Actuarial Report (31st) on the Canada Pension Plan

Accessibility statement

The Web Content Accessibility Guidelines (WCAG) defines requirements for designers and developers to improve accessibility for people with disabilities. It defines three levels of conformance: Level A, Level AA, and Level AAA. This report is partially conformant with WCAG 2.0 level AA. If you require a compliant version, please contact webmaster@osfi-bsif.gc.ca.

The Honourable Chrystia Freeland, P.C., M.P.

Minister of Finance

House of Commons

Ottawa, Canada

K1A 0A6

Dear Minister:

In accordance with section 115 of the Canada Pension Plan, which provides that an actuarial report shall be prepared every three years for purposes of the financial state review by the Minister of Finance and the ministers of the Crown from the provinces, I am pleased to submit the Thirty-First Actuarial Report on the Canada Pension Plan, prepared as at 31 December 2021.

Yours sincerely,

Assia Billig, FCIA, FSA, PhD

Chief Actuary

Table of contents

List of tables

- Table 1 Best-Estimate Assumptions

- Table 2 Population of Canada less Québec

- Table 3 Economic Assumptions

- Table 4 Contributions - Base CPP

- Table 5 Beneficiaries - Base CPP

- Table 6 Beneficiaries by Sex - Base CPP

- Table 7 Expenditures - Base CPP

- Table 8 Expenditures - Base CPP (millions of 2022 constant dollars)

- Table 9 Expenditures as Percentage of Contributory Earnings - Base CPP

- Table 10 Historical Results - Base CPP

- Table 11 Financial Projections - Base CPP, 9.9% Legislated Contribution Rate

- Table 12 Financial Projections – Base CPP, 9.9% Legislated Contribution Rate (millions of 2022 constant dollars)

- Table 13 Sources of Revenues and Funding of Expenditures - Base CPP, 9.9% Legislated Contribution Rate

- Table 14 Financial Projections - Base CPP, Minimum Contribution Rate of 9.56% for 2025-2033, 9.54% for 2034+

- Table 15 Progression of Minimum Contribution Rate over Time – Base CPP

- Table 16 Contributions - Additional CPP

- Table 17 Beneficiaries - Additional CPP

- Table 18 Beneficiaries by Sex – Additional CPP

- Table 19 Expenditures - Additional CPP

- Table 20 Expenditures – Additional CPP (millions of 2022 constant dollars)

- Table 21 Historical Results and Financial Projections - Additional CPP, 2.0%, 8.0% Legislated First and Second Additional Contribution Rates

- Table 22 Financial Projections - Additional CPP, 2.0%, 8.0% Legislated First and Second Additional Contribution Rates (millions of 2022 constant dollars)

- Table 23 Sources of Revenues - Additional CPP, 2.0%, 8.0% Legislated First and Second Additional Contribution Rates

- Table 24 Financial Projections - Additional CPP, First and Second Additional Minimum Contribution Rates of 1.97% / 7.88%

- Table 25 Progression of Additional Minimum Contribution Rates over Time

- Table 26 Change in Assets - 31 December 2018 to 31 December 2021 - Base CPP

- Table 27 Summary of Expenditures – 2019 to 2021 – Base CPP

- Table 28 Reconciliation of Changes in Minimum Contribution Rate

- Table 29 Change in Assets - 1 January 2019 to 31 December 2021 - Additional CPP

- Table 30 Reconciliation of Changes in Additional Minimum Contribution Rates

- Table 31 Legislated Contribution Rates

- Table 32 Projected Maximum Additional CPP Retirement Benefit

- Table 33 Legislated Pension Adjustment Factors

- Table 34 Projected Maximum Additional CPP Disability Benefit

- Table 35 Projected Maximum Additional CPP Survivor’s Benefit, Survivor under Age 65

- Table 36 Projected Maximum Additional CPP Survivor’s Benefit, Survivor Age 65 or Over

- Table 37 Data Sources

- Table 38 Cohort Fertility Rates by Age and Year of Birth

- Table 39 Fertility Rates for Canada

- Table 40 Percentage Increase in Mortality Rates

- Table 41 Assumed Annual Mortality Improvement Rates for Canada

- Table 42 Mortality Rates for Canada

- Table 43 Life Expectancies for Canada, without mortality improvements after the year shown

- Table 44 Life Expectancies for Canada, with mortality improvements after the year shown

- Table 45 Population of Canada by Age

- Table 46 Population of Canada less Québec by Age

- Table 47 Analysis of Population of Canada less Québec by Age

- Table 48 Births, Net Migrants, and Deaths for Canada less Québec

- Table 49 Active and Employed Populations (Canada, ages 15 and over)

- Table 50 Labour Force Participation, Employment, and Unemployment Rates (Canada, ages 15 and over)

- Table 51 Labour Force Participation Rates (Canada)

- Table 52 Employment of Population (Canada, ages 18 to 69)

- Table 53 Active and Employed Populations (Canada less Québec, ages 15 and over)

- Table 54 Labour Force Participation Rates (Canada less Québec)

- Table 55 Employment of Population (Canada less Québec, ages 18 to 69)

- Table 56 Real Wage Increase and Related Components

- Table 57 Inflation, Real AAE and AWE Increases

- Table 58 Average Annual Earnings (Canada less Québec, ages 18 to 69)

- Table 59 Total Earnings (Canada less Québec, ages 18 to 69)

- Table 60 Average Pensionable Earnings up to YMPE (Canada less Québec)

- Table 61 Average Pensionable Earnings up to YAMPE (Canada less Québec)

- Table 62 Proportion of Contributors to the CPP, by Age Group

- Table 63 Average Contributory Earnings for Pensionable Earnings up to YMPE

- Table 64 Average Contributory Earnings for Pensionable Earnings up to YAMPE

- Table 65 Total Adjusted Contributory Earnings for Pensionable Earnings up to YMPE

- Table 66 Total Adjusted Contributory Earnings for Pensionable Earnings up to YAMPE

- Table 67 Net Assets as at 31 December 2021

- Table 68 Initial Asset Mix as at 31 December 2021 for Base and Additional CPP

- Table 69 Real Rates of Return by Asset Type (before investment expenses and allocation for rebalancing and diversification)

- Table 70 Asset Mix, Portfolio Risk and Expected Rates of Return (before investment expenses)

- Table 71 Asset Mix, Portfolio Risk and Expected Rates of Return (before investment expenses)

- Table 72 Ultimate Rates of Return on Base and Additional CPP Assets

- Table 73 Annual Rates of Return on CPP Assets

- Table 74 Benefits Payable as at 31 December 2021 – Base CPP

- Table 75 Benefit Eligibility Rates by Type of Benefit

- Table 76 Proportion of Contributors to CPP (adjusted for benefit computation purposes)

- Table 77 Average Pensionable Earnings up to YMPE (adjusted for benefit computation purposes)

- Table 78 Average Pensionable Earnings up to YAMPE (adjusted for benefit computation purposes)

- Table 79 Average Earnings-Related Benefit as Percentage of Maximum Benefit - Base CPP

- Table 80 Average Additional Earnings-Related Benefit as Percentage of Maximum Additional Benefit - Additional CPP

- Table 81 Retirement Pension Take-up Rates (2031+)

- Table 82 New Retirement Beneficiaries and Pensions

- Table 83 Mortality Rates of Retirement Beneficiaries

- Table 84 Life Expectancies of Retirement Beneficiaries, with improvements after the year shown

- Table 85 Life Expectancies of Retirement Beneficiaries by Level of Base CPP Pension (2022), with future improvements

- Table 86 Proportion of CPP Retirement Beneficiaries who are Contributors

- Table 87 Average Contributory Earnings of Working Beneficiaries with Pensionable Earnings up to the YMPE

- Table 88 Average Contributory Earnings of Working Beneficiaries with Pensionable Earnings up to the YAMPE

- Table 89 Working Beneficiaries – Contributors, Contributions, and Post-Retirement Benefits

- Table 90 Ultimate Disability Incidence Rates (2026+)

- Table 91 New Disability Beneficiaries

- Table 92 New Disability Pensions and Post-retirement Disability Benefits

- Table 93 Disability Termination Rates in 2022 and 2035

- Table 94 Assumed Proportion of Contributors Married or in a Common-Law Relationship at Time of Death (2023+)

- Table 95 New Survivor Beneficiaries

- Table 96 New Survivor Pensions

- Table 97 Mortality Rates of Survivor Beneficiaries

- Table 98 Life Expectancies of Survivor Beneficiaries, with improvements after the year shown

- Table 99 Number of Death Benefits

- Table 100 New Children’s Benefits

- Table 101 Operating Expenses – Base CPP

- Table 102 Operating Expenses - Additional CPP

- Table 103 Full Funding Rates in Respect of the Amendments to the Base CPP

- Table 104 Additional CPP Balance Sheet (Open Group Basis)

- Table 105 Base CPP Balance Sheet (Open Group Basis)

- Table 106 Additional CPP Balance Sheet (Open Group Basis)

- Table 107 Reconciliation of Changes in Minimum Contribution Rate - Base CPP

- Table 108 Reconciliation of Changes in Additional Minimum Contribution Rates

- Table 109 Base CPP MCR as at December 31, 2021 based on Different Levels of Starting Assets

- Table 110 Probability Distribution of MCR as at 31 December 2024 based on 2022-2024 Intervaluation Investment Experience

- Table 111 Probability of MCR exceeding legislated rate of 9.9% as at 31 December 2024 based on 2022-2024 Investment Experience and Different Levels of MCRs at the Previous Valuation

- Table 112 Additional CPP FAMCR as at December 31, 2045 based on Different Levels of Starting Assets

- Table 113 Probability Distribution of FAMCR as at 31 December 2048 based on 2046-2048 Investment Returns Experience and Different Levels of FAMCRs at the Previous Valuation

- Table 114 Individual Sensitivity Test Assumptions

- Table 115 Sensitivity of Base CPP Minimum Contribution Rate

- Table 116 Sensitivity of Base CPP Assets/Expenditures Ratio

- Table 117 Sensitivity of Additional CPP Minimum Contribution Rates

- Table 118 Sensitivity of Additional CPP Assets/Expenditures Ratio

- Table 119 Higher and Lower Economic Growth Sensitivity Tests

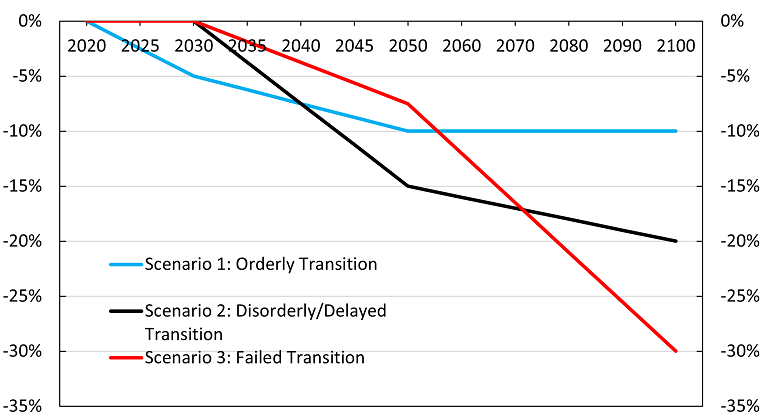

- Table 120 Climate Change Scenario - Real Annual Rate of Return on Base CPP assets

- Table 121 Climate Change Scenario - Base CPP MCR for 2034 and thereafter

List of charts

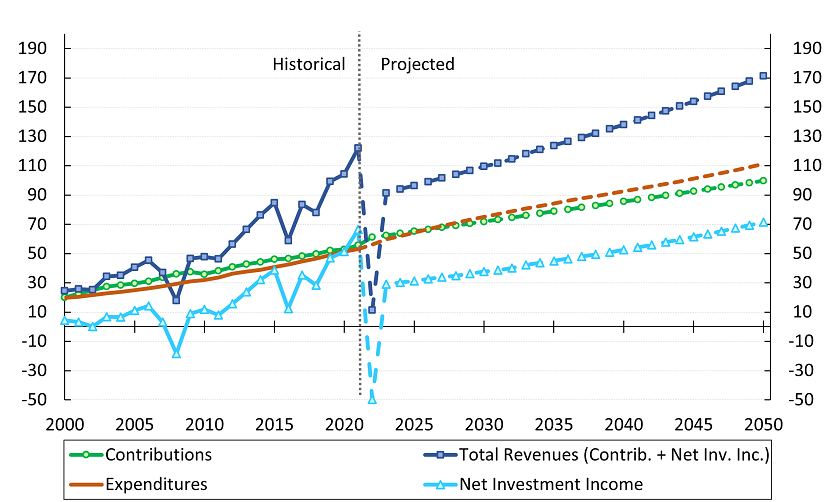

- Chart 1 Revenues and Expenditures - Base CPP, 9.9% legislated contribution rate (billions of 2022 constant dollars)

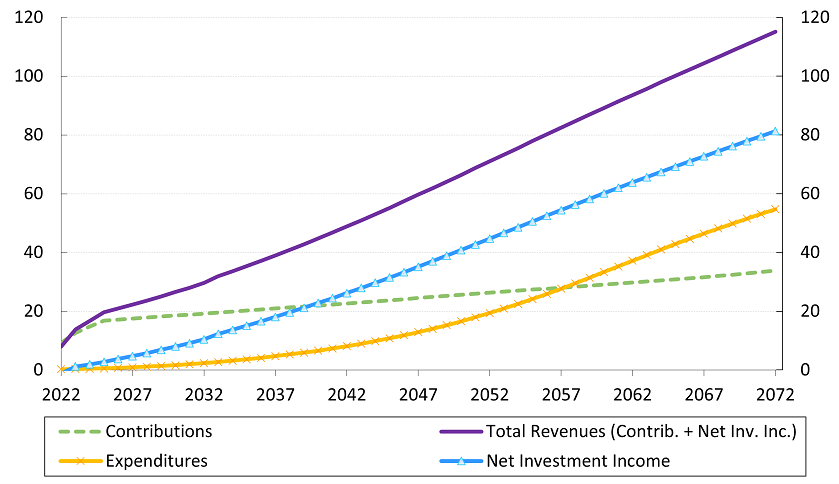

- Chart 2 Revenues and Expenditures - Additional CPP, 2.0%/8.0% legislated contribution rates

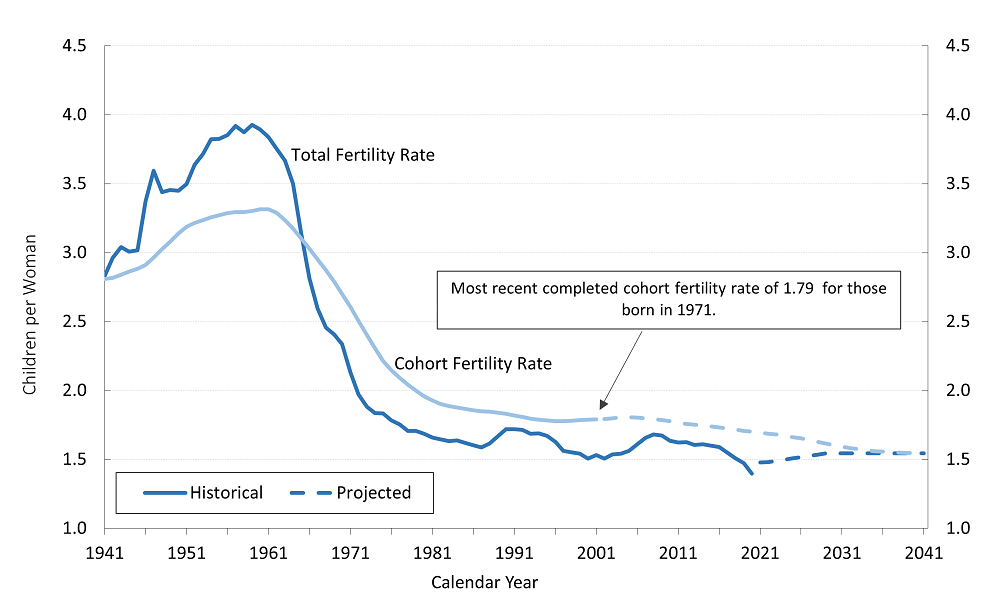

- Chart 3 Historical and Projected Total and Cohort Fertility Rates for Canada

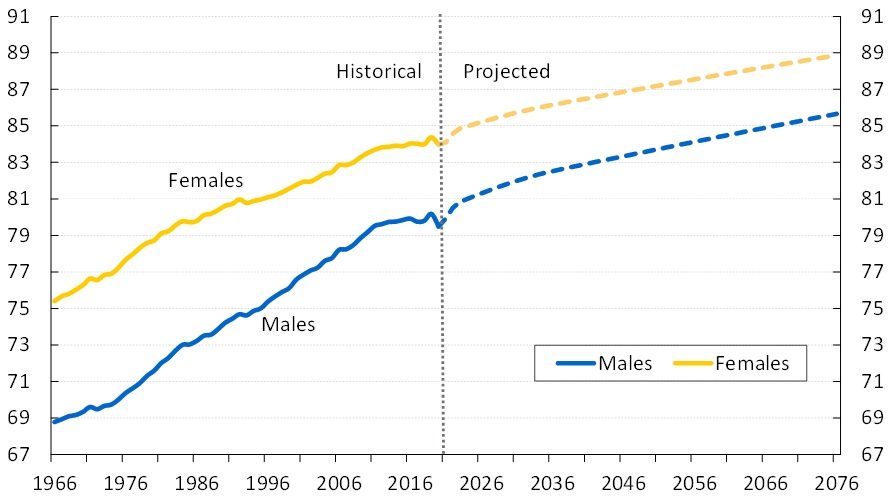

- Chart 4 Life Expectancies at Birth for Canada, without mortality improvements after the year shown

- Chart 5 Life Expectancies at Age 65 for Canada, without mortality improvements after the year shown

- Chart 6 Net Migration Rate (Canada)

- Chart 7 Age Distribution of the Population of Canada less Québec (thousands)

- Chart 8 Population of Canada less Québec

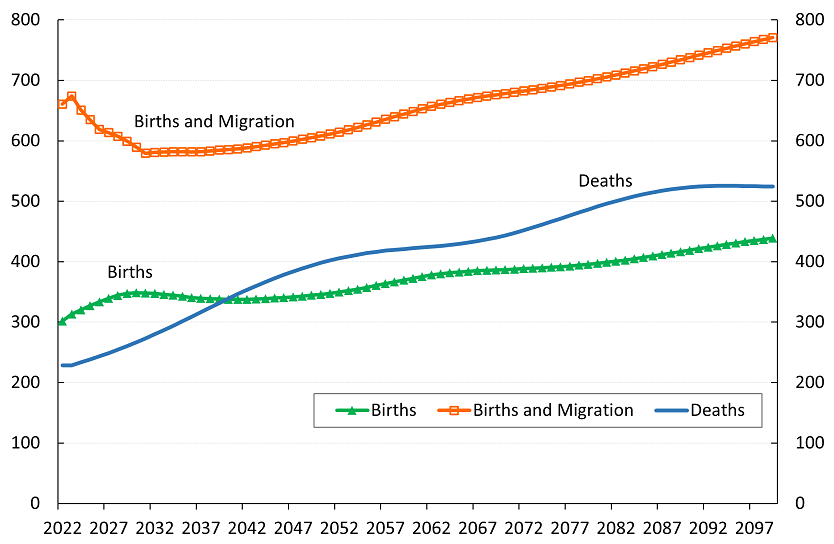

- Chart 9 Projected Components of Population Growth for Canada less Québec

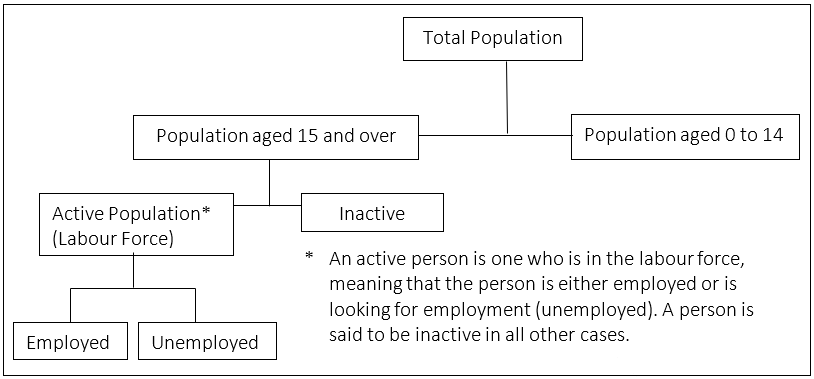

- Chart 10 Components of the Labour Market

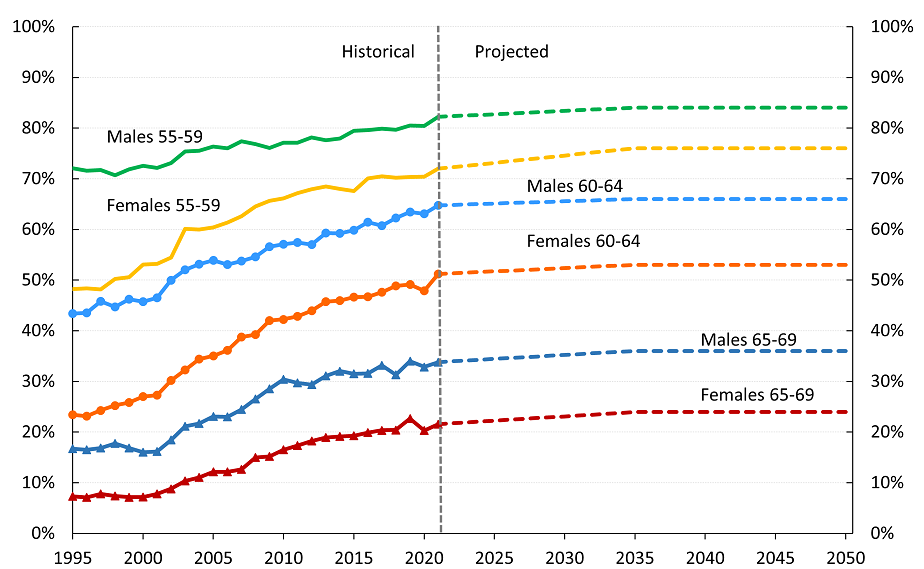

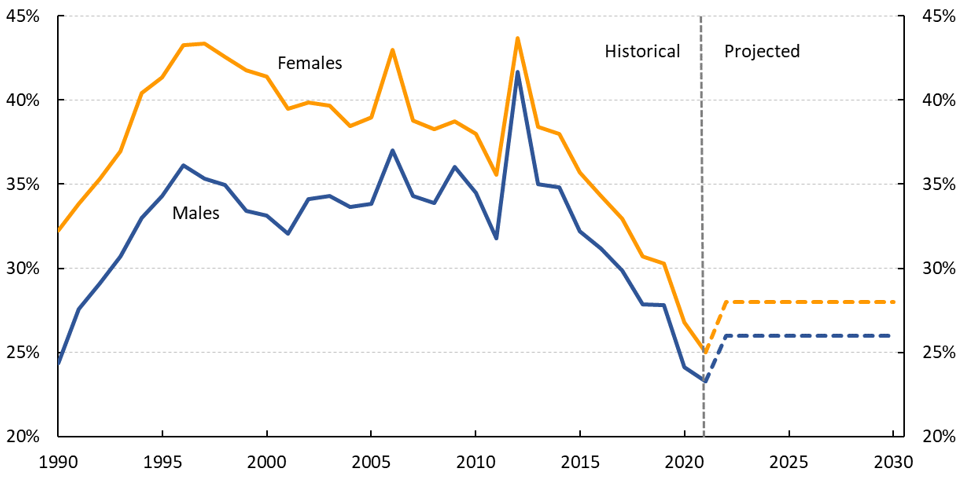

- Chart 11 Labour Force Participation Rates (Canada)

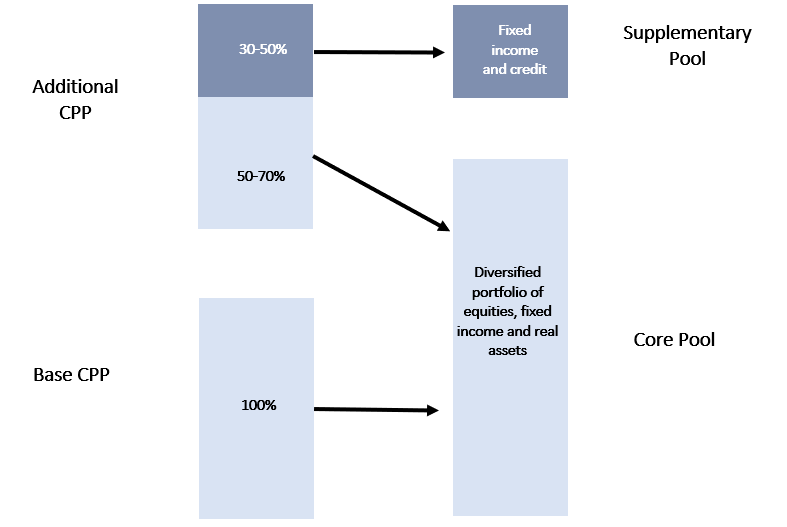

- Chart 12 Illustrative Two-Pool Investment Structure of the CPPIB

- Chart 13 Historical and Projected Retirement Pension Take-up Rates at age 60

- Chart 14 Historical Disability Incidence Rates

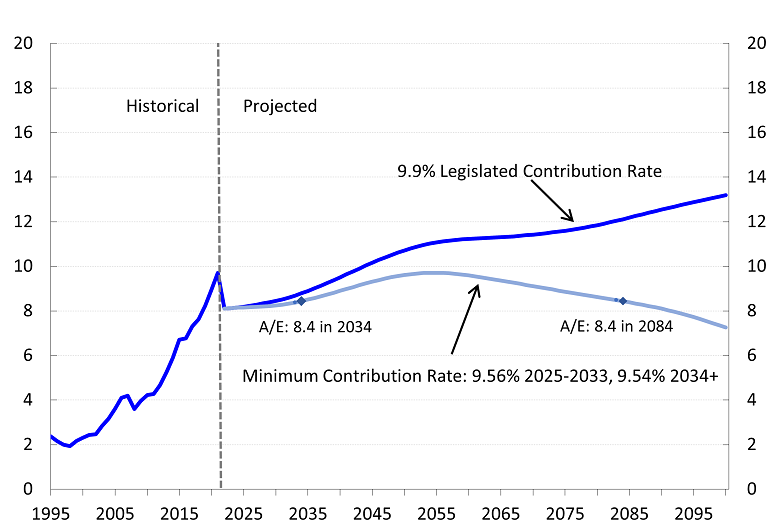

- Chart 15 Assets/Expenditures Ratio – Base CPP

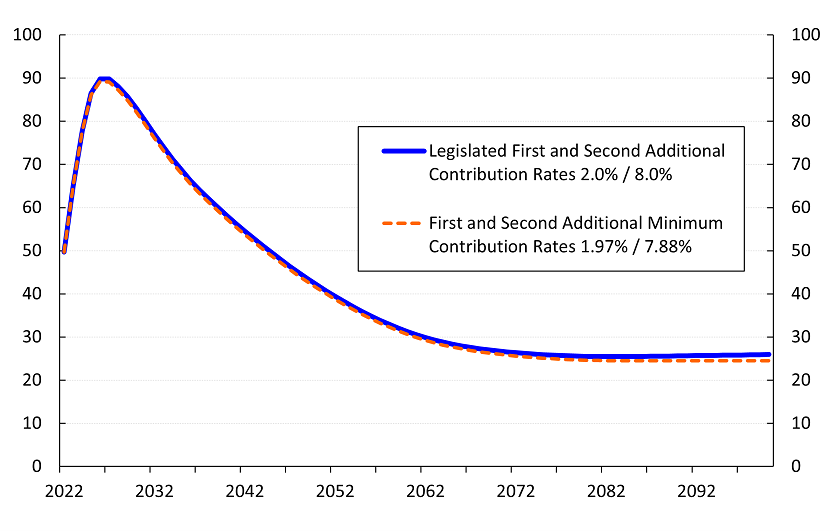

- Chart 16 Assets/Expenditures Ratio – Additional CPP (legislated and additional minimum contribution rates)

- Chart 17 Illustrative Climate Scenarios – Cumulative GDP Impact Relative to Baseline Scenario

1 Highlights of the Report

| Contributions | Base CPP | Additional CPP |

|---|---|---|

|

Legislated contribution rate of 9.9% for year 2022 and thereafter. |

Legislated first and second additional contribution rates of 2.0% for 2023 and thereafter and 8.0% for 2024 and thereafter respectively. |

|

|

The number of CPP contributors expected to grow from 15.2 million in 2022 to 19.3 million in 2050. |

||

|

Contributions expected to increase from $61 billion in 2022 to $177 billion in 2050. |

Contributions expected to increase from $9.3 billion in 2022 to $45 billion in 2050. |

|

|

Contributions projected to be higher than expenditures up to the year 2025 inclusive. |

Contributions projected to be higher than expenditures up to the year 2057 inclusive. |

|

| Expenditures |

The number of retirement beneficiaries expected to increase from 6.0 million in 2022 to 9.9 million in 2050. Total expenditures projected to grow from $56 billion in 2022 to $197 billion in 2050. |

The number of retirement beneficiaries expected to increase from 0.8 million in 2022 to 8.9 million in 2050. Total expenditures projected to grow from $0.3 billion in 2022 to $29 billion in 2050. |

| Assets |

Total assets projected to grow from $544 billion at the end of 2021 to $791 billion by 2030 and $2.2 trillion by 2050. In 2050, investment income is projected to represent 42% of revenues. |

Total assets projected to grow from $11 billion at the end of 2021 to $200 billion by 2030 and $1.4 trillion by 2050. In 2050, investment income is projected to represent 61% of revenues. |

| Minimum Contribution Rates needed to sustain the CPP |

The minimum contribution rate is 9.56% of contributory earnings for years 2025 to 2033 and 9.54% for years 2034 and thereafter. |

The first additional minimum contribution rate as a percentage of contributory earnings is 1.97% for years 2025 and thereafter. The second additional minimum contribution rate as a percentage of contributory earnings above the YMPE up to the YAMPE is 7.88% for years 2025 and thereafter. |

|

The respective legislated contribution rates are higher than the minimum contribution rates needed to sustain the Plan, and thus are sufficient to finance both the base and additional CPP over the long term. |

||

| Rate of Return Assumption | Base CPP | Additional CPP |

|---|---|---|

|

The 31st CPP Actuarial Report is based on an assumed 75-year average annual nominal rate of return of 5.79% for the base CPP and 5.37% for the additional CPP. |

||

|

If lower average returns are assumed (4.20% for the base CPP and 4.17% for the additional CPP), this would result in: |

||

|

The MCR increasing from 9.54% to 11.22%. |

The FAMCR increasing from 1.97% to 2.86%. |

|

|

If higher average returns are assumed (7.39% for the base CPP and 6.57% for the additional CPP), this would result in: |

||

|

The MCR decreasing from 9.54% to 7.89%. |

The FAMCR decreasing from 1.97% to 1.38%. |

|

| Intervaluation Investment Experience |

Based on the best-estimate assumptions of this report, the MCR at the next valuation as at 31 December 2024 is expected to be 9.55%, and the FAMCR is expected to be 1.97%. |

|

|

However, there is a 16% probability that the MCR at the next valuation as at 31 December 2024 will exceed the legislated rate of 9.9% due to investment experience alone. |

It is very unlikely that short-term investment experience would cause the AMCRs to fall outside the “no action” ranges prescribed by the Additional Canada Pension Plan Sustainability Regulations. As the plan matures, it will become much more sensitive to intervaluation investment experience. The probability of the FAMCR as at 31 December 2048 falling outside the 1.8% to 2.1% range due to investment experience during the 2046-2048 period is 32%. |

|

| Mortality Assumption |

The 31st CPP Actuarial Report is based on the assumption that mortality will continue to improve but at a slower pace than over the last few decades. |

|

|

If longevity were to improve faster than assumed (life expectancies at age 65 in 2050 that are about 2 years higher), this would result in: |

||

|

The MCR increasing from 9.54% to 9.86%. |

The FAMCR increasing from 1.97% to 2.12%. |

|

|

If longevity were to improve slower than assumed (life expectancies at age 65 in 2050 that are about 2 years lower), this would result in: |

||

|

The MCR decreasing from 9.54% to 9.17% |

The FAMCR decreasing from 1.97% to 1.79%. |

|

| Economic Growth |

The 31st CPP Actuarial Report is based on the assumption of moderate and sustained economic growth. |

|

|

If lower economic growth is assumed with total employment earnings in 2035 being 11% lower, this would result in: |

||

|

The MCR increasing from 9.54% to 10.12%. |

The FAMCR decreasing from 1.97% to 1.73%. |

|

| If higher economic growth is assumed with total employment earnings in 2035 being 15% higher, this would result in: | ||

|

The MCR decreasing from 9.54% to 9.11%. |

The FAMCR increasing from 1.97% to 2.34%. |

|

| The impacts are in the opposite direction for the base and additional Plans due to the different financing approaches of the two components of the CPP. The base CPP relies more heavily on contributions as a source of revenues than the additional CPP. | ||

|

Table B footnotes

|

||

|

The 31st CPP Actuarial Report includes a new section that focuses on understanding and assessing downside risks due to three potential or emerging trends. Since the additional CPP is still at its early stages, it focuses on the base CPP only. Furthermore, given the purpose of the section, only adverse scenarios are presented. It is not meant to represent forecasts or predictions, and should be interpreted with caution. |

|

| Earnings Distribution |

The 31st CPP Actuarial Report assumes the same increase in earnings at each earnings level. If different nominal wage increases by earnings level are assumed until 2045, with lower increases assumed for lower level earners and vice-versa (no change in overall nominal wage growth compared to the best-estimate assumption), this would result in:

|

|---|---|

| Stagflation Scenario |

The 31st CPP Actuarial Report is based on the assumption that the current environment of high inflation is temporary and that the Bank of Canada will be successful in reaching its current mid-point inflation target of 2.0% by 2026. Elevated inflation over a long period of time can lead to stagflation, which is characterized by a simultaneous economic stagnation and increase in inflation. A hypothetical stagflation scenario was developed in which inflation and unemployment rates are higher than under the best-estimate assumptions, while real-wage growth and investment returns are lower. This hypothetical stagflation scenario would result in:

|

| Climate Scenarios |

Climate change can affect the CPP through various channels. The demographic, economic and investment environments can all be affected by climate change in the future. However, there is a lot of uncertainty on the direction and magnitude of these potential impacts, and the risk is evolving constantly. In order to illustrate the potential downside risk, three intentionally adverse hypothetical climate change scenarios were developed based on publicly available information. The scenarios focus on differences in GDP growth rates from different transition pathways. Based on the three hypothetical scenarios:

|

|

Table C Footnotes

|

|

2 Introduction

2.1 Purpose of the report

This is the 31st Actuarial Report on the Canada Pension Plan since the inception of the Canada Pension Plan (CPP or the Plan) in 1966. The valuation date is 31 December 2021. This report has been prepared in compliance with the timing and information requirements of the Canada Pension Plan. Section 113.1 of the Canada Pension Plan provides that the Minister of Finance and ministers of the Crown from the provinces shall review the financial state of the CPP once every three years and may consequently make recommendations to change the benefits or contribution rates, or both. Section 113.1 identifies the factors the ministers consider in their review, including information to be provided by the Chief Actuary.

Since 1 January 2019, the CPP has two components: the base and additional Plans. The CPP consisted only of the base Plan (or base CPP) prior to 2019, and this component continues. The additional Plan (or additional CPP) is the new enhancement to the CPP as of 2019. When not qualified, the term “CPP” or the “Plan” used in this report refers to the entire CPP, that is, to both its components.

An important purpose of the report is to inform contributors and beneficiaries of the current and projected financial states of the base and additional CPP. The report provides information to evaluate the financial sustainability of the base and additional Plans over a long period, assuming that the legislation remains unchanged. Such information facilitates a better understanding of the financial states of the base and additional Plans and the factors that influence costs, and thus contributes to an informed public discussion of issues related to the finances of the two components of the CPP.

The previous triennial report was the 30th Actuarial Report on the Canada Pension Plan as at 31 December 2018, which was tabled in the House of Commons on 10 December 2019.

This 31st CPP Actuarial Report takes into account all amendments to date regarding the CPP statute, with the most recent listed in the following section. This CPP Actuarial Report also takes into account: recent demographic, economic, and investment experience data as described in section B.2 of Appendix B of this report; various forecasts by demographic, economic and investment experts; the continuing and evolving impacts of the COVID-19 pandemic; and the impacts of the escalation of the conflict in Ukraine, which was considered a subsequent event for the purpose of this CPP Actuarial Report, as described in section 2.3.

The report presents projections of its revenues and expenditures for both of its components, the base and additional CPP, over a long period of time. Given the length of the projection period and the number of assumptions required, it is unlikely that actual future experience will develop precisely in accordance with the best-estimate projections.

2.2 Recent Amendments

The Canada Pension Plan was subject to amendments after 31 December 2018 as follows:

- Under the Budget Implementation Act, 2019, No. 1, which received Royal Assent on 21 June 2019, the application for a CPP retirement pension is waived upon reaching age 70, effective 1 January 2020. This amendment is taken into account in this 31st CPP Actuarial Report. It was also taken into account and treated as a subsequent event in the 30th CPP Actuarial Report.Footnote 1

- Under the Budget Implementation Act, 2022, No. 1, which received Royal Assent on 23 June 2022, technical amendments are made regarding eligibility for the base CPP post-retirement disability benefit and determination of the additional CPP drop-in provisions.Footnote 2 The amendments reflect the original intent of the given benefit and drop-in provisions and thus were included in the projections of previous CPP actuarial reports. The amendments are likewise included in the projections of this 31st CPP Actuarial Report. As such, the amendments have no impact on the projections in this report.

2.3 Subsequent Events

The continuing and evolving impacts of the COVID-19 pandemic were exacerbated by the conflict in Ukraine, notably its escalation as of 24 February 2022. This escalation is considered to be a subsequent event for the purpose of this 31st CPP Actuarial Report since it started subsequent to the valuation date but before the date of this report. There is much uncertainty surrounding the evolving conflict and potential impacts on the projected financial state of the CPP, in particular resulting from changing levels of inflation and volatility in the financial markets. This uncertainty was taken into account for the purpose of this 31st CPP Actuarial Report.

There were no other events determined by the Chief Actuary to be subsequent events with material effects on the financial state of the CPP as projected under this 31st CPP Actuarial Report.

2.4 Independent Peer Review Process

As part of its policy of ensuring that it provides sound and relevant actuarial advice to Members of Parliament and to the Canadian population, as was done for previous reports, the Office of the Chief Actuary (OCA) has commissioned an external peer review Footnote 3 of this actuarial report on the CPP.

The external peer review is intended to ensure that the actuarial reports meet high professional standards, and are based on reasonable methods and assumptions. Over the years, peer review recommendations have been carefully considered and many of them implemented.

2.5 Scope of the Report

Section 3 presents a general overview of the methodology used in preparing the actuarial estimates included in this report, which are based on the best-estimate assumptions described in section 4. The results for the base Plan and additional Plan are presented separately in sections 5 and 6, respectively, and include for each component the projections of the revenues, expenditures, and assets over more than the next 75 years. Section 7 provides the reconciliation of the results for the base and additional Plans with those of the 30th CPP Actuarial Report, while section 8 provides the actuarial opinion.

The various appendices provide a summary of the Plan provisions, a description of the data, assumptions and methodology employed, supplemental information on the financing of the CPP, detailed reconciliations of the results with the previous report, the uncertainty of results, and acknowledgements of data providers and staff who contributed to this report.

3 Methodology

The actuarial examination of the CPP involves projections of the revenues and expenditures of both components (base CPP and additional CPP) over a long period of time, so that the future impact of historical and projected trends in demographic, economic and investment factors can be properly assessed. The actuarial estimates in this report are based on the provisions of the Canada Pension Plan as at 31 December 2021,Footnote 4 historical experience data used for the starting point of the projections, and best-estimate assumptions that take into account the subsequent event described in section 2.3.

The revenues of the base and additional Plans include both contributions and investment income. The projection of contributions begins with a projection of the working-age population. This requires assumptions regarding demographic factors such as fertility, migration, and mortality. Total contributory earnings for each component of the Plan are derived by applying labour force participation and job creation rates to the projected population and by projecting future average employment earnings. This requires assumptions about various factors such as wage increases, an earnings distribution, and unemployment rates. Contributions for each of the components of the CPP are obtained by applying the respective component’s contribution rate(s) to the respective contributory earnings. Investment income is projected on the basis of the existing portfolios of assets for the base and additional CPP, the respective projected net cash flows (contributions less expenditures), and the respective assumptions regarding the future asset mix and rates of return on investments net of investment expenses. Since the assumptions regarding the future asset mix differ between the base and additional Plans, the resulting assumptions regarding investment returns differ as well.

Expenditures for each component of the Plan consist of the benefits paid out and operating expenses. Newly emerging benefits are projected by applying assumptions regarding retirement, disability, and death to the populations eligible for benefits, together with the benefit provisions and the earnings histories of participants (actual and projected). The projection of total benefits, which includes the continuation of benefits already in pay at the valuation date, requires further assumptions. Operating expenses, excluding operating expenses relating to professional management of the CPP Fund by the Canada Pension Plan Investment Board (CPPIB), are projected by considering the historical and projected relationship between expenses and total employment earnings, while CPPIB operating expenses are considered in the determination of the rates of return.

The assumptions and results presented in the following sections make it possible to measure the financial states of the base and additional CPP separately in each projection year and to calculate the minimum contribution rates.

For the base Plan, the minimum contribution rate (MCR) is the sum of two types of rates. The first of these is separate from the full funding provision for increased or new benefits, and is referred to as the “steady-state” contribution rate. The second type of rate that makes up the MCR is the full funding rate for increased or new benefits.

For the additional CPP, there are two additional minimum contribution rates (AMCRs), the first additional minimum contribution rate (FAMCR) and the second additional minimum contribution rate (SAMCR). The FAMCR is applicable to contributory earnings below the Year’s Maximum Pensionable Earnings (YMPE) and the SAMCR is applicable to contributory earnings between the YMPE and the Year’s Additional Maximum Pensionable Earnings (YAMPE).

Details of the methodology used to determine the MCR and AMCRs are presented in Appendix C.

A wide variety of factors influence both the current and projected financial states of the components of the CPP. Accordingly, the results shown in this report differ from those shown in previous reports. Likewise, future actuarial examinations will reveal results that differ from the projections included in this report.

4 Best-Estimate Assumptions

4.1 Introduction

The information required by statute, which is presented in sections 5 and 6 of this report, necessitates making numerous assumptions regarding future demographic, economic, and investment trends. The projections included in this report cover a long period of time (over 75 years), and the assumptions are determined by examining historical long-term and short-term trends and applying judgment as to the extent these trends will continue in the future. These assumptions reflect the Chief Actuary’s best judgment and are referred to in this report as the best-estimate assumptions. The assumptions were chosen to be independently reasonable and appropriate in the aggregate, taking into account certain interrelationships between them.

The assumptions were developed taking into account subsequent events, that is, events that became known to the Chief Actuary after the valuation date, but before the report date, that were deemed to have an effect on the financial states of the base or additional CPP as at the valuation date or during the projection period. The continuing and evolving impacts of the COVID-19 pandemic were exacerbated by the conflict in Ukraine, notably its escalation as of 24 February 2022. For the purpose of this 31st CPP Actuarial Report, this escalation, was considered to be a subsequent event with significant impacts on the projected financial state of the CPP. The following assumptions were therefore reviewed in light of this subsequent event: inflation, real wage increases, interest rates as well as expected returns on various asset classes. These assumptions were revised to reflect updated data and forecasts available up to the end of June 2022, as well as continued short-term uncertainty.

All past and recent amendments to the CPP statute are reflected in this CPP Actuarial Report. The most recent amendments are contained in the Budget Implementation Act, 2022, No. 1, which received Royal Assent on 23 June 2022. That Act contains technical amendments regarding eligibility for the base CPP post-retirement disability benefit and determination of the additional CPP drop-in provisions under the CPP statute.Footnote 2 The amendments reflect the original intent of the given benefit and drop-in provisions and thus were included in the projections of previous CPP actuarial reports. The amendments continue to be reflected in the projections of this 31st CPP Actuarial Report and have no impact.

The Chief Actuary held a virtual seminar in September 2021 on the long-term demographic, economic, and investment outlook for Canada to obtain opinions from a wide range of individuals with relevant expertise. Nine experts in the fields of demographics, economics, and investments were invited to present their views. The topics discussed included short-term and long-term perspectives on mortality, immigration, the labour market and the economy, as well as the potential implications of climate change on the macroeconomic and investment outlook.

Among the participants at the seminar were representatives from the OCA, federal departments including Statistics Canada, Employment and Social Development Canada (ESDC), and the Department of Finance, representatives from provincial and territorial governments, as well as representatives from Retraite Québec, the CPPIB, and other organizations. Representatives of the OCA also attended a virtual seminar on the demographic and economic perspectives relating to retirement held by Retraite Québec in October 2021.

In addition to the above mentioned seminars, OCA staff sought expert perspectives on demographic, economic, and investment-related topics by attending various webinars, consulting numerous publications, and consulting with other experts. These expert perspectives were all considered in developing the best-estimate assumptions for this 31st CPP Actuarial Report.

Table 1 presents a summary of the most important assumptions used in this report compared with those used in the previous triennial report. The assumptions are described in more detail in Appendix B of this report.

| Canada | 31st Report (as at 31 December 2021) |

30th Report (as at 31 December 2018) |

||

|---|---|---|---|---|

| Total Fertility Rate | 1.54 (2029+) | 1.62 (2027+) | ||

| Mortality | Statistics Canada Life Tables (CLT 1-year table: 2019) with assumed future improvements |

Statistics Canada Life Tables (CLT 3-year average table: 2014 - 2016) with assumed future improvements |

||

| Canadian Life Expectancy | Males | Females | Males | Females |

|

at birth in 2022

|

86.7 years | 90.0 years | 87.1 years | 90.1 years |

|

at age 65 in 2022

|

21.3 years | 23.8 years | 21.6 years | 24.0 years |

| Net Migration Rate | 0.64% of population (for 2031+) | 0.62% of population (for 2021+) | ||

| Participation Rate (age group 18-69) |

80.0% (2035) | 79.2% (2035) | ||

| Employment Rate (age group 18-69) |

75.3% (2035) | 74.4% (2035) | ||

| Unemployment Rate (age group 18-69) |

5.9% (2027+) | 6.0% (2030+) | ||

| Rate of Increase in Prices | 2.0% (2026+) | 2.0% (2019+) | ||

| Real Wage Increase | 0.9% (2026+) | 1.0% (2025+) | ||

| Real Rate of Return (average 2022-2096) |

Base CPP Assets | 3.7% | 4.0% | |

| Additional CPP Assets | 3.3% | 3.5% | ||

| Retirement Rates for Cohort at Age 60 | Males | 26.0% (2022+) | Males | 27.0% (2021+) |

| Females | 28.0% (2022+) | Females | 29.5% (2021+) | |

| CPP Disability Incidence Rates (per 1,000 eligible) | Males | 2.90 (2026+) | Males | 2.97 (2019+)Table 1 Footnote 1 |

| Females | 3.60 (2026+) | Females | 3.66 (2019+)Table 1 Footnote 1 | |

|

Table 1 footnote

|

||||

4.2 Demographic Assumptions

The population projections start with the Canada and Québec populations on 1 July 2021, to which are applied fertility, migration, and mortality assumptions. The relevant population for the Canada Pension Plan is the population of Canada less that of Québec and is obtained by subtracting the projected results for Québec from those for Canada. The population projections are essential in determining the future number of CPP contributors and beneficiaries.

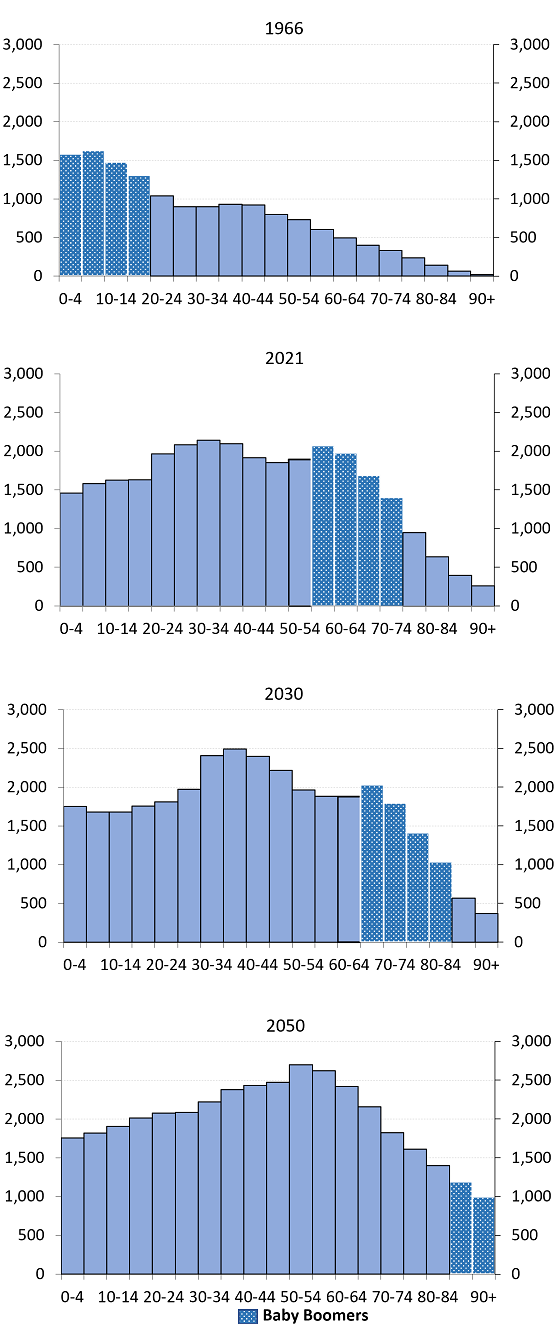

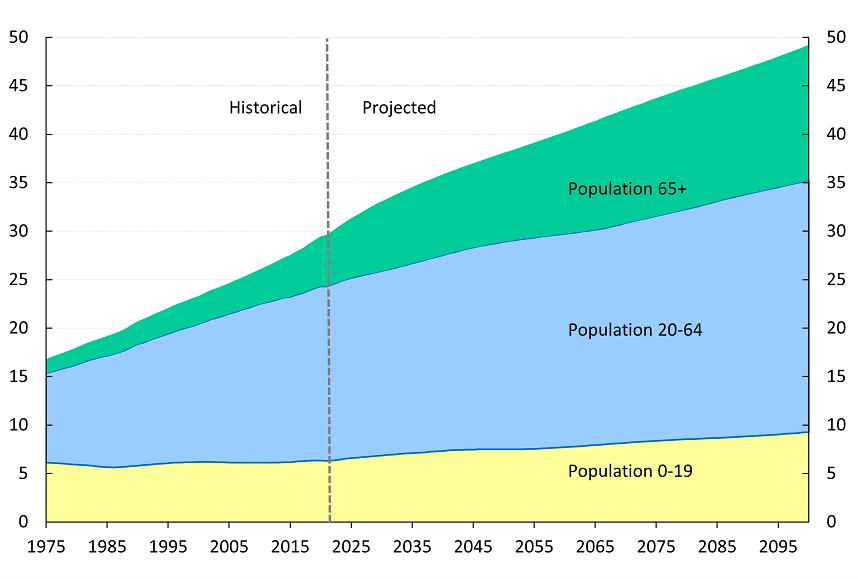

The age distribution of the population has changed significantly since the inception of the Plan in 1966. The proportion of the Canadian population aged 65 and above has increased from 7.6% in 1966 to 18.5% in 2021, which indicates an aging population. It is assumed that the population aging will continue in the future, albeit to a more modest extent.

4.2.1 Fertility

The first cause of the aging of the Canadian population is the decline in the total fertility rate that has occurred over the last 60 years. The total fertility rate in Canada decreased rapidly from a level of about 4.0 children per woman in the late 1950s to 1.6 by the mid-1980s. The total fertility rate rose slightly in the early 1990s, but then declined to a level of 1.5 by the late 1990s. Canada is one of many industrialized countries that saw their fertility rates increase starting in the 2000s. By 2008, the total fertility rate for Canada reached 1.68. However, in some industrialized countries, including Canada, the total fertility rate has decreased since 2008, which could be largely attributable to the 2008 economic downturn and continuing economic uncertainty. The total fertility rate for Canada stood at 1.47 in 2019, and decreased further to 1.40 in 2020. The significant decrease in 2020 could be due to the high level of uncertainty and much lower immigration caused by the COVID-19 pandemic.

Similar to Canada, the total fertility rate in Québec fell from a high of about 4.0 children per woman in the 1950s; however, the Québec rate fell to a greater degree, reaching 1.4 by the mid-1980s. The Québec rate then recovered somewhat in the early 1990s to over 1.6 and subsequently declined to below 1.5 by the late 1990s. Subsequently, Québec fertility rate increased for certain age groups with the introduction of the Québec Childcare Centres in 1997 and with the introduction of the Québec Parental Insurance Plan in 2006. There was a significant increase in the Québec fertility rate in the 2000s, with the rate reaching 1.74 in 2008. However, similar to Canada’s fertility rate, the fertility rate for Québec has been decreasing in recent years and stood at 1.57 in 2019 and 1.52 in 2020.

The overall decrease in the total fertility rate over the last 60 years occurred as a result of changes in a variety of social, medical, economic and environmental-related factors. Although there have been periods of growth in the total fertility rates in recent decades, it is unlikely that the rates will return to historical levels in the absence of significant societal changes.

In 2021, the Government of Canada announced that it would work with provinces and territories to establish a Canada-Wide Early Learning and Child Care PlanFootnote 5. Consistent with what was experienced in Québec with the introduction of Childcare Centres, the proposed plan is assumed to result in increases in fertility rates for certain age groups following the adoption of the Early Learning and Child Care Plan.

Given the uncertainty surrounding the effect of the COVID-19 pandemic on fertility rates for the year 2020 (the last year of available data at the time this report was prepared), the data for 2020 were excluded from the analysis for purposes of setting the fertility rates for years 2021 and beyond. A 15-year period ending in 2019 of data is used to establish a linear trending model which is also adjusted for the upcoming Canada-Wide Early Learning and Child Care Plan. The assumed age-specific fertility rates lead to an assumed total fertility rate for Canada that will increase from its 2019 level of 1.47 children per woman to an ultimate level of 1.54 in 2029. The assumed age-specific fertility rates for Québec lead to a total fertility rate for the province that will decrease from its 2019 level of 1.57 to an ultimate level of 1.55 in 2029.

4.2.2 Mortality

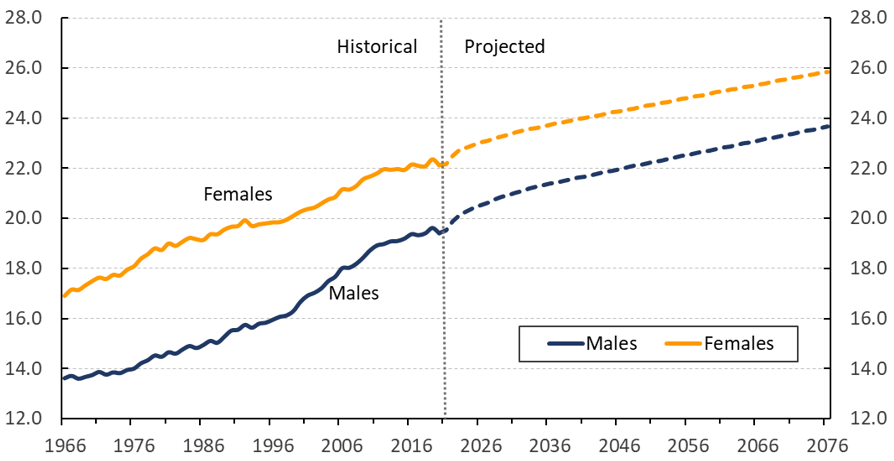

Another element that has contributed to the aging of the population is the significant reduction in the age-specific mortality rates. This can be measured by the increase in life expectancy at age 65, which directly affects how long retirement benefits will be paid to beneficiaries. Male life expectancy (without future mortality improvements, i.e. reductions in mortality) at age 65 increased by 44% between 1966 and 2019, rising from 13.6 to 19.6 years. For women, life expectancy at age 65 (without future improvements) increased by 31%, from 16.9 to 22.1 years over the same period. Although the overall gains in life expectancy at age 65 since 1966 are similar for males and females (between 5 and 6 years), about 70% of the increase occurred after 1990 for males, while for females, only about 50% of the increase occurred in that period.

Future mortality rates are determined by applying assumed mortality improvement rates to Statistics Canada’s 2019 life tables.

Statistics Canada’s 2020 life tables published in January 2022 were used to derive the annual mortality improvement rates for 2020. These tables reflect significant rate increases related to COVID-19 deaths. In 2020, life expectancy at birth (without future mortality improvements) stood at 79.5 for males and 84.0 for females, a decrease from 2019 of 0.7 and 0.4 for males and females respectively.

The 15-year average mortality improvement rates by age and sex for the period ending in 2019 are the starting point for the projected annual mortality improvement rates from 2021 onward. These projections disregard the impact of the COVID-19 pandemic. Mortality improvements are expected to continue in the future, but at a slower pace than most recently observed over the 15-year period ending in 2019. Further, it is assumed that ultimately, mortality improvement rates will be the same for males and females. The assumed mortality improvement rates are based on the analysis of the Canadian experience over the period 1921 to 2019 and of the possible drivers of future mortality improvements.

The projected mortality improvement rates are assumed to gradually reduce to their ultimate levels in 2039, which are for both sexes 0.8% per year for ages below 90, 0.5% for ages 90 to 94, and 0.2% for ages 95 and above.

In the short term, mortality rates were also adjusted to reflect assumed additional increases in mortality rates due to the COVID-19 pandemic. These assumed increases are related to two factors: i) direct increases in mortality due to COVID-19 deaths, affecting older age groups more and ii) indirect increases in mortality due to the impact of the pandemic on the opioids crisis, affecting mostly men in the age group 25 to 49Footnote 6.

For the direct increases in mortality due to COVID-19 deaths in 2021, mortality rates were adjusted using data on the number of COVID-19 deaths from both Health Canada and Statistics Canada. The pandemic is assumed to have a residual effect on mortality in 2022, followed by an assumed full recovery and reversion to the projected unadjusted mortality rates for years 2023 and onward. For the indirect increases related to the opioid crisis, projected mortality rates for affected age groups are assumed to revert back to normal levels, leading to a period of high growth in mortality improvement rates.

The resulting adjustments lead to mortality rates for the full population that are 5.5% higher on average in 2021 and 2.0% higher on average in 2022 than the rates developed using the information up to and including 2019.

Considering the above, life expectancy (with future improvements) at age 65 in 2022 is projected to be 21.3 years for males, and 23.8 years for females.

To project CPP benefits, the mortality rates for CPP retirement, survivor, and disability beneficiaries reflect actual experience for those segments of the population. Specific mortality experience for CPP beneficiaries is discussed further in Appendix B of this report.

4.2.3 Net Migration

Net migration corresponds to the number of immigrants less the net number of emigrants, plus the net increase in the number of non-permanent residents.

The components of net migration were analyzed separately by looking at trends in the historical data in order to select the assumptions regarding the short-term and ultimate rates. Over the past two years, net migration for Canada decreased significantly due to various COVID-19 safety measures such as border closures and flight cancellations. As such, data for the years 2020 and 2021 were excluded from the analysis. Consideration was given to the federal government’s short-term immigration targets and to long-term perspectives of various experts regarding future immigration levels, net increases in the number of non-permanent residents, and the impacts of the COVID-19 pandemic.

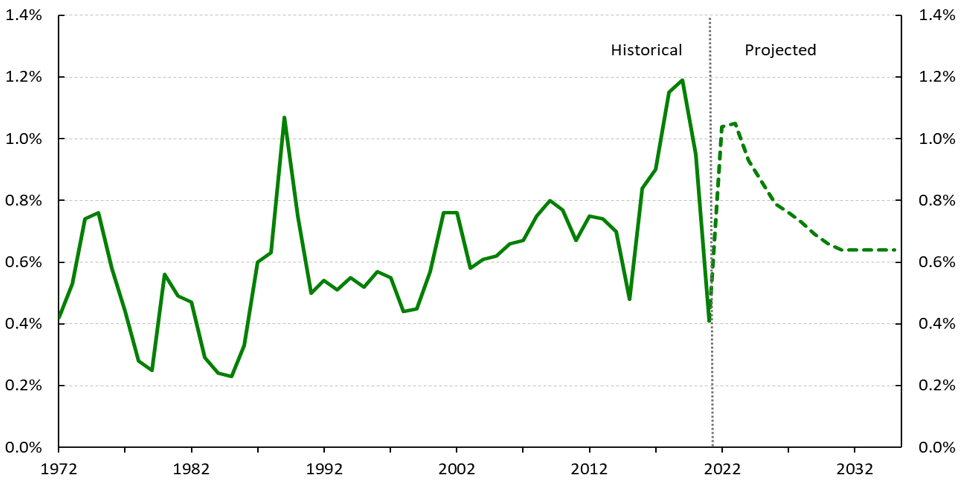

The net migration rate for Canada is projected to increase from its current (year ending June 2021) level of 0.41% of the population to 1.04% in 2022, 1.05% in 2023, 0.93% in 2024 and gradually reach an ultimate level of 0.64% of the population for the year 2031 and thereafter. The ultimate net migration rate of 0.64% corresponds to the average experience observed over the 10 years ending in 2019, excluding the net increase in non-permanent residents during that period. The assumed short-term net migration rate is higher than the ultimate rate of 0.64% due to the federal government’s short-term targets and the assumed gradual decrease to zero for the net increase in the number of non-permanent residents from 2022 through 2026.

For the Québec population, the 2031 ultimate net migration rate assumption corresponds to the 10-year average historical experience ending in 2019 for the province of 0.43%, excluding the net increase in non-permanents residents.

4.2.4 Population Projections

Table 2 shows the population of Canada less Québec for three age groups (0-19, 20-64 and 65 and over) throughout the projection period. The ratio of the number of people aged 20-64 to those aged 65 and over is a measure that approximates the ratio of the number of working-age people to retirees. Because of the aging population, this ratio is projected to drop from an estimated value of 3.3 in 2022 to 1.9 by 2070 and remain at that level thereafter.

| Year | Total | Age 0-19 |

Age 20-64 |

Age 65 and Over |

Ratio of 20-64 to 65 and Over |

|---|---|---|---|---|---|

| 2022 | 30,074 | 6,335 | 18,203 | 5,536 | 3.3 |

| 2023 | 30,519 | 6,429 | 18,344 | 5,746 | 3.2 |

| 2024 | 30,937 | 6,510 | 18,471 | 5,957 | 3.1 |

| 2025 | 31,333 | 6,581 | 18,579 | 6,173 | 3.0 |

| 2026 | 31,708 | 6,644 | 18,674 | 6,390 | 2.9 |

| 2027 | 32,073 | 6,705 | 18,768 | 6,600 | 2.8 |

| 2028 | 32,426 | 6,759 | 18,851 | 6,815 | 2.8 |

| 2029 | 32,764 | 6,814 | 18,929 | 7,022 | 2.7 |

| 2030 | 33,087 | 6,866 | 19,012 | 7,209 | 2.6 |

| 2035 | 34,557 | 7,105 | 19,580 | 7,873 | 2.5 |

| 2040 | 35,854 | 7,328 | 20,191 | 8,335 | 2.4 |

| 2045 | 37,008 | 7,474 | 20,836 | 8,699 | 2.4 |

| 2050 | 38,078 | 7,494 | 21,402 | 9,182 | 2.3 |

| 2055 | 39,128 | 7,548 | 21,797 | 9,783 | 2.2 |

| 2060 | 40,229 | 7,706 | 22,020 | 10,504 | 2.1 |

| 2065 | 41,398 | 7,932 | 22,211 | 11,255 | 2.0 |

| 2070 | 42,581 | 8,167 | 22,665 | 11,750 | 1.9 |

| 2080 | 44,799 | 8,531 | 23,763 | 12,505 | 1.9 |

| 2090 | 46,894 | 8,829 | 25,021 | 13,045 | 1.9 |

| 2100 | 49,228 | 9,267 | 25,996 | 13,966 | 1.9 |

4.3 Economic and Investment Assumptions

The main economic assumptions for the CPP are regarding: labour force participation rates, job creation rates, unemployment rates, the rate of increase in prices, and real increases in average employment earnings. For asset projections, further assumptions on real rates of return on invested assets are required.

One of the key elements underlying the best-estimate economic assumptions relates to the continued trend toward longer working lives. Older workers are expected to exit the workforce at a later age, which could alleviate the impact of the aging of the population on future labour force growth. However, despite the expected later exit ages, labour force growth is projected to weaken as the working-age population expands at a slower pace and baby boomers exit the labour force.

4.3.1 Labour Force

Employment levels vary with the rate of unemployment, and reflect trends in increased workforce participation by women, longer periods of formal education among young adults, changes in the age structure of the working-age population, as well as changing retirement patterns of older workers.

As the population ages, older age groups with lower labour force participation increase in size. As a result, the labour force participation rate for Canadians aged 15 and over is expected to decline from an estimated value of 65.1% in 2022 to 64.1% in 2035. A more useful measure of the working-age population is the participation rate of those aged 18 to 69, which is expected to increase from an estimated 76.7% in 2022 to 80.0% in 2035. The increase in the participation rate for those aged 18 to 69 reflects several trends.

For example, it is assumed that female participation rates will continue to grow at a faster pace than male participation rates thereby continuing to reduce the gap in participation rates between males and females, albeit at a slower pace than in the past. A part of this reduction comes from the expected impact on the female labour force participation due to the Early Learning and Child Care Plan initiative announced by the federal Government in 2021.

It is also assumed that participation rates for age groups 55 and over for both genders will increase as a result of an expected continued trend toward longer working lives.

Despite the assumed future increase in participation rates of women and older workers, it is still expected that there will be continued labour shortages in the future as the working-age population expands at a slower pace and as baby boomers continue to retire and exit the labour force. The participation rates for all age groups are therefore expected to increase due to the attractive employment opportunities resulting from labour shortages.

Overall, the male participation rate of those aged 18 to 69 is expected to be 80.8% in 2022 and to increase to 83.2% in 2035, while the female participation rate for the same age group is expected to be 72.6% in 2022 and to increase to 76.8% in 2035. As such, the difference between male and female participation rates for the age group 18 to 69 is projected to be 8.2 percentage points in 2022 and decrease to 6.4 percentage points by 2035. Thereafter, the gap between males and females in the age group 18 to 69 is projected to vary between 6.3 and 6.4 percentage points.

The job creation rate (i.e. the change in the number of persons employed) in Canada was on average 1.5% from 1976 to 2021 based on available employment data, and it is assumed that the rate will be 2.9% in 2022 as the labour market recovers from the COVID-19 pandemic. The job creation rate assumption is determined on the basis of expected moderate economic growth and an unemployment rate for Canada, ages 15 and over, that is expected to decrease from 7.5% in 2021 to 6.0% in 2022, 5.7% in 2023 and then increase to reach an ultimate level of 6.1% by 2027. The assumed job creation rate for Canada, ages 15 and over, is on average about 0.8% from 2024 to 2027, which is slightly lower than the labour force growth rate. It is assumed that, starting in 2027, the job creation rate will follow the labour force growth rate, with both averaging 0.8% per year between 2027 and 2035, and 0.4% per year thereafter. The aging of the population is the main reason behind the expected slower long-term growth in the labour force and job creation rate.

4.3.2 Price Increases

On December 13, 2021, the Bank of Canada and the federal Government renewed their commitment to keep inflation between 1% and 3% with a target at the mid-point of 2% until the end of 2026. They further noted that the Bank of Canada will use the flexibility of the 1% to 3% range to actively seek the maximum sustainable level of employment to an extent that is consistent with keeping medium-term inflation expectations at 2%.

Despite the mid-point target of 2%, price increases (inflation), as measured by changes in the Consumer Price Index (CPI), tend to fluctuate from year to year. The COVID-19 pandemic had an impact on the CPI. In 2020, the CPI rose by only 0.7% as a result of a decline in consumer spending stemming from various pandemic-related measures and restrictions. However, as the pandemic evolved and restrictions were lifted, consumer demand increased and supply issues arose. As a result, the increase in CPI was 3.4% in 2021, the fastest pace since 1991. The uncertainty surrounding high inflation due to the demand and supply shocks caused by the pandemic has been exacerbated by the escalation of the conflict in Ukraine.

This report considers the escalation of the conflict in Ukraine as a subsequent event. It is therefore assumed that inflation will be higher than the 2% target up until 2025. Increases in prices are assumed to be 6.9% in 2022, 3.0% in 2023, 2.5% in 2024, 2.25% in 2025, and 2.0% for 2026 and thereafter. These assumed price increases are based on short-term forecasts from various economistsFootnote 7 as well as on the expectation that the Bank of Canada and federal Government will continue to renew the inflation target at 2.0% and that the Bank of Canada will be successful in keeping inflation at its mid-point target in the long term.

4.3.3 Real Wage Increases

Wage increases affect the financial state of the CPP in two ways. In the short term, an increase in the average wage translates into higher contribution income, with little immediate impact on benefits. Over the long term, higher average wages produce higher benefits. The difference between nominal wage increases and inflation represents increases in the real wage, which is also referred to in this report as the real wage increase.

Two wage measures are used in this report: the average annual earnings (AAE) and the average weekly earnings (AWE). The assumed increase in AAE is used to project the total employment earnings of CPP contributors, while the assumed increase in the AWE is used to project the increase in the YMPE from one year to the next. The average difference between both measures has been relatively small over the period 1966 to 2019, and the two measures are assumed to grow at the same pace over the long term. However, they tend to grow at different paces in times of economic expansions and slowdowns.

Based on information up to the end of June 2022, the real AAE is projected to decrease by 2.4% in 2022 and by 0.1% in 2023. Real AAE are then projected to increase, with an ultimate real increase of 0.9% reached in 2026. The negative real AAE growth in the early years of the projection is a result of assumed wage dynamics in periods of high inflation stemming from the COVID-19 pandemic and exarcerbated by the escalation of the conflict in Ukraine, which is considered a subsequent event. The ultimate real AAE increase assumption is developed taking into account historical trends, labour productivity, labour shortages, and other contributing factors. The ultimate real AAE increase assumption combined with the ultimate price increase assumption results in an assumed nominal annual increase of 2.9% in 2026 and thereafter.

Real AWE are projected to decrease by 3.3% in 2022 and by 0.1% in 2023. In the following years, and consistent with the historical long-term relationship between the real change in the AWE and AAE, AWE is projected to increase, with an ultimate real increase of 0.9% reached in 2026, equal to the same ultimate real increase in AAE that year.

4.3.4 Real Rates of Return on Investments

Real rates of return on investments are the excess of the nominal rates of return over price increases and are required for the projection of revenue arising from investment income. A real rate of return is assumed for each year in the projection period and for each of the main asset categories in which the base and additional CPP assets are invested. The assumed long-term real rates of return on base and additional CPP assets take into account the assumed asset mixes of investments of each CPP component. The real rates of return on investments are net of all investment expenses, including the CPPIB operating expenses.

The escalation of the conflict in Ukraine has had significant impacts on financial markets. In an effort to control rising inflation exacerbated by this escalation, the Bank of Canada has increased its benchmark interest rate by 225 basis points so far in 2022 (as of July 13, 2022), which has impacted returns on fixed income investments. In addition, stock market indices in the first half of 2022 have decreased significantly across geographies and sectors.

This report considers the escalation of the conflict in Ukraine a subsequent event, and the assumed rates of return have been adjusted accordingly. More specifically, for 2022, the assumed nominal return is -9.0% for the base CPP and -7.7% for the additional CPP. In real terms, this translates into 2022 assumed returns of -15.9% and -14.6% for the base CPP and additional CPP respectively. These returns reflect actual CPPIB results up to 30 June 2022, and continued uncertainty for the remainder of the year. In addition, fixed income returns beyond 2022 are based on a revised interest rate path that reflects the significant rate hikes that occurred in the first half of 2022.

For the period 2023 to 2032, the assumed annual real rates of return are lower than the assumed ultimate real rates of return in 2033 due to lower expected bond returns between 2023 and 2033, and high inflation in the first few years. The average real rates of return for the 5-year period 2023-2027 for the base and additional CPP are respectively 3.56% and 2.70%, while the average real rates of return for the 10-year period 2023-2032 for the base and additional CPP are respectively 3.73% and 2.98%.

The ultimate real rates of return for the base and additional CPP are respectively 4.0% and 3.6%. The 75-year average real rate of return on the assets over the 2022-2096 projection period is assumed to be 3.69% for the base CPP and 3.27% for the additional CPP.

Table 3 summarizes the main economic assumptions over the projection period.

| Year | Real Increase Average Annual Earnings | Real Increase Average Weekly Earnings (YMPE) | Price Increase | Labour Force (Canada, 15+) | Real Rates of Return on Investments | ||||

|---|---|---|---|---|---|---|---|---|---|

| Participation Rate | Job Creation Rate | Unemployment Rate | Labour Force Annual Increase | Base CPP | Additional CPP | ||||

| 2022 | (2.4) | (3.3) | 6.9 | 65.1 | 2.9 | 6.0 | 1.3 | (15.9) | (14.6) |

| 2023 | (0.1) | (0.1) | 3.0 | 65.0 | 1.5 | 5.7 | 1.1 | 2.9 | 1.9 |

| 2024 | 0.4 | 0.4 | 2.5 | 64.8 | 0.9 | 5.8 | 1.0 | 3.4 | 2.5 |

| 2025 | 0.6 | 0.6 | 2.3 | 64.6 | 0.8 | 5.9 | 0.9 | 3.6 | 2.8 |

| 2026 | 0.9 | 0.9 | 2.0 | 64.5 | 0.8 | 6.0 | 0.9 | 3.9 | 3.1 |

| 2027 | 0.9 | 0.9 | 2.0 | 64.4 | 0.8 | 6.1 | 0.9 | 3.9 | 3.2 |

| 2028 | 0.9 | 0.9 | 2.0 | 64.3 | 0.8 | 6.1 | 0.8 | 3.9 | 3.2 |

| 2029 | 0.9 | 0.9 | 2.0 | 64.2 | 0.8 | 6.1 | 0.8 | 3.9 | 3.2 |

| 2030 | 0.9 | 0.9 | 2.0 | 64.1 | 0.7 | 6.1 | 0.7 | 3.9 | 3.3 |

| 2035 | 0.9 | 0.9 | 2.0 | 64.1 | 0.7 | 6.1 | 0.7 | 4.0 | 3.6 |

| 2040 | 0.9 | 0.9 | 2.0 | 63.7 | 0.5 | 6.1 | 0.5 | 4.0 | 3.6 |

| 2045 | 0.9 | 0.9 | 2.0 | 63.2 | 0.5 | 6.1 | 0.5 | 4.0 | 3.6 |

| 2050 | 0.9 | 0.9 | 2.0 | 62.8 | 0.4 | 6.1 | 0.4 | 4.0 | 3.6 |

| 2055 | 0.9 | 0.9 | 2.0 | 62.2 | 0.2 | 6.1 | 0.2 | 4.0 | 3.6 |

| 2060 | 0.9 | 0.9 | 2.0 | 61.5 | 0.2 | 6.1 | 0.2 | 4.0 | 3.6 |

| 2065 | 0.9 | 0.9 | 2.0 | 60.8 | 0.3 | 6.1 | 0.3 | 4.0 | 3.6 |

| 2070 | 0.9 | 0.9 | 2.0 | 60.4 | 0.4 | 6.1 | 0.4 | 4.0 | 3.6 |

| 2080 | 0.9 | 0.9 | 2.0 | 60.1 | 0.4 | 6.1 | 0.4 | 4.0 | 3.6 |

| 2090 | 0.9 | 0.9 | 2.0 | 60.1 | 0.4 | 6.1 | 0.4 | 4.0 | 3.6 |

| 2100 | 0.9 | 0.9 | 2.0 | 59.7 | 0.4 | 6.1 | 0.4 | 4.0 | 3.6 |

4.4 Other Assumptions

This report is based on several other key assumptions, such as retirement benefit take-up rates and disability incidence rates.

4.4.1 Retirement Benefit Take-up Rates

The retirement benefit take-up rates are determined on a cohort basis. The sex-distinct retirement benefit take-up rate for any given age and year from age 60 and above corresponds to the number of emerging (new) retirement beneficiaries divided by the total number of people eligible for retirement benefits for the given sex, age, and year.

The unreduced pension age under the Canada Pension Plan is 65. In 1987, the flexible retirement age provision became effective such that a person can choose to receive a reduced retirement pension as early as age 60 (as well as an increased pension after age 65). This provision had the overall effect of lowering the average age at pension take-up to below age 65. In 1986, the average age at pension take-up was 65.2, compared to an average age of 62.7 over the decade ending in 2019.

Since 2012, the age 60 retirement benefit take-up rates have continually decreased. For cohorts reaching age 60 in 2019 (before the pandemic), the retirement take-up rates were 27.8% for males and 30.3% for females. For cohorts reaching age 60 in 2021, the retirement take-up rates were 23.3% for males and 25.0% for females. The 2021 take-up rate for males is the lowest one since 1989, while the 2021 take-up rate for females is a record low since the flexible retirement age provision was first introduced in 1987. At this time, it is not clear to what extent the COVID-19 pandemic contributed to the significant reduction in retirement take-up rates at age 60 during the years 2020 and 2021. The decreasing trend will be monitored for the next CPP valuation.

The assumption reflects the pre-pandemic trend in retirement take-up rates at age 60, while giving partial credibility to the years 2020 and 2021. For cohorts reaching age 60 in 2022 and thereafter, the retirement benefit take-up rates are assumed to be 26.0% for males and 28.0% for females. The retirement take-up rates at age 65 are derived such that the sum of the retirement rates for each cohort is 100%. The resulting rates at age 65 are determined to be 42.5% for males and 43.8% for females in 2031 and thereafter. These rates result in projected average ages at retirement pension take-up in 2031 of 63.6 for males and 63.4 for females. The same retirement take-up rates for the base CPP apply to the additional CPP.

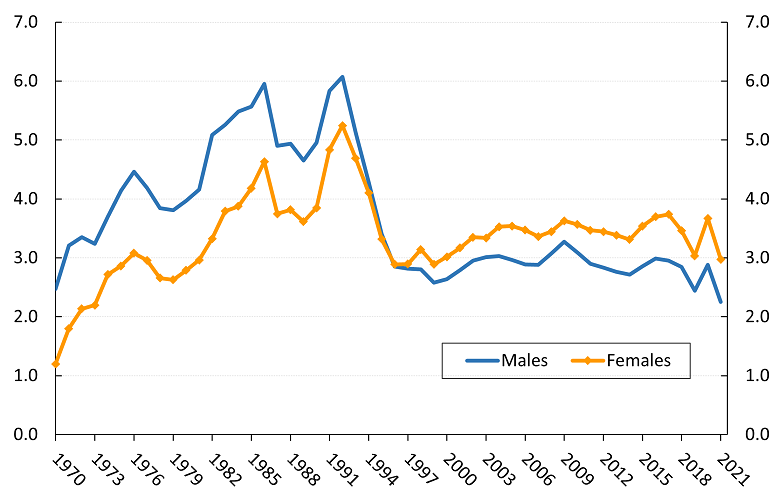

4.4.2 Disability Incidence Rates - Disability Pension and Post-Retirement Disability Benefit

The sex-distinct disability incidence rate in respect of a disability benefit – either the disability pension or post-retirement disability benefit – at any given age is the number of new disability beneficiaries divided by the total number of people eligible for the disability benefit at that age. The disability incidence rates for the base Plan in respect of the disability pension are the same as for the additional Plan. The disability incidence rates in respect of the post-retirement disability benefit apply only to the base Plan, since the benefit pertains only to the base Plan.

The assumptions for the disability incidence rates in respect of the disability pension recognize that current disability incidence rates are significantly below the levels experienced from the mid-1970s to mid-1990s for males and during the early 1980s and early to mid-1990s for females. With the exception of more recent years (2019-2021), the incidence rates for both sexes have been relatively stable since the late 1990s as a result of administrative changes made to the disability program. Volatility was observed in the incidence rates over the period 2019 to 2021, which is attributable to administrative and COVID-19 related factors. Such volatility is not expected to continue, and as such, the years 2019 to 2021 were not considered in developing the ultimate assumptions for the disability incidence rates.

Based on the above and experience over the period 2007 to 2018, incidence rates in respect of the disability pension are expected to increase gradually from 2021 to 2026 and are then assumed to remain constant thereafter at values of 2.90 per thousand eligible for males and 3.60 per thousand eligible for females.

For the base CPP post-retirement disability benefit, which came into effect in 2019 and applies only to early retirement beneficiaries (before age 65) who become disabled, the incidence rates by age and sex were derived based on post-retirement disability benefit data for years 2019 and 2020 along with historical records of earnings data of early retirement beneficiaries. It is projected that, in 2026, the overall disability incidence rates in respect of the post-retirement disability benefit for early retirement beneficiaries will be 10.08 per 1,000 eligible males and 9.06 per 1,000 eligible females . As more experience data regarding post-retirement disability benefits become available, the assumptions for the incidence rates will be revised accordingly for future CPP actuarial reports.

5 Results - Base CPP

5.1 Overview

The key observations and findings of the actuarial projections of the financial state of the base CPP presented in this report are as follows.

- With the legislated contribution rate of 9.9%, contributions to the base CPP are projected to be more than sufficient to cover the expenditures over the period 2022 to 2025. Thereafter, a portion of investment income is required to make up the difference between contributions and expenditures. In 2030, about 9% of investment income will be required to pay for expenditures. This is expected to gradually increase to about 16% by 2050 and about 34% by 2070, after which it is expected to be fairly stable.

- With the legislated contribution rate of 9.9%, total assets of the base Plan are expected to decrease in 2022 as a result of the current financial markets environment. Assets are then expected to increase over the projection period, with more significant growth in the first few years. Total assets are expected to decrease from $544 billion at the end of 2021 to $499 billion at the end of 2022 and then grow to $791 billion by the end of 2030. Assets are then projected to reach $2.2 trillion by 2050 and $17 trillion by 2100. The ratio of assets to the following year’s expenditures is projected to increase slightly from 8.1 to 8.4 between 2022 and 2030 and to continue to grow thereafter to values of 10.7 in 2050 and 13.2 in 2100.

- With the legislated contribution rate of 9.9%, investment income of the base Plan, which is expected to represent 32% of revenues (i.e. contributions and investment income) in 2023, is further projected to represent 34% of revenues in 2030, 42% of revenues in 2050 and 51% of revenues by 2100. This illustrates the importance of investment income as a source of revenues for the base Plan.

- The minimum contribution rate (MCR) to sustain the base Plan is 9.56% of contributory earnings for years 2025 to 2033 and 9.54% for the year 2034 and thereafter. The legislated contribution rate of 9.9% applies to the first three years after the valuation year, that is, to the current triennial review period of 2022-2024.

- The MCR consists of two separate components. First, the steady-state contribution rate, which is the lowest rate that results in the projected ratio of the assets to the following year’s expenditures of the base Plan remaining generally constant over the long term, before consideration of any full funding of increased or new benefits, is 9.53% for the year 2025 and thereafter. The second component is the full funding rate that is required to fully fund the amendments made to the Canada Pension Plan under the Budget Implementation Act, 2018, No. 1. The full funding rate is 0.03% for years 2025 to 2033 and 0.01% for the year 2034 and thereafter.

- Under the MCR, the ratio of assets to the following year’s expenditures is projected to increase slightly from 8.1 in 2025 to 8.4 in 2034 and to be the same fifty years later in 2084.

- The MCR determined for this report is lower than the MCR of 9.72% for years 2034 and thereafter determined under the 30th CPP Actuarial Report. Experience over the period 2019 to 2021 was better than expected overall, leading to a decrease in the MCR. The main contributing factor for this was better than expected investment experience, which lowers the MCR by 0.35. This decrease is partially offset by changes in real rate of return assumptions for 2022. The net result of all changes since the 30th CPP Actuarial Report is a decrease in the MCR of 0.18 percentage points for the year 2034 and thereafter.

- Overall, changes to the assumptions to reflect the subsequent event resulted in an increase in the MCR of 0.31. A large portion of this increase is due to reductions in the 2022 assumed nominal rate of return. The reduction in MCR due to 2019-2021 investment experience is therefore partially offset by lower assumed returns in 2022.

- Although the pay-as-you-go rate is expected to increase over time from 9.1% in 2022 to 13.3% by 2100 due to the retirement of the baby boom generation and the projected continued aging of the population, the legislated contribution rate of 9.9% is sufficient to finance the base Plan over the long term. The pay-as-you-go rate is the contribution rate that would need to be paid if there were no assets.

- The number of contributors to the CPP is expected to grow from 15.2 million in 2022 to 19.3 million in 2050 and 24.0 million by 2100. Under the legislated contribution rate of 9.9%, base CPP contributions are expected to increase from $61 billion in 2022 to $177 billion in 2050 and $929 billion by 2100.

- The number of base CPP retirement beneficiaries is expected to increase from 6.0 million in 2022 to 9.9 million in 2050 and 15.3 million by 2100.

- Total expenditures of the base Plan are expected to grow rapidly from approximately $56 billion in 2022 to $89 billion in 2030. Thereafter, total expenditures are projected to grow at a slower pace, reaching $197 billion in 2050 and $1.2 trillion by 2100.

5.2 Contributions

Projected contributions are the product of the contribution rate, the number of contributors, and the average contributory earnings. The contribution rate for the base CPP is set by law and is 9.9%. As of 1 January 2019, all contributors to the base CPP also contribute to the additional CPP.

Table 4 presents the projected number of CPP contributors, including CPP retirement beneficiaries who are working (i.e. “working beneficiaries”), their base CPP contributory earnings and contributions. The number of contributors who are not working beneficiaries is directly linked to the assumed labour force participation rates applied to the projected working-age population and the job creation rates. The number of working beneficiaries who are contributors is derived from the number of retirement beneficiaries in pay. Hence, the demographic, economic, and retirement-related assumptions have a great influence on the expected level of contributions. In this report, the number of CPP contributors is expected to increase continuously throughout the projection period, but at a generally decreasing pace, from an estimated 15.2 million in 2022 to 16.7 million in 2030, 19.3 million in 2050, and 24.0 million by 2100. The future increase in the number of contributors is limited due to the projected lower growth in the working-age population and labour force.

The growth in base CPP contributory earnings, which are derived by subtracting the Year’s Basic Exemption (YBE) from pensionable earnings (up to the YMPE) is linked to the growth in average employment earnings through the assumption regarding annual increases in wages and is affected by the freeze on the YBE since 1998.

Contributions to the base CPP are expected to increase from an estimated $61 billion in 2022 to $86 billion in 2030, $177 billion in 2050 and to continue increasing thereafter, reaching $929 billion in 2100 as shown in Table 4. The projected YMPE is also shown, which is assumed to increase according to the increases in the average weekly earnings assumption. The YMPE for 2023 reflects actual data up to April 2022. The YMPE is projected to increase from $64,900 in 2022 to $82,200 in 2030, $145,600 in 2050, and $608,200 by 2100.

Since the legislated contribution rate is constant at 9.9% for the year 2019 and thereafter, contributions to the base CPP increase at the same rate as total contributory earnings over the projection period.

| Year | Contribution Rate (%) | YMPE ($) | Number of Contributors (thousands) | Contributory Earnings ($ million) | Contributions ($ million) |

|---|---|---|---|---|---|

| 2022 | 9.9 | 64,900 | 15,235 | 616,668 | 61,050 |

| 2023 | 9.9 | 66,900 | 15,534 | 648,785 | 64,230 |

| 2024 | 9.9 | 69,200 | 15,751 | 680,189 | 67,339 |

| 2025 | 9.9 | 71,200 | 15,959 | 710,485 | 70,338 |

| 2026 | 9.9 | 73,300 | 16,114 | 739,632 | 73,224 |

| 2027 | 9.9 | 75,400 | 16,264 | 769,230 | 76,154 |

| 2028 | 9.9 | 77,600 | 16,419 | 800,229 | 79,223 |

| 2029 | 9.9 | 79,900 | 16,566 | 832,186 | 82,386 |

| 2030 | 9.9 | 82,200 | 16,708 | 864,552 | 85,591 |

| 2035 | 9.9 | 94,800 | 17,464 | 1,047,401 | 103,693 |

| 2040 | 9.9 | 109,400 | 18,057 | 1,254,280 | 124,174 |

| 2045 | 9.9 | 126,200 | 18,686 | 1,499,428 | 148,443 |

| 2050 | 9.9 | 145,600 | 19,263 | 1,784,712 | 176,687 |

| 2055 | 9.9 | 168,000 | 19,687 | 2,108,096 | 208,701 |

| 2060 | 9.9 | 193,800 | 19,992 | 2,474,655 | 244,991 |

| 2065 | 9.9 | 223,600 | 20,289 | 2,903,032 | 287,400 |

| 2070 | 9.9 | 258,000 | 20,699 | 3,421,988 | 338,777 |

| 2080 | 9.9 | 343,300 | 21,805 | 4,803,930 | 475,589 |

| 2090 | 9.9 | 457,000 | 22,975 | 6,744,599 | 667,715 |

| 2100 | 9.9 | 608,200 | 23,973 | 9,379,076 | 928,529 |

5.3 Expenditures

The projected number of base CPP beneficiaries by type of benefit is given in Table 5, while Table 6 presents information for male and female beneficiaries separately. The number of retirement, disability, and survivor beneficiaries increases throughout the projection period. In particular, the number of retirement beneficiaries is expected to increase from an estimated 6.0 million in 2022 to 7.7 million by 2030 or by 27% due to the aging of the population and retirement of the baby boomers.

By 2050, the number of retirement beneficiaries is projected to be 9.9 million and to then further increase to 15.3 million by 2100. Female retirement beneficiaries continue to outnumber their male counterparts, and by 2050 there is projected to be 793 thousand or 17% more female than male retirement beneficiaries. By 2100, the number of female retirement beneficiaries is projected to exceed the number of male beneficiaries by 1.1 million or 15%. Over the projection period, the number of disability and survivor beneficiaries is also projected to increase but at a slower average pace than for retirement beneficiaries.

| Year | Retirement Table 5 Footnote 2, Table 5 Footnote 3, Table 5 Footnote 4, Table 5 Footnote 5 | Disability Table 5 Footnote 4, Table 5 Footnote 6 | Survivor Table 5 Footnote 5, Table 5 Footnote 6 | Children | Death Table 5 Footnote 7 |

|---|---|---|---|---|---|

| 2022 | 6,025 | 365 | 1,353 | 221 | 176 |

| 2023 | 6,230 | 363 | 1,377 | 224 | 178 |

| 2024 | 6,444 | 365 | 1,403 | 228 | 184 |

| 2025 | 6,671 | 370 | 1,430 | 234 | 189 |

| 2026 | 6,893 | 375 | 1,458 | 241 | 194 |

| 2027 | 7,093 | 380 | 1,486 | 248 | 200 |

| 2028 | 7,288 | 384 | 1,515 | 254 | 205 |

| 2029 | 7,476 | 388 | 1,545 | 262 | 212 |

| 2030 | 7,651 | 393 | 1,575 | 269 | 218 |

| 2035 | 8,334 | 429 | 1,729 | 301 | 251 |

| 2040 | 8,834 | 476 | 1,874 | 335 | 285 |

| 2045 | 9,300 | 526 | 1,991 | 359 | 312 |

| 2050 | 9,869 | 562 | 2,070 | 368 | 332 |

| 2055 | 10,564 | 583 | 2,116 | 366 | 344 |

| 2060 | 11,353 | 586 | 2,148 | 362 | 350 |

| 2065 | 12,088 | 580 | 2,191 | 363 | 358 |

| 2070 | 12,661 | 594 | 2,261 | 369 | 373 |

| 2080 | 13,551 | 633 | 2,450 | 386 | 418 |

| 2090 | 14,266 | 685 | 2,554 | 394 | 447 |

| 2100 | 15,260 | 709 | 2,545 | 402 | 450 |

|

Table 5 Footnotes

|

|||||

| Year | Males | Females | ||||||

|---|---|---|---|---|---|---|---|---|

| Retirement Table 6 Footnote 2, Table 6 Footnote 3, Table 6 Footnote 4, Table 6 Footnote 5 | Disability Table 6 Footnote 4, Table 6 Footnote 6 | Survivor Table 6 Footnote 5, Table 6 Footnote 6 | Death Table 6 Footnote 7 | Retirement Table 6 Footnote 2, Table 6 Footnote 3, Table 6 Footnote 4, Table 6 Footnote 5 | Disability Table 6 Footnote 4, Table 6 Footnote 6 | Survivor Table 6 Footnote 5, Table 6 Footnote 6 | Death Table 6 Footnote 7 | |

| 2022 | 2,889 | 163 | 278 | 104 | 3,136 | 202 | 1,075 | 73 |

| 2023 | 2,982 | 161 | 287 | 104 | 3,248 | 201 | 1,090 | 74 |

| 2024 | 3,079 | 162 | 297 | 107 | 3,365 | 203 | 1,107 | 77 |

| 2025 | 3,182 | 164 | 306 | 109 | 3,488 | 207 | 1,124 | 80 |

| 2026 | 3,283 | 166 | 315 | 112 | 3,611 | 210 | 1,142 | 82 |

| 2027 | 3,372 | 167 | 325 | 114 | 3,721 | 213 | 1,161 | 85 |

| 2028 | 3,459 | 168 | 334 | 117 | 3,829 | 215 | 1,181 | 89 |

| 2029 | 3,542 | 170 | 344 | 120 | 3,934 | 219 | 1,201 | 92 |

| 2030 | 3,619 | 171 | 353 | 123 | 4,033 | 221 | 1,222 | 95 |

| 2035 | 3,904 | 186 | 396 | 138 | 4,430 | 244 | 1,333 | 113 |

| 2040 | 4,097 | 205 | 430 | 152 | 4,738 | 271 | 1,444 | 132 |

| 2045 | 4,281 | 227 | 453 | 164 | 5,019 | 299 | 1,537 | 149 |

| 2050 | 4,538 | 243 | 466 | 171 | 5,331 | 319 | 1,604 | 161 |

| 2055 | 4,878 | 252 | 473 | 176 | 5,686 | 331 | 1,643 | 168 |

| 2060 | 5,279 | 252 | 482 | 178 | 6,074 | 334 | 1,666 | 172 |