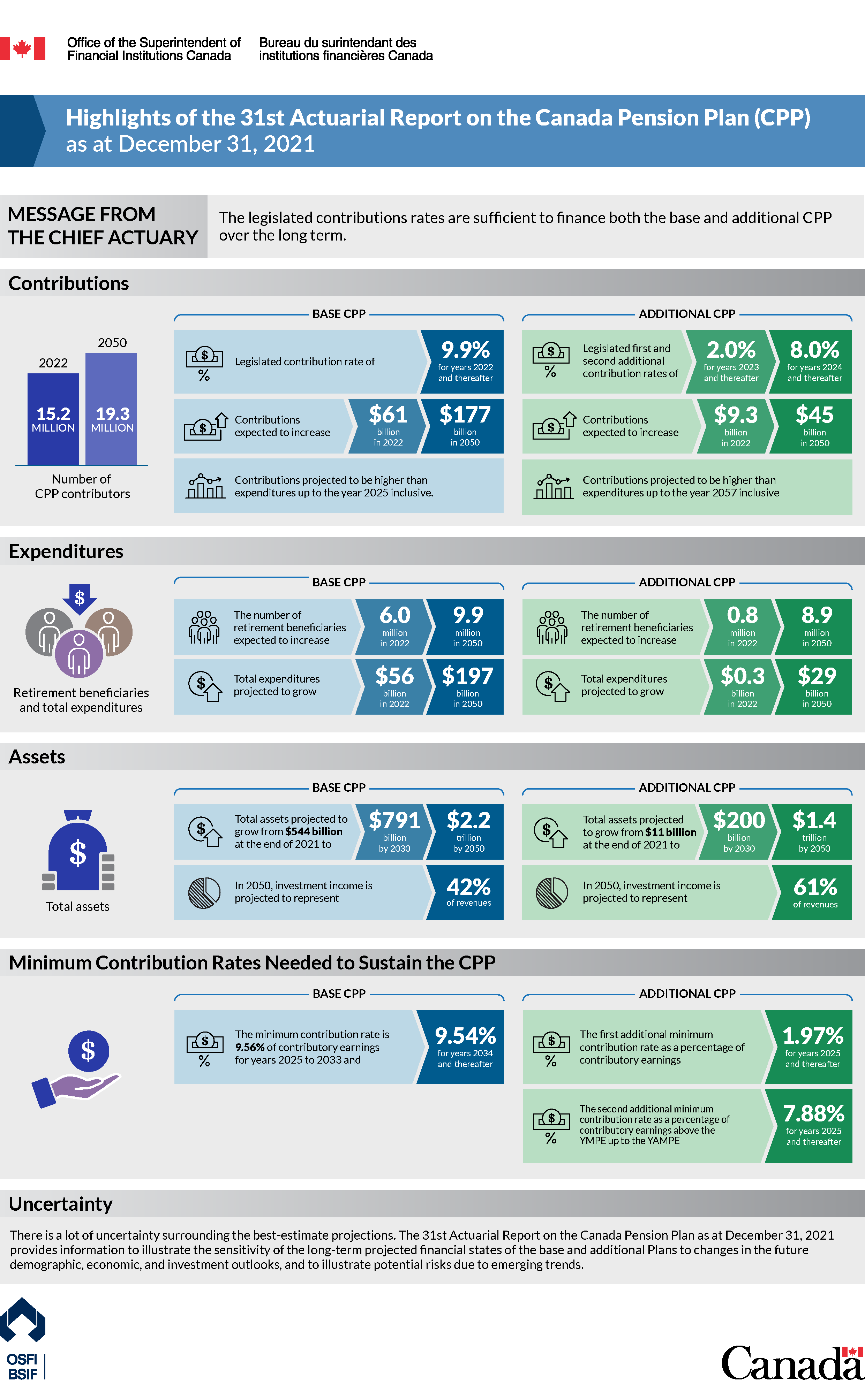

Highlights of the 31st Actuarial Report on the Canada Pension Plan (CPP) as of 31st December 2021

Report type

Canada Pension Plan

Published date

Text description - Highlights of the 31st Actuarial Report on the Canada Pension Plan (CPP) as of December 31, 2021

Message from the Chief Actuary

The legislated contributions rates are sufficient to finance both the base and additional CPP over the long term.

Contributions

Number of CPP contributors

- 15.2 million in 2022

- 19.3 million in 2050

Base CPP

- Legislated contribution rate of 9.9% for years 2022 and thereafter

- Contributions are expected to increase from $61 billion in 2022 to $177 billion in 2050

- Contributions projected to be higher than expenditures up to the year 2025 inclusive

Additional CPP

- Legislated first and second additional contribution rates of 2.0% for years 2023 and thereafter and 8.0% for years 2024 and thereafter

- Contributions expected to increase from $9.3 billion in 2022 to $45 billion in 2050

- Contributions projected to be higher than expenditures up to the year 2057 inclusive

Expenditures

Retirement beneficiaries and total expenses

Base CPP

- The number of retirement beneficiaries expected to increase from 6.0 million in 2022 to 9.9 million in 2050

- Total expenditures projected to grow from $56 billion in 2022 to $197 billion in 2050

Additional CPP

- The number of retirement beneficiaries is expected to increase from 0.8 million in 2022 to 8.9 million in 2050

- Total expenditures projected to grow from $0.3 billion in 2022 to $29 billion in 2050

Assets

Total assets

Base CPP

- Total assets projected to grow from $544 billion at the end of 2021 to $791 billion by 2030 and $2.2 trillion by 2050

- In 2050, investment income is projected to represent 42% of revenues

Additional CPP

- Total assets are projected to grow from $11 billion at the end of 2021 to $200 billion by 2030 and $1.4 trillion by 2050

- In 2050, investment income is projected to represent 61% of revenues

Minimum Contribution Rates Needed to Sustain the Base and Additional CPP

Base CPP

- The minimum contribution rate is 9.56% of contributory earnings for years 2025 to 2033 and is 9.54% for years 2034 and thereafter

Additional CPP

- The first additional minimum contribution rate as a percentage of contributory earnings is 1.97% for years 2025 and thereafter.

- The second additional minimum contribution rate as a percentage of contributory earnings above the YMPE up to the YAMPE is 7.88% for years 2025 and thereafter

Uncertainty

There is a lot of uncertainty surrounding the best-estimate projections. The 31st Actuarial Report on the Canada Pension Plan as at December 31, 2021 provides information to illustrate the sensitivity of the long-term projected financial states of the base and additional Plans to changes in the future demographic, economic, and investment outlooks, and to illustrate potential risks due to emerging trends.