary Estimates per the Appropriation Act in effect for the reporting period.

Financial review and highlights - Fiscal year to date

Statement of financial position and statement of cash flows

The majority of OSFI's revenue is derived from base assessments on FRFIs. Assessments are billed annually, usually in the second quarter of the fiscal year. As a result of this annual cycle, some accounts in OSFI's Statement of Financial Position can vary significantly throughout the year. In between base assessment billings, OSFI's cash entitlement balance decreases gradually as payments pertaining to operational costs and asset acquisitions are issued. Similarly, OSFI's accrued base assessments balance increases, to reflect expenses incurred but not yet billed. After the base assessments are billed and collected, cash and accounts receivable increase, as do unearned base assessments. OSFI last invoiced its base assessments in August 2024.

During the three months ended June 30, 2025, OSFI's cash entitlement balance decreased by $67.1 million, its trade and other receivables increased by $2.2 million, and its accrued base assessments increased by $69.2 million.

As explained in Note 2 (a) to the financial statements, OSFI has a revolving expenditure authority from the Treasury Board Secretariat to draw upon the Consolidated Revenue Fund to ensure the availability of funds prior to receipt of revenue. Additional information on OSFI's sources and uses of cash can be found in its Statement of Cash Flows .

Statement of operations

OSFI operates on a cost recovery model. Assessment revenue is recorded at an amount necessary to balance revenue and expenses after all other sources of revenue are taken into account. OSFI's total expenses for the three months ended June 30, 2025, were $76.4 million, a $2.0 million or 2.7% increase from the same period last year primarily due to increased personnel costs from normal escalation / merit increases.

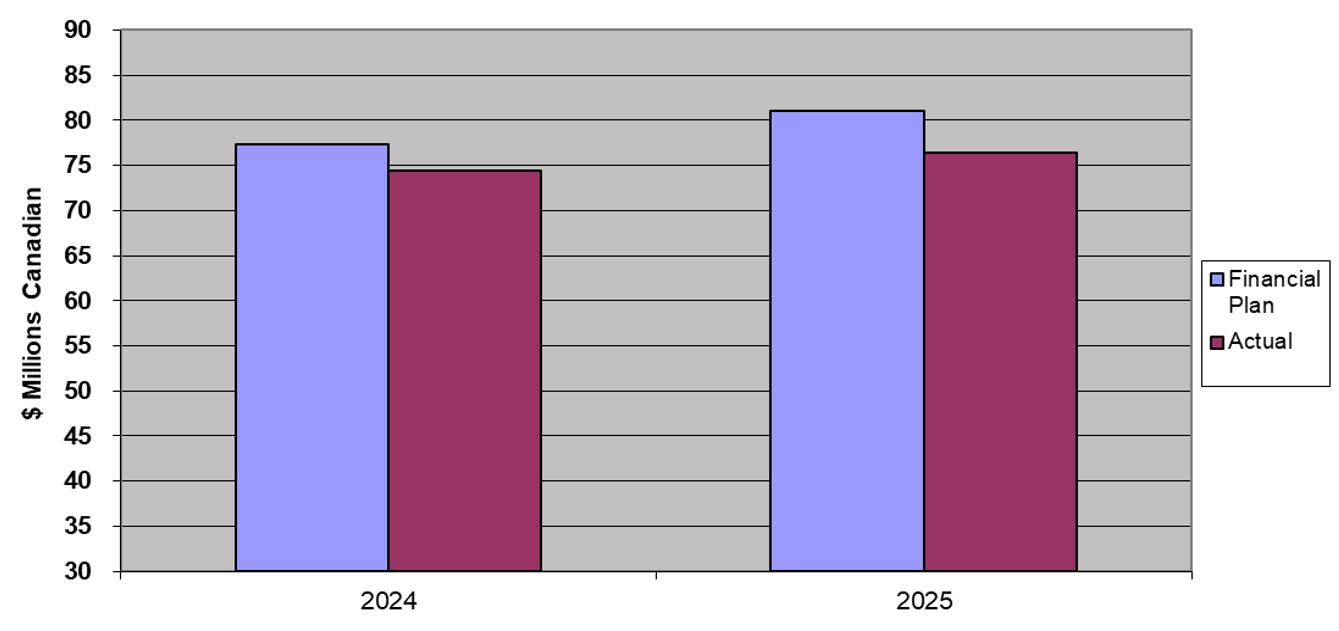

OSFI's total year-to-date expenses of $76.4 million were $4.7 million or 5.8% lower than planned (versus $3.0 million or 3.9% lower than planned for the same period last year). OSFI monitors its performance via monthly reporting and regular forecast exercises.

Chart 1 – Text version

| 2024 | 2025 | |

|---|---|---|

| Financial Plan ($million Canadian) | $77.4 | $81.1 |

| Actual ($millions Canadian) | $74.4 | $76.4 |

Government funding

In addition to its assessment and cost-recovered services revenues, OSFI was granted a parliamentary appropriation of $1.3 million for the fiscal year ending March 31, 2026 (2025 - $1.4 million). During the three months ended June 30, 2025, OSFI recognized $0.3 million (2024 - $0.3 million) of this annual amount.

Risks and uncertainties

OSFI operates in a constantly changing environment reflected in uncertain economic and financial conditions and an industry that can undergo periods of rapid change and that is becoming increasingly complex. The intensity and pace at which the risk environment is changing requires a reimagining of OSFI's approach to its risk appetite. OSFI needs a more rigorous and future focussed risk appetite framework that grapples with both identified and other yet-to-be foreseen risks. The risks that exist in such circumstances can have financial consequences, thereby affecting financial statements.

Enterprise risks

Through its Enterprise Risk Management (ERM) framework and processes, OSFI identifies its key external and internal risksFootnote 1. While OSFI continues to actively address the suite of risks covered by its framework, it also monitors for new ones.

External risks

External risks are closely monitored. For a fulsome narrative of external risks currently faced by the Canadian financial system, and the actions OSFI is taking in response (Integrity and security risk, Wholesale credit risk, Funding and liquidity risks, and Real estate secured lending and mortgage risks), please consult OSFI's 2025-26 Annual Risk Outlook.

Other key risks

It is worth noting the interdependencies that the four ARO risks have on industries we regulate and supervise. For instance, a housing market downturn could cause stress in the mortgage insurance industry. Credit risks and market volatility could impact investment portfolios, asset liability management, and hedging strategies for all insurers.

OSFI considers risks related to deposit-taking institutions, as well as those that are unique to the insurance and pension industries. For example, the impact of a large earthquake and changing weather and flood patterns on the property and casualty industry, as well as changes to life expectancy, impacts both life insurers and pension plans.

OSFI also assesses many other risks posed by cyber and technology, climate, third party outsourcing, and transmission risk from the less regulated or unregulated financial sector. We continue to monitor the number and severity of disruptive events arising from these risks. These events underscore the importance of operational resilience at institutions and pension plans. The direct costs and, more importantly, the reputational impacts of prolonged disruptions or outages can negatively impact the resilience and stability of an institution and create risk.

Internal risks

OSFI manages a suite of internal risks to support effective decision-making, optimally allocate resources and the investments needed to mitigate them appropriately. Areas of focus pertain to:

Information security

Given the external risk environment that reflects heightened cyber security and geopolitical risks, OSFI has recently modified its organizational structure, including hiring a new Chief Information Security Officer which underscores the importance of enhancing information security. This will help further mitigate the risk of unauthorized access or inappropriate use of sensitive information. OSFI is also enhancing its Cyber Security Strategy to manage information security risks.

Internal change agenda and organizational change management maturity

OSFI has undertaken several significant business changes in recent years, including enhancing its supervisory framework, organizational model alignment to address an increasingly complex risk environment and its expanded mandate of integrity and security, data and technology renewal, and a hybrid work model. There is a risk that delivering OSFI's internal change agenda could impact the effective delivery of its core mandate or impact its culture in terms of workforce wellbeing due to change fatigue. To mitigate this risk, OSFI's 2024-27 3-year Strategic plan supported by an annual single, enterprise-wide Operational Plan guides this transformation. Additionally, extensive efforts continue to be deployed in the area of change management.

Human resources capacity and capability

OSFI's success is dependent upon having employees with highly specialized knowledge, skills, and experience to regulate and supervise FIs. There is a risk that OSFI's human capital may be inadequate to deliver on its mandate due to skill gaps, experience gaps, a lack of technical knowledge to keep pace with FIs' evolving business models (FinTech), turnover, succession planning/ key person risk, or poor performers. In response to this risk, OSFI has been advancing the implementation of its comprehensive Human Capital Strategy since its launch in 2024. Efforts are underway to manage risks related to employee resilience following OSFI's transition to a hybrid workplace model.

Financial institution information and data

There is a risk that OSFI may over-rely on information provided by FIs' management to assess the quality of portfolios or that the FI data collected and OSFI's management of it are inadequate to effectively deliver on OSFI's mandate. This risk has increased in recent years due to the use of artificial intelligence in models for decision-making at FIs. OSFI continues to advance leading-edge data management, collection and analytical capabilities and systems.

Financial risks

Financial risks, primarily liquidity risk and credit risk, are closely managed and continue to be rated low. Please refer to Note 11 to the financial statements for a full analysis of the financial risks to which OSFI is exposed.

Significant changes in relation to operations, personnel and programs

There have been no significant changes in relation to Operations, Personnel and Programs during the quarter ended June 30, 2025.

Approval by Senior Officials

Approved by,

Adelle Laniel, CPA

Chief Financial

Peter Routledge,

Superintendent