Large Exposure Limits for Domestic Systemically Important Banks – Guideline (2019)

Information

Table of contents

I. Purpose of the Guideline

This guideline sets out OSFI's expectations for the effective measurement and control of risks associated with large exposures. The framework is designed to limit the maximum loss a financial institution could incur as a result of the sudden failure of an individual counterparty or a group of connected counterparties, such that the institution's survival as a going concern is not compromised. The framework also contributes to the stability of the financial system by mitigating the risk of contagion between systemically important banks.

OSFI, as a member of the Basel Committee on Banking Supervision (BCBS), participated in the development of the international large exposure framework. Parts of this guideline are drawn from the BCBS large exposure framework, entitled: Supervisory Framework for Measuring and Controlling Large Exposures (April 2014) and the BCBS Frequently Asked Questions on the Supervisory Framework for Measuring and Controlling Large Exposures (September 2016). Where relevant, the Basel text paragraph numbers and FAQ page numbers are provided in square brackets at the end of each paragraph referencing material from the BCBS large exposures framework.

The guideline complements OSFI's Supervisory Framework and Assessment Criteria.

Please refer to OSFI's Corporate Governance Guideline for OSFI's expectations of institution Boards of Directors in regards to operational, business, risk and crisis management policies.

II. Scope of Application

-

This guideline applies to Domestic Systemically Important Banks (D-SIBs), as designated by OSFI, on a consolidated basis. The consolidated entity includes all subsidiaries except insurance subsidiaries. This is consistent with the scope of regulatory consolidation used under the risk-based capital framework as set out in Chapter 1 of OSFI's Capital Adequacy Requirements (CAR) GuidelineFootnote 1. [BCBS Apr 2014 par 10, 11]

-

The application of this guideline at the consolidated level means that an institution is expected to consider all exposures to third parties across the relevant regulatory consolidated group and compare the aggregate of those exposuresFootnote 2 to the group's eligible capital base, defined in this guideline as Tier 1 Capital as specified in Chapter 2 of the CAR Guideline. The capital measure used for this guideline at any particular point in time is the Tier 1 Capital measure applying at that time under the risk-based capital framework. [BCBS Apr 2014 par 12]

III. Definition of a large exposure and reporting requirements

-

An exposure is considered a large exposure when the sum of all the exposures to a single counterparty or group of connected counterparties equals or exceeds 10% of the institution's Tier 1 Capital. [BCBS Apr 2014 par 14, 17]

-

D-SIBs are expected to report, on a frequency specified by OSFI, the following exposure values both before and after the application of any credit risk mitigation techniques:

-

all exposures meeting the definition of a large exposure;

-

all other exposures that would have met the definition of a large exposure if the effect of credit risk mitigation techniques were not taken into account;

-

all exempted exposuresFootnote 3, as listed in section V of this guideline, that meet the definition of a large exposure;

-

the 20 largest exposures to counterparties that are subject to the large exposure limits, irrespective of the value of these exposures relative to the institution's Tier 1 Capital.

[BCBS Apr 2014 par 15]

-

IV. Limits

-

The limits in this section apply to an institution's aggregate exposure value to a counterparty or group of connected counterparties.

-

Institutions should consider all exposures defined under the CAR guideline to counterpartiesFootnote 4, except those that are exempted under section V of this guideline. [BCBS Apr 2014 par 13, 30]

-

An institution's aggregate exposure value to a single counterparty or group of connected counterparties shall not exceed the following limits:

-

For Canadian Global Systemically Important Banks (G-SIBs):

-

15% of the institution's Tier 1 Capital when the counterparty is, or the group of connected counterparties includes, a G-SIBFootnote 5;

-

20% of the institution's Tier 1 Capital when the counterparty is, or the group of connected counterparties includes, a Canadian D-SIB that is not a G-SIB;

-

otherwise, 25% of the institution's Tier 1 Capital.

-

-

For Canadian D-SIBs (that are not G-SIBs):

-

20% of the institution's Tier 1 Capital when the counterparty is, or the group of connected counterparties includes, a Canadian D-SIB or a G-SIB;

-

otherwise, 25% of the institution's Tier 1 Capital.

-

[BCBS Apr 2014 par 16, 90]

-

-

Institutions should have processes for identifying and addressing any breaches of the regulatory limits and for notifying OSFI of breaches in a timely manner.Footnote 6 [BCBS Apr 2014 par 18]

-

Notwithstanding the regulatory limits, OSFI expects institutions to have a sound and comprehensive large exposure policy (LEXP)Footnote 7, consistent with the institution's Risk Appetite Framework.Footnote 8

-

The Risk Appetite Framework of an institution should establish limits regarding the level of risk that the institution is willing to accept with respect to risk concentrations and large exposure to individual counterparties or groups of connected counterparties. It should form the basis of the institution's LEXP. Institutions should revisit their LEXP on a regular basis.

-

Institutions should have adequate information systems and processes to identify large exposures and aggregate them on a timely basis. These systems and processes will help to facilitate the active management of large exposures.

-

Institutions should have effective control, monitoring, reporting and procedures to ensure ongoing operational compliance with the regulatory limits and their LEXP.

-

Notwithstanding the limits set out above, OSFI may set specific limits on an institution's exposures to particular counterparties.

V. Exemptions

-

The following exposures are exempted from the large exposure limits:

-

exposure amounts deducted from an institution's regulatory capital under Chapter 2 of the CAR GuidelineFootnote 9, except exposure amounts that are deducted for investments in banking, financial or insurance entities;

-

exposures, including direct obligations and guarantees, to the Government of Canada and the Bank of Canada;

-

exposures qualifying as Level 1 high quality liquid assets (HQLA) under Chapter 2 of the Liquidity Adequacy Requirements (LAR) Guideline;

-

exposures, including direct obligations and guarantees, to sovereigns or their central banks that are:

-

subject to a 0% risk weight under section 3.1.1 and section 3.1.2 of the CAR Guideline; and

-

denominated and funded in the domestic currency of that sovereign.

-

-

exposures to any other entities receiving a 0% risk weight under section 3.1.2 of the CAR Guideline;

-

exposures to the following non-central government public sector entities (PSEs):

-

a Canadian PSE that is treated as a sovereign under section 3.1.3 of the CAR Guideline

-

Subject to OSFI's approval, U.S. entities treated as PSEs for capital adequacy purposes if they are under conservatorship or receivership of the U.S. governmentFootnote 10;

-

a foreign PSE that is:

-

subject to a 0% risk weight under section 3.1.3 of the CAR Guideline; and

-

denominated and funded in the domestic currency of the sovereign where the PSE is established.

-

-

-

exposures to qualifying multilateral development banks that are subject to a 0% risk weight under section 3.1.4 of the CAR Guideline;

-

underwriting positions in regulatory capital instruments and/or Other TLAC Instruments issued by banking, financial, or insurance entities held for five working days or less consistent with the regulatory adjustments for investments in those entities set out in section 2.3 of the CAR Guideline;

-

exposures to Other TLAC Instruments issued by G-SIBs or Canadian D-SIBs held under the market-making exemption set out under section 2.3.3 of the CAR Guideline.

-

intra-day interbank exposures; and

-

exposures to qualifying central counterparties (QCCPs), as defined in section 4.1.1.1 of the CAR Guideline, that are related to clearing activities as specified in paragraph 29 of this guideline.

[BCBS Apr 2014 par 31, 45, 61, 65, BCBS FAQ #1 and #2, page 1, FAQ#5, page 2] -

Institutions should have adequate processes and controls in place (e.g., by way of internal limits) to monitor the exempted exposures and to report them to OSFI, as required.

-

-

Institutions should have adequate processes and controls in place (e.g., by way of internal limits) to monitor the exempted exposures and to report them to OSFI, as required.

VI. Exposure Measure

-

Institutions shall consider all on-balance sheet exposures and off-balance sheet exposures in both the banking book and trading book, and instruments with counterparty credit risk, for the measurement of the aggregate exposure values. [BCBS Apr 2014 par 30]

-

Exposure values for the following asset types are determined as follows:

-

for banking book on-balance sheet, non-derivative assets: the accounting value of the exposure that is net of specific allowancesFootnote 11 and accounting valuation adjustments (e.g. accounting credit valuation adjustments). An institution may use exposure values gross of specific allowances and accounting valuation adjustments. [BCBS Apr 2014 par 32]

-

for banking book off-balance sheet instruments: the exposure value is obtained by converting off-balance sheet exposures into credit equivalent amounts using the credit conversion factors applicable under the Standardized approach to credit risk, as set out in section 3.3 of the CAR Guideline, subject to a minimum value of 10%. [BCBS Apr 2014 par 35]

-

for instruments held in the banking book and trading book that give rise to counterparty credit risk (excluding securities financing transactions): the exposure at default according to the standardized approach for counterparty credit risk (SA-CCR), as detailed in section 4.1.6 of the CAR Guideline; and [BCBS Apr 2014 par 33]

-

for securities financing transactions (SFTs): the exposure value is measured using the comprehensive approach and supervisory haircuts according to section 5.1.3 of the CAR Guideline. [BCBS Apr 2014 par 34]

-

-

Institutions should measure their exposures to a given counterparty on both a gross and a net basis, i.e., before and after recognition of any eligible credit risk mitigation (CRM) technique, as specified hereafter. Only the aggregate net exposures are subject to the large exposure limits.

-

Eligible CRM techniques for purposes of this guideline are those that meet the minimum requirements and eligibility criteria for the recognition of unfunded protection (i.e. guarantees and credit derivatives) and financial collateral that qualify as eligible financial collateral under the standardized approach, as set out in section 5.1 of the CAR Guideline. [BCBS Apr 2014 par 36]

-

Other forms of collateral that are only eligible under the internal ratings based (IRB) approach, as specified in section 5.2 of the CAR Guideline, are not eligible to reduce exposure values for large exposure purposes. [BCBS Apr 2014 par 37]

-

Institutions should recognize eligible CRM techniques in determining exposure values if they are using such techniques to calculate their risk-based capital requirements for the same exposure, provided the CRM meets the conditions for recognition under this guideline. Institutions should have consistent approaches for recognizing CRM techniques for the purpose of this guideline and for the calculation of the capital floor as set out in section 1.9.1 of the CAR Guideline. [BCBS Apr 2014 par 38]

-

Where a maturity mismatch in respect of eligible CRM is recognized under risk-based capital requirements, the value of the credit protection for large exposure purposes should be adjusted using the same approach as set out in section 5.1.6 of the CAR Guideline.Footnote 12 [BCBS Apr 2014 par 39, 40]

-

Where institutions have legally enforceable netting arrangements for loans and deposits, they may calculate exposure values for large exposure purposes on the basis of net credit exposures, subject to the conditions set out in section 5.1.4 of the CAR Guideline. [BCBS Apr 2014 par 41]

-

To derive the net exposure, institutions should reduce the value of the gross exposure to the original counterparty, by the amount of the eligible CRM, which is equal to:

-

the value of the protected portion in the case of unfunded credit protection (e.g., recognized guarantees or recognized credit derivative contracts);

-

the value of the portion of the exposure collateralized by the market value of the recognized financial collateral for exposures in the banking book where the institution uses the simple approach for the purposes of calculating credit risk capital requirements;

-

the value of the collateral as recognized in the calculation of the counterparty credit risk exposure value for instruments with counterparty credit risk, such as derivatives; and

-

the value of collateral adjusted after applying the required haircuts where the institution uses the comprehensive approach in its treatment of recognized collateral for the purposes of calculating credit risk capital requirements. Internally modelled haircuts shall not be used.

[BCBS Apr 2014 par 42, BCBS FAQ#6, page 3]

-

-

When the exposure value to a counterparty is reduced due to an eligible CRM technique, an institutions should also recognize an exposure to the CRM provider equal to the amount by which the exposure value to the original counterparty was reduced.Footnote 13 [BCBS Apr 2014 par 43]

Covered bondsFootnote 14

-

Institutions may assign an exposure value of no less than 25% of the nominal value of the institution's qualifying covered bond holdings that satisfy the conditions of paragraph 27. The counterparty to which the exposure is assigned is the issuing institution. For non-qualifying covered bonds, institutions shall assign 100% of the nominal value of the covered bond holdings to the issuer of the covered bond. [BCBS Apr 2014 par 69]

-

A qualifying covered bond must meet the following conditions at the inception of the covered bond and throughout its remaining maturity:

-

the cover pool must consist of assets that are:

-

claims on, or guaranteed by, sovereigns, their central banks, public sector entities or multilateral development banks;

-

claims secured by mortgages on residential real estate that qualify for a 35% or lower risk weight under Chapter 3 of the CAR GuidelineFootnote 15 and have a loan-to-value ratio of 80% or lower;

-

claims secured by commercial real estate assets that qualify for the 100% or lower risk weight under Chapter 3 of the CAR GuidelineFootnote 16, and have a loan-to-value ratio of 60% or lower;

-

substitution assets and derivatives that are considered additional collateral.

-

-

the nominal value of the cover pool assigned to the covered bond instrument by its issuer exceeds its nominal outstanding value ("over-collateralization requirement") by at least 10%. For this purpose, the value of the cover pool does not need to be that required by the relevant legislative framework governing the issuance of such covered bonds. However, if the relevant legislative framework does not stipulate an over-collateralization requirement of at least 10%, the issuing institution needs to publicly disclose on a regular basis that the cover pool meets the over-collateralization requirement of 10% in practice. [BCBS Apr 2014 par 70]

-

-

In order to calculate the required maximum loan-to-value for residential real estate and commercial real estate referred to in paragraph 27, the operational requirements included in section 5.2.9 of the CAR Guideline regarding the objective market value of collateral and the frequent revaluation should be used. [BCBS Apr 2014 par 71]

Exposures to central counterparties

-

Exposures to a CCP related to clearing activities should be measured as follows:

Trade exposures The exposure value of trade exposures should be calculated using the exposure measures prescribed in other parts of this guideline for the respective types of exposures. Segregated initial margin The exposure value is zero. Non-segregated initial margin The exposure value is the nominal amount of initial margin posted. Pre-funded default fund contributions The exposure value is the nominal amount of the funded contribution. Unfunded default fund contributions The exposure value is zero. Equity stakes The exposure value is the nominal amount. [BCBS Apr 2014 par 87]

-

Exposures that are not directly related to clearing services provided by either a QCCP or a non-QCCP (e.g., funding facilities, credit facilities, and guarantees) should be measured according to the principles set out in the rest of this section, as for any other type of counterparty. The sum of these exposures is subject to the large exposure limits. [BCBS Apr 2014 par 89]

-

For exposures related to clearing services (i.e., where the institution acts as a clearing member or is a client of a clearing member), an institution should determine the counterparty to which exposures should be assigned in accordance with Chapter 4 of the CAR Guideline. [BCBS Apr 2014 par 88]

-

Institutions shall measure their exposure to a non-qualifying central counterparty ("non-QCCP") as the sum of both the clearing exposures described in paragraph 29 and the non-clearing exposures described in paragraph 30. The aggregate exposure to a non-QCCP is subject to the large exposure limits. [BCBS Apr 2014 par 85]

-

The concept of connected counterparties described in section VII of this Guideline does not apply in the context of exposures to CCPs that are specifically related to clearing activities. However, non-clearing exposures to CCPs should be aggregated with exposures to other counterparties when these are connected to the CCP as a result of meeting either the control or the economic interdependence criteria. [BCBS Apr 2014 par 86, BCBS FAQ#3, page 1]

Exposure values for trading book positions

-

Institutions should aggregate banking book and trading book exposures to determine the total exposure to an individual counterparty. The resulting exposure value is subject to the large exposure limits. [BCBS Apr 2014 par 44]

-

The exposure value for non-derivative ("plain vanilla") debt instruments and equity instruments is the accounting value of the exposure (i.e., the market value of the respective instruments). [BCBS Apr 2014 par 46]

-

Institutions should convert instruments such as swaps, futures and forwards into individual legs or positions according to appendix 9-3 of the CAR Guideline. The determination of the long/short direction of positions must be on the basis of long or short with respect to the underlying credit exposure.Footnote 17 Only transaction legs representing exposures that are associated with counterpartiesFootnote 18 need to be taken into account. [BCBS Apr 2014 par 47]

-

For credit derivatives that represent sold protection, the exposure to the referenced name is the amount due in the case that the referenced name triggers the instrument, minus the absolute market value of the credit protection. [BCBS Apr 2014 par 48]

-

For credit-linked notes, the protection seller should consider positions in respect of both the issuer of the note and the underlying reference obligation of the note. For positions hedged by credit derivatives, see paragraph 43. [BCBS April 2014 par 48]

-

For purposes of this guideline, the exposure value for options must be the change in the option's market value that would result from a default of the respective underlying instrument, as shown in Table 1.

Table 1 – Exposure values for call and put options Position Call Put Long V −S+V Short −V S−V where "V" is the option's market value and "S" the strike price.

[BCBS Apr 2014 par 49]

Offsetting long and short positions in the trading book

-

Institutions may offset long and short positions in the same issue (i.e., the issuer, coupon, currency, and maturity are identical). An institution should use the resulting net position in that specific issue to calculate its exposure to a particular counterparty. [BCBS Apr 2014 par 51]

-

Institutions may offset positions in different issues relating to the same issuer only when the short position is junior to the long position, or when the positions are of the same seniority. Securities may be allocated into broad buckets of degrees of seniority (including but not limited to: equity, subordinated debt, and senior debt) to determine their relative seniority. [BCBS Apr 2014 par 52, 54]

-

Institutions may opt not to allocate securities to different seniority buckets. Absent the bucketing, no offsetting of long and short positions in different issues relating to the same issuer can be recognized. [BCBS Apr 2014 par 55]

-

For positions hedged by credit derivatives, institutions may recognize the hedge only if the underlying of the hedge and the position hedged meet the conditions of paragraph 41. [BCBS Apr 2014 par 53]

-

For positions hedged by credit derivatives, institutions are to reduce the exposure to the original counterparty and assign a new exposure to the protection provider. When both of the following conditions are met, an institution may assign an exposure value to the protection provider equal to the exposure at default calculated using the SA-CCR:

-

The credit protection takes the form of a credit default swap (CDS); and

-

The CDS provider or the referenced entity, or both, is not a financial entity.Footnote 19

Otherwise, the exposure value assigned to the credit protection provider must be equal to the amount by which the exposure to the original counterparty was reduced.

[BCBS Apr 2014 par 56, 57]

-

-

An institution shall not net trading book positions against banking book positions. [BCBS Apr 2014 par 58]

-

When the result of the offsetting is a net short position with a counterparty, the net exposure must be set to zero. [BCBS Apr 2014 par 59]

Exposures to structured vehicles

-

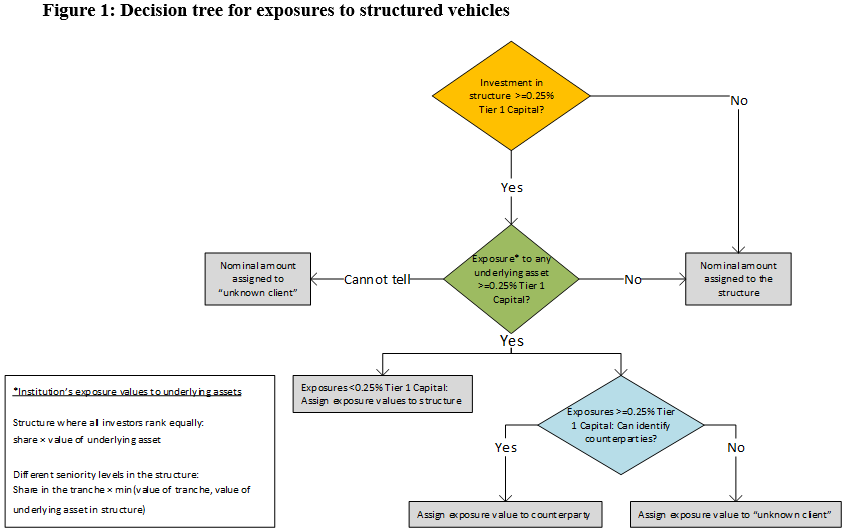

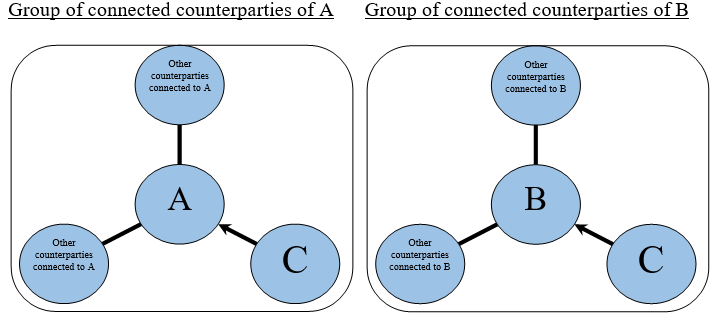

Institutions should consider exposures arising from transactions such as index positions, structured vehicles, hedge funds or investment funds in both the trading book and the banking book. Exposure values should be calculated according to the requirements set out in paragraphs 48 to 53 and described in the decision tree below. Such structures include funds, securitizations and other structures with underlying assets. [BCBS Apr 2014 par 50, 72]

Figure 1: Decision tree for exposures to structured vehicles

Description – Figure 1: Decision tree for exposures to structured vehicles

- Investment in structure >=0.25% Tier 1 Capital?

- Yes: ExposureImage footnote * to any underlying asset >=0.25% Tier 1 Capital?

- Yes: Exposures >=0.25% Tier 1 Capital: Can identify counterparties

- Yes: Assign exposure value to counterparty

- No: Assign exposure value to "unknown client"

- Yes: Exposures <0.25% Tier 1 Capital: Assign exposure values to structure

- No: Nominal amount assigned to the structure

- Cannot tell: Nominal amount assigned to "unknown client"

- Yes: Exposures >=0.25% Tier 1 Capital: Can identify counterparties

- No: Nominal amount assigned to the structure

- Yes: ExposureImage footnote * to any underlying asset >=0.25% Tier 1 Capital?

- Investment in structure >=0.25% Tier 1 Capital?

-

Exposure values should be calculated in accordance with paragraphs 49 to 52. An institution may assign the nominal amount it has to a structured vehicle to the structure itself, defined as a distinct counterparty, if:

-

the institution's exposure amount to the structure is less than 0.25% of the institution's Tier 1 Capital; or

-

the institution's exposure amount to the structure is equal to or greater than 0.25% of the institution's Tier 1 Capital and the institution can demonstrate that its exposure to each underlying asset in the structured vehicle is less than 0.25% of the institution's Tier 1 Capital.Footnote 20

[BCBS Apr 2014 par 73]

-

-

If the exposure amount is assigned to the structure, as set out in paragraph 48, the institution should be able to demonstrate that regulatory arbitrage considerations have not influenced the requirement to look through or not (e.g. the institution has not circumvented the large exposure limit by investing in several individually immaterial transactions with identical assets). [BCBS Apr 2014 par 76, 77]

-

If the criteria in paragraph 48 are not met and the exposure amount cannot be assigned to the structure, institutions shall look through the structured vehicle to identify the counterparty corresponding to any underlying asset for which an exposure value, as calculated according to paragraphs 51 and 52, is equal to or greater than 0.25% of the institution's Tier 1 Capital, so that these underlying exposures can be added to any other direct or indirect exposure to the same counterparty. The other underlying assets for which the institution's exposure represents less than 0.25% of Tier 1 Capital may be assigned to the structure itself (i.e., partial look-through is permitted). [BCBS Apr 2014 par 74]

-

For a structure where all investors rank pari passu, the exposure value to be assigned to a given counterparty is equal to the pro rata share of the institution's holding in the structured vehicle multiplied by the value of the corresponding underlying assets in the vehicle.Footnote 21 [BCBS Apr 2014 par 78]

-

For a structure with different seniority levels among investors (e.g., securitization), the exposure value to an underlying asset is measured assuming a pro rata distribution of losses amongst investors in a single tranche. To calculate the exposure value to an underlying asset, an institution should multiply its pro rata share in a given tranche by the lower of:

-

the value of the tranche in which the institution invests; and

-

the value of the underlying asset in the structured vehicle.Footnote 22

[BCBS Apr 2014 par 79]

-

-

If an institution is unable to determine the identity of the counterparties corresponding to the underlying assets for which the institution has determined that its exposure exceeds or is equal to 0.25% of Tier 1 Capital, these exposure amounts should be assigned to the "unknown client". All exposures assigned to the "unknown client" should be aggregated as if they were related to the same single counterparty. Exposures to the "unknown client" are also subject to the large exposure limit. [BCBS Apr 2014 par 75]

-

Institutions are generally expected to apply the look-through requirements only at one level, i.e. recognizing the exposures held directly by the structured vehicle. However, in cases where the size of the exposure to the underlying assets is material, it may be appropriate for an institution to look through further.

-

Where derivatives positions arise from looking through a structured vehicle, institutions may use the market value of the instruments as the exposure values.

-

Institutions must make reasonable efforts to apply the requirements set out in this section, including gathering the latest information related to structured vehicles. The frequency of the review of such structures must be documented in the LEXP.

-

Where structured vehicles qualify as eligible collateral as per paragraph 19, but the effort required to apply the requirements in this section of the guideline is impractical, exposure amounts should be assigned to both the original counterparty as if the transaction was unsecured (i.e., to the counterparty who posted the collateral) and to the structured vehicle itself.

Additional risks

-

Institutions should identify third parties that may constitute an additional risk factor to a structured vehicle through contractual obligations. Third parties may include, but are not limited to, liquidity providers and credit protection providers. This paragraph applies regardless of whether an institution has applied the look-through requirements in paragraphs 48 to 57. [BCBS Apr 2014 par 80, 83]

-

The exposure amount to be assigned to a third party is equal to an institution's exposure to a structured vehicle up to the maximum contractual obligation amount that the third party has with the vehicle.

-

Structured vehicles that share common additional risk factors should be treated as a group of connected counterparties. [BCBS Apr 2014 par 81]

-

Where multiple third parties are identified as drivers of additional risk to the same structure, the institution shall assign exposure amounts to each of the third parties. [BCBS Apr 2014 par 82]

-

Exposure amount resulting from third parties constituting additional risk factors should be aggregated with any other exposures the institution has to those third parties. [BCBS Apr 2014 par 81]

VII. Connected counterpartiesFootnote 23

-

Where two or more counterparties constitute a common risk, the counterparties should form a group of connected counterparties. The exposures to each of the counterparties in the group of connected counterparties should be aggregated and treated as an exposure to a single counterparty when applying large exposure limits. [BCBS Apr 2014 par 19]

-

The existence of common risk is to be determined on a case-by-case basis, with reference to the material facts of the situation and with sound judgment. The presence of either of the following conditions indicates the presence of common risk:

-

Control relationship: if one of the counterparties has direct or indirect control over the other(s), or if both counterparties are directly or indirectly controlled by a common person or entity.

-

Economic interdependence: if one counterparty were to experience financial difficulties, particularly funding or repayment difficulties, it would likely lead to funding or repayment difficulties of another counterparty.Footnote 24

[BCBS Apr 2014 par 20]

-

-

Institutions should have sound and robust policies and processes for assessing and identifying control relationships and economic interdependences for determining the existence of common risk. Institutions should first determine the existence of control relationships, and then assess economic interdependence between counterparties. [BCBS Apr 2014 par 21]

-

In determining the existence of a control relationshipFootnote 25, institutions should consider, at a minimum, any of the following:

-

if one counterparty owns more than 50% of the voting rights of the other counterparty. This condition will automatically satisfy paragraph 64.a above;

-

if one counterparty has control of the majority of the voting rights of the other counterparty (e.g. pursuant to an agreement with other shareholders);

-

if through ownership or common management, one counterparty controls, or is controlled by, another counterparty (including but not limited to an ownership position of 50% or greater);

-

if the counterparties are ultimately subject to substantially common ownership or management, notwithstanding that the institution may not have an exposure to the owner/controlling interest;

-

if one counterparty has significant influence on the appointment or dismissal of another counterparty's senior management committee or board of directors (e.g. the right to appoint or remove a majority of the members of the board of directors or management committee, or the fact that the majority of the members on the board of directors or management committee of a counterparty have been appointed solely as a result of another counterparty exercising its voting rights);

-

if one counterparty has significant influence on senior management, e.g. a counterparty has the power, pursuant to a contract or otherwise, to exercise a controlling influence over the management or policies of the other counterparty (i.e., through consent rights over key decisions).

[BCBS Apr 2014 par 22, 23]

-

-

If a controlling relationship has been established under paragraph 66 , institutions may still demonstrate in exceptional cases that such control does not necessarily result in the counterparties constituting a common risk, e.g. due to the existence of specific circumstances and corporate governance safeguards. [BCBS Apr 2014 par 25]

-

Institutions are expected to have processes to assess the presence of economic interdependence in a manner that is proportionate to the risks posed by the different types of exposures. Approaches may vary according to the size of the exposures, type of counterparties or credit adjudication processes. However, when the exposure to a single counterparty exceeds 5% of an institution's Tier 1 Capital, institutions are expected to perform a thorough investigation to identify possible counterparties connected by economic interdependence. [BCBS Apr 2014 par 28]

-

In establishing economic interdependence, institutions should consider, at a minimum, any of the following:

-

if 50% or more of a counterparty's annual gross receipts or gross expenditures is derived from transactions with the other counterparty;

-

if one counterparty has fully or partly guaranteed the exposure of the other counterparty or is liable by other means, and the exposure is significant such that the guarantor is likely to default if a claim occurs;

-

if a significant part of one counterparty's production (or output) is sold to another counterparty, which cannot easily be replaced by other customers;

-

if the expected source of funds to repay loans of both counterparties is the same and neither counterparty has another independent source of income from which the loan may be serviced and fully repaid;

-

if it is likely that the financial distress of one counterparty would affect the other counterparty's ability to repay fully its liabilities in a timely manner;

-

if the insolvency or default of one counterparty is likely to be associated with the insolvency or default of the other counterparty; or

-

if the counterparties rely on the same external source for the majority of their funding and, in the event of the common funds provider's default, it is expected that an alternative provider of funds could not be found.Footnote 26

[BCBS Apr 2014 par 26, BCBS FAQ#4, page 2]

-

-

Where an institution is able to demonstrate that a counterparty, which is economically closely related to another entity, may be able to overcome financial difficulties by finding alternative business partners or funding sources within a reasonable time period, the counterparties may not need to be combined to form a group of connected counterparties. [BCBS Apr 2014 par 27]

-

Where two or more counterparties are controlled by or are economically dependent on a counterparty that is exempted as per sub-paragraphs (b), (d), (e), (f) and (g) of paragraph 14, but are otherwise not connected, those counterparties do not need to be combined to form a group of connected counterparties. [BCBS Apr 2014 par 62]

-

Institutions should take a conservative approach in assessing the presence of common risk; that is, in circumstances where uncertainty arises as to whether counterparties should be connected, counterparties should be viewed as a common risk and be connected.

-

OSFI may require an institution to aggregate any of its exposures where OSFI is of the view that these exposures constitute a common risk.

-

Institutions should make available for OSFI review documented rationale and authorization (including exception processing) for either connecting or disaggregating exposures. The rationale and authorization should be subject to regular internal reviews as part of the institution's own risk management process and LEXP.

VIII. Guideline Administration

Non-compliance with the guideline

-

Where an institution fails to adequately account and control for the risk of large exposures, on a case-by-case basis, OSFI can take, or require the institution to take, corrective measures. OSFI actions can include heightened supervisory activity and/or the discretionary authority to adjust the institution's capital requirements commensurate with the risks being undertaken by the institution.

Annex 1 – Illustrative examples – Groups of connected counterparties

-

An institution's exposure to a group of connected counterparties is subject to the "single counterparty" large exposure limits. The factors for determining the existence of common risk and connecting counterparties are set out in section VII of this guideline. The high level principles for including an entity in a group of connected counterparties are:

-

Control relationships (paragraph 66); and

-

Economic interdependence (paragraph 69)

-

-

This Annex provides (non-exhaustive) examples that illustrate the application of the guideline to groups of connected counterparties and are provided for illustrative purposes only. The presence of control relationships or economic interdependence should be established on a case-by-case basis taking into consideration the relevant facts of the situation.

I – Connecting based on control relationships

-

In general, connecting based on controlling relationships consists of combining a counterparty with its controlling entity(ies), subsidiaries and affiliates.

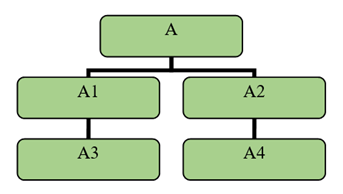

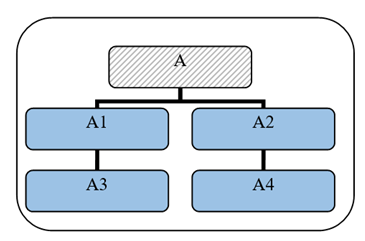

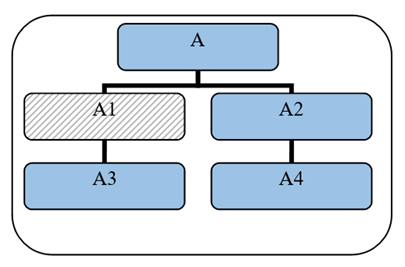

Example 1: A is the holding company of A1, A2, A3, and A4. All the entities falling within this controlling structure that are counterparties of the institution should be treated as a common risk and therefore be connected.

-

If the institution has exposures to A1, A2, A3, and A4 but not A; then A+A1+A2+A3+A4 should still be treated as a group of connected entities. The exposure amount subject to the large exposure limit will be the sum of exposures to A1+A2+A3+A4.

-

If the institution has exposures to A, A2, A3 and A4 (but not to A1), then the exposure amount subject to the limit will be the sum of exposures to A+A2+A3+A4, since the group of connected entities includes A+A1+A2+A3+A4.

II – Connecting based on economic interdependence

-

When assessing interconnectedness between counterparties based on economic interdependence, institutions should take into account the specific circumstances of each case, in particular whether the financial difficulties or the failure of a counterparty would lead to funding or repayment difficulties for another counterparty.

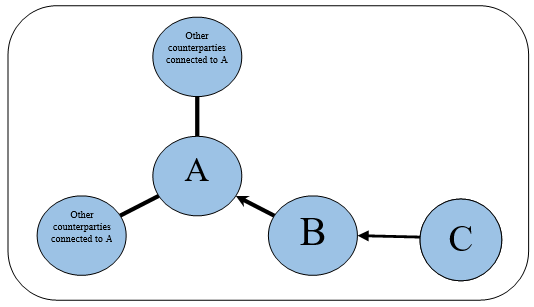

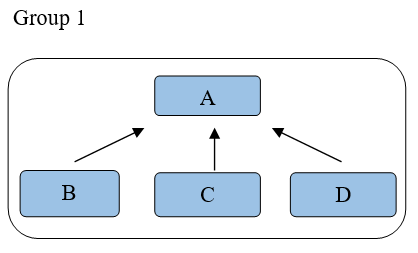

Example 2: B, C and D are three distinct counterparties all relying economically on a common entity A.

-

In this example, one group of connected counterparties (A+B+C+D) should be formed, as shown in Group 1. It is irrelevant that there is no dependency between B, C, and D.

-

If the institution only has exposures to B, C and D (but not A), and one of these exposures represent more than 5% of the institution's Tier 1 Capital, then all four entities should be treated as a group of connected entities (A+B+C+D), as shown in Group 2, as B, C and D all rely economically on A. The exposure amount subject to the limit will be the sum of exposures to B+C+D.

However, if A is an entity that is exempted as per sub-paragraphs (b), (d), (e), (f) and (g) of paragraph 14, then the large exposure limit would apply to B, C and D individually, since B, C and D do not need to be connected to form a group of connected counterparties, as per paragraph 71.

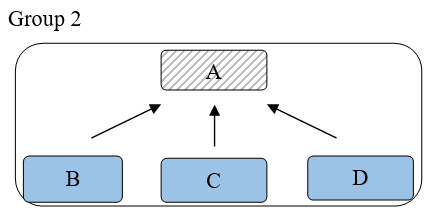

Example 3: An entity C is economically dependent on two distinct entities, A and B, but no dependency exist between A and B.

-

If an institution has exposures to all three entities A, B and C, then entity C should be included in two groups: the group of connected counterparties of A and the group of connected counterparties of B. This reflects a potential contagion effect of financial difficulties from A to C or from B to C. As there is no dependency between A and B, no comprehensive group (A+B+C) needs to be formed.

Example 4: Entity C is economically dependent on B, and B is economically dependent on A.

-

If an institution has exposures to all three entities (A, B and C), then the group of connected counterparties of A should include B and C since the financial difficulties of A could lead to the financial difficulties of C.