Pension Plans for the Canadian Forces – Regular Force and Reserve Force as at 31 March 2022

The Honourable Anita Anand, P.C., M.P.

President of Treasury Board

Ottawa, Canada

K1A 0R5

Dear Minister,

Pursuant to section 6 of the Public Pensions Reporting Act, I am pleased to submit the report on the actuarial review as at 31 March 2022 of the Canadian Forces Pension Plans. This actuarial review is in respect of pension benefits and contributions of both the Regular Force Pension Plan and the Reserve Force Pension Plan. The Regular Force Pension Plan is established by Parts I, III and IV of the Canadian Forces Superannuation Act, includes the Canadian Forces-related benefits provided under the Special Retirement Arrangements Act, and is subject to the Pension Benefits Division Act. The Reserve Force Pension Plan is established by Part I.1 of the Canadian Forces Superannuation Act and subject to the Pension Benefits Division Act.

Yours sincerely,

Assia Billig, FCIA, FSA, PhD

Chief Actuary

Table of contents

List of tables

- Table 1 Ultimate best-estimate economic assumptions

- Table 2 Demographic assumptions as at 31 March 2022 and as at 31 March 2019

- Table 3 State of the Canadian Forces Superannuation Account

- Table 4 Balance sheet of the Canadian Forces Pension Fund

- Table 5 Financial position - Reserve Force Pension Fund

- Table 6 Reconciliation of financial position from plan year 2019 to 2022 by account

- Table 7 Experience gains and losses from plan year 2019 to 2022 by account

- Table 8 Impact of the revision of actuarial assumptions on the actuarial liability by account

- Table 9 Current service cost for plan year 2024

- Table 10 Reconciliation of current service cost by account

- Table 11 Member contribution rates by pension plan

- Table 12 Projection of current service cost of the CFPF on a plan year basis ($ millions)

- Table 13 Projection of current service cost of the CFPF on a plan year basis (% of pensionable payroll)

- Table 14 Projection of current service cost of the RFPF on a plan year basis ($ millions)

- Table 15 Projection of current service cost of the RFPF on a plan year basis (% of pensionable payroll)

- Table 16 CFPF current service cost on a calendar year basis ($ millions)

- Table 17 CFPF current service cost on a calendar year basis (% of pensionable payroll)

- Table 18 RFPF current service cost on a calendar year basis ($ millions)

- Table 19 RFPF current service cost on a calendar year basis (% of pensionable payroll)

- Table 20 Administrative expenses by account

- Table 21 Estimated contributions for prior service by account

- Table 22 Sensitivity of current service cost for plan year 2024 to variations in key economic assumptions by pension plan

- Table 23 Sensitivity of actuarial liability as at 31 March 2022 to variations in key economic assumptions by account

- Table 24 Sensitivity of cohort life expectancy at age 65 to variation in longevity improvement factors as at 31 March 2022 and as at 31 March 2042

- Table 25 State of the RCA Account

- Table 26 Current service cost of the RCA by plan year

- Table 27 RCA current service cost on a calendar year basis ($ millions)

- Table 28 RCA current service cost on a calendar year basis (% of pensionable payroll)

- Table 29 Estimated government credit

- Table 30 Estimated government cost

- Table 31 Regular Forces member contribution rates

- Table 32 Reconciliation of balances in Superannuation Account for plan year 2019 to 2022

- Table 33 Reconciliation of balances in Canadian Forces Pension Fund

- Table 34 Reconciliation of balances in RCA Account

- Table 35 Reconciliation of balances in Reserve Force Pension Fund for plan year 2019 to 2022

- Table 36 Interest earnings and rates of return

- Table 37 Summary of membership data by plan

- Table 38 Reconciliation of Regular Force Plan contributors

- Table 39 Reconciliation of Reserve Force Plan contributors

- Table 40 Reconciliation of Regular Force Plan pensioners

- Table 41 Reconciliation of Reserve Force Plan pensioners

- Table 42 Reconciliation of spouse survivors by plan

- Table 43 Reconciliation of children/students survivors by plan

- Table 44 Actuarial value of Canadian Forces Pension Fund assets

- Table 45 Actuarial value of Reserve Force Pension Fund assets

- Table 46 Asset mix

- Table 47 Real rate of return by asset type

- Table 48 Overall rate of return on assets of the CFPF and RFPF

- Table 49 Rates of return on assets in respect of the CFPF and the RFPF

- Table 50 Transfer value

- Table 51 Economic assumptions

- Table 52 Sample of assumed seniority and promotional salary increases

- Table 53 Proportion of female members joining the plans

- Table 54 Assumed annual increases in number of contributors per pension plan

- Table 55 Sample of assumed rates of retirement for members of the Regular Force Plan

- Table 56 Sample of assumed rates of retirement of the Reserve Force members

- Table 57 Sample of assumed 3B disability incidence rates (own occupation) for the Regular Force Plan

- Table 58 Sample of assumed withdrawal rates of the Regular Force Plan

- Table 59 Assumed withdrawal rates for Reserve Force Plan for members below age 50

- Table 60 Sample of assumed rollover rates for Reserve Force Plan

- Table 61 Sample of assumed rates of mortality for plan year 2023 for contributors and retirement pensioners

- Table 62 Sample of assumed rates of mortality for plan year 2023 for disability (3A) pensioners

- Table 63 Sample of assumed rates of mortality plan year 2023 for surviving spouses

- Table 64 Sample of assumed longevity improvement factors at initial and ultimate plan year mortality reductions

- Table 65 Cohort life expectancy of contributors and retirement pensioners

- Table 66 Probability of an eligible spouse at death of member

- Table 67 Spouse age difference with the member at death of member

- Table 68 Assumed rates of children ceasing to be eligible for a survivor allowance

- Table 69 Wage measure - RFPF

- Table 70 Financial position of the CFPF as at 31 March 2025 due to asset return tail-events

- Table 71 Regular Force - Male officers

- Table 72 Regular Force - Male officers - Summary

- Table 73 Regular Force - Male other ranks

- Table 74 Regular Force - Male other ranks - Summary

- Table 75 Regular Force - Female officers

- Table 76 Regular Force - Female officers - Summary

- Table 77 Regular Force - Female other ranks

- Table 78 Regular Force - Female other ranks - Summary

- Table 79 Reserve Force - Male officers

- Table 80 Reserve Force - Male officers - Summary

- Table 81 Reserve Force - Male other ranks

- Table 82 Reserve Force - Male other ranks - Summary

- Table 83 Reserve Force - Female officers

- Table 84 Reserve Force - Female officers - Summary

- Table 85 Reserve Force - Female other ranks

- Table 86 Reserve Force - Female other ranks - Summary

- Table 87 Regular Force - Male officers - Retirement pensioners

- Table 88 Summary of Regular Force - Male officers - Retirement pensioners

- Table 89 Regular Force - Female officers - Retirement pensioners

- Table 90 Summary of Regular Force - Female officers - Retirement pensioners

- Table 91 Regular Force - Male other ranks - Retirement pensioners

- Table 92 Summary of Regular Force - Male other ranks - Retirement pensioners

- Table 93 Regular Force - Female other ranks - Retirement pensioners

- Table 94 Summary of Regular Force - Female other ranks - Retirement pensioners

- Table 95 Regular Force - Male officers - 3B Pensioners

- Table 96 Summary of Regular Force - Male officers - 3B Pensioners

- Table 97 Regular Force - Female officers - 3B Pensioners

- Table 98 Summary of Regular Force - Female officers - 3B Pensioners

- Table 99 Regular Force - Male other ranks - 3B Pensioners

- Table 100 Summary of Regular Force - Male other ranks - 3B Pensioners

- Table 101 Regular Force - Female other ranks - 3B Pensioners

- Table 102 Summary of Regular Force - Female other ranks - 3B Pensioners

- Table 103 Regular Force - Male officers - 3A Pensioners

- Table 104 Summary of Regular Force - Male officers - 3A Pensioners

- Table 105 Regular Force - Female officers - 3A Pensioners

- Table 106 Summary of Regular Force - Female officers - 3A Pensioners

- Table 107 Regular Force - Male other ranks - 3A Pensioners

- Table 108 Summary of Regular Force - Male other ranks - 3A Pensioners

- Table 109 Regular Force - Female other ranks - 3A Pensioners

- Table 110 Summary of Regular Force - Female other ranks - 3A Pensioners

- Table 111 Reserve Force - Male officers - Retirement pensioners

- Table 112 Summary of Reserve Force - Male officers - Retirement pensioners

- Table 113 Reserve Force - Male other ranks - Retirement pensioners

- Table 114 Summary of Reserve Force - Male other ranks - Retirement pensioners

- Table 115 Reserve Force - Female officers - Retirement pensioners

- Table 116 Summary of Reserve Force - Female officers - Retirement pensioners

- Table 117 Reserve Force - Female other ranks - Retirement pensioners

- Table 118 Summary of Reserve Force - Female other ranks - Retirement pensioners

- Table 119 Reserve Force - Officers - Disability pensioners

- Table 120 Summary of Reserve Force - Officers - Disability pensioners

- Table 121 Reserve Force - Other ranks - Disability pensioners

- Table 122 Summary of Reserve Force - Other ranks - Disability pensioners

- Table 123 Regular Force - Surviving spouses

- Table 124 Summary of Regular Force - Surviving spouses

- Table 125 Reserve Force - Surviving spouses

- Table 126 Summary of Reserve Force - Surviving spouses

List of charts

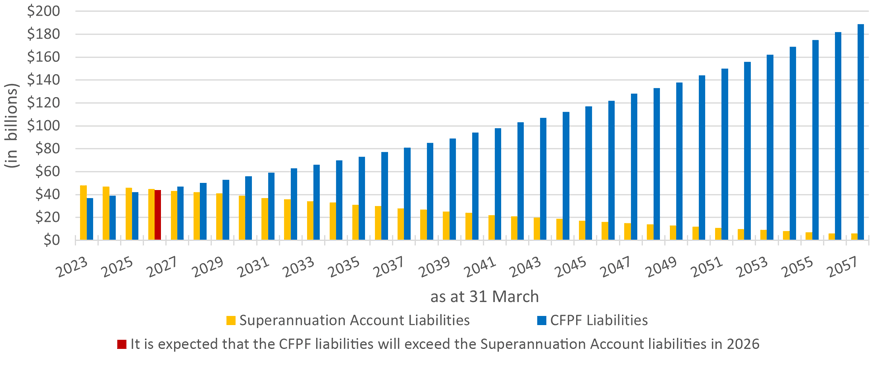

- Chart 1 Evolution of liabilities of Superannuation Account and CFPF over time

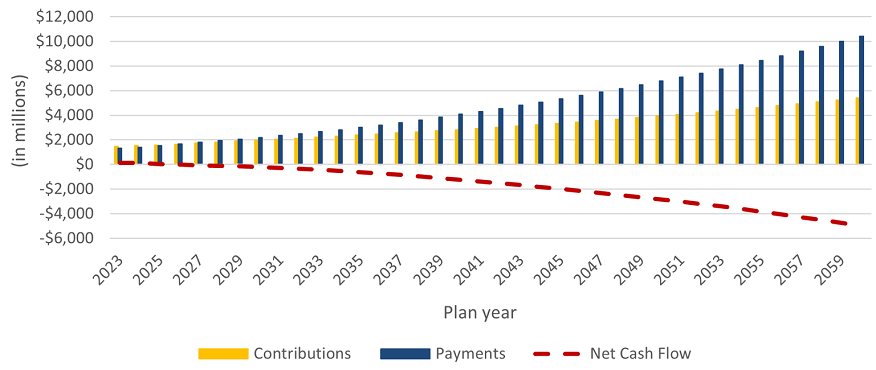

- Chart 2 Evolution of cash flows of the CFPF over time

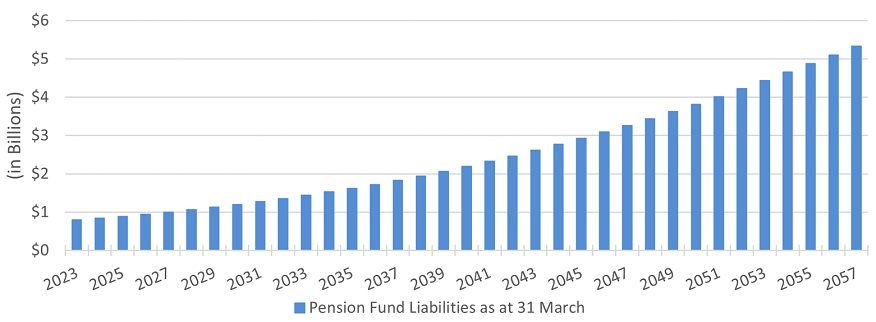

- Chart 3 Evolution of liabilities of the RFPF over time

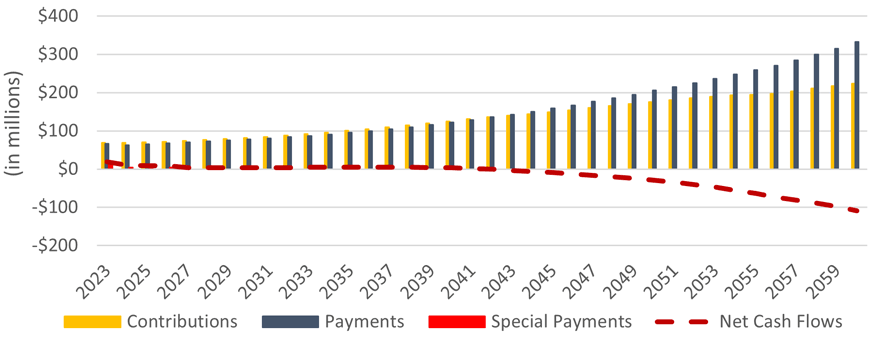

- Chart 4 Evolution of cash flows of the RFPF over time

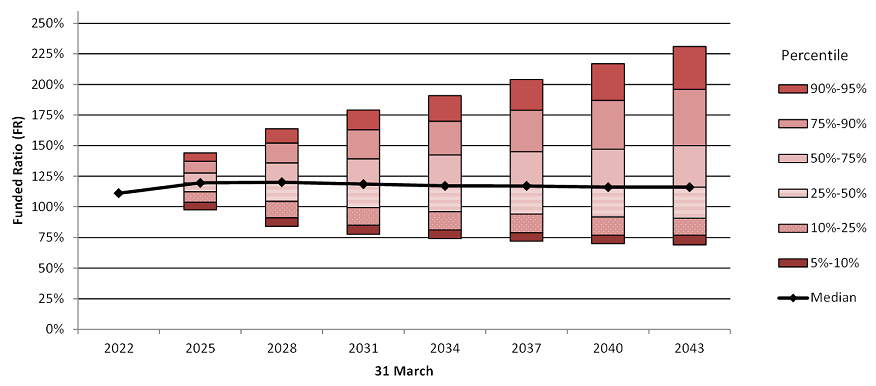

- Chart 5 Range of potential funding ratio for the best-estimate portfolio - CFPF

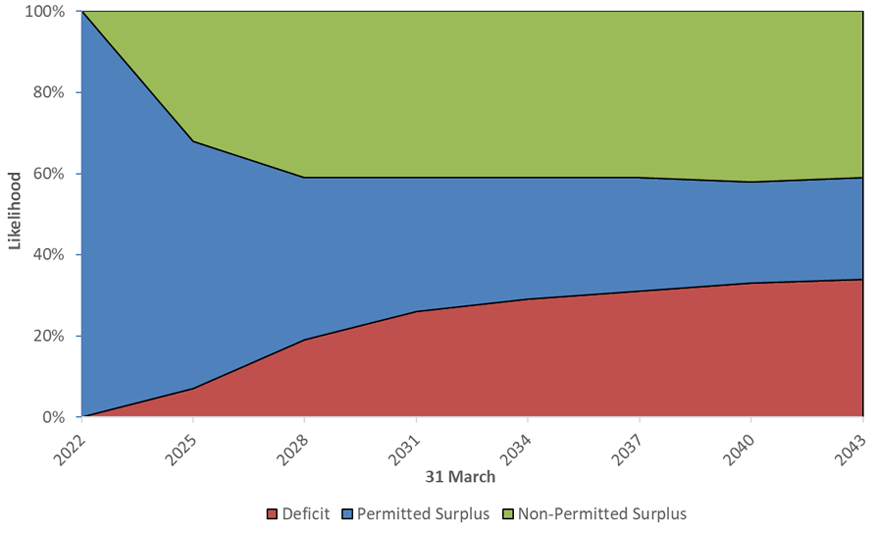

- Chart 6 Likelihood of deficits and non-permitted surplus due to investment volatility

1. Highlights of the report

| blank | Superannuation Account (Service prior to 1 April 2000) |

Pension Fund (Service since 1 April 2000) |

|---|---|---|

| Financial position |

|

|

|

|

|

|

|

|

| Funding ratio/special credits or payments |

|

|

| Member contribution rates |

|

|

| Projected current service cost in millions of dollars (Calendar year 2024) |

|

|

|

Section 1, Table A footnotes

|

||

| blank | Pension Fund (Service since 1 March 2007) |

|---|---|

| Financial position |

|

| Funding ratio/special payments |

|

| Member contribution rates |

|

| Projected current service cost in millions of dollars (Calendar year 2024) |

|

2. Introduction

This actuarial report on the Canadian Forces Regular Force Pension Plan (Regular Force Plan) and the Reserve Force Pension Plan (Reserve Force Plan) was made pursuant to the Public Pensions Reporting Act (PPRA).

This actuarial valuation is as at 31 March 2022 and is in respect of the pension benefits and contributions defined by Parts I, III and IV of the Canadian Forces Superannuation Act (CFSA), the Special Retirement Arrangements Act (SRAA), which covers the Retirement Compensation Arrangements (RCA), and the Pension Benefits Division Act (PBDA) for members of the Regular Force Plan. This valuation is also in respect of the pension benefits and contributions defined by Part I.1 of the CFSA and the PBDA for members of the Reserve Force Plan.

The previous actuarial report was prepared as at 31 March 2019. The date of the next periodic review is scheduled to occur no later than 31 March 2025.

2.1 Purposes of the report

The purposes of this actuarial valuation are to:

-

determine the state of the Regular Force Plan composed of the Canadian Forces Superannuation Account (Superannuation Account), the Canadian Forces Pension Fund (CFPF) and the Retirement Compensation Arrangements (RCA) Account;

-

determine the state of the Reserve Force Plan composed of the Reserve Force Pension Fund (RFPF);

-

determine the projected current service costs for the CFPF, the RFPF and the RCA Account; and

-

assist the President of the Treasury Board in making informed decisions regarding the financing of the government's pension benefit obligation.

This report may not be suitable for other purposes.

2.2 Scope of the report

Section 3 presents a general overview of the valuation basis used in preparing this actuarial report and section 4 presents the financial position of the plan as well as the reconciliation of the changes in financial position and the cost of certificate.

Finally, section 5 provides the actuarial opinion for the current valuation.

The various appendices provide a summary of the Regular Force Plan and Reserve Force Plan provisions, a description of data, methodology and assumptions employed. The appendices also provide the pension plan projections and the uncertainty of results.

3. Valuation basis

This report is based on pension benefit provisions enacted by legislation, summarized in Appendices A and B.

Contribution rates for Regular Force members for calendar years 2022 to 2024 (as approved by the Treasury Board) and for calendar year 2025 and beyond (estimated) have been updated since the last valuation and are assumed to be equal to the contribution rates of Group 1 contributors under the pension plan for the Public Service of Canada (PS pension plan).

Contribution rates for Reserve Force members are set by regulation.

The Canadian Forces Superannuation Act was amended by Bill C-97 which received Royal Assent on 21 June 2019. The amendment modified the rule regarding the non-permitted surplus, increasing the permitted surplus from 10% to 25% of liabilities. The regulations which outline the corresponding provisions for the Reserve Force Plan remain unchanged. There have been no other changes to the plan provisions of either plan since the previous valuation.

The Funding Policy for the Public Sector Pension Plans (Funding Policy) was approved by the Treasury Board in 2018. The policy provides guidance and rules to support prudent governance of the plansFootnote 1 and ensures that sufficient assets are accumulated to meet the cost of the accrued pension benefits. The methods and assumptions of this actuarial valuation are consistent with the provisions of the Funding Policy.

For the Regular Force Plan, the financial data on which this valuation is based are composed of:

-

The CFPF invested assets that the government has earmarked for the payment of benefits for service since 1 April 2000;

-

the Superannuation Account established to track the government's pension benefit obligations for service prior to 1 April 2000; and

-

the RCA Account for benefits in excess of those that can be provided under the Income Tax Act limits for registered pension plans.

For the Reserve Force Plan, the financial data on which this valuation is based are composed of RFPF invested assets that the government has earmarked for the payment of benefits for Reserve Force service.

These pension assets and accounts balances are summarized in Appendix C.

The membership data are provided by the Public Services and Procurement Canada (PSPC). Membership data and tests performed on them are summarized in Appendix D.

The valuation was prepared using accepted actuarial practices in Canada and is based on methods and assumptions summarized in Appendices E to H.

All actuarial assumptions used in this report are best-estimate assumptions and do not include any margin for adverse deviations. They are independently reasonable and appropriate in aggregate for the purposes of the valuation at the date of this report.

Actuarial assumptions used in the previous report were revised based on economic trends and demographic experience. A complete description of the assumptions is given in Appendices F to H.

A summary of the ultimate economic assumptions used in this and the previous report is shown in the following table.

| Economic assumptions | 31 March 2022 | 31 March 2019 |

|---|---|---|

| Assumed level of inflation | 2.00% | 2.00% |

| Real increase in pensionable earnings | 0.60% | 0.70% |

| Real increase in YMPE and MPETable 1 footnote a | 0.90% | 1.00% |

| Real rate of return on the Pension Fund | 4.00% | 4.00% |

| Real rate of return on the Superannuation Account and RCA Account | 2.00% | 2.50% |

|

Table 1 footnotes

|

||

Table 2 presents a summary of the main demographic assumptions used in this report and those used in the previous report.

| Demographic assumptions | 31 March 2022 | 31 March 2019 |

|---|---|---|

| Promotional and seniority rate of increaseTable 2 footnote a | ||

| Officer | 0.5% to 10.6% | 0.5% to 9.5% |

| Other rank | 0.5% to 5.4% | 0.5% to 7.3% |

| Cohort life expectancy at age 65 | ||

| Male officer | 23.5 | 23.6 |

| Male other rank | 20.8 | 21.2 |

| Female | 24.4 | 24.6 |

| Average age at retirement | ||

| Regular Force members | 52.7 | 53.7 |

| Reserve Force members | 58.8 | 57.0 |

|

Table 2 footnotes

|

||

As of the date of the signing of this report, we were not aware of any subsequent events that may have a material impact on the results of this valuation.

4. Valuation results

This report is based on pension benefit provisions enacted by legislation, summarized in Appendices A and B, and the financial and membership data summarized in Appendices C and D. The valuation was prepared using accepted actuarial practices in Canada as well as methods and assumptions summarized in Appendices E to H. Emerging experience that differs from the corresponding assumptions will result in gains or losses to be revealed in subsequent reports.

Projections of the financial positions of the Superannuation Account, the CFPF and the RFPF are shown in Appendix I.

4.1 Financial position

Beginning on 1 April 2000, member and government contributions of the Regular Force Plan are no longer credited to the Superannuation Account. Rather, they are credited to the CFPF, and the total amount of contributions net of benefits paid and administrative expenses is transferred to the Public Sector Pension Investment Board (PSP) and invested in the financial markets.

Contributions made by the government and members of the Reserve Force Plan are credited to the RFPF. The total amount of contributions net of benefits paid and administrative expenses is transferred to PSP and invested in the financial markets.

The valuation results of this section show the financial position as at 31 March 2022 for each financing arrangement under the CFSA. The results of the previous valuation are also shown for comparison.

4.1.1 Canadian Forces Superannuation Account

| Components of financial position | 31 March 2022 | 31 March 2019 |

|---|---|---|

| Assets | ||

| Recorded account balance | 45,303 | 45,607 |

| Present value of prior service contributions | 19 | 23 |

| Asset subtotal | 45,322 | 45,630 |

| Actuarial liability | ||

| Active contributors | 2,443 | 4,153 |

| Retirement pensioners | 32,329 | 31,609 |

| Disabled 3B | 9,639 | 8,602 |

| Disabled 3A | 114 | 122 |

| Deferred vested members | 83 | 69 |

| Eligible survivors | 3,703 | 3,356 |

| Outstanding payments | - dash | 1 |

| Administrative expenses | 111 | 145 |

| Total actuarial liability | 48,422 | 48,057 |

| Actuarial excess or shortfall | (3,100) | (2,427) |

In accordance with the CFSA, the actuarial shortfall of $3,100 million could be amortized over a maximum period of 15 years beginning on 31 March 2024. If the shortfall is amortized over the maximum period, 15 equal annual credits of $264 million could be made to the Superannuation Account. The time, manner and amount of such credits are to be determined by the President of the Treasury Board. It is expected that the government will amortize the actuarial shortfall through a one-time special credit to the Superannuation Account of $3,298 million as at 31 March 2024 that takes into account the interest on the shortfall accumulated from 31 March 2022 to 31 March 2024.

4.1.2 Canadian Forces Pension Fund

| Components of financial position | 31 March 2022 | 31 March 2019 |

|---|---|---|

| Actuarial value of assets | ||

| Market value of assets | 44,663 | 33,123 |

| Actuarial smoothing adjustment | (3,942) | (1,928) |

| Present value of prior service contributions | 297 | 328 |

| Amount receivable from Part I.1 - Rollover members | 73 | 63 |

| Total actuarial value of assets | 41,091 | 31,586 |

| Actuarial liability | ||

| Active contributors | 18,652 | 17,720 |

| Retirement pensioners | 9,328 | 7,213 |

| Disabled 3B | 8,399 | 5,701 |

| Disabled 3A | 11 | 7 |

| Deferred vested members | 273 | 147 |

| Eligible survivors | 212 | 136 |

| Outstanding payments | 97 | 83 |

| Total actuarial liability | 36,972 | 31,007 |

| Actuarial surplus/(deficit) | 4,119 | 579 |

As at 31 March 2022, the Pension Fund has a surplus of $4,119 million and the funding ratio is 111.1%. As such, no special payments are required and there is no non-permitted surplusFootnote 2.

4.1.3 Reserve Force Pension Fund

| Components of financial position | 31 March 2022 | 31 March 2019 |

|---|---|---|

| Actuarial value of assets | ||

| Market value of assets | 864 | 613 |

| Actuarial smoothing adjustment | (86) | (50) |

| Present value of prior service contributions | 33 | 38 |

| Amount payable to Regular Force pension plan | (73) | (63) |

| Total actuarial value of assets | 738 | 538 |

| Actuarial liability | ||

| Active contributors | 483 | 481 |

| Retirement pensioners | 287 | 215 |

| Disability pensioners | 0 | 1 |

| Surviving dependents | 5 | 4 |

| Outstanding payments | 17 | 10 |

| Total actuarial liability | 792 | 711 |

| Actuarial surplus/(deficit) | (54) | (173) |

In accordance with section 87 of the Reserve Force Pension Plan Regulations, the actuarial deficit is amortized with equal annual instalments over a period of 15 years. Taking into account the special payment of $17.4 million that was made on 31 March 2023, the actuarial deficit of $54 million could be amortized in 15 equal annual payments of $4.1 million beginning on 31 March 2024.

4.2 CFSA - Reconciliation of the changes in financial position

Table 6 presents the reconciliation of the changes in financial positions of the Superannuation Account, CFPF and the RFPF. Explanations of the main items responsible for the changes follow the table.

| Components of reconciliation of the financial position | Superannuation Account actuarial excess/(shortfall) | CFPF actuarial surplus/(deficit) | RFPF actuarial surplus/(deficit) |

|---|---|---|---|

| Financial position as at 31 March 2019 | (2,427) | 579 | (173) |

| Recognized investment gains/(losses) as at 31 March 2019 | n/a | 1,928 | 50 |

| Change in methodology | (70) | 34 | 0 |

| Retroactive changes to the population data | (59) | (15) | 0 |

| Revised initial financial position as at 31 March 2022 | (2,556) | 2,526 | (123) |

| Expected interest on initial financial position | (218) | 412 | (26) |

| Special credits or payments | 2,691 | 159 | 40 |

| Net experience gains and (losses) | (268) | 4,113 | 84 |

| Revision of actuarial assumptions | (2,739) | 935 | 68 |

| Change in the present value of prior service contributions | (7) | (84) | (11) |

| Change in the present value of administrative expenses | (3) | n/a | n/a |

| Unrecognized investment (gains)/losses as at 31 March 2022 | 0 | (3,942) | (86) |

| Financial position as at 31 March 2022 | (3,100) | 4,119 | (54) |

4.2.1 Recognized investment gains as at 31 March 2019

An actuarial asset valuation method that minimizes the impact of short-term fluctuations in the market value of assets was used in the previous valuation, causing the actuarial value of the CFPF assets to be $1,928 million less than their market value. The same actuarial asset valuation method was used for the RFPF, causing the actuarial value of the RFPF assets to be $50 million less than their market value.

4.2.2 Change in methodology

Two changes occurred since the last valuation:

-

New actuarial valuation software was used to complete the valuation.

-

As a result of the change in actuarial valuation software, the Age Last approach was replaced by an Age Nearest approach. These two methodologies are detailed in Appendix E.2.6.

The combined changes increased the Superannuation Account liability by $70 million and decreased the Pension Fund liability by $34 million. The impact was negligible for the Reserve Force Pension Fund.

4.2.3 Retroactive changes to the population data

The net impact of the retroactive changes to the population data received from PSPC resulted in an increase of $59 million in the Superannuation Account actuarial liabilities and an increase of $15 million in the CFPF actuarial liabilities.

4.2.4 Expected interest on revised initial financial position

The amount of interest expected to accrue during the intervaluation period increased the revised actuarial shortfall by $218 million for the Superannuation Account, increased the revised actuarial surplus by $412 million for the CFPF and increased the revised actuarial deficit by $26 million for the RFPF.

These amounts of interest were based on the Superannuation Account yields, the CFPF returns and the RFPF returns projected in the previous report for the three-year intervaluation period.

4.2.5 Special credit and payments made in the intervaluation period

An actuarial shortfall of $2,427 million was reported in the Superannuation Account as at 31 March 2019. The government made a one-time credit of $2,605 million as at 31 March 2021 which resulted in an increase of $2,691 million in the recorded balance of the Account as at 31 March 2022.

Even though no actuarial deficit was reported in the CFPF in the 31 March 2019 report, before the 31 March 2019 report was tabled, the government made a special payment of $145 million as at 31 March 2020 as per requested in the 31 March 2016 report. This payment resulted in an increase of $159 million in the CFPF as at 31 March 2022.

A deficit of $173 million was reported in the RFPF as at 31 March 2019 which was to be amortized over a period of 15 years in accordance with the Reserve Force Pension Plan Regulations. A total of $39 million of special payments were made to the RFPF during the intervaluation period that resulted in an increase of $40 million in assets after including the expected interest to 31 March 2022.

4.2.6 Experience gains and losses

Since the previous valuation, experience gains and losses have increased the Superannuation Account actuarial shortfall by $268 million. The CFPF actuarial surplus has increased by $4,113 and RFPF actuarial deficit has decreased by $84 million due to the experience gains and losses over the three-year intervaluation period. The main experience gain and loss items are described in Table 7.

| Component of experience gains and (losses) | Superannuation Account | CFPF | RFPF |

|---|---|---|---|

| Terminations | 3 | 39 | 2 |

| Rollover experience | n/a | n/a | (39) |

| Retirements | 43 | 12 | 2 |

| Disabilities | 22 | (6) | 0 |

| MortalityTable 7 footnote (i) | (105) | 46 | 4 |

| Promotional and seniority salary increasesTable 7 footnote (ii) | (74) | (309) | 0 |

| Interest and investment earningsTable 7 footnote (iii) | 8 | 4,845 | 137 |

| Pension indexationTable 7 footnote (iv) | (120) | (49) | (1) |

| Economic increases in pensionable earningsTable 7 footnote (v) | (37) | (273) | (5) |

| Transfer value ratesTable 7 footnote (vi) | 0 | (71) | (9) |

| PBDA payments | 32 | (93) | 0 |

| Miscellaneous | (40) | (28) | (8) |

| Total experience gains and (losses) | (268) | 4,113 | 84 |

|

Table 7 footnotes

|

|||

4.2.7 Revision of actuarial assumptions

Actuarial assumptions were revised based on economic trends and demographic experience as described in Appendices F and G. This revision has increased the Superannuation Account actuarial liability by $2,739 million, reduced the CFPF actuarial liability by $935 million and decreased the RFPF actuarial liability by $68 million. The impacts of these revisions are shown in the following table and the most important items are discussed thereafter.

| Actuarial assumption | Superannuation Account | CFPF | RFPF |

|---|---|---|---|

| Yields and rates of return | 206 | 2,103 | 40 |

| Increases in pensionable earnings and YMPE/MPE | (1) | 44 | 2 |

| Pension indexation | (3,172) | (1,366) | (24) |

| Transfer value rates | 0 | 154 | 35 |

| Mortality rates and improvement factors | 165 | 40 | 1 |

| Withdrawal ratesTable 8 footnote a | 0 | (113) | (39) |

| Retirement rates | 4 | 21 | 33 |

| Disability rates | 1 | 144 | 3 |

| Seniority and promotional increases | (1) | (186) | 0 |

| Proportion opting for a deferred annuity | 0 | 56 | 15 |

| Family composition | 59 | 38 | 2 |

| Net impact of revision | (2,739) | 935 | 68 |

|

Table 8 footnotes

|

|||

The net impact of the revision of the assumptions is largely attributable to the changes in the following economic assumptions:

-

the known pension indexation of 6.3% of 1 January 2023 and the increase of our assumption of 1 January 2024 to 5.1%; and

-

the increase in the expected return on assets assumptions for the Canadian Forces Pension Fund and the Reserve Force Pension Fund.

The impact of the change on the yields to the Superannuation Account are of lesser importance than the CFPF and the RFPF as the ultimate nominal yield was reduced from 4.5% to 4.0%; while nominal yields for the plan years 2023 through 2040 were increased. The equivalent flat nominal yield for the purpose of calculating the actuarial liability as at 31 March 2022 is 3.00% compared to a flat rate of 2.97% based on the stream of nominal yields from the previous valuation. As a result, there is a negligible decrease in the actuarial liability of the Superannuation Account.

Details of the changes in economic assumptions are described in Appendix F.

Details of the changes in demographic assumptions, in particular for mortality rates, are described in Appendix G.

4.2.8 Change in the present value of prior service contributions

The expected total government cost is shown in Table 30. The government is expected to make additional contributions in excess of the current service cost for members' prior service elections. The change in the present value of prior service contributions corresponds to members' elections since the last report where the members opted to pay for these elections by instalments. Members' prior service elections paid through instalments increased the Superannuation Account by $7 million and the CFPF and the RFPF assets by $84 million and $11 million less than expected respectively.

4.2.9 Change in the present value of administrative expenses for the Superannuation Account

The previous report annual administrative expenses assumption of 0.55% of total pensionable payroll is increased to 0.60% in this report. This increase is based on average administrative expenses observed during the intervaluation period.

For plan year 2023, 40.0% of total administrative expenses are being charged to the Superannuation Account; it is assumed that the proportion charged to the Superannuation Account will reduce at the same rate of 2.5% per year as assumed in the previous valuation.

4.2.10 Unrecognized investment gains

An actuarial asset valuation method that minimizes the impact of short-term fluctuations in the market value of assets was also used for this valuation. The method, which is described in Appendix E.2, resulted in an actuarial value of the CFPF and the RFPF assets that are $3,942 and $86 million less than their respective market values as at 31 March 2022.

4.3 CFSA - Cost certificate

4.3.1 Current service cost

The details of the current service cost for plan yearFootnote 3 2024 and reconciliation with the 2021 current service cost are shown below.

| Components of current service cost | CFPF | RFPF |

|---|---|---|

| Members required contributions | 590.0 | 24.1 |

| Government current service cost | 869.7 | 45.8 |

| Total current service cost | 1,459.7 | 69.9 |

| Total current service cost as % of expected pensionable payroll | 25.30% | 15.12% |

| Component of reconciliation of current service cost | CFPF | RFPF |

|---|---|---|

| Current service cost for plan year 2021 | 27.54 | 18.65 |

| Expected current service cost change between plan years 2021 and 2024 | (0.82) | (0.66) |

| Change in methodology | 0.39 | (0.13) |

| Intervaluation experience | (0.19) | (0.39) |

| Changes in administration expenses assumption | 0.04 | (0.47) |

| Changes in demographic assumptions | 0.02 | 0.20 |

| Changes in economic assumptions | (1.68) | (2.08) |

| Current service cost for plan year 2024 | 25.30 | 15.12 |

4.3.2 Projection of current service costs

The current service cost is borne jointly by the plan members and the government. The Regular Force Plan member contribution rates are determined on a calendar year basis and they have been changed since the last valuation. Contribution rates are set equal to the contribution rates of Group 1 contributors under the PS pension plan. Contribution rates for the Reserve Force Plan members are set by regulation. The contribution rates are as follows:

| Calendar year | Regular Force below YMPE | Regular Force above YMPE | Reserve Force |

|---|---|---|---|

| 2022 | 9.36% | 12.48% | 5.20% |

| 2023 | 9.35% | 12.37% | 5.20% |

| 2024 and after | 9.35% | 12.25% | 5.20% |

Current service costs on a plan year basis, expressed as a percentage of the projected pensionable payroll as well as in dollar amounts are shown in Table 12 and Table 13 for Regular Force Plan members and in Table 14 and Table 15 for Reserve Force Plan members. Member contributions and the government current service costs are also shown on a calendar year basis in Table 16 to Table 19.

| Plan year | Contributors | Government | Total |

|---|---|---|---|

| 2024 | 590 | 870 | 1,460 |

| 2025 | 611 | 916 | 1,527 |

| 2026 | 638 | 968 | 1,606 |

| 2027 | 669 | 1,025 | 1,694 |

| Plan year | Contributors | Government | Total |

|---|---|---|---|

| 2024 | 10.23 | 15.07 | 25.30 |

| 2025 | 10.19 | 15.28 | 25.47 |

| 2026 | 10.16 | 15.40 | 25.56 |

| 2027 | 10.12 | 15.52 | 25.64 |

| Plan year | Contributors | Government | Total |

|---|---|---|---|

| 2024 | 24.0 | 45.9 | 69.9 |

| 2025 | 25.6 | 48.7 | 74.3 |

| 2026 | 27.2 | 51.4 | 78.6 |

| 2027 | 28.9 | 54.2 | 83.1 |

| Plan year | Contributors | Government | Total |

|---|---|---|---|

| 2024 | 5.20 | 9.92 | 15.12 |

| 2025 | 5.20 | 9.89 | 15.09 |

| 2026 | 5.20 | 9.81 | 15.01 |

| 2027 | 5.20 | 9.77 | 14.97 |

| Calendar year | Contributors | Government | Total |

|---|---|---|---|

| 2024 | 606 | 904 | 1,510 |

| 2025 | 631 | 955 | 1,586 |

| 2026 | 661 | 1,011 | 1,672 |

| Calendar year | Contributors | Government | Total | Ratio of government to contributors' current service cost |

|---|---|---|---|---|

| 2024 | 10.20 | 15.23 | 25.43 | 1.49 |

| 2025 | 10.16 | 15.38 | 25.54 | 1.51 |

| 2026 | 10.13 | 15.49 | 25.62 | 1.53 |

| Calendar year | Contributors | Government | Total |

|---|---|---|---|

| 2024 | 25.2 | 48.0 | 73.2 |

| 2025 | 26.8 | 50.7 | 77.5 |

| 2026 | 28.5 | 53.5 | 82.0 |

| Calendar year | Contributors | Government | Total | Ratio of government to contributors' current service cost |

|---|---|---|---|---|

| 2024 | 5.20 | 9.90 | 15.10 | 1.90 |

| 2025 | 5.20 | 9.83 | 15.03 | 1.89 |

| 2026 | 5.20 | 9.78 | 14.98 | 1.88 |

4.3.3 Administrative expenses

Based upon the assumptions described in Appendix F.3.5, the CFPF and the RFPF administrative expenses are included in the total current service costs. As for the previous report, the expected administration expenses exclude PSP operating expenses as these are recognized implicitly through a decrease in the real rate of return. The estimated administrative expenses are shown in the following table:

| Plan year | Superannuation Account | CFPF | RFPF |

|---|---|---|---|

| 2023 | 13.9 | 20.9 | 6.5 |

| 2024 | 13.4 | 22.3 | 6.9 |

| 2025 | 13.0 | 24.1 | 7.3 |

| 2026 | 12.6 | 26.2 | 7.8 |

| 2027 | 12.3 | 28.6 | 8.2 |

The Superannuation Account administrative expenses have been capitalized and increase the liability for service accrued prior to 1 April 2000.

4.3.4 Contributions for prior service elections

Based on the valuation data and the assumptions described in Appendices F.2 and F.3 and recent statistical information provided by the PSPC, member and government contributions for prior service elections were estimated as follows:

| Plan year | Superannuation Account contributors | Superannuation Account government | CFPF contributors | CFPF government | RFPF contributors | RFPF government |

|---|---|---|---|---|---|---|

| 2025 | 1.3 | 1.3 | 15.0 | 24.5 | 2.0 | 3.2 |

| 2025 | 1.3 | 1.3 | 15.0 | 24.5 | 1.9 | 3.1 |

| 2026 | 1.2 | 1.2 | 14.4 | 23.5 | 1.9 | 3.0 |

| 2027 | 1.0 | 1.0 | 13.6 | 22.2 | 1.7 | 2.8 |

| 2028 | 0.9 | 0.9 | 12.6 | 20.5 | 1.4 | 2.4 |

|

Table 21 footnotes

|

||||||

4.4 Sensitivity to variations in key economic assumptions

The information required by statute, which is presented in the main report, has been derived using best-estimate assumptions regarding future demographic and economic trends. The key best-estimate assumptions, i.e. those for which changes within a reasonable range have the most significant impact on the long-term financial results, are described in Appendices F and G.

Given the length of the projection period and the number of assumptions required, it is unlikely that the actual experience will develop precisely in accordance with best-estimate assumptions that underlie the actuarial estimates. Individual sensitivity tests have been performed using alternative assumptions.

Table 22 presents the effect on the plan year 2024 current service cost for the Regular Force Plan and the Reserve Force Plan when key economic assumptions are varied by one percentage point per annum.

Similarly, Table 23 presents the effect on the liabilities as at 31 March 2022 for the Regular Force Plan and the Reserve Force Plan when key economic assumptions are varied by one percentage point per annum.

| Assumption varied | Regular Force | Effect | Reserve Force | Effect |

|---|---|---|---|---|

| None (i.e. current basis) | 25.30 | None | 15.12 | None |

| Investment yield is 1% higher | 20.33 | (4.97) | 13.30 | (1.81) |

| Investment yield is 1% lower | 32.18 | 6.88 | 18.01 | 2.89 |

| Pension indexation is 1% higher | 28.94 | 3.64 | 16.33 | 1.21 |

| Pension indexation is 1% lower | 22.43 | (2.87) | 14.19 | (0.93) |

| Salary, wage, YMPE and MPE are 1% higher | 27.47 | 2.16 | 15.94 | 0.83 |

| Salary, wage, YMPE and MPE are 1% lower | 23.42 | (1.88) | 14.39 | (0.73) |

| Inflation is 1% higherTable 22 footnote a | 24.75 | (0.56) | 14.84 | (0.27) |

| Inflation is 1% lowerTable 22 footnote a | 25.89 | 0.58 | 15.39 | 0.27 |

|

Table 22 footnotes

|

||||

| Assumption varied | Superannuation Account | Effect | CFPF | Effect | RFPF | Effect |

|---|---|---|---|---|---|---|

| None (i.e. current basis) | 48,422 | None | 36,972 | None | 792.0 | None |

| Investment yield is 1% higher | 42,887 | (5,535) | 31,612 | (5,360) | 683.1 | (108.9) |

| Investment yield is 1% lower | 55,255 | 6,833 | 44,172 | 7,200 | 936.5 | 144.5 |

| Pension indexation is 1% higher | 55,002 | 6,580 | 42,386 | 5,414 | 894.6 | 102.6 |

| Pension indexation is 1% lower | 42,984 | (5,438) | 32,806 | (4,166) | 711.8 | (80.2) |

| Salary, wage, YMPE and MPE are 1% higher | 48,454 | 32 | 38,161 | 1,189 | 820.0 | 28.0 |

| Salary, wage, YMPE and MPE are 1% lower | 48,390 | (32) | 36,092 | (880) | 767.6 | (24.4) |

| Inflation is 1% higherTable 23 footnote a | 48,294 | (128) | 36,664 | (308) | 784.0 | (8.0) |

| Inflation is 1% lowerTable 23 footnote a | 48,554 | 132 | 37,497 | 525 | 800.4 | 8.4 |

|

Table 23 footnotes

|

||||||

4.5 Assessing and illustrating downside risks

This section focuses on assessing and illustrating downside risks due to potential adverse scenarios. It illustrates the potential impacts of a decrease in the nominal yield on 10-year-plus Government of Canada bonds, as well as the potential impact of a scenario where future longevity improvement is higher than expected. Downside risks of future investment returns are illustrated in Appendix J.3.

Given the purpose of this section, only adverse scenarios are presented. This section is not meant to represent forecasts or predictions and should be interpreted with caution.

4.5.1 Decrease in the nominal yield on 10-year-plus Government of Canada bonds

In the event of a decrease of 1% in the nominal yield on 10-year-plus Government of Canada bonds, the resulting new money rate and consequently, the government's real cost of borrowing would also decrease by 1%. The financial impact on the Superannuation Account of this plausible adverse scenario would be an increase of $6,833 million in actuarial liabilities.

Considering the high termination and rollover incidence in the Reserve Force Plan, there would be a notable potential impact to the RFPF if a similar event resulted in a decrease of 1% in the assumed transfer value real interest rates (details in Appendix F.3.4). The financial impact on the RFPF of this plausible adverse scenario would be an increase of $72.7 million in actuarial liabilities, and an estimated increase representing 3.28% of pensionable payroll in the current service cost.

4.5.2 Future longevity improvement higher than expected

Mortality rates are reduced in the future in accordance with the same longevity improvement assumption used in the 31st Actuarial Report on the Canada Pension Plan. Mortality improvements are expected to continue in the future but at a slower pace, reaching the ultimate improvement rate of 0.8% for ages below 89 in plan year 2040. If these improvement factors were underestimated, future mortality would be lower than expected. For example, the financial impact of a possible adverse scenario where the ultimate longevity improvement was 50% higher than projected would be:

-

an increase of $132 million in actuarial liabilities of the Superannuation Account,

-

an increase of $172 million in actuarial liabilities of the CFPF,

-

an increase of $6 million in actuarial liabilities of the RFPF,

-

an increase of 0.18% of pensionable payroll in the CFPF current service cost, and

-

an increase of 0.18% of pensionable payroll in the RFPF current service cost.

The cohort life expectancy of a member aged 65 would be impacted, as presented in the table below:

| Longevity improvement factors | As at 31 March 2022 | As at 31 March 2042 | ||||

|---|---|---|---|---|---|---|

| Male officer | Male other rank | Female | Male officer | Male other rank | Female | |

| Best-estimate | 23.5 | 20.8 | 24.4 | 24.6 | 22.0 | 25.5 |

| if ultimate 50% higher | 23.6 | 20.9 | 24.6 | 25.1 | 22.6 | 26.2 |

4.6 RCA – Financial position

This section shows the financial position of the RCA Account as at 31 March 2022. The results of the previous valuation are also shown for comparison.

| Components of financial position | 31 March 2022 | 31 March 2019 |

|---|---|---|

| Actuarial value of assets | ||

| Recorded account balance | 499 | 443 |

| Tax credit (CRA refundable tax) | 493 | 439 |

| Total assets | 992 | 882 |

| Actuarial liability | ||

| Pensionable excess earnings from active contributors | 482 | 415 |

| Pensionable excess earnings from pensioners | 356 | 264 |

| Survivor allowance from active contributors | 18 | 7 |

| Survivor allowance from pensioners | 64 | 41 |

| Total actuarial liability | 920 | 727 |

| Actuarial excess or shortfall | 72 | 155 |

The sum of the recorded balance of the RCA Account and the tax credit (CRA refundable tax) is $992 million; it exceeds the actuarial liability of $920 million by $72 million as at 31 March 2022 ($155 million as at 31 March 2019). The SRAA does not allow for an adjustment to be made to the RCA Account that would allow the recorded balance to track the actuarial liability when there is an actuarial excess.

4.7 RCA – Current service cost

The projected current service cost, borne jointly by the members and the government, of 0.67% of pensionable payroll for plan year 2024 calculated in the previous valuation has increased to 0.76% in this valuation. The RCA current service cost is estimated to stay at 0.76% of pensionable payroll for Plan year 2024 to Plan year 2027 as shown the following table. Members' contributions and the government current service costs are also shown on a calendar year basis in Table 27 and Table 28.

| Components of current service cost | Plan year 2024 | Plan year 2025 | Plan year 2026 | Plan year 2027 |

|---|---|---|---|---|

| Pensionable excess earnings | 43.0 | 44.7 | 46.8 | 49.4 |

| Survivor allowance | 1.0 | 1.0 | 1.0 | 1.0 |

| Total current service cost | 44.0 | 45.7 | 47.8 | 50.4 |

| Less member contributions | (5.9) | (6.1) | (6.4) | (6.8) |

| Government current service cost | 38.1 | 39.6 | 41.4 | 43.6 |

| Current service cost as % of total pensionable payroll | 0.76% | 0.76% | 0.76% | 0.76% |

| Calendar year | Contributors | Government | Total |

|---|---|---|---|

| 2024 | 6.1 | 39.2 | 45.3 |

| 2025 | 6.3 | 41.0 | 47.3 |

| 2026 | 6.7 | 43.0 | 49.7 |

| Calendar year | Contributors | Government | Total | Ratio of government to contributors current service cost |

|---|---|---|---|---|

| 2024 | 0.10 | 0.66 | 0.76 | 6.60 |

| 2025 | 0.10 | 0.66 | 0.76 | 6.60 |

| 2026 | 0.10 | 0.66 | 0.76 | 6.60 |

4.8 Summary of estimated government cost

The following tables summarize the estimated total government credit and cost on a plan year basis.

| Plan year | RCA current service cost | Superannuation Account total prior service contributions | Superannuation Account special credit | RCA special credit | Total government credit |

|---|---|---|---|---|---|

| 2024 | 38.1 | 1.4 | 3,298.4 | 0.0 | 3,337.9 |

| 2025 | 39.6 | 1.3 | 0.0 | 0.0 | 40.9 |

| 2026 | 41.4 | 1.2 | 0.0 | 0.0 | 42.6 |

| Plan year | CFPF current service cost | RFPF current service cost | CFPF prior service contributions | RFPF prior service contributions | RFPF special payment | Total government cost |

|---|---|---|---|---|---|---|

| 2024 | 869.7 | 45.9 | 25.5 | 3.2 | 17.4 | 961.7 |

| 2025 | 915.9 | 48.7 | 24.5 | 3.1 | 4.1 | 996.3 |

| 2026 | 967.8 | 51.4 | 23.5 | 3.0 | 4.1 | 1,049.8 |

5. Actuarial opinion

In our opinion, considering that this report was prepared pursuant to the Public Pensions Reporting Act,

-

the valuation data on which the valuation is based are sufficient and reliable for the purposes of the valuation;

-

the assumptions used are individually reasonable and appropriate in aggregate for the purposes of the valuation; and

-

the methods employed are appropriate for the purposes of the valuation.

This report has been prepared, and our opinion given, in accordance with accepted actuarial practice in Canada. In particular, this report was prepared in accordance with the Standards of Practice (General Standards and Practice – Practice-Specific Standards for Pension Plans) published by the Canadian Institute of Actuaries.

To the best of our knowledge, after discussion with the Department of National Defence, there were no events between the valuation date and the date of this report that would have a material impact on the results of this valuation.

Assia Billig, FCIA, FSA

Chief Actuary

John Kmetic, FCIA, FSA

Senior Actuary

Yann Bernard, FCIA, FSA

Senior Actuary

Ottawa, Canada

29 September 2023

Appendix A ― Summary of pension benefit provisions

Pensions for members of the regular force were first provided under the Militia Pension Act of 1901, when in 1950 it became the Defence Services Pension Act until the Defence Services Pension Continuation Act and the Canadian Forces Superannuation Act (CFSA) were enacted in 1959. Benefits are also provided to members of the regular force under the Special Retirement Arrangements Act.

The enactment of Bill C-78 on 21 September 1999 gave authority to create a pension plan for the members of the reserve force. The Reserve Force Plan was established on 1 March 2007 and provides pension benefits to part-time members of the reserve force who meet the threshold requirements for becoming plan members. The benefit eligibility rules under this plan are the same as the rules that apply to Regular Force members starting on 1 March 2007.

Benefits under both the Regular Force Plan and the Reserve Force Plan may be reduced in accordance with the Pension Benefits Division Act if there is a breakdown of a spousal union.

This appendix summarizes the pension benefits for both Regular Force members and Reserve Force members, provided under the CFSA registered provisions, which are in compliance with the Income Tax Act. For the Regular Force Plan, the portion of the benefits in excess of the Income Tax Act limits for the registered provisions is provided under the RCA described in Appendix B.

The legislation shall prevail if there is a discrepancy between it and this summary.

A.1 Changes since the last valuation

The previous valuation report was based on the pension benefit provisions as they stood as at 31 March 2019. There were no changes to the plan provisions since the last valuation.

A.2 Membership

Regular Force membership in the Regular Force Plan is compulsory for all full-time members of the Canadian Forces.

As of 1 March 2007, a member of the reserve force is considered to be a member of the regular force and will become a member of the Regular Force Plan,

-

on 1 March 2007 if, on that date,

-

the member's total number of days of paid Canadian Forces service during any period of 60 months beginning on or after 1 April 1999 was no less than 1,674,

-

the member already was or became a member of the Canadian Forces during the first month of the period and remained a member of the Canadian Forces throughout the period without any interruption of more than 60 days,

-

the member is not a person required to contribute to the Public Service Pension Fund or the Royal Canadian Mounted Police Pension Fund, and

-

the member does not have any pensionable service to their credit under Part I of the CFSA;

-

-

in any other case, on the first day of the month following a period of 60 months ending after 1 March 2007 if

-

the member's total number of days of paid Canadian Forces service during the period was no less than 1,674,

-

the member already was or became a member of the Canadian Forces during the first month of the period and remained a member of the Canadian Forces throughout the period without any interruption of more than 60 days, and

-

the member does not have any pensionable service to their credit under Part I of the CFSA.

-

The general rule is that, once a Reserve Force member is deemed a Regular Force member for the purposes of Part I of the CFSA and does not fail to receive pensionable earnings in any 12 consecutive months, the member remains a contributor under Part I of the CFSA as long as they remain a member of the Reserve Force. There are exceptions to the general rule previously described but for the purpose of this report, these were considered immaterial.

A member of the reserve force is deemed to become a participant in the Reserve Force Plan, defined under Part I.1 of the CFSA, if,

-

during each of any two consecutive periods of 12 months beginning on or after 1 April 1999 and ending no later than 1 March 2007, the earnings that the member was entitled to receive were at least 10 per cent of the Annual Earnings ThresholdFootnote 4, provided that the member already was or became a member of the Canadian Forces during the first month of the first period and remained a member of the Canadian Forces, without any interruption of more than 60 days, until 1 March 2007; or

-

in any other case, on the first day of the month following two consecutive periods of 12 months, the second of which ending after 1 March 2007 and during each of which the earnings that they were entitled to receive were at least 10 per cent of the Annual Earnings Threshold, provided that the member already was or became a member of the Canadian Forces during the first month of the first period and remained a member of the Canadian Forces, without any interruption of more than 60 days, throughout those two periods.

A.3 Contributions

A.3.1 Members

For Regular Force members, during the first 35 years of pensionable service, members contribute according to the rates determined by the Treasury Board which must not exceed the contribution rates paid by Group 1 contributors under the Public Service pension plan (PS pension plan). Contribution rates of Group 1 contributors under the PS pension plan are shown in the following table. It is assumed that the Regular Force member contribution rates will be equal to those of the PS pension plan. More information on the rates assumed under the PS pension plan can be found in the Actuarial Report on the Pension Plan for the Public Service of Canada as at 31 March 2020. The contribution rates shown after calendar year 2024 are not final and are subject to change.

| blank | Calendar year | |||

|---|---|---|---|---|

| 2022 | 2023 | 2024 | 2025 | |

| Contribution rates on earnings up to the maximum covered by the Canada Pension Plan | 9.36% | 9.35% | 9.35% | 9.35% |

| Contribution rates on earnings over the maximum covered by the Canada Pension Plan | 12.48% | 12.37% | 12.25% | 12.25% |

For Reserve Force members, during the first 35 years of pensionable service, members contribute 5.2% on all earnings up to 66 2/3 times the defined benefit limit as determined under the Income Tax Regulations. After 35 years of pensionable service, members contribute only 1% of pensionable earnings.

A.3.2 Government

A.3.2.1 Current service

The government determines its normal monthly contribution as that amount which, when combined with the required member contributions in respect of current service and expected interest earnings, is sufficient to cover the cost, as estimated by the President of the Treasury Board, of all future payable benefits that have accrued in respect of pensionable service during that month and the administrative expenses incurred during that month.

A.3.2.2 Elected prior service

The government matches Regular Force member contributions credited under the Superannuation Account for prior service elections; however, no contributions are credited if the member is paying the double rate.

Government credits to the Canadian Forces Pension Fund in respect of elected prior service are as described for current service; however, if the member is paying the double rate the government contribution rate is generally adjusted so that total member and government contributions match the current service cost.

For Reserve Force members, this valuation assumes that the government will match member contributions for prior service elections.

A.3.2.3 Actuarial excess and surplus

In accordance with the CFSA, the government has the authority to:

-

debit the excess of accounts available for benefits over the actuarial liability from the Superannuation Account subject to limitations, and

-

deal with any actuarial surplus, subject to limitations, in the Canadian Forces Pension Fund as it occurs, either by reducing members and/or employer contributions or by making withdrawals.

The regulations under Part I.1 of the CFSA give the government the authority to deal with any actuarial surplus, subject to limitations, in the RFPF as it occurs by reducing employer contributions.

A.3.2.4 Actuarial shortfall and actuarial deficit

In accordance with the CFSA, if an actuarial shortfall under the Superannuation Account is identified through a statutory actuarial report, the actuarial shortfall can be amortized over a period of up to 15 years, such that the amount that in the opinion of the President of the Treasury Board will, at the end of the fifteenth fiscal year following the tabling of that report or at the end of the shorter period that the President of the Treasury Board may determine, together with the amount that the President of the Treasury Board estimates will be to the credit of the Superannuation Account at that time, meet the cost of the benefits payable in respect of pensionable service prior to 1 April 2000.

If an actuarial deficit under the CFPF is identified through a statutory actuarial report, the actuarial deficit can be amortized over a period of up to 15 years, such that the amount that in the opinion of the President of the Treasury Board will, at the end of the fifteenth fiscal year following the tabling of that report or at the end of the shorter period that the President of the Treasury Board may determine, together with the amount that the President of the Treasury Board estimates will be to the credit of the Canadian Forces Pension Fund at that time, meet the cost of the benefits payable in respect of pensionable service since 1 April 2000.

Similarly, if an actuarial deficit under the RFPF is identified through a statutory actuarial report, the RFPF is to be credited with such annual amounts that will fully amortize the actuarial deficit over a period of 15 years.

A.4 Summary description of benefits under the Regular Force Plan and the Reserve Force Plan

The objective of the Regular Force Plan and the Reserve Force Plan is to provide an employment earnings–related lifetime retirement pension to eligible members. Benefits to members in case of disability and to the spouse and children in case of death are also provided.

Regular Force Plan pension benefits are coordinated with the pensions paid by the CPP. The initial rate of a Regular Force Plan member's retirement pension is equal to 2% of the highest average of annual pensionable earnings over any period of five consecutiveFootnote 5 years, multiplied by the number of years of pensionable service not exceeding 35. The pension is indexed annually with the Consumer Price Index (CPI) and the accumulated indexation may be payable at age 55 at the earliest as defined in Appendix A.5.6. Entitlement to benefits depends on either the qualifying service in the Canadian Forces or the pensionable service, as defined below in Appendices A.5.7 and A.5.8.

Reserve Force Plan member's pension benefits are equal to 1.5% of the greater of the Reserve Force Plan member's total pensionable earnings and total updated pensionable earnings over the most recent 35 years of pensionable service (i.e. updated career average plan). The Reserve Force Plan also provides a bridge benefit equal to 0.5% of the greater of the pensioner's total bridge benefit earnings and total updated bridge benefit earnings over the most recent 35 years of pensionable service. Reserve Force pension and bridge benefits are indexed annually with the Consumer Price Index and the accumulated indexation may be payable at age 55 at the earliest, as defined in Appendix A.5.6.

Entitlement to benefits depends on either the qualifying service in the Canadian Forces or the pensionable service, as defined below in Appendices A.5.7 and A.5.8.

Detailed notes on the following overview are provided in Appendix A.5.

A.4.1 Active member benefit entitlement on the basis of qualifying service

A.4.1.1 Active Regular Force members

| Type of termination | Qualifying service in the Canadian Forces (Appendix A.5.7) |

Benefit |

|---|---|---|

| With less than two years of pensionable service (Appendix A.5.8) | Return of contributions (Appendix A.5.11) | |

| With two or more years of pensionable service (Appendix A.5.8); and | ||

| Retirement on completion of short engagement (an officer other than a subordinate officer who has not reached retirement age and is not serving on an intermediate engagement or for an indefinite period of service) (Appendix A.5.9) |

Less than 25 years (less than 20 years – old terms of service) |

At option of member

|

|

25 years or more (20 years or more – old terms of service) |

See "Retirement for reasons other than those previously mentioned" | |

| Retirement during an indefinite period of service after having completed an intermediate engagement and prior to reaching retirement age, for reasons other than disability or, to promote economy or efficiency | Any length | Immediate annuity to which member was entitled upon completion of intermediate engagement increased to such extent as prescribed by regulationSection A.4.1.1, Table A, footnote a (Appendix A.5.15) |

| Retirement on completion of intermediate engagement (a member who has not reached retirement age and is not serving for an indefinite period of service) (Appendix A.5.10) |

25 years or more (20 years or more – old terms of service) |

Immediate annuity (Appendix A.5.12) |

|

Section A.4.1.1, Table A, footnotes

|

||

| Type of termination | Qualifying service in the Canadian Forces (Appendix A.5.7) |

Benefit |

|---|---|---|

| With less than two years of pensionable service | Return of contributions (Appendix A.5.11) | |

| With two or more years of pensionable service; and | ||

| Compulsory retirement to promote economy or efficiency | Less than 10 years |

At option of member

|

|

At least 10 but less than 25 years (less than 20 years – old terms of service) |

At option of member

|

|

|

25 years or more (20 years or more – old terms of service) |

Immediate annuity (Appendix A.5.12) | |

| Retirement for reasons other than those previously mentioned |

Less than 25 years (less than 20 years – old terms of service) |

At option of member

|

| (At least 20 but less than 25 years – old terms of service) | Immediate reduced annuity (Appendix A.5.16) | |

| 25 years or more |

Officer: immediate reduced annuity (Appendix A.5.16); Other rank: immediate annuity (Appendix A.5.12) |

|

A.4.1.2 Active Reserve Force members

| Member's type of termination | Benefit |

|---|---|

| Retirement on completion of 25 years or more of Canadian Forces service (Appendix A.5.7) | Immediate annuity (Appendix A.5.12) |

A.4.2 Member benefit entitlement on the basis of pensionable service

A.4.2.1 Active Regular Force members

| Type of termination | Years of pensionable service (Appendix A.5.8) |

Benefit |

|---|---|---|

| Compulsory retirement because of disabilitySection A.4.2.1, Table A, footnote a | Less than 2 years | Return of contributions (Appendix A.5.11) |

| At least 2 but less than 10 years |

At option of member

|

|

| 10 years or more | Immediate annuity (Appendix A.5.12) | |

|

Section A.4.2.1, Table A footnotes

|

||

A.4.2.2 Active member benefit entitlement

| Type of termination | Benefit |

|---|---|

| With less than two years of pensionable service | Return of contributions (Appendix A.5.11) |

| With two or more years of pensionable service; and | |

| Involuntary termination due to a work force reduction program and | |

|

Immediate annuity (Appendix A.5.12) |

| Leaving prior to age 50, | |

|

Deferred annuity (Appendix A.5.13) or transfer value if under age 50 (Appendix A.5.14) |

|

Immediate annuity (Appendix A.5.12) |

| Leaving at age 50 or over, except for death or disability, and | |

|

Immediate annuity (Appendix A.5.12) |

|

Deferred annuity (Appendix A.5.13) or annual allowance (Appendix A.5.17) |

A.4.2.3 Benefits in case of death

| Status at death | Years of pensionable service (Appendix A.5.8) |

Benefit |

|---|---|---|

| Leaving no eligible spouse or children under 25 (Appendices A.5.18 and A.5.19) | Less than 2 years | Return of contributions |

| 2 years or more | Minimum death benefit (Appendix A.5.21) | |

| Leaving eligible spouse and/or children under 25 | Less than 2 years | Return of contributions or an amount equal to one month's earnings of the deceased member for each year of credited pensionable service, whichever is the greater |

| 2 years or more | Annual allowance (Appendix A.5.20) |

A.5 Explanatory notes

A.5.1 Pensionable earnings

For the Regular Force Plan, pensionable earnings means the salary at the annual rate prescribed by the regulations made pursuant to the National Defence Act together with the allowances for medical and dental care costs. Pensionable payroll means the aggregate pensionable earnings of all members with less than 35 years of pensionable service.

For the Reserve Force Plan, earnings means pay earned by a member of the Canadian Forces at the rates prescribed by the regulations made pursuant to the National Defence Act together with premiums in lieu of leave. Pensionable earnings means the earnings of a member with less than 35 years of pensionable service, who has completed the required two-year waiting period. Pensionable payroll means the aggregate pensionable earnings of all members.

A.5.2 Wage measure for Reserve Force Plan

Wage measure is

-

for a calendar year prior to 2024 , the corresponding rate of pay shown in Table 69 of this report; and

-

for a calendar year after 2023 , the greater of

-

the standard basic rate of pay for a period of duty or training of six hours or more, before any retroactive adjustment, that was prescribed or established under the National Defence Act, to be paid on October 1 of the preceding year to a member at the rank of Corporal (class A), and

-

the wage measure of the previous year.

-

A.5.3 Updated pensionable earnings for Reserve Force Plan

The updated pensionable earnings for a calendar year are the Reserve Force member's pensionable earnings for that year, subject to the Income Tax Act limits, times A/B, rounded to the nearest fourth decimal place, where

-

A = the average of the wage measures for five years consisting of the year the member most recently ceased to be a member and the most recent years during which the member was a member and, if necessary, the years preceding all of those years, and

-

B = the wage measure for that calendar year.

A.5.4 Bridge benefit earnings for Reserve Force Plan

Bridge benefit earnings for a calendar year are the lesser of

-

the member's pensionable earnings for that year, and

-

the Year's Maximum Pensionable Earnings (YMPE) for that year.

A.5.5 Updated bridge benefit earnings for Reserve Force Plan

Updated bridge benefit earnings for a calendar year are the lesser of

-

the member's updated pensionable earnings for that year, and

-

the average of the YMPE for five years consisting of the year the member most recently ceased to be a member and the preceding four years.

A.5.6 Indexation for Regular Force Plan and Reserve Force Plan

A.5.6.1 Level of indexation adjustments

All immediate and deferred annuities (pensions and allowances) are adjusted every January to the extent warranted by the increase, as at 30 September of the previous year, in the 12-month average Consumer Price Index. If the indicated adjustment is negative, annuities are not decreased for that year; however, the next following adjustment is diminished accordingly.

A.5.6.2 First Indexation adjustment

Indexation adjustments accrue from the end of the month in which employment or participation in the plan terminates. The first annual adjustment following termination of employment is prorated accordingly.

A.5.6.3 Commencement of indexation payments

Payment of the indexation portion of a retirement, disability or survivor pension normally commences when the pension is put into pay. However, regarding a retirement pension, the pensioner must be at least 55 years old and the sum of age and pensionable service at least 85; or the retirement pensioner must be at least 60 years old.

A.5.7 Qualifying service in the Canadian Forces (Regular Force Plan and Reserve Force Plan)

Qualifying service in the Canadian Forces means service for which a Regular or Reserve Force member is paid, and includes:

-

days of service in the Regular Force for which pay was authorized and periods of authorized leave of absence;

-

excluding any service for which a member was paid a return of contributions or lump sum payment under the CFSA that he or she did not elect to repay on subsequent enrolment;

-

-

days of service in the Reserve Force for which pay was authorized and authorized absences for maternity and parental purposes:

-

days of training or duty of less than 6 hours = half-day

-

days of Class "A" service = 1.4 days

-

periods before 1 April 1999 (when duration of period is verifiable but not the number of days) = quarter time

-

during maternity and parental leaves, days of Canadian Forces service are based on service in previous 12 months

-

A.5.8 Pensionable service

Pensionable service includes any period of service in the Regular Force or Reserve Force in respect of which an active member either (1) made contributions that remain in the Superannuation Account, CFPF or the RFPF, or (2) elected to contribute. It also includes any period of prior service for which an active member was paid a return of contributions or lump sum payment under the CFSA that he or she did elect to repay on subsequent enrolment. It also includes prior service in the Public Service of Canada, the Royal Canadian Mounted Police and the militaries of the Commonwealth of Nations that the member elected to count as pensionable service.

A.5.9 Short engagement for Regular Force Plan

Short engagement means a continuous period of service as a commissioned officer in the regular force for a period not exceeding nine years.

A.5.10 Intermediate engagement for Regular Force Plan

Intermediate engagement means, under the old terms of service, 20 years of continuous service as a member of the regular force. Under the new terms of service, an intermediate engagement is 25 years of continuous service as a member of the regular force.

A.5.11 Return of contributions

Return of contributions means the payment of an amount equal to the accumulated current and prior service contributions paid or transferred by the member into the Superannuation Account, the CFPF or the RFPF together with interest. Interest is calculated at the quarterly Pension Fund rate each quarter on the accumulated contributions with interest as at the end of the previous quarter.

A.5.12 Immediate annuity

For Regular Force Plan, immediate annuity means an unreduced pension that becomes payable immediately upon a pensionable retirement or a pensionable disability. The annual amount is equal to 2% of the highest average annual pensionable earnings (Appendix A.5.1) of the active member over any period of fiveFootnote 6 consecutiveFootnote 7 years, multiplied by the number of years of pensionable service not exceeding 35. However, if such highest five-year earnings average exceeds the yearly maximum prescribed for the calendar year in which service is terminated, then the annual amount is reduced by 2% of such excess, multiplied by the number of years of pensionable service after April 1995.

When a regular force pensioner attains age 65 or becomes entitled to a disability pension from the CPP, the annual amount of pension is reduced by a percentage of the indexed CPP annual pensionable earningsFootnote 8 (or, if lesser, the indexed five-year pensionable earnings average on which the immediate annuity is based), multiplied by the years of CPP pensionable serviceFootnote 9. The applicable percentage is 0.625%.

For Reserve Force Plan, immediate annuity means an unreduced pension that becomes payable immediately upon a pensionable retirement or a pensionable disability. The annual amount is equal to 1.5% of the greater of the member's total pensionable earnings and total updated pensionable earnings over the most recent 35 years of pensionable service, plus an additional bridge benefit equal to 0.5% of the greater of the member's total bridge benefit earnings and total updated bridge benefit earnings.

For both plans, annuities are payable in equal monthly instalments in arrears until the end of the month in which the pensioner dies or when the disability pensioner recovers from disability. Upon the death of the pensioner, either a survivor allowance (Appendix A.5.20) or a minimum death benefit (Appendix A.5.21) may be payable.

A.5.13 Deferred annuity

Deferred annuity means an annuity that becomes payable to a retirement pensioner when he or she reaches age 60. The annual payment is determined as for an immediate annuity (see Appendix A.5.12 above) but is adjusted to reflect the indexation (see Appendix A.5.6) from the date of termination to the commencement of annuity payments.

The deferred annuity becomes an immediate annuity during any period of disability beginning before age 60. If the disability ceases before age 60, the immediate annuity reverts to the original deferred annuity.

A.5.14 Transfer value

Active members who, at their date of termination of pensionable service, are under age 50 and who are eligible for a deferred annuity may elect to transfer the commuted value of their benefits, determined in accordance with the regulations, to

-

a locked-in Registered Retirement Savings Plan of the prescribed kind; or

-

another pension plan registered under the Income Tax Act; or

-

a financial institution for the purchase of a locked-in immediate or deferred annuity of the prescribed kind.

A.5.15 Annuity payable upon retirement during an indefinite period of service for Regular Force Plan

For a Regular Force active member who has not reached retirement age and who, while on an indefinite period of service after completing an intermediate engagement, ceases to be a member of the regular force for any reason other than disability, or to promote economy or efficiency, the Canadian Forces Superannuation Regulations (CFSR) prescribe an annuity that is equal to the greater of

-

an immediate annuity based on the pensionable service to the date of completion of the intermediate engagement only and the highest consecutive five-year earnings average at date of retirement, and

-

an immediate annuity based upon the total pensionable service to the date of retirement and the highest consecutive five-year employment earnings average at that date reduced by 5% for each full year by which

-

in the case of an officer, the age at the date of retirement is less than the retirement age applicable to the member's rank; or

-

in the case of a member of other rank, the age at the date of retirement is less than the retirement age applicable to the member's rank or the period of service in the Regular Force is less than 25 years, whichever is the lesser.

-

A.5.16 Reduced immediate annuity for Regular Force members

Reduced immediate annuity means an immediate annuity for which the annual amount of the annuity as determined in Appendix A.5.12 is reduced as stated below.

With the consent of the Minister of National Defence, a regular force active member who is required to terminate to promote economy or efficiency and has between 10 and 20 years of service in the regular force may choose an immediate annuity reduced, until attainment of age 65 but not thereafter, by 5% for each full year not exceeding six by which

-

the period of service in the regular force is less than 20 years; or

-