OSFI Superintendent Transition Binder

July 2021

Table of contents

About OSFI

A brief overview of our organization, including a journey through our history, understanding why we exist and our role in the industry, as well as an overview of our Strategic Plan.

Legal Primer

Statutory Mandate

OSFI’s mandate is set out in s. 4 of the Office of the Superintendent of Financial Institutions Act (OSFI Act), which is:

- to supervise financial institutions in order to determine whether they are in sound financial condition and are complying with their governing legislation and, in doing so, to strive to protect the rights and interests of depositors, policyholders and creditors of financial institutions;

- to supervise pension plans in order to determine whether they meet minimum funding requirements and are complying with the legislation and, in doing so, to strive to protect the rights and interests of plan members and other plan beneficiaries.

OSFI is considered as a “prudential” or “solvency” regulator (as opposed to “market conduct” regulator).

OSFI’s mandate can be described as trying to ensure that regulated entities will “keep their promises”:

- by ensuring that financial institutions prudently manage their assets so as to increase the chances they will have sufficient financial resources to fulfill the promises they made to their clients (i.e. to pay all amounts due under a certificate of deposit or to pay all insurance benefits due under an insurance policy);

- by ensuring that pension plans are adequately funded so as to increase the chances that there will be sufficient assets in the pension fund to fulfill the promises that employers made to their employees (i.e. to pay pension benefits and other benefits payable under the pension plan).

Supervised Institutions

OSFI supervises federally-regulated financial institutions (FRFIs), which include:

- banks and authorized foreign banks (also known as “foreign bank branches”);

- federally-incorporated insurance companies and foreign insurance companies (also known as “foreign insurance branches”);

- federally-incorporated trust or loan companies;

- federally-regulated cooperative credit associations.

OSFI has authority to supervise regulated bank holding companies and insurance holding companies. However, no such regulated holding companies currently exist (although some inactive insurance companies act as holding companies for their subsidiaries).

OSFI also supervises federally-registered pension plans, which include plans sponsored by employers engaged in federal works, undertakings, and businesses such as:

- banks;

- airlines;

- interprovincial transportation;

- telecommunications;

- employers in the Territories.

Federal Jurisdiction

Financial Institutions

- There is federal jurisdiction to regulate banks.

- There is federal jurisdiction to incorporate insurance, trust or loan companies, and cooperative credit associations and to regulate matters relating to their corporate status.

- There is provincial jurisdiction to incorporate insurance, trust or loan companies, and cooperative credit associations (credit unions) and to regulate their activities.

Pension Plans

- There is federal jurisdiction to regulate labour relations in organizations falling under federal jurisdiction. As such, there is federal jurisdiction to regulate pension plans sponsored by employers engaged in federal works, undertakings, and businesses.

- The vast majority of private pension plans in Canada are regulated under provincial legislation.

- Some plans are subject to both federal and provincial pension legislation. There currently are bilateral agreements between the Minister of Finance and the provinces that delegate powers to the authority to which most plan members are subject. The federal pension legislation authorizes the Minister to enter into a multi-lateral agreement which has the effect of adopting the laws of the authority to which the majority of plan members are subject.

Legislation Administered by OSFI

OSFI is responsible for the administration of the following statutes:

- Bank Act;

- Insurance Companies Act;

- Trust and Loan Companies Act;

- Cooperative Credit Associations Act [no entities are currently subject to this statute];

- Green Shield Canada Act;

- Pension Benefits Standards Act, 1985;

- Pooled Registered Pensions Plans Act;

- OSFI Act.

The Financial Consumer Agency of Canada (FCAC) is responsible for the administration of the consumer provisions that are found in the financial institutions legislation (i.e. the first four statutes on the list above)

OSFI has additional statutory duties under the following statutes:

- Canada Deposit Insurance Act;

- Protection of Residential Mortgage or Hypothecary Insurance Act;

- National Housing Act (examination of commercial operations of CMHC).

Intervention Powers

The legislation grants various intervention powers to OSFI for meeting its mandate, such as:

- conducting on-site inspections;

- requesting production of information;

- imposing terms and conditions;

- requiring special audit or special actuarial valuation;

- issuing a direction of compliance;

- removing directors or senior officers of financial institutions;

- replacing a pension plan administrator;

- imposing administrative monetary penalties (currently available only in respect of financial institutions not pension plans).

If a financial institution experiences financial difficulties which could jeopardize its solvency, OSFI can ultimately take control of the institution and request the Attorney General of Canada to apply for a winding-up order under the Winding up and Restructuring Act (WURA).

Similarly, if a pension plan experiences financial difficulties which could jeopardize the payment of benefits, OSFI can ultimately order the termination of the plan.

Delegation of Authority

- Any officer or employee of OSFI may exercise the powers of the Superintendent under the legislation if the person is appointed to serve in the Office in a capacity appropriate to the exercise of the power (s. 10 of the OSFI Act).

- As such, there is generally no need for any formal delegation of authority.

- However a few powers, like the authority to take control of an institution, have been excluded from the scope of that authority. Further, terms and conditions have been imposed by the Superintendent on the exercise of certain powers in the Delegation Framework for Exercising the Superintendent’s Powers.

Legal Status of OSFI

- OSFI is an office of the Government of Canada that was established pursuant to the OSFI Act.

- From an administrative standpoint, OSFI is generally considered as a government department.

- OSFI is not a separate legal entity from the Government of Canada.

- Unlike the Bank of Canada or the Canada Deposit Insurance Corporation, OSFI is not a Crown Corporation.

Reporting Relationship

- OSFI is headed by the Minister of Finance and reports to Parliament through the Minister.

- The Superintendent is the “deputy head” of OSFI and, from that perspective, can be compared to the Deputy Minister of a department.

- The legislation distinguishes between the intervention powers of the Superintendent over FRFIs (e.g. taking control of an institution) and those of the Minister (e.g. approval of corporate transactions). The Superintendent’s statutory powers can be exercised independently.

- The Superintendent is appointed by the Governor in Council (i.e. Cabinet) and holds office “during good behaviour” for a seven year term. The Superintendent can only be removed for cause by the Governor in Council; an Order in Council providing for the removal must be laid before Parliament.

- The legislation gives no specific authority to the Minister or the GIC to issue directions to the Superintendent.

- The Department of Finance is responsible for the development of the policy regarding the legislation that OSFI is responsible for administering.

- In practice, all applications for ministerial approval under the financial institutions legislation are processed by OSFI, which then makes a recommendation to the Minister.

Contracting Authority

- OSFI has no independent authority to enter into legally binding contracts.

- However, OSFI can contract on behalf of the Government of Canada (i.e. “Her Majesty in right of Canada”) pursuant to a formal delegation of signing authority from the Minister of Finance.

- OSFI is subject to government procurement and other contracting rules as administered by the Treasury Board Secretariat and Public Services and Procurement Canada.

Authority to sue and to be sued

- OSFI cannot sue or be sued in its own name.

- Generally, legal proceedings by or against OSFI are instituted by or against the Government of Canada in the name of the “Attorney General of Canada”.

- OSFI and its employees are protected from civil liability by an immunity clause for any action or omission made in good faith in the administration of any federal statutes (s. 39 of the OSFI Act).

- Any person directly affected by a decision made by OSFI may file an application for judicial review pursuant to s. 18.1 of the Federal Courts Act. Judicial review is an examination of whether the decision-maker had legal authority to make the decision, if its decision was reasonable and whether it followed the requirements of procedural fairness.

- Pursuant to s. 39.1 of the OSFI Act, OSFI officers are not compellable as witnesses in civil proceedings.

Staffing Authority and HR Management

- OSFI has no independent authority to hire its own employees.

- OSFI has received delegated staffing authority from the Public Service Commission to appoint employees on behalf of the Government of Canada pursuant to the Public Service Employment Act.

- OSFI is a “separate agency” and, as such, enjoys some flexibility in managing its human resources. OSFI can exercise the powers relating to personnel management that the Treasury Board normally exercises as employer of the rest of the public service. OSFI has authority to set certain terms and conditions of employment. OSFI can, subject to Governor in Council approval, enter into collective agreements with bargaining agents representing its unionized employees.

Financial Authority

- Most of OSFI’s operating costs are recovered from regulated institutions and pension plans pursuant to assessments.

- A small portion of OSFI’s budget relating to the Office of the Chief Actuary comes from public moneys appropriated by Parliament.

- OSFI is also subject to directives and guidelines issued by the Treasury Board (e.g. financial reporting, contracting, etc.).

- OSFI has a department audit committee (DAC) that provides objective advice and recommendations to the Superintendent regarding the sufficiency, quality and results of assurance on the adequacy and functioning of the department’s risk management, control and governance frameworks and processes.

- OSFI does not own property in its own name; all assets under the control of OSFI are the property of the Government of Canada (i.e. Crown assets).

Other Government Legislation

As a government agency, OSFI is subject to a number of statutes including:

- the Access to Information Act;

- the Privacy Act;

- the Official Languages Act;

- the Financial Administration Act;

- the Public Service Employment Act;

- the Federal Public Sector Labour Relations Act;

- the Canadian Human Rights Act;

- the Public Servants Disclosure Protection Act;

- the Conflict of Interest Act (only applicable to the Superintendent);

- the Lobbying Act;

- the Accessible Canada Act (regulations are not yet in force); and

- the Canada Labour Code-Part II (occupational health and safety).

Confidentiality

- The legislation provides that all information obtained by OSFI regarding a financial institution shall be treated as confidential (s. 22 of the OSFI Act and equivalent provisions in each of the financial institutions statute).

Office of the Chief Actuary

- The Chief Actuary is responsible for preparing various actuarial reports pursuant to the Canada Pension Plan, the Public Pensions Reporting Act and the Canada Student Financial Assistance Act.

- The Chief Actuary is appointed by the Superintendent.

Legal Services

- OSFI obtains its legal services from the Attorney General of Canada, which is responsible for advising federal departments on all legal matters pursuant to the Department of Justice Act.

What is OSFI?

Who we are and what we do

The Office of the Superintendent of Financial Institutions (OSFI) is an independent agency of the Government of Canada, established in 1987 to contribute to the safety and soundness of the Canadian financial system. OSFI supervises and regulates federally registered banks and insurers, trust and loan companies, as well as private pension plans subject to federal oversight. OSFI reports to the Parliament of Canada through the Minister of Finance.

OSFI allows financial institutions to take reasonable risks and compete effectively both at home and abroad, while at the same time safeguarding the interests of depositors, policyholders, beneficiaries and pension plan members. OSFI’s goal is to balance competitiveness with financial stability, and international standards with Canadian market realities.

OSFI does not manage the daily operations of financial institutions or private pension plans. Their executive management and boards of directors or trustees are ultimately responsible for the success or failure of the financial institution, but OSFI plays an important oversight role in ensuring that the risk management processes of the institution are prudent. OSFI’s mandate does not include consumer-related issues or the securities industry.

How OSFI is funded

OSFI’s costs are recovered through assessments on the financial services industry and private pension plans OSFI regulates and supervises, and through a user-pay program for selected services. A small portion of OSFI’s revenue is received through an appropriation from the Government of Canada for actuarial services relating to various public sector pension and benefit plans.

What is the OCA within the context of OSFI?

The Office of the Chief Actuary (OCA) is an independent unit within OSFI that provides a range of actuarial valuation and advisory services to the Government of Canada. The OCA provides appropriate check sand balances on the future costs of the different pension plans and social programs that fall under its responsibility, including the Canada Pension Plan (CPP), the Old Age Security Program and the Canada Student Loans Program.

OSFI Video Series

OSFI's YouTube Channel

The Office of the Superintendent of Financial Institutions (OSFI) is an independent agency of the Government of Canada, established in 1987 to contribute to the safety and soundness of the Canadian financial system. OSFI supervises and regulates federally registered banks and insurers, trust and loan companies, as well as private pension plans subject to federal oversight. OSFI reports to the Parliament of Canada through the Minister of Finance.

Operational Independence

Parliament’s intention to grant OSFI operational independence in carrying out its mandate is clear from the chosen statutory structure of the Office. For example, Parliament chose to establish OSFI as a separate Office under subsection 4(1) of the OSFI Act with, pursuant to section 3.1 of the Act, the stated purpose of contributing to public confidence in the Canadian financial system.

Section 5 of the OSFI Act provides that OSFI will be headed by a Superintendent who is appointed by the Governor-in-Council for a fixed term of seven years, a term that is not linked to the usual four-year mandate of the government in power. Further, the appointment is made “during good behaviour,” meaning that the Superintendent can only be removed for cause (as opposed to “during pleasure, ”where the incumbent can be easily replaced during a term), which ensures a material degree of operational independence.

OSFI has the sole legal mandate for the supervision of banks in Canada and is also responsible for supervising other FRFIs that are federally incorporated or registered. As an agency, OSFI demonstrates a strong consciousness of its mandate. The legislation OSFI administers provides OSFI with a wide range of powers that are essential to the performance of effective supervision and provides the framework within which OSFI sets and enforces the minimum prudential standards. The sunset clause (mandatory five-year revision) contained in the legislation governing FRFIs provides a legal framework with a ready capacity to be periodically updated to reflect the demands of the financial system and expectations placed on supervisory practice.

Mandate & Vision

Mandate

Protecting depositors, policyholders, financial institution creditors and pension plan members, while allowing financial institutions to compete and take reasonable risks. Providing actuarial valuation and advisory services to the Government of Canada.

Vision

Building OSFI for today and tomorrow: preserving confidence, ever vigilant, always improving

Corporate Artifacts

One Office, OSFI Compass, Corporate Values, our Vision, and more: corporate artifacts help define our identity

MANDATE

why we exist

Protect depositors, policyholders, financial institution creditors and pension plan members, while allowing financial institutions to compete and take reasonable risks. Provide actuarial valuation and advisory services to the Government of Canada through the Office of the Chief Actuary.

VISION

what success looks like

Building OSFI for today and tomorrow: preserving confidence, ever vigilant, always improving.

COMPASS

how we operate

- We are results-oriented

- We are principles-based

- We are risk-based

- We take a balanced approach

- We set the benchmark

ONE OFFICE

how we collaborate

One Office was created to minimize silos and to encourage communication and collaboration. It has 3 broad elements:

one mandate --- one activity --- one voice

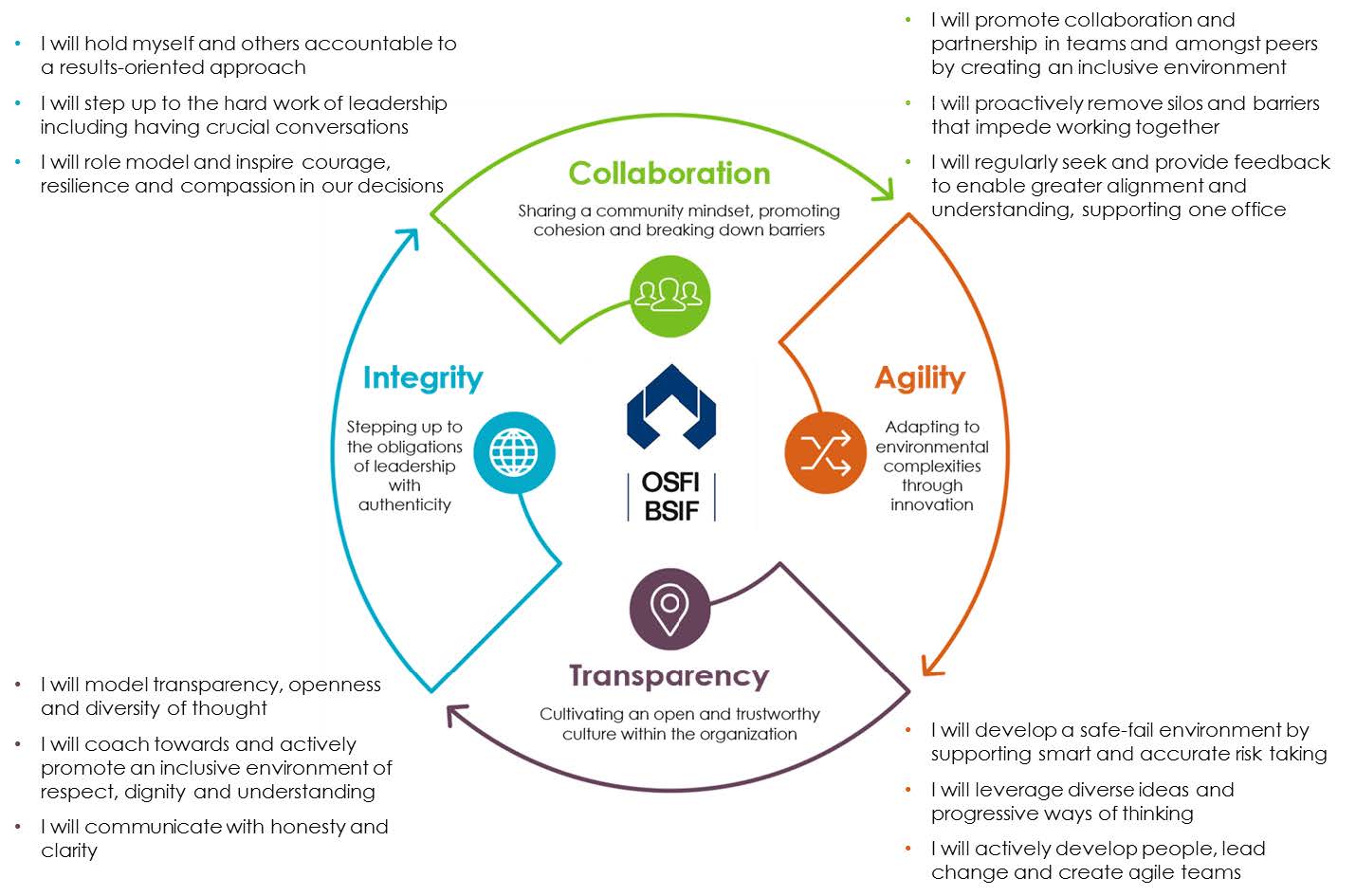

CORPORATE VALUES

how we live our values

RESPECT

We treat all people with respect by:

- Empowering diversity of thought

- Promoting inclusion and collaboration

- Behaving with authenticity and professionalism

STEWARDSHIP

We exhibit sound stewardship by:

- Acting with integrity and taking accountability

- Making decisions in an informed, transparent, balanced manner

- Upholding the credibility and reputation of OSFI

CURIOSITY

We embrace a mindset of curiosity by:

- Building knowledge through active engagement focused inquiry

- Improving continuously and innovating

- Building a safe-to-fail environment

- Challenging complacency and the status quo

Organizational Overview

An overview of the OSFI organizational structure and details of each business line, including the interaction and relationship between the business lines.

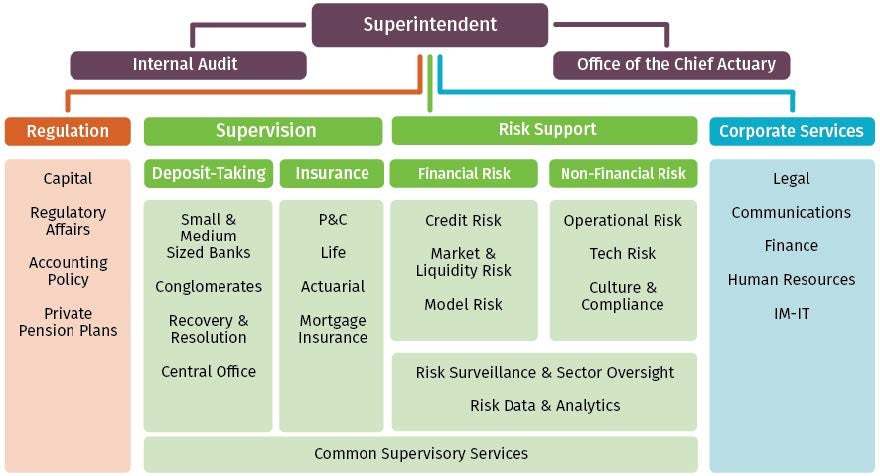

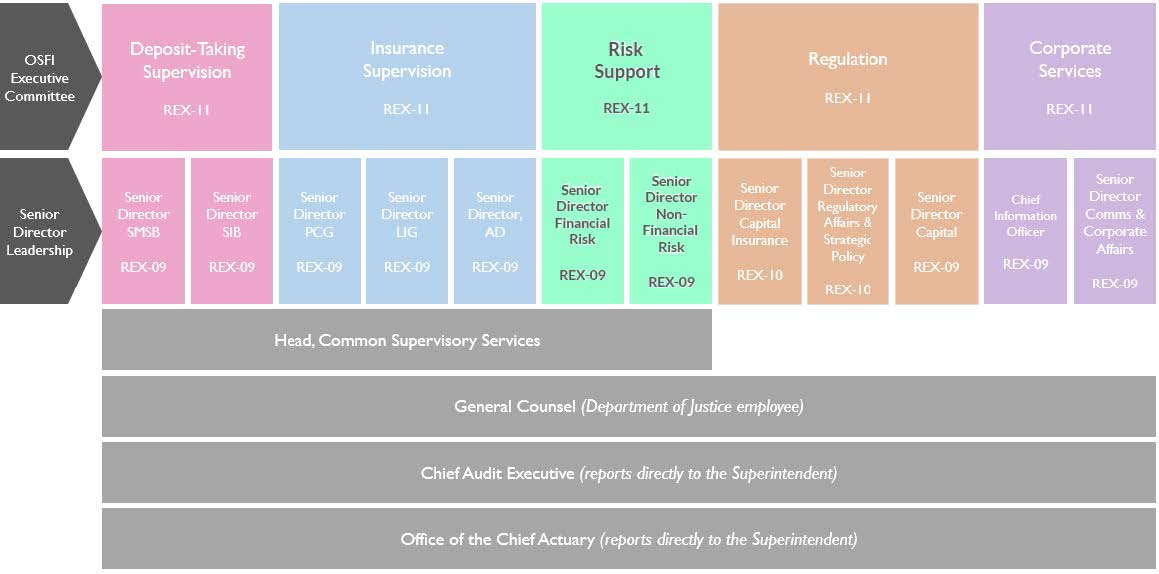

Org Structure

Text Description - Org Structure

Superintendent

- Internal Audit

- Office of the Chief Actuary

- Regulation

- Capital

- Regulatory Affairs

- Accounting Policy

- Private Pension Plans

- Supervision

- Deposit-Taking

- Small and Medium Sized Banks

- Conglomerates

- Recovery & Resolution

- Central Office

- Insurance

- P&C

- Life

- Actuarial

- Mortgage Insurance

- Risk Support

- Financial Risk

- Credit Risk

- Market & Liquidity Risk

- Model Risk

- Non-Financial Risk

- Operational Risk

- Tech Risk

- Culture & Compliance

- Risk Support Sector Oversight

- Risk and Data Analytics

- Financial Risk

- Common Supervisory Services

- Deposit-Taking

- Corporate Services

- Legal

- Communications

- Finance

- Human Resources

- IM-IT

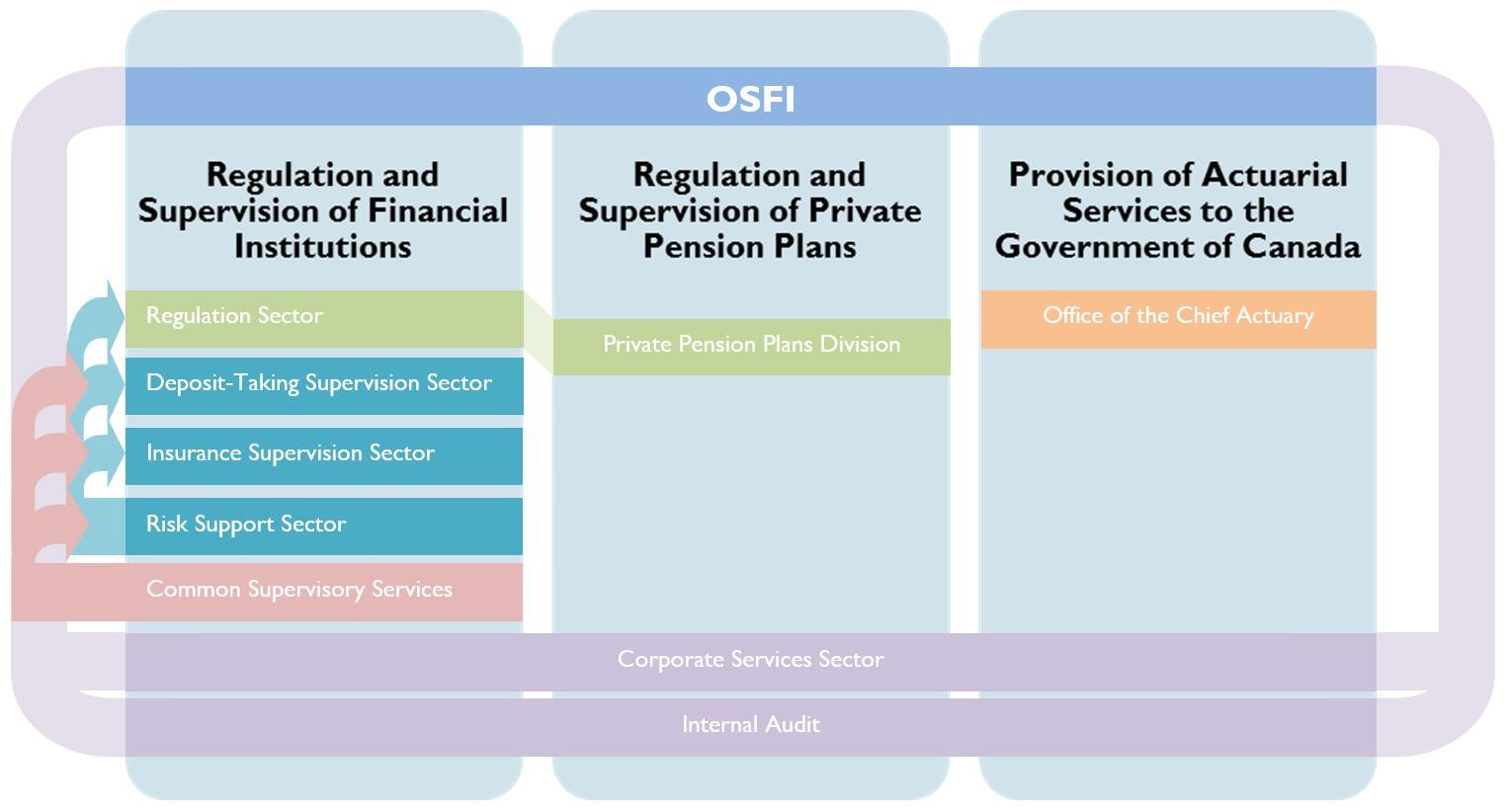

Overview

OSFI delivers on three major Business Lines in fulfilling our mandate to Canadians:

- Regulation and Supervision of Financial Institutions

- Regulation and Supervision of Private Pension Plans

- Provision of Actuarial Services to the Government of Canada

Each Business Line represents one activity that we deliver on through partnership. Every person and group has a role to play, and everyone is responsible for ensuring our success through partnership.

How we partner to deliver

As One Office, we are all partners in delivering on our Business Lines.

Text Description - Business Lines

This graphic shows the interrelationships between sectors within OSFI. Internal Audit and Corporate Services Sector interact with the entire organization. Common Supervisory Services supports Risk Support Sector, Insurance Support Sector, and Deposit-Taking Supervision Sector.

One Office

To achieve a positive, desired impact on financial institutions, pension plans and programs, all areas of OSFI must view themselves as partners whose individual contributions are continuously brought together in order to deliver on our Business Lines. When we see our own work as part of One Activity, because we partner with others outside of our immediate work area, and when we speak with One Voice to our stakeholders, because we communicate effectively with each other, we are working as One Office.

There is no single roadmap toward functioning as One Office. Each OSFI employee has something to contribute, and we need all of these contributions to bring us closer to our goal. Let us continue to build on our reputation as a world-leading prudential regulator and supervisor, and to recognize and encourage all efforts toward working as One Office.

Business Line:

Regulation and Supervision of Financial Institutions

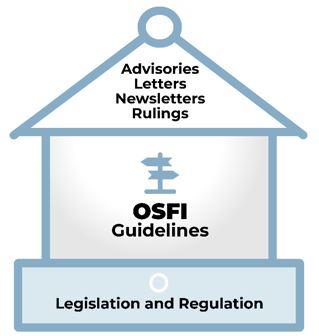

- Setting general expectations for the prudential management of FRFIs through our guidance

- Supervising individual institutions, on a risk basis, against applicable guidance, laws and regulations

- Conducting risk-based assessments and analysis of a FRFI’s activities through supervisory monitoring and reviews

- Intervening early when weaknesses are identified, working with a FRFI’s senior management and the board to take corrective actions

- Being prepared for a range of scenarios if a FRFI’s viability is in serious doubt, including taking control of the institution

Business Line:

Regulation and Supervision of Private Pension Plans

- Supervising federally-regulated private pension plans for the protection of pension plan members and other beneficiaries and promptly intervening where corrective action is necessary

- Setting general expectations through our guidance for the prudential management of private pension plans

- Administering regulatory approvals

Business Line:

Provision of Actuarial Services to the Government of Canada

- Conducting statutory actuarial valuations and providing actuarial advice on federal social insurance programs

- Conducting statutory actuarial valuations and providing actuarial advice on federal public sector insurance and pension programs, including benefits provided to veterans

OSFI-wide Support

- Providing the corporate services, tools and strategic advice required for Office-wide delivery on all Business Lines

- Providing assurance and advice that contributes to the improvement of OSFI internal controls, risk management and governance

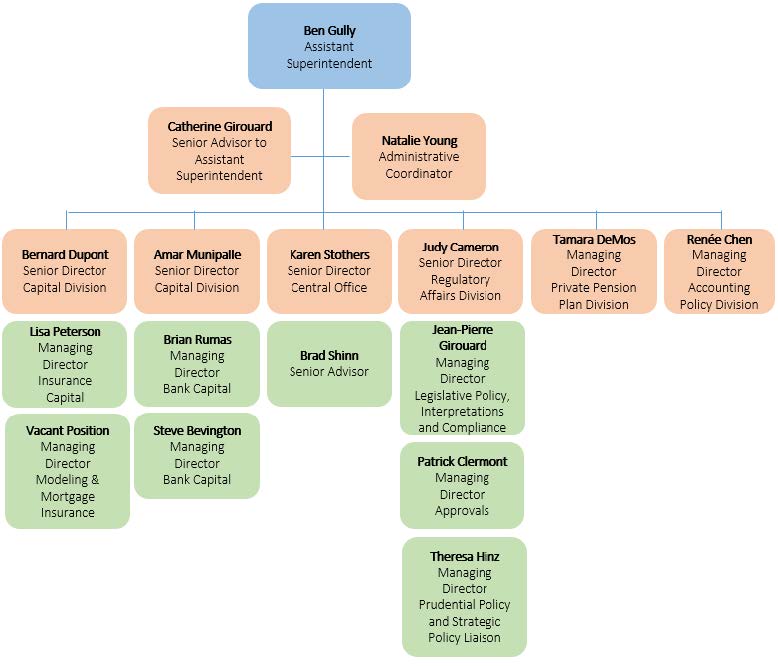

Regulation Sector

Text Description - Regulation Sector

This graphic shows the organizational structure for Regulation Sector in the following hierarchy:

Ben Gully

Assistant Superintendent

- Catherine Girouard

Senior Advisor to Assistant Superintendent - Natalie Young

Administrative Coordinator - Bernard Dupont

Senior Director

Capital Division- Lisa Peterson

Managing Director

Insurance Capital - Vacant Position

Managing Director

Modeling & Mortgage Insurance

- Lisa Peterson

- Amar Munipalle

Senior Director

Capital Division- Brian Rumas

Managing Director

Bank Capital - Steve Bevington

Managing Director

Bank Capital

- Brian Rumas

- Karen Stothers

Senior Director

Central Office- Brad Shinn

Senior Advisor

- Brad Shinn

- Judy Cameron

Senior Director

Regulatory Affairs Division- Jean-Pierre Girouard

Managing Director

Legislative Policy, Interpretations and Compliance - Patrick Clermont

Managing Director

Approvals - Theresa Hinz

Managing Director

Prudential Policy and Strategic Policy Liaison

- Jean-Pierre Girouard

- Tamara DeMos

Managing Director

Private Pension Plan Division - Renée Chen

Managing Director

Accounting Policy Division

Organizational Structure & Operations

Regulation Sector's work falls into two categories:

-

Regulation of FRFIs

The Regulation of Federally Regulated Financial Institutions (FRFIs) involves advancing a regulatory framework of guidance and rules that promotes the adoption by FRFIs of sound risk management practices, policies and procedures designed to plan, direct and control the impact on the institution of risks arising from its operations.

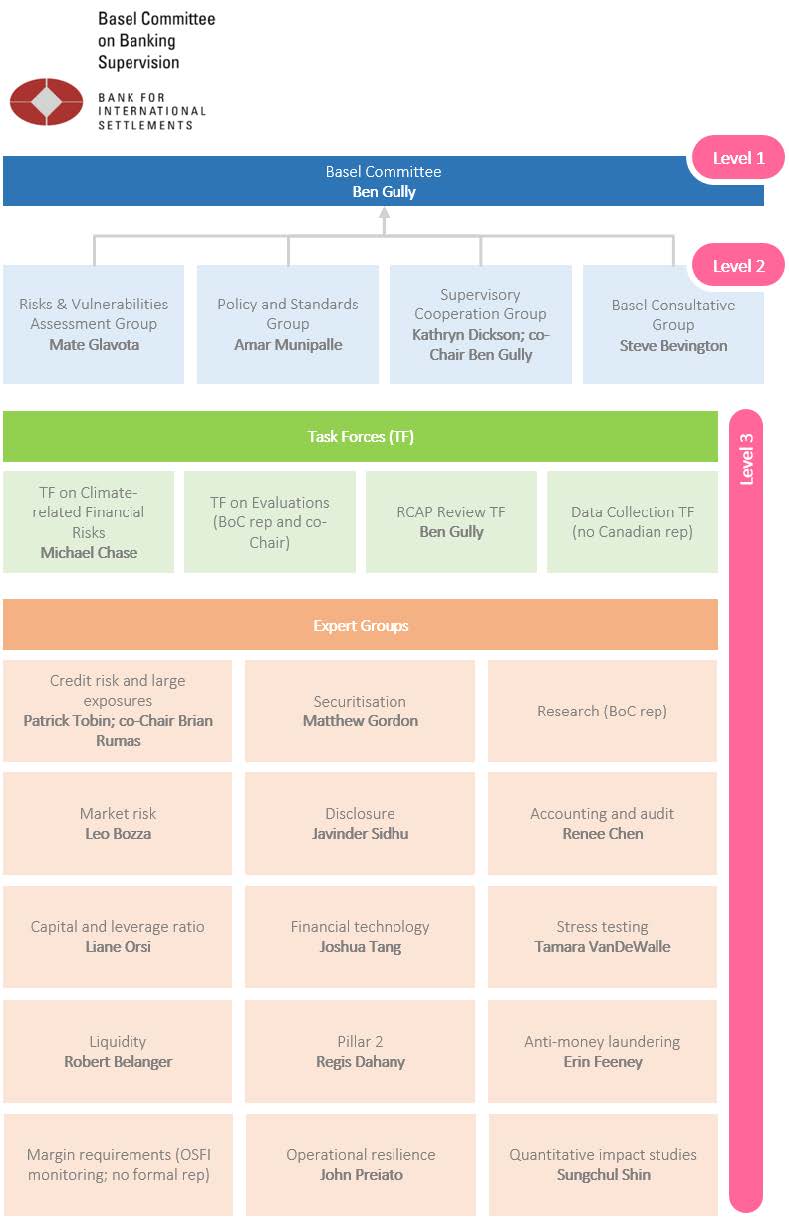

- Leading the development of the domestic framework for prudential regulation of FRFIs, including through participation on international standard-setting bodies (e.g. Basel Committee on Banking Supervision (BCBS), International Association of Insurance Supervisors (IAIS))

- Coordination of third-party reviews such as the International Monetary Fund Financial Sector Assessment Program (FSAP) and BCBS Regulatory Consistency Assessment Programme (RCAP)

- Strategically managing OSFI’s relationships with a range of domestic (i.e. provincial, federal) and international financial sector regulatory and government entities

- Administering an effective regulatory approvals and new entrant process, and making sound recommendations to the Superintendent and Minister

- Leading OSFI’s contributions toward the development of federal financial sector and pension policy, legislation, and regulations

- Supporting crisis management activities through provision of strategic advice, including options for transactions requiring statutory approval, letters for taking control, and communication with other Financial Institutions Supervisory Committee (FISC) partners

- Contributing toward the training of staff on the application of regulatory guidance and rules

-

Regulation and Supervision of PPPs

The Regulation and Supervision of Federally Regulated Private Pension Plans (PPPs) involves conducting risk assessments of pension plans and advancing a regulatory framework of guidance and rules that promotes the adoption of sound risk management practices, policies and procedures.

- Supervising PPPs and promptly intervening where corrective action is necessary

- Setting general expectations through guidance for the prudential management of PPPs and providing expert advice in changes to the pension regulatory framework

- Administering regulatory approvals and ensuring appropriate minimum funding requirements are met through actuarial reviews of valuation reports

Mandate and Overview of the Divisions within the Regulation Sector

Accounting Policy Division

Accounting Policy Division (APD) delivers a wide range of expert accounting, auditing and public disclosure advice within OSFI. It is also involved in the transfer of accounting knowledge to the office and contributes to the accounting and assurance standard-setting environment, both international and domestic, where there is a potential impact on OSFI’s strategic objectives.

Capital Division

Capital Division, which consists of a Banking Capital group and an Insurance Capital group, is responsible for developing, maintaining and interpreting prudential capital rules, guidelines and advisories for FRFIs, including deposit-taking institutions, life, property and casualty, and mortgage insurers.

Private Pension Plans Division

Private Pension Plans Division (PPPD) supervises federally regulated PPPs and protects pension plan members and other beneficiaries by developing guidance on risk management and mitigation, assessing whether private pension plans are meeting their funding requirements and managing risks effectively. PPPD intervenes promptly when corrective actions need to be taken.

Regulatory Affairs Division

Regulatory Affairs Division (RAD) is a team of technical and policy experts that is responsible for:

- Developing and implementing prudential and legislative guidance

- Interpreting and applying the federal financial institutions statutes primarily in relation to approvals, compliance and OSFI’s formal intervention tools

- Managing OSFI’s strategic relations with key domestic and international agencies

Central Office

Central Office contributes to the efficient and effective operation of Regulation Sector through the provision of continuous support in the areas of governance, planning, finance and people management. By enhancing the operating effectiveness of key sector processes, reporting, and planning, this allows the rest of Regulation Sector to be focused on their core work to meet OSFI’s mandate.

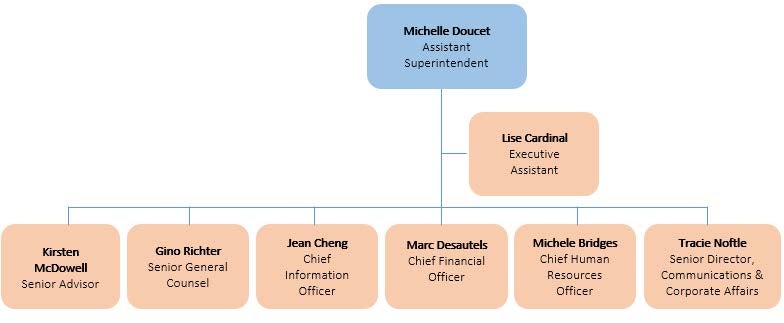

Corporate Services

Organizational Structure and Operations

Text Description - Organizational Structure and Operations

This graphic shows the organizational structure for Corporate Services Sector in the following hierarchy:

Michelle Doucet

Assistant Superintendent

- Lise Cardinal

Executive Assistant - Kirsten McDowell

Senior Advisor - Gino Richter

Senior General Counsel - Jean Cheng

Chief Information Officer - Marc Desautels

Chief Financial Officer - Michele Bridges

Chief Human Resources Officer - Tracie Noftle

Senior Director, Communications & Corporate Affairs

Background

Corporate Services Sector provides full service operational support for the Superintendent, the supervision and regulation and Office of the Chief Actuary including human resources, finance and procurement, facilities, security, corporate planning and reporting, communications and engagement, information management, information technology, and legal services.

- Reviews and enhances the suite of corporate services proactively and continually in response to shifts in strategic priorities and changing organizational needs.

- Provides assurance and advice that contributes to the improvement of internal controls, risk management and governance.

Corporate Services partners with all sectors as well as Common Supervisory Services and the Office of the Chief Actuary (OCA) in the design, implementation and evaluation of various enterprise-wide initiatives.

The dedicated divisions listed below work closely with their peers and clients to set and meet high standards for OSFI to manage its own resources, and to effectively deliver on its mandate.

Communications and Corporate Affairs

Communications and Corporate Affairs is comprised of Communications and Engagement (CE), the Strategic Governance Office, ATI and Privacy, Security and Facilities Services (SFS). The CE division provides comprehensive strategic communications support, services and advice. The SFS is responsible for physical security, business continuity planning and all facilities projects, in addition to providing administrative services. The SFS team is located in both Ottawa and Toronto. The Strategic Governance Office provides secretariat support to OSFI senior governance committees and houses the Access to Information and Privacy teams.

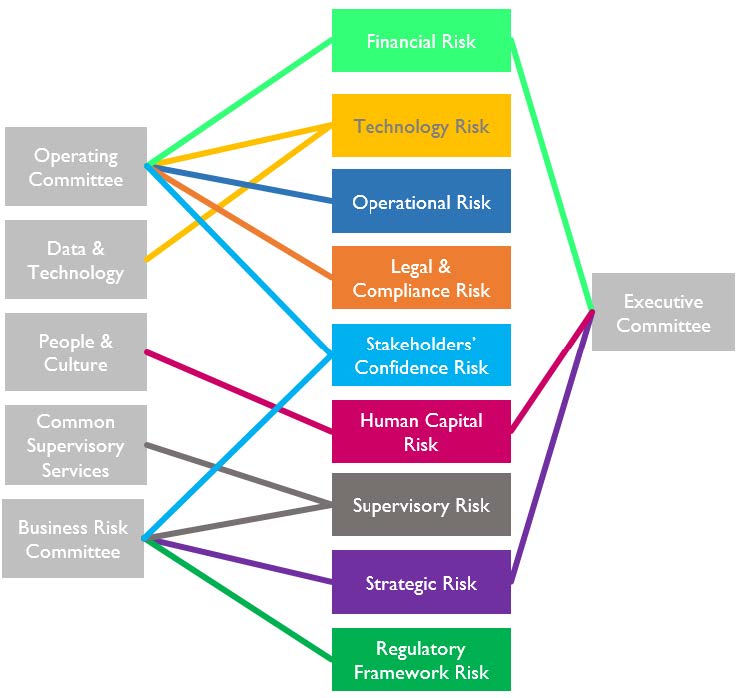

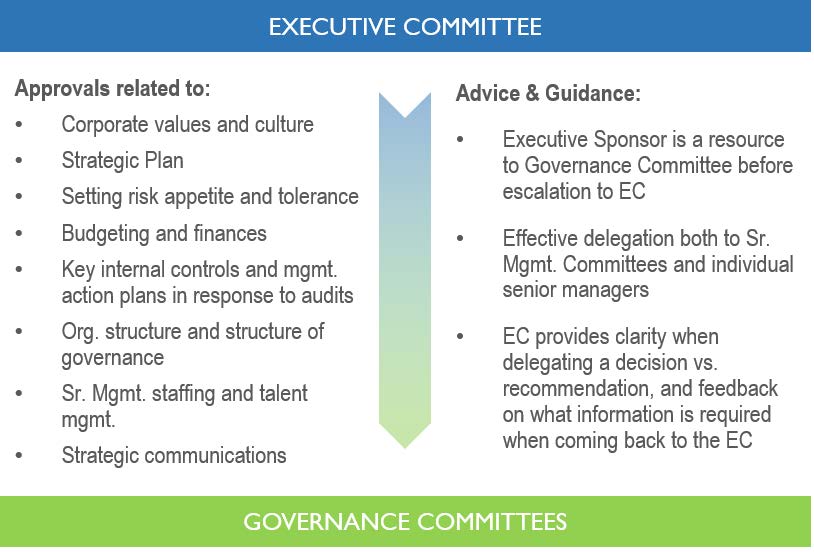

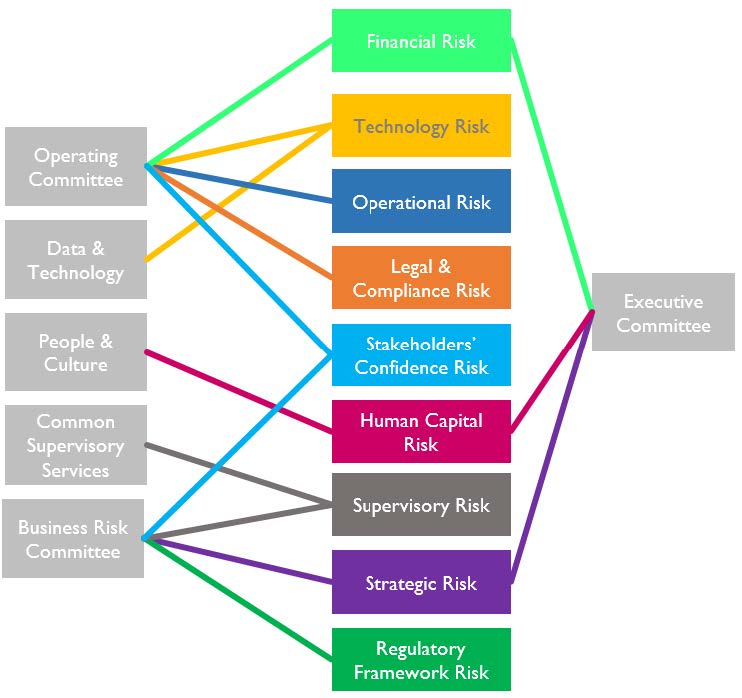

Finance & Corporate Planning

Finance and Corporate Planning (F&CP) provides high quality, cost effective, and responsive financial services, procurement services, corporate planning, enterprise risk management and enterprise change management solutions to OSFI management and employees. F&CP allows the Executive Committee and sector management teams to maximize the best use of OSFI’s resources by allocating them commensurate with the risks we see while respecting our overall budgetary limits.

Human Resources

Human Resources provides a full range of services including recruitment, compensation, classification, HR Programs (eg talent Management, leadership development, awards & recognition, official languages), DEI programs, learning and professional development, collective bargaining, labor relations, workplace violence prevention and support to manage performance and disability cases. Because OSFI is a separate employer, the HR team helps balance the needs of the organization for flexibility while respecting applicable government policies and legislation. The HR team is located in both Ottawa and Toronto.

Information Management & Information Technology (IM/IT)

Information Management and Information Technology has six divisions.

- IM/IT Strategic Management is responsible for the development and execution of the IM/IT plans, processes, governance and projects that enable IM/IT to provide well-coordinated and flexible IM/IT systems.

- Infrastructure and Technology Services is responsible for the oversight, maintenance, lifecycle management and projects required to support the computer operations and network infrastructure, in order to provide OSFI with an up-to-date reliable and secure computing environment.

- Application Services is responsible for configuring, maintaining and enhancing software to support business operations.

- Enterprise Information Management specializes in the organizations information and are responsible for building the framework around the collection, use, retention and disposition of our information.

- Client Relationship Management is responsible for facilitating and effective relationship between OSFI work teams and IM/IT, providing a clear understanding of business priorities and better awareness of how technology can support OSFI.

- Cybersecurity is responsible for ensuring OSFI’s cyber security risks are understood and the appropriate controls have been identified and implemented to keep OSFI’s information and systems secure.

Risk Support Sector

Organizational Structure and Operations

Background

The Risk Support Sector was restructured in 2017 to support Supervision and Regulation sectors. This presented an opportunity to evolve risk support at OSFI. The RSS Reset initiative was created to address the developments in the external risk environment such as non-financial risks as well as strengthening its core operations.

Organization Structure

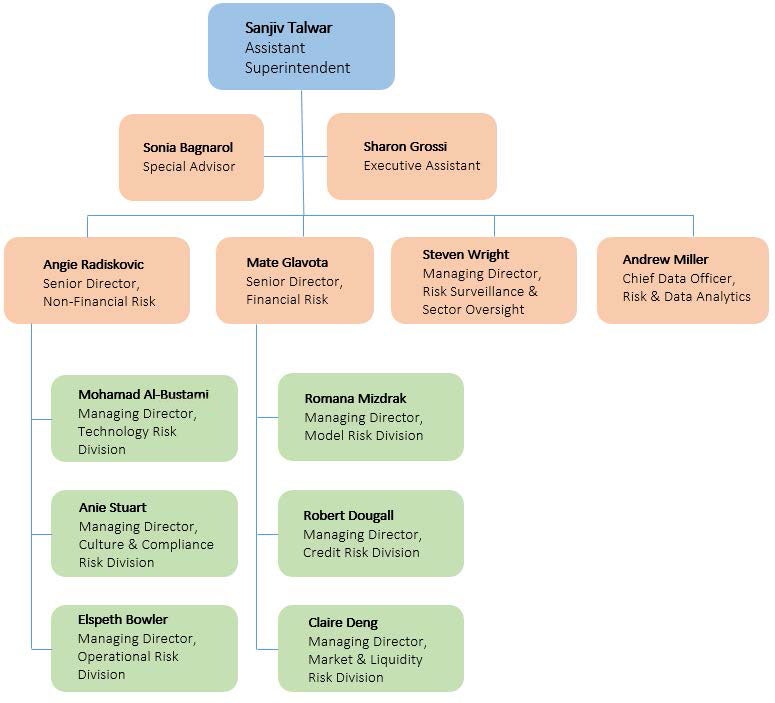

RSS Organization Structure – Sanjiv Talwar, Assistant Superintendent and his Leadership Team:

Text Description - RSS Organization Structure

This graphic shows the organizational structure for RSS in the following hierarchy:

Sanjiv Talwar

Assistant Superintendent

- Sonia Bagnarol

Special Advisor - Sharon Grossi

Executive Assistant - Angie Radiskovic

Senior Director, Non-Financial Risk- Mohamad Al-Bustami

Managing Director,

Technology Risk Division - Anie Stuart

Managing Director,

Culture & Compliance Risk Division - Elspeth Bowler

Managing Director,

Operational Risk Division

- Mohamad Al-Bustami

- Mate Glavota

Senior Director, Financial Risk- Romana Mizdrak

Managing Director,

Model Risk Division - Robert Dougall

Managing Director,

Credit Risk Division - Claire Deng

Managing Director,

Market & Liquidity Risk Division

- Romana Mizdrak

- Steven Wright

Managing Director,

Risk Surveillance & Sector Oversight - Andrew Miller

Chief Data Officer,

Risk & Data Analytics

Vision

An essential partner that strengthens the regulation and supervision of FIs through progressive and practical risk advisory services.

Mandate

We commit to deliver tailored and horizontal risk analysis, and value-added quality data and advisory services.

Mission

Approach

- We combine established methodologies with innovation, agility, objectivity, and excellence.

Relationships

- We foster collaborative relationships with stakeholder and offer integrated support to partners

People

- We cultivate an inclusive and diverse culture, and continuously develop expertise and leadership competencies

Mandate and Overview of the Divisions within the Risk Support Sector

Financial Risk Group

Provides specialty financial risk expertise to support partners and stakeholders in identifying FRFI-specific and system-wide risks, and assessing financial resilience. Financial risk expertise includes credit, model, and market and liquidity risks. Services include surveillance, risk assessment, benchmarking, communication of expectations and corresponding follow-up on areas of deficiency. Divisions integrate their work efforts across financial and non-financial risk to support supervision and regulation sectors

Credit Risk Division (CRD)

Provides specialty credit risk expertise in identifying FRFI-specific risks, industry-wide risks and/or sector specific trends and developments related to credit risk that may impact a FRFI’s financial resilience. CRD expertise includes both retail and wholesale credit risks inherent in loans, investments and other financial instruments, impacting DTIs, insurers and pension plans.

Market & Liquidity Risk Division (MLRD)

Provides specialty market and liquidity risk expertise in identifying FRFI-specific risks, industry-wide risks and/or sector specific trends and developments related to market and liquidity risks that may impact a FRFI’s financial resilience. MLRD expertise includes market and counterparty risks, treasury and investment risks, and liquidity risks impacting DTIs, insurers and pension plans.

Model Risk Division (MRD)

Provides specialty model risk and capital model assessment expertise in identifying FRFI-specific risks, industry-wide risks and/or sector specific trends and developments related to the use of models (including internal capital models) that may impact a FRFI’s financial and operational resilience. MRD’s expertise includes the application and assessment of quantitative methods and advanced analytics, including Artificial Intelligence and Machine Learning, to financial and non-financial risks affecting FRFIs DTIs, insurers and pension plans, and the governance and oversight of regulatory capital models for DTSS.

Financial Risk Analytics (FRA)

In order to advance FRG’s capacity and capability to supervise our FRFIs and FRPPs, FRA will provide data and analytics support to FRG, in close cooperation with RDA. The team will work collaboratively with other internal stakeholders, consulting frequently to ensure we are delivering analytic tools and specific analysis that meets client needs across OSFI. The team will contribute to aligning FRG with OSFI’s enterprise data strategy and towards the goal of enhancing data literacy and skillsets across our organization. FRA will also engage closely with other similar groups across OSFI to build a data and analytics community of innovation that is both agile and transparent.

Non-Financial Risk Group

Provides specialty non-financial risk expertise to support partners and stakeholders in identifying FRFI-specific and system-wide risks, and assessing operational resilience. Non-Financial risk expertise includes current and emerging operational risks. Services include surveillance, risk assessment, benchmarking, communication of expectations and corresponding follow-up on areas of deficiency. Divisions integrate their work efforts across financial and non-financial risk to support supervision and regulation sectors

Operational Risk Division (ORD)

Provides overarching operational risk management program expertise supporting the assessment of overall operational resilience, identifying FRFI-specific and industry-wide risks. ORD expertise includes assessment of governance and oversight of process and events impacting DTIs, insurers and pension plans.

Culture & Conduct Risk Division (CCRD)

Provides specialty culture and compliance risk expertise in identifying FRFI-specific risks, industry-wide risks and/or sector specific trends and developments related to culture and compliance risks that may impact a FRFI’s financial resilience. CCRD expertise includes culture, people and compliance impacting DTIs, insurers and pension plans.

Technology Risk Division (TRD)

Provides specialty technology and cyber risk expertise in identifying FRFI-specific risks, industry-wide risks and/or sector specific trends and developments related to technology and cyber risks that may impact a FRFI’s operational resilience. TRD expertise includes technology crisis reporting, cyber incident response and in-depth understanding and assessments of threats to any process or function that involves systems, data, infrastructure, networks, cyber security and digital technology impacting DTIs, insurers and pension plans.

Risk Surveillance & Sector Oversight (RSSO)

RSSO provides specialty risk expertise to support partners and stakeholders in identifying FRFI-specific and system-wide risks, and assessing organizational resilience. Risk expertise includes market surveillance, risk identification, risk analysis and risk measurement of new and/or interconnected multifactor risks and risk drivers. In addition, RSSO provides expertise and support in the establishment and maintenance of comprehensive governance and controls in the oversight of RSS activities, to align ensure alignment of work with strategic plans.

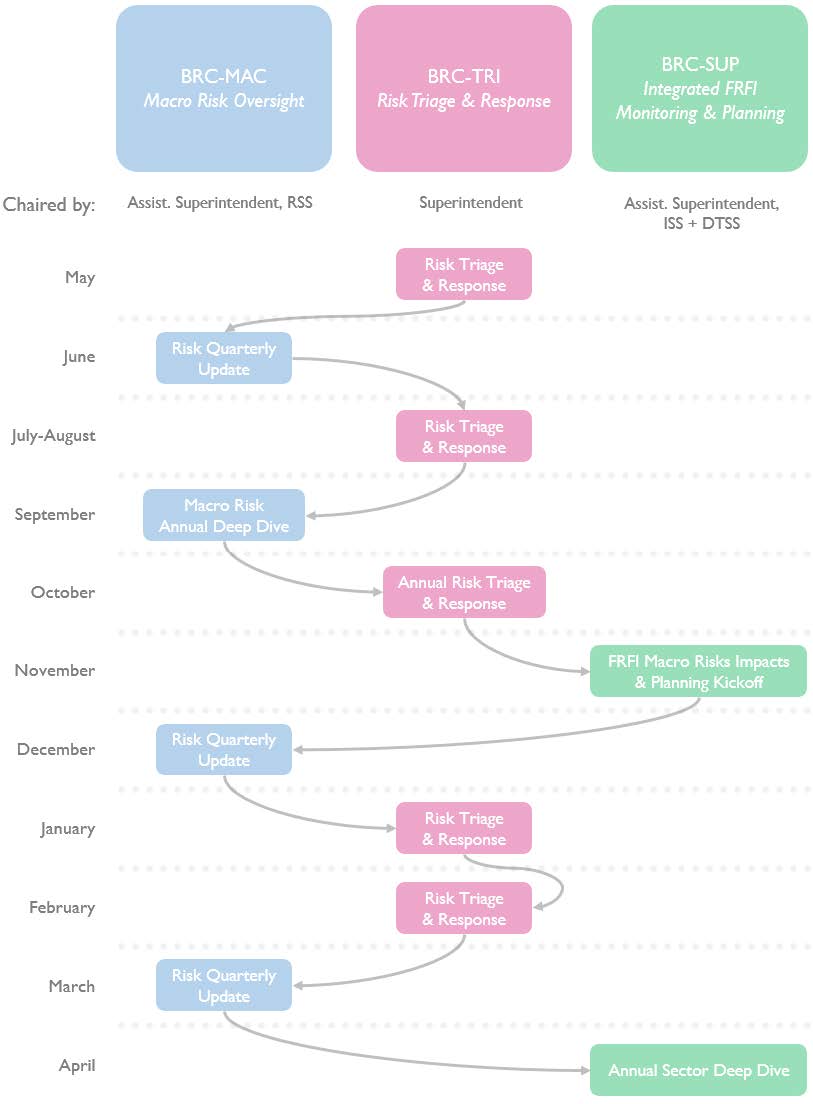

- Key initiatives: Integrated Risk Identification and Surveillance (IRIS) was created to coordinate surveillance efforts across all sectors via the Business Risk Committee (BRC) – Macro

Risk and Analytics Division (RDA)

RDA provides specialty data management and analytics expertise to all sectors at OSFI. RDA expertise includes oversight of data collection systems (both structured and unstructured), data quality processes, data workflow automation, BI reporting and the increasing use of advanced analytics. By executing on OSFI’s Enterprise Data Strategy, RDA aims to increase the efficiency and effectiveness of OSFI’s regulatory mandate by transforming data into analytical insights using modern tools and skillsets.

- Key initiatives: OSFI’s enterprise Data Strategy and Implementation Plan

Deposit-Taking Supervision Sector

Overview

Deposit-Taking Supervision Sector (DTSS) has the following responsibilities:

- Developing risk assessments, recommendations and intervention actions for federally regulated deposit-taking institutions (DTIs) through reviews and on-going monitoring.

- Advancing follow-up work to ensure that supervisory and intervention decisions are having the desired effect on Federally Regulated Financial Institutions (FRFI) behavior.

- Developing and coordinating crisis management & recovery planning and stress testing activities

- Determining and communicating the level of the Domestic Stability Buffer (DSB).

Vision

Continue to enhance the supervision of federally regulated deposit-taking institutions by:

- Improving risk assessments, recommendations, intervention decisions and follow-up work to ensure that supervisory and intervention decisions are having the desired effect on DTI behavior

- Improving the proportionality of supervision to reflect the different levels of risk, size and complexity of DTIs in line with the DTSS Risk Tolerance Framework (RTF)

- Focusing on risk by incorporating emerging risks and forward-looking analysis through stress testing (including MST (Macro Stress Test) and RSAT (Risk Scenario Analysis Tool)) in all aspects of supervisory processes (i.e. monitoring, reviews, ad-hoc, etc.)

- Coordinating the assessment of risks and vulnerabilities pertaining to decisions around the level of the DSB

- Advancing the development and coordination of crisis management and planning activities for DTIs and OSFI

- Modernizing and adapting supervisory processes to prepare for new developments such as continued digitization of the financial sector and fintech

- Incorporating elements of Corporate Governance assessments into supervisory work using the outcomes based approach

- Enabling greater focus on risk by improving supervisory processes, tools, data analysis and technology

- Advancing career development plans, training, and rotations

Org Structure

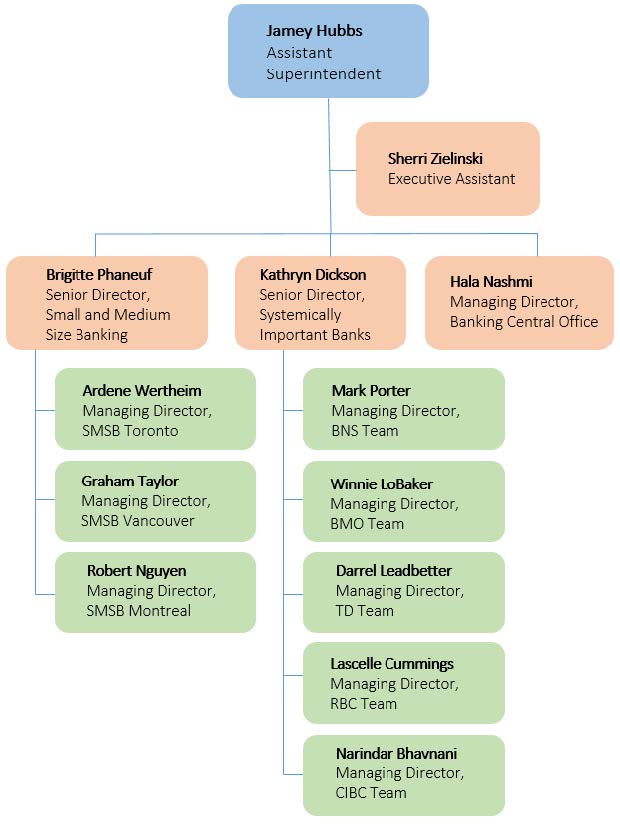

Text Description - DTSS Organizational Structure

This graphic shows the organizational structure for DTSS in the following hierarchy:

Jamey Hubbs

Assistant Superintendent

- Sherri Zielinski

Executive Assistant - Brigitte Phaneuf

Senior Director,

Small and Medium Size Banking- Ardene Wertheim

Managing Director,

SMSB Toronto - Graham Taylor

Managing Director,

SMSB Vancouver - Robert Nguyen

Managing Director,

SMSB Montreal

- Ardene Wertheim

- Kathryn Dickson

Senior Director,

Systemically Important Banks- Mark Porter

Managing Director,

BNS Team - Winnie LoBaker

Managing Director,

BMO Team - Darrel Leadbetter

Managing Director,

TD Team - Lascelle Cummings

Managing Director,

RBC Team - Narindar Bhavnani

Managing Director,

CIBC Team

- Mark Porter

- Hala Nashmi

Managing Director,

Banking Central Office

| DTSS FTEs | Number of FIs |

|---|---|

|

|

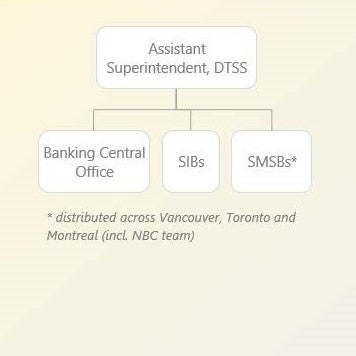

Text Description - Assistant Superintendent, DTSS

Assistant Superintendent, DTSS

- Banking Central Office

- SIBs

- SMSBs*

*distributed across Vancouver, Toronto and Montreal (incl. NBC team)

- There are three key areas under the Assistant Superintendent – DTSS: Small and Medium Size Banking Group (SMSB), Systemically Important Banking Group (SIBs) and Banking Central Office (BCO)

- SMSB Group has supervisory teams located in Toronto, Montreal (includes the NBC team) and Vancouver. The SIBs Group consists of the following supervisory teams - BMO, BNS, CIBC, RBC and TD

Banking Central Office (BCO) provides support to DTSS in areas such as annual sector-wide planning, Macro Stress Testing, Domestic Stability Buffer, Risk Appetite Framework, Recovery and Resolution Planning, managing the panel process and DTSS reporting

Sector Plan and Initiatives

A key project for DTSS is the Crisis Preparedness (CP) for deposit taking institutions (DTIs). The objective of this project is to improve our readiness in response to a DTI crisis by developing a framework and supporting capabilities. The project deliverable timelines were extended to shift resources and attention to the Crisis Management Working Group in 2020 due to the impact of COVID. CP Working Group meetings and work to complete outstanding project deliverables have resumed in 2021 (including planned training rollout).

Other key DTSS initiatives include:

- Stress-testing work for SMSB and Macro Stress Test for DSIBs

- Domestic Stability Buffer

- Support the development of Capital and Liquidity guidance for SMSB and SIBs, and implementation of OSFI’s Data Strategy

- Develop guidance on recovery planning for SMSB

Industry Landscape and FRFI Risks

[Information was severed in accordance with the Access to Information Act]

On a quarterly basis, Supervisory and RSS teams provide an update on the current assessment of risks for the industry, specific institutions and problem institutions.

Insurance Supervision Sector

Organizational Structure & Operations

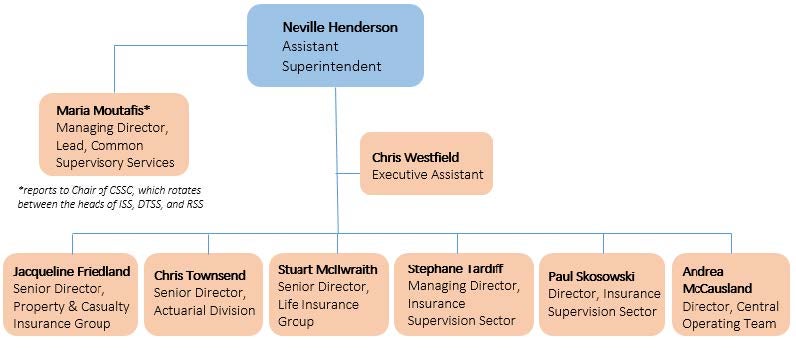

Text Description - ISS Organizational Structure

This graphic shows the organizational structure for ISS in the following hierarchy:

Neville Henderson

Assistant Superintendent

- Chris Westfield

Executive Assistant - Maria Moutafis*

Managing Director

Lead, Common Supervisory Services

* reports to Chair of CSSC, which rotates between the heads of ISS, DTSS, and RSS - Jacqueline Friedland

Senior Director,

Property & Casualty Insurance Group - Chris Townsend

Senior Director,

Actuarial Division - Stuart McIlwraith

Senior Director,

Life Insurance Group - Stephane Tardiff

Managing Director,

Insurance Supervision Sector - Paul Skosowski

Director,

Supervision Sector - Andrea McCausland

Director,

Central Operating Team

Insurance Supervision Sector (ISS) supervises federally regulated:

- Life insurance companies (including branches, foreign subsidiaries, fraternal and mutual companies) and their subsidiaries

- Property and casualty insurance companies (including branches, foreign subsidiaries, and mutual companies) and their subsidiaries

- Mortgage insurance companies

Property & Casualty Group (PCG)

PCG’s primary focus is on the OSFI mandate of “Protection of Policyholders". This means they assess the ability of property and casualty (P&C) institutions to pay claims (safety, soundness & solvency).

PCG supervise by conducting a risk assessment of significant activities by assessing the level of inherent risk and related mitigation via onsite visits to the institution and monitoring of financial performance of the institution. They also aim to provide early and appropriate intervention to address any areas of significant risk to the institution.

Mortgage Insurance Group (MIG)

MIG contribute to the overall safety and soundness of the Canadian financial system, through the oversight of one of the key elements underpinning housing finance in Canada. MIG is responsible for supervision of the Canadian mortgage insurance industry (which currently comprises a large Crown corporation, two significant private sector insurers, and a dormant company.

In addition to supervisory work, the MIG are also regularly involved in policy-related issues dealing with risk exposure and risk management in mortgage lending and mortgage insurance, working with colleagues in OSFI’s Regulation Sector and Risk Support Sector as well as the Department of Finance and Bank of Canada.

Beyond the focus on mortgage insurance, the MIG are also responsible for supervision of the title insurers operating in Canada. Title insurance is a specialized form of coverage that provides protection to homeowners, to cover the risk of financial loss arising from defects in their title to real property.

Mortgage Insurance Group (MIG)

The Life Insurance Group (LIG) contributes to the overall safety and soundness of Federal Regulated Financial Institutions (FRFIs) through performance of supervisory activities in accordance with the Supervisory Framework.

LIG is made up of two groups:

-

Life Insurance Group - Conglomerates (LIG-C)

The Conglomerate Teams contributes to the overall safety and soundness of the three largest life insurers in Canada (Manulife, SunLife and Canada Life) through risk-based supervisory activities. They maintain accurate risk profiles; assess ratings; build relationships with senior management and Boards; develop knowledge of the institutions and determine compliance with legislation. -

Life Insurance Group - Non Conglomerates (LIG-NC)

The focus of their work is risk based. This includes analysis of institutions through monitoring and onsite reviews and conducting industry analysis. Work done includes maintaining accurate risk profiles, assessing ratings, maintaining relationship with senior management of FRFIs, developing knowledge of institutions and determining compliance with legislation.

Actuarial Division (AD)

The Actuarial Division (AD) works jointly with all parts of ISS and the Regulations Sector to contribute to OSFI’s mandate of protecting policyholders and creditors of insurance companies from undue loss. The Actuarial Division, ensures appropriate actuarial knowledge, advice and standards are applied to OSFI's regulatory and supervisory functions.

The AD is responsible for managing the division’s relationship with other internal and external stakeholders with respect to OSFI’s domestic insurance strategic analysis and policy development for evolving issues related to insurance products, adequacy of risk provisioning in liabilities and capital, actuarial standards, risk-sensitive modeling techniques, and insurance supervision

Central Operations Team (COT)

The Central Operations Team (COT) in the Insurance Supervision Sector (ISS) acts as the ISS key point of contact for OSFI-wide strategic priorities and manages ISS operational activities, to enable Supervisors to better focus on core supervisory work. The COT provides support to ISS by managing and/or contributing to activities that improve on operational effectiveness for ISS. They are responsible for coordinating the ISS Strategic Plan, Budgets and HR Administration, engagement, change management, annual supervisory planning and ISS-wide performance reporting and communication.

Common Supervisory Services

Overview

OSFI’s Executive Committee (EC) established CSS in January 2016 as part of broader changes to the organizational changes. While the supervisory units have distinct responsibilities, they all need some similar services. As a result, CSS was to provide the following:

- Supervisory technology and tools: To include experienced supervisors who at the time were to support and launch the implementation of the Supervision Tools and Technology Review (STTR) initiative (which became Project Vu).

- Supervisory training: To include experienced supervisors who will work full time on training. While there was a Supervisory Training Initiative, full-time support for supervisory training was a new function.

- Supervisory methods: To include the development of the supervisory framework and support for its implementation. At inception, this included the activities of the former Practices Division but was expected to evolve.

- Supervisory consistency: To include the development and implementation of an oversight process to verify that similar institutions in similar circumstances receive comparable risk ratings and interventions. This was to be a new function.

The first Head of CSS was appointed in October 2016 at the Senior Director level, with an initial focus on establishing the rotational program and staffing levels. The delivery of CSS services commenced in the summer of 2017. The current Head of CSS was appointed on December 1, 2020 at the Managing Director level.

Guiding Principles

The EC memo established the following guiding principles:

- CSS should be active only in areas where it is more efficient to provide services from a common group rather than within each individual supervisory unit.

- CSS should be active only in areas that require supervisory experience and judgment.

- CSS should normally be staffed by experienced supervisors on assignment from one of the supervisory units for a fixed term of two to four years.

- CSS activities should be complementary to, but not overlapping with, those of other units. In particular: HR, IT and related functions belong in Corporate Services, processes for assessing and improving the quality of risk assessments and intervention decisions belong in the supervisory units themselves, and assurance activities (including what has been referred to as “Quality Assurance” in the supervisory units) belong in Internal Audit.

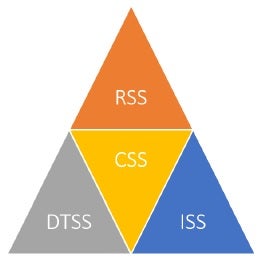

Text Description - CSS, DTSS, ISS, and RSS

This graphic highlights the importance of how CSS’s work impacts DTSS, ISS, and RSS. It shows a central triangle represented as CSS surrounded by three triangles represented by DTSS, ISS, and RSS.

Vision, Mission, and Mandate

Vision

Enhance the effectiveness and everyday life of supervisors in carrying out their risk assessment and supervisory activities.

Mission

Maintain the relevance, strength and appropriateness of OSFI’s supervisory methodology and provide a solid foundation of support to supervisors in the goal of ensuring a consistent interpretation and application of the Supervisory Framework with robust training and technology tools.

Mandate

-

Fostering sound risk management and governance practices

CSS, as the custodian of OSFI’s Supervisory Framework, advances and maintains a Supervisory Framework to support institutional risk assessments through ongoing monitoring, consideration and adopting as appropriate the theoretical foundations and best practice approaches of supervisory systems.

-

Supervision and early intervention

CSS supports the supervision of Federally Regulated Financial Institutions (FRFI’s) by providing support to supervisory risk assessments and actions through technology tools and training in the consideration of the Supervisory Framework implementation of new OSFI guidelines or risks in the environment.

-

Environmental scanning linked to safety and soundness of FRFIs

The CSS monitors rating distributions, trends and supervisory recommendations in order to facilitate a consistent application of the Supervisory Framework by providing supervisors and management with an independent source of benchmarking analytics to support their supervisory activities.

-

Taking a balanced approach

The CSS seeks to balance the application of theoretical and principles based foundations in the Supervisory Framework with a pragmatic, consistent and readily applied operationalization that inappropriately scalable for the size, nature and complexity of FRFI’s.

A review of the CSS Mandate and the responsibilities of each of the four CSS Teams will be completed by the current Head of CSS.

CSS Governance

As established by the EC, the governance of CSS is somewhat unique and complicated. Some of the features include:

- CSS will be led by a single REX manager (initially at the Senior Director level; currently at the Managing Director level).

- CSS will be governed by the heads of the supervisory units, acting as a group to be called the CSS Committee (CSSC). The CSSC will be responsible for determining the Terms of Reference for the committee and its chair, the job description of the head of CSS and for staffing that position. Among the committee’s most important responsibilities will be to determine the number of positions in CSS, which will be drawn from the combined resources of the supervisory units. It will also manage the rotation of supervisory staff into and out of CSS.

- The chair of the CSSC will rotate among the heads of DTSS, ISS and SSG. This rotation will spread the time commitment needed to oversee CSS among three people and reinforce that CSS does not “belong” to any single supervisory unit.

- The head of CSS will report directly to the chair of the CSSC who will provide direction, oversight and evaluation on behalf of the committee.

Effective April 2021, CSS will be rotating to report to the Assistant Superintendent, ISS.

Staffing Model

Similar to the governance model, the CSS staffing model is somewhat complicated and unique within OSFI.

- When created, the then members of Practices Division and those employees who were working full time on STTR were transferred into CSS.

- The original vision for the staffing plan per the EC memo stated that most, if not all, of the positions in CSS will be limited term assignments filled by indeterminate staff who already have permanent positions in one of the supervisory units. Over time, it was anticipated that many successful supervisors would have had a “tour of duty” in CSS as part of their career path. To ensure continuity and knowledge transfer in the functions provided by CSS, the term assignment staffing model was to be phased in over time.

This “rotational model” includes support for staff reintegration into their “home” sector, and the expectation has been that each member of CSS also participate in supervisory work annually. The “rotational model” has presented a number of challenges both from a recruitment perspective and in managing the CSS workplan. The model will be reviewed by the current Head of CSS.

As at March 31, 2021, approximately 54% of the CSS positions are “rotational” or on assignment, with at least 3 of the Director positions expected to rotate essentially within Q1 2021/22 (Tools and Technology, Consistency, and Training). The intent is to backfill these positions through the Talent Management Process, however it will be a significant draw on the supervisory sectors.

Funding Model

As with the governance and staffing model, the funding model for CSS is also complicated and unique.

- Conceptually, CSS does not have any funding of its own.

- Given that CSS was established to provide centralized services to the supervisory sectors where it was more efficient to do so, essentially the three supervision sectors fund CSS each year.

- Supervision sectors may transfer funds to the CSS Cost Centre or directly fund a position or initiative from their cost center. The training budget in the training cost center is an example of a direct allocation.

- The Supervision Career Management Program (SCMP) always had its own budget as part of supervision and with the transfer to the SCMP into CSS in April 2020, the budget for this was also transferred.

- Currently, CSS administers six cost centers to support its operations, however with the completion of the Vu Project, the Vu Build Cost Centre will be eliminated shortly

- Formal projects (i.e. Project Vu) would be funded directly from the OSFI budget and would be subject to Treasury Board requirements.

Office of the Chief Actuary

Overview

Mission & Mandate

The mandate of the Office of the Chief Actuary (OCA) is to conduct statutory actuarial valuations of the CPP, Old Age Security (OAS) program, federal public sector employee pension and insurance plans, Employment Insurance (EI) premium rate, and the Canada Student Loans Program (CSLP). These valuations estimate the financial status of these plans and programs as required by legislation.

The OCA also provides the relevant government departments, including the executive arm of provincial and territorial governments who are co-stewards of the CPP, with actuarial advice on the design funding and administration of these plans. The plans under the responsibility of the OCA have assets of over $650 billion. OCA clients include:

- Employment and Social Development Canada (ESDC)

- Finance, Treasury Board Secretariat (TBS)

- Public Services and Procurement Canada (PSPC)

- Department of National Defense (DND)

- Veterans Affairs Canada (VAC)

- Royal Canadian Mounted Police (RCMP)

- Justice Canada and Canada Employment Insurance Commission

In 2020, the management team of the OCA completed a vision exercise. The vision and related guiding principles were presented to OCA staff and are aimed at guiding us in our future endeavors. OCA’s guiding principles are aligned with OSFI values.

Accountability Framework

The OCA was established within the Office of the Superintendent of Financial Institutions as an independent unit. By being outside of the departments that use its services, the Chief Actuary can exercise independent and impartial professional judgement in discharging its mandate. Although the Chief Actuary reports to the Superintendent, the accountability framework of the OCA makes it clear that the Chief Actuary is solely responsible for content and actuarial opinions in reports prepared by the OCA.

Funding of the OCA

OCA provides both statutory and non-statutory services that are funded either by OSFI’s Appropriations, Client’s Appropriations or a Dedicated Fund. Funding through Client Appropriations and Dedicated Funds is usually provided for in MOUs with clients. The total OCA budget for 2021-2022 is $12.1M with 74% allocated to statutory services and 26% allocated to non-statutory services.

OCA does not formally have authority to provide non-statutory services to other departments and agencies – despite the OCA already providing such services via MOUs to certain clients (mainly Veterans Affairs Canada and the Treasury Board Secretariat for work related to the Public Accounts of Canada). Both OCA and OSFI are aware of this issue, but recognize it as a low risk situation.

Position within OSFI

Historically, the OCA had not been directly represented on the Executive Committee (EC) and the responsibility to ensure that the OCA was considered in EC decisions informally rested with the Superintendent. In practice, it meant that the OCA was not considered (or at least not consulted) in a variety of decisions.

Since March 2021, the Chief Actuary now participates in all of the activities of the Executive Committee on a test-and-lean basis until the end of June 2021. Including the Chief Actuary as part of this forum acknowledges her role as a decision-making partner on the issues that affect our common operating environment. It is expected that this arrangement will be refined and formalized with the new Superintendent.

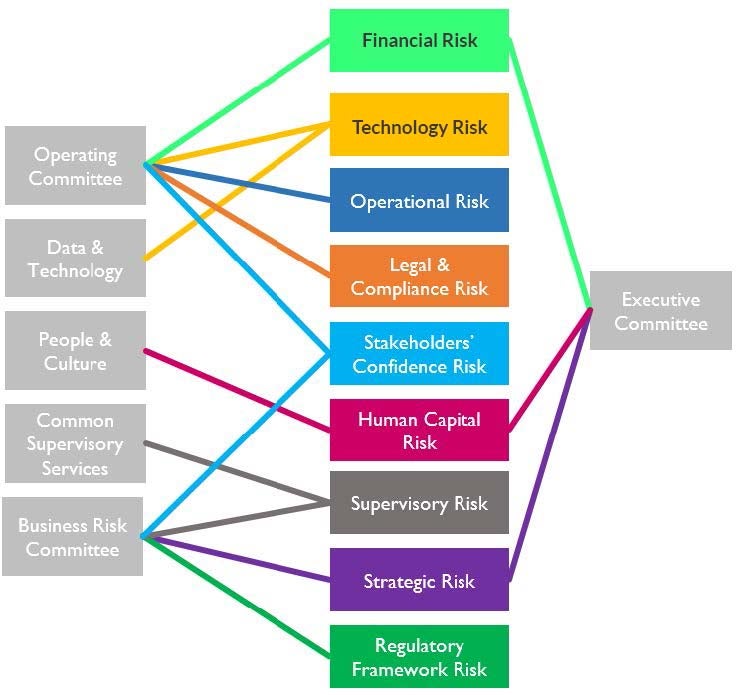

The OCA is also represented in the membership of four of the five OSFI’s governance committees (Data and Technology Committee, People and Culture Committee, Business Risk Committee, and Operating Committee). Due to the size and management team composition of the OCA, the representation on these committees include individuals at the One Director’s level.

In 2021, for the first time, the OCA prepared a Unit Plan and will report its progress towards this Plan through the Strategic Plan Implementation Report and the Strategic Plan Implementation Management Report.

Workforce

Office Structure

The OCA is composed of two Sections; one Section responsible for the work related to the social security programs (CPP, OAS, CSL, EI) and one Section responsible for the work related to the public sector pension and insurance programs. Each Section has three Directors leading teams of 4-7 people. The 3 Directors in the social security Section report to the Chief Actuary while the 3 Directors in the public sector pension and insurance programs Section report to a Managing Director who reports to the Chief Actuary.

Current Workforce

OCA’s workforce is made up of two administrative coordinators and 41 actuarial professionals most of whom have achieved Fellowship (17) or Associateship (14) designations with the Canadian Institute of Actuaries and/or the Society of Actuaries. Others continue to write exams to achieve their Associateship and some of those with Associateship are working toward their Fellowship designation. The OCA supports its employees in the achievement of actuarial designations through the Actuarial Study Time Policy.

The current Chief Actuary was appointed in April 2019 and, as a result of a process to staff Directors’ positions, 3 Directors were also appointed in 2019. Further, a Managing Director’s position was created and staffed in the summer of 2019. One Director is retiring in May 2021 at which time a new Director will be appointed.

Development Program for Actuaries

The OCA Development Program for Actuaries (DPA) was put in place in 2016 with the objective of developing high-caliber individuals through challenging work assignments, job coaching and a combination of formal and informal training which sharpens the knowledge, skills and competencies of individuals in order for them to move to higher working level positions (levels RE04 to RE07). All actuarial professionals at the RE levels had the opportunity to enter the DPA through a competitive process. All new hires since 2016 are entered in the DPA. More than 25 promotions have been made since the DPA was launched.

The current Chief Actuary was appointed in April2019 and, as a result of a process to staff Directors’ positions, 3 Directors were also appointed in 2019. Further, a Managing Director’s position was created and staffed in the summer of 2019. One Director is retiring in May 2021 at which time a new Director will be appointed.

Work Products

Work Cycles

The OCA prepares statutory actuarial reports for 8 programs on a triennial cycle and for EI on an annual cycle. In addition, the OCA prepares annually 12 actuarial reports for Public Accounts purposes, including one report which covers the 6 federal public sector pension plans. The OCA also provides assistance to federal and provincial Ministers of Finance during their regular triennial review of the CPP.

Some of the work of the OCA is also non-cyclical, such as: preparation of cost estimates for potential changes to the programs, preparation of projections of costs for budget purposes, preparation of actuarial studies, presentations to different stakeholders nationally and internationally, etc.

External Controls

Independent Peer Review of the CPP

- As part of its policy of ensuring that it is providing sound and relevant actuarial advice to Members of Parliament and to the Canadian population, the OCA commissions external peer reviews of its Actuarial Reports on the Canada Pension Plan. The external peer review is intended to ensure that the actuarial reports meet high professional standards, and are based on reasonable methods and assumptions.

- The external peer review process has been in place since 1999 and has generated a number of valuable recommendations that have been a source for continued improvements in the quality and transparency of actuarial reports. Each independent review brings fresh perspectives to continue to improve the quality of our work and strengthen the independence of our office.

- To ensure impartiality and to enhance the credibility of the peer review process, the globally recognized social security experts at the United Kingdom Government Actuary's Department (GAD) selects the panel members and provides an independent opinion on the work done by the reviewers.

- The data, assumptions and methodologies used for the CPP reports are also used for other programs falling under the responsibility of the OCA. As such, the findings and recommendations from the external peer review process are also applicable to other programs under the responsibility of the OCA.

Auditor General Audit

- In order to audit the Government of Canada’s liabilities related to pensions, severance benefits, student loans, health and dental post-retirement benefits, workers’ compensation benefits and Veterans’ future benefits shown in Public Accounts, the Auditor General uses the actuarial work of OCA as audit evidence. As part of their audit work, the Office of the Auditor General (OAG) reviews the data, methods and assumptions used by the OCA in their actuarial reports for Public Accounts purposes. Comments and recommendations put forward by the OAG are reflected in future actuarial reports, as appropriate.

Professional Standards

- Actuarial advice given and actuarial reports prepared by the OCA are prepared in accordance with accepted actuarial practice in Canada. In particular, the methodology and assumptions selected must comply with the Standards of Practice of the Canadian Institute of Actuaries. All Fellows and Associates of the Canadian Institute of Actuaries (F/ACIA) must strictly adhere to the CIA Rules of Professional Conduct.

Internal Controls

In addition to the external controls described above, the OCA has internal controls to ensure the accuracy and relevance of its actuarial advice. The statutory actuarial reports are signed by at least two OCA actuaries who are FCIAs to enhance the internal quality control process. A formal Quality Assurance (QA) exercise was also conducted in 2015/16 for all programs under the responsibility of the OCA which covered areas such as context of the requests, data validation, models, methodology and assumptions and communication of results. Results were shared with client departments and improvements were discussed for areas identified as weaker. A revised QA process is currently being developed and will be implemented in 2021/22.

Issues for the OCA

Recruiting and Retention

To operate effectively, the OCA requires staff with technical, actuarial and superior communication (written and verbal) skills. In recent years, it has been increasingly challenging to attract candidates with those qualifications to Ottawa. In addition, there are very few actuaries with experience with social security programs and actuaries with experience with pensions are becoming more rare with the decline in defined benefit pension plans. Finally, the skill sets of OCA’s employees make them attractive candidates, especially for certain groups at OSFI. Careful attention needs to be paid to the career opportunities offered at the OCA to avoid retention issues. Given the rarity of experienced actuaries in our fields of expertise, the OCA must hire employees at lower levels and assure their development. OCA’s budget for 21-22 includes 43 FTEs; currently the OCA has 40 positions filled. The three vacant positions are expected to be filled in the summer of 2021.

To address these challenges, a number of initiatives have been launched in the last few years:

- The DPA was changed to relax some hard experience and education criteria and to extend the program to the RE-07 level. These changes will give greater flexibility to the OCA in the hiring of candidates in a difficult hiring environment and will also allow the OCA to offer further opportunities for career advancement for RE-06 employees given the limited number of management positions.

- Engagement sessions were held with all employees at the RE levels in an effort to seek employee input to inform OCA on how they can best support REs. As a result, an action plan was developed to address the key points identified in the sessions. Most actions from the action plan were implemented in 2020.

- OCA is taking part in the pilot project for the Talent Management for REs

Adequate Level of Staffing

The economic, demographic and technological environments in which the OCA operates are becoming increasingly complex and sophisticated. As such, the OCA needs to have adequate staffing to not only fulfill its mandate but also keep pace with the environments and the various stakeholders. Employees need to have sufficient time to develop and expand their knowledge and sufficient time also need to be allocated to documentation and continuous improvements of tools and processes. It is important that OCA clients understand and support the level of staffing required to fulfil its mandate and work towards its vision.

Succession Planning

A number of OCA employees have significant program-specific knowledge which is somewhat isolated. 3 of the 6 Directors are within 5 years of retirement. Key positions need to be identified and a plan for succession needs to be in place. Sharing of knowledge needs to be prioritized. Leadership training, at all levels, is needed.

A number of actions have been taken to address the situation:

- All but one OCA executives have completed or are going through the Leadership Development Program and executives have access to coaching services.

- Two RE-06 employees are currently enrolled in the Aspiring Director program offered by the Canada School of Public Service.

- Another two RE-06 employees are enrolled in OSFI’s Management Essentials Program and future opportunities for leadership training will be aligned with the DPA.

Technology

OCA uses different tools than the rest of OSFI and some of these tools are unique. The workforce is also changing and it is becoming difficult to find employees with actuarial skills that also have strong programming skills. There is therefore a general need for documentation, training material and knowledge sharing. The OCA is currently engaging with OSFI IM/IT to benefit from their expertise.

Data

The OCA collects a large amount of data in order to perform the required analysis. Data security remains an ongoing issue for the OCA and the OCA is continuously engaging with OSFI IM/IT in this respect. The OCA is always looking at improving its data analytics capabilities and has engaged with the Risk & Data Analytics group.

Internal Audit

Overview

Mandate

The role of Internal Audit (IA) is to add value by assessing and contributing to the improvement of risk management, control and governance processes in accordance with the Treasury Board (TB) Policy on Internal Audit.

IA provides independent and objective assessments through assurance and consulting services to help OSFI management efficiently and effectively achieve its business objectives and fulfill OSFI’s mandate. The IA mandate is posted internally and can be found in the link provided above.

2021-2023 Internal Audit Plan

Internal Audit prepares an annual multi-year risk based plan (the Plan) in accordance with the Treasury Board Policy on Internal Audit and the Institute of Internal Auditors’ International Professional Practices Framework.

The Plan outlines the IA activities for the fiscal year 2021-22 and provides a comprehensive inventory for potential audits for future years. It is designed to ensure IA resources are allocated effectively to support OSFI in achieving its strategic priorities. The Plan is posted internally.

Strategy, Risk and Performance

OSFI Strategic Plan

2019-2022 OSFI Strategic Plan

Why a Strategic Plan?