2024 Actuarial report on the Employment Insurance Premium Rate

Commissioners of the Canada Employment Insurance Commission

Dear Commissioners,

Pursuant to section 66.3 of the Employment Insurance Act, I am pleased to submit the 2024 report, which provides actuarial forecasts and estimates for the purposes of sections 4, 66 and 69 of the Employment Insurance Act.

The estimates presented in this report are based on the Employment Insurance provisions and proposed program changes as of 22 July 2023.

Yours sincerely,

Mathieu Désy, FCIA, FSA, CFA

Senior Actuary, Employment Insurance Premium Rate-Setting

Office of the Chief Actuary

Office of the Superintendent of Financial Institutions Canada

Table of contents

List of tables

1 Executive summary

1.1 Main findings

| 2024 | 2023 | |

|---|---|---|

| Maximum insurable earnings (MIE) | $63,200 | $61,500 |

| 7-year forecast break-even rateMain findings table footnote 1 | 1.66% | 1.74% |

| Québec Parental Insurance Plan (QPIP) reduction | 0.34% | 0.36% |

| Qualified wage-Loss plans: EI savings |

$1,290 million | $1,322 millionMain findings table footnote 2 |

| Qualified wage-loss plans: Employer premium reductions |

|

|

| Employer multiplier: Outside Québec Based on a premium rate of 1.66% in 2024 and 1.63% in 2023 |

|

|

| Employer multiplier: Québec Based on a premium rate of 1.32% in 2024 and 1.27% in 2023 |

|

|

|

Main findings table footnotes

|

||

These estimates are based on the EI provisions as of 22 July 2023, on the information provided on or before 22 July 2023 by the Minister of Employment and Social Development and the Minister of Finance, and on the methodology and assumptions developed by the Actuary.

Accordingly, a premium rate corresponding to the 7-year forecast break-even rate (1.66%) from 2024 to 2030 would balance out the EI Operating Account at the end of 2030Footnote 1.

Table 1 below shows the status of the EI Operating Account for 2022, as well as its projected evolution for 2023 and 2024. This is based on the capped premium rate of 1.63% for 2023 and on a premium rate for 2024 equal to the 7-year forecast break-even rate (1.66%).

| Calendar year | Premium rate | Premium revenue | Expenditures | Annual surplus (deficit) |

Cumulative surplus (deficit) 31 December |

|---|---|---|---|---|---|

| 2022 | 1.58% | 26,798 | 25,595 | 1,204 | (24,661) |

| 2023 | 1.63% | 28,691 | 24,268 | 4,422 | (20,239) |

| 2024 | 1.66% | 30,056 | 28,599 | 1,458 | (18,781) |

It is important to note that the figures related to future expenditures and earnings base included in this report are projections, and eventual differences between future experience and these projections will be analyzed and considered in subsequent reports.

1.2 Purpose of the report

This Actuarial Report prepared by the Actuary, Employment Insurance Premium Rate-Setting, is the eleventh report to be presented to the Canada Employment Insurance Commission (Commission) in compliance with section 66.3 of the Employment Insurance Act (EI Act).

The Actuary is a Fellow of the Canadian Institute of Actuaries who is an employee of the Office of the Superintendent of Financial Institutions and who is engaged by the Commission to perform duties under section 66.3 of the EI Act. Pursuant to this section, the Actuary shall prepare actuarial forecasts and estimates for the purposes of calculating the maximum insurable earnings (MIE) under section 4 of the EI Act, the employment insurance (EI) premium rate under section 66 of the EI Act, and the premium reductions under section 69 of the EI Act for employers who sponsor qualified wage-loss plans, and for employees and employers of a province that has established a provincial plan. The actuary shall also, on or before 22 August of each year, provide the Commission with a report that sets out:

- the forecast premium rate for the following year and a detailed analysis in support of the forecast;

- the calculations performed for the purposes of sections 4 and 69 of the EI Act;

- the information provided under section 66.1 of the EI Act; and

- the source of the data, the actuarial and economic assumptions and the actuarial methodology used.

The purpose of this report is to provide the Commission with all the information prescribed under section 66.3 of the EI Act. The Commission shall, on or before 14 September, make available to the public this report along with the summary of this report. More information on the rate setting process along with the inherent deadlines can be found in Appendix A.

1.3 Scope of the report

Recent program changes and announcements are summarized in Section 2.

The methodology used in determining the 7-year forecast break-even rate, including the premium rate reduction for employees and employers of a province that has established a provincial plan such as Québec, and the reduction in employer premiums due to qualified wage-loss plans, is summarized in Section 3.

Section 4 provides an overview of the key assumptions used in projecting insurable earnings and EI expenditures, while Section 5 presents the main results, including the calculation of the 2024 EI 7-year forecast break-even rate and the projection of the EI Operating Account. Sensitivity tests on the main assumptions are outlined in Section 6.

A reconciliation between the 2023 and 2024 EI 7-year forecast break-even rates is presented in Section 7.

Concluding remarks and the actuarial opinion are presented in Section 8 and Section 9, respectively. The various appendices provide supplemental information on the EI program and on the data, assumptions and methodology employed. Detailed information on the calculation of the maximum insurable earnings (MIE) is presented in Appendix C.

1.4 Sensitivity of the 7-year forecast break-even rate

Two of the most relevant assumptions used to determine the 7-year forecast break-even rate are the unemployment rate, which is provided by the Minister of Finance, and the recipiency rate, which is projected by the Actuary.

Section 6 presents the sensitivity tests. They can be summarized as follows:

- a variation in the average unemployment rate of 0.5% over the period 2024-2030 would result in an increase/decrease between 0.06% and 0.07% in the 2024 EI 7-year forecast break‑even rate;

- a variation in the average recipiency rate of 5% over the period 2024-2030 would result in an increase/decrease of about 0.05% in the 2024 EI 7-year forecast break-even rate; and

- a variation in the premium rate of 0.01% of insurable earnings would result in a $1,534 million increase/decrease in the cumulative balance of the EI Operating Account at the end of the 7‑year forecast period.

1.5 Conclusion

This report was prepared by the Actuary in accordance with the relevant legislation.

In accordance with the methodology detailed in the EI Act and the relevant economic data, the 2024 MIE is $63,200.

Should the Commission set the 2024 premium rate at the 7-year forecast break-even rate, the 2024 premium rate would be equal to:

- 1.66% of insurable earnings for residents of all provinces except Québec; and

- 1.32% of insurable earnings for residents of Québec, after taking into account the QPIP reduction of 0.34%.

A reconciliation of the 7-year forecast break-even rate, from 1.74% in the 2023 Actuarial Report to 1.66% in the current report, is shown in Section 7. The decrease between the rate of 1.74% and 1.66% is mainly attributable to a lower initial deficit as of 31 December 2023, an increase in premium contributions due to a higher number of earners and a decrease in the average weekly benefits when compared to the projections from the previous report. These factors more than offset the expected impact from an increase in the unemployment rate in 2024.

The 2024 premium reduction for employers who sponsor qualified wage-loss plans is estimated at $1,290 million.

2 Recent program changes and announcements

2.1 Seasonal claimants

Budget 2023 extended the current temporary seasonal worker measure for a year until October 2024. This measure provides five additional weeks of EI regular benefits, for a maximum of 45 weeks, to eligible seasonal workers in 13 targeted EI economic regions.

2.2 Sickness benefits

Starting on 18 December 2022, the length of sickness benefits was enhanced from 15 to 26 weeks.

2.3 Training benefit

Employment and Social Development Canada indicated that the implementation of the new EI Training Support Benefit (part of the Canada Training Benefit) originally announced in Budget 2019 and proposed to be launched in late 2020 would be delayed. The benefit components are:

- The EI Training Support Benefit, designed to help workers cover their living expenses when they require time off work to pursue training; and

- The EI Premium Rebate for Small Businesses, designed to help offset the upward pressure on EI premiums resulting from the introduction of the new EI Training Support Benefit.

2.4 Other

Budget 2023 announced the following changes:

- Establishment of the EI Board of Appeal, originally announced in 2019, to replace the current EI appeals process under the Social Security Tribunal General Division; and

- Additional funding for the Labour Market Development Agreements (LMDA) for the fiscal year 2023-2024.

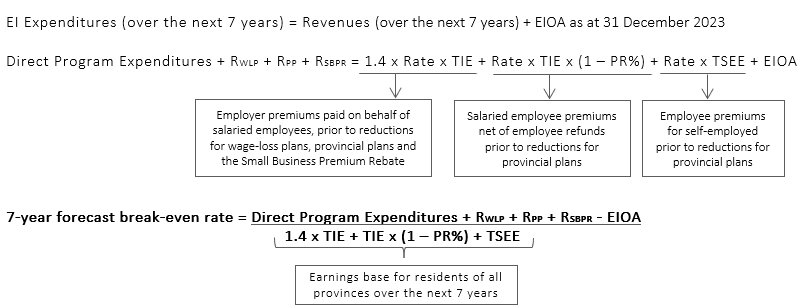

3 Methodology

In accordance with subsection 66(1) of the EI Act, the Commission shall set the premium rate each year in order to generate just enough premium revenue during the next seven years to ensure that at the end of this seven-year period, the total of the amounts credited to the EI Operating Account after 31 December 2008 is equal to the total of the amounts charged to that Account after that date. This calculated premium rate is referred to as the 7-year forecast break‑even rate.

Based on relevant assumptions, the 2024 EI 7-year forecast break-even rate is the premium rate that is expected to generate sufficient premium revenue to ensure that at the end of 2030, the EI Operating Account balance is $0. It is therefore based on:

- the projected balance of the EI Operating Account as of 31 December 2023; and

- the projection over a period of seven years of:

- the earnings base;

- the EI expenditures;

- the amount of premium reductions granted to employers who sponsor a qualified wage-loss plan; and

- the amount of premium reductions granted to employees and employers of a province that has established a provincial plan.

The projected rebate amounts for small businesses related to the new EI Training Support Benefit expected to be launched in 2024 are also considered.

The earnings base represents the total insurable earnings on which salaried employees and their employers pay EI premiums, and the earnings on which self‑employed individuals that opted into the EI program pay EI premiums. Prior to an adjustment to reflect employee premium refunds, the employer portion of the earnings base is equal to 1.4 times the employee portion of the earnings base.

For purposes of determining the 7-year forecast break-even rate, the earnings base and EI expenditures are projected over a seven‑year period.

The base year for the earnings base is 2021, which is the most recent year for which fully assessed T4 slips (Statement of Remuneration Paid) data are available. However, for certain assumptions, the 2022 partially assessed information is used. Complete data for 2022 will not become available until January 2024.

EI benefits are projected from actual 2022 benefits paid (base year) but adjusted based on the first six months of known data for 2023.

The earnings base and EI expenditures are projected from the base year using:

- Data and assumptions provided by the Minister of Employment and Social Development (ESD), including prescribed information as set out in section 66.1 of the EI Act (presented in Table 24, Appendix D);

- Assumptions and forecasts provided by the Minister of Finance in accordance with section 66.2 of the EI Act (presented in Table 25, Appendix D);

- Additional data provided by Service Canada, Employment and Social Development Canada (ESDC) and the Canada Revenue Agency (CRA); and

- Methodology and other assumptions developed by the Actuary.

In accordance with section 69 of the EI Act and related regulations, premium reductions are granted to employers who sponsor a qualified wage-loss plan as well as to employees residing in a province that has established a provincial plan and their employers. In addition, Budget 2019 proposed a Small Business Premium Rebate (related to the new EI Training Support Benefit and expected to be launched in 2024). The expected amounts of these premium reductions and rebate over the next seven years are included in the EI expenditures for purposes of determining the 7-year forecast break-even rate.

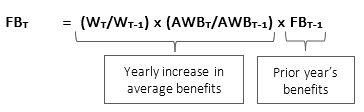

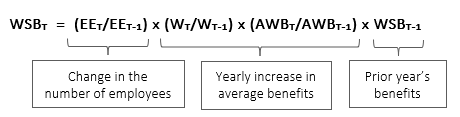

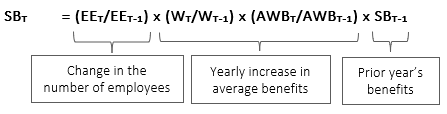

EI premiums paid by the employer are equal to the employer multiplier times the premiums deducted by the employer on behalf of its employees. Generally, the employer multiplier is equal to 1.4. However, pursuant to subsection 69(1) of the EI Act, the employer premiums can be reduced through a lower employer multiplier when its employees are covered under one of four types of qualified wage-loss plans which reduce EI special benefits otherwise payable. The 2024 premium reductions for those employers are determined in accordance with subsection 69(1) of the EI Act and related regulations. They are based on the methodology and assumptions developed by the Actuary.

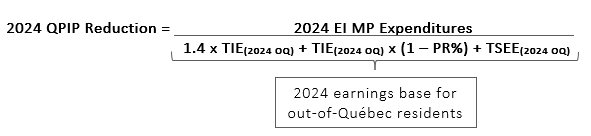

Québec is currently the only province that has established a provincial plan through the Québec Parental Insurance Plan (QPIP) which has been providing maternity and parental benefits to Québec residents since 1 January 2006. In accordance with subsection 69(2) of the EI Act and related regulations, a mechanism to reduce EI premiums paid by Québec residents and their employers was introduced. The 2024 reduction for Québec residents and their employers is determined in accordance with legislation and based on a methodology and on assumptions developed by the Actuary. The reduction is granted through a reduced premium rate. For 2024, this reduction is referred to as the 2024 QPIP reduction.

More information on the methodology used for calculating the 7-year forecast break-even rate and the premium reductions for 2024 is provided in Appendix B.

4 Assumptions

This section provides a brief overview of the main assumptions used in projecting the variables included in the calculation of the 7-year forecast break‑even rate. The section is broken down into two subsections: assumptions related to the projected earnings base and assumptions related to the projected expenditures. More detailed information and supporting data are provided in Appendix D.

4.1 Earnings base

The earnings base is detailed in the denominator of the formula for the 7-year forecast break-even rate and the QPIP reduction developed in Appendix B. The earnings base is comprised of:

- the total insurable earnings on which employers pay EI premiums prior to any adjustment for wage-loss plans or provincial plans;

- the total insurable earnings on which employees pay EI premiums adjusted to reflect employee premium refunds; and

- the earnings on which self‑employed individuals that opted into the EI program pay EI premiums.

The main assumptions used in determining the earnings base are presented in Table 2 below.

| Assumptions | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|

| Increase in maximum insurable earnings | 7.10% | 1.99% | 2.76% | 3.32% | 3.06% | 2.82% | 2.89% | 2.95% | 2.73% |

| Increase in number of earners | 6.47% | 0.67% | -0.67% | -0.08% | 0.14% | 0.40% | 0.73% | 0.74% | 0.78% |

| Increase in average employment incomeTable 2 footnote * | 3.57% | 3.32% | 3.47% | 3.24% | 3.11% | 2.96% | 2.92% | 2.89% | 2.87% |

| Increase in total employment income | 10.27% | 4.01% | 2.77% | 3.16% | 3.25% | 3.37% | 3.68% | 3.65% | 3.67% |

| Increase in total insurable earnings | 11.75% | 3.23% | 2.29% | 3.23% | 3.22% | 3.30% | 3.66% | 3.68% | 3.59% |

| Net transfer of insurable earnings to Québec reflecting the province of residence | 0.23% | 0.23% | 0.23% | 0.23% | 0.23% | 0.23% | 0.23% | 0.23% | 0.23% |

| Adjustment due to employee premium refunds (% of total insurable earnings) | 2.55% | 2.55% | 2.55% | 2.55% | 2.55% | 2.55% | 2.55% | 2.55% | 2.55% |

| Increase in covered self-employed earnings | |||||||||

|

Total

|

14% | 14% | 10% | 9% | 9% | 8% | 8% | 8% | 7% |

|

Out-of-Québec residents

|

15% | 14% | 10% | 9% | 9% | 8% | 8% | 8% | 8% |

|

Québec residents

|

12% | 12% | 8% | 8% | 8% | 7% | 7% | 7% | 7% |

|

Table 2 Footnote

|

|||||||||

4.1.1 Maximum insurable earnings

The MIE represents the income level up to which EI premiums are paid and up to which EI benefits are calculated and is a key element in determining the earnings base. Section 4 of the EI Act provides details on how to determine the yearly MIE. In accordance with this section, the MIE increases annually based on increases in the average weekly earnings, as reported by Statistics Canada.

The 2024 MIE is equal to $63,200, which represents a 2.8% increase from the 2023 MIE of $61,500. The projected MIE for years 2025 to 2030 are calculated based on estimates of the average weekly earnings provided by the Minister of Finance. Detailed explanations and calculations of the 2024 MIE are provided in Appendix C.

4.1.2 Number of earners

The number of earners and their distribution across income ranges is used to determine the earnings base of salaried employees. The projected number of employees per year, which is based on an average of the number of employees per month, is provided by the Minister of Finance. The total number of earners for a year is higher than the number of employees provided given that the number of earners includes all individuals who had earnings at any time during the year rather than an average per month.

The preliminary number of earners for the year 2022 is set such that the resulting insurable earnings are in line with the expected assessed premiums for 2022, which are derived from the 2022 year-to-date assessed premiums and the 2022 increase in average employment income provided by the Minister of Finance. The projected number of earners from 2023 to 2030 is derived from a regression analysis based on the historical number of earnersFootnote 2 and number of employeesFootnote 3.

The number of earners is expected to increase by 6.47% in 2022 and by 0.67% in 2023. The average annual increase for the following seven years is 0.29%. The projected distribution of earners as a percentage of average employment income is based on the 2021 distribution.

4.1.3 Average and total employment income

The increase in average employment income, combined with the increase in the number of earners, is used to determine the increase in total employment income. The 2021 distribution of the total employment income across income ranges is used to determine the future distribution of total employment income.

The increase in average employment income is provided by the Minister of Finance and is expected to be 3.57% and 3.32% in 2022 and 2023 respectively. The average annual increase for the following seven years is 3.07%.

Based on these increases in average employment income and the expected variations in the total number of earners, the total employment income is expected to increase by 10.27% in 2022 and by 4.01% in 2023. The variation in 2022 is mainly due to the economic recovery from the COVID-19 pandemic. The average annual increase for the following seven years is 3.36%.

4.1.4 Total insurable earnings

The total insurable earnings of salaried employees are equal to the total employment income, up to the annual MIE, earned by a person employed in insured employment. They are used to determine the earnings base for salaried employeesFootnote 4.

The earnings base for salaried employees is equal to 2.4 times the total insurable earnings since employee premiums are based on their total insurable earnings and employer premiums are generally equal to 1.4 times the employee premiums, for a combined total of 2.4.

Historical information regarding total insurable earnings is derived from aggregate assessed premiums gathered from T4 slips (provided by CRA) of all salaried employees. For employees with multiple employments in the year, this information is based on the combined total EI premiums. This means that, although insurable earnings of each employment are capped at the MIE, the combined total insurable earnings can exceed the MIE. The adjustment to insurable earnings and the earnings base reflecting multiple employments is captured in the employee premium refund section below.

The expected total employment income capped at the annual MIE for 2022 to 2030 is derived from:

- the 2021 distribution of the total employment income;

- the 2021 distribution of the total number of earners as a percentage of average employment income; and

- the expected increases in these variables.

Based on this methodology, the total insurable earnings, before any adjustment for premium refunds, are expected to increase by 11.75% in 2022 and by 3.23% in 2023. The average annual increase for the following seven years is 3.28%. For 2022, the resulting insurable earnings reflect the year-to-date assessed premiums and related total expected assessed premiums for 2022. The significant increase in 2022 is mainly attributable to the economic recovery from the COVID-19 pandemic.

4.1.5 Split of total insurable earnings due to provincial plan

For the purposes of determining the reduction that applies to residents of a province with a provincial plan, the earnings base for salaried employees must be split between residents of provinces with and without a provincial plan. The only province that currently has a provincial plan is Québec. Therefore, the earnings base for salaried employees must be split based on the province of residence (between out-of-Québec residents and Québec residents).

The information used to derive historical insurable earnings provided by CRA is on a T4 basis and is therefore based on the province of employment. The historical distribution of insurable earnings on a T4 basis shows that the proportion of insurable earnings that relates to employment in Québec generally decreased until 2015; between 2015 and 2021, a slight increase was observed. Based on the historical pattern, it is expected that the proportion of insurable earnings that relates to employment in Québec will reach 22.7% in 2022, and will slightly decrease over the 7-year projection period, but will remain close to 21.5%.

The information on historical assessed premiums provided by CRA includes adjustment payments made between the Government of Canada and the Government of Québec each year to reflect the province of residence rather than the province of employment of each employee. These adjustment payments are the object of an administrative agreement between both parties and can be used as a basis to adjust the distribution of insurable earnings to reflect the province of residence.

The methodology used in adjusting the distribution of insurable earnings based on aggregated adjustment payments was validated against administrative data. The administrative data were provided by CRA and are part of the annual exchange of information between the Government of Canada and the Government of Québec.

Based on information provided by CRA, the net annual transfer of insurable earnings on a T4 basis to reflect the actual province of residence was on average 0.23% of total insurable earnings for the last three years of available data (2019 to 2021) with the transfer of insurable earnings on a T4 basis going to Québec from the rest of Canada. It is assumed to remain at 0.23% of total insurable earnings until 2030.

4.1.6 Employee premium refunds

In general, salaried employees contribute EI premiums on their total insurable earnings in a given tax year up to the annual MIE. However, when filing their tax returns, some employees may exceed the maximum contribution and receive a refund of all or a portion of the EI premiums paid in the year (e.g., employees with multiple employers in the same year and employees with insurable earnings below $2,000). The insurable earnings that are subject to any subsequent premium refund must be excluded from the earnings base.

Given that the data used for projection purposes (T4 slips) include insurable earnings for which premiums may later be refunded, an adjustment must be made to reduce the earnings base. It is important to note that the employer does not receive a refund. Thus, only the employee's portion of the total earnings base is adjusted, which is reflected in the formulas presented in Appendix B.

The historical data provided by CRA show that the total insurable earnings subject to a subsequent employee refund as a percentage of total insurable earnings is relatively stable. Based on the average for the last five years of available data (2017 to 2021) this percentage is assumed to be 2.55% from 2022 to 2030.

4.1.7 Self-employed earnings

Since 31 January 2010, self‑employed workers may voluntarily opt into the EI program to receive EI special benefits for those who are sick, pregnant or have recently given birth, or are caring for their newborn or newly adopted child(ren) and for those caring for a critically ill or injured family member (family caregiver benefit) or at end-of-life (compassionate care benefit). Although self-employed residents of Québec can access maternity and parental benefits through their provincial plan, they may voluntarily opt into the EI program to access other special benefits.

Self-employed individuals who participate in the EI program contribute premiums based on their self-employed earnings, up to the annual MIE, at the employee rate that corresponds to their province of residence, and there are no employer premium contributions. Therefore, as with the insurable earnings of salaried employees, self-employed covered earnings must be split between out-of-Québec residents and Québec residents.

The increase in self-employed earnings reflects the expected increase in the number of participants and in the average earnings of self-employed individuals.

The projected number of participants is based on historical enrolment information, adjusted to reflect expected future changes in enrolment. The increase in average earnings is assumed to be the same as the one for salaried employees.

Based on this methodology, the covered earnings of all self-employed individuals are expected to increase on average by 8% per year from 2024 to 2030.

4.2 Expenditures

EI Part I benefits are projected from actual 2022 benefits paid (base year) but adjusted based on the first six months of known data for 2023.

Table 3 presents a summary of the key expenditure assumptions used in this report, followed by a short description for each of them. A detailed description of the methodology used to project all benefits is available in Appendix D.

| Assumptions | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|

| Increase in labour forceTable 3 footnote 1 | 1.5% | 2.2% | 0.9% | 0.5% | 0.3% | 0.6% | 0.9% | 0.9% | 0.8% |

| Unemployment rateTable 3 footnote 1 | 5.3% | 5.4% | 6.2% | 6.0% | 5.7% | 5.7% | 5.7% | 5.7% | 5.7% |

| Increase in average weekly earningsTable 3 footnote 1 | 3.1% | 3.0% | 3.1% | 2.9% | 2.9% | 2.9% | 2.9% | 2.8% | 2.8% |

| Increase in average weekly benefits | 8.1% | 3.2% | 3.0% | 3.1% | 3.0% | 2.8% | 2.9% | 2.9% | 2.8% |

| Potential claimants (as a % of unemployed) | 53.3% | 54.3% | 55.5% | 57.0% | 57.0% | 57.0% | 57.0% | 57.0% | 57.0% |

| Recipiency rate (as a % of potential claimants) | 66.8% | 62.8% | 72.5% | 72.5% | 72.5% | 72.5% | 72.5% | 72.5% | 72.5% |

| Number of weeks | 52.0 | 52.0 | 52.4 | 52.2 | 52.2 | 52.2 | 52.0 | 52.2 | 52.2 |

| Percentage of benefit weeks for claimants with insurable earnings above the MIE | 45.1% | 47.0% | 47.2% | 47.2% | 47.2% | 47.2% | 47.2% | 47.2% | 47.2% |

|

Table 3 footnotes

|

|||||||||

4.2.1 Labour force

The labour force affects most of Part I benefits directly by increasing/decreasing the number of potential claimants. The labour force population is expected to increase from 20.8 million in 2022 to 21.2 million in 2023. The average labour force population between 2024 and 2030 is 21.8 million. This assumption is provided by the Minister of Finance.

4.2.2 Unemployment rate

The unemployment rate affects regular EI benefits directly by also increasing/decreasing the number of potential claimants. The average unemployment rate was 5.3% in 2022 and is expected to increase to 5.4% in 2023 and to 6.2% in 2024. The unemployment rate is then expected to decrease over the following years to reach an ultimate value of 5.7% in 2026. This assumption is provided by the Minister of Finance.

4.2.3 Average weekly earnings

The growth in average weekly earnings on a calendar year basis is used, in conjunction with the increase in the MIE, to project the average weekly benefits. The expected growth in average weekly earnings is 3.0% in 2023 and 3.1% in 2024. The average annual growth for years 2025 to 2030 is 2.9%. This assumption is provided by the Minister of Finance.

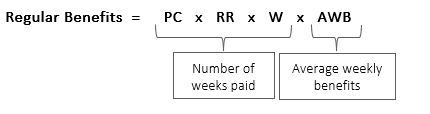

4.2.4 Average weekly benefits

The average weekly benefits growth affects EI expenditures directly through a corresponding increase/decrease in Part I expenditures. The average weekly benefits are equal to the benefit payments divided by the number of benefit weeks paid for Part I benefits.

The annual average weekly benefits growth rates are forecasted at 3.2% for 2023 and 3.0% for 2024. The average annual increase for years 2025 to 2030 is 2.9%. The growth rates are generally the same for all benefit types but the regular benefit was impacted differently by the COVID-19 pandemic recovery between years 2022 and 2023. As such, the assumed average weekly benefit growth for the regular benefit for the year 2023 was increased by an additional 3.8%, for a total of 7.0%.

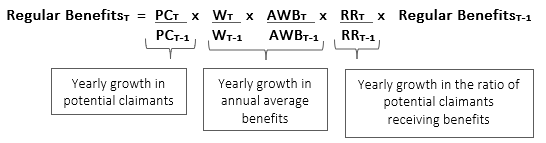

4.2.5 Potential claimants

The EI Program is designed to provide temporary income support to eligible insured persons who have lost their jobs through no fault of their own, such as due to a shortage of work, or as a result of seasonal or mass lay-offs and are available for work. The potential claimants represent the number of individuals or the percentage of unemployed individuals that meet the basic coverage criteria of the EI program. The number of potential claimants as a percentage of unemployed decreased from 65.3% in 2021 to 53.3% in 2022. Based on the experience of the first six months of 2023, it is expected to increase to 54.3% in 2023. Afterwards, it is expected to continue to increase up to 57.0% by 2025. The increase of the ultimate assumption from 55.0% in the previous report to 57.0% in the current report is mainly due to a revision of the data from Statistics Canada. Appendix D presents additional information on the potential claimants' calculation.

4.2.6 Recipiency rate

The recipiency rate represents the proportion of potential claimants in a given period who are receiving EI regular benefits. It is directly linked to the target population of the EI program (i.e., potential claimants) and does not consider individuals outside the target population of the EI program, such as the long-term unemployed and those who did not contribute to the program in the previous year. The recipiency rate is normally lower than 100% for multiple reasons, including that some potential claimants have not accumulated the required number of insurable hours, while other potential claimants do not apply for benefits, are serving the one-week waiting period, or have exhausted the number of weeks they were entitled to receive and remain unemployed.

The recipiency rate without emergency or temporary measures was estimated to be 91.2% in 2021 and 66.8% in 2022. People having benefited from measures are not considered in the recipiency rate since they were accounted for separately as recipients of these measures. Based on the experience of the first six months of 2023, the recipiency rate is assumed to decrease to 62.8% for the whole year 2023. From 2024 onwards, the recipiency rate is set at 72.5%. The reduction of the ultimate assumption from 75.0% in the previous report to 72.5% in the current report is mainly due to a revision of the data from Statistics Canada.

4.2.7 Number of weeks

EI expenditures are reported in the EI Operating Account on an accrual basis, that is, they are recorded in the period for which they should have been paid, regardless of the delay in processing the payment. Furthermore, EI benefits are paid on a weekly basis, but only weekdays that belong to a particular period are reported in that period.

The number of weeks affects Part I expenditures as benefits are payable for every weekday of the year, regardless of holidays. The number of workdays in a year ranges from 260 days to 262 days. Therefore, an adjustment is included to reflect the number of days benefits are paid in any year. The number of weeks for years 2022 to 2030 ranges between 52.0 and 52.4.

4.2.8 Percentage of benefit weeks for claimants with earnings above MIE

From analyses of administrative data provided by ESDC, 45.1% of benefit weeks for claims that accrued in 2022 were based on insurable earnings above the MIE compared to 37.9% in 2021. Based on partial data for 2023, the proportion of benefit weeks for claimants with insurable earnings above the MIE is assumed to increase to 47.0% in 2023. It is expected to further increase in 2024 up to 47.2% (observed average between 2017 and 2019) and to remain constant thereafter. The lower percentage of claims above the MIE for 2021 and 2022 is mostly due to the COVID-19 pandemic that caused greater unemployment for lower income Canadians.

4.2.9 Other expenditures

Additional information used to project expenditures such as pilot projects and temporary measures, the cost of new program changes, administration costs and employment benefits and support measures (EI Part II benefits) are provided by ESDC.

5 Results

5.1 Overview

This report provides actuarial forecasts and estimates for the purposes of sections 4, 66 and 69 of the EI Act. It has been prepared based on EI provisions as of 22 July 2023, on the information provided by the Ministers of ESD and Finance, and on the methodology and non-prescribed assumptions developed by the Actuary.

The key findings are as follows:

-

The 2024 MIE is equal to $63,200, an increase of 2.8% from the 2023 MIE of $61,500.

-

The 2024 EI 7-year forecast break-even rate is 1.66% of insurable earnings for residents of all provinces except Québec. The 2023 EI 7-year forecast break-even rate was 1.74% in the previous actuarial report. The decrease between the rate of 1.74% and 1.66% is mainly attributable to a lower initial deficit as at 31 December 2023, an increase in the contributions due to a higher number of earners and a decrease in the average weekly benefits when compared to the projections from the previous report. These factors more than offset the expected impact from an increase in the unemployment rate in 2024.

-

The 2024 premium reduction for residents of Québec due to its provincial plan is 0.34%.

-

The 2024 premium reduction for employers who sponsor qualified wage-loss plans is estimated at $1,290 million. This translates in premium reductions for employers who sponsor a qualified wage-loss plan corresponding to about 0.23%, 0.37%, 0.37% and 0.41% of insurable earnings for categories 1 through 4 respectivelyFootnote 5.

-

The total earnings base is expected to grow each year from $1,875 billion in 2022 to $2,426 billion in 2030.

-

Total expenditures are expected to decrease from $26 billion in 2022 to $24 billion in 2023 before increasing to $29 billion in 2024 and to $33 billion in 2030.

-

The EI Operating Account shows a cumulative deficit of $24.7 billion as of 31 December 2022. The projected cumulative deficit as of 31 December 2023 is $20.2 billion.

5.2 Earnings base

EI premiums, prior to any adjustment for wage-loss plans, are determined by the product of the premium rate and the earnings base. The national earnings base is required to determine the 7‑year forecast break-even rate while the earnings base of provinces not offering a provincial plan is required to determine the reduction due to those plans. Since Québec is the only province offering a provincial plan, the earnings base is split between Québec and out-of-Québec residents.

Based on the methodology and assumptions presented in Section 4, Table 4 shows the earnings base for Québec and out-of-Québec residents as well as the total number of earners.

| Calendar year | Earnings base ($ million) | Number of earners (thousands) |

||

|---|---|---|---|---|

| Out-of-Québec | Québec | Total | ||

| 2021 | 1,291,411 | 383,883 | 1,675,295 | 20,066 |

| 2022 | 1,445,229 | 429,454 | 1,874,683 | 21,364 |

| 2023 | 1,502,644 | 432,705 | 1,935,349 | 21,507 |

| 2024 | 1,541,117 | 438,680 | 1,979,798 | 21,363 |

| 2025 | 1,594,829 | 448,978 | 2,043,807 | 21,345 |

| 2026 | 1,649,838 | 459,865 | 2,109,703 | 21,374 |

| 2027 | 1,707,541 | 471,765 | 2,179,306 | 21,460 |

| 2028 | 1,772,528 | 486,545 | 2,259,073 | 21,618 |

| 2029 | 1,839,959 | 502,365 | 2,342,323 | 21,778 |

| 2030 | 1,907,988 | 518,464 | 2,426,453 | 21,947 |

These results are used in the calculation of the 2024 EI 7-year forecast break‑even rate and the 2024 QPIP reduction. A detailed explanation of the methodology and assumptions used to derive the results is available in Appendix D.

5.3 Expenditures

This section examines the expenditures side of the 7-year forecast break-even rate. EI expenditures include Part I (income benefits), Part II (Employment Benefits and Support Measures), administration costs, benefit repayments and bad debts. EI benefits may also include temporary spending initiatives, such as pilot projects and special measures announced by the Government of Canada. A detailed explanation of the methodology and assumptions used to derive the results is available in Appendix D.

For the purposes of the 7-year forecast break-even rate calculation, penalties and interest on overdue accounts receivable are included on the expenditures side of the equation.

Table 5 shows the breakdown of the 2022 EI expenditures, as well as a projection up to 2030.

| Calendar year | Part ITable 5 footnote 1 | Part II | Admin costs | Benefit repayments | Bad debt | Penalties | Interest | Total |

|---|---|---|---|---|---|---|---|---|

| 2022 | 20,818 | 2,488 | 2,691 | (406) | 47 | (20) | (24) | 25,595 |

| 2023 | 19,446 | 2,425 | 2,681 | (255) | 70 | (62) | (36) | 24,268 |

| 2024 | 24,362 | 2,208 | 2,499 | (431) | 82 | (78) | (43) | 28,599 |

| 2025 | 25,228 | 2,101 | 2,092 | (437) | 87 | (81) | (36) | 28,955 |

| 2026 | 25,405 | 2,101 | 1,969 | (434) | 89 | (81) | (35) | 29,015 |

| 2027 | 26,106 | 2,101 | 1,953 | (444) | 91 | (84) | (36) | 29,688 |

| 2028 | 27,011 | 2,101 | 1,949 | (460) | 94 | (86) | (37) | 30,573 |

| 2029 | 28,217 | 2,101 | 1,949 | (482) | 98 | (90) | (38) | 31,755 |

| 2030 | 29,220 | 2,101 | 1,949 | (499) | 102 | (94) | (40) | 32,740 |

|

Table 5 footnotes

|

||||||||

Table 6 shows the breakdown of Part I EI expenditures.

| Calendar year | Regular | Fishing | Work-Sharing | Training benefitTable 6 footnote 1 | Special benefits | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| MP | Sickness | Compas-sionate | Family caregiver benefit | Sub-total | Total | |||||

| 2022 | 13,223 | 378 | 38 | nil- | 4,996 | 2,017 | 53 | 113 | 7,179 | 20,818 |

| 2023 | 11,255 | 388 | 23 | nil- | 5,003 | 2,581 | 54 | 143 | 7,780 | 19,446 |

| 2024 | 15,492 | 402 | 19 | 22 | 5,160 | 3,066 | 55 | 147 | 8,428 | 24,362 |

| 2025 | 15,688 | 413 | 19 | 285 | 5,437 | 3,179 | 56 | 150 | 8,823 | 25,228 |

| 2026 | 15,551 | 426 | 20 | 294 | 5,602 | 3,299 | 58 | 155 | 9,114 | 25,405 |

| 2027 | 15,920 | 438 | 21 | 296 | 5,784 | 3,428 | 60 | 160 | 9,432 | 26,106 |

| 2028 | 16,482 | 448 | 21 | 296 | 5,973 | 3,564 | 62 | 165 | 9,763 | 27,011 |

| 2029 | 17,256 | 463 | 22 | 296 | 6,218 | 3,726 | 64 | 172 | 10,180 | 28,217 |

| 2030 | 17,856 | 476 | 23 | 296 | 6,441 | 3,883 | 67 | 178 | 10,568 | 29,220 |

|

Table 6 footnotes

|

||||||||||

5.4 Premium reductions and rebate

The employer premiums can be reduced through a lower employer multiplier when its employees are covered under a qualified wage-loss plan that reduces EI special benefits otherwise payable, provided that at least 5/12 of the reduction is passed on to employees. Premiums paid by employees and their employers can also be reduced when employees are covered under a plan established under provincial law that reduces EI maternity and parental benefits otherwise payable. An agreement must be in place between the Government of Canada and the province to establish a system for reducing premiums paid by residents of that province and their employers.

Budget 2019 announced an EI Small Business Premium Rebate to offset the upward pressure on EI premiums resulting from the EI Training Support Benefit (originally expected to be launched in late 2020, but now postponed to 2024). This rebate is proposed to be available to any business that pays employer EI premiums equal to or less than $20,000 for the 2024 calendar year. Using forecasted calendar year expenditures received from the Minister of ESD, the cost of the EI Training Support Benefit in 2024 (including the administration costs related to this benefit) is expected to represent 1.5 cent (1.45 cents unrounded, or 0.0145%). This cost is included in the 7‑year forecast break-even rate of 1.66%.

Table 7 shows the projection of the expected premium reductions and rebate up to 2030 taken into account in the determination of the 7-year forecast break-even rate. Temporary and permanent measures recently announced are considered in the projection of the premium reductions for qualified wage-loss plans and provincial plans.

| Calendar year | Qualified wage-loss plans | Provincial plans | SBPRTable 7 footnote 1 |

|---|---|---|---|

| 2024 | 1,290 | 1,492 | 26 |

| 2025 | 1,408 | 1,527 | 27 |

| 2026 | 1,486 | 1,564 | 28 |

| 2027 | 1,737 | 1,604 | 29 |

| 2028 | 1,934 | 1,654 | 29 |

| 2029 | 2,066 | 1,708 | 29 |

| 2030 | 2,184 | 1,763 | 29 |

|

Table 7 footnotes

|

|||

5.5 7-year forecast break-even rate

The 7-year forecast break-even rate is the rate that, based on relevant assumptions, is expected to generate sufficient premium revenue during the next seven years to ensure that, at the end of that seven-year period, the amounts credited and charged to the EI Operating Account (EIOA) after 31 December 2008 are equal.

This rate is expected to generate sufficient premium revenue during the 2024-2030 period to pay for the expected EI expenditures over that same period and to eliminate the projected deficit that has accumulated in the EI Operating Account as of 31 December 2023.

The expected amounts of the premium reductions over the next seven years for qualified wage‑loss plans (WLP) and for provincial plans (PP), as well as the Small Business Premium Rebate related to the EI Training Support Benefit expected to launch in 2024 are included in the EI expenditures for purposes of determining the 7-year forecast break-even rate. This ensures that in the absence of wage-loss plans, provincial plans and Small Business Premium Rebate, a premium rate set at the 7-year forecast break-even rate would generate enough revenues to cover all EI expenses for employees of every employer residing in any province.

Table 8 shows the projection of the variables used to determine the 7-year forecast break-even rate. The annual expected pay-as-you-go rates (PayGo) are the rates required to cover the expected expenditures of that year. The 7-year forecast break-even rate is higher than the average PayGo rates since the projected deficit as at 31 December 2023 is considered.

| Calendar year | Expenditures covered by the 7-year forecast break-even rate | Surplus (deficit) in the EIOA as at 31 December 2023 | Earnings base | Annual PayGo rate / 7-year forecast break-even rate (%) | ||||

|---|---|---|---|---|---|---|---|---|

| EI expenditures | Reduction for WLP | Reduction for PP | SBPRTable 8 footnote 1 | Total expenditures before reductions and rebate | ||||

| 2024 | 28,599 | 1,290 | 1,492 | 26 | 31,407 | nil- | 1,979,798 | 1.59% |

| 2025 | 28,955 | 1,408 | 1,527 | 27 | 31,917 | nil- | 2,043,807 | 1.56% |

| 2026 | 29,015 | 1,486 | 1,564 | 28 | 32,093 | nil- | 2,109,703 | 1.52% |

| 2027 | 29,688 | 1,737 | 1,604 | 29 | 33,058 | nil- | 2,179,306 | 1.52% |

| 2028 | 30,573 | 1,934 | 1,654 | 29 | 34,190 | nil- | 2,259,073 | 1.51% |

| 2029 | 31,755 | 2,066 | 1,708 | 29 | 35,558 | nil- | 2,342,323 | 1.52% |

| 2030 | 32,740 | 2,184 | 1,763 | 29 | 36,716 | nil- | 2,426,453 | 1.51% |

| 2024-30 | 211,325 | 12,106 | 11,311 | 198 | 234,939 | (20,239) | 15,340,463 | 1.66%Table 8 footnote 2 |

|

Table 8 footnotes

|

||||||||

Table 9 shows the projection of revenues, EI expenditures, and the account balance using the 7‑year forecast break-even rate and the premium reductions.

| Calendar year | Premium rate (%) | Revenues | Net premiums | Expend- itures |

Annual surplus (deficit) |

Cumul- ative surplus (deficit) 31 December |

||||

|---|---|---|---|---|---|---|---|---|---|---|

| Gross premiums after refunds | Reduction for WLP | Reduction for provincial plans | SBPRTable 9 footnote 1 | Other adj.Table 9 footnote 2 | ||||||

| 2022 | 1.58% | 29,620 | (1,186) | (1,632) | nil- | (4) | 26,798 | 25,595 | 1,204 | (24,661) |

| 2023 | 1.63% | 31,546 | (1,322) | (1,558) | nil- | 24 | 28,691 | 24,268 | 4,422 | (20,239) |

| 2024 | 1.66% | 32,865 | (1,290) | (1,492) | (26) | nil- | 30,056 | 28,599 | 1,458 | (18,781) |

| 2025 | 1.66% | 33,927 | (1,408) | (1,527) | (27) | nil- | 30,966 | 28,955 | 2,011 | (16,771) |

| 2026 | 1.66% | 35,021 | (1,486) | (1,564) | (28) | nil- | 31,943 | 29,015 | 2,928 | (13,843) |

| 2027 | 1.66% | 36,176 | (1,737) | (1,604) | (29) | nil- | 32,806 | 29,688 | 3,118 | (10,724) |

| 2028 | 1.66% | 37,501 | (1,934) | (1,654) | (29) | nil- | 33,883 | 30,573 | 3,311 | (7,414) |

| 2029 | 1.66% | 38,883 | (2,066) | (1,708) | (29) | nil- | 35,080 | 31,755 | 3,325 | (4,089) |

| 2030 | 1.66% | 40,279 | (2,184) | (1,763) | (29) | nil- | 36,303 | 32,740 | 3,563 | (526) |

|

Table 9 footnotes

|

||||||||||

The 2024 EI 7-year forecast break‑even rate is 1.66%. This rate would balance out the EI Operating Account at the end of 2030. The cumulative balance in the EI Operating Account at the end of 2030 is not exactly $0 since the 7-year forecast break-even rate is rounded to the nearest cent.

5.6 Québec Parental Insurance Plan (QPIP) reduction for 2024

EI maternity and parental (MP) benefits included in Part I special benefits, as well as direct EI administrative costs incurred to provide MP benefits (variable administrative costs (VAC)), are required to determine the QPIP reduction. VAC represent the direct operating costs incurred by the EI program associated with the administration of EI MP benefits outside Québec. They are determined each year by ESDC in accordance with the agreement between Canada and Québec, which stipulates a minimum VAC amount.

EI MP benefits are projected from the base year 2022 and reflect the impacts of program changes and special measures. The projected EI MP expenditures used to determine the 2024 QPIP reduction are shown in Table 10. They include the cost estimates provided by ESDC for temporary measures.

| Actual 2022 |

Forecast | ||

|---|---|---|---|

| 2023 | 2024 | ||

| EI MP benefits | 4,996 | 5,003 | 5,160 |

| Variable administration costs | 37 | 37 | 38 |

| MP expenditures | 5,033 | 5,040 | 5,198 |

The QPIP reduction is equal to the ratio of EI MP expenditures (EI MP benefits and VAC) to the earnings base of residents of all provinces without a provincial plan, that is, residents of all provinces except Québec. It is the premium reduction for Québec residents as it relates to the savings to the EI Program resulting from the QPIP.

Table 11 shows the estimates of the variables that are required in the calculation of the 2024 QPIP reduction, as well as the resulting 2024 QPIP reduction.

| Calculation parameters | 2024 Forecast |

|---|---|

| MP expenditures | 5,198 |

| MP earnings base (out-of-Québec residents) | 1,541,117 |

| Unrounded QPIP reduction | 0.3373% |

| QPIP reduction | 0.34% |

Consequently, the premium rate applicable to residents of all provinces except Québec for 2024 would be 1.66%Footnote 6. The premium rate applicable to residents of Québec would be 1.32% (1.66% minus 0.34%).

5.7 Qualified wage-loss plan reductions for 2024

Based on the methodology developed in Appendix B and on the 2024 projected insurable earnings of employees covered by a qualified wage-loss plan, the 2024 estimated reduction in employer premiums due to qualified wage-loss plans is $1,290 million, compared to $1,322 million for 2023.

EI premiums paid by the employer are equal to the employer multiplier times the premiums deducted by the employer on behalf of its employees. Generally, the employer multiplier is equal to 1.4. However, the employer premiums can be reduced through a lower employer multiplier when its employees are covered under one of four types of qualified wage-loss plans.

Table 12 shows the main results. A detailed explanation of the data and methodology used to derive the results is available in Appendix E.

| Wage-loss plan category | Unrounded rate of reduction | Rounded rate of reduction | Employer multiplier (out-of-Québec)Table 12 footnote 1 |

Employer multiplier (Québec)Table 12 footnote 1 |

2024 Estimated insurable earnings ($ million) |

2024 estimated premium reduction ($ million) |

|---|---|---|---|---|---|---|

| Category 1 | 0.2268% | 0.23% | 1.263 | 1.228 | 65,560 | 149 |

| Category 2 | 0.3743% | 0.37% | 1.175 | 1.116 | 30,939 | 116 |

| Category 3 | 0.3706% | 0.37% | 1.177 | 1.119 | 241,377 | 895 |

| Category 4 | 0.4065% | 0.41% | 1.155 | 1.092 | 32,282 | 131 |

| Total | N/A | N/A | N/A | N/A | 370,158 | 1,290 |

|

Table 12 footnotes

|

||||||

6 Uncertainty of results

The 7-year forecast break-even rate and the subsequent impact on the EI Operating Account (EIOA) depends on different demographic and economic factors. As actual experience over the next seven years will likely deviate from the assumptions presented throughout this report, this section presents individual tests, combined tests, and alternative scenarios for illustration purposes.

6.1 Individual tests

The individual tests illustrate the sensitivity of the 7-year forecast break-even rate to changes in the unemployment rate and the recipiency rate assumptions. Afterwards, the effect of a variation in the premium rate on the EIOA is examined.

6.1.1 Unemployment rate

The unemployment rate is closely related to the state of the economy and the supply of labour. The following table shows that a variation in the average unemployment rate of 0.5% over the period 2024-2030 would result in an increase/decrease between 0.06% and 0.07% in the 2024 EI 7‑year forecast break-even rate (assuming all other assumptions remain constant).

| Variation in average UR (2024-2030) |

Average UR (2024-2030) |

Resulting 7-year forecast break-even rate |

|---|---|---|

| (1.0%) | 4.8% | 1.53% |

| (0.5%) | 5.3% | 1.60% |

| Base | 5.8% | 1.66% |

| 0.5% | 6.3% | 1.73% |

| 1.0% | 6.8% | 1.80% |

6.1.2 Recipiency rate

The volatility shown by the recipiency rate in the past can be attributed to several factors, such as the decision of those eligible for EI to apply (or not) for the benefit. The following table shows that a variation in the average recipiency rate of 5% over the period 2024-2030 would result in an increase/decrease of about 0.05% in the 2024 EI 7-year forecast break-even rate (assuming all other assumptions remain constant).

| Variation in average RR (2024-2030) |

Average RR (2024-2030) |

Resulting 7-year forecast break-even rate |

|---|---|---|

| (10.0%) | 62.5% | 1.56% |

| (5.0%) | 67.5% | 1.61% |

| Base | 72.5% | 1.66% |

| 5.0% | 77.5% | 1.71% |

| 10.0% | 82.5% | 1.76% |

6.1.3 Premium rate

As shown in the following table, a variation in the premium rate of one‑hundredth percentage point (0.01% of insurable earnings) from the 7-year forecast break-even rate would result in a $1,534 million increase/decrease in the cumulative balance of the EIOA at the end of the 7‑year forecast period.

| Variation in EI 7-year forecast break-even rate | Resulting EI 7-year forecast break-even rate | Cumulative EIOA balance as at 31 Dec. 2030 ($ million) |

Variation in EIOA cumulative balance as at 31 Dec. 2030 ($ million) |

|---|---|---|---|

| (0.05%) | 1.61% | (8,196) | (7,670) |

| (0.01%) | 1.65% | (2,060) | (1,534) |

| Base | 1.66% | (526) | - nil |

| 0.01% | 1.67% | 1,008 | 1,534 |

| 0.05% | 1.71% | 7,144 | 7,670 |

6.2 Combined tests

The combined tests illustrate the sensitivity of the 7-year forecast break-even rate to simultaneous variations in the unemployment rate and the recipiency rate. Increases/decreases in the average unemployment rate and the average recipiency rate, of 0.5% and 5% respectively over the period 2024-2030, would result in a increase/decrease between 0.11% and 0.13% in the 2024 EI 7-year forecast break-even rate (assuming all other assumptions remain constant). If the unemployment rate increases by 0.5% while the recipiency rate decreases by 5% (or vice-versa) it results in a variation of about 0.02% in the 2024 EI 7-year forecast break-even rate.

| Variation in average UR (2024-2030) |

Average UR (2024-2030) |

Variation in average RR (2024-2030) |

Average RR (2024-2030) |

Resulting 7-year forecast break-even rate |

|---|---|---|---|---|

| (0.5%) | 5.3% | (5.0%) | 67.5% | 1.55% |

| (0.5%) | 5.3% | 5.0% | 77.5% | 1.64% |

| Base | 5.8% | Base | 72.5% | 1.66% |

| 0.5% | 6.3% | (5.0%) | 67.5% | 1.68% |

| 0.5% | 6.3% | 5.0% | 77.5% | 1.79% |

6.3 Scenarios

Canada's macroeconomic outlook remains uncertain and may results in different outcomes than the base scenario assumptions that were used to determine the EI 7-year forecast break-even rate.

Two alternative scenarios are presented in this section to demonstrate some possible impacts from different economic environments relative to the base scenario. These scenarios are for illustration purposes only and might not be considered as internally consistent. As such, the likelihood of these scenarios occurring was not considered.

These scenarios are created by changing various assumptions. For comparison purposes, Table 17 below presents the key assumptions that vary in the alternative scenarios.

| Calendar year | Labour force increase | Unemployment rate | Increase in average employment income | Recipiency rate |

|---|---|---|---|---|

| 2024 | 0.9% | 6.2% | 3.5% | 72.5% |

| 2025 | 0.5% | 6.0% | 3.2% | 72.5% |

| 2026 | 0.3% | 5.7% | 3.1% | 72.5% |

| 2027 | 0.6% | 5.7% | 3.0% | 72.5% |

| 2028 | 0.9% | 5.7% | 2.9% | 72.5% |

| 2029 | 0.9% | 5.7% | 2.9% | 72.5% |

| 2030 | 0.8% | 5.7% | 2.9% | 72.5% |

6.3.1 Moderate shock scenario

Under this scenario, each of the assumptions shown in Table 17 are changed to create pressure over a short-term period on the 2024 7-year forecast break-even rate. This would represent a hypothetical scenario where there is a moderate economic downturn starting in the year 2024 (regardless of the reason for the economic change). As shown in Table 18, the alternative assumptions are assumed to gradually return to the base scenario.

| Calendar year | Labour force increase | Unemployment rate | Increase in average employment income | Recipiency rate |

|---|---|---|---|---|

| 2024 | (2.3%) | 7.0% | 2.7% | 75.0% |

| 2025 | 0.4% | 6.5% | 2.7% | 75.0% |

| 2026 | 0.3% | 6.0% | 2.9% | 74.0% |

| 2027 | 0.5% | 5.7% | 2.7% | 73.0% |

| 2028 | 0.9% | 5.7% | 2.9% | 72.5% |

| 2029 | 0.8% | 5.7% | 2.9% | 72.5% |

| 2030 | 0.8% | 5.7% | 2.9% | 72.5% |

The results of this scenario on the 2024 7-year forecast break-even rate are illustrated in Table 19. The 7-year forecast break-even rate calculated for 2024 would increase from 1.66% in the base scenario to 1.72% in this scenario.

| Calendar year | 7-year break-even rate (%) | Net premiums | Expenditures | Annual surplus / Deficit on EIOA | Cumulative surplus / Deficit on EIOA (31 Dec.) |

|---|---|---|---|---|---|

| 2023 | N/A | N/A | N/A | N/A | (20.2) |

| 2024 | 1.72% | 30.0 | 30.2 | (0.3) | (20.5) |

| 2025 | 1.72% | 30.8 | 29.9 | 0.9 | (19.6) |

| 2026 | 1.72% | 31.8 | 29.0 | 2.8 | (16.9) |

| 2027 | 1.72% | 32.6 | 28.8 | 3.9 | (13.0) |

| 2028 | 1.72% | 33.7 | 29.5 | 4.2 | (8.8) |

| 2029 | 1.72% | 34.9 | 30.5 | 4.3 | (4.5) |

| 2030 | 1.72% | 36.1 | 31.5 | 4.6 | 0.1 |

6.3.2 High shock scenario

Under this scenario, each of the assumptions shown in Table 17 are changed to create pressure over a short-term period on the 2024 7-year forecast break-even rate. This would represent a hypothetical scenario where there is a severe economic downturn starting in the year 2024 (regardless of the reason for the economic change). As shown in Table 20, the alternative assumptions are assumed to gradually return to the base scenario.

| Calendar year | Labour force increase | Unemployment rate | Increase in average employment income | Recipiency rate |

|---|---|---|---|---|

| 2024 | (6.9%) | 9.5% | 2.0% | 77.5% |

| 2025 | 0.4% | 8.5% | 2.2% | 77.5% |

| 2026 | 0.2% | 7.5% | 2.6% | 76.5% |

| 2027 | 0.5% | 7.0% | 2.5% | 75.5% |

| 2028 | 0.8% | 6.5% | 2.9% | 74.5% |

| 2029 | 0.8% | 6.0% | 2.9% | 73.5% |

| 2030 | 0.8% | 5.7% | 2.9% | 72.5% |

The results of this scenario on the 2024 7-year forecast break-even rate are illustrated in Table 21. The 7-year forecast break-even rate calculated for 2024 would increase from 1.66% in the base scenario to 1.94% in this scenario.

| Calendar year | 7-year break-even rate (%) | Net premiums | Expenditures | Annual surplus / Deficit on EIOA | Cumulative surplus / Deficit on EIOA (31 Dec.) |

|---|---|---|---|---|---|

| 2023 | N/A | N/A | N/A | N/A | (20.2) |

| 2024 | 1.94% | 31.5 | 35.4 | (3.9) | (24.1) |

| 2025 | 1.94% | 32.4 | 34.0 | (1.6) | (25.7) |

| 2026 | 1.94% | 33.5 | 31.9 | 1.7 | (24.0) |

| 2027 | 1.94% | 34.5 | 31.1 | 3.3 | (20.7) |

| 2028 | 1.94% | 35.8 | 30.5 | 5.3 | (15.4) |

| 2029 | 1.94% | 37.2 | 30.0 | 7.2 | (8.2) |

| 2030 | 1.94% | 38.7 | 29.9 | 8.8 | 0.6 |

7 Reconciliation of changes in the 7-year forecast break‑even rate

The main elements of change in the 7-year forecast break-even rate since the 2023 Actuarial Report are presented in Table 22.

| 7-Year Forecast Break-Even Rate (%) | |

|---|---|

| 2023 Actuarial Report - After Rounding | 1.74 |

| 2023 Actuarial Report - Before Rounding | 1.7433 |

| Higher than Projected EI Operating Account as at 31 December 2022 | (0.0176) |

| Change in Unemployment Rate Assumptions | 0.0130 |

| Changes in Economics - Earnings Base | (0.0222) |

| Changes in Economics - Expenditures | (0.0328) |

| Updated Cost for Program Changes | (0.0004) |

| Change in 7-year period (2023-2029 to 2024-2030) | (0.0196) |

| 2024 Actuarial Report - Before Rounding | 1.6636 |

| 2024 Actuarial Report - After Rounding | 1.66 |

The actual 2022 expenditures were lower than projected in the 2023 Actuarial Report. This resulted in a decrease in the cumulative deficit of the EI Operating Account, i.e., $24,661 million compared to the projected deficit of $27,255 million. This decreased the 7‑year forecast break-even rate by almost 2 cents.

As shown in the sensitivity test section, the unemployment rate assumption has a significant impact on the 7-year forecast break-even rate. In comparison with the 2023 Actuarial Report, the unemployment rate assumption was revised upward, from 5.7% to 5.8% on average for the 2023-2029 period. This increased the 7-year forecast break-even rate by about 1 cent.

The higher projected earnings base, mainly due to a higher expected increase in the number of earners than previously estimated in the 2023 Actuarial Report, decreased the 7-year forecast break-even rate by about 2 cents.

The lower projected expenditures, mainly due to lower projected average weekly benefits than previously estimated in the 2023 Actuarial Report, decreased the 7-year forecast break-even rate by about 3 cents.

Finally, revisions to the expenditures estimates for program changes (i.e., Pilot Projects/Special Temporary Measures and Permanent Measures) did not significantly impact the 7-year forecast break-even rate.

Overall, the 7-year forecast break‑even rate decreased from 1.74% in 2023 to 1.66% in 2024.

8 Conclusion

This report was prepared by the Actuary in accordance with the relevant legislation and provides to the Commission the forecasts and estimates for the purposes of sections 4 (MIE), 66 (EI premium rate) and 69 (employers who sponsor qualified wage-loss plans and premium reductions for Québec residents and their employers) of the EI Act.

In accordance with the methodology detailed in the EI Act and the relevant economic data, the 2024 MIE is $63,200. In addition, the 2024 estimated employer premium reduction due to qualified wage-loss plans is $1,290 million, and the 2024 QPIP reduction is 0.34%.

Based on the assumptions of the relevant economic and demographic variables provided by the Minister of Finance, on the expenditure estimates provided by the Minister of ESD, and on the methodology and other assumptions developed by the Actuary, the 7-year forecast break-even rate that would generate sufficient premium revenue to cover the expected cost of the EI program for the period 2024-2030 and eliminate the projected $20.2 billion cumulative deficit in the EI Operating Account as of 31 December 2023, is 1.66% of insurable earnings.

Should the Commission set the 2024 premium rate at the 7-year forecast break-even rate, the 2024 premium rate would be equal to:

- 1.66% of insurable earnings for residents of all provinces except Québec; and

- 1.32% of insurable earnings for residents of Québec, after taking into account the QPIP reduction of 0.34%.

9 Actuarial opinion

In our opinion, considering that this report was prepared pursuant to the Employment Insurance Act:

- the data on which this report is based are sufficient and reliable for the purposes of this report;

- the assumptions are appropriate for the purposes of this report; and

- the methods employed are appropriate for the purposes of this report.

Based on the results of this valuation, we hereby certify that the 7-year forecast break-even rate required to generate sufficient premium revenue to cover the expected cost of the EI program over the period 2024-2030 and eliminate the projected cumulative deficit in the EI Operating Account as of 31 December 2023, is 1.66% of insurable earnings.

This report has been prepared, and our opinions given, in accordance with accepted actuarial practice in Canada.

The estimates presented in this report are based on prescribed information provided by the Minister of Employment and Social Development and the Minister of Finance.

As of the date of the signing of this report, we have not learned of any subsequent events that would have a material impact on the 2024 7-year forecast break-even rate presented in this report.

Mathieu Désy, FCIA, FSA

Senior Actuary, Employment Insurance Premium Rate-Setting

Marie-Pier Bernier, FCIA, FSA

Thierry Truong, FCIA, FSA

Ottawa, Canada

22 August 2023

Appendix A Summary of EI legislation

The Unemployment Insurance program was first implemented in 1940, with the last major reform occurring in 1996. At that time, the name of the program was changed from "Unemployment Insurance" to "Employment Insurance" to reflect the program's primary objective of promoting employment in the labour force and to better emphasize that individuals' access to the program is linked to significant workforce attachment.

The EI program provides temporary income support to individuals who have lost their employment through no fault of their own or are unable to work due to specific life circumstances. This Appendix provides a brief overview of the EI program.

Temporary measures, as well as future permanent changes, if any, not yet in effect are not shown in this Appendix; they are summarized in Section 2 and considered in the results presented in this report. It is important to note that the temporary measures currently in place take precedence over some of the normal program provisions described below.

A.1 EI Part I benefits

Although access and entitlement to benefits vary depending on each benefit type, the calculation of weekly benefit rates is the same for most benefit types. Weekly benefits are generally equal to 55% of the claimants' average weekly insurable earnings, during their variable best weeks over the qualifying period (generally 52 weeks), up to a maximum amount. The number of best weeks taken into account is determined by the regional unemployment rate and varies from 14 to 22 insurable earnings weeks. The maximum amount payable is determined by the MIE.

The EI family supplement provides additional benefits to low-income families with children. The family supplement rate is based on the net family income up to a maximum of $25,921 per year and the number of children in the family and their ages. The family supplement may increase benefits up to 80% of average weekly insurable earnings.

Benefits are not paid until claimants have served a waiting period of one week of unemployment.

To stay connected to the labour market and earn some additional income, EI claimants can work while they are on claim. This measure is available to those collecting regular, fishing, maternity, parental, sickness, compassionate care, or family caregiver benefits. Claimants can keep 50 cents of their EI benefits for every dollar they earn, up to a maximum of 90 per cent of the weekly insurable earnings used to calculate their EI benefit amount.

A.1.1 Regular benefits

EI regular benefits are provided to eligible insured persons who have lost their jobs through no fault of their own (for example, due to a shortage of work, seasonal or mass lay-offs) and are available for and able to work but can't find a job.

To qualify for regular benefits, individuals must have been without work and without pay for at least seven consecutive days. Claimants must have worked at least the minimum required hours of insurable employment, between 420 and 700 hours, as determined by the regional unemployment rate, in the last 52-week qualifying period or since their last claim, whichever is shorter. The number of insurable hours required to qualify is increased in cases of violations regarding prior EI claims. Claimants must also be available and actively looking for work in order to maintain eligibility.

The maximum number of regular benefit weeks varies from 14 to 45 weeks, depending on the number of insurable hours accumulated in the qualifying period and the regional unemployment rate. In certain circumstances, the maximum duration of benefits can be extended through temporary special measures.

A.1.2 Fishing benefits

EI provides fishing benefits to qualifying self-employed fishers who are actively seeking work. Unlike regular EI benefits, eligibility for EI fishing benefits is determined by the claimant's insurable fishing earnings accumulated during the qualifying period, not the number of hours worked. A self‑employed person engaged in fishing who has earned a minimum of between $2,500 and $4,200 (depending on the regional unemployment rate) during the maximum 31‑week qualifying period is eligible to receive up to 26 weeks of EI fishing benefits.

A.1.3 Work-Sharing benefits

To avoid lay-offs due to a temporary reduction in the normal level of business activity that is beyond the control of the employer, employers and employees can enter into a Work-Sharing agreement with the Commission through Service Canada to provide EI benefits to eligible workers willing to work a temporarily reduced work week. This enables employers to retain staff and adjust their work activity during temporary work shortages, as well as avoid the expenses of hiring and training new staff once business levels return to normal. Employees are able to retain their skills and jobs while receiving EI benefits for the days that they do not work.

Work-Sharing agreements have a minimum duration of 6 weeks and a maximum of 26 weeks, with a possible extension of up to 12 weeks for a maximum duration of 38 weeks. From time to time, the maximum duration of Work-Sharing agreements may be extended through temporary special measures.

A.1.4 Special benefits

To qualify for special benefits, the claimant's normal weekly earnings must be reduced by over 40% for at least one week. In addition, special benefits require a minimum of 600 hours of insurable employment in the 52-week qualifying period. Special benefits include:

-

Maternity benefits, for people who are away from work because they are pregnant or have recently given birth. These benefits can be paid for a maximum of 15 weeks. They can start as early as 12 weeks before the expected date of birth and can end as late as 17 weeks after the actual date of birth.

-

Parental benefits, for a parent to take care of their newborn or newly adopted child(ren). Parents may share the available weeks of parental benefits. There are two options available:

-

Standard parental benefits can be paid for a maximum of 40 weeks at 55% of the claimant's average weekly insurable earnings (up to a maximum) and must be claimed within a 52-week period (12 months) after the week the child was born or placed for the purpose of adoption. As no parent can access more than 35 weeks, sharing parental benefits is required to access the additional weeks.

-

Extended parental benefits can be paid for a maximum of 69 weeks at 33% of the claimant's average weekly insurable earnings (up to a maximum) and must be claimed within a 78-week period (18 months) after the week the child was born or placed for the purpose of adoption. As no parent can access more than 61 weeks, sharing parental benefits is required to access the additional weeks.

-

-

Sickness benefits, for people who are unable to work due to illness, injury or quarantine. These benefits can be paid for a maximum of 26 weeks (on or after 18 December 2022).

-

Compassionate care benefits, for people who take a temporary leave from work to provide end-of-life care or support for a family member who has a significant risk of death in the next 6 months. These benefits can be paid for a maximum of 26 weeks, which can be shared among eligible family caregivers.

-

Family Caregiver Benefit for Children, for family members who must be away from work to care for or support a critically ill or injured person under 18. This benefit can be paid for a maximum of 35 weeks, which can be shared among eligible family caregivers.

-

Family Caregiver Benefit for Adults, for family members who must be away from work to care for or support a critically ill or injured person 18 or over. This benefit can be paid for a maximum of 15 weeks, which can be shared among eligible family caregivers.

Since 2006, the Province of Québec has been responsible for providing maternity and parental benefits to residents of Québec through the QPIP. All other types of EI benefits remain available to residents of Québec.

Self-employed fishers can qualify for special benefits with fishing earnings of $3,760 or more during the 31-week qualifying period.

Self-employed Canadians voluntarily enter into an agreement with the Commission through Service Canada to contribute EI premiums and access EI special benefits. They must be registered for at least one year prior to claiming benefits and their self-employment earnings must meet the minimum self-employment eligibility threshold in the year preceding the claim.

Self-employed residents of Québec entering into an agreement with the Commission cannot access EI maternity and parental benefits, as maternity and parental (including adoption) benefits are already payable through QPIP, but can access sickness, compassionate care, and family caregiver benefits.

A.2 EI Part II benefits

Part II of the EI Act includes Employment Benefits and Support Measures, which are labour market programs and services established to help Canadians find and keep employment and to develop a labour force that meets the current and emerging needs of employers. These programs are delivered mostly by provincial and territorial governments through Labour Market Development Agreements.

A.3 Financing

The EI program is financed by contributions from employees and employers, via premiums paid on insurable earnings up to the MIE. Employee premiums apply to insurable earnings, up to the MIE. However, the EI program has specific provisions for contributors who are unlikely to qualify for benefits, e.g., employees with insured earnings of less than $2,000 are entitled to a refund of their EI premiums when they file an income tax return.

In addition, in accordance with subsection 69(2) of the EI Act and related regulations, a mechanism to reduce EI premiums paid by Québec residents and their employers was introduced. The reduced premium rate reflects the savings to the EI program due to the existence of the QPIP.

Since 31 January 2010, self-employed individuals may voluntarily opt into the EI program to receive EI special benefits. Self-employed individuals pay the same EI premium rate as salaried employees but are not required to pay the employer portion of premiums, as they do not have access to EI regular benefits.

Employers pay premiums at the rate of 1.4 times those of employees. Employers bear a higher overall share of program costs based on the principle that they have more control over layoffs. However, in accordance with subsection 69(1) of the EI Act, employers who sponsor a qualified wage-loss plan which reduces the EI special benefits otherwise payable receive a premium reduction if they meet the requirements set out by the Commission. In such cases, the employer pays premiums at a rate that is lower than 1.4 times those of employees, and a portion of those savings must be returned to their employees.

A.4 Premium rate

In accordance with subsection 66(1) of the EI Act, the Commission shall set the premium rate for each year in order to generate just enough premium revenue to ensure that, at the end of the seven-year period that commences at the beginning of that year, the total of the amounts credited to the EI Operating Account after 31 December 2008 is equal to the total of the amounts charged to that Account after that date. This calculated premium rate is referred to as the 7-year forecast break-even rate. In accordance with subsection 66(7), the premium rate is limited to an annual increase or decrease of 0.05%.

Legislative framework

The EI Act includes the following dates by which various responsibilities related to the setting of the EI premium rate must be met.

22 July

The Minister of Employment and Social Development (ESD) shall provide to the Actuary and the Commission the information prescribed in subsection 66.1(1) of the EI Act.

The Minister of Finance shall provide to the Actuary and the Commission the information prescribed in subsection 66.2(1) of the EI Act.

22 August

In accordance with section 66.3 of the EI Act, the Actuary shall prepare actuarial forecasts and estimates for the purposes of sections 4, 66 and 69 of the EI Act, and shall provide the Commission with a report that sets out:

- the forecast premium rate for the following year and a detailed analysis in support of the forecast;

- the calculations performed under sections 4 and 69 of the EI Act;

- the information provided under section 66.1 of the EI Act; and

- the source of the data, the actuarial and economic assumptions and the actuarial methodology used.

31 August

The Commission shall provide the Ministers of ESD and Finance with the report referred to in section 66.3 and a summary of that report.

14 September