Supplementary Information for Life Insurance Companies that Determine Segregated Fund Guarantee Capital Requirements Using an Approved Model – Revised Version

Information

Table of contents

Guidance to be rescinded

As a result of OSFI's policy review, this guidance was identified as outdated, redundant, or no longer fit-for-purpose. It will be rescinded and removed from the website by April 1, 2025.

Note:

Advisories describe how OSFI administers and interprets provisions of existing legislation, regulations or guidelines, or provide OSFI’s position regarding certain policy issues. Advisories are not law; readers should refer to the relevant provisions of the legislation, regulation or guideline, including any amendments that came into effect subsequent to the Advisory’s publication, when considering the relevancy of the Advisory.

Background:

On October 28, 2008, OSFI announced changes to the capital requirements for segregated fund guarantees for companies with an approved capital model (see Appendix 1). These changes offer such companies an opportunity to determine the segregated fund guarantee capital requirement using an alternative method (“Alternative Method”).

Since that announcement, OSFI has discussed the changes and their implementation with stakeholders. From these discussions, it became clear that there are a number of different ways of performing the calculations associated with the Alternative Method, particularly with respect to the ordering of scenarios underlying the calculation of the CTE(98), CTE(95) and CTE(90) values described in the October 28, 2008 announcement and the allocation of the actuarial liability to the respective cash flow buckets.

OSFI has also received requests from insurers with segregated fund guarantee exposures in more than one business unit, jurisdiction or entity (hereafter simply referred to as “business unit”) to rank scenarios in a way that is consistent across all business units to recognize that only one economic scenario should occur at any given time.

This advisory provides technical information on how the Alternative Method is to be implemented. It also provides information on the extent to which insurers with segregated fund guarantee exposures in more than one business unit may rank scenarios in a way that is consistent across business units and describes the precise ranking method that is to be used.

An earlier version of this advisory was published in December 2008. In that version, OSFI indicated that the method for calculating the CTE(98), CTE(95) and CTE(90) values associated with the Alternative Method would be reviewed in 2009. This review has now been completed and the applicable section of the advisory has been updated accordingly.

OSFI is aware that there may be other valid ways of implementing the Alternative Method or achieving consistency of results when a company has segregated fund guarantee exposures in more than one business unit. Accordingly, the methods described in this advisory may be modified in the future after additional research. However, to ensure consistency across the industry, companies electing to use the Alternative Method or electing to rank scenarios in a way that is consistent across business units must determine the segregated fund guarantee capital requirement using the methodology described in this advisory.

Calculation of the CTE(98), CTE(95) and CTE(90) Values Associated with the Alternative Method

Under the Alternative Method, the segregated fund guarantee capital requirement is to be determined in the following way:

-

A large number of stochastic investment return scenarios is generated. For clarity in the steps that follow, suppose that 5000 scenarios have been generated.

-

Segregated fund guarantee cash flows corresponding to these scenarios are determined based on the identified term of the liability.

-

In each scenario, cash flows are partitioned into buckets based on the timing of the cash flow as follows:

- 1 year or less

- greater than 1 year and less than or equal to 5 years

- greater than 5 years

-

For each scenario and each time bucket, the present value of benefit payments less guarantee premium receipts is calculated.

-

The result is four distributions of present values based on cash flow period:

- 1 year or less

- greater than 1 year and less than or equal to 5 years

- greater than 5 years

- all periods combined (i.e., no bucketing of cash flows)

-

The total requirement is the sum of:

- the total requirement for cash flows 1 year or less (the quantity T1 defined in steps 8 through 12)

- the total requirement for cash flows greater than 1 year and less than or equal to 5 years (the quantity T2 defined in steps 8 and 13)

- the total requirement for cash flows greater than 5 years (the quantity T3 defined in steps 14 through 22)

-

Required capital is the total requirement calculated in step 6 minus the lesser of:

- the segregated fund guarantee liability reported by the company and determined in accordance with actuarial practice standards (denoted by L in the steps that follow)

- the segregated fund guarantee liability based on a CTE(85) standard (the quantity Lu defined in steps 8 and 9)

In symbols, required capital is T1 + T2 + T3 − min(L, Lu), or 0 if this amount is negative.

Calculation of Lu, T1and T2:

-

The 5000 scenarios generated in step 1 are ordered according to the present value distribution for all cash flow periods combined (distribution in 5d), i.e., without respect to cash flow bucketing. The resulting ordering is labelled such that scenario 1 represents the greatest present value and scenario 5000 the least present value.

-

Calculation of Lu: The average present value for the distribution in 5d (present value cash flows for all periods combined) corresponding to scenarios 1 through 750 is calculated and denoted Lu. If the calculated value is negative, a value of 0 is assigned to Lu. The quantity Lu represents the total segregated fund guarantee liability based on a CTE (85) standard.

-

Scenarios 501 through 5000 are discarded.

-

Scenarios 1 through 500 are re-ordered according to the present value distribution for cash flows 1 year or less (distribution in 5a). The resulting re-ordering is labelled such that scenario 1* has the greatest present value with respect to cash flows 1 year or less and scenario 500* the least present value.

-

Calculation of T1: The average of the present values for the distribution in 5a (present value cash flows 1 year or less) corresponding to scenarios 1* through 100* is calculated and denoted T1. The quantity T1 represents the total requirement for cash flows 1 year or less. Note that T1 could be negative.

-

Calculation of T2: The average of the present value cash flows greater than 1 year and less than or equal to 5 years corresponding to scenarios 1 through 250 is calculated and denoted T2. Note that scenarios 1 through 250 (i.e., the scenarios for the ordering based on all cash flows combined) are used here, not scenarios 1* through 250*. The quantity T2 represents the total requirement for cash flows greater than 1 year and less than or equal to 5 years. Note that T2 could be negative.

Calculation of T3:

The total requirement for cash flows greater than 5 years is determined in the following way:

-

First, upper and lower bounds for the total requirement for this cash flow bucket are determined as well as the total requirement based on a CTE(95) standard.

-

Then, required capital amounts corresponding to the total requirement upper and lower bounds and the CTE(95) standard are determined assuming that required capital amounts are allocated to the three cash flow buckets in proportion to the corresponding total requirements floored at 0.

-

Following this, the required capital amount for the greater than 5 years cash flow bucket is determined using a weighted average of the previous quarter’s required capital amount for this cash flow bucket and the current quarter amount based on a CTE(95) standard, subject to the upper and lower bounds on required capital previously calculated.

-

Finally, the total requirement for the greater than 5 years cash flow bucket is inferred from the required capital amount just calculated based on the earlier assumption that required capital amounts are allocated to the three cash flow buckets in proportion to the corresponding total requirements.

The detailed calculations are described in steps 14 through 22 as follows:

Determination of upper and lower bounds for the total requirement and the total requirement based on CTE(95):

-

Scenarios 1 through 500 are re-ordered according to the present value distribution for cash flows greater than 5 years (distribution in 5c). The resulting re-ordering is labelled such that scenario 1*** has the greatest present value with respect to cash flows greater than 5 years and scenario 500*** the least present value.

-

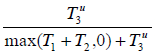

Calculation of upper bound T3u: The average of the present values for the distribution in 5c (present value cash flows greater than 5 years) corresponding to scenarios 1*** through 250*** is calculated and denoted T3u. The quantity T3u represents an upper bound for the total requirement before flooring for cash flows greater than 5 years.

-

Calculation of lower bound T3l: The average of the present values for the distribution in 5c (present value cash flows greater than 5 years) corresponding to scenarios 1*** through 500*** is calculated and denoted T3l. The quantity T3l represents a lower bound for the total requirement before flooring for cash floors greater than 5 years.

-

Calculation of CTE(95) proxy T3(95): The average of the present value cash flows greater than 5 years corresponding to scenarios 1 through 250 is calculated and denoted T3(95). Note that the scenarios 1 through 250 (i.e., the scenarios for the ordering based on all cash flows combined) are used here, not scenarios 1* through 250* or scenarios 1*** through 250***. The quantity T3(95)

represents the contribution to the total requirement of cash flows greater than 5 years when a total requirement standard of CTE(95) is used without cash flow partitioning.

Determination of corresponding required capital amounts:

-

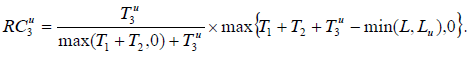

Calculation of upper bound RC3u: If T3u ≤ 0 then set RC3u = 0. Otherwise, if T3u > 0 then set

The quantity RC3u represents an upper bound on the current quarter required capital for cash flows greater than 5 years.

-

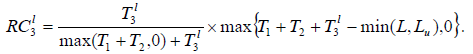

Calculation of lower bound RC3l: If T3l ≤ 0 then set RC3l = 0. Otherwise, if T3l > 0 then set

The quantity RC3l represents a lower bound on the current quarter required capital for cash flows greater than 5 years.

-

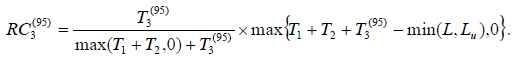

Calculation of RC3(95): If T3(95) ≤ 0 then RC3(95) = 0. Otherwise, if T3(95) > 0 then set

The quantity RC3(95) is the current quarter required capital amount to be used in the averaging formula.

Calculation of required capital for cash flows greater than 5 years based on averaging formula:

-

Define RC3 = max{RC3l, min(RC3u,95% × RC3p + 5% × RC3(95))}, where RC3p represents the previous quarter required capital for cash flows greater than 5 years. The quantity RC3 represents the current quarter required capital for cash flows greater than 5 years.

Calculation of corresponding total requirement for cash flows greater than 5 years:

-

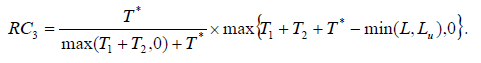

The total requirement for cash flows greater than 5 years is T3 = max(T3l, min(T*,T3u)) where the quantity T* is determined as follows: If RC3 = 0 then T* = 0. Otherwise, if RC3 > 0 then T* is the unique positive solution of the equation

Note that companies that determine segregated fund guarantee liability and capital requirements without separating guarantee fees from non-guarantee fees must add the absolute value of the recoverable portion of the unamortized amount of the deferred acquisition cost to the total requirement sums in steps 6, 18, 19, 20 and 22 (For example, in step 18, the unamortized amount of the deferred acquisition cost would be added to T1 + T2 + T3u but not to the numerator or denominator of

) and the quantity Lu in step 9 in order to determine the appropriate required capital amounts. Companies requiring further guidance on this matter should contact OSFI.

The quantity Lu defines a cap on the segregated fund guarantee liability that may offset the total requirement in the determination of segregated fund guarantee required capital (see step 7). The calculation of Lu described in step 9 is based on a CTE(85) liability standard and represents an interim measure. The calculation of Lu will be reviewed and may be modified in future reporting periods to become more closely aligned with the CTE(80) maximum liability standard promulgated by the Canadian Institute of Actuaries. Other aspects of the Alternative Method may be reviewed and modified in the future.

Determination of Segregated Fund Guarantee Capital Requirement When There is Segregated Fund Guarantee Exposure in More Than One Business Unit

Prior to the publication of the December 2008 version of this advisory, companies with segregated fund guarantee exposure in more than one business unit determined segregated fund guarantee capital requirements as if the business units were completely separate companies, i.e., segregated fund guarantee total requirements were determined based on business-unit-specific orderings of the present value distributions.

To recognize that only one economic scenario should occur at a given time, companies with segregated fund guarantee exposure in more than one business unit and approved capital models in all the impacted business units now have the option of determining the segregated fund guarantee capital requirement for the consolidated enterprise in the following way:

- A single set of integrated stochastic investment return and exchange rate scenarios (i.e., 5000 or more integrated scenarios) is generated and applied consistently to all business units, i.e., scenario 1 in business unit X is the same as scenario 1 in business unit Y, etc, subject to necessary adjustments to local currency.

- In each business unit, the scenario-specific present value requirements are determined. In scenarios where the present value requirement is less than 0, a value of zero is substituted, i.e., scenario-specific requirements are floored at 0. For companies adopting the Alternative Method, the present value requirements for the various time buckets are to be set equal to 0 in scenarios where the present value requirement without cash flow partitioning is less than 0.

- Scenario-specific present value requirements for the enterprise as a whole are determined by adding together the respective scenario-specific present value requirements for the various business units determined in step II, Text for screen readers: II = 2, using time 0 exchange rates to convert the amounts to a common currency as necessary. Note that the scenario-specific present value requirements for the various business units are to be floored at 0 before being summed. So, for example, if in scenario 1 the present value requirements for business units X, Y and Z are 10, -5 and 3 respectively then the corresponding scenario 1 requirement for the enterprise as a whole is 13 (= 10 + 0 + 3), not 8.

- The result of step III, Text for screen readers: III = 3, is a distribution of present value requirements for the enterprise as a whole (or for companies following the Alternative Method, four distributions of present value requirements based on time bucket for the enterprise as a whole). The segregated fund guarantee capital requirement for the enterprise as a whole is determined using this (these) distribution(s).

The method for determining the segregated fund guarantee capital requirement for consolidated enterprises is being reviewed and may be modified for future reporting periods. The method for determining requirements within business units is also being reviewed and may be modified for future reporting periods.

Companies that determine segregated fund guarantee liability and capital requirements without separating guarantee fees from non-guarantee fees should contact OSFI for further guidance on this calculation.

Appendix 1

Mr. Frank Swedlove

President

Canadian Life and Health Insurance Association Inc.

Queen Street East, Suite 1700<

Toronto, Ontario

M5C 2X9

Dear Mr. Swedlove:

Subject: Revisions to the Segregated Fund MCCSR Guidelines

Date: October 28, 2008

As you know, Guideline A, Minimum Continuing Capital and Surplus Requirements (MCCSR) establishes the minimum capital rules for segregated fund guarantee (SFG) obligations for life insurers that have approval to use internal models. While OSFI’s MCCSR internal models project is on a path to update such rules by 2011, market developments have highlighted the need to more expeditiously update these rules. As such, OSFI is revising such SFG capital rules.

SFG capital rules are currently based on a single confidence level of CTE95, regardless of the date on which an insurer is expected to make payments. As such, these rules may not sufficiently distinguish between the lower capital required to support distant payment obligations and the higher capital required to support near term payment obligations. This is due in large part to the evolution of the SFG products (e.g. SFG contracts generally had a term of 10 years or less when the current MCCSR rules were developed; they now have much longer terms, such as 30 years, or indefinite terms based on an annuitant’s life).

Further, the current SFG capital rules are point in time estimates of the risk associated with SFG obligations. As such, these rules may cause SFG capital requirements to be susceptible to dramatic swings that may not reflect changes in risk. The extent of this volatility in capital requirements is inconsistent with the purpose of building capital to absorb future unexpected losses.

Our approach for immediately revising the SFG capital rules for approved internal model companies is attached. These revisions seek to reduce volatility in capital requirements, to ensure that appropriate capital is held in respect of longer term payment obligations and shorter term payment obligations and to increase capital as payment dates become more proximate. These revisions would be an interim step until OSFI revises its approach to using models for MCCSR purposes.

We will prepare an amendment to our MCCSR Guideline to give effect to the attached approach. Provided an internal models-based SFG insurer elects to adopt these revisions, we intend that these changes would have effect for its SFG MCCSR calculations required after October 1, 2008.

Please communicate this approach to your members. Should your members have any comments or wish to discuss the approach, we would be pleased to discuss these modifications. Please direct any comments or questions to Bernard Dupont, Capital Division. Mr. Dupont may be reached by telephone at 613-993-7797 or by e-mail at bernard.dupont@osfi-bsif.gc.ca.

Yours sincerely,

Robert Hanna

Assistant Superintendent

Regulation Sector

Revisions to Segregated Fund Guarantee LICAT Rules

OSFI’s minimum capital rules for segregated fund guarantee (SFG) obligations for life insurers that have approval to use internal models are established in Guideline A: Life Insurance Capital Adequacy Test (LICAT). The LICAT SFG capital rules are revised as follows:

-

Minimum Capital Dependent on Expected Payment Date: Currently SFG capital is established based on a confidence level of CTE(95) over the term of a contract, regardless of whether the payments are expected to be due next quarter or in 30 years. OSFI believes that the confidence level and the capital requirement should reflect the proximity of the expected cash flows. Therefore, cash flows would be grouped into 3 categories according to expected dates and the following minimum confidence levels would apply: i) due in 1 year or less, CTE(98); ii) due between 1 and 5 years, CTE(95); and iii) due after 5 years, CTE(90).

-

>5 Yr Capital Increases Towards Capital Based On CTE(95): To help ensure sufficient capital is methodically accumulated for cash flows beyond 5 years and to allow such capital to grow towards a CTE(95) capital requirement, a calculation will be performed to measure the amount (the “Adjustment Amount”) that would, if accumulated over the next 20 quarters (and no other changes occur – i.e. all parts of the equation remain the same), be required to adjust the actual >5 year capital at the end of the prior quarter (the “>5Yr Previous Q Required Capital”) to equal the capital required at the end of the current quarter measured at a CTE(95) confidence level (the “Current Q >5Yr CTE(95) Capital). The Adjustment Amount would equal 5% of the amount obtained when the >5Yr Previous Q Required Capital is subtracted from the Current Q >5Yr CTE(95) Capital.

-

Actual >5Yr Required Capital: To mitigate volatility in capital requirements, the capital required to be held at the end of any quarter for >5 year cash flows is, subject to the minimum capital at CTE(90) (discussed above in para. 1) and subject to a maximum based on CTE(95) (i.e. testing the > 5 year cash flows at the end of the current quarter at CTE(95)), the aggregate of >5Yr Previous Q Required Capital and the Adjustment Amount (i.e. added if positive; subtracted if negative).

-

New Contracts and Ageing Contracts: Capital for new SFG cash flows in the >5 year category will be established indirectly by carrying forward the >5Yr Previous Q Required Capital and adding the Adjustment Amount; the protection against capital inadequacy being the CTE(90) minimum capital required for >5 year cash flows. Similarly, capital reductions in the >5 year category (due to cash flows moving from the >5 years category into <5 years category, etc.) may occur as a result of applying the Adjustment Amount but will not be directly calculated in the >5 year category; the accumulation of unnecessary capital will be avoided by capping the maximum required capital at CTE(95) for >5 year cash flows.

-

Allocation of TGCR and Actuarial Liabilities: As capital is calculated by deducting actuarial liabilities from the total gross calculated requirement (TGCR), both TGCR and liabilities for SFG will need to be allocated between the 3 different categories of cash flows. This allocation will need to be performed on a consistent basis applying the principles of conservatism, matching and maintaining sufficient reserves/liabilities and capital for all future obligations.

-

Implementation: The revised rules for SFG capital contained in this document may be adopted by insurers with approved internal SFG models for any quarter end commencing with their 2008 year end. Insurers are required to irrevocably elect by [March 31, 2009] to adopt these revised rules or to continue to calculate SFG capital (until the internal models project is implemented) using existing rules. For the first quarter using the revised rules, as OSFI determines is appropriate, the >5 year required capital will be established at CTE(90) at such date (i.e. the >5Yr Previous Q Required Capital will be assumed to be zero) or will be based on an amount calculated at earlier date (e.g. the >5Yr Previous Q Required Capital). It is expected that these revisions represent an interim step and would be replaced by the new capital rules resulting from OSFI’s internal models-based approach. These changes to the SFG capital rules will build on the existing SFG capital rules and, except as otherwise expressly amended once the guidance to implement this proposal is issued, the existing SFG capital rules (e.g. restrictions on switching from a models approach to a factor approach) will otherwise continue to apply.

APPENDIX A - EXAMPLE

| Period 1 | Period 2 | Period 3 | Period 4 | |

|---|---|---|---|---|

| Cash Flows 1 Year or Less | ||||

| 1 CTE 98 | Highlighted cell -4 | Highlighted cell -3 | Highlighted cell 1 | Highlighted cell 5 |

| 2 Liability | Highlighted cell -4.5 | Highlighted cell -3.25 | Highlighted cell 0 | Highlighted cell 1 |

| 3 Required Capital | 0.5 | 0.25 | 1 | 4 |

| Cash Flows 1-5 Years | ||||

| 4 CTE 95 | Highlighted cell 2 | Highlighted cell 4 | Highlighted cell 8 | Highlighted cell 4 |

| 5 Liability | Highlighted cell -1 | Highlighted cell 0.5 | Highlighted cell 2 | Highlighted cell 1 |

| 6 Required Capital | 3 | 3.5 | 6 | 3 |

| Cash Flows >5 Years | ||||

| 7 CTE 95 | Highlighted cell 7 | Highlighted cell 15 | Highlighted cell 14 | Highlighted cell 7 |

| 8 CTE 90 | Highlighted cell 5 | Highlighted cell 10 | Highlighted cell 9 | Highlighted cell 5 |

| 9 Liability | Highlighted cell 1 | Highlighted cell 3 | Highlighted cell 3 | Highlighted cell 1 |

| 10 Upper Bound for RC | 6 | 12 | 11 | 6 |

| 11 Lower Bound for RC | 4 | 7 | 6 | 4 |

| 12 Previous Period RC | n/a | 4 | 7 | 7.2 |

| 13 95% of (12) + 5% of (10) | n/a | 4.4 | 7.2 | 7.14 |

| 14 Required Capital ( (13) capped by (10) and floored by (11) ) | Highlighted cell 4 | 7 | 7.2 | 6 |

| 15 Total Required Capital ( (3) + (6) + (14) ) | 7.5 | 10.75 | 14.2 | 13 |