Limited Recourse Capital Notes

Type of publication: Capital ruling

Date: December 14, 2022

To: Federally Regulated Financial Institutions (FRFIs)

The December 2022 revisions to this ruling clarify the LRCN limitations applicable to property & casualty (P&C) insurers and mortgage insurers. The issue, background, facts, considerations and conclusion of the July 2020 ruling and subsequent March 2021 revisions remain unchanged.

Issue

The issue is whether to recognize Limited Recourse Capital Notes (LRCNs) issued by federally regulated financial institutions (FRFIs)

Background

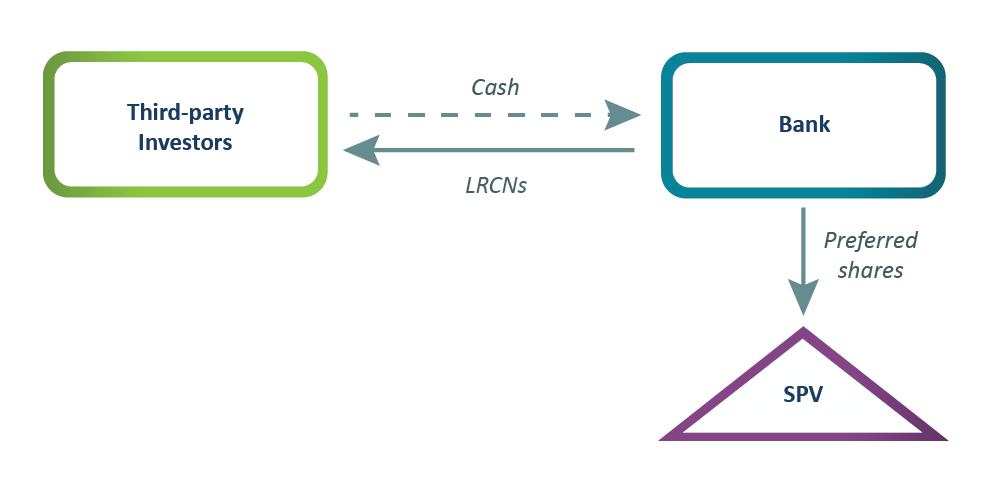

A Canadian bank (the Bank) recently issued the LRCNs to third-party investors. The structure consists of two instruments: (1) deeply subordinated interest-bearing LRCNs with a term to maturity of 60 years issued by the Bank directly to investors; and (2) perpetual, non-cumulative preferred shares issued by the Bank to a special purpose vehicle (SPV) for the benefit of LRCN holders.

Text Description

This figure illustrates the LRCN structure. The structure consists of two instruments: (1) the LRCNs issued by the Bank directly to investors for cash consideration; and (2) preferred shares issued by the Bank to a special purpose vehicle (SPV) for the benefit of LRCN holders.

In the event of the non-payment of principal or interest in cash on any interest payment date, upon an event of default

Considerations

In its evaluation of regulatory capital instruments, OSFI considers structures holistically. OSFI’s approach to reviewing the quality of instruments, including the LRCN structure, also emphasizes economic substance over legal form. Finally, OSFI’s assessment of instruments considers their potential behaviour and impacts on financial stability, particularly in periods of stress.

Taking into account the foregoing considerations, OSFI assessed the LRCNs and the underlying preferred shares held by the SPV both individually as well as in combination relative to the eligibility criteria set out in Chapter 2 of the CAR Guideline. OSFI’s conclusions on key interpretative questions are summarized below.

Issue #1: Does the Bank’s obligation to settle coupon payments in cash or through the delivery of the SPV’s underlying preferred shares comply with the CAR Guideline expectation that institutions must have full discretion to cancel payments and such cancelled payments must not be an event of default or otherwise impose restrictions on the issuer

OSFI concluded that the Bank has full discretion to trigger the delivery of the preferred shares to the LRCN holders in lieu of making interest payments on the LRCNs. Upon doing so, the LRCNs would be cancelled. Foregone interest payments would be cancelled, are non-cumulative and do not result in events of default or other restrictions.

Issue #2: Given the fixed maturity date of the LRCNs in year 60, do the LRCNs satisfy the CAR Guideline requirement that Additional Tier 1 instruments be perpetual

LRCN noteholders’ recourse is limited to perpetual Tier 1-qualifying instruments – Bank preferred shares or common shares – in all circumstances, including at maturity of the notes in year 60. OSFI concluded that the LRCN structure is perpetual based on its economic substance and consideration of the structure holistically rather than its component instruments.

Issue #3: Does the LRCN structure comply with the CAR Guideline requirement that Additional Tier 1 instruments should not embed incentives to redeem

OSFI concluded the LRCNs do not constitute an incentive to redeem that would be contrary to the CAR Guideline. In addition, the delivery of the preferred shares in exchange for the LRCNs under certain events would not be dilutive to the Bank’s shareholders’ equity, a key consideration in assessing incentives to redeem for instruments with mandatory or holder-initiated conversions to common shares.

Ruling

OSFI concluded that the LRCN structure meets all of the criteria to be recognized as Additional Tier 1 regulatory capital by the Bank. LRCNs issued by other FRFIs will also be eligible for recognition as regulatory capital as set out below:

-

Additional Tier 1 capital by deposit-taking institutions;

-

Tier 1 Capital other than Common Shares by life insurers; and

-

Category B capital by property & casualty insurers or mortgage insurers.

Recognition of the LRCNs as Additional Tier 1 capital (or equivalent by insurers) will be subject to the following limitations. OSFI may add to, amend, or delete these limitations at any time. Limitations may also vary by issuer and/or issuance.

Limitations on investor base

-

The LRCNs can only be issued to institutional investors and, in the case of closely-held FRFIs, to affiliates.

-

The LRCNs can only be issued in minimum denominations of at least $200,000 and integral multiples of $1,000 in excess thereof.

Limitations on LRCNs’ and preferred shares’ terms and conditionsFor clarity, any provision under these conditions applicable to a “preferred share” also applies to any other instrument recognized as Additional Tier 1 capital by OSFI.

-

LRCNs and preferred shares must have a minimum par or stated value of $1,000 and be traded on institutional desks (i.e. not exchange-listed).

-

The LRCNs must have an initial term to maturity of at least 60 years.

-

In addition to any expectations set out under OSFI’s Capital Guidelines, including the prior approval of the Superintendent, unless the instrument has been replaced with an instrument of higher capital quality (i.e. common shares or retained earnings) or the FRFI demonstrates that its capital position will be well above supervisory target capital requirements after the call option is exercised, the issuer will only be permitted to redeem the LRCNs or preferred shares where the carrying cost of the LRCNs or preferred shares exceeds the cost of replacement capital of equivalent quality (i.e. AT1).

Limits on LRCN issuances

-

LRCN issuances will be subject to a limit, or “Cap”, as measured on the date of issuance. Please refer to the Appendix for the specific Caps applicable to each FRFI sector. In calculating this limit, the issuer should compare the aggregate of its outstanding and proposed issuances of LRCNs on the date of issuance to the Cap. The limit should consider the issuer’s capital at the last reporting date with adjustments for subsequent transactions including issuances, redemptions, buybacks, and acquisitions.

-

LRCNs issued in excess of the Cap may be counted towards a FRFI’s Tier 2 capital (or Category C capital for property & casualty and mortgage insurers as set out in the Appendix), subject to any applicable capital composition limits. Such excess can be subsequently reallocated to Additional Tier 1 capital (or equivalent for insurers), when the FRFI has established capacity under its Cap.

-

The Cap may be removed with the prior approval of OSFI’s Capital Definition and Assessment Division. In seeking this approval, a FRFI must demonstrate that it has issued preferred shares and/or other Additional Tier 1 capital instruments (or equivalent for insurers), other than LRCNs, to institutional investors and/or affiliates that, in aggregate, are no less than the applicable Floor set out in the Appendix. If the FRFI’s outstanding preferred shares and/or other Additional Tier 1 capital instruments (or equivalent for insurers), issued to institutional investors and/or affiliates were to subsequently drop below the Floor, the FRFI would not be permitted to issue additional LRCNs in excess of the Cap until it has re-established compliance with the Floor.

Disclosure

- The disclosure and marketing of the LRCNs to investors must clearly disclose how the LRCNs’ risks are equivalent to the risks of investing directly in the associated limited recourse trust assets.

Appendix

LRCN issuance limitations by FRFI sector

Note: For life, P&C and mortgage insurers, the following limitations supplement and are subject to any existing capital composition limits set out in the applicable OSFI capital guideline.

| FRFI sector | Regulatory capital treatment | LRCN issuance cap | Floor | Regulatory capital treatment of LRCN’s issued in excess of Cap |

|---|---|---|---|---|

| Deposit-Taking Institutions | AT1 | Greater of $150 million, 0.75% Risk Weighted Assets (RWA), or 50% of the institution’s aggregate net AT1 capital | Lesser of 0.30% RWA or 20% of the institution’s aggregate net AT1 capital | Tier 2 |

| Life Insurers, and fraternal benefit societies | Tier 1 Capital other than Common Shares | Greater of $150 million or 12.5% of Net Tier 1 capital | 5.0% of Net Tier 1 capital | |

| P&C and Mortgage Insurers | Category B | Greater of $150 million or 20% of Total Capital Available, excluding accumulated other comprehensive income (AOCI) | 8.0% of Total Capital Available, excluding AOCI | Category C |