Office of the Superintendent of Financial Institutions 2024–25 Departmental plan

Office of the Superintendent of Financial Institutions

2024–25 Departmental Plan

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

© His Majesty the King in Right of Canada, as represented by the Minister of Finance, 2024

ISSN 2371-7343

From the Superintendent

Peter Routledge

Superintendent of the Office of the Superintendent of Financial Institutions

I am pleased to present the 2024-25 Departmental Plan for the Office of the Superintendent of Financial Institutions (OSFI). This report shows what we plan to do during the upcoming year and the results we expect to achieve.

What we do

Our purpose is to contribute to public confidence in the Canadian financial system by regulating and supervising approximately 400 federally regulated financial institutions (FRFIs) and 1,200 federally regulated pension plans (FRPPs).

We also house the Office of the Chief Actuary (OCA). This independent body provides a range of independent actuarial valuation and advisory services to the federal government. This includes actuarial reports on the Canada Pension Plan (CPP), the Old Age Security Program, and the Canada Student Financial Assistance Program. Although the Chief Actuary reports to the superintendent, they are solely responsible for the content and actuarial opinions in the reports.

Review of 2023-24 fiscal year

Some financial systems outside Canada came under stress this year, and, once again, Canada's financial system stood out for its resiliency during these events. We see this outcome as the product of good governance at FRFIs and FRPPs and effective regulation and supervision by OSFI. This is important because Canada's resilient financial system contributes significantly to economic growth and because many Canadian financial institutions are global leaders in their industries which means that OSFI's performance is important to Canada's international peers.

Our success in contributing to public confidence in Canada’s financial system arises from a responsible, principles-based application of domestic and international regulatory standards to the supervision and regulation of FRFIs and FRPPs in Canada.

OSFI’s Departmental Plan for 2024-25

OSFI funds its activities through fees charged directly to the FRFIs and FRPPs that it supervises, recovering virtually all its costs directly from these entities. Despite this, OSFI will deliver on the direction in Budget 2023 to reduce planned administrative expenses by 3% over the next three fiscal years, and reduce spending on consulting, other professional services, and travel by 15%. We are committed to fiscal restraint.

In addition to meeting our responsibility for fiscal restraint, we will also meet the opportunity presented by Parliament’s expansion of OSFI’s mandate in Budget 2023. OSFI now has duties that extend the historic definition of financial resilience, covering protection against integrity and security threats, including foreign interference. This new mandate will require skillsets not currently present at OSFI as well as capital investments and non-personnel expenditures. In addition, OSFI is working jointly with the Bank of Canada and the Canada Deposit Insurance Corporation (CDIC) to rationalize, modernize, and consolidate the collection of financial institution data.

Looking ahead

As the risks to Canada’s financial system continue to grow in the year ahead, we will act early when we see risks develop and provide transparency about our actions.

I’m confident the work we have planned for 2024-25 will allow us to consistently deliver on our promise to Canadians: to protect the rights and interests of depositors, policyholders and creditors of FRFIs and FRPPs, while allowing those institutions to compete effectively and take reasonable risks.

Peter Routledge

Superintendent

Plans to deliver on core responsibilities and internal services

Core responsibilities and internal services

Financial Institution and Pension Plan Regulation and Supervision

Description

The Office of the Superintendent of Financial Institutions (OSFI) advances a regulatory framework designed to control and manage risk to federally regulated financial institutions (FRFIs) and private pension plans (FRPPs) and evaluates system-wide or sectoral developments that may have a negative impact on their financial condition. It also supervises financial institutions and pension plans to determine whether they are in sound financial condition and meeting regulatory and supervisory requirements. The Office promptly advises financial institutions and pension plan administrators if there are material deficiencies, and takes corrective measures or requires that they be taken to expeditiously address the situation. It acts to protect the rights and interests of depositors, policyholders, financial institution creditors and pension plan beneficiaries, while having due regard for the need to allow financial institutions to compete effectively and take reasonable risks.

Quality of life impacts

This core responsibility contributes to the “Good Governance” domain of the Quality of Life Framework for Canada and, more specifically, “Confidence in institutions”, through all of the activities mentioned in the core responsibility description.

Results and targets

The following tables show, for each departmental result related to Financial Institution and Pension Plan Regulation and Supervision, the indicators, the results from the three most recently reported fiscal years, the targets and target dates approved in 2024–25.

Table 1: Indicators, results and targets for departmental result federally regulated financial institutions and private pensions plans are in sound financial condition

|

Indicator

|

2020–2021 result

|

2021–2022 result

|

2022–2023 result

|

Target

|

Date to achieve

|

|---|---|---|---|---|---|

|

% of financial institutions with a Composite Risk Rating of low or moderate.

|

96%

|

96%

|

96%

|

At least 80%

|

March 31, 2025

|

|

Number of financial institutions for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three-month period.

|

0

|

0

|

1 or less

|

March 31, 2025

|

|

|

Number of pension plans for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three-month period.

|

0

|

1

|

1 or less

|

March 31, 2025

|

|

|

Table 1 footnotes

|

|||||

Table 2: Indicators, results and targets for departmental result regulatory and supervisory frameworks contribute to the safety and soundness of the Canadian financial system

|

Indicator

|

2020–2021 result

|

2021–2022 result

|

2022–2023 result

|

Target

|

Date to achieve

|

|---|---|---|---|---|---|

|

The Office of the Superintendent of Financial Institutions’ level of compliance with the International Monetary Fund’s Financial Sector Assessment Program core principles.

|

N/A

|

N/A

|

100%

|

March 31, 2026

|

|

|

The Office of the Superintendent of Financial Institutions’ level of compliance with Basel standards as assessed by the Regulatory Consistency Assessment Programme of the Bank for International Settlements.

|

N/A

|

N/A

|

90%

|

March 31, 2025

|

|

|

Table 2 footnotes

|

|||||

The financial, human resources and performance information for OSFI’s program inventory is available on GC InfoBase.

Plans to achieve results

Deliver upon our expanded mandate by aligning our supervisory and regulatory frameworks to help ensure FRFIs address risks to their integrity and security.

Implementing OSFI’s New Mandate

The government introduced a new mandate to OSFI in Budget 2023 to ensure FRFIs manage risks to their integrity and security responsibly. The previous plan did not include resources dedicated to fulfilling the new mandate obligation. This is notable because the implementation of the new mandate, including the development and issuance of guidance, commenced in 2023-24. While OSFI has made a substantial reallocation of internal resources to implement the new mandate, we require new skillsets in 2024-27 to ensure a responsible implementation, including:

- Creating a new unit within our organizational structure that focuses on National Security and building up OSFI’s capacity and capability to collaborate with security and intelligence departments and agencies, and to provide effective advice to the Superintendent and the Minister regarding national security and foreign interference in the financial sector.

- Building integrity and security guidance with new frameworks and guidelines, and obtaining necessary legislative tools needed to fulfil this expanded mandate.

- Developing supervisory expectations to guide supervisors to supervise effectively against key non-financial risk guidelines.

- Fostering the understanding of our role and expectations related to integrity and security among key stakeholders and the public.

- Establishing effective risk surveillance and oversight, governance enablement, data requirements, a reporting performance framework and internal audit oversight related to the new mandate.

- Developing processes to apply expanded intervention responsibilities effectively.

Resources included in this plan to implement the new mandate requirements have been carefully considered to be aligned with the disciplined approach to government spending. Given how significant this new mandate is, it will take some time to assess the sufficiency of these new initiatives and planned resources beyond 2024-2025. OSFI will continue to implement an agile resource management approach, reallocating resources internally first, before increasing budget requirements associated with the new mandate implementation in future years.

Continue to renew our supervisory actions to ensure we have the capacity and capability to provide effective supervision and timely interventions supported by a mature, risk-based framework.

In 2024-25, we will also continue to ensure that supervisory actions are delivered using sound judgement and informed decision-making. In renewing our approach to supervision, we will advance the standardization and simplification of supervisory methods, practices, and processes. To do so, we will:

- Work towards implementing a Supervision Apprenticeship Program aimed at developing and maturing specialized skills of new OSFI supervisors. This will include establishing a robust onboarding program, comprehensive training material, and a respected apprenticeship model to grow and develop our talent.

- Demonstrate accountability through consistent quality assurance.

- Utilize tools and technologies to help supervisors assess risk and intervene early through supporting the implementation of a new Supervisory Framework, effective April 1, 2024.

- Develop supervisory and regulatory policy to support the operational and financial resilience of FRFIs.

- Supervise the application of key policies and practices by FRFIs to ensure consistency with international standards and domestic modifications.

Carry out critical functions while responding to uncertainty and emerging risks to ensure FRFIs are in sound financial condition, FRPPs are meeting the minimum funding requirements and that social security programs and public sector pension and insurance arrangements remain sound and sustainable for Canadians.

We will conduct effective supervision of FRFIs and FRPPs, being reflective of risks and the shifting environment, while also delivering risk-aware advice and regulatory guidance. As part of this work, we will:

- Ensure supervision of FRFIs and FRPPs is informed by robust risk analytics, consistent with OSFI’s Risk Appetite Statement (RAS) and the Annual Risk Outlook (ARO).

- Conduct our supervisory and regulatory activities such as targeted monitoring, revisions to guidance, and assessments. We will do so in line with the ARO, responding to key areas of focus in the risk environment to ensure FRFIs and FRPPs remain prudentially sound.

- Contribute to the stability of the financial system through regular reviews and announcements of the Minimum Qualifying Rate and the Domestic Stability Buffer.

Key risks

Our ARO provides a forward-looking systemic view of the most material risks facing FRFIs, FRPPs, and Canada’s financial system. Through our supervisory and regulatory response, we aim to efficiently mitigate significant financial risks, including those associated with a housing market downturn, liquidity and funding, and commercial real estate. Additionally, we will monitor non-financial risks such as governance, culture and cyber risks facing FRFIs and FRPPs, while also actively managing our internal risks. Our dedicated Enterprise Risk Management (ERM) function provides oversight and monitoring for all risks in accordance with the RAS.

Snapshot of planned resources in 2024–25

- Planned spending: $185,309,931

- Planned full-time resources: 811

Related government priorities

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

To contribute to public confidence in the Canadian financial system, OSFI pursues sustainable development in accordance with its prudential mandate, as climate-related risks are drivers of financial and non-financial risks for FRFIs. Our contributions to the Federal Sustainable Development Strategy and three UN Sustainable Development Goals (SDGs), being SDG 10, 12, and 13, stem from our prudential policy making and supervisory activities, along with our internal operations. In 2024-25, we will develop and table a report that provides an update to our 2023-2027 Departmental Sustainable Development Strategy.

More information on OSFI’s contributions to Canada’s Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in our Departmental Sustainable Development Strategy.

Program inventory

Financial Institution and Pension Plan Regulation and Supervision is supported by the following programs:

- Risk Assessment and Intervention – Federally Regulated Financial Institutions

- Regulation and Guidance of Federally Regulated Financial Institutions

- Regulatory Approvals and Legislative Precedents

- Federally Regulated Private Pension Plans

Supporting information on planned expenditures, human resources, and results related to OSFI’s program inventory is available on GC InfoBase.

Actuarial Services to Federal Government Organizations

Description

The Office of the Chief Actuary (OCA) provides a range of actuarial services, including statutory actuarial valuations required by legislation and checks and balances on the future costs of programs for the Canada Pension Plan, Old Age Security, Employment Insurance and Canada Student Loans programs, as well as pension and benefits plans covering the Federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police, federally appointed judges, and Members of Parliament.

Quality of life impacts

This core responsibility contributes to the “Good Governance” domain of the Quality of Life Framework for Canada and, more specifically, “Confidence in institutions”, through all of the activities mentioned in the core responsibility description.

Results and targets

The following tables show, for each departmental result related to Actuarial Services to Federal Government Organizations, the indicators, the results from the three most recently reported fiscal years, the targets and target dates approved in 2024–25.

Table 3: Indicators, results and targets for departmental result stakeholders receive accurate and high-quality actuarial information on the cost of public programs and government pension and benefit plans

|

Indicator

|

2020–2021 result

|

2021–2022 result

|

2022–2023 result

|

Target

|

Date to achieve

|

|---|---|---|---|---|---|

|

% of members of a panel of Canadian peer actuaries that deem the Canada Pension Plan actuarial valuation accurate and of high quality

|

100%

|

N/A

|

100% Agreement among all three members of peer review panel

|

March 31, 2025

|

|

|

% of public pension and insurance plan valuations that are deemed accurate and high quality

|

100%

|

100%

|

100%

|

100%

|

March 31, 2025

|

|

Table 3 footnotes

|

|||||

The financial, human resources and performance information for OSFI’s program inventory is available on GC InfoBase.

Plans to achieve results

Carry out critical functions while responding to uncertainty and emerging risks to ensure FRFIs are in sound financial condition, FRPPs are meeting the minimum funding requirements and that social security programs and public sector pension and insurance arrangements remain sound and sustainable for Canadians

The OCA contributes to financial system oversight by helping to ensure that social security programs and public sector pension and insurance arrangements remain sound and sustainable for Canadians. In 2024-25, the OCA will deliver high-quality actuarial services to the Government of Canada by:

- Developing a coordinated approach towards strategic stakeholder management by continuing its work on clarifying its authorities and modernizing its financing model.

- Beginning work on the triennial Actuarial Report on the Canada Pension Plan (CPP) as at 31 December 2024, which projects CPP revenues and expenditures over a 75-year period in order to assess the future impact of historical and projected demographic and economic trends.

- As part of the preparatory work, the OCA will organize an inter-disciplinary seminar on Demographic, Economic and Investment Perspectives for Canada attended by representatives from federal, provincial, and territorial governments in September 2024.

- Ensuring the provision of high-quality actuarial information on the cost of public programs and government pension and benefit plans by submitting the following actuarial reports to the President of Treasury Board for tabling before Parliament in 2024-25:

- Actuarial Report on the Pension Plan for the Public Service of Canada as at 31 March 2023

- Actuarial Report on the Public Service Death Benefit Account as at 31 March 2023

- Submitting the 2025 Actuarial Report on the Employment Insurance Premium Rate to the Canada Employment Insurance Commission to be tabled before Parliament in 2024-25.

- Submitting the Actuarial Report on the Canada Student Financial Assistance Program as at 31 July 2023 to the Minister of Employment, Workforce Development and Official Languages to be tabled before Parliament in 2024-25.

- Submitting various actuarial reports for the purpose of Public Accounts of Canada, presenting the obligations and costs, as at 31 March 2024, associated with federal public sector pension and benefit plans including future benefits to veterans.

- Preparing the Actuarial Report on the Government Annuities as at 31 March 2024 and the Actuarial Report on the Civil Service Insurance Program as at 31 March 2024.

- Publishing an actuarial study in 2024-25 on the potential impacts of climate change on the plans and programs under the responsibility of the OCA.

- Assisting several government departments in designing, funding, and administering the plans and programs for which they are responsible. Client departments include:

- Federal and provincial Departments of Finance, Employment and Social Development Canada, Treasury Board Secretariat, Veterans Affairs Canada, National Defence, Royal Canadian Mounted Police, the Department of Justice, and Public Services and Procurement Canada (PSPC).

Snapshot of planned resources in 2024–25

- Planned spending: $12,530,230

- Planned full-time resources: 57

Program inventory

Actuarial Services to Federal Government Organizations is supported by the following programs:

- Actuarial Valuation and Advice

Supporting information on planned expenditures, human resources, and results related to OSFI’s program inventory is available on GC InfoBase.

Internal services

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Plans to achieve results

Deliver upon our expanded mandate by aligning our supervisory and regulatory frameworks to help ensure FRFIs address risks to their integrity and security.

This plan seeks to enhance some of our internal services by improving tools, systems, and authorities to support both the core responsibilities and the expanded mandate. We will broadly enhance our physical and virtual infrastructures to support the expectations surrounding our new mandate requirements. This will include building IT systems and processes in support of a classified space and working alongside the security and intelligence community across the government of Canada to address risks of foreign interference against FRFIs.

Embed a culture within our organization that ensures our employees can thrive in an ever-changing and uncertain environment and embrace our critical success factors of grit, integrity, and urgency in all aspects of our work.

In order to effectively support employees through changing conditions, we will embed and uphold a culture at OSFI that will provide employees with the tools to thrive. In 2024-25, we will:

- Modernize onboarding and orientation practices for new employees by implementing new frameworks.

- Develop a change management strategy relating to culture.

- Conduct a Gender-based Analysis (GBA) Plus review and pilot, and develop culture metrics as part of our diversity, equity, and inclusion (DEI) strategy and objectives.

- Continue to implement our future of hybrid work model, including the modernization of office workspaces.

- Leverage innovation, experimentation, knowledge sharing, and enabling technology while fostering a sense of shared purpose.

Advance leading-edge data management, collection, and analytical capabilities and systems.

Data Collection Modernization (DCM)

The DCM project is a crucial foundation for collecting high-quality data that is more relevant, timely, standardized, and granular as we adapt to changes in the risk environment. We are leading the tri-agency initiative alongside the Bank of Canada and the Canada Deposit Insurance Corporation to modernize regulatory data collection for FRFIs and FRPPs. As part of the DCM initiative, we will add capacity and develop and implement a strategy for the replacement of the Regulatory Return System. Additionally, we will assess existing regulatory data for opportunities to enhance and implement an industry engagement model to support and drive overall adoption. This project will allow us to be consistent with initiatives currently underway with international peers and ensure that the collection of data is not disrupted. We will work with the industry throughout this initiative to understand implications and adapt accordingly.

In 2024-25, we will continue to develop OSFI as a risk-aware, proactive regulator that uses leading data and analytics capabilities in decision-making. To achieve that, we will:

- Implement the OSFI Data Literacy Strategy to establish a new competency for learning and development opportunities and enhance technical data skills throughout the organization.

- Continue the development of the IM/IT Strategy covering objectives such as data accessibility, transformation enablement, and advanced technology introductions.

Moreover, we will continue to build data-driven delivery of legislative obligations to Financial Information Committee (FIC)

- Continue the optimization of data access, use, governance, and management practices across internal data and technology platforms.

- Build out analytical capabilities such as implementation of the Vision 2030 Data and Analytics Strategy and launch of the Analytics Advisory Committee.

Maintain and continue to build upon our operational resilience to deliver critical functions despite adversity and uncertainties and remain agile in our response to current and emerging threats and opportunities.

We will actively continue developing capacity and capabilities to deliver critical functions including responding to crisis events through key activities. We will:

- Deploy OSFI’s ERM and governance functions through the roll out of the ERM plan, which includes change management considerations and second line challenge functions.

- Deliver coordinated stakeholder engagement by establishing a formal strategic stakeholder relations function.

- Continue the implementation of strategies that deliver enterprise-wide solutions in support of our day-to-day corporate functions such as human resources, internal finance, IM/IT solutions, and corporate security.

Snapshot of planned resources in 2024-25

- Planned spending: $124,097,700

- Planned full-time resources: 430

Related government priorities

Planning for contracts awarded to Indigenous businesses

OSFI continues to support the Government of Canada’s commitment to achieve the 5% target of contract spend with Indigenous businesses through diligent efforts when contracting for both goods and services. When contracting for goods, and in particular IT goods and office furniture, we will continue to identify Indigenous suppliers holding Supply Arrangements or Standing Offers with PSPC and Shared Services Canada for the required goods to the greatest extent possible. When contracting for services using a competitive selection method with PSPC Supply Arrangements, we will take steps to ensure an increase in Indigenous business participation. Specifically, we will ensure the solicitation invitation includes pre-qualified Indigenous suppliers whenever there is capacity available for the services required. When feasible, we will use a voluntary set-aside, or will conditionally set the requirement aside, for Indigenous business to bid on, should there be sufficient Indigenous business capacity for the requirement(s). In addition, our procurement team has been consulting internally with the significant users of competitive service contracts, to educate and ensure support and endorsement for the approach to increase Indigenous business participation in future procurement solicitations. Collectively, these focused efforts will help our organization to continue to achieve the departmental target.

In planning for future results, it is assumed that OSFI will successfully increase Indigenous business participation amongst solicitations for service contracts awarded in 2023-24 and that this level of engagement will be maintained in 2024-25. The expected increase in services contracts awarded to Indigenous businesses, coupled with planned procurement of IT goods and office furniture will be the primary drivers enabling us to meet our 5% spend target. It should be noted that we adjusted our 2023-24 planned Indigenous procurement target, which was originally set at 7.5%, decreasing it to 5% based on changes to the timing of larger planned expenditures on office furniture.

Table 4: Planning for contracts awarded to Indigenous businesses

|

5% reporting field

|

2022-23 actual result

|

2023-24 forecasted result

|

2024-25 planned result

|

|---|---|---|---|

|

Total percentage of contracts with Indigenous businesses

|

5.88%

|

5%

|

5%

|

Planned spending and human resources

This section provides an overview of OSFI’s planned spending and human resources for the next three fiscal years and compares planned spending for 2024–25 with actual spending from previous years.

Spending

Table 5: Actual spending summary for core responsibilities and internal services ($ dollars)

The following table shows information on spending for each of OSFI’s core responsibilities and for its internal services for the previous three fiscal years. Amounts for the current fiscal year are forecasted based on spending to date.

|

Core responsibilities and internal services

|

2021–2022 actual expenditures

|

2022–2023 actual expenditures

|

2023–2024 forecast spending

|

|---|---|---|---|

|

1. Financial Institution and Pension Plan Regulation and Supervision

|

115,971,511

|

125,838,034

|

155,331,658

|

|

2. Actuarial Services to Federal Government Organizations

|

8,054,564

|

10,042,756

|

10,871,419

|

|

Subtotal

|

124,026,075

|

135,880,790

|

166,203,077

|

|

Internal services

|

83,602,340

|

103,865,350

|

146,035,391

|

|

Total

|

207,628,415

|

239,746,140

|

312,238,468

|

Explanation of table 5

Overall spending increases of 15.5% in 2022-23 and 30.2% in 2023-24 are largely driven by the implementation of OSFI’s Blueprint and the 2022-2025 Strategic Plan as outlined in OSFI’s 2023-24 Departmental Plan.

Forecast spending for 2023-24 of $312.2M exceeds the planned spending outlined in the 2023-24 Departmental Plan ($294.7M) by $17.5M. This variance includes economic adjustments for collective agreements ($14.1M), spending related to OSFI’s new mandate ($4.4M), offset by $1.0M in reductions to be realized as part of refocusing government spending announced in Budget 2023. The reductions were achieved through savings in travel, hospitality and discretionary professional services. Planned spending for these items was not included in the 2023-24 Departmental Plan.

Economic adjustments related to collective agreements included within the 2023-24 Departmental Plan were based on a compounded 1.5% rate adjustment; however, the compounded rate increases recently negotiated by various public service bargaining groups were higher (4.75% in 2022-23, 3.5% in 2023-24, and 2.25% in 2024-25). These increases are non-discretionary and a normal course of operational budget growth. The core public service follows a similar approach whereby appropriated departments’ and agencies’ budget levels increase as collective agreements are ratified and signed.

OSFI’s new mandate was announced in Budget 2023 to ensure FRFIs manage risks to their integrity and security responsibly. Implementation of the new mandate, including the development and issuance of guidance, commenced in 2023-24 to position OSFI to have required elements in place for January 1, 2024.

Further information on the new mandate can be found in the plans to achieve results sections of this Departmental Plan.

Table 6: Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of OSFI’s core responsibilities and for its internal services for the upcoming three fiscal years.

|

Core responsibilities and internal services

|

2024-25 budgetary spending (as indicated in Main Estimates)

|

2024-25 planned spending

|

2025-26 planned spending

|

2026-27 planned spending

|

|---|---|---|---|---|

|

1. Financial Institution and Pension Plan Regulation and Supervision

|

185,309,931

|

185,309,931

|

197,343,671

|

199,147,413

|

|

2. Actuarial Services to Federal Government Organizations

|

12,530,230

|

12,530,230

|

13,535,414

|

13,690,292

|

|

Subtotal

|

197,840,161

|

197,840,161

|

210,879,085

|

212,837,705

|

|

Internal services

|

124,097,700

|

124,097,700

|

123,151,724

|

124,584,147

|

|

Total

|

321,937,861

|

321,937,861

|

334,030,809

|

337,421,852

|

Explanation of table 6

Planned spending for 2024-25 and 2025-26 of $321.9M and $334.0M, respectively, represent increases of $37.0M (13.0%) and $51.9M (18.4%) versus planned spending for these fiscal years as outlined in OSFI’s 2023-24 Departmental Plan.

Additional new spending of $26.8M for 2024-25, $41.7M in 2025-26 and $41.0M in 2026-27 are reflected for new priorities arising subsequent to the tabling of the 2023-24 Departmental Plan, and primarily includes requirements related to the operationalization of OSFI’s new integrity and security mandate and the DCM project.

In particular, OSFI’s new mandate will require significant investment of $22.9M in 2024-25, $32.6M in 2025-26, and $31.7M in 2026-27 to create capacity and enable operations with other Government of Canada security partners by creating secure physical and digital infrastructure.

The DCM project, which is a tri-agency initiative alongside the Bank of Canada and the Canada Deposit Insurance Corporation to modernize regulatory data collection for FRFIs and FRPPs, will increase OSFI’s planned spending by $2.1M in 2024-25, $5.9M in 2025-26 and $6.0M in 2026-27. Planned spending for DCM was not included in OSFI’s 2022-25 Strategic Plan as reasonable estimates were unavailable at that time.

In addition to requirements for the new mandate and DCM, planned spending includes $14.8M in 2024-25, $16.4M in 2025-26 and $17.7M in 2026-27 for economic increases to cover anticipated collective bargaining increases for employees based on recently ratified agreements within the core public service.

These increases are offset by reductions to be realized as part of refocusing government spending announced in Budget 2023 and amount to $4.6M in 2024-25, $6.3M in 2025-26 and $8.8M in 2026-27.

Funding

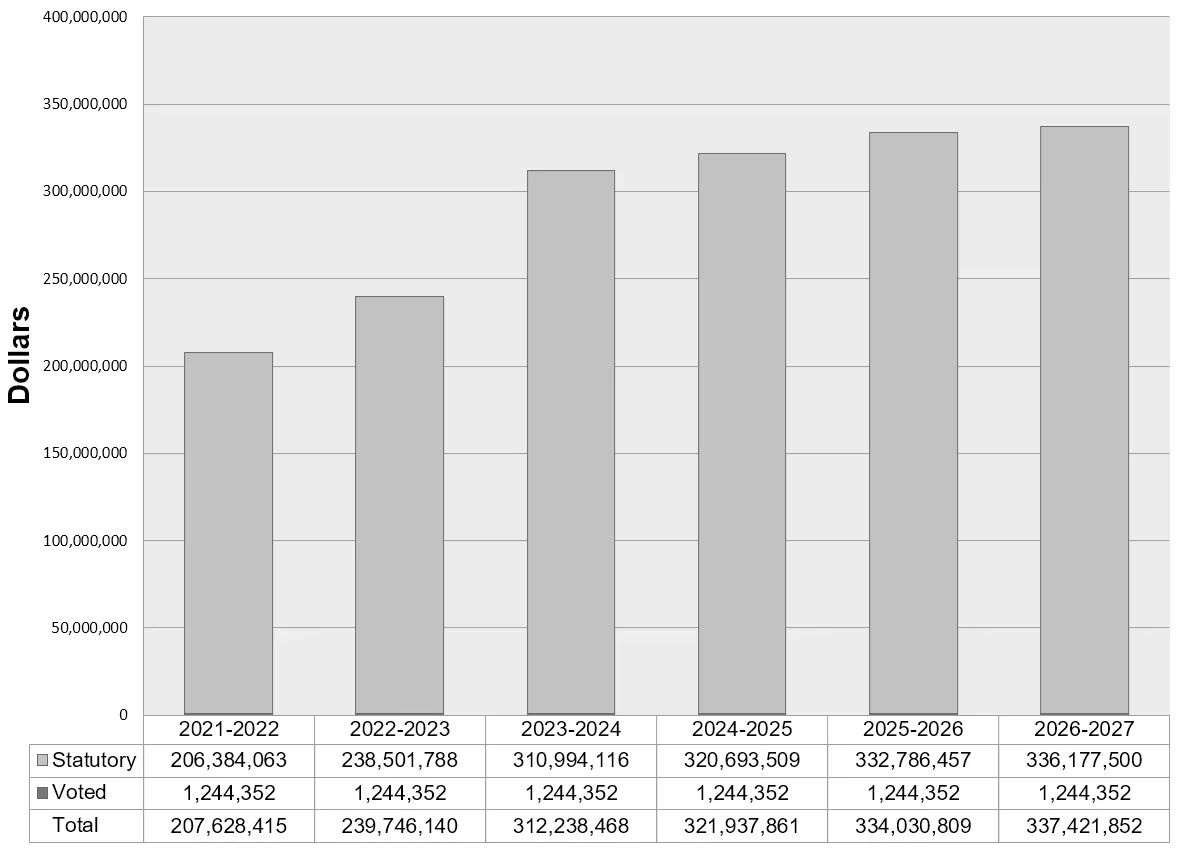

Departmental spending 2021–22 to 2026–27

The following graph presents planned spending (voted and statutory expenditures) over time.

Text description of figure 1

| Fiscal year | 2021-2022 | 2022-2023 | 2023-2024 | 2024-2025 | 2025-2026 | 2026-2027 |

|---|---|---|---|---|---|---|

| Statutory | 206,384,063 | 238,501,788 | 310,994,116 | 320,693,509 | 332,786,457 | 336,177,500 |

| Voted | 1,244,352 | 1,244,352 | 1,244,352 | 1,244,352 | 1,244,352 | 1,244,352 |

| Total | 207,628,415 | 239,746,140 | 312,238,468 | 321,937,861 | 334,030,809 | 337,421,852 |

Explanation of figure 1

The graph above represents OSFI’s actual spending for 2021-22 and 2022-23, and current planned spending thereafter. Statutory expenditures, which are recovered from respendable revenue, represent over 99% of total expenditures. The remainder of OSFI’s spending is funded from a parliamentary appropriation for actuarial services related to federal public sector pension and benefit plans.

The significant increase in 2022-23 and 2023-24 reflects the implementation of OSFI’s Blueprint and the 2022-25 Strategic Plan. Starting in 2023-24, OSFI began implementation of its new mandate, as well as work on the DCM project. Incremental spending for the new mandate and DCM are further reflected in fiscal years 2024-25 to 2026-27. Increased spending also reflects the impact of economic increases for collective bargaining, offset by the reductions for refocusing government spending initiative.

Estimates by vote

Information on OSFI’s organizational appropriations is available in the 2024-25 Main Estimates.

Future-oriented condensed statement of operations

The future-oriented condensed statement of operations provides an overview of OSFI’s operations for 2023–24 to 2024–25.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future-oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available at OSFI’s website.

Table 7: Future-oriented condensed statement of operations for the year ending March 31, 2025 (dollars)

|

Financial information

|

2023-24 forecast results

|

2024-25 planned results

|

Difference

(2024-25 planned results minus 2023-24 forecast results) |

|---|---|---|---|

|

Total expenses

|

313,727,465

|

324,143,453

|

10,415,988

|

|

Total revenues

|

312,483,113

|

322,899,101

|

10,415,988

|

|

Net cost of operations before government funding and transfers

|

1,244,352

|

1,244,352

|

- nil

|

Human resources

Table 8: Actual human resources for core responsibilities and internal services

The following table shows a summary of human resources, in full-time equivalents (FTEs), for OSFI’s core responsibilities and for its internal services for the previous three fiscal years. Human resources for the current fiscal year are forecasted based on year to date.

|

Core responsibilities and internal services

|

2021-22 actual FTEs

|

2022-23 actual FTEs

|

2023-24 forecasted FTEs

|

|---|---|---|---|

|

1. Financial Institution and Pension Plan Regulation and Supervision

|

583

|

621

|

768

|

|

2. Actuarial Services to Federal Government Organizations

|

40

|

45

|

50

|

|

Subtotal

|

623

|

666

|

818

|

|

Internal services

|

297

|

358

|

479

|

|

Total

|

920

|

1,024

|

1,297

|

Explanation of table 8

The growth in FTEs are mainly due to the implementation of OSFI’s 2022-25 Strategic Plan, which entails FTE increases across OSFI.

Table 9: Human resources planning summary for core responsibilities and internal services

The following table shows information on human resources, in full-time equivalents (FTEs), for each of OSFI’s core responsibilities and for its internal services planned for 2024-25 and future years.

|

Core responsibilities and internal services

|

2024–25 planned full-time equivalents

|

2025–26 planned full-time equivalents

|

2026–27 planned full-time equivalents

|

|---|---|---|---|

|

1. Financial Institution and Pension Plan Regulation and Supervision

|

811

|

809

|

809

|

|

2. Actuarial Services to Federal Government Organizations

|

57

|

58

|

58

|

|

Subtotal

|

868

|

867

|

867

|

|

Internal services

|

430

|

436

|

431

|

|

Total

|

1,298

|

1,303

|

1,298

|

Explanation of table 9

Through the 2024-25 to 2026-27 planning period, the incremental FTEs are required to deliver on the new mandate, predominantly in the Financial Institution and Pension Plan Regulation and Supervision core responsibility.

Corporate information

Organizational profile

Appropriate minister(s):

Chrystia Alexandra Freeland

Institutional head:

Peter Routledge

Ministerial portfolio:

Finance

Enabling instrument(s):

Office of the Superintendent of Financial Institutions Act (OSFI Act)

Year of incorporation / commencement:

1987

Organizational contact information

Mailing address:

Office of the Superintendent of Financial Institutions

255 Albert Street

Ottawa, Ontario K1A 0H2

Telephone:

1-800-385-8647

TTY:

1-800-465-7735

Fax:

1-613-990-5591

Email:

Website(s):

Supplementary information tables

The following supplementary information tables are available on OSFI’s website:

Information on OSFI’s departmental sustainable development strategy can be found on OSFI’s website.

Federal tax expenditures

OSFI’s Departmental Plan does not include information on tax expenditures.

Tax expenditures are the responsibility of the Minister of Finance. The Department of Finance Canada publishes cost estimates and projections for government wide tax expenditures each year in the Report on Federal Tax Expenditures.

This report provides detailed information on tax expenditures, including objectives, historical background and references to related federal spending programs, as well as evaluations, research papers and gender-based analysis plus.

Definitions

List of terms

- Appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- Budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- Core responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A document that sets out a department’s priorities, programs, expected results and associated resource requirements, covering a three‑year period beginning with the year indicated in the title of the report. Departmental Plans are tabled in Parliament each spring.

- Departmental result (résultat ministériel)

- A change that a department seeks to influence. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- Departmental result indicator (indicateur de résultat ministériel)

- A factor or variable that provides a valid and reliable means to measure or describe progress on a departmental result.

- Departmental results framework (cadre ministériel des résultats)

- A framework that consists of the department’s core responsibilities, departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department’s actual performance in a fiscal year against its plans, priorities and expected results set out in its Departmental Plan for that year. Departmental Results Reports are usually tabled in Parliament each fall.

- Full‑time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person‑year charge against a departmental budget. Full‑time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- Gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

- An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives. GBA Plus is a process for understanding who is impacted by the issue or opportunity being addressed by the initiative; identifying how the initiative could be tailored to meet diverse needs of the people most impacted; and anticipating and mitigating any barriers to accessing or benefitting from the initiative. GBA Plus is an intersectional analysis that goes beyond biological (sex) and socio-cultural (gender) differences to consider other factors, such as age, disability, education, ethnicity, economic status, geography, language, race, religion, and sexual orientation.

- Government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2024–25 Departmental Plan, government-wide priorities are the high-level themes outlining the government’s agenda in the 2021 Speech from the Throne: building a healthier today and tomorrow; growing a more resilient economy; bolder climate action; fighter harder for safer communities; standing up for diversity and inclusion; moving faster on the path to reconciliation and fighting for a secure, just, and equitable world.

- Horizontal initiative (initiative horizontale)

- An initiative in which two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- Indigenous business

- As defined on the Indigenous Services Canada website in accordance with the Government of Canada’s commitment that a mandatory minimum target of 5% of the total value of contracts is awarded to Indigenous businesses annually.

- Non‑budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- Performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- Plan (plan)

- The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

- Planned spending (dépenses prévues)

-

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- Program (programme)

- Individual or groups of services, activities or combinations thereof that are managed together within a department and that focus on a specific set of outputs, outcomes or service levels.

- Program inventory (répertoire des programmes)

- An inventory of a department’s programs that describes how resources are organized to carry out the department’s core responsibilities and achieve its planned results.

- Result (résultat)

- An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead, they are within the area of the organization’s influence.

- Statutory expenditures (dépenses législatives)

- Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- Target (cible)

- A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- Voted expenditures (dépenses votées)

- Expenditures that Parliament approves annually through an Appropriation Act. The vote wording becomes the governing conditions under which these expenditures may be made.