OSFI Annual Report 2021-22

Table of contents

April 1, 2021 to March 31, 2022

Office of the Superintendent of Financial Institutions (OSFI)

Message from the Superintendent

I am very proud to present you with OSFI’s 2021-22 Annual Report.

OSFI’s purpose is to ensure that financial institutions and pension plans are regulated by an office of the Government of Canada so as to contribute to public confidence in the Canadian financial system. We fulfill that purpose by pursuing our objects, which call on OSFI to:

- Supervise federally-regulated financial institutions and pension plans to ensure they are in sound financial condition;

- Promptly advise the management and boards of directors of financial institutions, and the administrators of pension plans, in the event their organizations are not in sound financial condition or otherwise are not complying with governing statutes and/or supervisory requirements;

- Take necessary corrective measures in response to a failure to remain in sound financial condition or otherwise comply with governing statutes and or supervisory requirements;

- Promote the adoption by management and boards of directors of financial institutions, and the administrators of pension plans, of policies and procedures designed to control and manage risk; and

- Monitor and evaluate system-wide or sectoral events or issues that may have a negative impact on the financial condition of financial institutions.

In pursuing our objects, OSFI takes a balanced approach that protects depositors, policyholders, creditors, and pension plan beneficiaries while respecting financial institutions’ responsibility to compete and take risks.

This Annual Report will demonstrate just how we went about fulfilling our purpose and pursuing our objects over the past year.

We have organized this year’s report a little differently, as it presents an opportunity to account for the successful completion of OSFI’s 2019-2022 Strategic Plan and, more importantly, shift our risk focus to the risks on OSFI’s horizon.

Therefore, we detail the results we achieved in 2021-22 as organized according to the four goals in our 2019-22 Strategic Plan. I would like to thank my predecessor, Jeremy Rudin, for leading our organization with integrity and distinction over the past seven years. This Annual Report also provides a window into how the COVID-19 pandemic affected our operations and those of the institutions we oversee.

Although we are proud of the accomplishments outlined in this report, OSFI has turned its attention to a horizon populated by risks which will challenge OSFI and the financial institutions and pension plans it supervises.

Those dynamic risks include the digitalization of money, the intensifying prudential implications of climate change, and the economic and financial challenges brought on by an unexpected global pandemic and its aftermath. Moreover, there remains risks beyond the horizon, not yet in view, towards which OSFI must remain vigilant.

How will OSFI address that threatening risk environment moving forward?

Our work is already underway. This past November, we launched our Blueprint for Transformation, which provides an updated vision for OSFI through 2025. Shortly thereafter, we released a roadmap for how we’ll get there: a new, updated Strategic Plan.

The goals, priorities, and concrete actions outlined in these initiatives ensure we will continue to deliver on our most important work: contributing to Canadians’ confidence in their financial system.

I look forward to providing you with an update on all of that work in 2023.

Thank you,

Peter Routledge

About OSFI

The Office of the Superintendent of Financial Institutions (OSFI) is an independent federal government agency that regulates and supervises federally regulated financial institutions and pension plans to determine whether they are in sound financial condition and meeting requirements.

Mandate

Our mandate focuses on four elements as outlined below. In fulfilling our mandate, we support the government’s objective of contributing to public confidence in the Canadian financial system.

Fostering sound risk management and governance practices

We advance a regulatory framework designed to control and manage risk.

Supervision and early intervention

We supervise federally regulated financial institutions (FRFIs) and federally regulated pension plans (FRPPs) to ensure they are in sound financial condition and meet regulatory and supervisory requirements.

We notify financial institutions and pension plans if there are material deficiencies. If there are, we take or order corrective action to quickly address the situation.

Environmental scanning linked to safety and soundness of financial institutions

We monitor and evaluate system-wide or sectoral developments that may affect the financial condition of FRFIs.

Taking a balanced approach

We act to protect the rights and interests of depositors, policyholders, financial institution creditors and pension plan beneficiaries.

We consider financial institutions’ need to compete effectively and take reasonable risks.

We recognize that an organization’s management, boards of directors and pension plan administrators are accountable for all risk decisions. We recognize that financial institutions can fail, and pension plans can experience financial difficulties resulting in the loss of benefits.

Office of the Chief Actuary

The Office of the Chief Actuary (OCA) is an independent unit within OSFI that provides a range of actuarial valuation and advisory services to the Government of Canada. The OCA’s mandate is to conduct statutory actuarial valuations as well valuations for Public Accounts Canada of the Canada Pension Plan (CPP), Old Age Security (OAS) program, federal public sector employee pension and insurance plans, Employment Insurance premium rate, and the Canada Student Financial Assistance Program. These valuations estimate the financial status of these plans and programs as required by legislation.

OSFI by the numbers

Over

400

FRFIs regulated and supervised by OSFI

Approx.

1200

FRPPs regulated and supervised by OSFI

9

new or revised guidance documents released

Over

960

OSFI employees

Over

140

new FRFI transactions and business undertakings were approved

18

actuarial reports or studies prepared by the Office of the Chief Actuary

Over

50

external engagements

13

interactive events that brought OSFI colleagues together to engage in inclusion issues

Over

130

FRFI supervisory reviews were conducted

13

new pension plans were approved for registration

17

news releases and media advisories issued

4

offices located in Ottawa, Montreal, Toronto, and Vancouver

Our accomplishments

In March 2019, we released our 2019-22 Strategic Plan. The plan proposed an ambitious set of goals to help us thrive as a regulator in an increasingly complex financial system.

During 2019-22, dynamic new risks like the digitalization of money and climate change, combined with challenges brought on by an unexpected global pandemic, illustrated the need for strong financial regulation in Canada. Although the Strategic Plan was finalized before the COVID-19 pandemic took hold, we adapted our plan to include our internal response and the measures we took to mitigate its effects on Canada’s financial sector.

As we bring the 2019-22 Strategic Plan to a close, we know that our actions contributed to FRFIs maintaining the financial strength required to meet their obligations to policyholders, depositors, and other creditors. In doing so, we delivered on the main goal of OSFI’s mandate: contributing to public confidence in the Canadian financial system.

This Annual Report details the results we achieved in 2021-22 against the four goals in our 2019-22 Strategic Plan:

Text description - Goals

- Goal 1

Federally regulated financial institution (FRFI) and pension plan (FRPP) preparedness and resilience to financial risk is improved, both in normal conditions and in the next financial stress event - Goal 2

FRFIs and FRPPs are better prepared to identify and develop resilience to non-financial risks before they negatively affect their financial condition - Goal 3

Our agility and operational effectiveness are improved - Goal 4

Support from Canadians and cooperation from the financial industry are preserved

- Goal 1

Federally regulated financial institution (FRFI) and pension plan (FRPP) preparedness and resilience to financial risk is improved, both in normal conditions and in the next financial stress event - Goal 2

FRFIs and FRPPs are better prepared to identify and develop resilience to non-financial risks before they negatively affect their financial condition - Goal 3

Our agility and operational effectiveness are improved - Goal 4

Support from Canadians and cooperation from the financial industry are preserved

Goal 1 – Federally regulated financial institution (FRFI) and pension plan (FRPP) preparedness and resilience to financial risk is improved, both in normal conditions and in the next financial stress event.

Through this goal, we ensured FRFIs continued to provide financial services to Canadians and maintain market confidence, both in normal conditions and in times of stress. Similarly, we ensured pension plans continued to enhance their awareness of emerging risks and related risk management processes. This section showcases some of our accomplishments from the past year.

Proactively supporting FRFIs and FRPPs in weathering the risks posed by COVID-19

Throughout the COVID-19 pandemic, we strove to ensure that our guidance remained credible, consistent, necessary, and fit for purpose. This work included several regulatory and supervisory adjustments to support FRFI financial and operational resilience.

Domestic stability buffer

In June 2021, we announced that OSFI was raising the Domestic Stability Buffer (DSB) level from 1.00% to 2.50% of risk weighted assets effective October 31, 2021. The DSB, an important policy tool that helps ensure the stability of Canada’s financial system, requires Canada’s largest Domestic Systemically Important Banks (D-SIBs) to build up a capital buffer as vulnerabilities grow.

The June 2021 decision was based on the emerging economic recovery from the pandemic and the demonstrated resilience in banks’ capital levels. It also considered key vulnerabilities that had persisted since the 2020 DSB decision, including high levels of borrower indebtedness.

In December 2021, we maintained the DSB at 2.50%. This decision was based on our assessment that system vulnerabilities such as household indebtedness and housing-related asset imbalances remained elevated, while near-term risks were moderate and stable. At that time, we also committed to reviewing the DSB’s design and range.

Minimum qualifying rate for uninsured mortgages

In April 2021, we published a letter proposing a new qualifying rate for uninsured mortgages (i.e., loan-to-value less than 80 percent) and reinforcing the principles of sound mortgage underwriting in Guideline B‑20 (Residential Mortgage Underwriting Practices and Procedures). We received over 170 stakeholder submissions in response to our letter.

Effective June 1, 2021, we confirmed the MQR for all uninsured mortgages should be the greater of the mortgage contractual rate plus 200 basis points, or 5.25 percent, and updated Guideline B-20.

Following implementation, we closely monitored underwriting criteria like amortization periods and debt service limits to prevent circumvention of this revised qualifying rate. In December 2021, we confirmed the rate would remain the same. This followed analysis and consultation with federal regulatory partners.

Other temporary measures

In August 2021, we announced our intention to unwind a regulatory relief measure related to deposit-taking institutions’ (DTIs) leverage. Beginning on January 1, 2022, DTIs were once again required to include certain sovereign-issued securities in their leverage ratio exposure measures.

In November 2021, we lifted temporary restrictions on increases to regular dividends, common share repurchases, and raises in executive compensation.

Enhancing and aligning assurance expectations on capital, leverage, and liquidity

Regulatory returns are key inputs to the assessment of FRFIs’ safety and soundness. In April 2021, we released a discussion paper entitled “Assurance on Capital, Leverage and Liquidity Returns”. The purpose was to engage FRFIs and other interested stakeholders in a dialogue aimed at proactively enhancing and aligning assurance expectations related to key regulatory returns. We received feedback on our discussion paper from FRFIs, audit firms, industry, and professional associations.

In March 2022, we issued for public comment the draft guideline, “Assurance on Capital, Leverage and Liquidity Returns”. The draft guideline seeks to better inform auditors and institutions on OSFI’s expectations related to regulatory returns. This will also enhance and align our assurance expectations across all FRFIs.

Preparing for and supporting the robust implementation of new international standards

All FRFIs in Canada are required to follow International Financial Reporting Standards (IFRS) and International Standards on Auditing. Our role at OSFI is to interpret and assess international rules that may apply to Canadian financial institutions.

In 2021-22, we worked through the Basel Committee on Banking Supervision (BCBS) and the International Association of Insurance Supervisors (IAIS) to provide comment letters and verbal feedback on various standards, including:

- International Accounting Standards Board (IASB) Request for Information on the Third Agenda Consultation

- IASB Request for Information on the Post-implementation Review of IFRS 9 classification and measurement requirements

We also supported the IFRS Foundation Constitution Amendments to Accommodate an International Sustainability Standards Board to set IFRS Sustainability Standards. We helped to improve audit standards and frameworks by:

- Hosting the 2021 Financial Stability Board (FSB) Roundtable on External Audit. This promoted international financial stability by enhancing public confidence in auditors and the quality of audits, especially for systemically important financial institutions.

- Supporting the development of high-quality audit standards through membership on the Public Interest Oversight Board.

The International Financial Reporting Standard 17 (IFRS 17) is an international financial accounting standard that was issued by the IASB in May 2017. In June 2021, we launched a public consultation on revised draft capital guidelines updated for IFRS 17. At the same time, we conducted another quantitative impact study (QIS) to assess insurers’ capital ratios under the draft frameworks. This consultation and quantitative testing resulted in enhancements to the draft capital guidelines. To further inform final decisions, data calls involving select insurers were completed in early 2022. Final versions of the capital guidelines were made public in summer 2022.

Improving our understanding of climate-related financial risks

We advanced our work on several key climate-related initiatives. These included developing policy, working collaboratively with the Bank of Canada on a scenario analysis pilot project, and expanding our international presence.

On policy development, we summarized and published stakeholder feedback following a public consultation on our climate risk discussion paper: “Navigating Uncertainty in Climate Change”. Respondents generally supported our focus on climate-related risks, indicating they were in the early stages of assessment and quantification. Respondents suggested that these risks could be managed through existing governance and risk management frameworks, while also recognizing the need to address data-related challenges and further develop scenario analysis and stress testing capabilities. In addition, we issued a letter to industry outlining the prudential outcomes that we plan to integrate into draft climate risk management guidance.

OSFI and the Bank of Canada concluded a scenario analysis pilot project to assess climate transition risks. The work involved six Canadian financial institutions and considered the impact of intentionally adverse but plausible climate transition scenarios. The scenarios highlighted that meeting climate targets will lead to significant structural changes for the Canadian and global economies and that delaying climate policy action increases the overall economic impacts and risks to financial stability. OSFI and the Bank of Canada are continuing this collaboration to analyze flood risk impacts on residential mortgage portfolios and transition risk impacts on wholesale loan and securities portfolios.

Internationally, we continued our work as a member of the BCBS’s high-level task force on climate-related financial risks, sharing regulatory and supervisory initiatives with other banking regulators. We also expanded our international climate-related presence by joining the Network for Greening the Financial System.

Advancing supervisory actions for FRFIs

In 2021-22, our focus remained on ensuring financial institutions were well capitalized and resilient, and we continued to adapt supervisory actions and interactions with financial institutions to ensure they remained appropriate. Areas of particular focus included loan performance, expected credit losses, stress testing and credit risk management practices, both from an origination and portfolio management perspective. Our key accomplishments included:

- Conducting enhanced monitoring on regulatory capital models and sensitivity analysis assessing the availability of capital buffers under various stress conditions.

- Completing an Integrated Credit Risk Plan (ICRP) that encompassed real estate secured lending, commercial real estate and commercial/corporate workstreams.

- Continuing credit quality enhanced monitoring for systemically important banks and large and mid-size insurance companies and completing planned Significant Activity Reviews. As well, we worked with the industry to ensure that OSFI’s supervisory expectations around combined loan products (CLPs) were clarified.

- Undertaking stress testing for DTIs, to assess the resiliency of capital positions under adverse scenarios.

- Conducting various reviews focused on credit risk management practices.

- Leveraging appointed actuaries’ financial condition testing reports for insurance companies to understand how the risk of inflation was being managed by insurers. We also conducted sensitivity testing of the impact of a significant drop in equity markets on property and casualty insurers. For life insurers, enterprise-wide stress testing was reviewed, and reviews were conducted to support capital management assessments.

Advancing our regulation and supervision of FRPPs

We advanced our work in key areas to strengthen our principles and risk-based approach to pension plan supervision. In 2021-22, our key accomplishments included:

- Releasing a consultation paper on Pension Investment Risk Management in March 2022. The consultation paper introduced principles for the management of investment risk that we believe are relevant for federally regulated pension plans.

- Collaborating with the Financial Services Regulatory Authority of Ontario (FSRA) on the Technical Advisory Committee for the Review of Defined Contribution Plans. In October 2021, the Committee issued a Summary of Outcomes and Recommendations. In November 2021, OSFI and FSRA hosted a webinar to share these outcomes and recommendations with the pension industry. Through this collaboration, OSFI and FSRA worked towards improving outcomes for plan members and enhancing regulatory efficiency and effectiveness for defined contribution plans.

- Consulting with plan administrators and third-party service providers to better understand the potential risks associated with pension technology (including cyber and third-party risk). Analyzing data collected through a pension technology questionnaire gave us a deeper understanding of the nature and level of pension technology risks, as well as the current practices used to mitigate these risks. This information will inform our supervisory approach to cyber and third-party risk.

- Advancing our work with Canadian Association of Pension Supervisory Authorities (CAPSA) on a principles-based guideline on Environmental, Social and Governance (ESG) Considerations in Pension Plan Management. We chaired CAPSA’s ESG Committee and, with input from an industry working group, the ESG Committee made significant progress on this initiative.

We also published guidance for pension plans, including:

- In May 2021, we published final instruction guides for the Termination of a Defined Benefit Pension Plan and the Termination of a Defined Contribution Pension Plan. The instruction guides included updates that clarified our expectations and reflected amendments made to the Assessment of Pension Plans Regulations that came into effect in April 2019.

- In July 2021, we consulted on the draft revisions to section 2.7.4 of the Instruction Guide for the Preparation of Actuarial Reports for Defined Benefit Pension Plans. Section 2.7.4 sets out expectations for plans using a replicating portfolio approach. The final instruction guide was posted in November 2021.

- In January 2022, we updated the Instruction Guide for the Solvency Information Return (SIR). This guide helps pension plan administrators complete the SIR that they are required to file with OSFI.

- In February 2022, we posted for consultation draft instruction guides for the Registration of a Defined Benefit Pension Plan and the Registration of a Defined Contribution Pension Plan. The consultation period ended in April and final instruction guides are expected to be posted in 2022.

- In May and November 2021, we published a newsletter called InfoPensions. It included announcements and reminders for plan administrators, pension advisors and other stakeholders. It also had descriptions of how we apply provisions of pension legislation and our guidance.

Promoting sound management practices with FRFIs

Through our supervisory practices and regulation, we play an important oversight role. We provide guidance and develop guidelines, policies, and procedures for institutions. These are designed to control and manage risk and promote public confidence in the Canadian financial system.

Guidance – Deposit Taking Institutions

In January 2022, we finalized revisions to the Capital Adequacy Requirements (CAR) Guideline, Leverage Requirements (LR) Guideline and Liquidity Adequacy Requirements (LAR) Guideline. These were prepared for implementation at the beginning of DTIs’ fiscal Q2-2023. The final revisions to the CAR and LR guidelines reflect our domestic implementation of the final Basel III reforms. All three guidelines also propose revisions to reflect specific capital and liquidity requirements for small and medium sized banks (SMSBs).

In January 2022, we also finalized the SMSB Capital and Liquidity Guideline, which helps stakeholders understand how the CAR, LR and LAR guidelines apply to SMSBs (including deposit-taking subsidiaries of D-SIBs).

Anti-Money Laundering/Anti-Terrorist Financing (AML/ATF)

We rescinded Guideline B-8 (Deterring and Detecting Money Laundering and Terrorist Financing) as of July 26, 2021. This supported an initiative by OSFI and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) to eliminate duplication and redundancy in how AML/ATF regulatory requirements are applied to FRFIs.

A joint agency information session on AML/ATF supervision was held for industry in October 2021 to clarify how OSFI and FINTRAC will work together. We will continue to coordinate and share relevant information with FINTRAC, the federal AML/ATF supervisor.

Guideline E-4: Foreign entities Operating in Canada on a branch basis

In June 2021, we issued the final version of Guideline E-4: Foreign Entities Operating in Canada on a Branch Basis, which replaced the existing Guideline E-4A Role of the Chief Agent and Record Keeping Requirements. Guideline E-4 places greater emphasis on the expectations of the foreign entity operating in Canada. It better reflects the responsibilities of the foreign entity and its management for overseeing the day-to-day operations of its business in Canada. It also reflects new requirements under the Insurance Companies Act that came into force in July 2021 governing the location of records.

Capital guidance

We continued to develop a new approach for determining capital requirements for segregated fund guarantee risk that will reflect IFRS 17. The new approach will replace the current Chapter 7 of the Life Insurance Capital Adequacy Test guideline.

In June 2021, we announced that we were deferring the implementation date of the new approach to January 1, 2025 (from January 1, 2023). The deferral will provide more time to develop the new approach and help insurers balance their contributions to this important project and their implementation of IFRS 17.

In February 2022, we launched a consultation of the draft approach, a QIS, and sensitivity tests. Submissions are due in May 2022, and we will use them to assess whether further refinements to the methodology are needed.

Reinsurance

Reinsurance is essentially insurance for insurance companies. A comprehensive review of reinsurance practices has been a key OSFI initiative over the past few years. In February 2022, final B-3 and B-2 guidelines were issued. These revised guidelines have a three-year transition period, coming into effect on January 1, 2025. This gives federally regulated insurers the time necessary to adjust their business practices.

Goal 2 - FRFIs and FRPPs are better prepared to identify and develop resilience to non-financial risks before they negatively affect their financial condition.

This section shows how we have advanced our work over the past year to ensure FRFIs and FRPPs are resilient to non-financial risks.

Monitoring and issuing guidance in relation to technology risks and digitalization

In 2021-22, we continued to build our capability to respond to technology risk. Technology risk, which includes cyber risk, is the risk arising from the inadequacy, disruption, failure, loss or malicious use of the information technology systems, infrastructure, people, or processes that enable and support business needs. The lack or ineffectiveness of controls to mitigate these risks can impact the confidentiality, integrity and availability of data and systems that support business services.

In August 2021, we updated our Cyber Self-Assessment tool and refreshed our Technology and Cyber Incident Reporting Advisory, supporting an integrated approach to technology and cyber security incidents at FRFIs. This enabled us to get better insights and information on cyber and technology incidents impacting our institutions. In addition to using this work to inform our supervisory and risk management work, we intend to share intelligence with FRFIs and our partners.

We also released in November 2021 the draft Guideline B-13 on Technology and Cyber Risk Management for a three-month consultation. After receiving feedback from industry, we issued the final guideline in early summer 2022.

Advancing supervisory expectations for the use of advanced analytical techniques

Advanced analytics tools such as Artificial Intelligence and Machine Learning (AI/ML) are gaining momentum in the financial industry. They are used to enhance or create new products and services and advance model risk management frameworks. In addition to their benefits and opportunities, these advanced techniques give rise to a diverse set of challenges. They can exacerbate risks due to complexity, extensive amounts of data, and the speed at which these models can change.

As a result, we continued in 2021-22 to assess how institutions use and manage AI/ML. We are also developing additional principles to address emerging risks and challenges resulting from the use of this technology by financial institutions. This work is ongoing and will be used to inform an industry letter on model risk and advanced analytics, as well as a revised model risk guideline, to be published in 2022-23.

Addressing culture risks

An organization’s culture can influence its risk management, potentially leading to excessive risk-taking and negative financial and reputational outcomes. We recognize that each FRFI’s culture is unique and determined by the institution. As a prudential regulator, understanding the impact of culture can provide an early warning and help prevent or minimize events that can weaken an institution’s operational resilience.

The pandemic and geopolitical environment highlighted the importance of a culture of resilience and management’s role in supporting it. As a member of a global Supervisors’ Roundtable on Governance Effectiveness, we participated in an industry workshop called Tomorrow’s Leaders of the Financial Sector: Perspectives on Culture Change, Resilience, Agility and Continuous Improvement, in April 2021.

Through 2021-22, we continued to enhance our assessment of culture risks. We formed a more comprehensive view of the adequacy and effectiveness of FRFI culture risk management by incorporating culture risks in our supervisory reviews and piloting new approaches for culture risk monitoring.

Our March 2021 letter on culture risks outlined desired outcomes of effective culture risk management, including on dimensions of group dynamics and decision-making and leadership, compensation, people management and incentives, accountability and ownership, risk mindsets and behaviours, group dynamics and decision-making, and resilience. This will form the basis of a principles-based, outcomes-focused culture risk management guideline for consultation in late 2022.

Implementing regulatory and supervisory expectations on operational risk and resilience

Operational resilience, defined as the ability of an institution to deliver critical operations during disruption, has emerged as a key priority for financial institutions and regulators in recent years.

In July 2021, we released a letter on operational risk and resilience which underscored our view that operational resilience is an important outcome of effective operational risk management practices. These include:

- Articulating risk appetite and setting risk tolerances

- Identifying critical operations, interconnections, and interdependencies

- Using scenarios and testing to assess resilience

- Preventing, responding, adapting, recovering, and learning from operational disruption

Advancing regulatory and supervisory expectations for third party risk

Canadian financial institutions have become increasingly reliant on third parties to deliver critical services. As this reliance continues to grow, several trends are emerging, including:

- An increase in the complexity and interdependency of the third-party’s supply chain, including the use of fourth and further parties

- A rise in the frequency and severity of cyber and other disruptions at third parties or their subcontractors

- An increase in the use of offshore suppliers, augmenting geopolitical risks

- The emergence of a few critical service providers, elevating the potential that a material incident at a dominant-provider results in a disruption across the financial services sector

These trends amplify third-party risk and underscore the importance of FRFIs’ third-party risk management frameworks. This includes both the supplier’s and the institution’s business continuity and disaster recovery plans, as well as robust third-party contingency planning. We developed a revised Guideline B-10, which was released in April 2022.

Goal 3 - Our agility and operational effectiveness are improved

This section shows how we have ensured we have the right people, skills, and infrastructure to meet the needs of the organization and are able to leverage them in a timely and effective manner.

Completing OSFI’s multi-year Human Capital Strategy

Our leadership team believes in investing in human capital. OSFI’s five-year Human Capital Strategy (HCS), launched in 2017, provided a framework for how we manage and develop our people. The HCS consisted of five priority areas: leadership development; talent management; learning and development; culture and community; and enterprise change management. These contributed to a culture of high performance that embodies our values of Respect, Curiosity and Stewardship, and encourages diversity of thought. The following provides an overview of key achievements in 2021-22, which was the last year of implementation of our HCS:

- The launch of OSFI’s Wellbeing Strategy and Wellbeing Hub, which aspire to create and foster an environment that: promotes healthy living, mental health, and minimizing stigma; strives to prevent illness; and supports employees with services, resources, and tools.

- The implementation of the action plan following the 2020-21 review of our hiring and promotion processes and practices, which focused on educating hiring managers, enhancing the staffing process, increasing transparency, and improving access and representation.

- The creation in May 2021 of the Diversity, Equity, and Inclusion Unit, which is responsible for advancing our commitment to become a more representative and inclusive organization. The OSFI Diversity, Equity and Inclusion Strategy 2022-25 was launched in March 2022 and includes a comprehensive action plan and performance measurement framework to support its implementation. In addition, we launched a self-identification campaign and our first-ever Inclusion Award, which recognizes contributions to a healthy, inclusive, and respectful environment that supports diversity of thought and promotes a psychologically safe workplace.

- Continued support for leadership development. We launched two new programs, a Leadership Development program for Aspiring and New Directors and the OSFI Leaders’ Program for senior leaders. We also held a virtual Senior Leaders Workshop focused on creating a psychologically safe workplace that brought more than 60 senior leaders together.

- OSFI’s updated Leadership Competency Model (LCM), which is a cornerstone of our culture transformation. The updates reflect the emerging skillsets and behaviours that are considered most important for being effective leaders at OSFI. We use the LCM to effectively identify, develop, evaluate, retain, and promote employees at all levels in our organization.

- Increased accessibility to language training and the development of a new Directive on Official Languages for Workplace Communications.

Ensuring our preparedness for FRFI crises

In 2021-22, we continued to build on crisis management processes, tools and strategies developed the previous year. This has strengthened our ability to manage crises in an effective and agile way and supports operational readiness.

Building on recent experiences and lessons learned from inter-agency tabletop exercises and the COVID-19 pandemic, 2021-22 key achievements included:

- Development of an updated crisis preparedness framework and strategy, including a refined crisis communication strategy and updated operational playbooks

- Development and delivery of a training program for staff to ensure operational readiness for a one-office response to a FRFI crisis

- Finalization of standing emergency contract processes to be ready to operationalize the contracts effectively and efficiently in a time of crisis

Implementing our enterprise Data Strategy

We have been implementing our multi-year enterprise Data Strategy, strengthening data management, data governance, and advanced analytic capabilities. The Data Strategy has modernized data management and enabled internal and external strategic collaboration. Initiatives under the strategy are implemented in close collaboration with key internal technology and business partners to drive adoption and increase overall data literacy across OSFI.

The importance of timely and accurate data was heightened throughout the pandemic and continued to be an area of focus. In 2021-22, the Data Strategy transformed the way our supervisors work with, and derive value from, the data we collect. Key achievements included:

- The continued build-out of data and analytics resources to expand internal capabilities in four key areas: Data Collection, Data Management and Transformation, Data Engineering and Analytics, Advanced Analytics and Data Governance

- Acquisition of new enterprise tools to modernize business intelligence reporting, data workflow automation, data quality assessments and advanced analytics sandbox environments

- Enhanced agility of data governance processes

- Expanded training and knowledge to further develop data literacy skills across OSFI

Advancing our Cloud Strategy, IM/IT Strategy and digital

We continued to evolve and deliver on our Cloud Strategy and Information Management/Information Technology (IM/IT) Strategy with a digital focus. A successful migration to the Cloud continued to be a key priority. Microsoft 365 Office applications were rolled out to all staff and collaboration tools were adopted, strengthening our remote work posture. Key achievements in 2021-22 include:

- Development of five micro-strategies to respond to emerging requirements for collaboration tools, case management technology, cyber security, and the OSFI Data Strategy

- Launch of multiple new technology services and use cases of OSFI’s Technology Exploration Space (TES), enabling data science research and experimentation with new cloud-based capabilities, including machine learning and artificial intelligence

- Rollout of cloud-based productivity applications (Word, Excel, PowerPoint) and enhancement of end-user mobility tools. These were accompanied by electronic signature capabilities, the automation of secure internal network access for remote workers and the introduction of biometric authentication to enhance enterprise single sign on capabilities

- Implementation of an Organizational Change Management strategy and program to better support employees in the adoption and use of newly deployed cloud technology

- Support of PIVOT, our hybrid working model and office modernization program, through the deployment of new onsite collaboration and meeting technologies, such as videoconferencing equipment

- Development of a Cloud Information Governance Strategy in support of the migration of document management systems to the cloud

- Reorganization of application development resources around an agile software development and IT operations (DevOps) model, where dedicated program teams focused on supporting specific business units, enabling a modern and responsive delivery organization

- Launch of mandatory cyber security training to standardize and improve our security posture relative to new cloud-based and hybrid work models

- Design of IM/IT risk dashboards and indicators to consistently articulate IM/IT’s risk landscape and enable better governance decision-making

Improving our agility and resilience

In 2021-22, we continued to demonstrate our ability to remain flexible, adapt to the modern workplace and ways of working, and thrive in new circumstances. We also celebrated OSFI being named for the second consecutive time, one of the National Capital Region’s top employers.

Employees at home and in the office

We continued to support our employees – the vast majority of whom currently work remotely – through flexible work arrangements that considered mental and physical well-being while maintaining business operations. In 2021-22, we continued the virtual delivery of our human resources services, including recruitment and onboarding of new employees, learning and development, leadership development, awards and recognition, and performance management.

Throughout the COVID-19 pandemic waves in 2021-22, we supported all employees who were working from home and ensured those performing essential functions onsite were equipped to do their jobs safely.

Government-wide vaccination policy

Following the Government of Canada’s August 2021 announcement of its intent to require COVID-19 vaccination across the federal public service, we led the development and successful implementation of OSFI’s Policy on COVID-19 Vaccination, two accompanying frameworks, and an IT solution that enabled employees to attest to their vaccination status.

Hybrid Workplace: PIVOT

Our integrated approach to our hybrid working model and office modernization, OSFI’s PIVOT program, continued to gain momentum through grass roots employee engagement and the development of a clearer view of OSFI’s workplace of the future. Key achievements in 2021-22, include:

- Held leadership focus groups and union engagement to support the establishment of hybrid workplace principles.

- Successfully opened our offices and workspaces for those who wished to work onsite on a voluntary basis. We equipped employees with a full work-from-office guide to help ease this transition.

- Started developing floor plans for our future space . The team piloted Government of Canada coworking and activity-based working concepts, and equipped offices in an “interim state” capacity until the 2024 target implementation date.

- Transitioned our Vancouver office to an interim space and designed the new space as our PIVOT pilot project.

- Started developing a flexible Hybrid Work Model Playbook. The playbook sets out guiding principles, an operating model, organizational parameters, and the desired mindsets and behaviors for our new hybrid work environment.

Goal 4 - Support from Canadians and cooperation from the financial industry are preserved

This section describes the steps taken in 2021-22 to strengthen Canadians’ trust in the safety and soundness of financial institutions and pension plans.

Expanding stakeholder outreach

We expanded outreach to external stakeholders to increase understanding of key risk issues, share OSFI’s role and perspective, and provide training and understanding of issues faced by regulated entities.

Domestic work with partners

We work with our Canadian partners to share information on matters relating to the supervision of FRFIs and ensure the effective oversight of Canada’s financial system. We also participate in committees of other financial and oversight bodies to learn from and provide input into their work.

Oversight of Canada’s Financial System

We report to Parliament through the Minister of Finance and work closely with federal partners, including the Department of Finance, the Bank of Canada, the Canada Deposit Insurance Corporation (CDIC) and the Financial Consumer Agency of Canada. We also work with the FINTRAC and consult with provincial counterparts and industry stakeholders. In 2021-22, we continued to hold regular meetings with our partners and industry stakeholders. We also participated in crisis management meetings with the CDIC to assess institutional preparedness.

Canadian Association of Pension Supervisory Authorities

OSFI is a member of CAPSA, a national association of pension regulators with a mission to facilitate an efficient and effective pension regulatory system in Canada. As a result of a collaboration between OSFI and the Financial Services Regulatory Authority of Ontario (FSRA), and with the guidance of a Technical Advisory Committee, a plain-language, member-focused guide for defined contribution (DC) pension plans was developed. This guide, titled Defined Contribution Pension Plans: Did You Know?, was endorsed by CAPSA and published on its website in October 2021. The guide provides retirement basics, key information on DC plans, and information about how to obtain good retirement outcomes through membership in a DC plan.

Other committees and outreach

We actively participate in domestic standard-setting and oversight bodies related to Canadian auditing and accounting standards. In 2021, we joined as an observer the Independent Review Committee on Standard Setting Canada. We helped review the governance and structure for establishing Canadian accounting, auditing, and assurance standards, as well as sustainability standards for the future.

In October 2021, we co-hosted a virtual meeting on audit quality with the Canadian Public Accountability Board and the Canadian Securities Administrators. The forum allowed us to discuss ways to contribute to public confidence in external audit quality in Canada.

International work with partners

OSFI has earned a strong international reputation through our active participation with international organizations. This allows us to share the Canadian perspective and help shape new international regulatory and supervisory rules and accounting and actuarial standards that are fit for purpose for the Canadian financial system.

Financial Stability Board

Canadian representation on the FSB includes the Department of Finance, the Bank of Canada and OSFI. During 2021-22, our role included membership on the FSB Plenary, Steering Committee, and Standing Committee on Supervisory and Regulatory Cooperation, as well as:

- Helping coordinate the global response to the COVID-19 pandemic, including the unwinding of temporary measures

- Co-leading the Working Group on Climate Risk, leading to the publication of the interim FSB Report on Supervisory and Regulatory Approaches to Climate-related Risks

- Building on a stock-take of financial authorities’ experience with climate risk inclusion in their financial stability monitoring

- Publishing a report on the Assessment of Risks to Financial Stability from Crypto-assets

- Publishing a progress report on the Regulation, Supervision and Oversight of “Global Stablecoin” Arrangements

- Working with other jurisdictions in advancing reform around major interest rate benchmarks and the transition away from London InterBank Offered Rate

- Publishing a biennial report on compensation practices including the use of non-financial measures and participating in a workshop panel led by the Compensation Monitoring Contact Group

- Working with standard-setting bodies to finalize and operationalize the implementation of G20 post-crisis financial sector reforms in insurance and resolution regimes

- Chairing the FSB’s Roundtable on External Audit

Basel Committee on Banking Supervision

We are an active member of the Basel Committee on Banking Supervision (BCBS), which provides a forum for international rulemaking and cooperation on banking supervisory matters. We worked closely with the BCBS on several important initiatives related to the three main areas of focus of their 2021-22 work programme: i) COVID-19 resilience and recovery; ii) horizon scanning, analysis of structural trends and mitigation of risks; and iii) strengthening supervisory coordination and practices.

Specifically in 2021-22, we:

- Actively participated in BCBS discussions and information-gathering exercises to better understand the impact of the COVID-19 pandemic on the global banking system

- Continued to co-chair the Supervisory Cooperation Group, which aims to strengthen supervision of banks worldwide and promote strong and effective supervisory cooperation on cross-border banking issues

- Continued to co-chair the Credit Risk and Large Exposures Group, a technical working group that provides analysis and policy recommendations related to international credit risk and large exposure frameworks

- Continued to participate in the BCBS’s Accounting and Audit Experts Group’s (AAEG) monitoring of COVID-19-related accounting and auditing issues, including co-chairing the Expected Credit Loss (ECL) Workstream to assess ECL issues pertaining to internationally active banks

In May 2021, then OSFI Superintendent Jeremy Rudin chaired the FSB’s Roundtable on External Audit. This event brought together senior representatives from FSB member authorities, the BCBS, International Organization of Securities Commissions, the International Forum of Independent Audit Regulators, as well as regional and national audit oversight bodies. The roundtable facilitated dialogue among the official sector community to support and coordinate audit-related initiatives and to promote financial stability by enhancing public confidence in the quality of external audit.

Colleges of Supervisors and Crisis Management Groups

In 2021-22, we hosted four Colleges of Supervisors sessions, which involve large banks and insurers as well as international regulators. We also conducted quarterly conference calls with international regulators to identify potential issues in their jurisdiction before they manifest and attended the colleges of companies with significant operations in Canada.

In addition, we participated in several Crisis Management Group (CMG) meetings for the two Globally Systemically Important Banks (G-SIBs) and attended the CMGs of foreign G-SIBs with significant operations in Canada. In December 2021, the Co-operation Agreement for recovery and resolution planning between home and relevant host authorities was executed for Canada’s first G-SIB.

Actuarial events and presentations

The OCA hosted and presented work for domestic and international stakeholders. In 2021-22, a Virtual Seminar on Demographic, Economic, and Investment Perspectives for Canada was held to consult with experts in the fields of demography, economics, and investments before setting the assumptions for the CPP actuarial report. The Chief Actuary and OCA staff also presented at the International Social Security Association’s 20th International Conference of Social Security Actuaries, Statisticians, and Investment Specialists.

Assessing implications of digital innovation through work with partners

We are working with partners to assess the implications of digital money innovations like cryptocurrencies on our regulatory frameworks. In 2021-22, we worked with the Department of Finance and other federal partners on the development of a Government of Canada-endorsed data mobility framework to address the rise of open banking and other consumer-directed finance arrangements. We are also considering ways to facilitate entry into the regulated federal financial system by non-traditional financial services providers.

We also reviewed the extent to which stablecoin activities that FRFIs might wish to pursue are permissible under the relevant federal legislation and ensure appropriate federal prudential oversight. We are working closely with our federal and provincial partners to ensure an appropriate and coordinated Canadian regulatory response to stablecoin arrangements.

Increasing our transparency

In 2021-22, we continued to promote transparency and understanding of what we do through a variety of means, including by increasing the number of speaking engagements by OSFI executives, publishing changes such as the DSB and MQR (under Guideline B-20), publicly releasing our Blueprint, new Strategic Plan and Annual Risk Outlook, and increasing our social media presence on Twitter, LinkedIn and YouTube. We also made improvements to our forward-looking agenda on policy priorities.

Annual Risk Outlook

In 2021-22, OSFI developed its first Annual Risk Outlook, which provides details of the risks facing Canada’s financial system, such as cyber attacks, digital innovation, housing-related considerations, climate change, and more. The 2022-2023 Annual Risk Outlook was released in April 2022 and includes OSFI’s plans to address the risks in the coming year.

Forward-looking agenda on policy priorities

The activities listed in our updated forward policy plans are relevant to our mandate and the institutions we oversee. They are responsive to risks in an uncertain environment and realistic in both timing and substance to ensure our regulatory framework remains fit for purpose.

Following the suspension of policy initiatives on March 13, 2020, we took a prudent and risk-focused approach to relaunching our policy development work. By September 2020, it was clear that prudential policy development work needed to continue and be adapted to the new normal. At that time, we issued our first near-term plan to provide the industry and stakeholders clarity on our policy direction through to June 2021. At the end of June 2021, we had delivered on 80% of that plan.

In May 2021, we released our prudential policy priorities for the next year. This plan built on lessons and work throughout the COVID-19 pandemic, setting clear priorities and timelines to develop policies and guidance that support the continued resilience of FRFIs and FRPPs.

Contributing to a financially sound and sustainable system through our actuarial work

In 2021-22, the OCA tabled several actuarial reports, contributing to a financially sound and sustainable system. The following are highlights on select reports.

The 17 Actuarial Report on the Old Age Security Program

The 17 Actuarial Report supplementing the Actuarial Report on the OAS program as at 31 December 2018 was tabled in Parliament in February 2022. It provides information on the OAS program’s future expenditures until 2060. This information facilitates a better understanding of the program and the factors that influence its costs. The 17 Actuarial Report has been prepared to show the effect of increasing the OAS pension payable to individuals aged 75 or older by 10% as of July 1, 2022, on the long‑term financial status of the OAS program. The projected number of OAS pensioners who will benefit from the increase is 3.2 million in 2022 and is expected to grow to 3.8 million by 2026.

Public-Sector Pension and Benefit Plans

In 2021-22, the OCA tabled in Parliament three actuarial reports on public sector insurance and pension plans:

- The Actuarial Report on the Pension Plan for the Public Service of Canada as at 31 March 2020

- The Actuarial Report on the Public Service Death Benefit Account as at 31 March 2020

- The Actuarial Report on the Benefit Plan Financed Through the Royal Canadian Mounted Police (Dependents) Pension Fund, as at 31 March 2019

These reports provide actuarial information to decision-makers, parliamentarians, and the public, thereby increasing transparency and confidence in Canada’s retirement income system. Most importantly, the Actuarial Report on the Pension Plan for the Public Service of Canada provides advice to the Government of Canada for setting pension employee contribution rates for federal public servants, and members of the Canadian Armed Forces (Regular Force) and the Royal Canadian Mounted Police. These reports also reflect the expected impacts of the COVID-19 pandemic on the economic assumptions.

Actuarial Report on the Employment Insurance program – premium rate

In December 2021, the OCA tabled in Parliament the Canada Employment Insurance Commission the 2022 Actuarial Report on the Employment Insurance Premium Rate. The report provides the forecast breakeven premium rate for the upcoming year and a detailed analysis.

Looking ahead

The 2021-22 fiscal year marked the final year of our 2019-22 Strategic Plan. Over the course of that plan, dynamic new risks like the digitalization of money and climate change, combined with the challenges brought on by an unexpected global pandemic, illustrated the need for strong financial regulation in Canada.

In June 2021, Peter Routledge assumed the role of Superintendent, succeeding Jeremy Rudin. With a new Superintendent at the helm and a renewed appreciation of our risk environment, we engaged in strategic exercises to adapt for the years ahead.

In December 2021, we released our aspirational Blueprint for Transformation, 2022-25, which will guide our overall direction. It sets the foundation for how we intend to go about preparing for fundamental changes in our risk environment and consists of three foundational elements and six transformative initiatives. The foundational elements are:

- refocusing the delivery of our mandate to place greater emphasis on contributing to public confidence in the Canadian financial system;

- expanding our risk appetite and risk practices;

- and further embedding our corporate values to create a culture where everyone can flourish.

The transformative initiatives are:

- culture initiatives

- risk, strategy and governance

- strategic stakeholder and partner engagement

- policy innovation

- supervisory framework

- data management and analytics

The work started by the Blueprint continued through the remainder of 2021-22, culminating in the release of OSFI’s 2022-25 Strategic Plan in April 2022. This new Strategic Plan, developed by a group of OSFI senior leaders, sets out the concrete actions we will take to implement the Blueprint.

With the Blueprint and accompanying Strategic Plan in hand, we announced in March 2022 changes to our organizational structure to better align with the new strategy. This new structure, which involved significant planning and numerous staffing actions, will position OSFI to fulfill its mandate, contributing to confidence in Canada’s financial system.

“OSFI has an impressive record of accomplishment in helping to keep Canada’s financial system resilient. To sustain that record of service, we must be prepared and well positioned to not only react, but also adapt urgently to an [intensifying] risk environment.”

- Peter Routledge, Superintendent

Disclosure of Information

Under the OSFI Act, the Bank Act, the Trust and Loan Companies Act and the Insurance Companies Act, the Superintendent is required to report to Parliament each year on the disclosure of information by financial institutions and the progress made in enhancing the disclosure of information in the financial services industry.

We promote effective disclosure by publishing select financial information on our external website, providing guidance to federally regulated financial institutions (FRFIs) on their disclosures to the public, and participating in international supervisory groups with similar objectives.

Public Disclosures Associated with Maintaining Financial Stability

Public disclosure of risk management practices and risk exposures made by FRFIs are paramount to maintaining financial stability and market confidence. Over the past several years, publications released by international organizations such as the FSB and the Basel Committee on Banking Supervision (BCBS) have stressed the need for clear, comprehensive, and meaningful risk disclosures. We believe that strong disclosures and market discipline are key elements of effective corporate governance and sound risk management practices within an institution.

In January 2022, we issued final guidelines on Pillar 3 Disclosure Requirements for Canadian D-SIBs and Pillar 3 Disclosure Requirements for SMSBs.

In 2021-22, we participated as a member of the FSB’s Work Stream on Climate Disclosures, which reported to the G20 Finance Ministers and Central Bank Governors on promoting globally comparable, high-quality, auditable standards of climate-related financial disclosures.

We carried out stakeholder engagement efforts regarding progress on FRFIs’ climate-related financial risk disclosures to help inform our future guidance in this area.

We are committed to continuing to improve public disclosures to promote safety and soundness in the way institutions conduct business, and to contribute to public confidence in the Canadian financial system. We will continue to support disclosure initiatives through our membership in international associations and by reviewing our domestic disclosure requirements and practices.

OSFI's Financial Review and Highlights

We are funded mainly through assessments on the financial institutions and private pension plans that we regulate and a user-pay program for legislative approvals and other select services.

The amount charged to individual institutions is set out in regulations for our main activities:

- risk assessment and intervention (supervision);

- approvals and precedents; and

- regulation and guidance.

In general, our system is designed to allocate costs based on the approximate amount of time spent supervising and regulating each industry. Costs are then assessed to individual institutions within an industry based on the applicable formula for the industry and the size of the institution. Staged institutions are assessed a surcharge on their base assessment, approximating the extra supervision resources required.

In addition to yearly reporting of our financial statements through this report, we publish quarterly financial statements.

We also receive revenues for cost-recovered services. These include revenues from federal Crown corporations such as the Canada Mortgage and Housing Corporation (CMHC), which OSFI supervises under the National Housing Act, provinces for which OSFI provides supervision of their institutions on contract, and revenues from other federal organizations to which OSFI provides administrative services.

We collect administrative monetary penalties from financial institutions when they contravene a provision of a financial institutions Act and are charged in accordance with the Administrative Monetary Penalties (OSFI) Regulations. These penalties are collected and remitted to the Consolidated Revenue Fund. By regulation, OSFI cannot use these funds to reduce the overall assessment costs for the industries it regulates.

The Office of the Chief Actuary (OCA) is funded by fees charged for actuarial valuation and advisory services relating to the Canada Pension Plan, the Old Age Security program, the Canada Student Loans Program and various public sector pension and insurance plans, and by a parliamentary appropriation.

2021-2022 Financial Overview

Our financial statements for the 2021-22 fiscal year can be found in Annex A.

Our total costs were $212.5 million, an $11.2 million or 5.6% increase from the previous year. Personnel costs, OSFI’s largest expense, rose by $9.2 million, or 5.8%. This variance reflects an increase in the number of full-time equivalent employees, and normal economic and merit increases. Machinery and equipment costs increased by $1.1 million or 68.3% due to computer equipment (laptops and peripherals); the pandemic delayed/slowed down the replacement of some equipment last year, resulting in more cost this year. Professional services costs increased by $0.5 million or 2.6% because of new and expanded initiatives such as the transition to the Cloud and Diversity Equity and Inclusion (DEI). Rental costs increased by $0.4 million or 3.0% because of increased software licensing fees related to planned growth in headcount. All other costs, in total, remained stable.

OSFI’s full-time equivalent employees in 2021-2022 was 920, a 6.1% increase from the previous year due to staffing actions (e.g., vacant positions and new positions tied to strategic initiatives such as Cloud and DEI initiatives) and lower than anticipated turnover rates.

Federally Regulated Financial Institutions

Revenues

Total revenues from federally regulated financial institutions were $193.5 million, an increase of $9.8 million or 5.3% from the previous year. Base assessments on financial institutions, which are recorded at an amount necessary to balance revenue and expenses after all other sources of revenue are taken into account, increased by $10.9 million or 6.0% from the previous year.

Revenue from user fees and charges decreased by $0.8 million or 52.3% because of a reduction in surcharge assessments.

Costs

Total costs attributed to federally regulated financial institutions were $193.5 million, an increase of $9.8 million or 5.3% from the previous year. The increase is primarily due to higher personnel costs ($8.6 million), and higher machinery and equipment costs ($1.1 million), as explained above.

Base Assessments by Industry

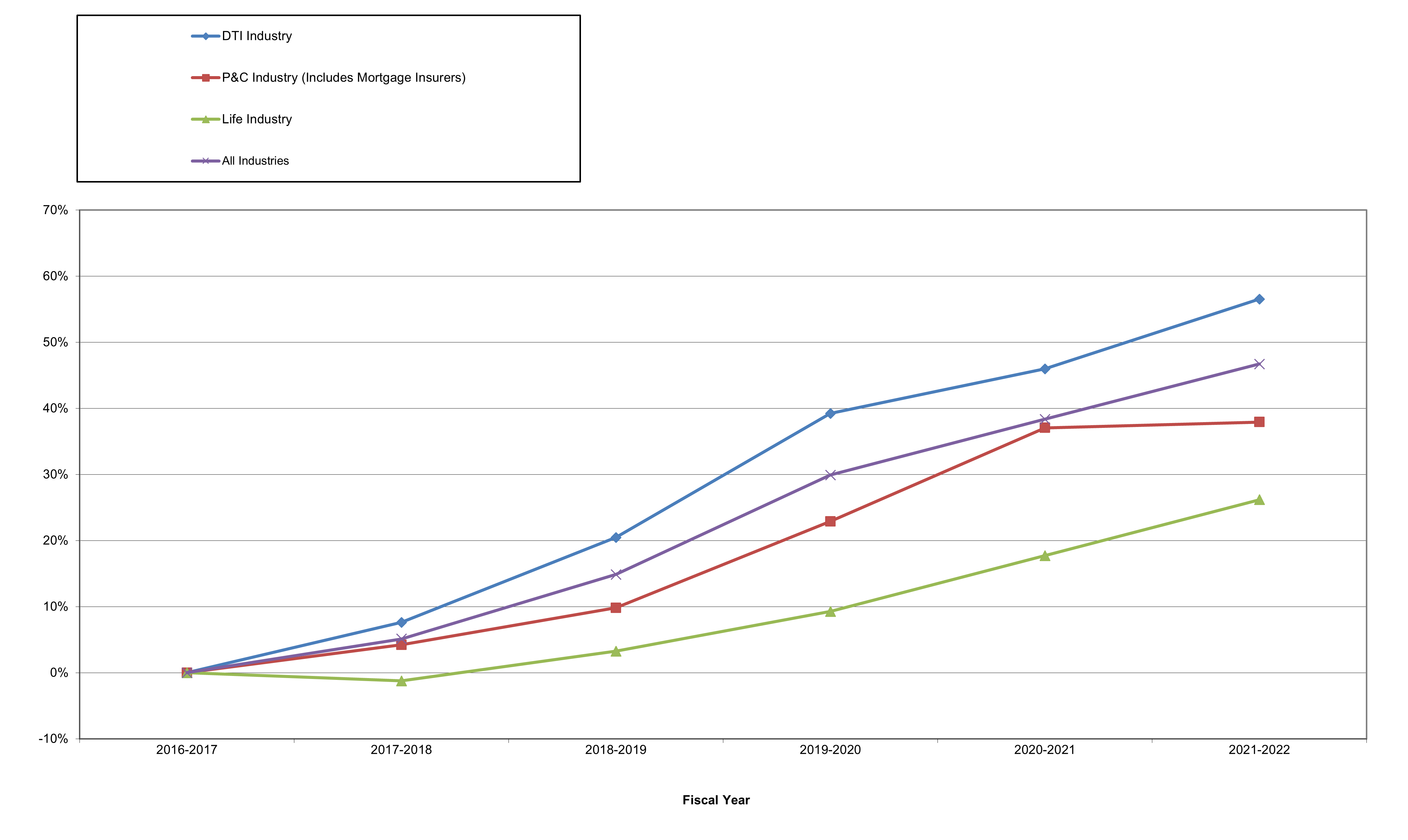

Base assessments are the costs allocated to an industry, less user fees and charges and cost-recovered services revenues. Base assessments are differentiated to reflect the share of OSFI’s costs allocated to each industry group. The chart below compares the cumulative growth of base assessments by industry group over the past five years, using 2016-2017 as the base year.

Base Assessments by Industry

Cumulative Growth Rates from Fiscal Year 2016-17

Base Assessments by Industry Cummulative Growth Rates from Fiscal Year 2016-17

| blank | 2016-2017 | 2017-2018 | 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 |

|---|---|---|---|---|---|---|

| DTI Industry | 0.0% | 7.6% | 20.5% | 39.2% | 46.0% | 56.5% |

| P&C Industry (Includes Mortgage Insurers) | 0.0% | 4.2% | 9.8% | 22.9% | 37.1% | 37.9% |

| Life Industry | 0.0% | -1.2% | 3.3% | 9.3% | 17.7% | 26.2% |

| All Industries | 0.0% | 5.1% | 14.9% | 29.9% | 38.4% | 46.7% |

The overall growth in assessments from 2016-2017 to 2021-2022 primarily reflects the growth in full time equivalent employees to deliver on OSFI’s vision and strategic priorities. In 2018-2019, investments to implement a comprehensive human capital strategy, modernize OSFI’s supervisory processes, practices and tools, and execute a cyber-security strategy and its associated action plan increased base assessments across all industries. In 2019-2020 through 2021-2022, we made investments in additional employees, supervisory tools and supporting resources to implement OSFI’s 2019-2022 three-year Strategic Plan. The implementation of the Strategic Plan allowed OSFI to keep pace with the continually evolving and increasingly complex environment within which it operates.

- The rate of growth in the deposit-taking institutions (DTI) industry since 2016-2017 has been higher than the overall growth in assessments during the same period because of greater resources dedicated to this sector, primarily related to increased time spent on mortgage underwriting, the domestic stability buffer, non-financial risks and small and medium-sized banks.

- The rate of growth in the P&C industry was fairly consistent with the overall rate of growth at OSFI from 2016-17 through 2020-21. In 2021-22, base assessments grew but at a lower rate than the growth in OSFI’s expenses primarily because of a lower utilization of shared regulatory and supervisory resources for P&C insurance matters.

- After completion of the Life Insurance Capital Adequacy Test Guideline (LICAT) in 2015-2016, the rate of growth in the Life insurance dropped below OSFI’s overall growth rate through 2019-2020. Since 2020-21, the rate of growth in this sector approximates the overall OSFI growth rate.

Federally Regulated Private Pension Plans

Assessments

Our costs to regulate and supervise private pension plans are recovered from an annual assessment charged to plans based on their number of beneficiaries. Plans are assessed upon applying for registration under the Pension Benefits Standards Act, 1985 (PBSA) and annually thereafter.

The assessment rate is established based on our estimate of current year costs to supervise these plans, adjusted for any accumulated excess or shortfall of assessments in the preceding years. The estimate is then divided by the anticipated number of assessable beneficiaries to arrive at a base fee rate. The rate established for 2021-2022 was $10.00 per assessable beneficiary, unchanged from the previous year. Total fees assessed during the fiscal year were $7.1 million ($7.1 million in 2020-21) whereas total fees recognized as revenue in 2021-2022 were $7.4 million (up from $7.2 million in 2020-2021). The difference between revenue recognized and fees assessed gives rise to the drawdown of excess assessments from prior years, as discussed below.

The excess or shortfall of assessments in any particular year is amortized over five years in accordance with the assessment formula set out in regulations whereby the annual shortfall or excess is recovered or returned to the pension plans over a period of five years commencing one year from the year in which they were established through an adjustment to the annual fee rate. The rate established and published in the Canada Gazette in September 2021 for 2022-2023 is set at $10.00 per assessable beneficiary, unchanged from 2021-2022. OSFI anticipates that the rate for 2022-2023 will fully recover the estimated annual costs of this program; however, variations between actual and estimated costs or plan beneficiaries in any particular year will cause an excess or shortfall of assessments.

Costs

The cost of administering the PBSA for 2021-2022 was $7.4 million, an increase of $0.2 million or 2.5% from the previous year primarily due to an increase in in the provision for doubtful accounts due to slow collection on some pension plan assessments.

| Fiscal year | 2016-2017 | 2017-2018 | 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 |

|---|---|---|---|---|---|---|

| Assessments | 6,366 | 5,612 | 5,612 | 6,295 | 7,131 | 7,093 |

| Costs | 7,035 | 7,193 | 6,664 | 6,646 | 7,175 | 7,351 |

| Basic fee rateFootnote * per assessable beneficiary |

9 | 8 | 8 | 9 | 10 | 10 |

Table 1 footnote

|

||||||

Actuarial Valuation and Advisory Services

The OCA is funded by fees charged for actuarial valuation and advisory services and by an annual parliamentary appropriation. Total expenses in 2021-22 were $11.6 million, an increase of $1.3 million, or 12.5%, from the previous year primarily due to higher personnel costs as a result of staffing vacant positions and an increase in associated overhead costs.

Independent Auditor’s Report

To the Superintendent of Financial Institutions and the Minister of Finance

Opinion

We have audited the financial statements of the Office of the Superintendent of Financial Institutions (“OSFI”), which comprise the statement of financial position as at March 31, 2022, and the statements of operations, changes in net financial assets and cash flow for the year then ended, and notes to the financial statements, including a summary of significant accounting policies (collectively referred to as the “financial statements”). In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of OSFI as at March 31, 2022, and the results of its operations and its cash flows for the year then ended in accordance with Canadian public sector accounting standards (“PSAS”).

Basis for Opinion

We conducted our audit in accordance with Canadian generally accepted auditing standards (“Canadian GAAS”). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of OSFI in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Responsibilities of Management and Those Charged with Governance for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with Canadian accounting standards for public sector, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is responsible for assessing OSFI’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate OSFI or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing OSFI’s financial reporting process.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian GAAS will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. As part of an audit in accordance with Canadian GAAS, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

- Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of OSFI’s internal control.

- Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

- Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on OSFI’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s report. However, future events or conditions may cause OSFI to cease to continue as a going concern.

- Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation. We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

Deloitte LLP Chartered Professional Accountants

Licensed Public Accountants

June 27, 2022

Deloitte LLP

100 Queen Street Suite 1600

Ottawa, ON K1P 5T8 Canada

Tel: 613-236-2442 Fax: 613-236-2195

www.deloitte.ca

Financial Statements: March 31, 2022

Statement of Management Responsibility Including Internal Control over Financial Reporting

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2022 and all information contained in these statements rests with the management of the Office of the Superintendent of Financial Institutions (OSFI). These financial statements have been prepared by management using the Government of Canada’s accounting policies, which are based on Canadian public sector accounting standards.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management’s best estimates and judgment, and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of OSFI’s financial transactions. Financial information submitted in the preparation of the Public Accounts of Canada, and included in OSFI’s Departmental Results Report, is consistent with these financial statements.

Management is also responsible for maintaining an effective system of internal control over financial reporting (ICFR) designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are properly authorized and recorded in accordance with the Financial Administration Act and other applicable legislation, regulations, authorities and policies.

Management seeks to ensure the objectivity and integrity of data in its financial statements through careful selection, training, and development of qualified staff; through an organizational structure that provides appropriate divisions of responsibility; through communication programs aimed at ensuring that regulations, policies, standards, and managerial authorities are understood throughout OSFI; and through conducting an annual assessment of the effectiveness of the system of ICFR.