InfoPensions – Issue 26 – May 2022

InfoPensions includes announcements and reminders on matters relevant to federally regulated private pension plans including pooled registered pension plans. To receive email notifications of new items posted to OSFI’s website, including this newsletter and other pension-related documents, please subscribe using Email Notifications.

If you have any questions about the articles you read in InfoPensions or if you have suggestions for future articles, please contact us at pensions@osfi-bsif.gc.ca. We expect to publish the next issue of InfoPensions in November 2022.

For general enquiries, including pension-related questions, please contact us at information@osfi-bsif.gc.ca. If you prefer to contact us by telephone, by fax or by mail, please refer to the contact information on OSFI’s website.

Table of contents

Supervision

Reminder to update contact information

As previously communicated in InfoPensions 24, OSFI would like to remind plan administrators that they have a responsibility to keep their pension plan’s Organization Profile in the Regulatory Reporting System (RRS) up-to-date. Any changes to the pension plan’s contact information must be updated as soon as possible.

Retiree and survivor audits

As communicated in InfoPensions 10, OSFI’s view is that conducting a retiree and survivor audit is a good governance practice to keep records up to date and to confirm that pension benefit payments being paid from the pension fund continue to be paid to the correct person. For example, the use of direct deposit to pay pension benefit payments may result in some delays in plan administrators being notified of a retiree’s or survivor’s death as it may take some time for the next of kin to contact them. This is one of the reasons why OSFI encourages plan administrators to conduct these audits regularly.

Plan administrators can consult our previous article in InfoPensions 10 that outlines alternative measures when attempts to contact the retiree or survivor by phone, mail or e-mail have failed. The article also outlines the requirement of the Pension Benefits Standards Act, 1985 to continue paying a pension until death and the expectation that a plan administrator establishes a sufficient and reasonable basis on which to conclude that a retiree or survivor is deceased.

Guidance and legislative matters

OSFI consultation paper: Pension Investment Risk Management

On March 17, 2022, OSFI published a consultation paper on Pension Investment Risk Management. The paper introduces principles for the management of investment risk that OSFI believes are relevant for federally regulated pension plans. The principles-based expectations cover four areas: independent risk oversight, risk appetite and risk limits, portfolio and risk reporting and valuation policies and processes.

On April 7, 2022, OSFI held an information session for plan administrators and pension industry stakeholders to comment and ask questions on the proposed regulatory expectations set out in the paper.

In response to the consultation, which closed on May 13, 2022, OSFI received several submissions. OSFI is currently reviewing these submissions. Feedback received will help to ensure that guidance on pension investment risk management reflects and accommodates the circumstances of all pension plans, including plans of various sizes, degrees of investment sophistication and risk profiles.

Thank you to everyone who provided input.

Third party survey on the use of technology

Following OSFI’s issuance of a discussion paper on Developing financial sector resilience in a digital world (see article in InfoPensions 25), we are reviewing the use of technology by federally regulated pension plans to better understand the risks and determine the need for additional guidance. Our review includes looking into the technologies used by third-party service providers.

Given the heavy reliance on third-party service providers, OSFI sent a survey to several third-party service providers in November 2021 to better understand technology-related risks and measures that are in place to mitigate the risk to plan beneficiaries. The survey focused on five key themes: services offered; the transfer of information and data; personal and financial data record keeping; oversight and compliance, and technological failures.

OSFI is continuing to analyze the responses received, however we have already noted the importance of clearly setting out the roles and responsibilities of the third-party service provider in the contract and ensuring that the terms of that contract are clearly understood.

OSFI’s analysis of the survey responses will help determine if there is a need for additional guidance for plan administrators on these risks.

Thank you to everyone who participated in the survey.

Culture risk management

In March 2022, OSFI published a letter to all federally regulated financial institutions (FRFIs) and federally regulated pension plans (FRPPs) seeking comments on how culture risks can affect FRFIs and FRPPs, to inform its prudential approach. While the letter refers to FRFIs throughout, FRPPs often face similar risks and the themes raised in the letter may apply to FRPPs as well.

One of the discussion questions is: How do culture risks influence the way FRPPs are managed and administered? What are the benefits of similar outcomes-focused guidance for FRPPs?

Stakeholders can submit comments to Culture@osfi-bsif.gc.ca by May 31, 2022.

Government of Canada’s Budget 2022

On April 7, 2022, the federal government released Budget 2022: A Plan to Grow Our Economy and Make Life More Affordable (Budget 2022), which includes several proposed initiatives involving federally regulated pension plans. Budget 2022 announces that the federal government:

- intends to move forward with requirements for disclosure of environmental, social, and governance (ESG) considerations, including climate-related risks, for federally regulated private pension plans.

- proposes to amend the Pension Benefits Standards Act, 1985 (PBSA) and the Pooled Registered Pension Plans Act to improve the sustainability and long-term security of federally regulated pensions for all plan members and retirees through improved governance and administration and new frameworks for solvency reserve accounts and variable payment life annuities.

On April 28, 2022, the Government of Canada tabled Bill C-19, An Act to implement certain provisions of the budget tabled in Parliament on April 7, 2022 and other measures (the Budget Implementation Act, 2022, No. 1 or BIA 1). BIA 1 includes amendments to the PBSA:

- to require plan administrators to establish a governance policy for all federally regulated private pension plans.

- to establish a framework for solvency reserve accounts.

- to permit regulations to be made respecting the investment of the assets of a pension fund, allowing regulations to be made to require disclosure of ESG considerations.

Please note that the changes regarding governance policies and solvency reserve accounts are not expected to be brought into force until associated changes to the Pension Benefits Standards Regulations, 1985 are implemented.

The additional initiatives mentioned in Budget 2022 involving federally regulated private pension plans may be included in a future budget implementation act.

Guidance posted on OSFI’s website

The following documents were posted to the OSFI website since the last edition of InfoPensions:

- May 2022 – the Instruction Guide for the Replicating Portfolio Information Summary.

- February 2022 – the draft Instruction Guide for the Registration of a Defined Benefit Pension Plan and the draft Instruction Guide for the Registration of a Defined Contribution Pension Plan and their accompanying application forms. The consultation period ended on April 25, 2022 and OSFI is currently reviewing the comments received.

- January 2022 – the Instruction Guide for the Solvency Information Return.

- December 2021 – the updated Life Income Fund (LIF), Restricted Life Income Funds (RLIF) and Variable Benefits Accounts Maximum Annual Payment Amount Table. The table was updated to include the factors applicable in 2022.

Actuarial

Estimated solvency ratio results

OSFI regularly estimates the solvency ratio for federally regulated pension plans with defined benefit provisions. The Estimated Solvency Ratio (ESR) exercise assists OSFI in identifying solvency issues that could affect the security of pension benefits promised to members and beneficiaries before a plan files their actuarial report. The ESR results also help identify broader trends.

The ESR is calculated using the most recent actuarial, financial and membership information filed with OSFI for each plan before the analysis date. Assets are projected based on either the rate of return provided on the Solvency Information Return (SIR) or an assumed rate of return for the plan when no SIR has been filed. Solvency liabilities are projected using relevant commuted value and annuity proxy rates prescribed by the Canadian Institute of Actuaries. Expected contributions, benefit payments, and expenses are taken into account and an ESR based on the estimated adjusted market value of the fund and estimated liabilities is then calculated for each plan.

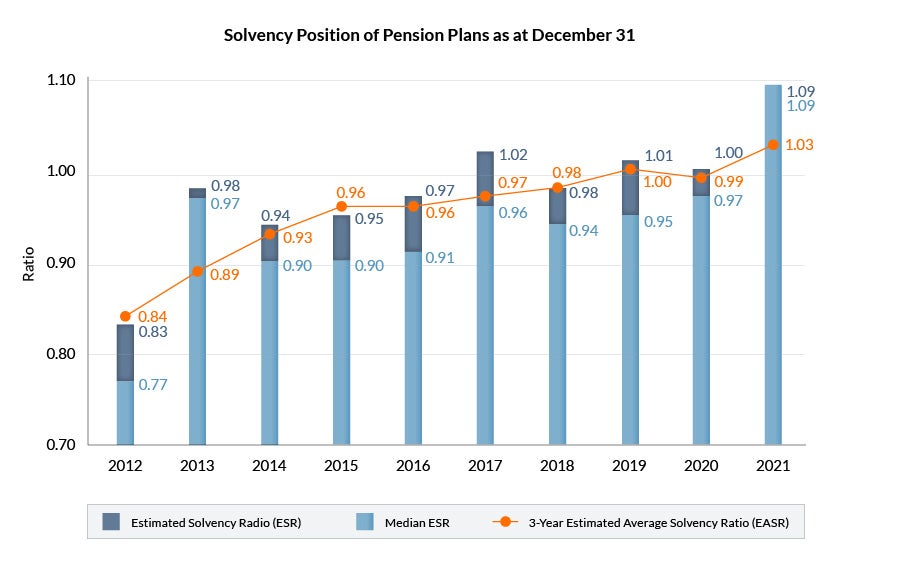

The solvency position of pension plans improved significantly in 2021. The median ESR for the 333 plans included in the exercise (down from 342 last year) increased to 1.09 as at December 31, 2021, up from 0.97 at the end of 2020. The liability weighted average ESR for all plans is also 1.09 as at December 31, 2021, up from 1.00 at the end of 2020. The main drivers of the increase in the ESR are higher solvency discount rates and strong investment returns in 2021. The three-year estimated average solvency ratio (EASR), on which funding requirements are based, has increased to 1.03 as at December 31, 2021, up from 0.99 at the end of 2020. The graph below shows the current and previous ESRs, median ESRs, and the three-year EASRs dating back to December 2012.

Text Description - Solvency Position of Pension Plans as at December 31

| Solvency | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|

| Median ESR | 0.77 | 0.97 | 0.90 | 0.90 | 0.91 | 0.96 | 0.94 | 0.95 | 0.97 | 1.09 |

| Estimated Solvency Ratio (ESR) | 0.83 | 0.98 | 0.94 | 0.95 | 0.97 | 1.02 | 0.98 | 1.01 | 1.00 | 1.09 |

| 3-year Estimated Average Solvency (EASR) | 0.84 | 0.89 | 0.93 | 0.96 | 0.96 | 0.97 | 0.98 | 1.00 | 0.99 | 1.03 |

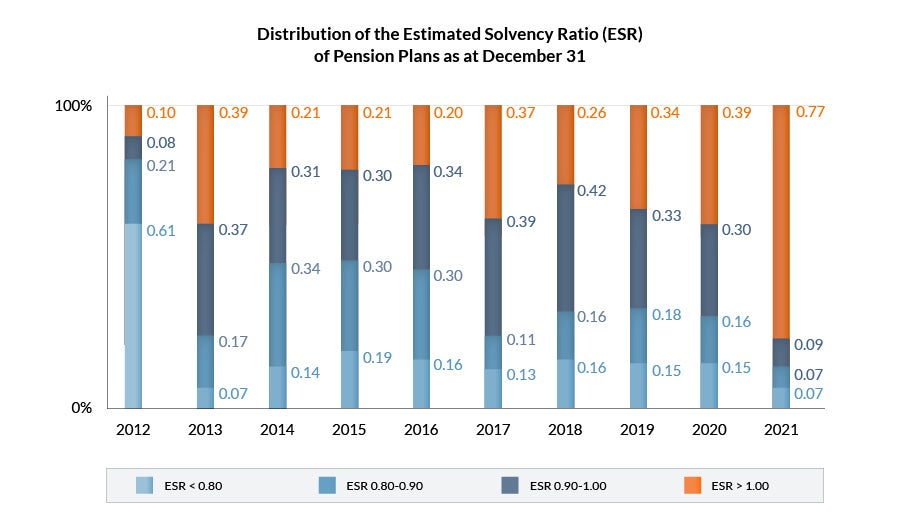

The most recent ESR results show that around three-quarters of defined benefit plans are fully funded – the first time that most pension plans have been fully funded in a number of years! There was a significant reduction in the percentage of plans that were underfunded (23% in 2021 versus 61% in 2020). The number of plans that were significantly underfunded (ESRs below 0.80) also decreased (7% in 2021 down from 15% in 2020). It should be noted that these plans are all designated plans and therefore their funding is limited by the Income Tax Regulations. The graph below illustrates the distribution of the ESR results as at December 31 of each year since 2012.

Text Description - Distribution of the Estimated Solvency Ratio (ESR) of Pension Plans as at December 31

| Distribution | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|

| ESR < 0.80 | 0.61 | 0.07 | 0.14 | 0.19 | 0.16 | 0.13 | 0.16 | 0.15 | 0.15 | 0.07 |

| ESR 0.80-0.90 | 0.21 | 0.17 | 0.34 | 0.30 | 0.30 | 0.11 | 0.16 | 0.18 | 0.16 | 0.07 |

| ESR 0.90-1.00 | 0.08 | 0.37 | 0.31 | 0.30 | 0.34 | 0.39 | 0.42 | 0.33 | 0.30 | 0.09 |

| ESR > 1.00 | 0.10 | 0.39 | 0.21 | 0.21 | 0.20 | 0.37 | 0.26 | 0.34 | 0.39 | 0.77 |

Actuarial reports – Items warranting review

Actuarial reports submitted to OSFI are generally reviewed by each plan’s Relationship Manager, who may refer the report to the actuarial team for a more detailed review.

The Instruction Guide for the Preparation of Actuarial Reports for Defined Benefit Pension Plans (Guide) sets out the reporting requirements for actuarial reports filed with OSFI. Based on the Standards of Practice of the Canadian Institute of Actuaries, it is expected that plan actuaries provide sufficient details in their actuarial report to enable another actuary to assess the reasonableness of the data, assumptions, and methods used.

OSFI would like to share with plan actuaries its expectations relating to the following item that warranted a more detailed review in some actuarial reports:

Going concern valuation – Adjustment of OSFI’s maximum going concern discount rate

In accordance with the Guide, the actuary should adjust the maximum rate for a plan using an asset mix expected to generate a lower return and may adjust the maximum rate for a plan using an asset mix expected to generate a higher return, than that obtained by using a 50% fixed-income allocation. The actuary should disclose the adjusted maximum rate in the actuarial report calculated based on the asset mix and expected return for each asset class of the plan.

Some pension plans use a target asset mix in accordance with their investment policy that includes derivative instruments for implementing risk management strategies to limit exposure to various risks related to assets and liabilities. This approach is different than a contingent immunization strategy where part of the pension fund is actively managed to potentially obtain higher returns over the immunized bond portfolio.

Generally, one of the objectives pursued by a pension plan when managing risks is to match more closely the interest rate sensitivity of the plan’s assets to that of its liabilities. A common approach is to increase the interest rate exposure of the assets by extending their duration. An overlay strategy allows a plan to achieve this objective without otherwise changing its investment holdings, including the fund’s exposure to return seeking assets such as equities.

For the purpose of adjusting the maximum rate, some actuaries use the plan’s allocation to fixed-income investments net of the overlay financing. However, this approach does not appear appropriate, as it effectively ignores the additional exposure of the plan to bonds through the overlay.

As an example, consider the following asset mix, which includes an overlay strategy used by the plan to manage duration exposures. For the purpose of adjusting the maximum rate, the allocation of 20% related to the overlay financing would not be reflected. Rather, the maximum discount rate would be based on a fixed-income allocation of 50% (60% / 120%).

| Asset | Target Asset Allocation (%) |

|---|---|

| Fixed income | 60 |

| Equities | 50 |

| Real estate and alternatives | 10 |

| Overlay financing | (20) |

| Total | 100 |

Regulatory filings and important dates

Consolidated and blackline versions of plan texts

We ask that when plan administrators send OSFI a consolidated plan text, that they also include a blackline version to assist OSFI’s Relationship Manager with ongoing monitoring activities. In the Regulatory Reporting System, plan administrators can upload the two documents in one zip file.

Applications for approvals to be filed using the Regulatory Reporting System

Previously, certain applications requiring the Superintendent’s authorization could not be submitted via the Regulatory Reporting System (RRS) and had to be submitted by email.

Starting May 1, 2022, plan administrators are required to file applications for approvals, along with all supporting documents, using RRS for the following transactions that require the Superintendent’s authorization:

- Termination of a defined contribution or defined benefit or pension plan

- Asset transfers related to defined contribution provisions (provincial plan members only) or defined benefit provisions

- Amendments reducing benefits in defined benefit pension plans

- Refund of surplus to the employer

For additional information including new RRS instruction guides for filing an application for each of the six types of transactions outlined above, please visit the Applications and Approvals section of OSFI’s website.

Pension plan registration applications for the Superintendent’s authorization should continue to be submitted by email to pensions@osfi-bsif.gc.ca (i.e., they cannot be submitted via RRS).

In addition, applications for converting plans from defined benefit to defined contribution, can be submitted using RRS or by email to pensions@osfi-bsif.gc.ca.

Important reminders and dates

Annual filings and plan amendments must be filed using the Regulatory Reporting System (RRS).

Documents in support of an application that require the Superintendent’s authorization (except for plan registrations) can also be filed using RRS.

Under the Pension Benefits Standards Act, 1985:

| Action or Required Filing | Deadline |

|---|---|

| Annual Information Return (OSFI 49) and Schedule A – Canada Revenue Agency Information Requirements (OSFI 49A) | 6 months after plan year end |

| Pension Plan Annual Corporate Certification (PPACC) | 6 months after plan year end |

| Certified Financial Statements (OSFI 60), Auditor’s Report Filing Confirmation (ARFC) and, if required, an Auditor's Report | 6 months after plan year end |

| Plan Assessments | Payable upon receipt of the OSFI-issued invoice |

| Annual statements to members and former members and their spouses or common-law partners | 6 months after plan year end |

| Amendments to documents that create or support the plan or pension fund | Within 60 days after the amendment is made |

| Action or Required Filing | Deadline |

|---|---|

| Actuarial Report and Actuarial Information Summary and, if required, Replicating Portfolio Information Summary | 6 months after plan year end |

| Solvency Information Return (OSFI 575) | The later of 45 days after the plan year end or February 15 |

Under the Pooled Registered Pension Plans Act:

| Action or Required Filing | Deadline |

|---|---|

| Pooled Registered Pension Plan Annual Information Return (includes financial statements) | April 30 (4 months after the end of the year to which the document relates) |

| Auditor's Report | April 30 (4 months after the end of the year to which the document relates) |

| Pension Plan Annual Corporate Certification (PPACC) | April 30 (4 months after the end of the year) |

| Plan Assessments | Payable upon receipt of the OSFI-issued invoice |

| Annual statements to members and their spouses or common-law partners | February 14 (45 days after the end of the year) |

Other topics

OSFI’s Blueprint for Transformation, Strategic Plan and Re-organization

Last Fall, the Executive Committee launched OSFI’s Blueprint to guide the overall direction and transformation of the organization through to 2025. OSFI’s transformation involves the development of new strategic and operational plans as well as a new organizational structure that will make our efforts more relevant to the financial sector and Canada as a whole.

On March 9, 2022, the Superintendent of Financial Institutions announced OSFI’s new top-level organizational structure effective in April 2022. This structure will position OSFI to fulfill its mandate of contributing to public confidence in Canada’s financial system in today’s volatile risk environment.

Since April 1, 2022, OSFI has moved the functions of the Private Pension Plans Division into the new Supervision sector and the Policy, Innovation and Stakeholder Affairs sector. We believe that this new organizational structure will allow us to continue working effectively with private pension plan partners, to refocus on our mandate, expand and fortify our risk management capabilities and enhance our culture. Ultimately, we are certain that these changes will result in even better collaboration with our stakeholders.

Upcoming retirements

Please join us in extending our best wishes to our colleagues who will be retiring in June and July:

- Tamara DeMos, Managing Director, Private Pension Plans Division.

- Marc Sauvé, Senior Manager, Actuarial, Private Pension Plans Division.