InfoPensions – Issue 28 – May 2023

InfoPensions includes announcements and reminders on matters relevant to federally regulated private pension plans including pooled registered pension plans. To receive email notifications of new items posted to OSFI’s website, including this newsletter and other pension-related documents, please subscribe using Email Notifications.

If you have any questions about the articles you read in InfoPensions or if you have suggestions for future articles, please contact us at pensions@osfi-bsif.gc.ca. We expect to publish the next issue of InfoPensions in November 2023.

For general enquiries, including pension-related questions, please contact us at information@osfi-bsif.gc.ca. If you prefer to contact us by telephone, by fax or by mail, please refer to the contact information on OSFI’s website.

Table of contents

Supervision

Crypto-assets and crypto-related activities

OSFI recognizes that innovations in the field of crypto-assets and crypto-related activities may provide opportunities for the financial system and Canadians. These new activities are evolving rapidly and may also pose new risks for federally regulated private pension plans (FRPPs) to identify, assess and manage.

In January 2023, OSFI sent a survey to 31 of our largest FRPPs (by plan assets) to assess the potential exposure of FRPPs to crypto-assets and crypto-related activities. Thank you to everyone who participated in the survey.

The information collected demonstrates that the majority of FRPPs surveyed do not have any exposures to crypto-assets or crypto-related activities. These FRPPs also indicated that they were not currently considering making these types of investments. While a few of the FRPPs surveyed reported having indirect exposures to crypto-assets through third-party managers, such as hedge funds and pooled funds, these exposures were minimal. FRPPs and pension industry stakeholders that did not have the opportunity to participate in the above-mentioned survey are welcome to send any comments or relevant information to OSFI at pensions@osfi-bsif.gc.ca.

OSFI continues to monitor the risks that crypto-assets and crypto-related activities may pose to FRPPs. It’s also important to note that, as explained in the article below titled Government of Canada’s Budget 2023, the federal government has announced that it will require FRPPs to disclose to OSFI their crypto-assets exposures. Although there are no further details available at this time, plan administrators should be aware of this upcoming requirement. OSFI will communicate details of this requirement at a later date.

OSFI’s expectations for the Canadian Dollar Offered Rate transition

As previously communicated in InfoPensions 27, OSFI published a letter in May 2022 outlining expectations with respect to transactions linked to the Canadian Dollar Offered Rate (CDOR) and transition to the alternative interest rate benchmarks and reference rates in Canada, prior to the respective cessation dates.

These expectations apply to federally regulated private pension plans (FRPPs). For example, FRPPs may have exposures to transactions linked to CDOR through interest rate or foreign exchange derivatives, money market securities, floating rate notes, or variable rate lending agreements.

Consistent with the two-stage transition approach outlined in the white paper released by the Canadian Alternative Reference Rate Working Group (CARR) on December 16, 2021, OSFI expects that all new derivative contracts (bilateral, cleared, and exchange-traded) and securities (assets and debt liabilities) make the transition to alternative reference rates by June 30, 2023. No new CDOR exposures should be booked after that date, with limited exceptions for risk mitigation requirements as referenced in the white paper.

OSFI expects FRPPs to monitor the volumes and outstanding non-transitioned exposures until the cessation of CDOR on June 28, 2024, and to manage the transition.

OSFI surveys federally regulated pension plans after the United Kingdom gilt market event

During the fall of 2022, liability-driven investment (LDI) funds in the United Kingdom (UK) experienced severe collateral calls as a result of turmoil in the gilt market. In light of this event, OSFI is assessing the potential vulnerabilities to similar market and liquidity shocks of federally regulated pension plans (FRPPs) that use leverage (such as derivatives and securities financing transactions).

In October 2022, OSFI sent a survey to the plan administrators of selected large FRPPs (by plan assets) to better understand their use of leverage and the impact that a scenario like the one in the UK would have on their plans. The following are key takeaways from this survey:

- Based on the data provided, we understand that the selected large FRPPs that use leverage may be less leveraged than their UK counterparts.

- Almost all the FRPPs surveyed confirmed that they have sufficient liquidity to cover their collateral obligations should a similar event occur in Canada.

- There appear to be differences between UK pension plans’ LDI practices and those of FRPPs in Canada. For example, there are differences in how leverage is measured, how it is used in pooled funds, and what can be used as collateral.

OSFI continues to consider the use of leverage by FRPPs and how it should be measured and reported. In April 2023, OSFI sent an expanded survey to a larger number of plan administrators to better understand their plans’ exposures to leverage and associated liquidity risks. OSFI received responses in May and is continuing to analyze them. Thank you to everyone who participated in the expanded survey.

OSFI is also working with the Canadian Association of Pension Supervisory Authorities (CAPSA) to develop harmonized expectations with regards to the use of leverage. As mentioned in InfoPensions 27, a draft CAPSA guideline on Leverage and the Effective Management of Associated Risks was published for consultation in June 2022 (the consultation period ended on October 14, 2022). CAPSA has proposed to make this guideline part of an inclusive Risk Management Guideline. OSFI continues to support CAPSA’s efforts to finalize guidance in this area.

Guidance and legislative matters

Government of Canada’s Budget 2023

On March 28, 2023, the federal government released Budget 2023: A Made-in-Canada Plan: Strong Middle Class, Affordable Economy, Healthy Future (Budget 2023), which includes proposed initiatives involving federally regulated pension plans. Budget 2023 announced that the federal government:

- will require federally regulated pension funds to disclose their crypto-asset exposures to OSFI; and

- propose to amend the Pension Benefits Standards Act, 1985 (PBSA) and the Pooled Registered Pension Plans Act (PRPP Act) to improve retirement security for plan members and retirees through new frameworks for variable payment life annuities and technical housekeeping amendments.

On April 20, 2023, the federal government tabled Bill C-47, An Act to implement certain provisions of the budget tabled in Parliament on March 28, 2023 (the Budget Implementation Act, 2023, No.1, or the BIA 1). The BIA 1 includes amendments to the PBSA and the PRPP Act to provide legislative frameworks for variable life benefit payments and variable life payments.

An Act to amend the Bankruptcy and Insolvency Act, the Companies’ Creditors Arrangement Act and the Pension Benefits Standards Act, 1985 (Bill C-228)

An Act to amend the Bankruptcy and Insolvency Act, the Companies’ Creditors Arrangement Act and the Pension Benefits Standards Act, 1985 (the Act) (proposed as bill C-228, a private member’s bill) received Royal Assent on April 27, 2023. The Act amends the federal Bankruptcy and Insolvency Act (BIA) and Companies’ Creditors Arrangement Act (CCAA) to provide super-priority protection for pension plan deficits on bankruptcy, insolvency, or restructuring, and amends provisions of the Pension Benefits Standards Act, 1985 regarding the annual report that the Superintendent of Financial Institutions submits to the federal Minister of Finance for tabling in Parliament. The Act includes transitional provisions, with the effect that the amendments to the BIA and CCAA do not apply to employers already participating in a pension plan until four years after the Act comes into force.

Manitoba and Newfoundland and Labrador join the 2020 Agreement Respecting Multi-Jurisdictional Pension Plans

On May 11, 2023, the Canadian Association of Pension Supervisory Authorities (CAPSA) announced that Manitoba and Newfoundland and Labrador have joined the 2020 Agreement Respecting Multi-Jurisdictional Pension Plans (2020 Agreement) effective July 1, 2023, through the 2023 Amending Agreement. As a result, all jurisdictions in Canada that have pension legislation and all multi-jurisdictional pension plans in Canada will be subject to the 2020 Agreement.

The 2020 Agreement was already in place between the governments of Canada, British Columbia, Alberta, Saskatchewan, Ontario, Quebec, New Brunswick and Nova Scotia, to simplify and clarify the supervision of pension plans in Canada with members in more than one jurisdiction. The original 2020 Agreement came into effect on July 1, 2020.

Please refer to OSFI's FAQ series for additional details on the 2020 Agreement.

Amendments to the Multilateral Agreement Respecting Pooled Registered Pension Plans and Voluntary Retirement Savings Plans

Effective May 1, 2023, New Brunswick joined the Multilateral Agreement Respecting Pooled Registered Pension Plans and Voluntary Retirement Savings Plans (the Agreement) which was already in place between the governments of Canada, British Columbia, Nova Scotia, Quebec, Saskatchewan, Ontario, and Manitoba.

The Agreement effectively delegates to OSFI responsibility for licensing, registering, and supervising pooled registered pension plans (PRPP) whose operations fall within the jurisdiction of both the federal government and that of a participating province. The Agreement does not give OSFI responsibility with respect to Quebec’s voluntary retirement savings plans (VRSP) but permits authorized VRSP administrators to act as PRPP administrators under the federal PRPP Act if they register a PRPP federally.

The 2023 Agreement amending the Multilateral Agreement Respecting Pooled Registered Pension Plans and Voluntary Retirement Savings Plan (the 2023 Agreement) amends the Agreement to include New Brunswick and to clarify that OSFI will not exercise the powers of a provincial supervisory authority with respect to certain activities (e.g., approving unlocking or financial hardship withdrawals from retirement savings plans or locked-in accounts where those funds originated from a PRPP).

The 2023 Agreement was published in the Canada Gazette Part 1, Volume 157, Number 14 on April 8, 2023. While a consolidated version of the Agreement including the 2023 amendments is not available at this time, the most recent prior consolidation of the Agreement is available on OSFI’s website.

Guideline B-15 - Climate Risk Management

On March 7, 2023, OSFI released the final version of Guideline B-15: Climate Risk Management (Guideline B-15) for federally regulated financial institutions (FRFIs). This guideline does not apply to federally regulated pension plans (FRPPs).

OSFI received over 4,300 submissions on the draft Guideline B-15 that was published last summer. The feedback received came from a wide range of respondents, including FRPPs. A consultation summary was published with the final Guideline B-15, including a summary of the feedback received as well as OSFI’s responses.

As mentioned in InfoPensions 27, the Canadian Association of Pension Supervisory Authorities (CAPSA) published its draft guideline on Environmental, Social and Governance Considerations in Pension Plan Management for consultation from June 9 to October 14, 2022. OSFI continues to work with CAPSA on this topic and will assess whether additional OSFI guidance is needed in this area once the CAPSA guideline is finalized.

Guidance posted on OSFI’s website

The following documents were posted to OSFI’s website since the last edition of InfoPensions:

- March 2023 - Final Instruction Guide for Asset Transfers related to Defined Contribution Provisions of Pension Plans

- March 2023 - Final Instruction Guide on Buy-in Annuity Products. This guide updates the guidance published in September 2012 and includes new requirements for the valuation of assets and liabilities and additional considerations for the administration of pension plans and pension funds.

- January 2023 - Guidance on the Maximum going concern discount rate for plans using an overlay strategy

- January 2023 - 2023 YMPE Updates - Unlocking funds from a pension plan or from a locked-in retirement savings plan FAQ#2

- January 2023 - 2023 YMPE Updates - Form 1 and Instructions - Attestation Regarding Withdrawal Based on Financial Hardship.

- December 2022 - 2023 Maximum Annual Amount of Income from a LIF, RLIF and Variable Benefit Account

- December 2022 - Final Instruction Guide - Authorization of Amendments Reducing Benefits in Defined Benefit Pension Plans

- November 2022 - Revised Instruction Guide for the Preparation of Actuarial Reports for Defined Benefit Pension Plans. This guide reflects OSFI’s updated expectations regarding the maximum going concern discount rate and revised expectations due to the update to Part 3000 of the Canadian Institute of Actuaries Standards of Practice.

Actuarial

Estimated solvency ratio results

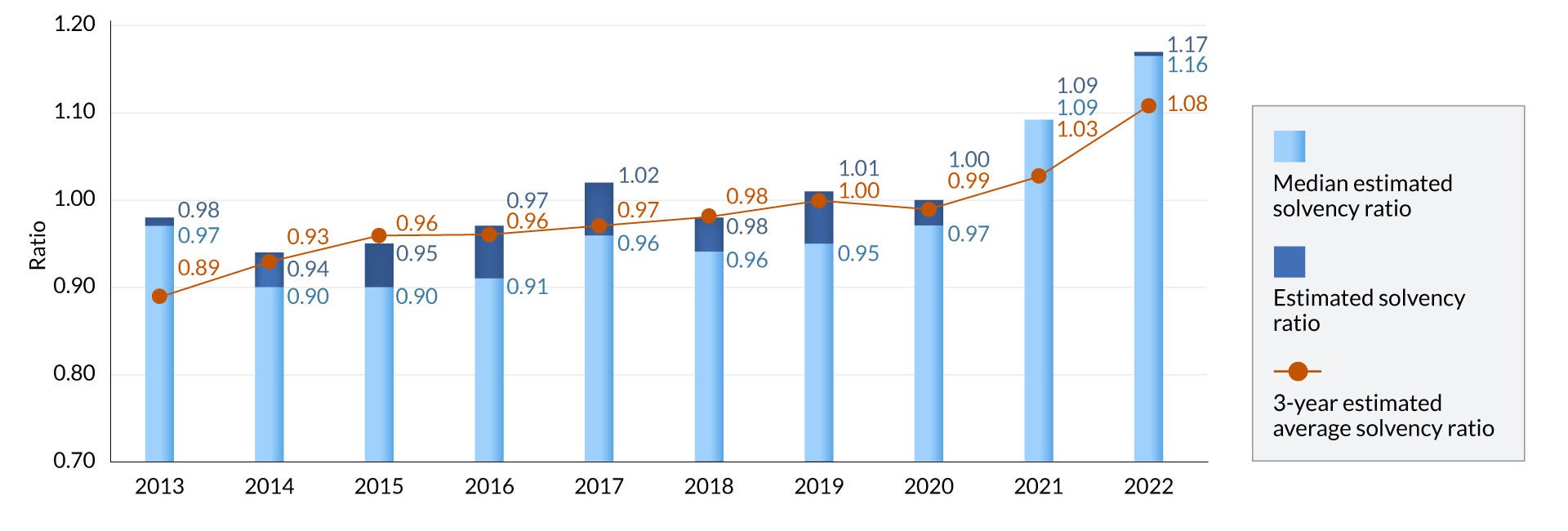

OSFI regularly estimates the solvency ratio for federally regulated pension plans (FRPPs) with defined benefit provisions. The Estimated Solvency Ratio (ESR) exercise assists OSFI in identifying solvency issues that could affect the security of pension benefits promised to members and beneficiaries before a FRPP files their actuarial report. The ESR results also help identify broader trends.

The ESR is calculated using the most recent actuarial, financial and membership information filed with OSFI for each plan before the analysis date. Assets are projected based on either the rate of return provided on the Solvency Information Return (SIR) or an assumed rate of return for the plan when no SIR has been filed. Solvency liabilities are projected using relevant commuted value and annuity proxy rates prescribed by the Canadian Institute of Actuaries. Expected contributions, benefit payments, and expenses are taken into account and an ESR based on the estimated adjusted market value of the fund and estimated liabilities is then calculated for each plan.

The solvency position of FRPPs with defined benefit provisions improved significantly in 2022. The median ESR for the 324 plans included in the exercise (down from 333 last year) increased to 1.16 as at December 31, 2022, up from 1.09 at the end of 2021. The liability weighted average ESR for all plans is 1.17 as at December 31, 2022, up from 1.09 at the end of 2021. The main drivers of the variation in the ESR in 2022 are the higher solvency discount rates offset by the negative investment returns. The three-year estimated average solvency ratio (EASR), on which funding requirements are based, has increased to 1.08 as at December 31, 2022, up from 1.03 at the end of 2021.

The graph below shows the current and previous ESRs, median ESRs, and the three-year EASRs dating back to December 2013.

Solvency position of pension plans as at December 31

Solvency position of pension plans - text description

| Year | Median estimated solvency ratio | Estimated solvency ratio | 3-Year Estimated average solvency ratio |

|---|---|---|---|

| 2013 | 0.97 | 0.98 | 0.89 |

| 2014 | 0.90 | 0.94 | 0.93 |

| 2015 | 0.90 | 0.95 | 0.96 |

| 2016 | 0.91 | 0.97 | 0.96 |

| 2017 | 0.96 | 1.02 | 0.97 |

| 2018 | 0.94 | 0.98 | 0.98 |

| 2019 | 0.95 | 1.01 | 1.00 |

| 2020 | 0.97 | 1.00 | 0.99 |

| 2021 | 1.09 | 1.09 | 1.03 |

| 2022 | 1.16 | 1.17 | 1.08 |

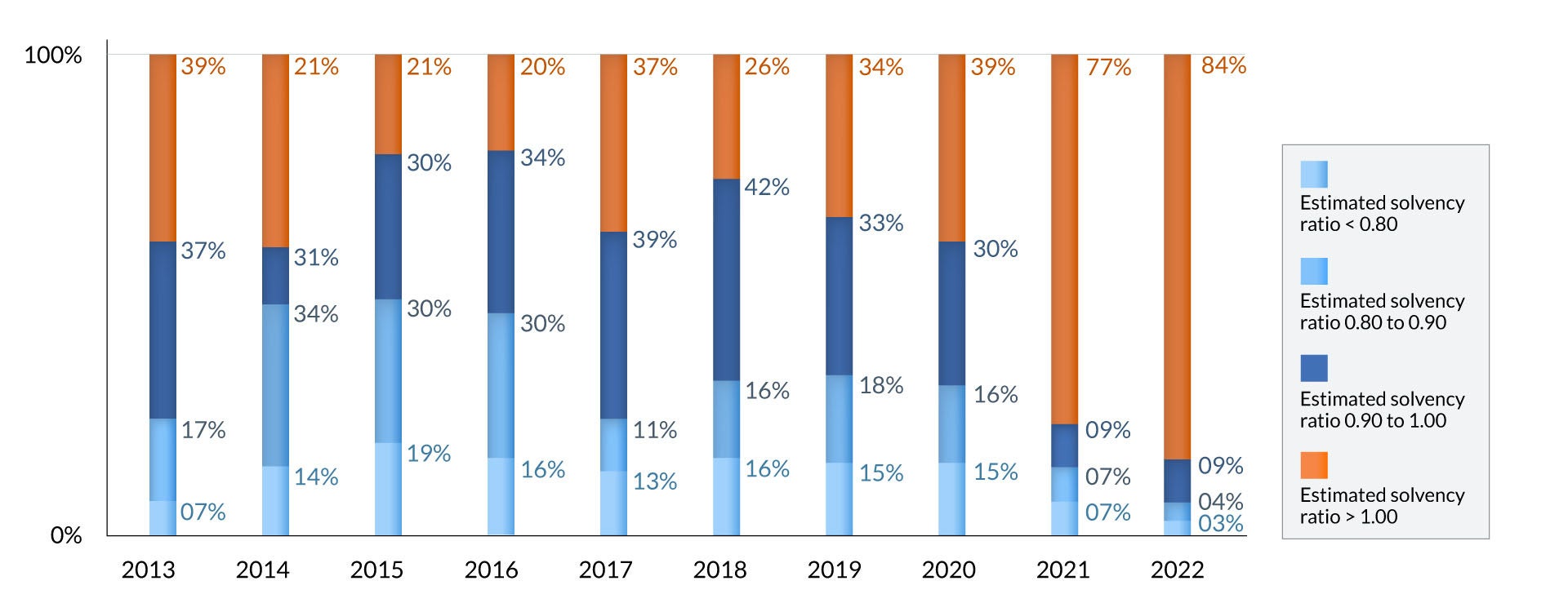

The most recent ESR results show that nearly 85% of FRPPs with defined benefit provisions are fully funded. There was a reduction in the percentage of plans that were underfunded (16% in 2022 versus 23% in 2021). The number of plans that were significantly underfunded (ESRs below 0.80) also decreased (3% in 2022 down from 7% in 2021). It should be noted that all significantly underfunded plans are designated plans and therefore their funding is limited by the Income Tax Regulations. The graph below illustrates the distribution of the ESR results as at December 31 of each year since 2013.

Distribution in % of the estimated solvency ratio of pension plans as at December 31

Distribution of the estimated solvency ratio of pension plans - text description

| Year | Estimated solvency ratio < 0.80 | Estimated solvency ratio 0.80 to 0.90 | Estimated solvency ratio 0.90 to 1.00 | Estimated solvency ratio > 1.00 |

|---|---|---|---|---|

| 2013 | 7% | 17% | 37% | 39% |

| 2014 | 14% | 34% | 31% | 21% |

| 2015 | 19% | 30% | 30% | 21% |

| 2016 | 16% | 30% | 34% | 20% |

| 2017 | 13% | 11% | 39% | 37% |

| 2018 | 16% | 16% | 42% | 26% |

| 2019 | 15% | 18% | 33% | 34% |

| 2020 | 15% | 16% | 30% | 39% |

| 2021 | 7% | 7% | 9% | 77% |

| 2022 | 3% | 4% | 9% | 84% |

Regulatory filings and important dates

Important reminders and dates

Annual filings and plan amendments must be filed using the Regulatory Reporting System (RRS).

Under the Pension Benefits Standards Act, 1985:

| Action or required filing | Deadline |

|---|---|

| Annual Information Return (OSFI 49) and Schedule A - Canada Revenue Agency Information Requirements (OSFI 49A) | 6 months after plan year end |

| Pension Plan Annual Corporate Certification (PPACC) | 6 months after plan year end |

| Certified Financial Statements (OSFI 60), Auditor’s Report Filing Confirmation (ARFC) and, if required, an Auditor's Report | 6 months after plan year end |

| Payment of Plan Assessments | Upon receipt of the OSFI-issued invoice |

| Annual statements to members and former members and their spouses or common-law partners | 6 months after plan year end |

| Amendments to documents that create or support the plan or pension fund | Within 60 days after the amendment is made |

| Action or required filing | Deadline |

|---|---|

| Actuarial Report and Actuarial Information Summary and, if required, Replicating Portfolio Information Summary | 6 months after plan year end |

| Solvency Information Return (OSFI 575) | The later of 45 days after the plan year end or February 15 |

Documents in support of an application for plan registration must be submitted by email to Approvals-Approbations@osfi-bsif.gc.ca. All other documents in support of an application that requires the Superintendent’s authorization must be filed using RRS. For additional information including instruction guides for filing an application using RRS, please visit the Amendments, Applications and Approvals section of OSFI’s website.

Under the Pooled Registered Pension Plans Act:

| Action or required filing | Deadline |

|---|---|

| Pooled Registered Pension Plan Annual Information Return (includes financial statements) | April 30 (4 months after the end of the year to which the document relates) |

| Auditor's Report | April 30 (4 months after the end of the year to which the document relates) |

| Pension Plan Annual Corporate Certification (PPACC) | April 30 (4 months after the end of the year) |

| Payment of Plan Assessments | Upon receipt of the OSFI-issued invoice |

| Annual statements to members and their spouses or common-law partners | February 14 (45 days after the end of the year) |

Other topics

OSFI’s Blueprint for Transformation - Update

Supervision sector

Effective February 2023, the Pension Supervision team is being supported by two Directors:

- Benoit Brière is responsible for the actuarial, systems and overall risk management functions; and

- Kim Page is responsible for the ongoing monitoring and supervision of all federally regulated pension plans (FRPP).

As you may already know, OSFI assigns a Relationship Manager to each FRPP, and that person is the main point of contact for the FRPP’s administrator. Please note that OSFI now refers to this role as the Lead Supervisor rather than Relationship Manager. Although the name is different, the role has not changed.

Regulatory response sector

The Policy, Innovation and Stakeholder Affairs Sector has been renamed the Regulatory Response (RR) Sector. Theresa Hinz has been appointed as Executive Director of the Regulatory Affairs Directorate within the RR Sector. She is continuing her role as OSFI’s Primary Member for CAPSA.

As we continue to support our transformation efforts, further organizational changes may occur. We will keep you informed.