Guide for Incorporating Federally Regulated Insurance Companies

Document Properties

- Type of Publication: Instruction Guide

- Category: Application Guides

- Date: December 2001

- Revised: August 2004

- Revised: May 2013

- Audiences: Life insurance companies and fraternal benefit societies, Property and casualty companies

Table of contents

Introduction

The Office of the Superintendent of Financial Institutions (OSFI) is responsible for administering a number of federal statutes, including the statute applicable to the regulation of federally incorporated insurance companies (the Insurance Companies Act (ICA)). As part of the regulatory process, OSFI assesses applications for incorporation and makes recommendations to the Minister of Finance (the Minister), the individual that has the ultimate responsibility for approving the incorporation of a federal regulated insurance company (FIC) under the ICA.

Please note that the May 2013 revisions to this Guide reflect OSFI’s expectations and practices as at December 31, 2012. As these expectations and practices continue to evolve, this Guide will be updated when and as needed.

Purpose

This Guide sets out the various prudential, regulatory and legislative criteria and information requirements relative to applications for the incorporation of a FIC.Footnote 1 One of the primary objectives of this Guide is to promote awareness and enhance the transparency of the assessment criteria and processes for the incorporation of a FIC.

Part I of this Guide identifies the information that applicantsFootnote 2 are generally expected to submit in support of an application to the Minister seeking the issuance of letters patent of incorporation (Letters Patent) establishing the FIC. Part II identifies the information that is generally expected in support of the subsequent application to the Superintendent of Financial Institutions (the Superintendent) for the making of an order to commence and carry on business (Order). Part III provides administrative guidance.

OSFI will generally evaluate a proposed incorporation against the criteria in this Guide; however, as the particular circumstances and facts of each application are different, this Guide should not be viewed as an exhaustive set of criteria and information requirements.Footnote 3 OSFI officers from the Regulatory Affairs Division and Supervision Sector jointly review and assess each application for the incorporation of a FIC.

This Guide does not apply to:

- the establishment of a foreign insurance branch in Canada;Footnote 4 or

- the incorporation of, or continuance as, an insurance holding company, mutual company or fraternal benefit society.

Applicants are encouraged to contact OSFI for further information regarding the establishment, incorporation or continuance of these entities.

Please note that this Guide relates solely to the ICA and does not address any provincial or territorial requirements, or Assuris or PACICC requirements, that may apply to a FIC’s insurance activities in Canada. Accordingly, OSFI recommends that:

- applicable provincial and territorial insurance statutes be reviewed, and the agencies that administer them be consulted, in connection with the business of a proposed FIC; and

- the applicable membership requirements of Assuris (the life insurance compensation fund)Footnote 5, or the Property and Casualty Insurance Compensation Corporation, be reviewed, and that compensation fund officials be consulted accordingly.

Overview

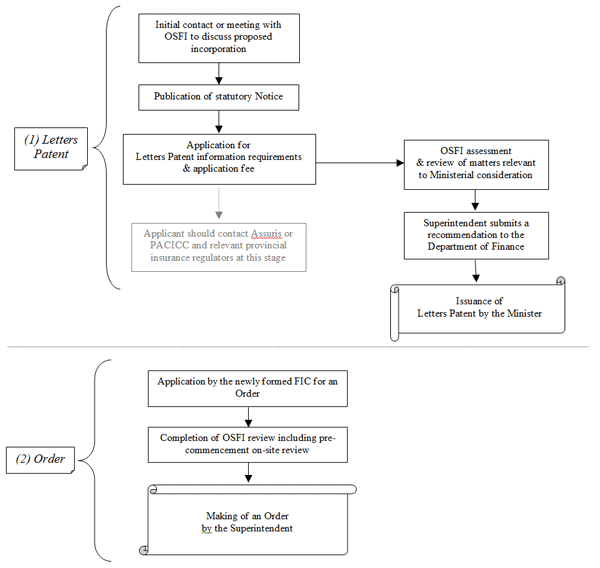

There are two main components involved with an application to establish a FIC in Canada: (i) obtaining Letters Patent from the Minister; and (ii) obtaining an Order from the Superintendent.

Part I of this Guide deals with obtaining Letters Patent, which are issued by the Minister upon recommendation of the Superintendent. Part II deals with obtaining an Order, which is made by the Superintendent after the Letters Patent have been issued. Part III provides administrative guidance to applicants in respect of Parts I and II.

Initial Discussion with OSFI

Prior to filing an application, prospective applicants are strongly encouraged to contact OSFI to schedule an initial discussion with the Regulatory Affairs Division regarding the nature of the proposed FIC, including an overview of the proposed owners, ownership structure, the business plan and the eligibility requirements.Footnote 6 This discussion provides an opportunity for OSFI to identify those persons who should be considered applicants for the purpose of this Guide, as well as any apparent or potential regulatory, prudential or public policy issues.

Notice of Intention to Apply

Before making an application, the prospective applicant must give notice of its intention to apply for Letters Patent (Notice). The primary purpose of the Notice is to inform the public of the identity of the persons making the application and to allow for public comment. The ICA states that the Notice must be published once a week for four consecutive weeks in the Canada Gazette and in a newspaper in general circulation at or near the place where the head office of the FIC is to be situated. The ICA also specifies that the Notice must be in a form satisfactory to the Superintendent. As such, a draft copy of the Notice should be provided to OSFI for review prior to publication to avoid the possibility of having to republish the Notice.Footnote 7 In this regard, OSFI’s expectation is that the Notice will set out:

- the name of the applicant;

- the geographical location/jurisdiction of the applicant;

- the proposed name of the FIC; and

- a brief description of the proposed activities of the FIC.

The ICA provides that a person may formally object to the proposed incorporation of a FIC by submitting the objection, in writing, to the Superintendent within 30-days of the last publication of the Notice. Where an objection is submitted, the Superintendent will assess its merits and determine whether a public inquiry into the objection is warranted, informing the Minister of the objection and the findings of any such inquiry.

At or around the time at which an application is made to incorporate a FIC, applicants are encouraged to contact Assuris (the life insurance compensation fund) or the Property and Casualty Insurance Compensation Corporation (PACICC), as the case may be, to ascertain the requirements for membership. As the regulation of FICs is shared between the federal and provincial and territorial governments, applicants are also encouraged to engage the relevant provincial and territorial insurance regulators at this time with respect to any licensing and other regulatory requirements in those jurisdictions.

OSFI Review Process

Part I (Letters Patent)

OSFI will review the whole application with a view to ascertaining whether the criteria related to the Ministerial approval for the issuance of the Letters Patent have been met.Footnote 8 In this regard, and prior to recommending that the Minister issue Letters Patent, the primary emphasis of OSFI’s review will focus on determining whether the following broad considerations – which are further informed by the requirements set out in the remainder of this Guide – have been satisfied:

- the applicant has sufficient resources to provide continuing financial support to the proposed FIC;

- the applicant’s business record and experience is appropriate;

- the applicant is of good character and integrity and has a good reputation;

- any concerns raised by the application relative to Canada’s national security, international relations and international legal obligations are addressed;Footnote 9

- the business plan for the proposed FIC is sound and feasible;

- the applicant has adequately assessed the risks to which the proposed FIC will be exposed and has satisfied OSFI that it has the capability to implement, prior to the commencement of business by the FIC, proper policies, processes and systems in place to monitor and mitigate those risks;

- the proposed FIC’s initial capital will be sufficient to support the business plan and provide adequate protection to policyholders and creditors;

- the prospective managers and directors of the proposed FIC have the necessary experience and competence to fulfil their roles;

- any integration of the applicant’s businesses and operations with those of the proposed FIC is appropriate for the proposed FIC;

- any supervisability concerns presented by the ownership structure of the proposed FIC are addressed;

- any legislative compliance or public policy issues raised by the application are addressed; and

- the issuance of the Letters Patent will be in the best interests of the financial system in Canada.

Applicants should also note that additional information will be requested if the proposed FIC is to be a subsidiary of a foreign institutionFootnote 10 and the application for letters patent to incorporate the FIC is made by a non-World Trade Organization (WTO) Member foreign institution.Footnote 11

OSFI will review the application and will contact the applicant to discuss its completeness, status, and outstanding issues. Where necessary, OSFI will request additional information to complete the assessment of the application, which may include additional corroborating information or analysis from third parties. OSFI’s assessment will also be informed by its experience of the actual performance of existing FICs in similar business lines.

OSFI may discontinue its review of an application where, in OSFI’s view, based on the quality of the applicant’s submissions, and despite significant feedback from OSFI, the applicant is unable to satisfy the information requirements in support of the application. In this regard, applicants should note that they bear the onus of satisfying OSFI’s information requirements in a timely, clear and complete manner.

Part II (Order)

OSFI’s review relative to the making of the Order will focus on whether the FIC’s management, policies, processes and systems are in place and meet OSFI’s expectations. Part II of the process will normally culminate in an on-site review of the FIC by OSFI to determine whether the FIC is sufficiently prepared to commence business operations.

Application Timeframes

While there is no specific time limit on the assessment of applications, OSFI endeavours to complete all application assessments as quickly as possible. As the assessment of each application will depend on its own specific facts and circumstances, applicants should note that the issuance of Letters Patent and an Order for a new FIC is generally expected to take at least 12 to 18 months from the initial application to completion. OSFI will communicate regularly with the applicant throughout this process.

In OSFI’s experience, delays in receiving the requested approval(s) most often result from the complexities presented in the application, the provision of incomplete information by the applicant in support of the application, and/or a failure on the part of the applicant to sufficiently address additional information requests from OSFI in a timely manner. In such circumstances, the above noted timeframe may be significantly longer.

Applicants should also note that a newly incorporated FIC may require several months to prepare for the on-site review prior to receiving its Order, and the timing related to the making of an Order will largely depend on the on-site review readiness of the FIC. In this regard, applicants should note that subsection 57(3) of the ICA specifies that the Superintendent shall not make an Order more than one year after the issuance of Letters Patent incorporating the FIC.

PART I

1.0 Requirements for the Issuance of Letters Patent by the Minister

OSFI expects applications to contain all the information requirements set out in sections 1.1 to 1.9 of this Guide. The level of detail of the information to be provided will depend on the size of the proposed FIC, its corporate group, the ownership structure of the applicant and the nature, complexity and related inherent risks of the proposed FIC’s business.

In certain circumstances, it may not be feasible for an applicant to provide all the information set out below at the time of the application. Where this is the case, applicants should explain to OSFI which information items will be provided at a later date. OSFI will not, however, begin its review of an application until the Notice has been published and the commitment referred to in section 1.1(r) of this Guide has been provided.

1.1 Ownership and Financial Strength

The applicant is generally expected to provide, as applicable:

- the name of the applicant;

- the name of the jurisdiction and date of incorporation or establishment of the applicant;

- the address of the principal place of business and head office of the applicant;

- a certified copy of the constating documents and current company by-laws of the applicant;

- the current organization chart (with percentages owned) of the applicant’s corporate group, including entities in which the applicant (and any of its parents that are not also applicants) beneficially owns 10% or more of the voting rights (indicate by an asterisk whether any of the entities shown on the chart operate in Canada, and provide a summary of these operations);

- details regarding any voting agreement or other similar arrangements that involve persons exercising direct or indirect control over the applicant;

- the names of all persons owning more than 10% of any class of shares or ownership interests in the applicant (and in any of its parents that are not also applicants), and the percentage of shares or ownership interests held (to the extent not already shown in the organization chart referred to in (e), Text for screen readers: (e) = , above);

- details of any shares or ownership interests of the applicant (and any of its parents that are not also applicants) that are held by a government or a political subdivision, an agent or agency thereof, together with a summary of its involvement in the operation and affairs of the applicant;Footnote 12

- a summary of the current and proposed financial services and other key activities carried on by the applicant and its affiliates (other than the proposed FIC), including a list of jurisdictions in which they operate and the nature and degree of regulatory oversight applicable to the financial services activities;

- if the applicant is a foreign-owned financial institution:

- the name and contact information of an individual from the applicant’s home regulator that is familiar with the applicant’s activities,

- confirmation that the applicant’s home regulator is aware of the applicant’s intention to incorporate the proposed FIC, details regarding whether the applicant requires regulatory approval from its home regulator to incorporate the proposed FIC, and if so, confirmation that any such approval has been obtained,

- information on whether, and in what manner, the applicant is subject to comprehensive consolidated supervision and regulation by its home regulator, and

- a report of the examination in respect of the applicant, issued by its home regulator, if available, or confirmation from the applicant’s home regulator that it reports favourably on the applicant;

- a copy of the most recent annual report of the applicant (and of any of its parents that are not also applicants);

- the audited consolidated financial statements of the applicant (and of any of its parents that are not also applicants) for the last three years (balance sheet, income statement, statement of changes in shareholders’ equity);Footnote 13

- a copy of the most recent report on the applicant (and on any of its parents that are not also applicants) issued by a recognized credit rating agency, if available;

- details of whether the applicant (and any of its affiliates that are not also applicants) has been denied a request to establish a financial institution or a branch;

- details of whether the applicant (and any of its affiliates that are not also applicants) has been the subject of any criminal proceedings or administrative sanctions;

- details in support of the applicant’s capacity to provide continuing financial, managerial and operational support to the proposed FIC, including:

- if the applicant is, or controls, a regulated financial institution, confirmation that the institution meets the minimum capital requirements in its home jurisdiction,Footnote 14 and

- if the applicant is not a regulated financial institution, a list of its corporate group’s principal competitors, the key financial metrics for the group’s industry (e.g., return on equity, debt to equity) and, for each metric identified, the industry average in each of the past 5 years and the group’s performance against the average;

- if the applicant is an individual:

- a completed OSFI Security Information Form,Footnote 15

- a curriculum vitae, and

- information that demonstrates that the applicant has, or has access to, the necessary resources to provide on-going financial support to the FIC;

- at the time the application is filed, a written commitment from the applicant to provide the proposed initial capital of the FIC as detailed in the business plan of the FIC;

- a certified copy of a resolution of the board of directors of the applicant approving the application; and

- if the applicant, or an entity affiliated with the applicant, is an entity referred to in section 508 of the Bank Act (BA), an analysis demonstrating compliance with Part XII of the BA.Footnote 16

1.2 Business Plan

The applicant is generally expected to provide a minimum three-year business plan for the proposed FIC, including:

- the reasons why the applicant is seeking to establish a FIC;

- an analysis of target markets and opportunities that the FIC will pursue and the plans to address them;

- an analysis of competitors, showing both challenges and opportunities, and plans to address them;

- the reasons why the applicant believes that the FIC will be successful, and the overall strategy for achieving this success, including a discussion of key assumptions;

- the location(s) of the proposed office(s) and/or agency(ies) of the FIC in Canada;

- a detailed description of each line of business to be conducted by the FIC and the products and services to be offered, including how the lines of business interrelate;

- an analysis on how the risks that the FIC would insure, in respect of its lines of business, fall within the classes of insurance set out in the Schedule to the ICA;

- details regarding the projected insurance policy limits by class of insurance;

- sources of initial and future capital in the form of a capital plan and funding policies;

- three-year pro forma financial statements (base case) for the FIC, including:

- balance sheet,

- income statement showing premium volumes on a gross and net basis, premiums earned, net claims and adjustment expenses, acquisition expenses, investment income and net income,

- details regarding any key assumptions, including actuarial assumptions, supporting the pro forma financial statements, including those related to underlying claims, valuation, pricing, underwriting, expenses, and persistency of policies, and

- detailed calculations of financial ratios relevant to the proposed business of the FIC;Footnote 17

- a detailed description of all projected reinsurance arrangements involving the FIC, including planned net retentions per class of insurance requested;Footnote 18

- if the applicant is proposing to establish a property and casualty FIC, three-year pro forma Minimum Capital Test (MCT)Footnote 19 calculations or Mortgage Insurer Capital Adequacy Test (MICAT)Footnote 19 calculations, as applicable, or if the applicant is proposing to establish a life FIC, three-year pro forma Life Insurance Capital Adequacy Test (LICAT)Footnote 20 calculations, including:

- base case and scenario stress testing supporting the FIC’s proposed internal target ratio showing the results on the base case business plan (including a worst case scenario and a scenario with a maximum single loss),Footnote 21

- a detailed description of the applicant’s contingency plans to address the worst case and other adverse scenarios, and

- details regarding the source(s) of the initial and future capital provided for in the base case, worst case and other adverse scenarios;Footnote 22

- a detailed description of any proposed material outsourcing arrangements involving the FIC and how these arrangements would be managed;Footnote 23

- the intended financial year-end for the FIC; and

- a copy of any proposed shareholders’ agreement.

1.3 Management

The applicant is generally expected to provide:

- details regarding the projected staff complement and an organization chart showing reporting lines for senior positions and key responsibilities in the FIC over the lifespan of the business plan, including proposed mandates for each senior position and any senior management committees;

- details regarding the hiring criteria, including knowledge and experience, for each senior position;

- information on each proposed senior officer of the FIC, including:

- a completed OSFI Security Information Form,Footnote 24

- the title of the position the individual would hold within the FIC,

- details of whether the individual, and/or any entity in which the individual is or was a senior officer, have been the subject of any criminal proceedings or administrative sanctions, and

- the individual’s current curriculum vitae demonstrating that the individual has the necessary qualifications and expertise to manage or direct the FIC’s proposed business;

- the name and address of the proposed appointed actuary of the FIC and confirmation that the proposed appointed actuary meets the suitability requirements set out in the ICA and OSFI guidance;Footnote 25 and

- the name and address of the proposed external audit firm, and the specific partner of that firm, that will be responsible for auditing the FIC, and confirmation that the proposed external auditor meets the suitability requirements set out in the ICA.Footnote 26

1.4 Risk Management: Policies, Procedures and Risk Management Controls

The applicant is generally expected to provide:

- a detailed description of all risks to which the FIC would be exposed as well as the manner in which it would monitor and manage these risks, including:

- market and credit risk,

- operational and regulatory compliance risk,

- reputational and strategic risk, and

- product design, pricing and underwriting risk;

- draft copies of the FIC’s proposed:

- stress testing policies and procedures,Footnote 27

- reinsurance risk management policy,Footnote 28

- operational risk management policies,Footnote 29

- business continuity management policy, business impact analysis and plans for business continuity and disaster recovery,Footnote 30

- investment and lending policies, standards and procedures,Footnote 31

- compensation policy for all human resources,Footnote 32

- dividend and capital management policy,Footnote 33 and

- if applicable, the proposed provisioning policies and a description of the collective allowances that are anticipated in executing the FIC’s business plan;

- the name of the proposed senior officer to be responsible for risk management oversight of the proposed FIC and a description of the resources and authority allocated to discharge this responsibility;

- the risk appetite framework for the proposed FIC;Footnote 34 and

- details of any proposed risk management and control processes that will be integrated with those of the operations of the applicant or other entities in the applicant’s group.

1.5 Board of Directors and Committees

The applicant is generally expected to provide:

- the information listed in subsection 1.3(c) of this Guide in respect of each proposed director of the FIC;Footnote 35

- a description of:

- the compositionFootnote 36 and mandate of the proposed board of directors (the Board) and its committees,Footnote 37

- the Board’s proposed policies and practices,

- the proposed self-assessment programs of the Board, and

- the Board’s proposed responsibilities with respect to risk management and internal controls;Footnote 38

- a draft copy of the FIC's proposed conflict of interest policy and, if applicable, details regarding the oversight that will be provided by the management committee(s) of the FIC’s parent; and

- an analysis demonstrating that the proposed FIC’s corporate governance policies and practices will comply with OSFI’s Corporate Governance Guideline.Footnote 39

1.6 Internal Audit

The applicant is generally expected to provide:

- a description of the proposed mandate, organization structure, and methodology and practices of the internal audit function; and

- where applicable, a description of the involvement of any internal audit group(s) of the FIC’s affiliates to assess the internal controls of the FIC.

1.7 Compliance Management

The applicant is generally expected to provide a detailed description of the proposed internal controls, policies and procedures that the FIC would follow to ensure compliance with:

- the ICA and OSFI issued guidance, including the name of the proposed senior officer that would be responsible for such compliance, and a description of the resources and authority to be allocated to that person to discharge this responsibility;

- sections 83.08 to 83.12 of the Criminal Code and the Regulations Implementing the United Nations Resolutions on the Suppression of Terrorism (UNSTR) and related directives issued by OSFI and the Government of Canada, including the name of the proposed senior officer that would be responsible for compliance with the Criminal Code and UNSTR, and a description of the resources and authority to be allocated to that person to discharge this responsibility;

- the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), and related guidelines issued by the Financial Transactions and Reports Analysis Centre of Canada and OSFI Guideline B-8 - Deterring and Detecting Money Laundering, including the name of the proposed Chief Anti-Money Laundering Officer that would be appointed under the PCMLTFA, a description of the resources and authority to be allocated to that person to discharge this responsibility, and an assessment of the money laundering and terrorist financing risks relevant to the proposed FIC’s business plan; and

- all other pertinent Canadian legislation.Footnote 40

1.8 Information Technology

The applicant is generally expected to provide:

- a description of the FIC’s proposed information technology (IT) environment;

- a risk assessment of the IT operations;

- a description of any integration with third party systems;

- the proposed end user computing policy; and

- the proposed IT policy and governance structure, including roles and responsibilities, and details on resources and staffing.

1.9 Other Requirements

The applicant is also generally expected to provide:

- the FIC’s proposed by-laws, including capital by-laws;

- the proposed nameFootnote 41 of the FIC, in English, French, or both (as required), and a name search reportFootnote 42 accompanied by an analysis in support of the applicant’s conclusion that the proposed name of the FIC:

- is available for use in Canada, and

- is not prohibited by the ICA and meets the requirements of any other relevant Canadian legislation, including all pertinent financial institution statutes;Footnote 43

- where the proposed name of the FIC is substantially the same as that of an affiliated entity:

- the consent in writing of that entity, or from the controlling parent of the corporate group on behalf of that entity, to use the name, and

- a description of the mitigants already in place, or mitigating measures that the FIC would undertake, to avoid potential confusion in the marketplace;

- a statutory declaration or affidavit by a representative of the newspaper and Canada Gazette pertaining to the dates that the applicant’s Notice was published, along with a copy of the published Notice;Footnote 44

- an acknowledgement of the Support Principle;Footnote 45

- if the proposed FIC is to be a subsidiary of a non-WTO Member foreign institutionFootnote 46 that is engaged in the insurance business, the applicant must demonstrate that treatment as favourable for FICs exists, or will be provided, in the jurisdiction in which the non-WTO Member foreign institution principally carries on business, either directly or through a subsidiary;Footnote 47

- a draft copy of OSFI-57 Return of Corporate Information; and

- the non-refundable service charge in respect of the application, as required by the Service Charges (Office of the Superintendent of Financial Institutions) Regulations.Footnote 48

2.0 Letters Patent

The FIC comes into existence on the date provided in the Letters Patent. The Minister may set out in the Letters Patent terms and conditions in respect of the FIC’s business to address supervisory and regulatory concerns raised by the corporate structure of the applicant.

Please note that the FIC may not carry on any business until the Superintendent has made an Order in respect of the FIC.

PART II

3.0 Requirements for the Making of an Order by the Superintendent

Once the Letters Patent has been issued, and before an Order is made, OSFI must be satisfied that the FIC has the necessary systems, management structure, control processes and compliance management systems in place. All policies and procedures should be finalised and approved prior to the making of an Order. An on-site review is usually arranged after the issuance of Letters Patent and the anticipated areas for review and discussion will be provided by OSFI at that time. The purpose of the review is to assess the control processes and management systems referred to in section 1.4 of this Guide and to ensure that the FIC is capable of producing the required statutory and supervisory information in an accurate and timely manner at the commencement of operations.

In support of its application for an Order, the FIC is generally expected to provide:

- a certified copy of the minutes of the first meeting of the Board;

- a confirmation that the FIC has the required amount of paid-in capital;

- a certified copy of the minutes of the first meeting of the shareholders of the FIC;

- a detailed description of the amounts paid, or to be paid, by the FIC in connection with its incorporation and organization, and a statement that the amounts are reasonable;

- a signed letter of commitment by the FICFootnote 49 to the effect that it will provide OSFI with adequate advance notice of any proposed material changes to the business plan;Footnote 50 and

- a confirmation that the FIC has applied for membership in Assuris (the life insurance compensation fund), or the Property and Casualty Insurance Compensation Corporation, as the case may be.

4.0 Order

The FIC may only commence business on the date provided in the Order. The Superintendent may set out in the Order conditions or limitations on the FIC’s business to address supervisory and regulatory concerns.

The Superintendent may not make an Order more than one year after the day on which the FIC came into existence.Footnote 51 Therefore, the FIC should ensure that all of the information required for the issuance of an Order is submitted to the Superintendent as soon as possible after it receives its Letters Patent.

The FIC will be required to publish notice of the making of the Order in a newspaper in general circulation in the city where the FIC’s head office is located. OSFI is also required to publish a notice of the making of the Order in the Canada Gazette.Footnote 52

PART III

5.0 Administrative Guidance

This Part provides additional guidance to applicants in respect of ownership and the factors the Superintendent will take into account in determining OSFI’s ability to supervise and regulate a FIC.

5.1 Significant Interest and Control

Acquisitions of a significant interestFootnote 53 in, and/or controlFootnote 54 of, a FIC are subject to Ministerial approval.Footnote 55 Where such an approval is required in the context of the incorporation of a FIC, a separate application in respect of that acquisition is not necessary.

5.2 Part XII of the Bank Act

Where the applicant controls or is a major ownerFootnote 56 of a FIC, the applicant and its affiliates will, if they are entities referred to in section 508 of the BA, have a financial establishment in Canada (where the group does not already have such an establishment) for purposes of Part XII of the BA.Footnote 57 In such circumstances, the applicant and its affiliates become subject to an operating framework in Canada that is substantively equivalent to the one applicable to Canadian banks in certain areas, such as substantial investments.

5.3 Non-Eligible Applicants

Applicants who fall within the following categories are not eligible to apply for Letters Patent:

- Her Majesty in right of Canada or in right of a province, an agency of Her Majesty in either of those rights or an entity controlled by Her Majesty in either of those rights;

- the government of a foreign country or any political subdivision thereof;

- an agency of the government of a foreign country or any political subdivision thereof; or

- an entity that is controlled by the government of a foreign country or any political subdivision thereof, other than a foreign institution or a subsidiary of a foreign institution.Footnote 58

5.4 No Composite Companies

The ICA prohibits the establishment a composite FIC, namely, a FIC that would be authorized to insure both risks falling within the class of life insurance, and risks falling within any other class of insurance other than accident and sickness, credit protection insurance and other approved products insurance.Footnote 59

5.5 Reinsurance with a Related Unregistered Reinsurer

The ICA provides that, subject to approval of the Superintendent, a FIC may not cause itself to be reinsured, in respect of risks undertaken under its policies, by an “unregistered” related party (i.e., a related party that is neither a federally regulated insurance company nor a foreign insurer that would reinsure in Canada the risks).Footnote 60 Accordingly, if an applicant’s reinsurance program for the proposed FIC entails ceding risks to an unregistered related party, the applicant should refer to Transaction Instruction DA No 21 – Reinsurance with Related Unregistered Reinsurer with respect to the requisite approval of the Superintendent.

5.6 Supervision and Regulation (Supervisability)

In all applications to incorporate a FIC, the Superintendent will assess OSFI’s ability to supervise, examine and regulate the FIC effectively. This assessment will entail an examination of the proposed corporate structure. Where appropriate, the Superintendent may consider whether the proposed structure would hinder effective implementation of corrective measures in the future.

The Superintendent will generally consider the following factors in assessing the level of risk posed by the proposed corporate structure and its impact on OSFI’s ability to effectively supervise and regulate the FIC:

- the activities in which the FIC proposes to engage;

- the systemic importance of the proposed FIC, including the absolute size or intended role of the FIC, relative to the Canadian financial sector;

- the predominant nature of the applicant’s group-wide financial activities, including the extent of the financial services activities of the applicant’s group, having regard to:

- the complexity of the corporate structure of the group,

- the strategic direction of the group or the nature of the planned financial services of the group,

- the potential for prudential concerns (e.g., contagion, connected lending among members of the group),

- the size of the FIC relative to the group,

- the existence and extent of financial services activities carried on by the group in other jurisdictions, and

- the branding to be used by the FIC and the extent to which it differs from the branding used in respect of the other activities of the group;

- the extent to which the FIC will be an independent and self-sustaining operation with the authority to make decisions independent of the group, having regard to:

- the extent to which directors on the Board will be independent from the boards of the other entities in the group, and

- the extent of the involvement, if any, of the FIC’s management in the business and affairs of the other entities in the group; and

- the extent to which affiliates within the corporate group are supervised by other regulatory agencies with whom OSFI has concluded a Memorandum of Understanding pertaining to regulatory co-operation and to supervision of these affiliates.

There are various ways that supervisory concerns arising out of corporate structures could be addressed. One possibility would be for an applicant to address such concerns through an undertaking to OSFI that restricts certain activities of the corporate group.

Contact Details for Additional Information

All enquiries regarding the incorporation of a FRFI should be directed to:

- Office of the Superintendent of Financial Institutions

- Approvals

- Regulatory Affairs Division

- 15th Floor, 255 Albert Street

- Ottawa, Ontario, Canada, K1A 0H2

- Website: http://www.osfi-bsif.gc.ca/

- Email: approvals-approbations@osfi-bsif.gc.ca

Footnotes

- Footnote 1

-

In respect of the requirements related to applications for continuance, please refer to OSFI Transaction Instruction A No. 13 – Continuance of a Body Corporate and sections 32 through 38 of the ICA.

- Footnote 2

-

For the purpose of this Guide, any reference to applicant generally includes any entity or individual who would hold the shares of the FIC and any other person identified by OSFI.

- Footnote 3

-

The ICA provides broad authority to the Minister and Superintendent to take into account all matters that they consider relevant in the circumstances related to the granting of any approval (e.g., s. 1016.1 of the ICA).

- Footnote 4

-

Please refer to OSFI Transaction Instruction A No. 4 - Establishment of Branch by Foreign Insurer (Order to Insure in Canada Risks).

- Footnote 5

-

Please note that section 449 of the ICA generally requires life FICs to become a member of Assuris.

- Footnote 6

-

Please see, in particular, sections 1.2 and 5.3 of this Guide.

- Footnote 7

-

Review by OSFI of the draft Notice will ensure that the applicant has performed the requisite name use analysis, and that the form and information contained in the Notice provides the necessary information to the public. Please see sections 1.9(b) and (c), Text for screen readers: 1.9(b) and (c) = 1.9(2) and (3), of this Guide.

- Footnote 8

-

Please see section 27 of the ICA.

- Footnote 9

-

Please see section 1016.1 of the ICA.

- Footnote 10

-

Please see the definition of “foreign institution” in subsection 2(1) of the ICA.

- Footnote 11

-

Please see section 24 of the ICA and section 1.9(f) of this Guide.

- Footnote 12

-

Please see section 5.3 of this Guide.

- Footnote 13

-

If the person is a foreign entity, provide a comparison between the accounting standards used to complete the applicant’s financial statements and Canadian generally accepted accounting principles.

- Footnote 14

-

Please note that, in certain circumstances, OSFI may request that the applicant provide information that demonstrates that the institution meets the minimum capital requirements in both its home jurisdiction and in Canada.

- Footnote 15

-

The OSFI Security Information Form(s) must be provided to OSFI in the following two formats: (a) a signed and dated original hard-copy, and (b) an electronic version in Excel format. Once OSFI receives the completed forms, they are then forwarded to the relevant Canadian law enforcement and intelligence agencies to carry out the requisite background and security assessments. Please note that the time required by law enforcement and intelligence agencies to complete these assessments is not within OSFI’s control, and the Superintendent will generally not seek the Minister’s approval in respect of the Letters Patent until these assessments are completed without issue. As such, applicants are strongly encouraged to remit the completed OSFI Security Information Form(s) at the earliest possible stage in the application.

- Footnote 16

-

Please see section 5.2 of the Guide for additional information in this regard.

- Footnote 17

-

Premium volumes and sales targets should be supported by market studies in Canada and projected results should be compared to the peer group or industry as a whole. Major asset, liability, income and expense categories should also be identified, including start-up costs and any amount and description of off-balance sheet activities.

- Footnote 18

-

Please see OSFI Guideline B-3 - Sound Reinsurance Practices and Procedures.

- Footnote 19

-

Please see OSFI Guideline – Minimum Capital Test or Guideline – Mortgage Insurer Capital Adequacy Test, as applicable, and Guideline A-4: Internal Target Capital Ratio for Insurance Companies.

- Footnote 20

-

Please see OSFI Guideline - Life Insurance Capital Adequacy Test and Guideline A-4: Internal Target Capital Ratio for Insurance Companies.

- Footnote 21

-

Please see OSFI Guideline E-18 - Stress Testing. Applicants are strongly encouraged to contact OSFI to ensure scenarios correctly stress the FIC’s proposed businesses. Please note that the maximum single loss scenario should be calculated without regard to the probability of the event occurring leading to that loss. In addition, the maximum single loss scenario should explicitly set out the considerations of the relationship between: (a) the maximum policy limits offered by the FIC; (b) the FIC’s reinsurance arrangements; and (c) the FIC’s capital levels and MCT/MICAT/LICAT calculations.

- Footnote 22

-

Paragraph 57(1) of the ICA require that the FIC has paid-in capital of at least $5 million (CAD), or any greater amount that may be specified by the Minister, prior to the issuance of an Order. OSFI generally expects the internal MCT target ratio to be at least 300%, the internal MICAT target ratio to be at least 300%, and the internal LICAT ratio to be at least 150%, as the case may be, for all newly established FICs. OSFI generally expects that the initial amount of paid-in capital will be sufficient, at all times, to maintain the FIC’s MCT, or MICAT, or LICAT internal target ratio above its selected internal target for at least the first three years of operations.

- Footnote 23

-

Please see OSFI Guideline B-10 – Outsourcing of Business Activities, Functions and Processes.

- Footnote 24

-

Please see footnote 15.

- Footnote 25

-

Please see Division XIV of Part VI of the ICA and OSFI Guideline E-15 - Appointed Actuary: Legal Requirements, Qualifications and External Review.

- Footnote 26

-

Please see section 338 of the ICA.

- Footnote 27

-

Please see OSFI Guideline E-18 - Stress Testing.

- Footnote 28

-

Please see OSFI Guideline B-3 - Sound Reinsurance Practices and Procedures.

- Footnote 29

-

OSFI generally expects the FIC’s operational risk management policies to include policies related to the following: outsourcing risk, business continuity and disaster recovery, privacy risk, information technology, information management and security, physical security, fraud risk, and records retention. Please also see OSFI’s Supervisory Framework.

- Footnote 30

-

In particular, the FIC’s business continuity plan should ensure that the proposed FIC has in its possession or can readily access all records necessary to allow it to sustain business operations, meet its regulatory obligations, and provide all information as may be required by OSFI to meet its legislated mandate.

- Footnote 31

-

Please see OSFI Guideline B-1 - Prudent Person Approach, OSFI Guideline B-2 - Large Exposure Limits (life) or Guideline B-2 - Investment Concentration Limit for Property and Casualty Insurance Companies, as applicable.

- Footnote 32

-

The compensation policy is expected to be consistent with Financial Stability Board Principles for Sound Compensation and related Implementation Standards.

- Footnote 33

-

The capital management policy should detail the internal targeted levels of capital and describe ongoing monitoring procedures to ensure that the FIC will meet OSFI’s minimum capital requirements. Please see OSFI Guideline A-4: Internal Target Capital Ratio for Insurance Companies.

- Footnote 34

-

Please see OSFI’s Corporate Governance Guideline.

- Footnote 35

-

The proposed directors named in the application for Letters Patent hold office until the election of directors at the first shareholders’ meeting. Please note that OSFI will assess the strength of the Board at the time of incorporation and the Board’s effectiveness going forward.

- Footnote 36

-

Relevant financial institution and risk management expertise are key competencies for the Board. There should be reasonable representation of these skills at the Board and Board committee levels.

- Footnote 37

-

Particular attention should be given to the audit and conduct review committees. In this regard, subsection 165(2) of the ICA requires that the directors of the FIC establish audit and conduct review committees.

- Footnote 38

-

Please see OSFI’s Corporate Governance Guideline.

- Footnote 39

-

The corporate governance practices adopted by a FIC will likely depend on the nature, scope, complexity, and risk profile of that institution.

- Footnote 40

-

Please see OSFI Guideline E-13 - Legislative Compliance Management System.

- Footnote 41

-

The proposed name can be reserved under the ICA. Please see Index A No. 20 – Name Reservation for information requirements and administrative guidance in relation to name reservation applications.

- Footnote 42

-

OSFI will accept a Newly Upgraded Automated Name Search (NUANS) report, which includes a list of business names and trademarks that sound similar to the name being proposed. If the proposed FIC would conduct business in the Province of Québec, a search of the Québec Corporations Database at “Registraire des entreprises” is also required.

- Footnote 43

-

If the FIC will use both an English and French form of the proposed name, a name search report and corresponding analysis must be provided in respect of both forms of that name. Reference should also be made to OSFI Advisory 2002-01-R1 - Corporate Names, Registered Names and Trade Names.

- Footnote 44

-

Please see section 25 of the ICA.

- Footnote 45

-

The Support Principle that the applicant is expected to acknowledge will be provided by OSFI. Where no person will control the FIC, the applicant will not be required to provide this acknowledgement.

- Footnote 46

-

Please see subsection 2(1) of the ICA for the definition of “non-WTO Member foreign institution”.

- Footnote 47

-

Please see section 24 of the ICA.

- Footnote 48

-

A wire transfer, cheque or draft should be made payable to the “Receiver General for Canada”.

- Footnote 49

-

The letter of commitment that the FIC is expected to sign will be provided by OSFI.

- Footnote 50

-

Material changes to the business plan may include new product offerings, changes in management structure or growth of the business beyond what was contemplated in the initial business plan submitted in support of the application for Letters Patent.

- Footnote 51

-

Please see subsection 57(3) of the ICA.

- Footnote 52

-

Please see section 60 of the ICA.

- Footnote 53

-

Please see section 8 of the ICA.

- Footnote 54

-

Please see section 3 of the ICA.

- Footnote 55

-

Please see sections 407 and 407.1 of the ICA.

- Footnote 56

-

Please see subsections 507(9) and (10) of the BA.

- Footnote 57

-

Please see paragraphs 507(15)(d) and 507(16)(d) of the BA.

- Footnote 58

-

Please see section 23 of the ICA.

- Footnote 59

-

Please see section 445 of the ICA.

- Footnote 60

-

Please see section 523 of the ICA.