Public consultation on guideline B-20: Residential Mortgage Underwriting

Type of publication: Consultative document

Date: January 2023

In brief

- Mortgage lending risks, particularly related to debt serviceability, have increased considerably since the onset of the pandemic

- In addition to the Minimum Qualifying Rate (MQR), or “stress test”, OSFI is exploring complementary measures to better mitigate risks to FRFIs arising from high consumer indebtedness

- New measures being considered include volume limits on high Loan-to-Income (LTI) and high debt service lending

B-20 consultation

An initial focus on debt serviceability measures

Mortgage lending risks have continued to build

In recent years, risks in the Canadian residential mortgage market have continued to build. Unprecedented house price increases have been accompanied by record levels of household indebtedness, of which residential mortgages account for a large share. Federally regulated financial institution (FRFI) lenders, which hold approximately 80% of all residential mortgages in Canada, are exposed to heightened risks from this indebtedness.

FRFI lenders have a broad obligation to manage mortgage lending risks

Guideline B-20 (B-20) Principle 3, and the associated expectations for debt service coverage under that principle, reflect the broader OSFI expectation that lenders test borrowers with an interest rate that is above the contractual mortgage interest rate.

- B-20 Principle 3

-

FRFIs should adequately assess the borrower’s capacity to service their debt obligations on a timely basis.

- Associated expectations for debt service coverage

-

GDS and TDS ratios should be calculated conservatively (i.e., appropriately stressed for varied financial and economic conditions and/or higher interest rates).

The Minimum Qualifying Rate (or, as it is often referred to, the “stress test”) was introduced to ensure a minimum threshold in this respect. Throughout the years, different designs and calibrations have been implemented in response to the prevailing risk environment. The principles-based regulatory approach of B-20 places the onus on FRFIs to appropriately assess and manage their risks, which includes establishing policies aligned with their board-approved risk appetite. Regulatory limits and floors are not a substitute for discretion and risk-based decision-making by FRFIs.

The MQR has helped, but additional measures may be needed to mitigate mortgage lending risks

The MQR is designed to test a borrower’s ability to service debt. More specifically, for a given loan amount, it tests whether a borrower could manage a higher mortgage payment due to higher mortgage interest rates. This helps mitigate the risks that borrowers may face from future increases in mortgage rates, decreases in income, or unexpected increases in other expenses.

During the pandemic, many borrowers qualified at the 5.25% MQR “floor” with actual mortgage rates near or even below 2%. Since early 2021, mortgage rates have risen materially from the historic low levels experienced at the onset of the COVID-19 pandemic. The MQR has proven a crucial risk mitigant against this increase in rates, elevated inflation and the potential loss or reduction of borrower income.

However, FRFI lenders still face increased risks. Mortgage interest rates are at their highest in over a decade. Borrowers are facing record levels of indebtedness. Additionally, as noted in the Bank of Canada’s latest Monetary Policy Report, the pace of economic growth in Canada is slowing and is expected to moderate further, with the potential for downside global risk due to the combined tightening of central banks.

These heightened near-term risks underscore the need to consider complementary measures to mitigate them. Accordingly, in its Annual Risk Outlook 2022-23, OSFI committed to initiate consultations on B-20 in the first calendar quarter of 2023. Throughout 2023, OSFI will carry out a full review of B-20, starting with this initial consultation on debt serviceability measures, examining additional tools to preserve credit quality and sound underwriting at FRFIs.

Proposals

OSFI is seeking stakeholder feedback on the following debt serviceability measures, including impacts they may have on borrowers and lenders:

- Loan-to-income (LTI) and debt-to-income (DTI) restrictions – i.e., measures that restrict mortgage debt or total indebtedness as a multiple, or percentage, of borrower income.

- Debt service coverage restrictions – i.e., measures that restrict ongoing debt service (principal, interest and other related expenses) obligations as a percentage of borrower income.

- Interest rate affordability stress tests – i.e., a minimum interest rate that is applied in debt service coverage calculations to test a borrower’s ability to afford higher debt payments in the event of negative financial shocks.

It is worth noting that these measures could be implemented at the:

- Loan level – i.e., applied for each borrower’s mortgage application; or,

- Lender level – i.e., applied on the lender’s aggregate volume or portfolio of mortgage business.

At the lender level, limits can also be applied at different levels of measurement, restricting either the dollar value or count of the:

- Flow, or volume, of new mortgages underwritten; or,

- Stock of outstanding mortgages (portfolio).

Above all, any new measures would be intended to reinforce B-20 Principle 3 and the expectation that borrowers are appropriately assessed for varied financial and economic conditions and/or higher interest rates.

OSFI welcomes stakeholder views on these measures, how they might be implemented, and other measures that could address prudential risks arising from high household indebtedness. OSFI may choose to pursue one or more of these measures or others that meet OSFI’s policy objective.

- Policy objective

-

To enhance the credit quality of residential mortgage assets and underwriting practices of federally regulated lenders.

1. Loan-to-income and debt-to-income restrictions

Some jurisdictions employ limits on either mortgage debt relative to borrower income (loan-to-income or “LTI”) or total indebtedness relative to borrower income (debt-to-income or “DTI”). The purpose of these limits is to control the extent of indebtedness. Lower indebtedness reduces the probability of borrower default by making ongoing debt payments more manageable and limits a lender’s potential losses in case of borrower default.

Although specific LTI or DTI limits have not been prescribed for FRFIs, an LTI of 4.5x (450%) or more is generally considered to be “high,” and in the past, OSFI has used a threshold of 3.5x (350%) LTI in its industry surveillance activities. That said, an appropriate level for LTI is informed by prevailing interest rates and can, therefore, shift over time. For example, as interest rates rise, a lower LTI limit may be more appropriate.

A lender-level volume restriction on high LTI lending, often referred to as a “flow limit” or “speed limit,” could support the policy objective outlined above. Such a limit would allow lenders discretion to underwrite a certain number of loans that exceed a prudent threshold but which may, based on other lending criteria, be permissible under their residential mortgage underwriting policies (RMUPs). Imposing such limits may also reduce the potential for policy leakage and migration of lending activity to the unregulated lending sphere.

A lender-level volume restriction on high LTI lending could complement existing measures. To operate effectively, OSFI is considering:

- A clear and consistent definition of “income”, for the purpose of calculating LTI;

- Appropriate “high” LTI thresholds (e.g., 3.5x, 4.5x), in view of different macroeconomic conditions, and through-the-cycle; and,

- A credible, industry-wide LTI volume limit (e.g., 20 – 30%);

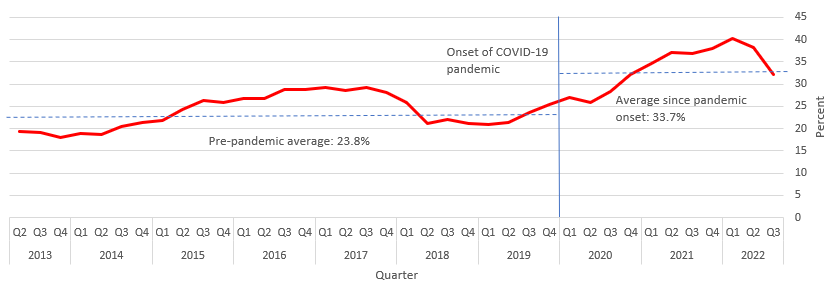

OSFI is seeking stakeholder input on a specific proposal to adopt a “high” LTI threshold of 4.5x, with a 25% quarterly volume limit on originations that exceed this threshold. The proposed limit would apply on the total dollar value of quarterly originations. Compared to a restriction on loan count, this would limit incentives to concentrate high LTI lending in a small number of loans.

Chart 1 - Share of high loan-to-income (>4.5x) originations, industry-wide (volume)

Text description - Chart 1

| Quarter | Industry-wide |

|---|---|

| 2022 Q3 | 32.13 |

| 2022 Q2 | 38.16 |

| 2022 Q1 | 40.17 |

| 2021 Q4 | 38.03 |

| 2021 Q3 | 36.95 |

| 2021 Q2 | 37.2 |

| 2021 Q1 | 34.67 |

| 2020 Q4 | 32.1 |

| 2020 Q3 | 28.4 |

| 2020 Q2 | 25.84 |

| 2020 Q1 | 26.92 |

| 2019 Q4 | 25.5 |

| 2019 Q3 | 23.57 |

| 2019 Q2 | 21.35 |

| 2019 Q1 | 20.95 |

| 2018 Q4 | 21.07 |

| 2018 Q3 | 22 |

| 2018 Q2 | 21.1 |

| 2018 Q1 | 25.8 |

| 2017 Q4 | 28.19 |

| 2017 Q3 | 29.27 |

| 2017 Q2 | 28.5 |

| 2017 Q1 | 29.22 |

| 2016 Q4 | 28.86 |

| 2016 Q3 | 28.84 |

| 2016 Q2 | 26.84 |

| 2016 Q1 | 26.72 |

| 2015 Q4 | 25.97 |

| 2015 Q3 | 26.4 |

| 2015 Q2 | 24.36 |

| 2015 Q1 | 21.85 |

| 2014 Q4 | 21.43 |

| 2014 Q3 | 20.45 |

| 2014 Q2 | 18.74 |

| 2014 Q1 | 18.92 |

| 2013 Q4 | 17.93 |

| 2013 Q3 | 19.21 |

| 2013 Q2 | 19.38 |

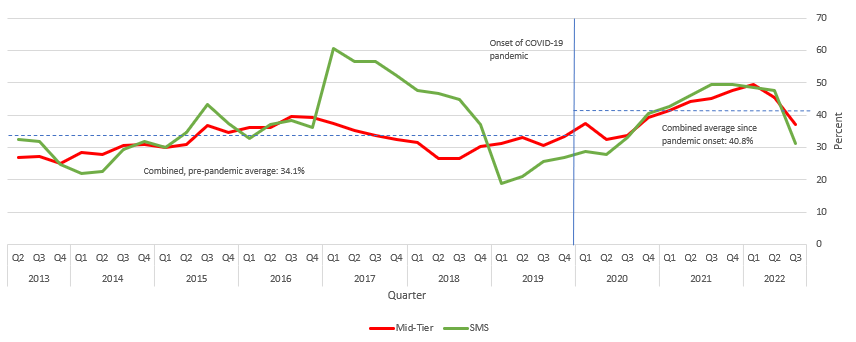

High LTI lending is not evenly distributed across FRFI lenders, and OSFI is aware that smaller and medium-sized lenders tend to have a greater proportion of high LTI loans in their portfolios. Accordingly, any transition would consider the need for different FRFIs to adapt their business plans and RMUPs. High LTI-related risks could also be addressed through the capital framework, such that more capital is set aside for high LTI loans.

Chart 2 - Share of high loan-to-income (>4.5x) originations, Mid-Tier and Small and Medium-sized (SMS) Institutions (volume)

Text description - Chart 2

| Quarter | Mid-Tier | SMS |

|---|---|---|

| 2022 Q3 | 37.16 | 31.25 |

| 2022 Q2 | 45.35 | 47.71 |

| 2022 Q1 | 49.39 | 48.6 |

| 2021 Q4 | 47.75 | 49.42 |

| 2021 Q3 | 45 | 49.49 |

| 2021 Q2 | 44.1 | 46.05 |

| 2021 Q1 | 41.56 | 42.54 |

| 2020 Q4 | 39.16 | 40.43 |

| 2020 Q3 | 33.86 | 33.02 |

| 2020 Q2 | 32.52 | 27.95 |

| 2020 Q1 | 37.37 | 28.75 |

| 2019 Q4 | 33.33 | 26.91 |

| 2019 Q3 | 30.71 | 25.73 |

| 2019 Q2 | 33.07 | 21.17 |

| 2019 Q1 | 31.14 | 18.76 |

| 2018 Q4 | 30.31 | 37.2 |

| 2018 Q3 | 26.6 | 44.76 |

| 2018 Q2 | 26.47 | 46.8 |

| 2018 Q1 | 31.44 | 47.5 |

| 2017 Q4 | 32.56 | 52.38 |

| 2017 Q3 | 33.83 | 56.6 |

| 2017 Q2 | 35.2 | 56.72 |

| 2017 Q1 | 37.33 | 60.63 |

| 2016 Q4 | 39.26 | 36.29 |

| 2016 Q3 | 39.44 | 38.35 |

| 2016 Q2 | 36.24 | 37.03 |

| 2016 Q1 | 36.25 | 32.67 |

| 2015 Q4 | 34.53 | 37.35 |

| 2015 Q3 | 36.9 | 43.4 |

| 2015 Q2 | 30.78 | 34.72 |

| 2015 Q1 | 30.1 | 30.06 |

| 2014 Q4 | 30.82 | 31.91 |

| 2014 Q3 | 30.62 | 29.28 |

| 2014 Q2 | 27.77 | 22.62 |

| 2014 Q1 | 28.58 | 22.11 |

| 2013 Q4 | 25.19 | 24.79 |

| 2013 Q3 | 27.3 | 31.89 |

| 2013 Q2 | 26.96 | 32.48 |

Finally, an LTI measure may require ongoing monitoring and calibration, similar to the current MQR, to reflect prevailing interest rate and other macroeconomic conditions.

Question 1

What are your views on a new lender-level volume restriction on high LTI lending?

- How should an LTI threshold be determined?

- What measure (i.e., dollar value or count) and frequency (e.g., quarterly) of volume restriction would be most appropriate?

- What reasonable exemptions should OSFI consider (e.g., for smaller or less complex lenders, lenders with low mortgage volumes)?

- Are capital framework measures appropriate for addressing risks from high LTI lending?

- Should OSFI explore broader restrictions on indebtedness (i.e., DTI) that capture additional, non-mortgage debt?

- To what extent do you believe that a new LTI restriction will meet OSFI’s policy objective?

2. Debt service coverage restrictions

Debt service coverage ratios are already employed by federally regulated lenders, with the Gross Debt Service (GDS) and Total Debt Service (TDS) ratios most commonly used. For insured mortgages in Canada, GDS and TDS limits are prescribed in law and are currently set at 39% and 44%, respectively.

Beyond those requirements, B-20 does not articulate limits on GDS and TDS for uninsured mortgages and generally permits FRFIs to establish debt serviceability metrics under their RMUPs that facilitate an accurate assessment of a borrower’s capacity to service the loan. Regardless of the metric used, OSFI still expects FRFIs to calculate the average GDS and TDS scores for all mortgages underwritten and/or acquired and ensure that they are less than the FRFI’s stated maximums, as articulated in its RMUP, and reflect a reasonable distribution across the portfolio.

Existing OSFI guidance could be strengthened by introducing a lender-level volume restriction on loans with high debt service ratios. For such a measure to operate effectively, OSFI is considering:

- The formulas and definitions for GDS and TDS and whether to adopt those that currently exist for insured mortgages;

- Appropriate GDS and TDS thresholds for uninsured mortgages, which could involve graduated or tiered limits; and,

- An explicit amortization limit used for qualification in B-20 that, in combination with debt service ratio restrictions, would limit excessive leverage.

GDS and TDS limits would need to be periodically reviewed to ensure they remain suitable for the risk environment. Similar to an LTI limit, OSFI believes that transitional implementation arrangements would need to accompany this measure since impacts may fall disproportionately on smaller and less complex FRFI lenders. OSFI is also exploring whether high debt service ratio lending could be addressed through the capital framework, such that more capital is set aside for high GDS and TDS loans.

Question 2

What are your views on a new lender-level volume restriction on loans with high debt service ratios?

- Are the formulas and definitions for insured mortgage GDS and TDS appropriate for uninsured mortgages? What alternatives should OSFI consider?

- How should GDS and TDS thresholds for uninsured mortgages be determined? Should there be a single set of limits, or should these be graduated or tiered?

- Should OSFI introduce an explicit amortization limit in Guideline B-20 that is used only for qualification?

- What measure (i.e., dollar value or count) and frequency (e.g., quarterly) of volume restriction would be most appropriate?

- What reasonable exemptions should OSFI consider (e.g., for smaller or less complex lenders, lenders with low mortgage volumes)?

- Are capital framework measures appropriate for addressing risks from high debt service lending?

- To what extent do you believe that a new restriction on high debt service lending will meet OSFI’s policy objective?

3. Interest rate affordability stress tests

As outlined above, the MQR is a minimum interest rate that is applied in debt service coverage ratio calculations to test the borrower’s ability to afford higher debt payments in case of negative shocks to income, or increases in interest rates or expenses. The MQR is currently applied in the GDS calculation (i.e., mortgage-related debt service) at underwriting. OSFI maintains the MQR for uninsured mortgages, which is founded in B-20. The federal Minister of Finance maintains the MQR that applies to insured mortgages. As part of its annual review, on December 15, 2022, OSFI held the MQR steady, at the greater of the mortgage contractual rate plus 2% or 5.25%.

A minimum affordability test, while beneficial, can also reduce lenders’ incentives to establish more risk-sensitive affordability tests within their own RMUPs (i.e., tests that may be applied differently for various risk and product characteristics). For example, some loan types, such as variable rate mortgages or mortgages with shorter terms, can carry heightened payment and renewal risk. A higher affordability test on such mortgages may, therefore, better respond to underlying risk. Conversely, loans with fixed rates and longer terms may pose less risk.

As such, OSFI is exploring design elements that could result in the adoption of more risk-sensitive tests of affordability, and could respond better to risks arising from high household indebtedness. Some of these design elements include:

- Creating an explicit principles-based expectation that lenders establish, monitor and report on different MQRs, in addition to the current MQR set in regulation, according to different risk characteristics and product types;

- An expectation that the MQR be applied to a borrower’s total debt service (i.e., for other existing mortgages and non-mortgage debt obligations), in addition to gross debt service; and, similarly,

- Tests of affordability and other debt serviceability measures for non-mortgage retail lending outside of B-20.

Question 3

What are your views on making tests of affordability more risk-sensitive and other measures to strengthen tests of affordability?

- Should the MQR, or a similar interest rate affordability stress test, be applied to a borrower’s total debt service (i.e., for other existing mortgages and non-mortgage debt obligations), in addition to gross debt service?

- Are there other measures OSFI should consider to address prudential risks from non-mortgage consumer indebtedness?

- To what extent do you believe that the potential adaptations to the MQR would meet OSFI’s policy objective?

Question 4

Considering each of the proposals in this paper collectively:

- What are your views on their potential joint impact, or interconnectedness?

- How would you rank or prioritize them in terms of their expected effectiveness in achieving OSFI’s policy objective?

- Are there alternative options that OSFI should consider that would better achieve its policy objective?

Next steps

Stakeholders who wish to make a submission should do so before the consultation closing date of April 14, 2023. Submissions should be made via email to B-20@osfi-bsif.gc.ca.

In drafting submissions, OSFI encourages stakeholders to clearly identify the question(s) to which they are responding. Stakeholders need not respond to every question in this document. Longer submissions should be accompanied by a brief summary. OSFI may publish anonymized summaries of consultation feedback it receives.

OSFI wishes to thank stakeholders who make a submission to this consultation. Their input will inform revisions to B-20, which will be issued for public consultation at a future date. OSFI may also publish interim guidance to industry based on this consultation.