Business Specifications for the Climate-Related Risk Returns for Deposit-Taking Institutions

Information

Table of contents

Return files

Purpose

The purpose of the Climate Risk Returns is to collect standardized climate-related emissions and exposure data, directly from all institutions to enable OSFI to carry out evidence-based policy development, regulation, and prudential supervision as it pertains to climate risk management.

These returns capture data to enable quantification of the Deposit-Taking Institutions’ (DTIs’) 1) potential and realized physical risk exposures; and 2) potential transition risk exposures, as at fiscal year-end.

More specifically, these returns collect data on:

- asset exposures that are subject to physical risk, by geophysical location

- absolute greenhouse gas (GHG) emissions (Scopes 1, 2 and 3)

The data collection is confidential and will not be released publicly.

Application

These returns apply to all DTIs, except for foreign bank branches.

Frequency

Annual.

Filing Format

Returns are to be filed through RRS in .CSV format.

Implementation Date

These Returns are effective on or after October 31, for the following fiscal years:

- 2024, for Domestic Systemically Important Banks (DSIBs)

- 2025, for Small and medium size banks (SMSBs)

Reporting Date

The returns must be completed on a fiscal year-end basis and filed within 180 days of the fiscal year-end date.

For example, a DSIB with an October 31 fiscal year-end would complete its first return for the 2024 fiscal year, using data as at October 31, 2024 and file it by the end of April 2025. An SMSB with a December 31 fiscal year end would complete its first return for the 2025 fiscal year, using data as at December 31, 2025 and file it by the end of June 2026.

Contact Agency

Office of the Superintendent of Financial Institutions (OSFI).

Contact Person

For business and/or interpretation questions on the final version of the return, contact us through the Climate Risk Return email address: ClimateRiskReturn-ReleveRisquesClimatiques@osfi-bsif.gc.ca.

Key Terms and Definitions

| Key Term | Definition |

|---|---|

| Absolute emissions |

Volume of greenhouse gas (GHG) emissions expressed in tonnes of carbon dioxide-equivalent (CO2-e). For the purposes of this return, "absolute emissions" refers to generated emissions and not values relating to avoided emissions or emission removals. |

| Asset class |

A group of financial instruments that have similar financial characteristics. |

| Carbon dioxide-equivalent (CO2-e) |

The universal unit of measurement to show the global warming potential (GWP) of each of the seven greenhouse gases, expressed in terms of the GWP of one unit of carbon dioxide for 100 years. This unit is used to evaluate releasing different greenhouse gases against a common basis. |

| Exposure |

The book value of a facility or a position, or asset class thereof. |

| Financed Emissions |

Absolute greenhouse gas (GHG) emissions that DTIs and investors finance through their loans and investments. See absolute emissions. |

| Greenhouse gas (GHG) emissions |

Emissions of the seven greenhouse gases listed in the Kyoto Protocol–carbon dioxide (CO2); methane (CH4); nitrous oxide (N2O); hydrofluorocarbons (HFCs); nitrogen trifluoride (NF3); perfluorocarbons (PFCs); and sulphur hexafluoride (SF6). |

| Peril |

The four types of climate-related perils that may impact DTIs are : 1) wildfire, 2) flood, 3) Severe convective storms, and 4) hurricanes.

|

| Physical risks |

Risks resulting from climate change that can be event-driven (acute) or from longer-term shifts (chronic) in climate patterns. These risks may carry financial implications for entities, such as direct damage to assets, and indirect effects of supply-chain disruption. DTIs’ financial performance may also be affected by changes in water availability, sourcing and quality; and extreme temperature changes affecting entities’ premises, operations, supply chain, transportation needs and employee safety. |

| Scope 1 greenhouse gas (GHG) emissions |

Direct GHG emissions that occur from sources owned or controlled by the DTI —i.e., GHG emissions from combustion in owned or controlled boilers, furnaces, vehicles, etc. |

| Scope 2 greenhouse gas (GHG) emissions |

Indirect greenhouse gas (GHG) emissions from the generation of purchased or acquired electricity, steam, heating, or cooling consumed by the DTI. |

| Scope 3 greenhouse gas (GHG) emissions |

All other indirect GHG emissions (not included in Scope 2) that occur in the value chain of the reporting company. For the purposes of this return, Scope 3 emissions include the following categories (consistent with the GHG Protocol): (1) to (14) – DTI’s Own Emissions/Non-Financed Emissions Upstream:

Downstream:

See definitions of "Financed Emissions" above. |

| Transition risks |

Moving to a lower-carbon economy may entail extensive policy, legal, technology and market changes to address mitigation and adaptation requirements relating to climate change. Depending on the nature, speed and focus of these changes, transition risks may pose varying levels of financial and reputational risk to DTIs. |

| Value chain |

The full range of activities, resources and relationships related to a DTI’s business model and the external environment in which it operates. |

Units of Measurement for Reporting

Financial Figures

Reported financial figures, such as outstanding loan balances or investment security values, should be expressed in Canadian Dollars or Canadian Dollar Equivalent, with no commas or other separators, unless otherwise specified.

Greenhouse gas (GHG) Emissions

All reporting on Absolute GHG Emissions, including Scope 1, Scope 2 and Scope 3 emissions should be reported in metric tons of carbon dioxide-equivalent (tCO2-e).

Probabilities and Percentages

All probabilities and percentages should be reported as their decimal equivalents. For example, a probability of default (PD) of 1.09% should be reported as 0.01090.

Greenhouse gas emissions accounting

Regarding calculation of GHG emissions, the DTI is expected to use the latest GHG Protocol Corporate Accounting and Reporting Standard and the latest GHG Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard.

Regarding calculation of the portion(s) of Scope 3 GHG emissions, pertaining to the DTI’s Financed GHG emissions, the DTI is expected to use the latest Partnership for Carbon Accounting Financials’ (PCAF’s) Global GHG Accounting and Reporting Standard for the Financial Industry (PCAF Standard).

OSFI recognizes that there is often a lag between financial reporting and required data becoming available, such as a bank’s counterparty emissions data. Accordingly, for Financed GHG Emissions, the DTI may use the most recently available emissions-related data from entities within its value chain alongside its own current year financial data. For example, when filing for fiscal year 2024, use financial data for fiscal year 2024 and GHG emissions data for fiscal year 2023.

Structure of the Climate-Related Risk Returns for DTIs

Tabular Structure of the Climate-Related Data Return Templates

Each data return is structured to contain three types of data fields:

- Sub-Table Field

- Categorical Data Fields

- Calculated Data Fields

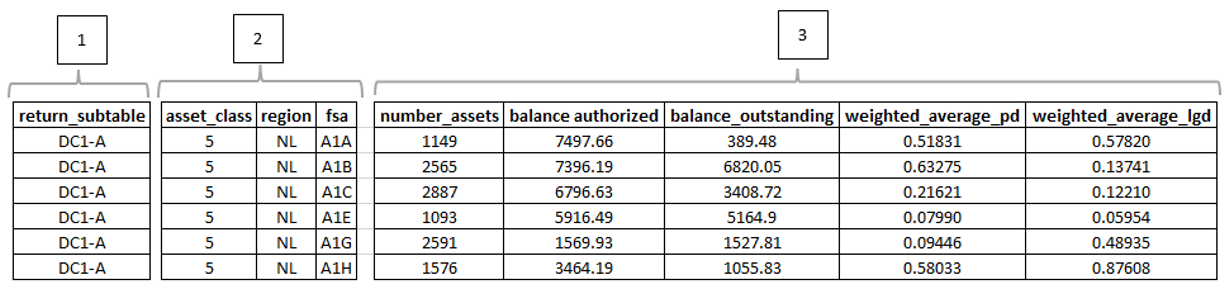

An illustration, using an example from the structure of the DC1 (OSFI 1000) Return, is shown below.

- Sub-Table Field: This data field is used to report the Sub-Table of the return (

return_subtable). See the section Return Sub-Tables below for further details. - Categorical Data Fields: These data fields are used to report qualitative data that are mutually exclusive. Categorical fields used in the Climate-Related Risk Returns for DTIs has submission keys as follows:

asset_class,region,sector,credit_qualityandfsa. - Calculated Data Fields: The data reported in these fields are to be calculated to reflect the maximum granularity established by the applicable Categorical Data Fields, unless otherwise noted. Referencing the illustration above, the number of loans reported as 1149 in the first row in the field

number_assetswould represent (be calculated as) the count of assets (loans) in the Forward Sortation Area (fsa) A1A that are of theasset_classcode ‘5’ (‘PSE’).

Reference Format

Submission keys that identify each data field being collected are included in the first row of each template. For ease of identification within this document, submission keys are formatted in lower case with underscored spacing, such as return_subtable.

For categorical fields, categorical codes and their related values are listed in single quotes, such as code ‘19’ and ‘Commercial Real Estate’ respectively.

Categorical Field Selections

Tables listing the comprehensive list of the codes (range of expected values) applicable to each of the categorical fields, other than fsa, are provided in the appendices to this document as follows:

- Appendix I – Asset Classes

- Appendix II – Regions

- Appendix III – Sectors

- Appendix IV – Credit Quality Ratings

These tables correspond to those included in the input templates for the DC1 (OSFI 1000) and DC2 (OSFI 1001) returns.

Return Sub-Tables

For reporting purposes, each return consists of a single data table that are divided into sub-tables that group related reporting data elements. The sub-tables for each of the returns are as follows:

| Return Sub-Table Name | Return Sub-Table Code | Applicable DTIs |

|---|---|---|

| Exposures and Credit Risk Metrics – In Canada by FSA | DC1-A | DSIBs, SMSBs |

| Exposures and Credit Risk Metrics – Outside of Canada by Region | DC1-B | DSIBs, SMSBs |

| Return Sub-Table Name | Return Sub-Table Code | Applicable DTIs |

|---|---|---|

| Entity-level DTI’s Own GHG Emissions by Scope | DC2-A | DSIBs, SMSBs |

| Financed GHG Emissions by Asset Class | DC2-B | DSIBs, SMSBs |

Field Applicability by Sub-Table

The fields applicable for each Sub-Table are outlined in the Field Applicability Matrices document (XLSX, 167 KB). As shown in the Field Applicability Matrices, the calculated fields are to be reported based upon the Return Sub-Table and the asset_class field value for both the DC1 (OSFI 1000) and DC2 (OSFI 1001) returns. Non-applicable fields should be reported as blank on each row.

Instructions for the Physical Risk Return DC1 (OSFI 1000)

This return collects foundational risk exposures and select credit risk data at an FSA level of geophysical granularity on loans subject to potential climate-related physical risk from DTIs within Canada, and at a regional level of granularity outside of Canada. The data collected will be combined with other climate peril data to assess DTIs’ exposures to physical risk.

Overview of Return Data Fields

The following fields are included in the DC1 (OSFI 1000) return template:

Sub-Table Field

return_subtable

Categorical Data Fields

asset_classregionfsa

Calculated Fields

number_assetsbalance_authorizedbalance_outstandingweighted_average_pdweighted_average_lgd

The above fields are to be reported by completing the template contained in the technical specifications document provided at DC1 (OSFI 1000) Technical Specifications (XLSX, 55 KB), following the instructions below for reporting loan exposures and credit metrics applicable in Canada and outside of Canada.

Field Applicability by Sub-Table

The fields applicable for each Sub-Table are outlined in the Field Applicability Matrices (See Link: Field Applicability Matrices document (XLSX, 167 KB)).

Sub-Table DC1-A: Exposures and Credit Risk Metrics – In Canada

Report on all fields in the template for loans to borrowers and/or secured on assets residing in Canada on each row, per the instructions by submission key below.

Sub-Table Field

return_subtable– Set field value to ‘DC1-A’

Categorical Data Fields

asset_class– Report the applicableasset_classcode per table in Appendix I – Asset Classes.region– Report the province or territory of Canada of the reportedfsaif applicable.fsa– Report the 3-digit Forward Sortation Area (FSA) location reference of the borrowers/assets, for Canadian addresses only. If the DTI’s reported assets, such as borrowings that are tied to physical location of assets for certain large accounts, such as corporates, banks or sovereign borrowers (e.g. Government of Canada) that cannot be specifically divided across multiple FSAs using available client data, DTIs should report using the code ‘ZZZ’ for the FSA.

Calculated Data Fields

number_assets– Report the count of the assets (e.g., non-residential mortgage loans) outstanding for a givenasset_classin each reportedfsabalance_authorized– Report the sum of the maximum gross dollar amounts of exposure authorized within a givenasset_classin each reportedfsabalance_outstanding– The sum of gross amounts of exposures outstanding for a givenasset_classin each reportedfsa-

weighted_average_pd– Report the exposure weighted average probability of default for theasset_classin each reportedfsawhere applicable.Note:

- DTIs applying the IRB approach to credit risk should report the regulatory capital PD weighted by outstanding amount

- DTIs not applying the IRB approach to credit risk should report the IFRS 9 PD weighted by outstanding amount

-

weighted_average_lgd– Report the exposure weighted average LGD for theasset_classin each reportedfsaNote:

- DTIs applying the IRB approach to credit risk should report the regulatory capital LGD weighted by outstanding amount

- DTIs not applying the IRB approach to credit risk should report the IFRS 9 LGD weighted by outstanding amount

Amounts reported for balance_authorized and balance_outstanding should be calculated as the sums of each type of exposure at the appropriate level of granularity. weighted_average_pd and weighted_average_lgd reported should reflect the exposure weighted average for each asset_class for each fsa.

Sub-Table DC1-B: Exposures and Credit Risk Metrics – Outside Canada (By Region)

Report on all fields in the template for loans to borrowers and/or secured on assets residing outside Canada. Report all fields in the template, per the instructions by submission key below. However, the fsa data field should be reported as blank on each reported row.

Sub-Table Field

return_subtable– Set field value to ‘DC1-B’ on each row reported

Categorical Data Fields

asset_class– Report the applicableasset_classcode per table in Appendix I – Asset Classes.region– Report the applicable code for eachregionof the USA and the ‘Other’ geographic region per the table in Appendix II – Regions on each row reported. If the DTI’s reported assets, such as borrowings that are tied to physical location of assets by for large client accounts in the USA, such as corporates, banks or sovereign borrowers that cannot be specifically divided across multiple regions using available client data, DTIs should report using theregion‘USA-Other’.fsa– Report as blank (this field is applicable In Canada only)

Calculated Data Fields

number_assets– Report the count of the loans outstanding for a givenasset_classin each reportedregionbalance_authorized– Report the sum of the maximum gross dollar amounts of exposure authorized within a givenasset_classin each reportedregionbalance_outstanding– The sum of gross amounts of exposures outstanding for a givenasset_classin each reportedregion-

weighted_average_pd– Report the exposure weighted average probability of default for theasset_classin each reportedregionNote:

- DTIs applying the IRB approach to credit risk should report the regulatory capital PD weighted by outstanding amount

- DTIs not applying the IRB approach to credit risk should report the IFRS 9 PD weighted by outstanding amount

-

weighted_average_lgd– Report the exposure-weighted average LGD for each applicableasset_classin each reportedregionNote:

- DTIs applying the IRB approach to credit risk should report the regulatory capital LGD weighted by outstanding amount

- DTIs not applying the IRB approach to credit risk should report the IFRS 9 LGD weighted by outstanding amount

Amounts reported for balance_authorized and balance_outstanding should be calculated as the sum of each type of exposure for each asset_class for each region that is outside of Canada. weighted_average_pd and weighted_average_lgd should be calculated to reflect the exposure weighted average for each applicable asset_class for each region that is outside of Canada.

Additional Reporting Guidance

The technical specifications document for the DC1 (OSFI 1000) return, that includes a template sheet, field definitions and reference tables is available at DC1 (OSFI 1000) Technical Specifications (XLSX, 55 KB). For a reference example of a completed template that contains an abbreviated listing of completed rows following the above DC1 (OSFI 1000) template instructions, see the sample DC1 (OSFI 1000) Return template (CSV, 6 KB).

Instructions for the Transition Risk Return DC2 (OSFI 1001)

This return collects entity-level absolute GHG emissions by scope, including Scope 3 Financed GHG Emissions that are assigned to Investment Securities and Loans.

Overview of Return Data Fields

The following fields are included in the DC2 (OSFI 1001) Return templates:

Sub-Table Field

return_subtable

Categorical Data Fields

asset_classsectorregioncredit_quality

Calculated Fields

scope_1_dti_own_emissionsscope_2_dti_own_emissionsscope_3_dti_own_emissionsscope_1_counterparty_absolute_emissionsscope_2_counterparty_absolute_emissionsweighted_avg_scope_1_counterparty_data_quality_scoreweighted_avg_scope_2_counterparty_data_quality_scoreweighted_avg_counterparty_data_quality_scoreasset_balanceweighted_average_maturitybalance_5_maturitybalance_10_maturity

The above fields are to be reported by completing the template contained in the technical specifications document provided at DC2 (OSFI 1001) Technical Specifications (XLSX, 59 KB), following the instructions below for reporting loan exposures and credit metrics applicable in Canada and outside of Canada.

Field Applicability by Sub-Table

The fields applicable for each Sub-Table are outlined in the Field Applicability Matrices (See Link: Field Applicability Matrices document (XLSX, 167 KB)).

Sub-Table DC2-A: Entity-level GHG Emissions by Scope

Report emissions by scope for each row using the instructions by submission key below.

Sub-Table Field

return_subtable– Report field value as ‘DC2-A’

Categorical Data Fields

asset_class– Set field value to code ‘26’ (‘Unattributable – GHG emissions unattributable to a specific asset’) for each row reported; reporting on other asset categories is not applicable for Sub-Table DC2-A (see Field Applicability by Sub-Table section above for details)sector– Not applicable; report as blankregion– Report theregioncode applicable province or territory of Canada, Region of USA or ‘Other’ geographic region per the table in Appendix II – Regionscredit_quality– Not applicable; report as blank

Calculated Data Fields

scope_1_dti_own_emissions– Report the DTI’s Own Scope 1 Absolute GHG Emissions (in tCO2-Equivalent) produced within each reportedregionscope_2_dti_own_emissions– Report the DTI’s Own Scope 2 Absolute GHG Emissions (in tCO2-Equivalent) within each reportedregionscope_3_dti_own_emissions– Report the DTI’s Own Scope 3 Absolute GHG Emissions (in tCO2-Equivalent) within each reportedregion- Report the following fields as blank on each row:

asset_balanceweighted_average_maturitybalance_5_maturitybalance_10_maturity

Sub-Table DC2-B: Financed GHG Emissions by Asset Class

For purposes of reporting Scope 3 Financed Emissions, report on each row using the instructions by submission key below.

Sub-Table Field

return_subtable– Set field value to ‘DC2-B’

Categorical Data Fields

asset_class– Report on each of the defined asset categories (see table in Appendix I – Asset Classes for reference). Do not report usingasset_classcode ‘26’ (‘Unattributable – GHG emissions unattributable to a specific asset’) for reporting on Financed GHG Emissions. For each selection within theasset_class, certain categorical fields may be applicable (see Field Applicability by Sub-Table section above for reference).sector– If applicable per the Field Applicability Matrices, report the applicablesectorcode for eachasset_classper the table in Appendix III – Sectors; otherwise report thesectorfield for each of the non-applicable rows as blankregion– If applicableregioncode for the applicableasset_classper the Field Applicability Matrices, report the applicable province or territory of Canada, Region of USA or ‘Other’ geographic region per the table in Appendix II – Regions; If the DTI’s reported assets, such as borrowings that are tied to physical location of assets by for certain large accounts, such as corporates, banks or sovereign borrowers that cannot be specifically divided across multiple regions using available client data, filers should report using ‘Canada-Other’ and/or ‘USA-Other’ in theregionfield.credit_quality– If applicable for theasset_classper the Field Applicability Matrices, report the applicablecredit_qualitycode for each row per the table in Appendix IV – Credit Quality Ratings; otherwise, report thecredit_qualityfield for the non-applicable rows as blank

Calculated Fields

scope_1_counterparty_absolute_emissions– Report the applicable amount of the DTI’s Counterparty Scope 1 Absolute GHG Financed Emissions for eachasset_classby eachregioncategory (if applicable) by eachsectorcategory (if applicable) by eachcredit_qualitycategory (if applicable).scope_2_counterparty_absolute_emissions– Report the applicable amount of the DTI’s Counterparty Scope 2 Absolute GHG Financed Emissions for eachasset_classby eachregioncategory (if applicable) by eachsectorcategory (if applicable) by eachcredit_qualitycategory (if applicable).weighted_avg_scope_1_counterparty_data_quality_score– Report the PCAF Data quality score for the DTI's Counterparty Total Absolute Emissions (Scope 1) weighted by outstanding amount for eachasset_classby eachregioncategory (if applicable) by eachsectorcategory (if applicable) by eachcredit_qualitycategory (if applicable).weighted_avg_scope_2_counterparty_data_quality_score– Report the PCAF Data quality score for the DTI's Counterparty Total Absolute Emissions (Scope 2) weighted by outstanding amount for eachasset_classby eachregioncategory (if applicable) by eachsectorcategory (if applicable) by eachcredit_qualitycategory (if applicable).weighted_avg_counterparty_data_quality_score– Report the PCAF Data quality score for the DTI's Counterparty Total Absolute Emissions (Scope 1) and (Scope 2) weighted by outstanding amount for eachasset_classby eachregioncategory (if applicable) by eachsectorcategory (if applicable) by eachcredit_qualitycategory (if applicable).asset_balance– Report the applicable amount outstanding in dollar for eachasset_classby eachregioncategory (if applicable) split by eachsectorcategory (if applicable) by eachcredit_qualitycategory (if applicable).weighted_average_maturity– Report the applicable exposure weighted remaining maturity, measured in years, for eachasset_classsplit by eachregioncategory by eachsectorcategory (if applicable) by eachcredit_qualitycategory (if applicable).balance_5_maturity– Report the dollar amount of theasset_balancewith a remaining maturity of between 5 and 10 years.balance_10_maturity– Report the dollar amount of theasset_balancewith a remaining maturity greater than 10 years.

Additional Reporting Guidance

The technical specifications document for the DC2 (OSFI 1001) return, that includes a template sheet, field definitions and reference tables is available at DC2 (OSFI 1001) Technical Specifications (XLSX, 59 KB). For a reference example of a completed template that contains an abbreviated listing of completed rows following the above DC2 (OSFI 1001) template instructions, see the sample DC2 (OSFI 1001) Return template (CSV, 6 KB).

Appendix I – Asset Classes

The coding selections below reflect the asset classifications of the Capital Adequacy Requirements (CAR) Guideline.

DC1 (OSFI 1000) – Physical Risk Returns

The coding provided in the table below should be used for the asset_class field when completing the following DC1 (OSFI 1000) Returns:

- Sub-Table DC1-A: Exposures and Credit Risk Metrics – In Canada by FSA

- Sub-Table DC1-B: Exposures and Credit Risk Metrics – Outside of Canada

Report in the asset_class field using the codes shown below.

asset_class |

Asset Class Names |

|---|---|

| 1 | Sovereign and central bank - Bond |

| 2 | Sovereign and central bank - Loan |

| 5 | Public Sector Entities (PSE) |

| 6 | Multilateral Development Banks (MDB) |

| 7 | Bank |

| 8 | Covered bonds |

| 9 | Securities firms and other financial institutions |

| 10 | Corporate - Securities |

| 11 | Corporate - Loans |

| 12 | Subordinated debt, equity and other capital instruments |

| 13 | Regulatory Retail |

| 14 | Other Retail - Auto Loan |

| 15 | Residential Real Estate - Mortgage - CMHC Insured |

| 16 | Residential Real Estate - Mortgage - Other Insured |

| 17 | Residential Real Estate - Mortgage - Not Insured |

| 18 | Residential Real Estate - HELOC |

| 19 | Commercial Real Estate |

| 20 | Land acquisition, development and construction |

| 21 | Reverse Mortgages |

| 22 | Mortgage-backed securities |

| 23 | Equity investment in fund - Public Equity |

| 24 | Equity investment in fund - Private Equity |

| 25 | Securitization |

DC2 (OSFI 1001) – Transition Risk Returns

Sub-Table DC2-A: Entity-level DTI Own GHG Emissions by Scope (Canada and outside of Canada)

The ‘Unattributable – GHG emissions unattributable to a specific asset’ asset class is to be used for reporting on entity-wide emissions in the DC2 return sub-table 'DC2-A' only, and it is not intended to be used in lieu of reporting emissions by specific asset classes in DC2 return sub-table 'DC2-B'.

The coding provided in the table below should be used for the the asset_class field when completing the DC2 (OSFI 1001) Returns.

asset_class |

Asset Class Names |

|---|---|

| 26 | Unattributable – GHG emissions unattributable to a specific asset |

Sub-Table DC2- B: Financed GHG Emissions by Scope (Canada and outside of Canada)

The coding selections below reflect the asset classifications of the Capital Adequacy Requirements (CAR) Guideline except:

- “Sovereign and central bank – bond” excludes sub-sovereigns, central banks and supranationals

- “Sovereign and central bank – loan” excludes sub-sovereigns, central banks and supranationals

Sub-table DC2-B should be completed using the selected coding included in the table below.

asset_class |

Asset Class Names |

|---|---|

| 3 | Sovereign and central bank - Bond (excluding sub-sovereigns, central banks and supranationals) |

| 4 | Sovereign and central bank - Loan (excluding sub-sovereigns, central banks and supranationals) |

| 10 | Corporate - Securities |

| 11 | Corporate - Loans |

| 12 | Subordinated debt, equity and other capital instruments |

| 14 | Other Retail - Auto Loan |

| 15 | Residential Real Estate - Mortgage - CMHC Insured |

| 16 | Residential Real Estate - Mortgage - Other Insured |

| 17 | Residential Real Estate - Mortgage - Not Insured |

| 19 | Commercial Real Estate |

| 21 | Reverse Mortgages |

| 23 | Equity investment in fund - Public Equity |

Appendix II – Regions

The categorical codes shown in the table below are to be used for the region field when completing the DC1 (OSFI 1000) Return and the DC2 (OSFI 1001) Return. The name for each region, along with a Region Description that lists the constituent region(s) associated to each Region code are also listed in the table below. For example, the region code ‘US2’, described as ‘USA Midwest’ is constituted of a grouping of states of the USA including: ‘IA’, ‘IL’, ‘IN’, ‘KS’, ‘MI’, ‘MN’, ‘MO’, ‘ND’, ‘NE’, ‘OH’, ‘SD’, and ‘WI’.

Report in the region field using the codes shown below.

region |

Region Name | Region Description |

|---|---|---|

| AB | Alberta, Canada | Alberta, Canada |

| BC | British Columbia, Canada | British Columbia, Canada |

| MB | Manitoba, Canada | Manitoba, Canada |

| NB | New Brunswick, Canada | New Brunswick, Canada |

| NL | Newfoundland and Labrador, Canada | Newfoundland and Labrador, Canada |

| NT | Northwest Territories, Canada | Northwest Territories, Canada |

| NS | Nova Scotia, Canada | Nova Scotia, Canada |

| NU | Nunavut, Canada | Nunavut, Canada |

| ON | Ontario, Canada | Ontario, Canada |

| PE | Prince Edward Island, Canada | Prince Edward Island, Canada |

| QC | Quebec, Canada | Quebec, Canada |

| SK | Saskatchewan, Canada | Saskatchewan, Canada |

| YK | Yukon, Canada | Yukon, Canada |

| C1 | Canada-Other | Unattributable to a single location in Canada |

| U1 | USA West | Region of USA that includes the following US States: AK, CA, CO, HI, ID, MT, NV, OR, UT, WA, WY |

| U2 | USA Midwest | Region of USA that includes the following US States: IA, IL, IN, KS, MI, MN, MO, ND, NE, OH, SD, WI |

| U3 | USA Northeast | Region of USA that includes the following US States: CT, MA, ME, NH, NJ, NY, PA, RI, VT |

| U4 | USA Southwest | Region of USA that includes the following US States: AZ, NM, OK, TX |

| U5 | USA Southeast | Region of USA that includes the following US States: AL, AR, DE, FL, GA, KY, LA, MD, MS, NC, SC, TN, VA, WV as well as DC |

| U6 | USA-Other | Unattributable to a single location in the USA |

| ZZ | Other | All other regions worldwide |

| ZZZ | FSA level reporting | Unattributable to a single FSA in Canada for DC1-A reporting |

Appendix III – Sectors

The coding selections shown in Table 1 below are to be used for the sector field when completing the DC2 Return.

Table 1 lists 25 Sectors, most of which are sensitive to the transition toward a low-carbon economy, starting with Sector codes ‘1’ (‘ELEC-RNEW – Electricity Production from Renewable Sources and Nuclear ’) and ending with codes ‘25’ (‘OTHR’- ‘Other Industries).

Within the table, each sector code has a sector name, a sector description and the corresponding 2022 North American Industry Classification System (NAICS) code(s).

The sectorial assignment is based on “leading NAICS codes” which is defined as follows: if a NAICS code belongs to a sector, all the NAICS codes that start with the same digits also belong to that sector. For example, 111 is the NAICS code for Crop Production and therefore, all the NAICS codes that start with the digits 111 also belong to this sector, e.g., 1113 is the NAICS code for Fruit and Tree Nut Farming and belongs to the Crop Production sector.

Note that there are codes which are used for more than one sector, i.e., 213119 for EINT-MINE and COAL (for a complete list see Table 2 – NAICS codes with multiple sectors). This is because there is no further granularity available for these NAICS codes. Exposures to counterparties that are mapped to one of these NAICS codes would be classified to one of the sectors based on the nature of the counterparty.

Report the sector field using the codes shown below (Table 1).

| Code | Sector | Sector Description | Industry | NAICS Code (Canada 2022) | NAICS Code (US 2022) |

|---|---|---|---|---|---|

| 1 | ELEC-RNEW | Electricity Production from Renewable Sources and Nuclear | Electricity Support and Distribution | 221113, 221119 | 221113, 221114, 221115, 221116, 221117, 221118 |

| 2 | ELEC-FOSS | Fossil Fuel Electricity Production | Electricity Support and Distribution | 221112 | 221112 |

| 3 | ELEC-HYDR | Hydro Electricity Production | Electricity Support and Distribution | 221111 | 221111 |

| 4 | ELEC-OTHR | Electricity Support and Distribution | Electricity Support and Distribution | 22112, 23713, 335 | 22112, 23713, 335 |

| 5 | EINT-MANF | Manufacturing | Energy Intensive Industries | 325, 327, 331, 332 | 325, 327, 331, 332 |

| 6 | EINT-MINE | Mining | Energy Intensive Industries | 2122, 2123, 213117, 213119 | 2122, 2123, 213114, 213115 |

| 7 | EINT-PAPR | Paper and Pulp | Energy Intensive Industries | 322 | 322 |

| 8 | EINT-WATR | Water and Sewage System and Waste Management | Energy Intensive Industries | 2213, 23711, 562 | 2213, 23711, 562 |

| 9 | COAL | Coal Industry and Support | Fossil Fuels | 2121, 213117, 213119 | 2121, 213113 |

| 10 | RFND | Fossil Fuel Refinery | Fossil Fuels | 324, 326, 412, 457, 486 | 324, 326, 4247, 457, 486 |

| 11 | GAS | Natural Gas Industry and Support | Fossil Fuels | 21111, 213111, 213118, 2212, 23712 | 21113, 213111, 213112, 2212, 23712 |

| 12 | OIL-EXTR | Oil Extraction | Fossil Fuels | 21111, 213111 | 21112, 213111 |

| 13 | OIL-OTHR | Oil Extraction Support | Fossil Fuels | 213118, 23712 | 213112, 23712 |

| 14 | OIL-SAND | Sand Oil Extraction and Support | Fossil Fuels | 21114 | 21112 |

| 15 | TRNS-AIR | Air Transportation | Transportation | 481, 4881 | 481, 4881 |

| 16 | TRNS-RAIL | Rail Transportation | Transportation | 482 | 482 |

| 17 | TRNS-OTHR | Other Transportation | Transportation | 336, 483, 484, 485, 487, 4882, 4883, 4884, 4885, 4889 | 336, 483, 484, 485, 487, 4882, 4883, 4884, 4885, 4889 |

| 18 | CROP | Crop Production and Support | Agriculture and Forestry | 111, 1151, 41112 | 111, 1151 |

| 19 | LIVE | Livestock Production and Support | Agriculture and Forestry | 112, 1152, 41111 | 112, 1152 |

| 20 | FORS | Forestry and Support | Agriculture and Forestry | 113, 1153, 321 | 113, 1153, 321 |

| 21 | FINC | Finance and Insurance | Other Sectors | 52 | 52 |

| 22 | FOOD | Food and Beverage industry and support | Other Sectors | 114, 311, 312, 4131, 4132, 445 | 114, 311, 312, 4244, 4248, 445 |

| 23 | REST | Real Estate | Other Sectors | 53 | 53 |

| 24 | SERV | Service Sectors | Other Sectors | 323, 41113, 41119, 4133, 4134, 414, 415, 416, 417, 418, 419, 441, 444, 449, 455, 456, 458, 459, 49, 51, 54, 55, 561, 61, 62, 71, 72, 81, 91 | 323, 423, 4241, 4242, 4243, 4245, 4246, 4249, 425, 441, 444, 449, 455, 456, 458, 459, 49, 51, 54, 55, 561, 61, 62, 71, 72, 81, 92 |

| 25 | OTHR | Other Industries | Other Sectors | 236, 2372, 2373, 2379, 238, 313, 314, 315, 316, 333, 334, 337, 339 | 236, 2372, 2373, 2379, 238, 313, 314, 315, 316, 333, 334, 337, 339 |

| Code | Sector Code 1 | Sector Code 2 |

|---|---|---|

| 213117 | COAL | EINT - MINE |

| 213119 | COAL | EINT - MINE |

| 21111 | OIL - EXTR | GAS |

| 21112 | OIL - EXTR | OIL - SAND |

| 213111 | OIL - EXTR | GAS |

| 213112 | OIL - EXTR | GAS |

| 213118 | OIL - OTHR | GAS |

| 23712 | OIL - OTHR | GAS |

Appendix IV – Credit Quality Ratings

Externally-assigned ratings of long-term borrower creditworthiness are assigned on debt security issuers and wholesale borrowers including corporates, banks and sovereigns. To facilitate comparison, ratings from several recognized credit rating organizations should be mapped into the credit_quality categories shown in the table below. For reporting purposes on the DC2 (OSFI 1001) return, borrowers should be grouped within each credit_quality category; borrowers are not to be reported individually.

Report in the credit_quality field using the codes shown below.

credit_quality |

S&P | DBRS | Moody’s | Fitch | KBRA |

|---|---|---|---|---|---|

| 1 | AAA to AA- | AAA to AA (low) | Aaa to Aa3 | AAA to AA- | AAA to AA- |

| 2 | A+ to A- | A (high) to A (low) | A1 to A3 | A+ to A- | A+ to A- |

| 3 | BBB+ to BBB- | BBB (high) to BBB (low) | Baa1 to Baa3 | BBB+ to BBB- | BBB+ to BBB- |

| 4 | BB+ to BB- | BB (high) to BB (low) | Ba1 to Ba3 | BB+ to BB- | BB+ to BB- |

| 5 | B+ to B- | B (high) to B (low) | B1 to B3 | B+ to B- | B+ to B- |

| 6 | Below B- | CCC or lower | Below B3 | Below B- | Below B- |

| 7 | Not Rated | Not Rated | Not Rated | Not Rated | Not Rated |