Registered Pension Plans (RPP) and Other Types of Savings Plans – Coverage in Canada

RPP By Number (2019)

The total number of active RPP members increased steadily from 5.1 million in 1989, to 6.0 million in 2009, and to 6.5 million in 2019.

In 2019, women accounted for 51% of the 6.5 million active RPP members. The share of RPP membership for women has been increasing through time. In 1989, only 37% (1.8 million) of active RPP members were women. This proportion increased to 45% (2.4 million) in 1999, was 50% (3.0 million) in 2009 and 51% (3.3 million) in 2019.

RPP Coverage by Number of Employees

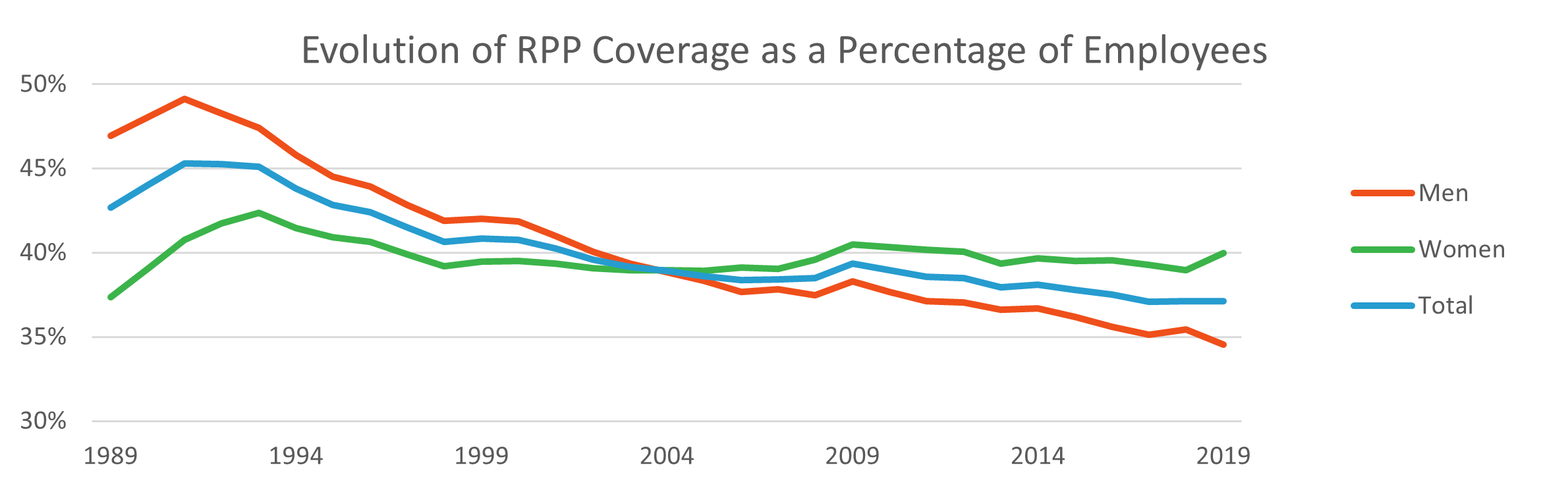

Although the number of active RPP members has increased in the last ten years, the number of employees has grown at a faster pace. As presented in the chart below, the proportion of employees covered by a RPP decreased from 43% in 1989 to 37% in 2019. As a proportion of employees, the coverage for women has been higher than the coverage for men over the last fifteen years.

Chart 1 - Evolution of RPP Coverage as a Percentage of Employees

Line graph showing the evolution of RPP coverage as a percentage of employee from 1989 to 2019. Y-axis represents the percentage of employees covered by RPP. X-axis represents time in years.

From 1989 to 2004, The RPP coverage decreased from 48% to 39% for men and increased from 37% to 39% for women. From 2004 to 2019, the RPP coverage decreased from 39% to 35% for men and increased slightly from 39% to 40% for women. In aggregate, the RPP decreased from 43% in 1989 to 37% in 2019.

RPP Coverage by Sector of Activity

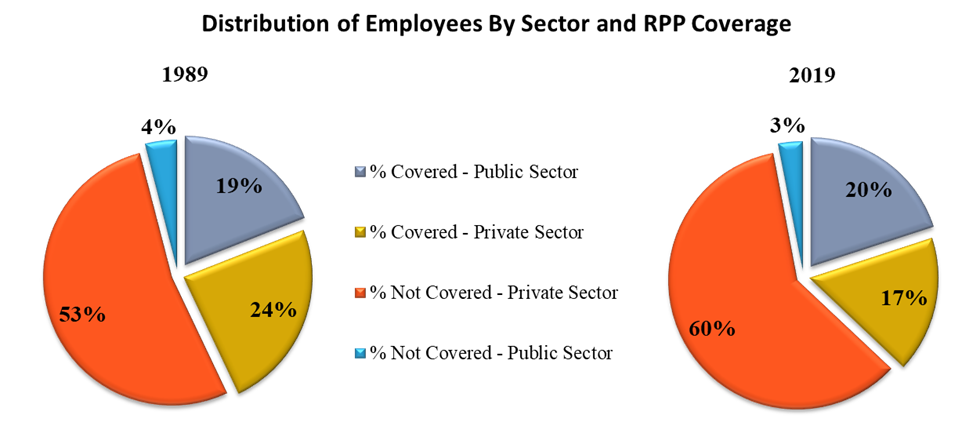

The charts below summarize the change of RPP coverage of Canadian employees by sector of activity between 1989 and 2019.

Chart 2 - Distribution of Employees by Sector and RPP Coverage

Two pie charts showing the distribution of employee covered by an RPP in the public and private sectors in 1989 and 2019.

In 1989, 19% of employee were in the public sector and covered by an RPP, 5% were in the public sector and not covered by an RPP, 24% were in the private sector and covered by and RPP, and 53% were in the private sector and not covered by an RPP.

In 2019, 20% of employee were in the public sector and covered by an RPP, 3% were in the public sector and not covered by an RPP, 17% were in the private sector and covered by and RPP, and 60% were in the private sector and not covered by an RPP.

RPP By Type of Plan - Defined Benefit Plan, Defined Contribution Plan and Other Plans

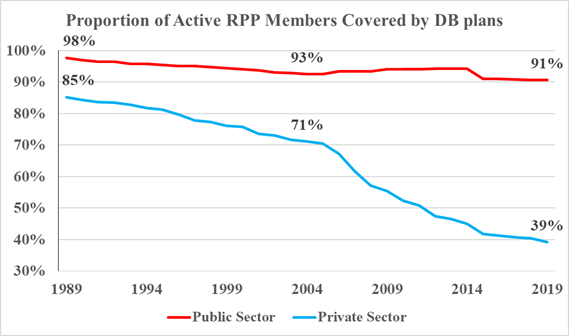

Overall, the proportion of active RPP members in Defined Benefit (DB) plans has declined from 90% in 1989 to 67% in 2019. The chart on the right presents the evolution of the DB coverage for active RPP members in the public and private sectors during this period. It shows that the reduction in DB plan coverage has been more significant for private sector employees.

Chart 3 - Proportion of Active RPP Members Covered by DB plans

A line graph comparing the proportion of active RPP members covered by DB plans between public sector and private sector from 1989 to 2018. Y-axis represents the proportion of active RPP member covered by DB plans. X-axis represents time in years.

The proportion of active RPP members covered by DB plans in the public sector was 98% in 1989.It decreased slightly from 1989 to 2004 at 93%, and stayed stable until 2014, when it dropped to 91%.

The proportion of active RPP members covered by DB plans in the private sector was 85% in 1989, it decreased steadily to 71% in 2004, to approximately 42% in 2015, and plateaued between 2016 to 2019 at approximately 39%.

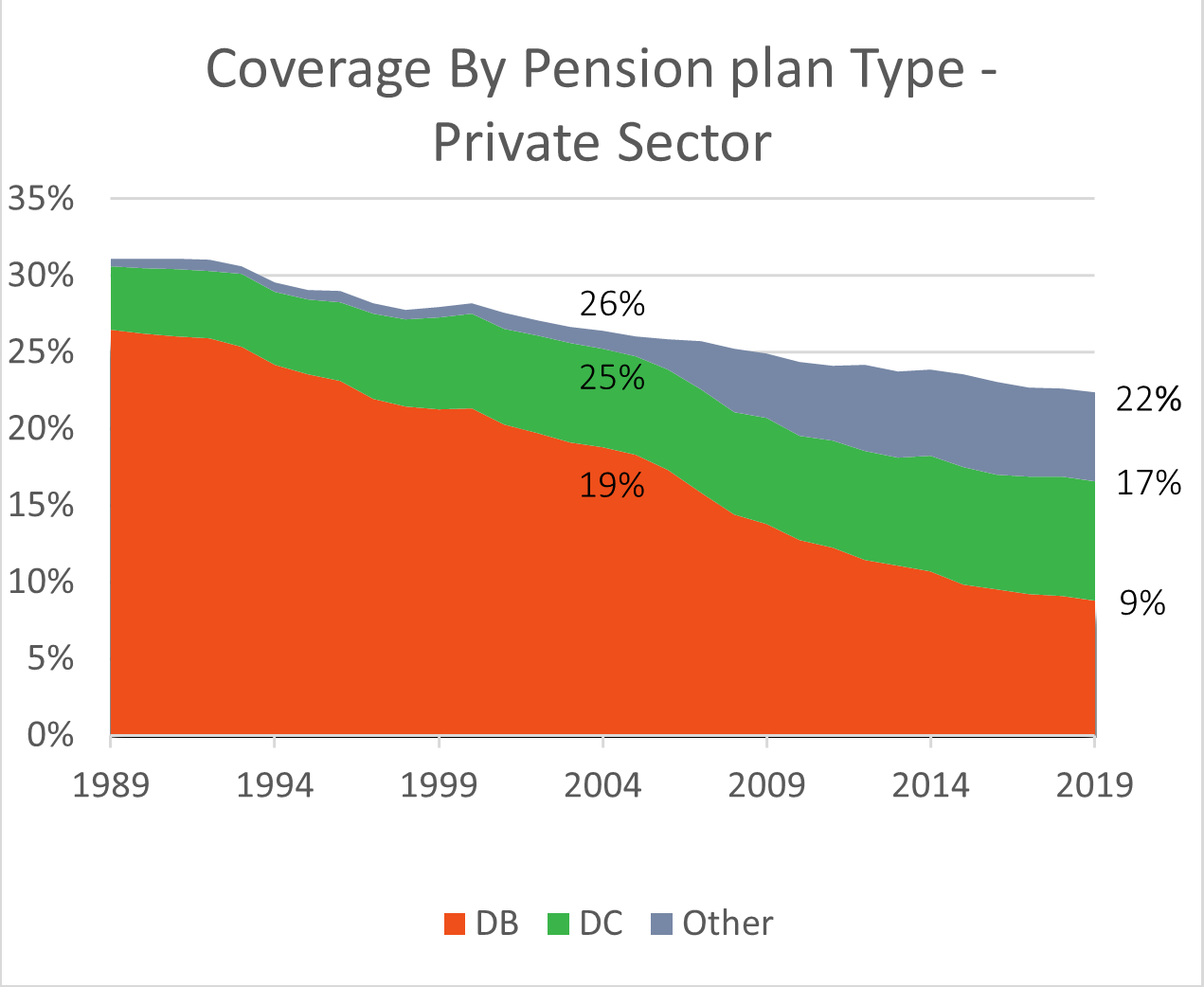

Chart 4 - Coverage by Pension Plan Type - Private Sector

Line graph showing the proportion of employees covered by different types of RPP plan in the private sector. Y-axis represents the proportion of active RPP member covered by DB plans. X-axis represents time in years.

The proportion of private sector employees covered by DB plans was 26% in 1989, decreased steadily to 19% in 2004, and 9% in 2019.

The proportion of private sector employees covered by DC plans was 4% in 1989, increase to 6% in 2004, and 8% in 2019.

The proportion of private sector employees sector covered by other type plans was 0.5% in 1989, 1% in 2004, and increase to 5% in 2019.

Since 2004, there has been a trend whereby employers, particularly those in the private sector, have been either establishing or converting their existing DB plan to either a DC or another type of plan. These other types of plans include plans with DB and DC components, target benefit or shared-risk plans, and any other types of hybrid plans. The number of active members in these other types of plans increased from 18,000 in 2004 to 752,000 in 2019. In 2019, 90% of these members were private sector employees. The chart to the left provides more details on the evolution of RPP coverage by type of plans for private sector employees since 1989.

Estimation of Other Types of Tax-Assisted Plans Offered by Employers (2019)

In 2019, there were 6.5 million active RPP members, which represented 32% of the labour force and 37% of employees.

Based on the 2019 Survey of Financial Security, an additional 2.0 million individuals participated in an employer-sponsored Group Registered Retirement Savings Plan (RRSP) and/or a Deferred Profit Sharing Plan (DPSP) and were not active members of a RPP. As a result, employer-sponsored tax-assisted plans coverage rates are 42% of the labour force and 48% of employees.

Assuming that all 2.0 million individuals are in the private sector, the theoretical 2019 coverage rate for employees in the private sector would increase from 22% to 37%.

Statistics Canada plans to release a new edition of its Survey of Financial Security, on which the present results are based. New estimates should therefore be available once the data of the new survey becomes available, currently scheduled for the end of 2023.

Registered Retirement Savings Plans (RRSP) (2019)

The number of tax filers who contributed to an RRSP (group and individual) was 6.0 million in 2009 and 5.9 million in 2019. The proportion of tax filers who contributed to an RRSP decreased from 25% to 22% over the same period.

However, the average annual contributions to an RRSP increased by an average of 3.1% per year between 2009 and 2019, going from $5,530 to $7,488. By comparison, the inflation during this period averaged 1.8% per year.

Tax Free Savings Account (TFSA) (2019)

Since 2009, Canadians also have the option to contribute to a TFSA. As of the end of 2019, there were 15.3 million TFSA holders, which represents an increase of 10.5 million since 2009. The proportion of tax filers holding a TFSA increased from 20% to 56% during this period.

The total contributions in TFSA’s increased from $19 billion in 2009 to $71 billion in 2019. The average annual contributions per tax filers increased from $4,195 to $8,160 between 2009 and 2019.

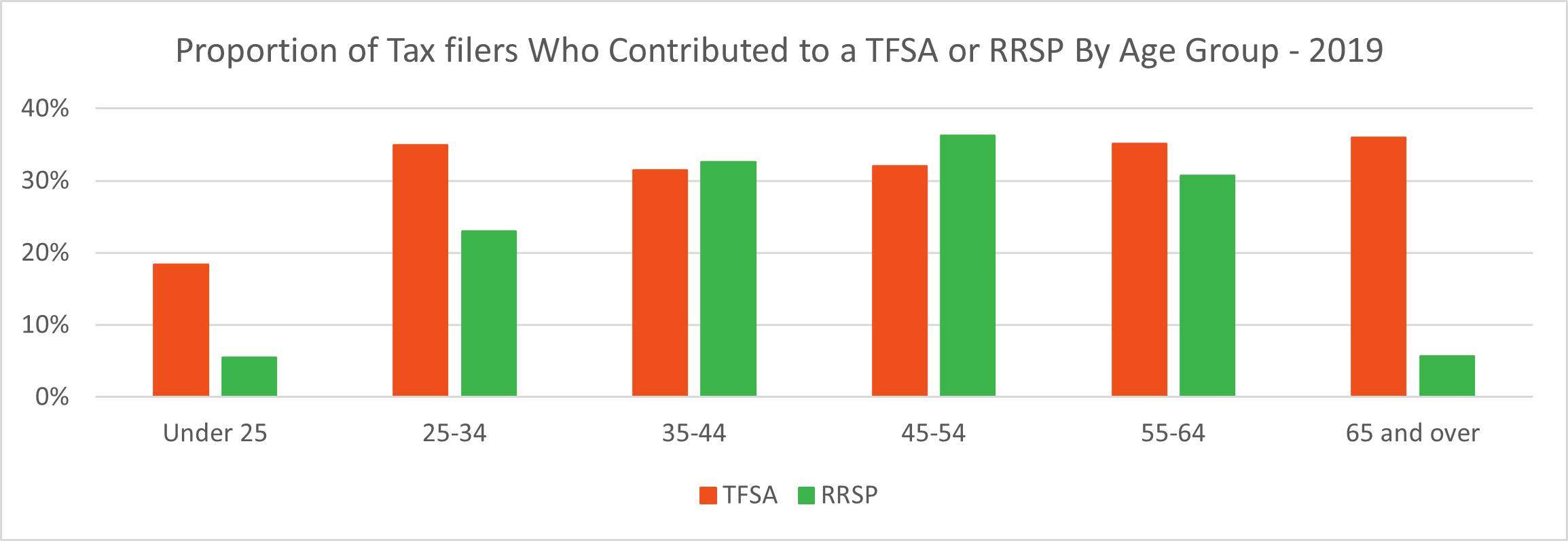

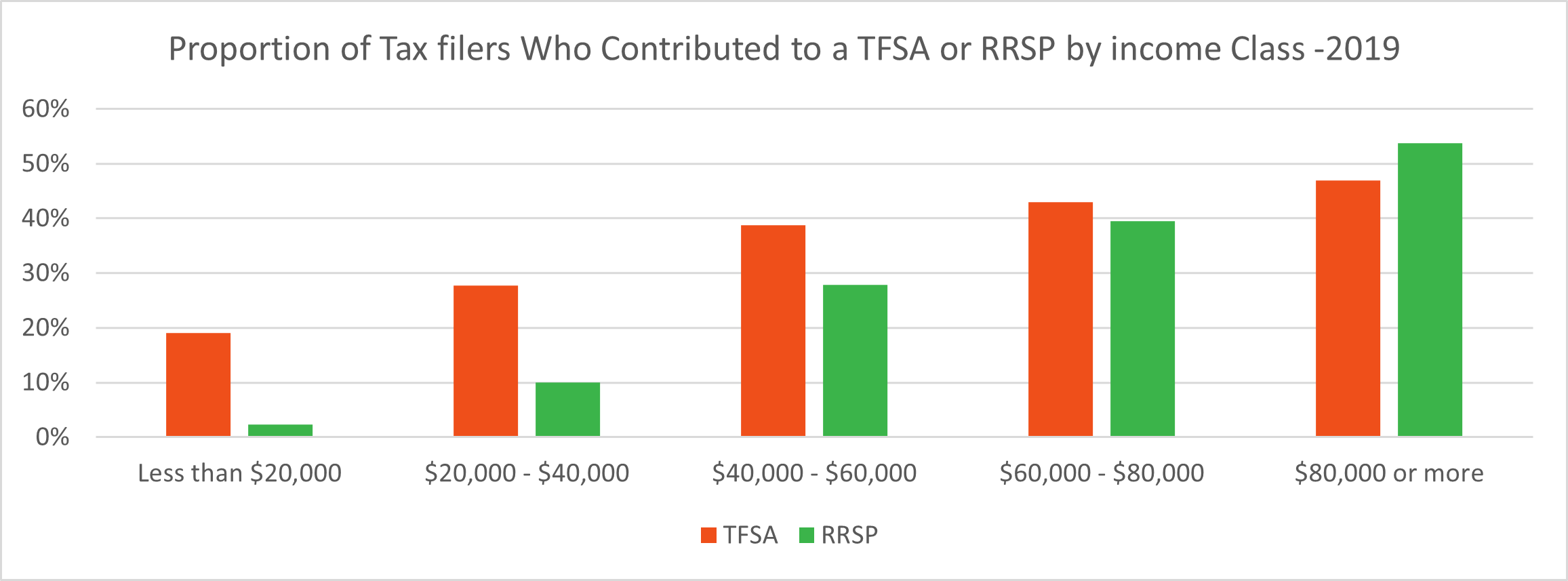

The graphs below show the proportion of tax filers who contributed to an RRSP or a TFSA by age group and by total income class in 2019.

Chart 5 – Proportion of Tax Filers Who Contributed to a TFSA or RRSP by Age Group - 2019

Bar graph showing the proportion of tax filers who contributed to a TFSA or RRSP by age group in 2019. Y-Axis represents the proportion of tax filers who contributed to a TFSA or RRSP. X-axis represents the age group.

The proportion of tax filers who contributed to a RRSP in 2019 was 5% for tax filers under 25 years old; 23% for tax filers aged between 25 and 34, 33% for tax filers aged between 35 and 44; 36% for tax filers aged between 45 and 54; 31% for tax filers aged between 55 and 64; and 6% for tax filers over 65.

The proportion of tax filers who contributed to a TFSA in 2019 was 18% for tax filers under 25 years old; 35% for tax filers aged between 25 and 34, 31% for tax filers aged between 35 and 44; 32% for tax filers aged between 45 and 54; 35% for tax filers aged between 55 and 64; and 36% for tax filers over 65.

Chart 6 – Proportion of Tax Filers Who Contributed to a TFSA or RRSP by Class Income - 2019

Bar graph showing the proportion of tax filers who contributed to a TFSA or RRSP by income class in 2019. Y-Axis represents the proportion of tax filers who contributed to a TFSA or RRSP. X-axis represents the income class.

The proportion of tax filers who contributed to a RRSP in 2019 was 2% for tax filers with an income less than 20,000$; 10% for tax filers with an income between 20,000$ and 40,000$; 28% for tax filers with income between 40,000$ and 60,000$; 40% for tax filers with an income between 60,000$ and 80,000$; 54% for tax filers with an income over 80,000$.

The proportion of tax filers who contributed to a TFSA in 2019 was 19% for tax filers with an income less than 20,000$; 28% for tax filers with an income between 20,000$ and 40,000$; 39% for tax filers with income between 40,000$ and 60,000$; 43% for tax filers with an income between 60,000$ and 80,000$; 47% for tax filers with an income over 80,000$.

Conclusion

The number of active RPP members has increased over the last ten years, with the number of women increasing faster than the number of men. Despite this, the number of active RPP members as a percentage of employees has slightly decreased. The proportion of active RPP members in DB plans continued to decrease over the last fifteen years, particularly in the private sector.

From 2009 to 2019, the number of tax filers who have contributed to an RRSP has been decreasing. However, the average annual contributions increased by more than 35% during the same period. Over the same period, the proportion of tax filers holding a TSFA almost tripled, and the average annual contribution doubled.

Source of Information

- Various Statistics Canada data tables;

- Information provided by the Income, Pensions and Wealth Division, Statistics Canada; and,

- Canada Revenue Agency TFSA statistics.

Contact Information

For more information about the Office of the Chief Actuary or the Office of the Superintendent of Financial Institutions Canada, please

- Visit our Web site at www.osfi-bsif.gc.ca, or

- Toll-Free line: 1-800-385-8647

- Local calls (Ottawa and Gatineau): (613) 943-3950