OSFI Annual report 2022-2023

April 1, 2022 to March 31, 2023

Office of the Superintendent of Financial Institutions (OSFI)

Chapter 1 – Message from the Superintendent

I, Peter Routledge, on behalf of the Office of the Superintendent of Financial Institutions (OSFI), present the annual performance statement of OSFI for the Fiscal Year 2022-23 reporting period, as required under the Bank Act, the Trust and Loan Companies Act, the Insurance Companies Act, the Cooperative Credit Associations Act, the Pension Benefits Standards Act and the Pooled Registered Pension Plans Act. In my opinion, this annual report accurately presents the performance of OSFI and complies with section 40 of the OSFI Act.

I am pleased to present our 2022-23 Annual Report. We are Canada's prudential regulator and supervisor of banks, most insurance companies and a large number of private pension plans. We also house the Office of the Chief Actuary (OCA), which is an independent unit within our organization that provides a range of actuarial valuation and advisory services to the federal government. Through our work, we ensure that Canadians' confidence in the financial system remains unwavering.

In the 2022-23 fiscal year, Canada’s financial system began to adjust to a rising interest rate environment caused by a significant acceleration in the inflation rate. At the Office of the Superintendent of Financial Institutions (OSFI), we took early and proactive steps to ensure the institutions and pension plans we supervise can adapt to this shift in our risk environment. We have sustained this approach in the new fiscal year, 2023-24.

This behaviour accords with our Blueprint for Transformation, launched two years ago. The Blueprint’s underlying vision is to ensure that we thrive in intensifying uncertainty. Our Blueprint vision compels us to act early when we see risks emerge. That means that we accept the risks of engaging too early to minimize the risks that stem from being slow to act.

In this report, you will find information on the many ways in which we are already living our Blueprint vision, and I am proud of the progress we’ve made this past year. For example, we implemented an enterprise risk appetite statement to support our strategic and operational management. We also started work to renew our approach to supervision, modernize how we develop our guidance, and simplify the way we collect data.

I am confident that our focus on thriving in increasing uncertainty will help us respond to a shifting risk environment and deliver on the significant broadening of our mandate introduced in Bill C-47.

I am proud of all that we have achieved this year and how OSFI has furthered the safety and soundness of Canada’s financial system.

Thank you,

Peter Routledge

Superintendent

Chapter 2 – Executive summary

In fiscal year 2022-23, we showed agility and effectiveness in a dynamic operating environment. With a dedicated team of over 1,000 full-time equivalent employees, we successfully regulated and supervised 373 federally regulated financial institutions (FRFIs) and 1,180 federally regulated pension plans (FRPPs). We also provided critical actuarial advice to federal and provincial governments while delivering on an ambitious transformation agenda.

We steered through a rapidly changing financial landscape marked by transformative forces. Global financial systems adjusted to inflationary pressures, a shifting interest rate environment, and disruptive technological innovations. We proactively addressed these challenges while also advancing initiatives that reinforced the Canadian financial system’s resilience.

This Annual Report highlights what we achieved in fiscal year 2022-23. It shows how we have met our strategic and operational objectives and delivered on the priorities set out in the Strategic Plan 2022-25 and Departmental Plan 2022-23. Our key achievements are the following:

- Publicly defining our risk appetite, supported by a separate enterprise risk management function, to ensure a consistent and appropriate organization-wide response to risk.

- Actively supervising financial institutions and responding quickly and decisively to address emerging issues they face, including the collapse of Silicon Valley Bank and Credit Suisse.

- Strengthening our supervision function by integrating teams with complementary interests and renewing the Supervisory Framework.

- Publishing our climate risk guideline (Guideline B-15) to help financial institutions manage and disclose climate-related risks.

- Publishing climate change scenarios as part of the 31st Actuarial Report on the Canada Pension Plan.

- Establishing the Digital Innovation and Impact Hub to develop policy and supervisory tools.

- Developing a separate stakeholder affairs function to conduct rich, ongoing engagement with industry, Indigenous partners, civil society, academia, and the public.

- Updating our governance structures and decision processes to enable early risk detection and promote timely decision-making.

- Reviewing actuarial reports of federally regulated defined benefit private pension plans and conducting risk-based in-depth reviews of selected reports while actively supervising and intervening where necessary.

- Enhancing our organizational capacity to address emerging risks in the financial system swiftly and effectively.

- Advancing our multi-departmental data collection modernization project to ensure the availability of accurate and timely information for informed decision-making.

- Creating a renewed set of cultural work objectives known as "promises and commitments" to make our organization a workplace of choice.

- Establishing the Culture, Diversity, Equity, and Inclusion (DEI) unit, evolving our Human Capital Strategy, and developing a new DEI performance measurement framework, and employee engagement survey approach.

- Increasing our capacity to communicate and engage effectively with Canadians, stakeholders, Parliamentarians, and other key audiences about us, our work, and related issues, in support of transparency and openness, and maintaining confidence in Canada’s financial system.

Through these initiatives, we strengthened our ability to navigate an evolving landscape in fulfilling our mandate. One of our main assets is our diverse workforce, which is dedicated to achieving results and working towards a common goal. Employees drive our accomplishments, guided by a variety of perspectives and mindsets. Their work is the reason why the transformation journey is possible. Our continued efforts will ensure that the organization thrives in growing uncertainty, while maintaining unwavering public confidence in a sound financial system.

For the third consecutive year, in 2023 OSFI was named as a National Capital Region Top Employer

Chapter 3 – About us

OSFI in numbers 2022-23

OSFI was established in 1987 to protect depositors, policyholders, financial institution creditors and pension plan members, while allowing financial institutions to compete and take reasonable risks

Supervise and regulate 373 federally regulated financial institutions

19 New or revised guidance documents (including pensions)

Over 20 DEI large scale events

More than 40 external engagements

Over 1,000 full-time staff

Over 130 reviews conducted

Supervise and regulate 1,180 federally regulated pension plans that include 1.2 million active members and beneficiaries and assets of $238 billion

Office of the Chief Actuary prepared 19 actuarial reports or studies

Over 114 new federally regulated financial institutions were approved and 28 new pension plans were processed for approval

Legislative foundation

OSFI is an independent agency of the Government of Canada, established to protect depositors, policyholders, financial institution creditors, and pension plan members, while allowing financial institutions to compete and take reasonable risks. In addition to our enabling act, the Office of the Superintendent of Financial Institutions Act, we operate within the framework of other key legislationFootnote 1 and regulations. These acts set out specific requirements and provisions relating to the operation, governance, capital adequacy, risk management, and prudential supervision of financial institutions and pension plans in Canada. These provide the legal authority and framework for us to fulfill our mandate.

In Canada, federally regulated entities include all banks and all federally incorporated or registered trust and loan companies, insurance companies, cooperative credit associations, fraternal benefit societies and private pension plans. OSFI’s scope of regulation does not include consumer or consumer-related issues or the securities sector, which are the responsibility of other federal and/or provincial agencies.

Mandate

Our overarching mandate is to contribute to strengthening public confidence in the Canadian financial system by:

- Fostering sound risk management and governance practices.

- Supervising and intervening early.

- Conducting environmental scanning for the safety and soundness of financial institutions.

- Taking a balanced approach.

The Office of the Chief ActuaryFootnote 2 (OCA) is an independent unit within OSFI that provides a range of actuarial valuation and advisory services to the Government of Canada. The OCA contributes to public confidence in the resilience and soundness of the Canada Pension Plan (CPP) and other programs that fall under its responsibility by providing appropriate checks and balances on the future costs of the CPP and these other programs.

Values

Our values represent both who we are as an organization and where we want to go. Those values—Respect, Curiosity, and Stewardship—guide our actions and decision-making and are embedded as an essential part of our Blueprint vision.

Respect

Curiosity

Stewardship

Respect

We promote inclusion, collaboration and professionalism by fostering a commitment to DEI throughout our human capital practices. Embracing DEI is not just a business imperative but a moral one.

Curiosity

Our mission revolves around curiosity, encouraging diverse mindsets and a safe environment to explore and innovate. Learning from attempts and failures drives positive transformation.

Stewardship

We act with integrity, accountability, and transparency, upholding our credibility and reputation. Our Blueprint vision calls for a macro-responsive mindset, recalibrating how we manage risks for a better balance between individual institutions and broader macro-risks. Developing a risk appetite enables us to make decisions quickly and confidently while managing associated risks with agility.

Risk philosophy

As part of our transformation, we implemented an enterprise risk management function, which recognizes the dynamism and interconnectivity of the strategic and operational environments. Designed to manage and respond to the ever-intensifying risks, the enterprise risk management function supports us in fulfilling our mandate, contributing to confidence in a sound financial system.

We adopted a Three Lines Model that provides roles and responsibilities for different stakeholders in risk management and governance. We use this model to promote partnership and coordination, which ultimately enhances our risk management capabilities and the achievement of our mandate.

We developed and adopted an enterprise-wide risk appetite statement (RAS). The statement identifies, at the highest level, the types of risk we are willing to accept. The RAS is defined by categories (reputational, strategic, supervision and regulation, operational and culture) and risk levels (very low, low, moderate, and high). Together, the categories and the risk levels shape our priority setting and provide structure for decision-making. The overarching guidance resulting from the RAS can be summarized as:

-

Prioritizing early intervention to address risks to Canadian financial system confidence.

-

Accepting orderly failures but avoiding surprise failures.

-

Prioritizing confidentiality and avoiding regulatory capture.

-

Promoting a safe and diverse workplace culture.

-

Guiding resource allocation based on risk and analytics.

-

Valuing agility and efficiency over perfection in decision-making.

-

Empowering employees to make risk-intelligent decisions with imperfect information.

-

Adopting a responsive risk management approach, prioritizing impactful actions, and sharing significant risks through the Annual Risk Outlook.

Partnerships

Oversight of Canada’s financial system

We work closely with the Bank of Canada, the Department of Finance, the Canada Deposit Insurance Corporation, and the Financial Consumer Agency of Canada. These organizations comprise the Financial Institutions Supervisory Committee (FISC) to share information on matters relating to supervising FRFIs.

These same partners also form the Senior Advisory Committee (SAC), which is a discussion forum for financial sector policy issues, including financial stability and systemic weaknesses. The SAC advises the Minister of Finance and serves as a forum to coordinate actions among the agencies. These effective partnerships help to make Canada’s financial system one of the strongest and safest in the world.

Professional relationships

We are an active leader and participant in the international fora. We maintain relationships and share information through memberships on global standard-setting bodies such as the Financial Stability Board, the Basel Committee on Banking Supervision, and the International Association of Insurance Supervisors. These bodies set minimum thresholds for banking and insurance standards. Member countries have discretion about how to implement the standards in their own country.

When adapting international requirements to the Canadian context, we conduct robust and careful assessments to make sure they are suitable. We often require institutions to go beyond the required international minimum standards. This approach has served Canada well in the past and will help us maintain Canada’s reputation of having a stable financial system.

At home, we have continued to expand our engagement with stakeholders. During fiscal year 2022-23, we undertook several engagement activities including meetings with industry associations such as the Canadian Bankers Association, the Insurance Bureau of Canada, the Canadian Life and Health Insurance Association, the Association of Canadian Pension Management, and the Banks and Trust Companies Association, as well as participated in several industry events. These engagements gave us the opportunity to interact with, receive feedback from, and show accountability to our various partners and stakeholders.

While OSFI and provincial regulators have separate mandates, we coordinate to ensure effective oversight and regulatory consistency. We share information and collaborate on plans to promote a stable financial system.

On pensions, through collaborations with the Canadian Association of Pension Supervisory Authorities (CAPSA), draft guidelines were proposed for the industry, which focused on risk management and pension plan oversight by administrators.

Chapter 4 – Management and accountability

Ministerial authority, accountability and organizational authority

We report to Parliament through the Minister of Finance. Although the Minister of Finance is responsible for our organization, the Superintendent is solely responsible for exercising the powers provided by the financial institution and pension legislation, and reporting to the Minister on the administration of said legislation.

Various formal and informal processes enable us to fulfill our mandate. For example, the FISC, which the Superintendent chairs, meets on a quarterly basis to exchange information relating to the supervision of FRFIs. Our accountability framework also includes:

- Issuing an annual report and departmental plan.

- Submitting financial statements and related control processes to an annual external audit.

- Maintaining a Departmental Audit Committee and Internal Audit group and reviewing audit reports.

- Maintaining and enforcing conflict of interest and code of ethics policies.

- Consulting with stakeholders before introducing new requirements.

- Updating, informing and reporting to Parliament by responding to order paper questions, appearing before parliamentary and senate committees, providing written responses to committee questions, committee appearances, and other means.

- Participating in reviews to determine whether we are meeting internationally established standards for prudential regulators.

We implemented a new top-level organizational structure, effective in April 2022. This structure positions us to fulfill our mandate of contributing to public confidence in Canada’s financial system in today’s volatile risk environment. Our new structure has five areas of responsibility plus the independent Internal Audit function reporting to the Superintendent:

Peter Routledge

Superintendent, OSFI

OSFI protects depositors, policyholders, financial institutions, creditors and pension plan members, while allowing financial institutions to compete and take reasonable risks.

Ben Gully

Deputy Superintendent, Supervision Sector

The Supervision Sector supervises FRFIs and FRPPs to ensure their sound financial condition and compliance with applicable regulatory and supervisory requirements.

Tolga Yalkin

Assistant Superintendent, Regulatory Response Sector

The Regulatory Response Sector leads and facilitates our regulatory response to new and evolving risks and administers the legislative framework for which we are responsible.

Angie Radiskovic

Assistant Superintendent and Chief Strategy and Risk Officer,

Strategy, Risk and Governance Sector

The Strategy, Risk and Governance Sector promotes and advances governance and evidence-based and risk-intelligent decision-making in support of our regulatory, supervisory, and operational activities.

Assia Billig

Chief Actuary, Office of the Chief Actuary

The OCA provides independent actuarial services to the Government of Canada. The Chief Actuary, reporting to the Superintendent, assumes sole responsibility for the content and actuarial opinions in OCA reports and advice, ensuring compliance with legal mandates.

Michelle Doucet

Assistant Superintendent and Chief Operating Officer,

Corporate Services and Transformation Sector

The Corporate Services and Transformation Sector delivers organization-wide core operating functions including human resources, finance, procurement and contracting, facilities, security, information management, information technology, internal communications and partner engagement, legal services, and various transformation initiatives.

Lissa Lamarche

Chief Audit Executive

The Internal Audit function provides independent assurance of the effectiveness of, and adherence to, our internal control, risk management and governance processes.

Audit Committee

The Audit Committee provides independent advice on our financial reporting, internal controls, and audit functions. The Committee is made up of the following members who have extensive public and private sector experiences.

Frederick W. Gorbet, O.C., Ph.D.

With an extensive career spanning the Canadian public service, life insurance industry and regulatory roles, Mr. Gorbet brings valuable experience to our Audit Committee. He has served in leadership roles at various organizations, including Deputy Minister of Finance Canada, Executive Director of the Task Force on the Future of the Canadian Financial Services Sector, Director and Board Chair of Assuris, and Trustee and Board Chair of the North American Electric Reliability Corporation. He has a Ph.D. in Economics, was appointed to the Order of Canada in 2000, and promoted to Officer of the Order in 2014. He has chaired our Audit Committee since April 2020.

Helen R. del Val

Helen R. del Val served as Chair of British Columbia's Financial Institutions Commission from 2011 to 2016. She has extensive experience in regulation and administrative law and previously worked in business law and telecommunications. She has also served on the Canadian Radio-television and Telecommunications Commission and various other regulatory boards. In addition to her professional achievements, she is actively involved in community service. Helen was appointed to our Audit Committee in May 2017 and served until April 2023.

Helen Sinclair

Helen Sinclair is a corporate director and former producer of digital programming. Her early career was at The Bank of Nova Scotia where she held various positions and later became head of strategic planning and public affairs. She served as President and CEO of the Canadian Bankers Association from 1989 to 1996 and has held numerous board positions in both public and non-profit sectors. Ms. Sinclair holds degrees from York University and the University of Toronto and completed the Advanced Management Program at Harvard Business School. She was appointed to our Audit Committee in July 2021.

Yves Gauthier

Yves Gauthier is a Fellow Chartered Professional Accountant with extensive experience, namely in risk management at KPMG, at the Mouvement Desjardins and at the Caisse de Dépôt et Placement du Québec. He serves on multiple boards and audit committees at various levels of government, including Heritage Canada, cities of Montreal and Laval, and the Museum of Contemporary Arts of Montreal. He was appointed to our Audit Committee in November 2022.

Robert Samels

Robert Samels is an experienced executive and board member in the oil and gas industry and PricewaterhouseCoopers. He serves on international committees, including the Independent Oversight Advisory Committee of the World Food Programme and the Audit and Finance Committee for the Global Fund. Mr. Samels holds degrees from the University of Manitoba and is a Chartered Professional Accountant. He was appointed to our Audit Committee in November 2022.

2022-23 Financial review and highlights

We are primarily funded through assessments on financial institutions and private pension plans. Costs are assigned based on effort spent regulating each industry and assigned to institutions using specific formulas. We also receive revenues from cost-recovered services and collect administrative monetary penalties for violations.

The OCA provides a range of actuarial valuation and advisory services to the CPP and some federal government entities, including providing advice in the form of reports tabled in Parliament. These services are funded by fees charged to either the underlying pension plan or the federal government entity to which advisory services are provided, and by parliamentary appropriation.

2022-23 Financial overview

In the 2022-23 fiscal year, our total costs were $242.8 million, a 14.3% increase from the previous year. Personnel costs rose by 12.7% due to increased full-time equivalent employees and normal wage and merit adjustments. By the end of the fiscal year, there were 1,024 full-time equivalent employees, an 11.3% increase from the previous year due to the implementation of our Blueprint. Professional services costs increased by 31.9% to support new initiatives. Travel costs rose as in-person activities resumed, and rental costs increased due to software licensing fees.

Federally regulated financial institutions

Revenues from FRFIs increased by $29.2 million (15.1%) to $222.7 million. Base assessments on financial institutions increased by $29.7 million (15.5%). Revenue from cost-recovered services decreased by $0.4 million (25.6%) due to reduced work for federal Crown corporations.

Total costs for FRFIs rose by $29.2 million (15.1%) to $222.7 million. The increase is primarily due to higher expenses in personnel ($20.6 million), professional services ($5.6 million), travel ($1.5 million), and rentals ($1.3 million).

Actuarial valuation and advisory services

The OCA is funded by fees charged for actuarial valuation, advisory services, and parliamentary appropriations. Expenses in 2022-23 totalled $14.4 million, up $2.8 million (24.3%) from the previous year. The increase is mainly due to an increase in the number of full-time equivalent employees to implement Blueprint and normal economic and merit increases.

Federally regulated private pension plans

Private pension plans are subject to annual assessments based on the number of beneficiaries to cover regulatory and supervisory costs. The assessment rate is determined by estimating current expenses, adjusting for past surpluses or deficits, and dividing by the expected number of beneficiaries. For 2022-23, the rate remained at $10.00 per beneficiary, resulting in assessed fees of $7.2 million whereas total fees recognized as revenue in 2022-23 were $5.6 million (down from $7.4 million in 2021-22).

Revenue is recognized at an amount equal to expenses incurred. The excess or shortfall of assessments over revenue recognized in any particular year is treated as unearned or accrued assessments in our financial statements. The annual shortfall or excess is recovered from or returned to the pension plans over a period of five years commencing one year from the year in which they arose through an adjustment to the annual fee rate. The 2023-24 rate has been set at $11.00 per beneficiary, aiming to fully recover expected costs. However, variations in actual costs or number of plan beneficiaries in any particular year will cause an excess or shortfall in assessments.

The administration cost of the Pension Benefits Standards Act, 1985 for 2022-23 was $5.6 million, a decrease of $1.7 million (23.6%) compared to the previous year. The decrease is mainly due to vacancies in the Pension Division caused by retirements and turnover.

Chapter 5 – Accomplishments and results achieved

This section showcases a collection of key achievements related to our transformation initiatives, as well as achievements across our five fundamental areas of work: proactive and active supervision, responsive and prudent regulatory framework, risk informed management and decisions, critical actuarial services to the Government of Canada, and effective enabling infrastructure.

Transformation progress

Chief Transformation Officer

During the first year of our transformation journey, we made significant progress across all six key initiatives outlined in our Strategic Plan. In moving forward with our transformation, we adopted a new mindset characterized by agility, efficiency, and innovation. We also put a strong focus on risk management. Outlined below are some of the key transformation achievements.

Culture and enabler initiatives

- We established the Culture, Diversity, Equity, and Inclusion unit as part of a three-year plan. We also evolved our Human Capital Strategy, and developed a new DEI performance measurement framework and employee engagement survey approach.

- We focused on renewing change management fundamentals and established a set of cultural work objectives known as "promises and commitments" to guide a renewed culture. We also created two new sectors (Strategy, Risk and Governance and Regulatory Response) within the organization to enhance our transformation and enable new capabilities.

Risk, strategy and governance

- We redesigned and launched a new internal governance structure focused on risk management and decision-making and adopted a risk management Three Lines Model.

- We developed and adopted an enterprise-wide risk appetite statement, identifying at the highest level, the types of risk we are willing to accept.

Strategic stakeholder and partner engagement

- We developed the Stakeholder Affairs Framework, which guides our strategic approach to stakeholder and partner engagement, and developed and tested a stakeholder engagement tracking and reporting tool.

- We developed draft brand strategies for the Superintendent and Chief Actuary and a strategy for internal and external partner engagement through public opinion research.

Policy innovation

Specialist - Climate Risk Hub

- We refined the policy innovation architecture and regulatory response vision to align with the evolving risk landscape. As part of this effort, we established the Digital Innovation and Impact Hub, which will aid in policy and supervisory tool development to address emerging risks from digitalization.

- To address climate risks, we created the Climate Risk Hub and developed a comprehensive plan for our climate risk response, including policy, climate scenario analysis, regulatory capital, data, and regulatory returns.

Supervision renewal

- We improved tools for integrated risk analysis, financial resilience assessment and enhanced collaboration.

- We established the Risk Assessment and Intervention Hub, with front-line supervisory teams and the Risk Advisory Hub, with an integrated organizational structure for capital and liquidity assessment and supervisory data and analytics.

- We created the Supervision Quality Assurance Division to ensure robust quality assurance across all of Supervision.

- Supervision Methods, Standards and Controls Division continued work on a comprehensive update of the Supervisory Framework to ensure it remained relevant, fit for purpose, and responsive to changes in risks within the Canadian financial system.

Data management and analytics

- We initiated "Vision 2030," identified a cloud-based solution, and prepared for a new phase of data and analytics improvements.

- We introduced self-service analytics and reporting tools, and created enterprise datasets for seamless access to regulatory returns data, promoting data-driven decision-making and efficiency.

- We advanced preparatory work for the Data Collection Modernization initiative.

Achievements across our five fundamental areas

1. Proactive and active supervision

We supervise FRFIs and FRPPs to determine whether they are in sound financial condition and meeting regulatory and supervisory requirements. The key achievements for 2022-23 are:

Protecting creditors and responding to bank failure

On March 12, 2023, the Superintendent took control of the assets of Silicon Valley Bank’s Canadian branch after United States authorities shut down its parent bank. This decisive action was followed by a court-supervised, orderly restructuring process protecting the interests of Canadian creditors.

“I took this action to affect an orderly transition of the Canadian branch of Silicon Valley Bank to the FDICFootnote 3 bridge bank. I am satisfied that this approach, developed with officials in the United States, is in the best interest of the branch’s creditors."

- Peter Routledge, Superintendent of Financial Institutions

Supervision and early intervention

Director - Domestic Banking

In fiscal year 2022-23, we integrated financial risk analysis functions, including expertise for capital and liquidity, with front-line supervision teams. This approach enables timely assessment of financial resilience, including governance and balance sheet strength. Throughout the year, our supervision teams provided regular risk assessment and monitoring of the adequacy of capital and liquidity of FRFIs. They worked closely with FRFIs to ensure corrective action in response to identified deficiencies.

Advancing supervisory actions

In fiscal year 2022-23, we focused on the resilience and capitalization of financial institutions in a higher risk environment. We adapted supervisory actions to ensure they remained appropriate in the rapidly evolving risk landscape. Some of our key accomplishments include:

- Monitoring the structural interest rate risk impacted by rapidly rising rates, and deepening insights from an expanded use of data included in regulatory returns and management reports.

- Monitoring FRFI downturn readiness, focusing on risk appetite, credit loss provisioning, credit risk modeling, and capital and funding implications.

- Addressing key risk areas through the Annual Risk Outlook and communicating expectations to FISC partners.

- Progressing work on liquidity risk.

- Engaging with FRFI senior leadership through regular discussions and semi-annual meetings.

- Streamlining reporting for domestic systemically important banks.

- Issuing an advisory setting out mortgage insurer capital adequacy test revisions for variable rate mortgages.

- Implementing several internationally agreed upon Basel III reforms with remaining updates all scheduled for implementation in 2024.

Reviews and letters completed and issued

Supervisory workFootnote 4 in 2022-23 assessed key risk areas. It also ensured strong capitalization and resilience of financial institutions. The supervisory letter, the main written communication to FRFIs, summarizes key findings, recommendations, and requirements. Several reviewsFootnote 5 were conducted, leading to supervisory letters with recommendations to enhance controls and processes. In total, we issued over 370 supervisory letters in 2022-23, in line with the number issued during the previous year.

Number of approvals

FRFIs must obtain regulatory approval from us or the Minister of Finance (supported by our advice) before engaging in specific transactions. This requirement applies to incorporating a FRFI, as well as foreign banks or insurance companies seeking to establish a presence or make certain investments in Canada. In 2022-23, we provided over 200 such regulatory approvals to the institutions we regulate. Our regulatory approval process is effective, responsive, innovative, and transparent. We approved various applications for acquisitions and new entrants, enabling financial institutions to compete, take calculated risks, and safeguard the rights of depositors, policyholders, and creditors. In addition, 36 pension transactions were submitted for approval in 2022-23.

Supervision stakeholder engagement

We regularly hosted supervisory colleges and roundtables with regulators to promote dialogue and cooperation. These events facilitate information sharing and strengthen the supervision of Canada’s financial institutions. The roundtables, involving regulatory agencies from the United States, the United Kingdom, the European Union, the Caribbean, and Canada, enhance preparedness and crisis management in the event of a cross-border financial crisis. Supervisory colleges strengthened the supervision of international banking groups and major Canadian life insurance companies.

| Number of colleges hosted by OSFI | ||

|---|---|---|

| 2020-21 | 2021-22 | 2022-23 |

| 4 | 4 | 7 |

Advancing supervisory data and analytical techniques

We made significant improvement to our supervisory capabilities through the use of data and analytics. This included creating the Risk Assessment Data Analytics Report (RADAR), a business intelligence tool for major industries such as banking, property and casualty insurance, and life insurance, enabling comprehensive and timely risk analysis. In addition, we developed an insurance supervisory rating tool to ensure consistent supervisory ratings, and implemented regulatory returns for financial condition testing in insurance.

Private pension plans

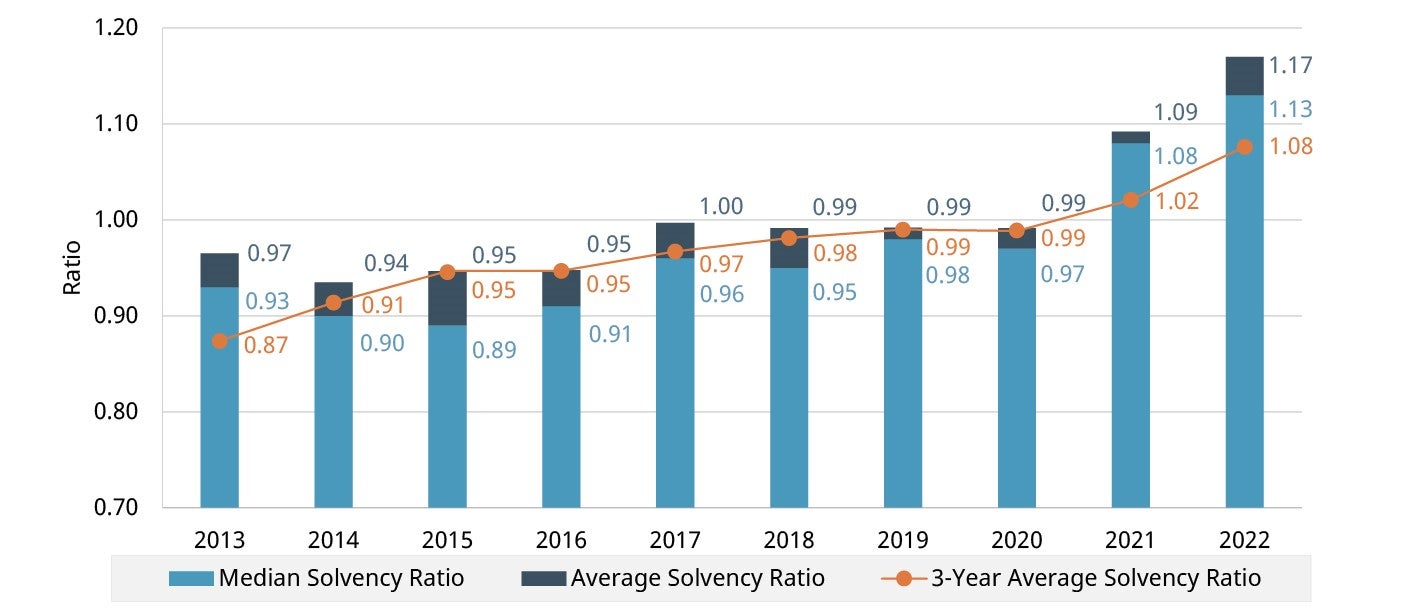

In fiscal year 2022-23,Footnote 6 the overall solvency position of federally regulated defined benefit private pension plans showed significant improvement. Despite the negative market performance and investment returns globally, the prescribed discount rates used to assess pension plan solvency liabilities, which are directly tied to Canadian bond rates, increased substantially throughout the year. The resulting decrease in solvency liabilities more than offset the negative investment returns, resulting in federally regulated private pension plans with defined benefit provisions starting calendar year 2023 in better financial health (assets less solvency liabilities) compared to the previous year. Based on the last filed actuarial reports, the solvency positions of the plans had improved with the median solvency ratio increasing to 1.13 at the end of calendar year 2022, up from 1.08 at the end of calendar year 2021. In 2022-23, the overall asset distribution remained about the same.

| Indicators | Type | As of March 31, 2022 | As of March 31, 2023 |

|---|---|---|---|

| Number of plans | Defined benefitTable 2 footnote 1 | 255 | 240 |

| CombinationTable 2 footnote 2 | 120 | 117 | |

| Defined contributionTable 2 footnote 3 | 821 | 823 | |

| Total | 1,196 | 1,180 | |

| Active membership | Defined benefit | 172,900 | 161,800 |

| Combination | 329,900 | 352,500 | |

| Defined contribution | 157,200 | 168,100 | |

| Total | 660,000 | 682,400 | |

| Other beneficiaries | Defined benefit | 239,400 | 226,600 |

| Combination | 290,300 | 310,800 | |

| Defined contribution | 24,200 | 27,100 | |

| Total | 553,900 | 564,500 | |

|

Table 2 footnotes

|

|||

Risk-based supervision for private pension plans

In the fiscal year 2022-23, we maintained our collaborative efforts with Canadian Association of Pension Supervisory Authorities (CAPSA) to establish consistent regulatory expectations for effective risk management and oversight of private pension plans by administrators.

As part of the ongoing review of pension plan investment supervision, we published a summary of the feedback received on the Pension Investment Risk Management consultation paper in October 2022. This feedback was shared with CAPSA as collaboration continued on developing guidance on principles for managing investment risk.

Additionally, we collaborated with CAPSA on the development of principles-based guidelines, which were released for consultation in June 2022. These guidelines addressed gaps in pension technology and cyber risk management (CAPSA Guideline on Cyber Risk for Pension Plans). They also focused on the integration of environmental, social, and governance (ESG) factors in pension fund investment and risk management (CAPSA Guideline on ESG Considerations in Pension Plan Management). The promotion of good governance in leveraging practices and understanding the implications of leverage on risk management was also highlighted (CAPSA Guideline on Leverage and the Effective Management of Associated Risks).

Actuarial reports of private pension plans

We review actuarial reports of federally regulated defined benefit private pension plans and conduct risk-based in-depth reviews of selected reports. In the 2022-23 fiscal year, 256 actuarial reports were filed with us. In-depth reviews of selected reports identified certain actuarial assumptions that raised questions and enabled interventions to ensure compliance with legislation and guidance. The issues uncovered during these reviews were communicated to plan actuaries, particularly when they impacted current and future funding requirements. As a result of our interventions, some plans amended and re-submitted their actuarial reports.

2. Responsive and prudent regulatory framework

Our regulatory framework refers to the set of rules, guidelines, standards, and principles to regulate and supervise FRFIs and FRPPs. The framework provides a structured approach to ensure the safety and soundness of these institutions and contributes to maintaining the stability of the Canadian financial system. The key achievements for 2022-23 are:

Publishing Guideline B-15 on climate risk management

Applicable to more than 350 federally regulated banks and insurers

We published Guideline B-15, which is the first climate-sensitive model for managing risk in Canada's financial system. This guideline outlines expectations for understanding and managing climate-related risks, adopting appropriate governance and risk management practices, and ensuring operational and financial resilience. We conducted extensive consultations to better understand the impact of the guidelines on FRFIs and received over 4,300 submissions.

Ensuring Canadian accounting and assurance standard setting is fit for the future

Final report: IRCSS including 26 recommendations

We contributed to the Independent Review Committee on Standard Setting (IRCSS) in Canada by reviewing the governance and structure for Canadian accounting and assurance standards. We also explored the need to set up a Canadian Sustainability Standards Board to support international developments on sustainability standards. Our work contributed to ensuring independent and globally recognized accounting, auditing, and sustainability reporting standards in Canada. These standards support quality reporting, our supervisory framework, and public confidence.

Strengthening regulatory guidance for sound residential mortgage underwriting

We are actively enhancing the credit quality of residential mortgage assets and underwriting practices through adjustments to Guideline B-20. We launched a comprehensive review of the Guideline in the 2022-23 fiscal year, starting with debt serviceability measures. We will use feedback to inform revisions to the Guideline, on which we will publicly consult in the future.

Advancing expectations and supervisory processes for emerging digital innovation risks

Principal Analyst

Integrity and Security Build Team

We launched the Digital Innovation Impact Hub, which focused on using emerging technology and addressed key issues. This included exploring guidance on crypto-assets, engaging with technology entities through initiatives like "Digital Open Door," and issuing a tri-agency letter on crypto-asset risks.

Domestic Stability Buffer

The Domestic Stability Buffer (DSB) is a policy tool in Canada that contributes to financial system stability. It applies to the country's largest banks and requires them to build capital to absorb losses and support lending during economic stress. In December 2022, we increased the DSB’s level to 3% as of February 1, 2023, and increased the DSB’s range from 0 to 4%, instead of the previous 0 to 2.5%. These actions help to address elevated systemic vulnerabilities, including Canadian household indebtedness and increased asset imbalances.

Minimum Qualifying Rate for uninsured mortgages

The Minimum Qualifying Rate (MQR) is used by FRFIs in Canada to assess the borrower’s ability to repay mortgages in adverse financial circumstances. This helps ensure sound mortgage underwriting and the safety of the financial system. We regularly review and disclose the MQR for uninsured mortgages. In December 2022, we announced that the MQR for uninsured mortgages would be the greater of the mortgage contract rate plus 2% or 5.25%.

3. Risk-informed management and decisions

These activities are related to both internal risk management within our organization and to prioritizing current and evolving risks that we supervise against in the institutions and pension plans we oversee. The overarching objective is to promote stability and protect the interests of stakeholders within the financial system. Accomplishments for 2022-23 include:

Bolstered risk management

We worked to improve risk identification and management within our organization, including by appointing a Chief Strategy and Risk Officer, creating an enterprise risk management function, and adopting enhanced environmental scanning, stress testing, and risk analytics capacity.

Strategic risk oversight

In addition to implementing a risk appetite statement, we published our first Annual Risk Outlook (ARO) in April 2022, followed by an update in October 2022. The ARO is one of our key strategic risk oversight tools and focuses on external drivers and provides a forward-looking view of the most significant risks facing FRFIs and FRPPs. Additionally, the ARO outlines the regulatory and supervisory response to these risks and guides planned supervisory work for the next fiscal year. Through the ARO, we are promoting sound risk management in the financial sector in a deliberate, proactive, and transparent way.

4. Critical actuarial services to the Government of Canada

Actuarial Advisor - Public Pensions

This area includes statutory actuarial valuations required by legislation and checks and balances on the future costs of programs for the Canada Pension Plan, Old Age Security, Employment Insurance, and Canada Student Financial Assistance programs. It also includes pension and benefits plans covering the federal public service, the Canadian Forces, the Royal Canadian Mounted Police, federally appointed judges, and Members of Parliament. Key achievements for fiscal year 2022-23 are outlined below.

OCA statutory reporting

The OCA contributed to strengthening confidence in the financial system by helping to ensure the stability and sustainability of social programs, public sector pension plans, and insurance arrangements in Canada. During 2022-23, the OCA provided independent, accurate, and high-quality actuarial reports, as well as professional actuarial services and advice. The key achievements for this period include:

- Completion of the Actuarial Report on the Pension Plan for the Royal Canadian Mounted Police (RCMP) as at March 31, 2021. This report, submitted to the President of the Treasury Board and tabled in Parliament on November 18, 2022, offered actuarial information to decision-makers, Parliamentarians, and the public. By increasing transparency and confidence in Canada's retirement income system, the RCMP report facilitated informed decision-making.

- Presentation of the 2023 Actuarial Report on the Employment Insurance Premium Rate to the Canada Employment Insurance Commission. This report, tabled in Parliament on September 29, 2022, provided a forecast of the break-even premium rate for the upcoming year, accompanied by a detailed analysis. This information supported the Commission in making informed decisions regarding employment insurance premiums, ensuring the financial sustainability of the Program.

- Completion of the triennial CPP Actuarial Report as at December 31, 2021, being the 31st Report, which was submitted to the Minister of Finance and tabled in Parliament on December 14, 2022. This triennial report projected CPP revenues and expenditures over a 75-year period to assess the future impact of historical and projected demographic and economic trends.

Christine Dunnigan

Director - Social Insurer Programs- In addition, the OCA commissioned an independent peer review of this report, being the ninth review of this kind, with results released early in fiscal year 2023-24. The independent panel’s findings confirm that the work performed by the OCA on the Report meets professional standards of practice and statutory requirements, and that the assumptions and methods used are reasonable. The panel also stated that the Report fairly communicates the results of the work performed by the Chief Actuary and her staff.

- Initiation of work on the triennial Actuarial Report on the Old Age Security as at December 31, 2021.

- Preparation of the Actuarial Report on the Canada Student Financial Assistance Program as at July 31, 2021, the Actuarial Report on the Government Annuities as at March 31, 2022, and the Actuarial Report on the Civil Service Insurance Program as at March 31, 2022.

- Submission of various actuarial reports supporting the Public Accounts of Canada, presenting the obligations and costs, as at March 31, 2022, associated with federal public sector pension and benefit plans including future benefits to veterans.

Actuarial research

As part of its ongoing research, the OCA published the Old Age Security (OAS) Program Mortality Experience Fact Sheet in April 2022. The Fact Sheet shows that there were an estimated 20,000 extra deaths caused by the COVID-19 pandemic during 2020. In addition, the following research results were presented:

- Scenario analysis to assess climate transition risks at the Institute for Governance of Private and Public Organizations' major pension conference;

- Employment Insurance Premium Reduction and Sickness Benefits presentation at the Canadian Institute of Actuaries 2022 Annual Conference;

- Mortality Projection from a Social Security Panel presentation at the Society of Actuaries’ Living to 100 Symposium; and

- Towards Financially Sustainable, Green and Resilient Social Security presentation at the International Social Security Association World Social Security Forum.

5. Effective enabling infrastructure

These are the activities and resources deemed essential for supporting the operations. Here are the significant accomplishments for the fiscal year 2022-23:

Diversity, equity, and inclusion

We made significant strides in embedding DEI into our organizational culture, fostering an environment where employees can truly be themselves.

A DEI performance measurement framework and logic model serve as the foundation to monitor the progress of enacting the multi-year strategy. This framework enables us to track our advancements and ensures accountability.

To support continuous growth and promote an inclusive workplace culture, executive leaders participated in anti-racism learning events, which foster understanding and empathy and support their commitment to anti-racism.

We launched two initiatives to facilitate employee development: SponsorMe and MentorMe. The SponsorMe initiative supports employees from equity-seeking groups, providing them with sponsorship opportunities. The MentorMe program is open to all employees, offering mentorship relationships to support their professional advancement.

To engage employees and raise awareness on DEI-related issues, more than 20 large-scale events took place. These events served as a platform for discussions on topics such as unconscious bias, diversity of thought, multiculturalism, mental health, and family responsibilities.

As part of the Government of Canada's commitment to addressing accessibility issues in the workplace and to uphold the Accessible Canada Act principles, we published an Accessibility Plan for the period of 2023 to 2026. This comprehensive plan sets out clear expectations and goals for enhancing overall accessibility. It includes specific measures to improve the use of accessible technologies and products, ultimately creating an inclusive and accessible environment for all employees.

Communication and engagement

Director

Culture, Inclusion and Development

Throughout fiscal year 2022-23, we effectively advanced our capacity to bring attention to our work across many key audiences. This included issuing over 25 news releases and statements, supporting executive members’ delivery of more than 10 speeches across Canada and supporting officials at multiple parliamentary and senate committee hearings. In addition, we responded to more than 100 questions from Parliament, provided responses to more than 150 media queries, and led numerous media briefings, interviews, and engagements.

Internal Audit

Internal Audit conducts assurance and advisory engagements aimed to protect and enhance organizational value while assisting us in achieving our business objectives. Pursuant to our commitment to governance, accountability and transparency, four audits were completed as per our audit plan. They provided feedback on risk and control effectiveness to management including, but not limited to, our human capital management and supervision processes. Investments in technology enabled new data analytical processes for continuous risk and control assessments.

Information Management (IM)/Information Technology (IT) strategy and roadmap

We developed an adaptable IM/IT strategy, along with an operating model and organization structure. The strategy aligns IM/IT activities with our Blueprint and Strategic Plan, supporting our mandate and core activities. It strengthens the ability to deliver on objectives and fosters collaboration throughout the organization.

Cloud adoption roadmap

Due to the pandemic, we expedited our cloud adoption plans and transitioned to a modern, hybrid enterprise environment. In addition to our progress with enterprise data access and capabilities, we successfully completed several critical projects including:

- Implementing cloud-based tools, enhanced mobile devices, and electronic signatures.

- Automating secure network access, introducing advanced mobile capabilities, and reorganizing application teams.

- Enforcing cybersecurity training for standardized security and modern systems delivery.

These advancements demonstrate a commitment to harness the power of data and leveraging emerging technologies to enhance analytical capabilities. By investing in these initiatives, we strengthened our ability to derive valuable insights, promote innovation, and make informed decisions in a dynamic and data-driven landscape.

Corporate services and security facilities services

Over the past year, we demonstrated operational readiness and agility by successfully accommodating a substantial increase in our workforce. All support teams contributed to successfully recruiting and onboarding 200 new employees, marking the largest staff expansion within a single year since we were established in 1987.

To optimize operations during a period of growth, we conducted comprehensive reviews of corporate service offerings. By aligning services with the evolving needs as we transition from small to medium-sized, we made efforts to enhance overall effectiveness.

For example, we:

- Implemented secure onsite work procedures during crises.

- Introduced the Pivot project for a new hybrid work structure, including collaborative workspaces, a working group, and knowledge sessions for employees.

- Enhanced the Travel Security Program for improved safety during travel.

- Conducted information security awareness sessions and provided investigation support.

These achievements demonstrate a commitment to ensuring secure and efficient operations, promoting a flexible and collaborative work environment, enhancing travel safety measures, and maintaining strong information security practices.

Chapter 6 – Legislated reporting requirements

Our reporting requirements are set out in the Office of the Superintendent of Financial Institutions Act and other related acts.Footnote 7

Disclosure

Under section 22(6) the Office of the Superintendent of Financial Institutions Act, the Superintendent must report the disclosure of information by financial institutions and describe the state of progress made in enhancing the disclosure of information in the financial services industry.

Disclosure plays a crucial role in building confidence in the Canadian financial system. When FRFIs and FRPPs disclose relevant information to investors, customers, and the public, it helps create a more level playing field and reduces information asymmetry. We promote effective disclosure by publishing select financial information on our website, providing guidance to FRFIs and FRPPs on their disclosures to the public, and participating in international supervisory groups with similar objectives. In addition, we enhance disclosure of information of FRFIs and FRPPs through the following policy instruments:

- In April 2022, we changed the guidelines related to accounting for structured settlements and financial instruments. Structured settlements are contractual arrangements where an insurer settles a claim by purchasing an annuity providing periodic payments to the claimant. We provide guidance on how insurance companies should account and what information to disclose for these settlements and other financial instruments. These changes were aimed at aligning with the accounting standard International Financial Reporting Standard 17 entitled Insurance Contracts (IFRS 17). IFRS 17 is a standard that helps ensure consistent and transparent accounting practices for insurance contracts. Overall, these changes are intended to support a robust implementation of IFRS 17 in Canada and ensure better transparency in financial reporting.

- In January 2023, we updated Guideline E-16 – Participating Account Management and Disclosure to Participating Policyholders and Adjustable Policyholders. The Guideline outlines expectations regarding the implementation of the requirements found in the Insurance Companies Act and the Policyholders Disclosure Regulations. They are intended to help companies understand what they are expected to do and how to interpret the Insurance Companies Act provisions about their participating policy operations. By updating the Guideline, we aimed to ensure that insurance companies are managing the participating accounts and sharing information with policyholders in a way that is fair and transparent.

- In March 2023, we published Guideline B-15 - Climate risk management. This guideline addresses the challenges posed by climate change and outlines the expectations for FRFIs. Climate change brings about a range of issues from severe weather events, rising sea levels, and variations in temperature patterns to changes in policy, markets, and technology. These changes can have major implications for businesses and the overall economy. It becomes crucial for financial institutions to proactively manage and disclose the risks and opportunities associated with climate change. Chapter 2 of the Guideline, entitled Climate-related financial disclosures, specifically focuses on disclosure expectations. In simpler terms, it highlights what kind of information financial institutions should provide. The aim is to foster transparency and enable a clear understanding of how climate change may impact their business operations, financial well-being, and future plans. By disclosing this information, financial institutions offer valuable insights to investors, customers, and other stakeholders. It allows them to make informed decisions and assess the potential risks linked to climate change. This promotes a stronger financial system for Canada.

By continuously working towards enhancing disclosure by FRFIs and FRPPs, we contribute to building confidence in the financial system by:

- promoting transparency

- enabling informed decision-making

- protecting investors

- enhancing market efficiency

- facilitating regulatory oversight

- fostering stakeholder engagement

Pension Benefits Standards Act

After receiving royal assent on 27 April 2023, Bill C-228 amended section 40 of the Pension Benefits Standards Act and introduced new reporting requirements. While these new reporting requirements are not applicable to the fiscal year represented in this annual report, we began preparing implementation models in 2022-23 in anticipation of the Bill receiving royal assent.

"40(1) The Superintendent shall, after consultation with the Chief Actuary of the Office of the Superintendent of Financial Institutions and as soon as possible after the end of each fiscal year, submit to the Minister a report on (a) the operation of this Act during that year; and (b) the success of pension plans in meeting the funding requirements, determined in accordance with section 9, and the corrective measures taken or directed to be taken to deal with any pension plans that are not meeting the funding requirements. "

Interventions

We intervene to protect members’ benefits first by clearly communicating expectations directly with plan administrators and employers and then, if necessary, exercising our power to enforce legislative requirements. In the fiscal year 2022-23, 292Footnote 8 pension plans did not meet the minimum funding requirements. This was due to insufficient negotiated contributions or outstanding required contributions for over 30 days. To address this issue, we issued letters to employers who failed to remit contributions on time to remind them of their obligation to make the required contributions. Despite these efforts, five plans continued to have outstanding contributions for an extended period. In response, we intervened by either issuing a notice of intent to issue a direction of compliance or issuing a direction of compliance. These interventions were successful in ensuring that all outstanding contributions and interest were remitted. Through these actions, we actively protected members’ benefits and ensured that pension plan administrators and employers met their obligations in a timely manner.

In March 2023, the Superintendent terminated a defined contribution plan due to the employer’s bankruptcy. However, all members will receive the full value of their benefit entitlements, ensuring the security of their pension benefits.

Actuarial reports

To ensure the security of pension benefits for members and beneficiaries, we closely monitor the financial position of federally regulated defined benefit private pension plans. Annually, we estimate the projected solvency ratio of these plans, allowing for proactive communication with plan administrators regarding potential issues such as significant anticipated contribution increases associated with the next actuarial report filing. Following the 2022 assessment, no concerns were raised or actions taken due to improvements in the solvency positions of the plans.

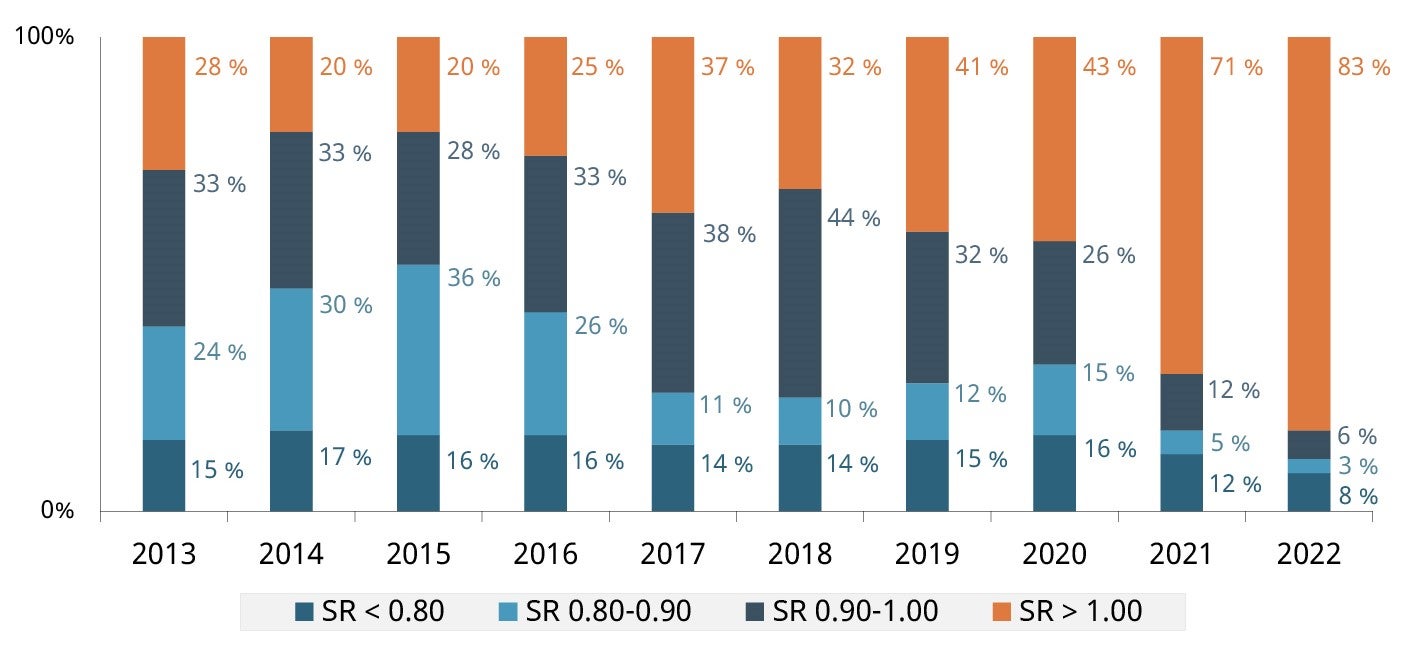

As of December 31, 2022, nearly 85% of federally regulated private pension plans with defined benefit provisions were fully funded. The percentage of underfunded plans decreased to 17% in 2022 compared to 29% in 2021. This year-over-year improvement in the solvency ratio is primarily due to the increase in interest rates used to value solvency liabilities. Notably, all significantly underfunded plans are designated plans, subject to funding limitations under the Income Tax Regulations.

Chart 1 – Text description

| blank | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|

| SR < 0.80 | 15% | 17% | 16% | 16% | 14% | 14% | 15% | 16% | 12% | 8% |

| SR 0.80–0.90 | 24% | 30% | 36% | 26% | 11% | 10% | 12% | 15% | 5% | 3% |

| SR 0.90–1.00 | 33% | 33% | 28% | 33% | 38% | 44% | 32% | 26% | 12% | 6% |

| SR > 1.00 | 28% | 20% | 20% | 25% | 37% | 32% | 41% | 43% | 71% | 83% |

Chart 2 – Text description

| December 31 | Median solvency ratio | Average solvency ratio | 3-Year average solvency ratio |

|---|---|---|---|

| 2013 | 0.93 | 0.97 | 0.87 |

| 2014 | 0.90 | 0.94 | 0.91 |

| 2015 | 0.89 | 0.95 | 0.95 |

| 2016 | 0.91 | 0.95 | 0.95 |

| 2017 | 0.96 | 1.00 | 0.97 |

| 2018 | 0.95 | 0.99 | 0.98 |

| 2019 | 0.98 | 0.99 | 0.99 |

| 2020 | 0.97 | 0.99 | 0.99 |

| 2021 | 1.08 | 1.09 | 1.02 |

| 2022 | 1.13 | 1.17 | 1.08 |

Examinations

In our supervisory approach, we employ a risk-based framework that allocates resources to monitoring activities, desk reviews, and examinations. In the fiscal year 2022-23, we conducted a limited number of examinations and desk reviews. Looking ahead to fiscal year 2023-24, the examinations will mainly focus on investment risk management, reflecting the areas identified for supervisory oversight during that period.

Pooled Registered Pension Plans Act

"78 The Superintendent must, as soon as feasible after the end of each fiscal year, submit to the Minister a report on the operation of this act during that year."

Under the Pooled Registered Pension Plans Act, the Superintendent is responsible for licensing pooled registered pension plans (PRPP) administrators, registering PRPPs, and conducting ongoing supervision of these pension plans. At the end of 2022, there were five federally registered PRPPs, covering 17 employers and 184 members (the total value of investments was $1.2 million).

Effective May 1, 2023, New Brunswick joined the Multilateral Agreement Respecting Pooled Registered Pension Plans and Voluntary Retirement Savings Plans (PRPP Agreement). This agreement is already in place between the governments of Canada, British Columbia, Nova Scotia, Quebec, Saskatchewan, Ontario, and Manitoba.

The PRPP Agreement effectively delegates to OSFI responsibility for licensing, registering, and supervising PRPPs whose operations fall within the jurisdiction of both the federal government and that of a participating province. The PRPP Agreement does not give OSFI responsibility with respect to Quebec’s voluntary retirement savings plans (VRSPs) but permits authorized VRSP administrators to act as PRPP administrators under the federal PRPP Act if they register a PRPP federally.

Guidance and newsletters

During the fiscal year 2022-23 reporting period, we published guidance documents for pension plans, which encompassed the following areas:

- In May 2022, we published the Instruction Guide for the Replicating Portfolio Information Summary to help administrators complete the related form.

- In May 2022, we published a letter that outlined expectations for pension plans regarding transactions related to the Canadian Dollar Offered Rate and the transition to alternative interest-rate benchmarks and reference rates in Canada. This guidance aims to ensure a smooth transition before the respective cessation dates in June 2024.

- We released two editions of our newsletter called InfoPensions in May and November 2022. These newsletters served as a valuable communication tool, providing important announcements, reminders, and descriptions of how we apply pension legislation and its guidance. They were designed to keep plan administrators, pension advisors, and other stakeholders informed about key developments in the pension industry.

- In August 2022, we published the final instruction guides for the Registration of a Defined Benefit Pension Plan and the Registration of a Defined Contribution Pension Plan, including their accompanying application forms. These included revisions to reflect the 2020 Agreement Respecting Multi-Jurisdictional Pension Plans and other updates.

- In September 2022, we consulted on the draft Instruction Guide for Asset Transfers related to Defined Contribution Provisions of Pension Plans and its accompanying form, with the final instruction guide and form published in March 2023.

- In November 2022, we published the revised Instruction Guide for the Preparation of Actuarial Reports for Defined Benefit Pension Plans. This guide reflects our updated expectations regarding the maximum going concern discount rate and revised expectations due to the update to Part 3000 of the Canadian Institute of Actuaries’ Standards of Practice.

- In December 2022, we published the final Instruction Guide for the Authorization of Amendments Reducing Benefits in Defined Benefit Pension Plans. This guide gives clear instructions on the filing requirements and outlines the principles and considerations relevant to applications seeking the Superintendent's authorization for an amendment regarding paragraph 10.1(2)(a) of the Pension Benefits Standards Act. This guidance aims to aid applicants in navigating the authorization process effectively.

- In January 2023, we published new guidance on the maximum going concern discount rate for plans using an overlay strategy, which reflects our updated expectations.

- In March 2023, we published the Instruction Guide on Buy-in Annuity products. This instruction guide serves as an update to the guidance published in September 2012. It incorporates new requirements for the valuation of assets and liabilities, along with additional considerations for the administration of pension plans and pension funds. By providing updated information and guidelines, this instruction guide ensures that pension plans and funds adhere to the latest requirements and best practices.

Approvals

Pension plans are required to obtain the approval of the Superintendent for various types of transactions, including plan registrations, terminations, asset transfers, surplus refunds, and accrued benefits reductions. In the fiscal year 2022-23, we:

- Registered nine new plans, all of which were defined contribution plans.

- Approved nine plan termination reports.

- Authorized seven defined benefit asset transfer requests.

In total, 36 pension transactions were submitted for approval in 2022-23, compared to 27 in the previous fiscal year. We processed 28 applications and successfully met our service standard for pension approvals.

Chapter 7 – Looking ahead to 2023-24

In fiscal year 2023-24, we will supervise and regulate FRFIs and FRPPs with a focus on ensuring they adapt responsibly to their risk environment. We will also continue our transformation journey outlined in the 2022-25 Blueprint and the 2022-25 Strategic Plan. We will focus our efforts in the following areas.

Strengthening our capacity to respond

We recognize that the economic environment has and will likely continue to pose a risk to the safety and soundness of FRFIs. In such situations, our ability to intervene quickly, decisively, and effectively is critical. As such, we will strengthen our supervisory capacity by diverting resources as required from other areas to ensure readiness. At the same time, we will double down on our effort to ensure timely and proactive due diligence on our business as usual supervisory activities. This will involve some delays in other initiatives, the impacts of which we will seek to mitigate by targeting our resources to priorities.

Developing our approach to our new mandate

Our mandate has traditionally been to ensure the sound financial condition of banks, insurance companies, and pension funds. In 2023, Parliament introduced changes to our mandate. In addition to soundness, it has mandated us to address the integrity and security of financial institutions, including foreign interference. Consistent with this new mandate, we will work to ensure FRFIs establish policies and procedures to safeguard against such threats, which we will examine and report findings to the Minister of Finance.

Enhancing workplace culture and operational resiliency

We recognize the importance of workplace culture and organizational preparedness in an uncertain environment. In line with the Common hybrid work model for the Federal Public Service and to strengthen cultural resiliency, we will adapt our hybrid organization and implement a consistent approach to risk management. This will enhance our ability to respond effectively to risks and opportunities in a complex and interconnected risk landscape.

We will work together as one office to demonstrate our respect for one another through diversity of thought and inclusion, to continuously improve and innovate through our collective curiosities, and to act with integrity and stewardship by being transparent and thoughtful in our decision-making. As we build our operational resiliency and internal culture, we will focus on preserving confidence, remaining vigilant, and always improving.

Progressing in year two of transformation

We are in the second year of a transformation journey to thrive in uncertainty and maintain confidence in the financial system. Our focus will be on implementing initiatives, sustaining progress, and building capacity to address emerging risks in a dynamic environment. We have consistently proven that we can overcome challenges while successfully fulfilling our mandate and installing our transformative plans, and we will continue to do this as fiscal year 2023-24 progresses.

Advancing our supervisory capabilities

As part of our transformation agenda, we will invest in our supervisory practices, people, technology (Suptech), and data analytics to enhance our ability to assess risk and enable more effective and efficient supervision.

The new supervisory framework to guide our oversight of FRFIs and FRPPs, which will be effective on April 1, 2024, will be a comprehensive update to our existing framework and will allow for more effective intervention at the first sign of an emerging issue.

We established the Supervision Institute dedicated to building supervisory capacity. New learning and development programs will be launched to strengthen the supervision talent pool and provide supervisory staff with the knowledge and competencies they need to excel in their roles.

Statement of management responsibility including internal control over financial reporting

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2023 and all information contained in these statements rests with the management of the Office of the Superintendent of Financial Institutions (OSFI). These financial statements have been prepared by management using the Government of Canada’s accounting policies, which are based on Canadian public sector accounting standards.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management’s best estimates and judgment, and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of OSFI’s financial transactions. Financial information submitted in the preparation of the Public Accounts of Canada, and included in OSFI’s Departmental Results Report, is consistent with these financial statements.

Management is also responsible for maintaining an effective system of internal control over financial reporting (ICFR) designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are properly authorized and recorded in accordance with the Financial Administration Act and other applicable legislation, regulations, authorities and policies.

Management seeks to ensure the objectivity and integrity of data in its financial statements through careful selection, training, and development of qualified staff; through an organizational structure that provides appropriate divisions of responsibility; through communication programs aimed at ensuring that regulations, policies, standards, and managerial authorities are understood throughout OSFI; and through conducting an annual assessment of the effectiveness of the system of ICFR.

The system of ICFR is designed to mitigate risks to a reasonable level based on an on-going process to identify key risks, to assess effectiveness of associated key controls, and to make any necessary adjustments.

Under the responsibility of the Chief Financial Officer, a risk based assessment of the system of ICFR for the year ended March 31, 2023 was completed in accordance with the Treasury Board Policy on Financial Management and the results and action plans are summarized in the annex.

The effectiveness and adequacy of OSFI’s system of internal control is reviewed by the internal audit staff, who conduct periodic risk based audits of different areas of OSFI’s operations, and by OSFI’s Audit Committee, which oversees management’s responsibilities for maintaining adequate control systems and the quality of financial reporting, and which reviews and provides advice to the Superintendent on the audited financial statements.

Deloitte LLP has audited the financial statements of OSFI and reports on their audit to the Minister of Finance. This report does not include an audit opinion on the annual assessment of the effectiveness of OSFI’s internal controls over financial reporting.

Michael Hammond CPA, CGA

Chief Financial Officer

Peter Routledge

Superintendent of Financial Institutions

Ottawa, Canada

June 29, 2023

Independent auditor’s report

To the Superintendent of Financial Institutions and the Minister of Finance

Opinion

We have audited the financial statements of the Office of the Superintendent of Financial Institutions (“OSFI”), which comprise the statement of financial position as at March 31, 2023, and the statements of operations, changes in net financial assets and cash flow for the year then ended, and notes to the financial statements, including a summary of significant accounting policies (collectively referred to as the “financial statements”).

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of OSFI as at March 31, 2023, and the results of its operations and its cash flows for the year then ended in accordance with Canadian public sector accounting standards (“PSAS”).

Basis for opinion

We conducted our audit in accordance with Canadian generally accepted auditing standards (“Canadian GAAS”). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of OSFI in accordance with the ethical requirements that are relevant to our audit of the financial statements in Canada, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Responsibilities of management and those charged with governance for the financial statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with Canadian accounting standards for public sector, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing OSFI’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate OSFI or to cease operations, or has no realistic alternative but to do so.