2021 Actuarial Report on the Employment Insurance Premium Rate

Accessibility statement

The Web Content Accessibility Guidelines (WCAG) defines requirements for designers and developers to improve accessibility for people with disabilities. It defines three levels of conformance: Level A, Level AA, and Level AAA. This report is partially conformant with WCAG 2.0 level AA. If you require a compliant version, please contact webmaster@osfi-bsif.gc.ca.

Commissioners of the Canada Employment Insurance Commission

Dear Commissioners,

Pursuant to section 66.3 of the Employment Insurance Act, I am pleased to submit the 2021 report, which provides actuarial forecasts and estimates for the purposes of sections 4, 66 and 69 of the Employment Insurance Act.

The estimates presented in this report are based on the Employment Insurance provisions as of 22 July 2020. They also take into account additional information received from Employment and Social Development Canada on 6 August 2020 (announced by the Government on 20 August 2020). This information includes upcoming temporary measures aimed at facilitating access to Employment Insurance, as well as a confirmation of a premium rate freeze in 2021. However, the estimates were not revised for the additional 4‑week extension of the Canada Emergency Response Benefit (including the EI Emergency Response Benefit) newly announced on 20 August 2020.

Yours sincerely,

Annie St-Jacques, FCIA, FSA

Senior Actuary, Employment Insurance Premium Rate-Setting

Office of the Chief Actuary

Office of the Superintendent of Financial Institutions Canada

Table of contents

List of Tables

- Table 1 Summary of the EI Operating Account

- Table 2 Assumptions for Earnings Base

- Table 3 Assumptions for Expenditures

- Table 4 Earnings Base and Number of Earners

- Table 5 Expenditures

- Table 6 Part I Expenditures

- Table 7 Premium Reductions and Rebate

- Table 8 Calculation of the 7-Year Forecast Break-Even Rate

- Table 9 Projection of the EI Operating Account using the 7-year forecast break-even rate

- Table 10 Projection of the EI Operating Account using a Premium Rate of 1.58%

- Table 11 MP Expenditures

- Table 12 Calculation of the QPIP Reduction

- Table 13 Reduction in Employer Premiums Due to Qualified Wage-Loss Plans

- Table 14 Sensitivity of the 7-Year Forecast Break-Even Rate to the Unemployment Rate

- Table 15 Sensitivity of the 7-Year Forecast Break-Even Rate to the Recipiency Rate

- Table 16 Sensitivity of the EIOA Balance to the 7-Year Forecast Break-Even Rate

- Table 17 Reconciliation of Changes in the 7-Year Forecast Break-Even Rate

- Table 18 Maximum Insurable Earnings

- Table 19 Prescribed Information Provided by the Minister of ESD

- Table 20 Prescribed Information Provided by the Minister of Finance

- Table 21 Historical Comparison of the Number of Employees and Number of Earners

- Table 22 Projected Number of Earners

- Table 23 Historical Distribution of Earners by Level of Average Employment Income

- Table 24 Number of Earners Below and Above the MIE

- Table 25 Projected Total Employment Income

- Table 26 Historical Distribution of Employment Income as a % of Average Employment Income

- Table 27 Distribution of Employment Income for Earners Below and Above the MIE

- Table 28 Derived Insurable Earnings from Assessed Premiums

- Table 29 Projected Total Insurable Earnings

- Table 30 Split of Insurable Earnings Between Québec and Out-of-Québec, Based on Province of Employment (T4 data)

- Table 31 Historical Adjustment Payments Between the Government of Canada and the Government of Québec to Reflect Province of Residence

- Table 32 Adjustment to Insurable Earnings Split to Reflect Province of Residence

- Table 33 Split of Salaried Insurable Earnings Based on Province of Residence

- Table 34 Calculation of the Adjusted Premium Refunds

- Table 35 Total Insurable Earnings Subject to a Subsequent Premium Refund

- Table 36 Projected Self-Employed EI Participants

- Table 37 Projected Covered Earnings for Self-Employed EI Participants

- Table 38 Percentage of Benefit Weeks for Claimants with IE above the MIE

- Table 39 Average Weekly Benefits Growth Factors

- Table 40 Historical Number of Potential Claimants

- Table 41 Projected Number of Potential Claimants

- Table 42 Historical Recipiency Rate

- Table 43 Number of Weeks

- Table 44 Regular Benefits

- Table 45 Fishing Benefits

- Table 46 Work-Sharing Benefits

- Table 47 Special Benefits

- Table 48 EI Benefit Repayments

- Table 49 Employment Benefits and Support Measures

- Table 50 Administration Costs

- Table 51 Variable Administrative Costs

- Table 52 Bad Debt Expense

- Table 53 Penalties

- Table 54 Interest on Overdue Accounts Receivable

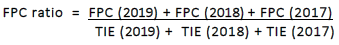

- Table 55 First Payer Cost Ratio for Calculating 2021 Rates of Reduction

- Table 56 Job-Attached EI Sickness Benefits per Category of Wage-Loss Plan

- Table 57 Allocation of Insurable Earnings for Employers With a Qualified Wage-Loss Plan

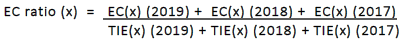

- Table 58 Experience Cost Ratio per Category

- Table 59 2021 Rates of Reduction

- Table 60 2021 Estimated Amount of Premium Reduction

1. Executive Summary

1.1 Purpose of the Report

This Actuarial Report prepared by the Actuary, Employment Insurance Premium Rate-Setting, is the eighth report to be presented to the Canada Employment Insurance Commission (Commission) in accordance with the Employment Insurance Act (“EI Act”).

Pursuant to section 66.3 of the EI Act, the purpose of this report is to provide the Commission with actuarial forecasts and estimates for the purposes of calculating the maximum insurable earnings (MIE) under section 4 of the EI Act, the employment insurance (EI) premium rate under section 66 of the EI Act, and the premium reductions under section 69 of the EI Act for employers who sponsor qualified wage-loss plans, and for employees and employers of a province that has established a provincial plan. The report also provides a detailed analysis in support of the forecasts, including data sources, methodology and assumptions.

The Commission shall, on or before 14 September, make available to the public this report along with the summary of this report.

COVID-19 Pandemic

Starting mid-March, the COVID-19 pandemic resulted in a health and economic crisis that created an unprecedented shock to the Canadian labour market. As part of the Government of Canada’s COVID-19 Economic Response Plan, the Government announced new emergency response benefits, the Canada Emergency Response Benefit (CERB) and the EI Emergency Response Benefit (EI ERB), and temporary changes to the Work-Sharing program. Furthermore, on 6 August 2020, Employment and Social Development Canada (ESDC) provided additional information to be taken into account when determining the forecast break-even rate for 2021. This information, announced by the Government on 20 August 2020, included a number of temporary measures aimed at facilitating access to EI as the EI ERB and the CERB are being wound down, as well as an EI premium freeze for 2021. This report takes all of the above into consideration. However, the estimates were not revised for the additional 4‑week extension of the CERB (including the EI ERB) newly announced on 20 August 2020.

1.2 Overview of Methodology

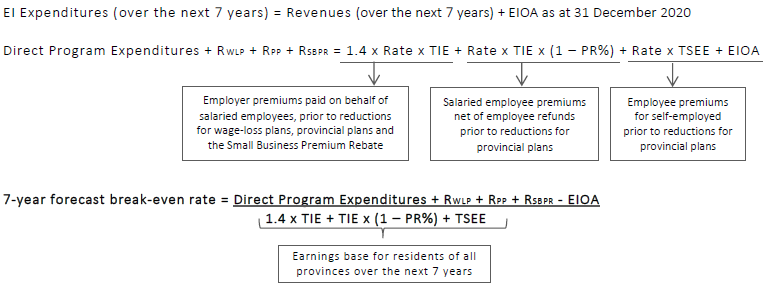

In accordance with subsection 66(1) of the EI Act, the Commission shall set the premium rate each year in order to generate just enough premium revenue during the next seven years to ensure that at the end of this seven-year period, the total of the amounts credited to the EI Operating Account after 31 December 2008 is equal to the total of the amounts charged to that Account after that date. This calculated premium rate is referred to as the 7-year forecast break‑even rate. Subsection 66(7) of the EI Act states that the premium rate may not be increased or decreased by more than 0.05% (five cents) from one year to the next.

For 2021, the Government has already confirmed that the premium rate would not be allowed to increase and would remain frozen at the 2020 premium rate level of 1.58%. This report will nevertheless show how the 7-year forecast break-even rate is determined in order for the projected balance in the EI Operating Account as at 31 December 2027 to be $0. This rate is expected to generate sufficient premium revenue during the 2021-2027 period to pay for the expected EI expenditures over that same period and to eliminate the projected deficit that has accumulated in the EI Operating Account as of 31 December 2020.

The 7-year forecast break-even rate is calculated each year based on a seven‑year projection of the insurable earnings, the EI expenditures, and the amount of premium reductions granted to employers who sponsor a qualified wage-loss plan as well as to employees and employers of a province that has established a provincial plan. The proposed Small Business Premium Rebate (related to the new EI Training Support Benefit, originally expected to be launched in late 2020, but now delayed to December 2021) is also considered. All projections are based on a methodology developed by the Actuary using prescribed information and assumptions provided by the Ministers of ESD and Finance, as well as non-prescribed assumptions determined by the Actuary.

In addition to the calculation of the 7-year forecast break-even rate, this report sets out the premium reductions that will apply in 2021 for employers who sponsor a qualified wage-loss plan, and for employees and employers of a province that has established a provincial plan.

Generally, EI premiums paid by the employer are equal to 1.4 times the premiums deducted by the employer on behalf of its employees, referred to as the employer multiplier. However, pursuant to subsection 69(1) of the EI Act, the employer premiums can be reduced through a lower employer multiplier when its employees are covered under one of four types of qualified wage-loss plans which reduce EI special benefits otherwise payable.

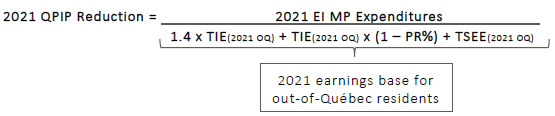

Québec is currently the only province that has established a provincial plan through the Québec Parental Insurance Plan (QPIP) which has been providing maternity, parental and adoption (MPA) benefits to Québec residents since 1 January 2006. In accordance with subsection 69(2) of the EI Act and related regulations, a mechanism to reduce EI premiums paid by Québec residents and their employers was introduced. The 2021 reduction for Québec residents and their employers is determined in accordance with legislation. The reduction is granted through a reduced premium rate, referred to as the 2021 QPIP reduction.

1.3 Main Findings

The following estimates are based on the EI provisions as of 22 July 2020, on the information provided on or before 22 July 2020 by the Minister of ESD and the Minister of Finance, and on the methodology and assumptions developed by the Actuary. They also incorporate additional information and upcoming temporary measures provided by ESDC on 6 August 2020 as a result of the exceptional circumstances created by the COVID-19 pandemic.

In 2021, insured employees and their employers will pay EI premiums on their earnings up to the 2021 MIE of $56,300, an increase of $2,100, or 3.9%, from the 2020 MIE of $54,200.

The 2021 EI 7-year forecast break-even rate, which is the rate needed to generate just enough premium revenue such that the projected EI Operating Account balances out as of 31 December 2027, is 1.93%. This represents a significant increase from the 2020 break-even rate of 1.58% and is the result of the situation created by the COVID-19 pandemic. Based on estimates received from ESDC, the largest part of this increase (0.29%) can be attributed to the EI ERBFootnote 1. Another portion of the increase (0.06%) can be attributed to the upcoming temporary measures recently announced by the Government to help people transition from the CERB and the EI ERB to EI.

The 2021 QPIP reduction is 0.40% and represents the estimated savings to the EI program due to the existence of the Québec Parental Insurance Plan, which provides MPA benefits to residents of Québec.

The 2021 estimated cost savings to the EI program that are generated by employer sponsored qualified wage-loss plans are $1,055 million. This translates in premium reductions for employers who sponsor a qualified wage-loss plan corresponding to about 0.23%, 0.37%, 0.37% and 0.40% of insurable earnings for categories 1 through 4 respectively.

Premium Freeze in 2021

The Government confirmed that it will freeze the EI premium rate for 2021 at the 2020 premium rate. Consequently, the premium rate applicable to residents of all provinces except Québec will be 1.58%. The premium rate applicable to residents of Québec will be 1.18% (1.58% - 0.40%).

With the exception of employers who sponsor a qualified wage-loss plan, employers will pay 1.4 times the employees’ premiums. For employers who sponsor a qualified wage-loss plan, based on a premium rate of 1.58%, employer multipliers for out-of-Québec employers will be reduced from 1.4 to 1.257, 1.166, 1.166 and 1.144 for categories 1 through 4 respectively (1.209, 1.086, 1.086 and 1.057 for Québec employers based on a premium rate of 1.18%).

Table 1 shows the status of the EI Operating Account for 2019, as well as its projected evolution for 2020 and 2021. This is based on a premium rate freeze for 2021 at the same level as 2020 (i.e. 1.58%). The expected deficit at the end of calendar year 2020 corresponds to $35.8 billion and is mainly attributable to the EI ERBFootnote 1 introduced by the Government at the beginning of the COVID‑19 pandemic. The expected deficit at the end of calendar year 2021 corresponds to $44.2 billion. A premium rate corresponding to the 7-year forecast break-even rate (1.93%) from 2021 to 2027 would balance out the EI Operating Account at the end of 2027Footnote 2.

| Calendar Year |

Premium Rate |

Premium Revenue |

Expenditures | Annual Surplus (Deficit) |

Cumulative Surplus (Deficit) 31 December |

|---|---|---|---|---|---|

| 2019 | 5,174 | ||||

| 2020 | 1.58% | 20,909 | 61,872 | (40,963) | (35,789) |

| 2021 | 1.58% | 22,573 | 30,990 | (8,417) | (44,206) |

It is important to note that the figures related to future expenditures and earnings base included in this report are projections, and eventual differences between future experience and these projections will be analyzed and taken into account in subsequent reports.

1.4 Sensitivity of the 7-Year Forecast Break-Even Rate

Two of the most relevant assumptions used to determine the 7-year forecast break-even rate are the unemployment rate, which is provided by the Minister of Finance, and the recipiency rate, which is projected by the Actuary.

With all other assumptions remaining constant:

- a variation in the average unemployment rate of 0.5% over the period 2021-2027 would result in an increase/decrease of about 0.07% in the 2021 EI 7-year forecast break‑even rate;

- a variation in the average recipiency rate of 5% over the period 2021-2027 would result in an increase/decrease of about 0.06% in the 2021 EI 7-year forecast break-even rate; and

- a variation in the premium rate of 0.01% of insurable earnings from the 7-year forecast break-even rate would result in a $1,253 million increase/decrease in the cumulative balance of the EI Operating Account at the end of the 7‑year forecast period.

1.5 Conclusion

This report was prepared by the Actuary in accordance with the relevant legislation.

The main results are as follows:

- The 2021 MIE is $56,300, based on the methodology detailed in the EI Act and the relevant economic data.

- The 7-year forecast break‑even rate for 2021 is 1.93% of insurable earnings.

- The 2021 QPIP reduction is 0.40% .

- The 2021 premium reduction for employers who sponsor qualified wage-loss plans is estimated at $1,055 million.

A reconciliation of the 7-year forecast break-even rate, from 1.58% in the 2020 Actuarial Report to 1.93% in the current report, is shown in Section 7. The increase is mainly attributable to the EI Emergency Response BenefitFootnote 1 introduced in response to COVID-19 and the upcoming temporary measures recently announced by the Government aimed at facilitating access to EI.

The Government confirmed that it will freeze the EI premium rate for 2021 at the 2020 premium rate. Consequently, the 2021 premium rate will be equal to:

- 1.58% of insurable earnings for residents of all provinces except Québec; and

- 1.18% of insurable earnings for residents of Québec, after taking into account the QPIP reduction of 0.40%.

2. Introduction

2.1 Purpose of the Report

This Actuarial Report prepared by the Actuary, Employment Insurance Premium Rate-Setting is the eighth one to be presented to the Canada Employment Insurance Commission (Commission) in compliance with section 66.3 of the EI Act.

The Actuary is a Fellow of the Canadian Institute of Actuaries who is an employee of the Office of the Superintendent of Financial Institutions and who is engaged by the Commission to perform duties under section 66.3 of the EI Act. Pursuant to this section, the Actuary shall prepare actuarial forecasts and estimates for the purposes of sections 4, 66 and 69 of the EI Act, and shall, on or before 22 August of each year, provide the Commission with a report that sets out:

- the forecast premium rate for the following year and a detailed analysis in support of the forecast;

- the calculations performed for the purposes of sections 4 and 69 of the EI Act;

- the information provided under section 66.1 of the EI Act; and

- the source of the data, the actuarial and economic assumptions and the actuarial methodology used.

The purpose of this report is to provide the Commission with all the information prescribed under section 66.3 of the EI Act. The Commission will make available to the public this report along with its summary. More information on the rate setting process along with the inherent deadlines can be found in Appendix A.

2.2 Changes Announced in 2020

- As part of the Government of Canada’s COVID-19 Economic Response Plan, the Government announced the following new emergency response benefits and temporary changes to the Work-Sharing program:

- The Canada Emergency Response Benefit (CERB) and the EI Emergency Response Benefit (EI ERB) support eligible workers by providing $500 a week for up to 24 weeks for the period between 15 March 2020 and 3 October 2020. The CERB expenses are being charged to the Consolidated Revenue Fund while the EI ERB expenses are being charged to the EI Operating Account. As a result of the implementation of the EI ERB:

- New EI regular and sickness benefit claims during this period are processed as claims for the EI ERB. Claims established prior to 15 March 2020, continue to be processed under the traditional EI rules.

- EI special benefits, excluding EI sickness benefits, continue unchanged.

- Several temporary special Work-Sharing measures were introduced to support employers and workers affected by COVID-19. Changes include extending the maximum duration of agreements, waiving the mandatory waiting period, expanding eligibility criteria and streamlining the application process from 30 days to 10 days. The temporary measures are in place from 15 March 2020 to 14 March 2021.

- The Canada Emergency Response Benefit (CERB) and the EI Emergency Response Benefit (EI ERB) support eligible workers by providing $500 a week for up to 24 weeks for the period between 15 March 2020 and 3 October 2020. The CERB expenses are being charged to the Consolidated Revenue Fund while the EI ERB expenses are being charged to the EI Operating Account. As a result of the implementation of the EI ERB:

- EI regulations were amended to extend the period of eligibility under the seasonal claimant pilot project announced in Budget 2018. This measure provides up to five additional weeks of EI regular benefits to eligible seasonal claimants in 13 targeted EI economic regions. The additional five weeks of benefits were originally available for claims established between 5 August 2018 and 30 May 2020. The period for the pilot project has been extended to include eligible claims established between 30 May 2020 and 30 October 2021.

- ESDC indicated that the implementation of the new EI Training Support Benefit (part of the Canada Training Benefit) originally announced in Budget 2019 and proposed to be launched in late 2020 would be delayed by at least 1 year. The benefit components delayed are:

- The EI Training Support Benefit, designed to help workers cover their living expenses when they require time off work to pursue training, and

- The EI Premium Rebate for Small Businesses, designed to help offset the upward pressure on EI premiums resulting from the introduction of the new EI Training Support Benefit.

- On 6 August 2020, ESDC confirmed the introduction of a number of transition measures for a period of one year to facilitate access to EI. This report takes into account the estimated costs received for the following measures:

- A minimum unemployment rate of 13.1% to be used for all EI regions beginning 9 August 2020 (announced by the Government on 10 August 2020). This will result in a uniform entrance requirement of 420 hours for eligibility to EI regular benefits (before application of hours credits) and a minimum entitlement to 26 weeks of EI regular benefits.

- A credit of 300 insurable hours and a minimum weekly benefit rate of $400 for EI regular benefits, including work-sharing benefits (announced by the Government on 20 August 2020).

- A credit of 480 insurable hours and a minimum weekly benefit rate of $400 ($240 for extended parental benefits) for EI special benefits (announced by the Government on 20 August 2020).

- On 6 August 2020, ESDC confirmed that the Government will freeze the EI premium rate for 2021 at the 2020 premium rate.

2.3 Scope of the Report

The methodology used in determining the 7-year forecast break-even rate, including the premium rate reduction for employees and employers of a province that has established a provincial plan such as Québec, and the reduction in employer premiums due to qualified wage-loss plans, is summarized in Section 3.

Section 4 provides an overview of the key assumptions used in projecting insurable earnings and EI expenditures, while Section 5 presents the main results, including the calculation of the 2021 EI 7-year forecast break-even rate and the projection of the EI Operating Account. Sensitivity tests on the main assumptions are outlined in Section 6.

A reconciliation between the 2020 and 2021 EI 7-year forecast break-even rates is presented in Section 7.

Concluding remarks and the actuarial opinion are presented in Section 8 and Section 9, respectively. The various appendices provide supplemental information on the EI program and on the data, assumptions and methodology employed. Detailed information on the calculation of the maximum insurable earnings (MIE) is presented in Appendix C.

3. Methodology

In accordance with subsection 66(1) of the EI Act, the Commission shall set the premium rate each year in order to generate just enough premium revenue during the next seven years to ensure that at the end of this seven-year period, the total of the amounts credited to the EI Operating Account after 31 December 2008 is equal to the total of the amounts charged to that Account after that date. This calculated premium rate is referred to as the 7-year forecast break‑even rate. The 2020 Actuarial Report calculated the 2020 7-year forecast break-even rate at 1.58%. Subsection 66(7) of the EI Act states that the premium rate may not be increased or decreased by more than 0.05% (five cents) from one year to the next.

For 2021, the Government has already confirmed that the premium rate would not be allowed to increase and would remain frozen at the 2020 premium rate level of 1.58%. This report will nevertheless show how the 7-year forecast break-even rate is determined in order for the projected balance in the EI Operating Account as at 31 December 2027 to be $0.

Based on relevant assumptions, the 2021 EI 7-year forecast break-even rate is the premium rate that is expected to generate sufficient premium revenue to ensure that at the end of 2027, the amounts credited and charged to the EI Operating Account after 31 December 2008 are equal. It is therefore based on the projected balance of the EI Operating Account as of 31 December 2020 and the projection over a period of seven years of the earnings base, the EI expenditures as well as the amount of premium reductions granted to employers who sponsor a qualified wage-loss plan and to employees and employers of a province that has established a provincial plan. The projected rebate amounts for small businesses related to the new EI Training Support Benefit expected to be launched in December 2021 are also considered.

The earnings base represents the total insurable earnings on which salaried employees and their employers pay EI premiums, and the earnings on which self‑employed individuals that opted into the EI program pay EI premiums. Prior to an adjustment to reflect employee premium refunds, the employer portion of the earnings base is equal to 1.4 times the employee portion of the earnings base.

For purposes of determining the 7-year forecast break-even rate, the earnings base and EI expenditures are projected over a seven‑year period. The base year for the earnings base is 2018, which is the most recent year for which fully assessed T4 slips (Statement of Remuneration Paid) data are available. However, for certain assumptions, the 2019 partially assessed information is used. Complete data for 2019 will not become available until January 2021. The base year for EI benefits is calendar year 2019.

The earnings base and EI expenditures are projected from the base year using:

- Data and assumptions provided by the Minister of Employment and Social Development (ESD), including prescribed information as set out in section 66.1 of the EI Act (presented in Table 19, Appendix D);

- Assumptions and forecasts provided by the Minister of Finance in accordance with section 66.2 of the EI Act (presented in Table 20, Appendix D);

- Additional data provided by Service Canada, Employment and Social Development Canada (ESDC), and the Canada Revenue Agency (CRA); and,

- Methodology and other assumptions developed by the Actuary.

In accordance with section 69 of the EI Act and related regulations, premium reductions are granted to employers who sponsor a qualified wage-loss plan as well as to employees residing in a province that has established a provincial plan and their employers. In addition, Budget 2019 proposed a Small Business Premium Rebate (related to the new EI Training Support Benefit, originally expected to be launched in late 2020, but now delayed to December 2021). The expected amounts of these premium reductions and rebate over the next seven years are included in the EI expenditures for purposes of determining the 7-year forecast break-even rate.

Generally, EI premiums paid by the employer are equal to 1.4 times the premiums deducted by the employer on behalf of its employees, referred to as the employer multiplier. However, pursuant to subsection 69(1) of the EI Act, the employer premiums can be reduced through a lower employer multiplier when its employees are covered under one of four types of qualified wage-loss plans which reduce EI special benefits otherwise payable. The 2021 premium reductions for those employers are determined in accordance with subsection 69(1) of the EI Act and related regulations, and are based on the methodology and assumptions developed by the Actuary.

Québec is currently the only province that has established a provincial plan through the Québec Parental Insurance Plan (QPIP) which has been providing maternity, parental and adoption (MPA) benefits to Québec residents since 1 January 2006. In accordance with subsection 69(2) of the EI Act and related regulations, a mechanism to reduce EI premiums paid by Québec residents and their employers was introduced. The 2021 reduction for Québec residents and their employers is determined in accordance with legislation and based on a methodology and on assumptions developed by the Actuary. The reduction is granted through a reduced premium rate. For 2021, this reduction is referred to as the 2021 QPIP reduction.

More information on the methodology used for calculating the 7-year forecast break-even rate and the premium reductions for 2021 is provided in Appendix B.

4. Assumptions

This section provides a brief overview of the main assumptions used in projecting the variables included in the calculation of the 7-year forecast break‑even rate. More detailed information and supporting data are provided in Appendix D. The section is broken down into two subsections: assumptions related to the projected earnings base and assumptions related to the projected expenditures.

4.1 Earnings Base

The earnings base is detailed in the denominator of the formula for the 7-year forecast break-even rate and the QPIP reduction developed in Appendix B. The earnings base is comprised of:

- the total insurable earnings on which employers pay EI premiums prior to any adjustment for wage-loss plans or provincial plans;

- the total insurable earnings on which employees pay EI premiums adjusted to reflect employee premium refunds, and;

- the earnings on which self‑employed individuals that opted into the EI program pay EI premiums.

The main assumptions used in determining the earnings base are presented in Table 2 below.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

|---|---|---|---|---|---|---|---|---|---|

| Increase in Maximum Insurable Earnings | 2.71% | 2.07% | 3.87% | 1.60% | 2.10% | 2.57% | 2.34% | 2.28% | 2.23% |

| Increase in Number of Earners | 2.10% | (6.79%) | 3.82% | 2.05% | 1.70% | 1.53% | 1.18% | 1.07% | 1.08% |

| Increase in Average Employment Income Table 2 - Footnote * | 2.76% | 1.37% | 2.58% | 2.95% | 2.55% | 2.07% | 2.26% | 2.22% | 2.49% |

| Increase in Total Employment Income | 4.91% | (5.51%) | 6.51% | 5.05% | 4.29% | 3.63% | 3.46% | 3.32% | 3.59% |

| Increase in Total Insurable Earnings | 4.95% | (6.20%) | 7.82% | 4.61% | 4.04% | 3.91% | 3.51% | 3.35% | 3.45% |

| Net Transfer of Insurable Earnings to Québec Reflecting the Province of Residence |

0.28% | 0.28% | 0.28% | 0.28% | 0.28% | 0.28% | 0.28% | 0.28% | 0.28% |

| Adjustment Due to Employee Premium Refunds (% of Total Insurable Earnings) |

2.47% | 2.47% | 2.47% | 2.47% | 2.47% | 2.47% | 2.47% | 2.47% | 2.47% |

| Increase in Covered Self-Employed Earnings: | |||||||||

| Total | 12% | 40% | 9% | 9% | 8% | 7% | 7% | 7% | 7% |

| Out-of-Québec Residents | 13% | 39% | 9% | 9% | 8% | 8% | 7% | 7% | 7% |

| Québec Residents | 8% | 51% | 6% | 6% | 6% | 5% | 5% | 5% | 5% |

|

|||||||||

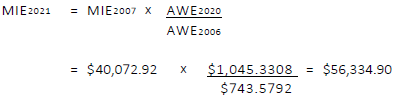

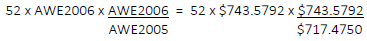

4.1.1 Maximum Insurable Earnings

The MIE represents the income level up to which EI premiums are paid and up to which EI benefits are calculated, and is a key element in determining the earnings base. Section 4 of the EI Act provides details on how to determine the yearly MIE. In accordance with this section, the MIE increases annually based on increases in the average weekly earnings, as reported by Statistics Canada.

The 2021 MIE is equal to $56,300, which represents a 3.9% increase to the 2020 MIE of $54,200. The projected MIE for years 2022 to 2027 are calculated based on estimates of the average weekly earnings provided by the Minister of Finance. Detailed explanations and calculations of the 2021 MIE are provided in Appendix C.

4.1.2 Number of Earners

The number of earners and their distribution across income ranges is used to determine the earnings base of salaried employees. The projected number of employees per year, which is based on an average of the number of employees per month, is provided by the Minister of Finance. The total number of earners for a year is higher than the number of employees provided given that the number of earners includes all individuals who had earnings at any time during the year rather than an average per month.

The preliminary number of earners for the year 2019 is set such that the resulting insurable earnings are in line with the expected assessed premiums for 2019, which are derived from the 2019 year-to-date assessed premiums and the 2019 increase in average employment income provided by the Minister of Finance. The projected number of earners from 2020 to 2027 is derived from a regression analysis based on the number of earnersFootnote 3 and the number of employeesFootnote 4.

The number of earners is expected to increase by 2.10% in 2019 and decrease by 6.79% in 2020. The average annual increase for the following seven years, from 2021 to 2027, is 1.77%. Given the historical year-to-year stability of the distribution of earners across income ranges, the projected distribution of earners as a percentage of average employment income is based on the 2018Footnote 5 distribution.

4.1.3 Average and Total Employment Income

The increase in average employment income, combined with the increase in the number of earners, is used to determine the increase in total employment income. The 2018Footnote 5 distribution of the total employment income across income ranges is used to determine the future distribution of total employment income.

The increase in average employment income is provided by the Minister of Finance and is expected to be 2.76% and 1.37% in 2019 and 2020 respectively. The average annual increase for the following seven years, from 2021 to 2027, is 2.45%. Based on these increases in average employment income and the expected increases in the total number of earners, the total employment income is expected to increase by 4.91% in 2019 and decrease by 5.51% in 2020. The average annual increase for the following seven years, from 2021 to 2027, is 4.27%.

4.1.4 Total Insurable Earnings

The total insurable earnings of salaried employees are equal to the total employment income, up to the annual MIE, earned by a person employed in insured employment. They are used to determine the earnings base for salaried employees. Prior to any adjustments for employee premium refunds, the earnings base for salaried employees is equal to 2.4 times the total insurable earnings (employer premiums are generally equal to 1.4 times the employee premiums, for a combined total of 2.4).

Historical information regarding total insurable earnings is derived from aggregate assessed premiums gathered from T4 slips of all salaried employees, and is provided by CRA. For employees with multiple employments in the year, this information is based on the combined total EI premiums. This means that, although insurable earnings of each employment are capped at the MIE, the combined total insurable earnings can exceed the MIE. The adjustment to insurable earnings and the earnings base reflecting multiple employments is captured in the employee premium refund section below.

The expected total employment income capped at the annual MIE for 2019 to 2027 is derived from the 2018Footnote 5 distribution of the total employment income and of the total number of earners as a percentage of average employment income, and the expected increases in these variables.

Based on this methodology, the total insurable earnings, before any adjustment for premium refunds, are expected to increase by 4.95% in 2019 and decrease by 6.20% in 2020. The average annual increase for the following seven years, from 2021 to 2027, is 4.38%. For 2019, the resulting insurable earnings reflect the year-to-date assessed premiums and related total expected assessed premiums for 2019.

4.1.5 Split of Total Insurable Earnings Due to Provincial Plan

For the purposes of determining the reduction that applies to residents of a province with a provincial plan, the earnings base for salaried employees must be split between residents of provinces with and without a provincial plan. The only province that currently has a provincial plan is Québec. Therefore, the earnings base for salaried employees must be split based on the province of residence (between out-of-Québec residents and Québec residents).

The information used to derive historical insurable earnings provided by CRA is on a T4 basis, and is therefore based on the province of employment. The historical distribution of insurable earnings on a T4 basis shows that the proportion of insurable earnings that relates to employment in Québec generally decreased until 2015; between 2015 and 2019, a slight increase was observed. Based on the historical pattern, it is expected that the proportion of insurable earnings that relates to employment in Québec will remain relatively stable at 22.2% in 2019 and 2020, and will slightly decrease over the 7-year projection period, but will remain close to 22%.

The information on historical assessed premiums provided by CRA includes adjustment payments made between the Government of Canada and the Government of Québec each year to reflect the province of residence rather than the province of employment of each employee. These adjustment payments are the object of an administrative agreement between both parties, and can be used as a basis to adjust the distribution of insurable earnings to reflect the province of residence. The methodology used in adjusting the distribution of insurable earnings based on aggregated adjustment payments was validated against administrative data. The administrative data were provided by CRA and are part of the annual exchange of information between the Government of Canada and the Government of Québec.

Based on information provided by CRA, the net annual transfer of insurable earnings on a T4 basis to reflect actual province of residence was on average 0.28% of total insurable earnings for the last five years of available data, 2014 to 2018, with the transfer of insurable earnings on a T4 basis going to Québec from the rest of Canada. It is assumed to remain at 0.28% of total insurable earnings until 2027.

4.1.6 Employee Premium Refunds

In general, salaried employees contribute EI premiums on their total insurable earnings in a given tax year up to the annual MIE. However, when filing their tax returns, some employees may exceed the maximum contribution and receive a refund of all or a portion of the EI premiums paid in the year (e.g. employees with multiple employers in the same year and employees with insurable earnings below $2,000). The insurable earnings that are subject to any subsequent premium refund must be excluded from the earnings base. Given that the data used for projection purposes (T4 slips) include insurable earnings for which premiums may later be refunded, an adjustment must be made to reduce the earnings base. It is important to note that the employer does not receive a refund. Thus, only the employee’s portion of the total earnings base is adjusted, which is reflected in the formulas presented in Appendix B.

The historical data provided by CRA show that the total insurable earnings subject to a subsequent employee refund as a percentage of total insurable earnings is relatively stable. Based on the average for the last five years of available data, 2014 to 2018, this percentage is assumed to be 2.47% from 2019 to 2027.

4.1.7 Self-Employed Earnings

Since 31 January 2010, self‑employed workers may voluntarily opt into the EI program to receive EI special benefits for those who are sick, pregnant or caring for a newborn or adopted child, and for those caring for a critically ill or injured family member (family caregiver benefit), or at end-of-life (compassionate care benefit). Although self-employed residents of Québec are able to access MPA benefits through their provincial plan, they may voluntarily opt into the EI program to access other special benefits. As such, the earnings base used in calculating the forecast break-even rate must take into account the covered earnings of self-employed individuals who opt into the EI program.

Self-employed individuals who participate in the EI program contribute premiums based on their self-employed earnings, up to the annual MIE, at the employee rate that corresponds to their province of residence, and there are no employer premium contributions. Therefore, as with the insurable earnings of salaried employees, self-employed covered earnings must be split between out-of-Québec residents and Québec residents.

The increase in self-employed earnings reflects the expected increase in the number of participants, and in the average earnings of self-employed individuals.

The projected number of participants is based on historical enrolment information, adjusted to reflect expected future changes in enrolment. The increase in average earnings is assumed to be the same increase in average earnings as the salaried employees.

Based on this methodology, the covered earnings of all self-employed individuals are expected to increase on average by 8% per year from 2021 to 2027. It is worth noting that 2020 shows an increase of 40% in total covered self-employment earnings. This can most likely be attributed to the COVID‑19 pandemic, as more self-employed people seeked some form of sickness coverage. This assumption will be adjusted as experience data fully becomes available.

4.2 Expenditures

EI Part I benefits are projected from actual 2019 benefits paid using several economic and demographic assumptions.

Table 3 presents a summary of the key expenditure assumptions used in this report, followed by a short description for each of them. A detailed description of the methodology used to project all benefits is available in Appendix D.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

|---|---|---|---|---|---|---|---|---|---|

| Increase in Labour ForceTable 3 - Footnote * | 1.9% | (2.1%) | 1.4% | 0.7% | 1.0% | 1.2% | 1.2% | 1.2% | 1.2% |

| Unemployment Rate Table 3 - Footnote * | 5.7% | 9.8% | 7.8% | 6.7% | 6.2% | 5.9% | 5.9% | 5.9% | 5.8% |

| Increase in Average Weekly Earnings Table 3 - Footnote * | 2.7% | 2.8% | 1.7% | 2.7% | 2.4% | 2.2% | 2.2% | 2.2% | 2.3% |

| Increase in Average Weekly Benefits | 1.7% | 2.1% | 3.0% | 2.1% | 2.2% | 2.4% | 2.3% | 2.2% | 2.3% |

| Potential Claimants (as a % of Unemployed) |

54.1% | 65.5% | 57.5% | 56.5% | 56.5% | 55.5% | 55.5% | 55.5% | 55.5% |

| Recipiency Rate (as a % of Potential Claimants) |

72.9% | 45.0% | 70.0% | 72.5% | 75.0% | 75.0% | 75.0% | 75.0% | 75.0% |

| Number of weeks | 52.2 | 52.4 | 52.2 | 52.0 | 52.0 | 52.4 | 52.2 | 52.2 | 52.2 |

| Percentage of Benefit Weeks for Claimants with Insurable Earnings above the MIE |

47.9% | 47.2% | 47.2% | 47.2% | 47.2% | 47.2% | 47.2% | 47.2% | 47.2% |

|

|||||||||

4.2.1 Labour Force

The labour force affects most of Part I benefits directly by increasing/decreasing the number of potential claimants. The labour force population is expected to decrease from 20.2 million in 2019 to 19.8 million in 2020. This decrease can be attributed to the forced shutdown of the economy created by the COVID‑19 pandemic that saw many people temporarily leave the labour force. In 2021, the labour force is expected to start increasing again to reach 21.4 million in 2027. The average annual increase between 2019 and 2027 is 0.7%. This assumption is provided by the Minister of Finance.

4.2.2 Unemployment Rate

The unemployment rate affects regular EI benefits directly by also increasing/decreasing the number of potential claimants. The average unemployment rate was 5.7% in 2019, and is expected to increase to 9.8% in 2020 before decreasing over the following four years to reach 5.9% in 2024. It is then expected to remain at that level until it reaches its ultimate value of 5.8% in 2027. The large increase in 2020 is attributable to the health and economic crisis resulting from the COVID-19 pandemic. This assumption is provided by the Minister of Finance.

4.2.3 Average Weekly Earnings

The growth in average weekly earnings on a calendar year basis is used, in conjunction with the increase in the MIE, to project the average weekly benefits. The expected growth in average weekly earnings is 2.8% in 2020 and decreases to 1.7% in 2021. The average annual growth for years 2022 to 2027 is 2.3%. This assumption is provided by the Minister of Finance.

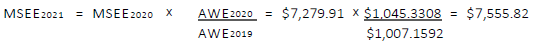

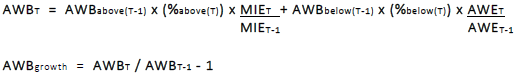

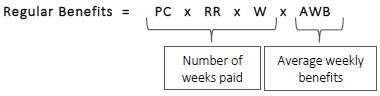

4.2.4 Average Weekly Benefits

The average weekly benefits growth affects EI expenditures directly through a corresponding increase/decrease in Part I expenditures. The average weekly benefits are equal to the benefit payments divided by the number of benefit weeks paid for Part I benefits.

The annual average weekly benefits growth rates are forecasted at 2.1% for 2020 and 3.0% for 2021. The average annual increase for years 2022 to 2027 is 2.3%. The growth rates are generally the same for all benefit types. However, after further analysis of claims data for the first six months of 2020, the assumed average weekly benefit growth for 2020 for sickness and Work-Sharing benefits was adjusted.

4.2.5 Potential Claimants

The EI Program is designed to provide temporary income support to eligible insured persons who have lost their jobs through no fault of their own, such as due to a shortage of work, or as a result of seasonal or mass lay-offs, and are available for work. The potential claimants represent the number of individuals or the percentage of unemployed individuals that meet the basic coverage criteria of the EI program. The number of potential claimants as a percentage of unemployed increased from 51.0% in 2018 to 54.1% in 2019. Based on the experience of the first six months of 2020, it is expected to increase to 65.5% in 2020 before starting to decrease to reach its ultimate value of 55.5% in 2024. The large increase in 2020 is attributable to the forced shutdown of the economy created by the COVID‑19 pandemic. Compared to other years, a larger proportion of employees lost their job through no fault of their own and remained available for work, putting upward pressure on the potential claimants’ rate.

4.2.6 Recipiency Rate

The recipiency rate represents the proportion of potential claimants in a given period who are receiving EI regular benefits. It is directly linked to the target population of the EI program (i.e. potential claimants) and does not consider individuals outside the target population of the EI program, such as the long-term unemployed and those who did not contribute to the program in the previous year. The recipiency rate is lower than 100% for multiple reasons, including that some potential claimants have not accumulated the required number of insurable hours, while other potential claimants do not apply for benefits, are serving the one-week waiting period, or have exhausted the number of weeks they were entitled to receive and remain unemployed.

The actual recipiency rate was 78.8% in 2018 and decreased to 72.9% in 2019 due to the termination of some temporary measures. Based on the experience of the first six months of 2020, it is assumed to decrease to 45.0% for the whole year 2020. The recipiency rate is set at 70.0% for 2021, 72.5% for 2022 and 75.0% from 2023 onwards. The low recipiency rate for 2020 and 2021 is attributable to the EI ERB put in place by the Government for claims starting 15 March 2020, as well as to the transition measures aimed at facilitating access to EI as the EI ERB and the CERB are being wound down. The majority of people who would have normally received regular EI benefits and been counted as regular EI recipients are receiving the special measure benefits instead, and are accounted for elsewhere as recipients of that measure.

4.2.7 Number of Weeks

EI expenditures are reported in the EI Operating Account on an accrual basis, that is, they are recorded in the period for which they should have been paid, regardless of the delay in processing the payment. Furthermore, EI benefits are paid on a weekly basis, but only weekdays that belong to a particular period are reported in that period.

The number of weeks affects Part I expenditures as benefits are payable for every weekday of the year, regardless of holidays. The number of workdays in a year ranges from 260 days to 262 days. Therefore, an adjustment is included to reflect the number of days benefits are paid in any year. The number of weeks for years 2019 to 2027 ranges between 52.0 and 52.4.

4.2.8 Percentage of Benefit Weeks for Claimants with Earnings Above MIE

From analyses of administrative data provided by ESDC, 47.9% of benefit weeks for claims that accrued in 2019 were based on insurable earnings above the MIE compared to 47.0% in 2018. Based on partial data for 2020, the proportion of benefit weeks for claimants with insurable earnings above the MIE is assumed to decrease slightly in 2020 to 47.2% and to remain constant thereafter.

4.2.9 Other Expenditures

Additional information used to project expenditures such as pilot projects and temporary measures, the cost of new program changes, administration costs and employment benefits and support measures (EI Part II benefits) are provided by ESDC.

The EI ERB put in place by the Government to support workers affected by the COVID-19 pandemic, as well as the temporary measures introduced to facilitate access to EI make up a large proportion of the expenditures. As per the cost estimates provided by ESDC, an EI ERB expenditure of $36.2 billion was added in 2020, while transition measures expenditures of $968 million and $5.1 billion were added in 2020 and 2021 respectively.

5. Results

5.1 Overview

This report provides actuarial forecasts and estimates for the purposes of sections 4, 66 and 69 of the EI Act. It has been prepared based on EI provisions as of 22 July 2020, on the information provided on or before 22 July 2020 by the Ministers of ESD and Finance, and on the methodology and non-prescribed assumptions developed by the Actuary. Additional information and upcoming temporary measures provided by ESDC on 6 August 2020 were also considered.

The key findings are as follows:

- The 2021 MIE is equal to $56,300, which represents a 3.9% increase to the 2020 MIE of $54,200.

- The 2021 EI 7-year forecast break-even rate is 1.93% of insurable earnings for residents of all provinces except Québec. This represents a significant increase from the 2020 break-even rate of 1.58% and is the result of the situation created by the COVID-19 pandemic. Based on estimates received from ESDC, the largest part of this increase (0.29%) can be attributed to the EI ERBFootnote 1. Another portion of the increase (0.06%) can be attributed to the upcoming temporary measures recently announced by the Government to help people transition from the CERB and the EI ERB to EI.

- The 2021 premium reduction for residents of Québec due to its provincial plan is 0.40%.

- The 2021 premium reduction for employers who sponsor qualified wage-loss plans is estimated at $1,055 million. This translates in premium reductions for employers who sponsor a qualified wage-loss plan corresponding to about 0.23%, 0.37%, 0.37% and 0.40% of insurable earnings for categories 1 through 4 respectively.

- The total earnings base is expected to grow each year from $1,569 billion in 2019 to $1,986 billion in 2027, with the exception of 2020, where a decrease is expected due to the COVID‑19 pandemic.

- Total expenditures are expected to increase from $21 billion in 2019 to $62 billion in 2020. This large increase is mainly due to the estimated cost of the EI ERBFootnote 1 provided by ESDC. They are then expected to decrease considerably in 2021, while remaining high at $31 billion, due to the temporary measures to help people transition from the CERB and the EI ERB to EI. They are expected to continue to decrease over the following two years, before resuming a more normal upward progression until they reach the expected level of $27 billion in 2027.

- The EI Operating Account is expected to have a cumulative deficit of $35.8 billion as of 31 December 2020, which is mainly attributable to the EI ERBFootnote 1 introduced by the Government at the beginning of the COVID‑19 pandemic.

The Government confirmed that it will freeze the EI premium rate for 2021 at the 2020 premium rate. Consequently, the 2021 premium rate will be equal to:

- 1.58% of insurable earnings for residents of all provinces except Québec; and

- 1.18% of insurable earnings for residents of Québec, after taking into account the QPIP reduction of 0.40%.

5.2 Earnings Base

EI premiums, prior to any adjustment for wage-loss plans, are determined by the product of the premium rate and the earnings base. The national earnings base is required to determine the 7‑year forecast break-even rate while the earnings base of provinces not offering a provincial plan is required to determine the reduction due to those plans. Since Québec is the only province offering a provincial plan, the earnings base is split between Québec and out-of-Québec residents.

Based on the methodology and assumptions presented in Section 4, Table 4 shows the earnings base for Québec and out-of-Québec residents as well as the total number of earners.

| Calendar Year | Earnings Base ($ million) | Number of Earners (thousands) |

||

|---|---|---|---|---|

| Out-of-Québec | Québec | Total | ||

| 2018 | 1,162,494 | 332,042 | 1,494,536 | 19,620 |

| 2019 | 1,216,023 | 353,142 | 1,569,165 | 20,032 |

| 2020 | 1,141,581 | 330,372 | 1,471,952 | 18,672 |

| 2021 | 1,231,817 | 355,257 | 1,587,073 | 19,386 |

| 2022 | 1,289,553 | 370,621 | 1,660,174 | 19,783 |

| 2023 | 1,342,691 | 384,556 | 1,727,247 | 20,118 |

| 2024 | 1,396,240 | 398,505 | 1,794,745 | 20,426 |

| 2025 | 1,446,322 | 411,363 | 1,857,685 | 20,666 |

| 2026 | 1,495,791 | 424,196 | 1,919,987 | 20,888 |

| 2027 | 1,548,627 | 437,647 | 1,986,275 | 21,113 |

These results are used in the calculation of the 2021 EI 7-year forecast break‑even rate and the 2021 QPIP reduction. A detailed explanation of the methodology and assumptions used to derive the results is available in Appendix D.

5.3 Expenditures

This section examines the expenditures side of the 7-year forecast break-even rate. EI expenditures include Part I (income benefits), Part II (Employment Benefits and Support Measures (EBSM)), administration costs, benefit repayments and bad debts. EI benefits may also include temporary spending initiatives, such as pilot projects and special measures announced by the Government of Canada. More specifically, in 2020, EI benefits include the EI ERB put in place to support workers affected by the COVID‑19 pandemic. A detailed explanation of the methodology and assumptions used to derive the results is available in Appendix D.

For the purposes of the 7-year forecast break-even rate calculation, penalties and interest on overdue accounts receivable are included on the expenditures side of the equation.

Table 5 shows the breakdown of the 2019 EI expenditures, as well as a projection up to 2027.

| Calendar Year |

Part ITable 5 - Footnote * | Part II | EI - ERB | Admin. Costs |

Benefit Repayments |

Bad Debt | Penalties | Interest | Total |

|---|---|---|---|---|---|---|---|---|---|

| 2019 | 17,208 | 2,464 | - | 1,890 | (289) | 74 | (55) | (22) | 21,269 |

| 2020 | 21,041 | 2,899 | 36,200 | 1,944 | (276) | 158 | (72) | (22) | 61,872 |

| 2021 | 27,127 | 2,529 | - | 1,860 | (464) | 57 | (93) | (27) | 30,990 |

| 2022 | 22,575 | 2,532 | - | 1,796 | (357) | 33 | (77) | (23) | 26,478 |

| 2023 | 21,472 | 2,107 | - | 1,789 | (328) | 59 | (74) | (23) | 25,002 |

| 2024 | 21,534 | 2,107 | - | 1,784 | (321) | 76 | (74) | (24) | 25,081 |

| 2025 | 22,145 | 2,107 | - | 1,783 | (330) | 83 | (76) | (27) | 25,685 |

| 2026 | 22,901 | 2,107 | - | 1,783 | (342) | 86 | (79) | (30) | 26,426 |

| 2027 | 23,568 | 2,107 | - | 1,783 | (351) | 88 | (81) | (33) | 27,080 |

|

|||||||||

Table 6 shows the breakdown of Part I EI expenditures.

| Calendar Year |

RegularTable 6 - Footnote * | Fishing | Work- Sharing |

Training BenefitTable 6 - Footnote ** |

Special BenefitsTable 6 - Footnote * | Total | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| MPTable 6 - Footnote *** | Sickness | Compassionate | Family Caregiver Benefit | Sub- Total |

||||||

| 2019 | 10,715 | 340 | 13 | - | 4,139 | 1,864 | 49 | 88 | 6,140 | 17,208 |

| 2020 | 14,619 | 348 | 117 | - | 4,313 | 1,509 | 48 | 87 | 5,956 | 21,041 |

| 2021 | 19,485 | 357 | 47 | 22 | 4,954 | 2,095 | 59 | 108 | 7,216 | 27,127 |

| 2022 | 14,989 | 363 | 17 | 285 | 4,771 | 1,998 | 54 | 98 | 6,921 | 22,575 |

| 2023 | 13,762 | 371 | 18 | 294 | 4,852 | 2,023 | 54 | 97 | 7,026 | 21,472 |

| 2024 | 13,466 | 383 | 19 | 296 | 5,088 | 2,122 | 56 | 102 | 7,369 | 21,534 |

| 2025 | 13,827 | 391 | 20 | 296 | 5,257 | 2,191 | 58 | 106 | 7,611 | 22,145 |

| 2026 | 14,305 | 399 | 20 | 296 | 5,443 | 2,267 | 60 | 109 | 7,879 | 22,901 |

| 2027 | 14,683 | 408 | 21 | 296 | 5,637 | 2,347 | 62 | 113 | 8,159 | 23,568 |

|

||||||||||

5.4 Premium Reductions and Rebate

The employer premiums can be reduced through a lower employer multiplier when its employees are covered under a qualified wage-loss plan which reduces EI special benefits otherwise payable, provided that at least 5/12 of the reduction is passed on to the employees. Premiums paid by employees and their employers can also be reduced when employees are covered under a plan established under provincial law which reduces EI maternity and parental (MP) benefits otherwise payable. An agreement must be in place between the Government of Canada and the province to establish a system for reducing premiums paid by residents of that province and their employers.

Budget 2019 announced an EI Small Business Premium Rebate to offset the upward pressure on EI premiums resulting from the EI Training Support Benefit (originally expected to be launched in late 2020, but now postponed to December 2021). This rebate is proposed to be available to any business that pays employer EI premiums equal to or less than $20,000 for the 2021 calendar year. Using forecasted calendar expenditures received from the Minister of ESD, the cost of the EI Training Support Benefit in 2021 (including the administration costs related to this benefit) is expected to represent 2 cents (1.77 cents unrounded, or 0.0177%). This cost is included in the 7‑year forecast break-even rate of 1.93%. The details of the rebate were not confirmed at the time the report was produced and will still need to be approved through legislation.

Table 7 shows the projection of the expected premium reductions and rebate up to 2027 taken into account in the determination of the 7-year forecast break-even rate.

| Calendar Year | Qualified Wage-Loss Plans | Provincial Plans | SBPRTable 7 - Footnote * |

|---|---|---|---|

| 2021 | 1,055 | 1,421 | 26 |

| 2022 | 1,114 | 1,371 | 27 |

| 2023 | 1,157 | 1,384 | 28 |

| 2024 | 1,202 | 1,474 | 29 |

| 2025 | 1,252 | 1,481 | 29 |

| 2026 | 1,294 | 1,570 | 29 |

| 2027 | 1,338 | 1,619 | 29 |

|

|||

5.5 7-Year Forecast Break-Even Rate

The 7-year forecast break-even rate is the rate that, based on relevant assumptions, is expected to generate sufficient premium revenue during the next seven years to ensure that, at the end of that seven-year period, the amounts credited and charged to the EI Operating Account (EIOA) after 31 December 2008 are equal.

For 2021, the Government has already confirmed that the premium rate would not be allowed to increase and would remain frozen at the 2020 premium rate level of 1.58%. For information purposes, this report shows how the 7-year forecast break-even rate is determined in order for the projected balance in the EI Operating Account as at 31 December 2027 to be $0. This rate is expected to generate sufficient premium revenue during the 2021-2027 period to pay for the expected EI expenditures over that same period and to eliminate the projected deficit that has accumulated in the EI Operating Account as of 31 December 2020.

The expected amounts of the premium reductions over the next seven years for qualified wage‑loss plans (WLP) and for provincial plans (PP), as well as the Small Business Premium Rebate related to the EI Training Support Benefit expected to launch in December 2021 are included in the EI expenditures for purposes of determining the 7-year forecast break-even rate.

This ensures that in the absence of wage-loss plans, provincial plans and Small Business Premium Rebate, a premium rate set at the 7-year forecast break-even rate would generate enough revenues to cover all EI expenses for employees of every employer residing in any province.

Table 8 shows the projection of the variables used to determine the 7-year forecast break-even rate. The annual expected pay-as-you-go rates (PayGo) are the rates required to cover the expected expenditures of that year. The 7-year forecast break-even rate is higher than the average PayGo rates since the projected deficit as at 31 December 2020 is considered.

| Calendar Year |

Expenditures Covered by the 7-Year Forecast Break-Even Rate | Surplus (Deficit) in the EIOA as at 31 December 2020 |

Earnings Base |

Annual PayGo Rate / 7-Year Forecast Break- Even Rate |

||||

|---|---|---|---|---|---|---|---|---|

| EI Expenditures | Reduction for WLP |

Reduction for PP |

SBPRTable 8 - Footnote * | Total Expenditures Before Reductions and Rebate |

||||

| 2021 | 30,990 | 1,055 | 1,421 | 26 | 33,493 | 1,587,073 | 2.11% | |

| 2022 | 26,478 | 1,114 | 1,371 | 27 | 28,990 | 1,660,174 | 1.75% | |

| 2023 | 25,002 | 1,157 | 1,384 | 28 | 27,571 | 1,727,247 | 1.60% | |

| 2024 | 25,081 | 1,202 | 1,474 | 29 | 27,787 | 1,794,745 | 1.55% | |

| 2025 | 25,685 | 1,252 | 1,481 | 29 | 28,446 | 1,857,685 | 1.53% | |

| 2026 | 26,426 | 1,294 | 1,570 | 29 | 29,318 | 1,919,987 | 1.53% | |

| 2027 | 27,080 | 1,338 | 1,619 | 29 | 30,067 | 1,986,275 | 1.51% | |

| 2021-27 | 186,742 | 8,412 | 10,321 | 198 | 205,673 | (35,789) | 12,533,186 | 1.93%Table 8 - Footnote ** |

|

||||||||

Table 9 shows the projection of revenues, EI expenditures, and the account balance using the 7‑year forecast break-even rate and the premium reductions.

| Calendar Year |

Premium Rate (%) |

Revenues | Net Premiums |

Expenditures | Annual Surplus (Deficit) |

Cumulative Surplus (Deficit) 31 December |

||||

|---|---|---|---|---|---|---|---|---|---|---|

| Gross Premiums after Refunds |

Reduction for WLP |

Reduction for Provincial Plans |

SBPRTable 9 - Footnote * | Other Adj. Table 9 - Footnote ** |

||||||

| 2019 | 1.62% | 25,420 | (1,004) | (1,307) | - | 58 | 23,169 | 21,269 | 1,900 | 5,174 |

| 2020 | 1.58% | 23,257 | (1,007) | (1,255) | - | (86) | 20,909 | 61,872 | (40,963) | (35,789) |

| 2021 | 1.93% | 30,631 | (1,055) | (1,421) | (26) | - | 28,128 | 30,990 | (2,862) | (38,651) |

| 2022 | 1.93% | 32,041 | (1,114) | (1,371) | (27) | - | 29,529 | 26,478 | 3,051 | (35,600) |

| 2023 | 1.93% | 33,336 | (1,157) | (1,384) | (28) | - | 30,766 | 25,002 | 5,764 | (29,835) |

| 2024 | 1.93% | 34,639 | (1,202) | (1,474) | (29) | - | 31,933 | 25,081 | 6,852 | (22,984) |

| 2025 | 1.93% | 35,853 | (1,252) | (1,481) | (29) | - | 33,092 | 25,685 | 7,407 | (15,577) |

| 2026 | 1.93% | 37,056 | (1,294) | (1,570) | (29) | - | 34,164 | 26,426 | 7,737 | (7,839) |

| 2027 | 1.93% | 38,335 | (1,338) | (1,619) | (29) | - | 35,349 | 27,080 | 8,268 | 429 |

|

||||||||||

The 2021 EI 7-year forecast break‑even rate is 1.93%. This rate would balance out the EI Operating Account at the end of 2027. The cumulative balance in the EI Operating Account at the end of 2027 is not exactly $0 since the 7-year forecast break-even rate is rounded to the nearest cent.

5.6 2021 Premium Freeze

On 6 August 2020, the Government confirmed that it will freeze the EI premium rate for 2021 at the 2020 premium rate. Consequently, the premium rate applicable to residents of all provinces except Québec will be 1.58%. The premium rate applicable to residents of Québec will be 1.18% (1.58% - 0.40%).

Table 10 shows the projection of revenues and the corresponding account balances for 2020 and 2021 based on a premium rate of 1.58%. Expenditures and premium reductions are the same as the ones shown in Table 9. For years after 2021, a premium rate would be recalculated each year based on the 7-year forecast break-even rate methodology considering the existing economic environment and revised assumptions at that time. The expected deficit at the end of calendar year 2020 corresponds to $35.8 billion and is mainly attributable to the EI ERBFootnote 6 introduced by the Government at the beginning of the COVID‑19 pandemic.

| Calendar Year |

Premium Rate (%) |

Revenues | Net Premiums |

Expenditures | Annual Surplus (Deficit) |

Cumulative Surplus (Deficit) 31 December |

||||

|---|---|---|---|---|---|---|---|---|---|---|

| Gross Premiums after Refunds |

Reduction for WLP |

Reduction for Provincial Plans |

SBPRTable 10 - Footnote * | Other Adj. Table 10 - Footnote ** |

||||||

| 2019 | 1.62% | 25,420 | (1,004) | (1,307) | - | 58 | 23,169 | 21,269 | 1,900 | 5,174 |

| 2020 | 1.58% | 23,257 | (1,007) | (1,255) | - | (86) | 20,909 | 61,872 | (40,963) | (35,789) |

| 2021 | 1.58% | 25,076 | (1,055) | (1,421) | (26) | - | 22,573 | 30,990 | (8,417) | (44,206) |

|

||||||||||

5.7 Québec Parental Insurance Plan (QPIP) Reduction for 2021

EI MP benefits included in Part I special benefits, as well as direct EI administrative costs incurred to provide MP benefits (variable administration costs (VAC)), are required to determine the QPIP reduction. The VAC represent the direct operating costs incurred by the EI program associated with the administration of EI MP benefits outside Québec. They are determined each year by ESDC in accordance with the agreement between Canada and Québec, which stipulates a minimum VAC amount.

EI MP benefits are projected from the base year (2019) and reflect the impacts of any program changes and special measures. The projected EI MP expenditures used to determine the 2021 QPIP reduction are shown in Table 11. They include the cost estimates provided by ESDC for the new Parental Sharing Benefits implemented in March 2019 and the temporary measures recently announced by the Government aimed at facilitating access to EI benefits.

| Actual | Forecast | ||

|---|---|---|---|

| 2019 | 2020 | 2021 | |

| EI MP Benefits | 4,139 | 4,313 | 4,954 |

| Variable Administration Costs | 17 | 17 | 17 |

| MP Expenditures | 4,156 | 4,330 | 4,971 |

The QPIP reduction is equal to the ratio of EI MP expenditures (EI MP benefits and VAC) to the earnings base of residents of all provinces without a provincial plan, that is, residents of all provinces except Québec. It is the premium reduction for Québec residents as it relates to the savings to the EI Program resulting from the QPIP.

Table 12 shows the estimates of the variables that are required in the calculation of the 2021 QPIP reduction, as well as the resulting 2021 QPIP reduction.

| 2021 Forecast | |

|---|---|

| MP Expenditures | 4,971 |

| MP Earnings Base (Out-of-Québec residents) | 1,231,817 |

| Unrounded QPIP Reduction | 0.4035% |

| QPIP Reduction | 0.40% |

5.8 Qualified Wage-Loss Plan Reductions for 2021

Based on the methodology developed in Appendix B and on the 2021 projected insurable earnings of employees covered by a qualified wage-loss plan, the 2021 estimated reduction in employer premiums due to qualified wage-loss plans is $1,055 million, compared to $1,007 million for 2020.

Table 13 shows the main results. A detailed explanation of the data and methodology used to derive the results are available in Appendix E.

| Wage-Loss Plan Category |

Unrounded Rate of Reduction |

Rounded Rate of Reduction |

Employer Multiplier (Out-of-Québec)Table 13 - Footnote * |

Employer Multiplier (Québec)Table 13 - Footnote * |

2021 Estimated Insurable Earnings ($ million) |

2021 Estimated Premium Reduction ($ million) |

|---|---|---|---|---|---|---|

| Category 1 | 0.2254% | 0.23% | 1.257 | 1.209 | 51,771 | 117 |

| Category 2 | 0.3704% | 0.37% | 1.166 | 1.086 | 25,785 | 96 |

| Category 3 | 0.3683% | 0.37% | 1.166 | 1.086 | 202,476 | 746 |

| Category 4 | 0.4048% | 0.40% | 1.144 | 1.057 | 24,049 | 97 |

| Total | N/A | N/A | N/A | N/A | 304,081 | 1,055 |

|

||||||

6. Uncertainty of Results

The 7-year forecast break-even rate and the subsequent impact on the EI Operating Account (EIOA) depends on different demographic and economic factors. The age distribution of the Canadian population has changed considerably over the last decades; the average age has been increasing as the baby boom cohorts have continued to age, the fertility rate has remained low and longevity has been increasing. Larger numbers of young people have chosen to pursue higher levels of education, delaying their full-time entry into the workforce. These changes have had a direct impact on the labour force. Countering these effects have been factors such as younger cohorts’ greater attachment to the labour force due to their higher level of education and older workers delaying their retirement due to their expected increase in longevity.

Economic cycles have also had an impact on the labour force and the unemployment rate. In times of recession, jobs were lost and workers found themselves involuntarily unemployed, while in times of growth, more workers were needed and wages tended to increase as companies competed for qualified labour. The current health and economic crisis resulting from the COVID-19 pandemic created an unprecedented shock to the Canadian labour market. The situation remains fluid and will likely continue to evolve for some time. The final impacts on the assumptions used in this report are still unknown.

The objective of this section is to illustrate the sensitivity of the 7-year forecast break-even rate to changes in the unemployment rate and the recipiency rate assumptions. Afterwards, the effect of a variation in the premium rate on the EIOA is examined.

6.1 Unemployment Rate

The unemployment rate is closely related to the state of the economy and the supply of labour. The following table shows that a variation in the average unemployment rate of 0.5% over the period 2021-2027 would result in an increase/decrease of about 0.07% in the 2021 EI 7‑year forecast break-even rate (assuming all other assumptions remain constant).

| Variation in Average UR (2021-2027) |

Average UR (2021-2027) |

Resulting 7-Year Forecast Break-Even Rate |

|---|---|---|

| (1.0%) | 5.3% | 1.79% |

| (0.5%) | 5.8% | 1.86% |

| Base | 6.3% | 1.93% |

| 0.5% | 6.8% | 2.00% |

| 1.0% | 7.3% | 2.07% |

6.2 Recipiency Rate

The volatility shown by the recipiency rate in the past can be attributed to a number of factors, such as the decision of those eligible for EI to apply (or not) for the benefit. The following table shows that a variation in the average recipiency rate of 5% over the period 2021-2027 would result in an increase/decrease of about 0.06% in the 2021 EI 7-year forecast break-even rate (assuming all other assumptions remain constant).

| Variation in Average RR (2021-2027) |

Average RR (2021-2027) |

Resulting 7-Year Forecast Break-Even Rate |

|---|---|---|

| (10.0%) | 63.9% | 1.81% |

| (5.0%) | 68.9% | 1.87% |

| Base | 73.9% | 1.93% |

| 5.0% | 78.9% | 1.98% |

| 10.0% | 83.9% | 2.04% |

6.3 Premium Rate

As shown in the following table, a variation in the premium rate of one‑hundredth percentage point (0.01% of insurable earnings) from the 7-year forecast break-even rate would result in a $1,253 million increase/decrease in the cumulative balance of the EIOA at the end of the 7‑year forecast period.

| Variation in EI 7-Year Forecast Break-Even Rate |

Resulting EI 7-Year Forecast Break-Even Rate |

Cumulative EIOA Balance as at 31 Dec. 2027 ($ million) |

Variation in EIOA Cumulative Balance as at 31 Dec. 2027 ($ million) |

|---|---|---|---|

| (0.05%) | 1.88% | (5,838) | (6,267) |

| (0.01%) | 1.92% | (824) | (1,253) |

| Base | 1.93% | 429 | - |

| 0.01% | 1.94% | 1,682 | 1,253 |

| 0.05% | 1.98% | 6,695 | 6,267 |

7. Reconciliation of Changes in the 7-Year Forecast Break‑Even Rate

The main elements of change in the 7-year forecast break-even rate since the 2020 Actuarial Report are presented in Table 17.

| 7-Year Forecast Break-Even Rate (%) |

|

|---|---|

| 2020 Actuarial Report - After Rounding | 1.58 |

| 2020 Actuarial Report - Before Rounding | 1.5764 |

| Higher than Projected EI Operating Account as at 31 December 2019 | (0.0086) |

| Change in Unemployment Rate assumptions over 7-year period | 0.1398 |

| Changes in Economics - Earnings Base | 0.0053 |

| Changes in Economics - Expenditures | (0.1235) |

| EI - Emergency Response Benefit | 0.2888 |

| Temporary Measures - Transition from CERB/EI ERB | 0.0611 |

| Change in 7-year period (2020-2026 to 2021-2027) | (0.0129) |

| 2021 Actuarial Report - Before Rounding | 1.9265 |

| 2021 Actuarial Report - After Rounding | 1.93 |

The 2019 experience was better than anticipated overall as revenues were slightly higher than projected in the 2020 Actuarial Report while expenditures were lower than expected. The net effect is an increase in the Cumulative Surplus of the EI Operating Account as at 31 December 2019 of $1,053 million, i.e. $5,174 million compared to $4,121 million projected in the 2020 Actuarial Report. This lowered the 7‑year forecast break-even rate.

As shown in the sensitivity test section, the unemployment rate assumption has a significant impact on the 7-year forecast break-even rate. In comparison with the 2020 Actuarial Report, the unemployment rate assumption was revised upward, from around 5.8% to 6.9% on average for the 2020-2026 period. The increase of the expected unemployment rate in the short term is due to the health and economic crisis resulting from the COVID-19 pandemic. This increased the 7-year forecast break-even rate.

Although the unemployment rate reached a record high in May 2020 and is expected to remain higher than the previous report’s projection for the next few years, the total amount of normal EI benefit expenditures for the projection period is similar to the previous report since unemployed Canadians were covered by the emergency response benefits (CERB and EI ERBFootnote 1) put in place as part of the Government of Canada’s COVID-19 Economic Response Plan. In the above table, this is reflected in the item “Changes in Economics – Expenditures”. The estimated cost of the EI ERB significantly increased the 7-year forecast break-even rate, accounting for more than 80% of the total increase.

The Government has confirmed the introduction of temporary transition measures aimed at facilitating access to EI. These measures include the application of a minimum unemployment rateFootnote 7 and a minimum weekly benefit rate, as well as a credit of insurable hours for regular and special EI benefits. These measures increased the 7-year forecast break-even rate.

Overall, the 7-year forecast break‑even rate increased from 1.58% in 2020 to 1.93% in 2021. However, as already mentioned, the Government confirmed that it will freeze the EI premium rate at 1.58% in 2021.

8. Conclusion

This report was prepared by the Actuary in accordance with the relevant legislation and provides to the Commission the forecasts and estimates for the purposes of sections 4 (MIE), 66 (EI premium rate) and 69 (employers who sponsor qualified wage-loss plans and premium reductions for Québec residents and their employers) of the EI Act.

In accordance with the methodology detailed in the EI Act and the relevant economic data, the 2021 MIE is $56,300. In addition, the 2021 estimated employer premium reduction due to qualified wage-loss plans is $1,055 million, and the 2021 QPIP reduction is 0.40%.

Based on the assumptions of the relevant economic and demographic variables provided by the Minister of Finance, on the expenditure estimates provided by the Minister of ESD, and on the methodology and other assumptions developed by the Actuary, the 7-year forecast break-even rate that would generate sufficient premium revenue to cover the expected cost of the EI program for the period 2021-2027 and eliminate the projected $35.8 billion cumulative deficit in the EI Operating Account as of 31 December 2020, is 1.93% of insurable earnings. The increase between the 2020 and 2021 forecast break-even rate (1.58% to 1.93%) is the result of the situation created by the COVID-19 pandemic. Based on estimates received from ESDC, the largest part of this increase (0.29%) can be attributed to the EI ERBFootnote 1. Another portion of the increase (0.06%) can be attributed to the upcoming temporary measures recently announced by the Government to help people transition from the CERB and the EI ERB to EI.

However, the Government already confirmed that it will freeze the EI premium rate for 2021 at the 2020 premium rate. Consequently, the 2021 premium rate will be equal to:

- 1.58% of insurable earnings for residents of all provinces except Québec; and