2022-23 Departmental Plan

Office of the Superintendent of Financial Institutions

2022-23 Departmental Plan

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

© Her Majesty the Queen in Right of Canada, as represented by the Minister of Finance, 2022

Catalogue No. IN3-31E-PDF

ISSN 2371-7343

Table of contents

From the Superintendent

I am pleased to present the 2022-23 Departmental Plan for the Office of the Superintendent of Financial Institutions (OSFI). This report presents what we plan to do during the upcoming year and the results we expect to achieve.

What we do

OSFI is an independent federal government agency that regulates and supervises federally regulated financial institutions including banks, insurance companies and pension plans. By doing so, we build public confidence in the Canadian financial system and contribute to a marketplace where banks can continue to make loans and take deposits, insurance companies can pay policyholders, and pension plans can continue to make payments to retirees.

We also house the Office of the Chief Actuary (OCA), which provides a range of actuarial valuation and advisory services to the federal government. The OCA helps ensure that social programs and public sector pension and insurance arrangements remain sound and sustainable for Canadians.

The global financial system has endured multiple bouts of volatility since the turn of the century, including the recession of the early 2000s, the Global Financial Crisis of 2008-9, the European sovereign debt crisis between 2010 and 2012, and the arrival of the COVID-19 pandemic . In Canada, we weathered these volatility storms better than most nations and OSFI deserves praise for its role in helping Canada get through them successfully.

Looking ahead, however, we must assume and plan for more frequent bouts of volatility, of varying degrees of intensity. That volatility may arise from identifiable sources. Climate change will alter the cash flows generated by some capital assets and occasionally trigger noticeable changes in valuation. These capital asset valuation changes may be felt unevenly across OSFI's regulated constituency. The digitalization of financial services will affect all business models and threaten an unknowable few; the rising incidence of cyber-attacks across the globe add to the volatility produced by digitalization. Climate change and digitalization represent the known unknowns in OSFI's risk environment. In addition, other macro sources of volatility will emerge from unknown places.

To effectively address our intensifying risk environment, OSFI will implement a bold transformation plan to guide the organization through to 2025. OSFI's transformation plan is built on three foundational elements which aim to:

- Refocus the delivery of our mandate to place greater emphasis on contributing to public confidence in the Canadian financial system;

- Expand and fortify our risk management capabilities and risk appetite to support strategic and operational management; and

- Embed our corporate values to enhance our culture so that individuals can flourish in an increasingly uncertain operating environment.

The Blueprint sets our overall strategic direction and informs the development of supporting initiatives and operational plans over the coming years, starting with the Strategic Plan, to be released in early 2022-23.

What we are trying to achieve

We constantly monitor those emerging risks that have the potential to materially impact the financial institutions and pension plans that we oversee. Therefore, planning for severe yet plausible disruptive scenarios will remain the core of what we do.

To thrive in an intensified risk environment, we require a diverse group of colleagues who will apply their unique perspectives and mindsets to the problems OSFI encounters. Therefore, OSFI will focus obsessively on diversity and psychological safety. We will be better prepared for whatever arrives if we have an organization of people with diverse skills and mindsets, drawn in full proportion from the Canadian mosaic, who feel safe bringing their true and best selves to work everyday.

We will adjust our regulatory stance to reflect our prudential focus in a rapidly evolving environment by advocating for equity and fairness, as well as embracing and fostering diversity and inclusiveness, both internally and externally.

Looking ahead

As our risk environment changes, OSFI will change how we view risk, and we believe the financial industry will have to do so, as well. Moving forward, OSFI expects to engage and communicate with stakeholders frequently and clearly. We expect to increase our contribution to public policy, with a view to ensuring that Canada's financial system is sustainable, protected and respected worldwide thanks to the prudence exercised by all actors.

Peter Routledge

Superintendent

Plans at a glance

In 2022-23, OSFI is embarking on a transformational journey defined in A Blueprint for OSFI's Transformation, 2022-25 (Blueprint). A significant strategic and operational planning exercise was launched in 2021-22 to articulate the roadmap for the delivery of OSFI's Blueprint. The 2022-2025 Strategic Plan will be published early in 2022-23. This document will outline strategic goals, corresponding priorities, and success indicators supporting the achievement of OSFI's mandate and transformation agenda.

The six priority initiatives defined in the Blueprint guiding OSFI's work and transformation in 2022-23 through 2024-25 are as follows:

01. Culture Initiatives: OSFI is a workplace where curious, diverse, high integrity colleagues are safe to bring their true and best selves to work everyday and are safe to fail and then adapt.

This work will entail developing and executing an updated Human Capital Strategy, embedding Diversity, Equity and Inclusion (DEI) within OSFI, implementing ongoing monitoring of OSFI's cultural promises and commitments, reviewing competency models and performance assessment methods, and implementing training and support to nurture the fulfilment of OSFI's promises and commitments.

02. Risk, Strategy and Governance: OSFI makes risk-intelligent decisions every day that reflect its transparent and revealed risk appetite via leadership and governance that delegates out decision-making, from the top to the leaders best positioned to make decisions.

This work will entail establishing a new Enterprise Risk and Strategy function, designing and implementing an enterprise-wide risk appetite framework, and embracing a three lines of defense model by implementing a true second line of defense that provides an effective challenge function to OSFI's operations.

03. Strategic Stakeholder and Partner Engagement: OSFI integrates and aligns with key stakeholders and partners inside and outside of the federal financial safety net in a manner that maximizes its influence and preserves its integrity in fulfilling its purpose and mandate.

This work will entail developing an integrated approach to external stakeholder management, making more effective use of the Superintendent’s and the Chief Actuary’s public presence, using the Financial Institutions Supervisory Committee more effectively as an accountability mechanism, and better leveraging the expertise of OSFI’s partnerships to mobilize resources to expand OSFI’s reach.

04. Policy Innovation: OSFI becomes a global leader in prudential supervision by making policy to ensure operational and financial resilience of its regulated entities in the face of climate-related, digitalization, and other yet-to-be foreseen risks.

This work will entail developing and implementing a strategic response framework for emerging risks, establishing more focussed and applied research capabilities to improve OSFI's identification and analysis of emerging risks, and establishing an expanded and dedicated team for climate risk. OSFI will advance its analysis, insights, and skillsets with respect to the digitalization of business model disruption, societal changes, cyber risk, digital money, third-party risk management, and operational resilience.

05. Supervisory Framework: OSFI's Supervisory Framework guides supervisors to efficiently manage their portfolio of regulated entities, liberating them for true, value-added tasks and eliminating unnecessary burdens.

This work will entail a substantial investment in the updating and ongoing maintenance of OSFI's Supervisory Framework to better reflect the assessment of broad macro-risks, financial risk, non-financial risks, and operational resilience for regulated entities. It will involve building a greater risk appetite for earlier corrective actions, developing more differentiated risk ratings for institutions, and implementing enhancements to OSFI's supervisory management system.

06. Data Management and Analytics: OSFI's data platform enables the vast majority of analytical research and insight-generation while simultaneously eliminating the necessity of most ad-hoc data requests made to regulated entities.

This work will entail executing a medium-term strategy to restructure OSFI's data environment, further promoting analytical innovation, supporting all OSFI enterprise functions with improved data and analytics capabilities, and enhancing data literacy skills.

For more information on Office of the Superintendent of Financial Institution's plans, see the "Core responsibilities: planned results and resources" section of this plan.

Core responsibilities: planned results and resources

This section contains information on the department's planned results and resources for each of its core responsibilities.

Financial Institution and Pension Plan Regulation and Supervision

Description

The Office of the Superintendent of Financial Institutions advances a regulatory framework designed to control and manage risk to federally regulated financial institutions and private pension plans and evaluates system-wide or sectoral developments that may have a negative impact on their financial condition. It also supervises financial institutions and pension plans to determine whether they are in sound financial condition and meeting regulatory and supervisory requirements. The Office promptly advises financial institutions and pension plan administrators if there are material deficiencies, and takes corrective measures or requires that they be taken to expeditiously address the situation. It acts to protect the rights and interests of depositors, policyholders, financial institution creditors and pension plan beneficiaries, while having due regard for the need to allow financial institutions to compete effectively and take reasonable risks.

Planning highlights

The transformation initiatives guiding OSFI's work in 2022-23 to 2024-25 will support the delivery of OSFI's two departmental results under its first core responsibility: ensuring that federally regulated financial institutions (FRFIs) and private pensions plans (FRPPs) are in sound financial condition, and that OSFI's regulatory and supervisory frameworks contribute to the safety and soundness of the Canadian financial system.

Through OSFI's transformation, strengthening public confidence in Canada's financial system will become the key driver of OSFI's work, aligning with the broader demands of the risk environment. Supported by OSFI's internal capabilities, as described in the Internal Services section, OSFI's focus in 2022-23 will be on launching the following transformation initiatives to improve how OSFI delivers on its core responsibilities in 2022-23 to 2024-25.

Strategic Stakeholder and Partner Engagement: OSFI integrates and aligns with key stakeholders and partners inside and outside of the federal financial safety net in a manner that maximizes its influence and preserves its integrity in fulfilling its purpose and mandate.

OSFI's transformation agenda aims to maximize OSFI's influence in all matters pertaining to its mandate. OSFI's independence affords a level of influence on public policy, and OSFI needs to be able to leverage all approaches available to address risks on the horizon. As a result, OSFI's public policy contribution will increase, and OSFI will need to build on its credibility and impact. OSFI will accomplish this by being more forthright with sharing its perspectives and authority, while being more open to outside challenge, debate and scrutiny. OSFI will also leverage the expertise of its partnerships so that it can mobilize resources as dictated by the changing environment. Achieving this outcome in 2022-23 to 2024-25 will involve:

- Developing an integrated approach to external stakeholder management to manage an intensifying public policy environment. A new central function will leverage existing resources and efforts.

- Developing an integrated strategy for managing major public policy files by making more effective use of the Superintendent's public presence and the broader external stakeholder ecosystem.

- Using the Financial Institutions Supervisory Committee (FISC) more effectively as an accountability mechanism for OSFI.

- As part of OSFI’s operating model, better leveraging the expertise of OSFI’s partnerships to mobilize resources to expand OSFI’s reach.

Policy Innovation: OSFI becomes a global leader in prudential supervision by making policy to ensure the operational and financial resilience of its regulated entities in the face of climate-related, digitalization, and other yet-to-be foreseen risks.

The risk environment offers increasing uncertainty and volatility and OSFI needs to position itself to respond quickly and thoroughly to the most urgent risks. Policy innovation and development typically represents the first response to an emerging risk, followed by supervision and review. OSFI aims to address and respond to risks in a more agile manner, building on work done related to digitalization, climate change, and demographic change. Achieving this outcome in 2022-23 to 2024-25 will involve:

- Establishing an expanded and dedicated team for climate risk that builds out the work of OSFI's climate risk working group.

- Advancing analysis, insights, and expanded skillsets with respect to the digitalization of business model disruption, societal changes, cyber risk, digital money, third-party risk management, and operational resilience.

- Developing and implementing a strategic response framework for emerging risks that reflects a life cycle in prudential oversight, from policy innovation and risk identification through to policy setting, and onto supervision and ongoing review.

- Establishing more focussed and applied research capabilities to improve the identification and analysis of emerging risks in both supervisory and regulatory environments.

Supervisory Framework: OSFI's Supervisory Framework guides supervisors to efficiently manage their portfolio of regulated entities, liberating them for true, value-added tasks and eliminating unnecessary burdens.

The Supervisory Framework underpins OSFI's supervisory practices and how it assesses and responds to risk in its regulated entities. OSFI aims to modernize the Framework to ensure methods are fit for the new risk environment and new risks as they emerge. Risks have become more diverse and systemic, particularly through the advancement of new technology. OSFI will further its best practices similar to other supervisory authorities who increasingly employ their own forms of technology, or "sup-tech", to maintain sound and timely risk assessment capabilities. Achieving this outcome in 2022-23 to 2024-25 will involve:

- Developing more differentiated risk ratings for institutions, particularly for Stage 0 institutions.

- Building greater risk appetite for earlier corrective actions into the Supervisory Framework.

- A substantial investment in the updating and ongoing maintenance of OSFI's Supervisory Framework to better reflect the assessment of broad macro-risks, financial risk, non-financial risks, and operational resilience for regulated entities.

- Implementing enhancements to OSFI's supervisory management system to achieve better data quality, more effective reporting of risk and more insightful analyses.

Other Regulation and Supervision Priorities

In parallel with the planned transformational efforts, OSFI will continue to deliver expected results supporting its core mandate. Highlights of OSFI's regulation and supervision priorities for the 2022-23 reporting period are as follows:

- Ensuring FRFI risk measures and OSFI's capital and liquidity regimes remain appropriate in stress scenarios, reflecting evolving and emerging risks in the financial sector. This continued work involves the robust implementation of international standards with domestic modifications where appropriate, enhancing assurance expectations over key regulatory returns, and ensuring proportionality to enhance the regulation of small and medium-sized FRFIs.

- Ensuring that risk management expectations better reflect the risk environment FRFIs operate in, particularly as it relates to mortgage underwriting and counterparty risk management. OSFI will work to ensure that Guideline B-20 – Residential Mortgage Underwriting Practices and Procedures supports prudent mortgage underwriting and will clarify the expectations in Guideline B-20 around re-advanceable products (e.g., Combined Mortgage-Home Equity Line of Credit (HELOC) Loan Plans – "CLPs" and other mortgage-related products). This will involve working with industry participants to ensure compliance with those expectations, including heightened focus on CLP/HELOC account management programs.

- Continuing to prepare for the January 2023 implementation of International Financial Reporting Standard (IFRS 17) - Insurance Contracts by finalizing capital guidance for mortgage, life and property and casualty insurers, monitoring industry progress through semi-annual progress reports, and providing training to OSFI supervisors.

- Advancing the development of a new approach for determining capital requirements for segregated fund guarantee risk for life insurers, which will become effective January 2025.

- Ensuring that OSFI's regulatory approach for the identification, assessment, and monitoring of technology and non-financial risks is clear and transparent, particularly as it relates to FRFI and FRPP risk management practices for technology, cyber, and third-party risk. This includes issuing guidance and consultations on these non-financial risks as well as developing and executing supervisory expectations for operational resilience and advancing regulatory and supervisory expectations for culture and compliance risk.

- Reviewing the Minimum Qualifying Rate for Uninsured Mortgages and publicly disclosing the results of these reviews and any changes.

- Reviewing the Domestic Stability Buffer semi-annually and publicly disclosing the results of these reviews.

- For transactions that require regulatory approval, continuing to evaluate and process applications for regulatory consent, establishing positions on the interpretation and application of relevant legislation, identifying precedential transactions, and developing recommendations.

- Ensuring OSFI's expectations and supervisory processes better support effective regulation and supervision of FRPPs, particularly for pension investments, by developing pension plan investment risk management guidance.

- Working with the Canadian Association of Pension Supervisory Authorities on producing a draft guideline on Environmental, Social and Governance (ESG) considerations.

The Near-Term Plan of Prudential Policy, which outlines OSFI's guidance priorities, is available on OSFI's website. The next update on OSFI's guidance priorities will be posted early in the 2022-23 fiscal year.

United Nations' (UN) 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

Through OSFI's regulatory and supervisory responses to climate risks, scenario analysis work conducted jointly with the Bank of Canada, and stakeholder engagement, including domestically with Canada's Sustainable Finance Action Council and internationally with the Basel Committee on Banking Supervision, Financial Stability Board, International Association of Insurance Supervisors and the Network for Greening the Financial System, the Office supports UN SDG 13 by: strengthening resilience and adaptive capacity in responding to climate-related hazards (13.1); integrating climate change measures into policies, strategies and planning (13.2); and improving awareness and institutional capacity on climate change mitigation, adaptation, impact reduction, and early warning (13.3).

Through the ongoing execution of its mandate as a prudential financial regulator, OSFI supports SDG 8.10 by strengthening the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services. OSFI also supports SDG 10.5 by improving the regulation and monitoring of global financial markets and institutions and strengthening the implementation of such regulations.

Experimentation

To thrive in increasingly uncertain times, OSFI will pursue broad cultural shifts in various areas. In particular, OSFI seeks to prioritize innovation over the status quo, nurture a culture of curiosity that fosters acceptance of diverse mindsets where it is safe to be different and safe to fail, and shift towards greater risk-taking informed by a robust analysis of risk trade-offs. Through its transformation, OSFI will foster a culture that embraces experimentation and innovation and will assess whether tools, techniques, and practices remain fit for purpose. For example, OSFI's work on data analytics and experimentation with new technologies, outlined under the Internal Services section of this plan, will support effective regulation and supervision of financial institutions as well as the execution of the Policy Innovation and Supervisory Framework initiatives.

Planned results for Financial Institution and Pension Plan Regulation and Supervision

The following table shows, for Financial Institution and Pension Plan Regulation and Supervision, the planned results, the result indicators, the targets and the target dates for 2022–23, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result |

Departmental result indicator |

Target | Date to achieve target |

2018‑19 actual result |

2019‑20 actual result |

2020‑21 actual result |

|---|---|---|---|---|---|---|

| Federally regulated financial institutions and private pensions plans are in sound financial condition. | % of financial institutions with a Composite Risk Rating of low or moderate. | At least 80% | March 31, 2023 | 94% | 96% | 96% |

| Number of financial institutions for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three-month period. | 1 or less | March 31, 2023 | 5 | 0 | 0 | |

| Number of pension plans for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three-month period. | 1 or less | March 31, 2023 | 0 | 0 | 0 | |

| Regulatory and supervisory frameworks contribute to the safety and soundness of the Canadian financial system. | The Office of the Superintendent of Financial Institutions' level of compliance with the International Monetary Fund's Financial Sector Assessment Program core principles. | 100% | March 31, 2024 | 100% | N/A | N/ATable 1 footnote * |

| The Office of the Superintendent of Financial Institutions' level of compliance with Basel standards as assessed by the Regulatory Consistency Assessment Programme of the Bank for International Settlements. | 90% | March 31, 2023 | 100% | N/A | N/ATable 1 footnote ** | |

Table 1 Footnote

|

||||||

Financial, human resources and performance information for Office of the Superintendent of Financial Institution’s program inventory is available on GC InfoBase.

Planned budgetary spending for Financial Institution and Pension Plan Regulation and Supervision

The following table shows, for Financial Institution and Pension Plan Regulation, budgetary spending for 2022–23, as well as planned spending for that year and for each of the next two fiscal years.

| 2022–23 budgetary spending (as indicated in Main Estimates) |

2022-23 planned spending |

2023-24 planned spending |

2024-25 planned spending |

|---|---|---|---|

| 117,806,081 | 117,806,081 | 119,698,835 | 121,777,262 |

Financial, human resources and performance information for Office of the Superintendent of Financial Institution’s program inventory is available on GC InfoBase.

Planned human resources for Financial Institution and Pension Plan Regulation and Supervision

The following table shows, in full time equivalents, the human resources the department will need to fulfill this core responsibility for 2022–23 and for each of the next two fiscal years.

| 2022-23 planned full-time equivalents |

2023-24 planned full-time equivalents |

2024-25 planned full-time equivalents |

|---|---|---|

| 577 | 576 | 579 |

The planned spending and full-time equivalents presented in the two tables above reflect the 2022-23 Main Estimates, which were based on OSFI's prior outlook before the development of the Blueprint. Incremental spending requirements to deliver on OSFI's transformation agenda will only be known following completion of its strategic, operational, and financial planning exercises towards the end of the fourth quarter of 2021-22. The expected budget increases will not impact OSFI's appropriations given its full recovery funding model.

Additional details are provided under the "Planned spending and human resources" section of the report.

Financial, human resources and performance information for Office of the Superintendent of Financial Institution's program inventory is available on GC InfoBase.

Actuarial Services to Federal Government Organizations

Description

The Office of the Chief Actuary (OCA) provides a range of actuarial services, including statutory actuarial valuations required by legislation and checks and balances on the future costs of programs for the Canada Pension Plan (CPP), Old Age Security, Employment Insurance and Canada Student Loans programs, as well as pension and benefits plans covering the Federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police, federally appointed judges, and Members of Parliament.

Planning highlights

The OCA contributes to financial system oversight by helping to ensure that social programs and public sector pension and insurance arrangements remain sound and sustainable for Canadians. In line with OSFI's transformative vision, the OCA aims to make public confidence in the programs under its responsibility one of the key drivers of its activities. Specifically, the OCA's contributions to OSFI's transformation in 2022-23 will involve:

- Establishing more focussed and applied research capabilities to improve the analysis of risks with respect to the statutory responsibility of the OCA .

- Participating in the development of an integrated strategy for managing major public policy files.

- Participating in OSFI's enterprise risk management, strategy and governance renewal.

In 2022-23, work will continue with supporting the execution of the OCA's mandate, ensuring the provision of high-quality actuarial information on the cost of public programs and government pension and benefit plans. The Actuarial Report on the Pension Plan for the Royal Canadian Mounted Police as at March 31, 2021 and the 2023 Employment Insurance Premium Rate Report will be submitted to the appropriate authority for tabling before Parliament in 2022-23.

Additionally, the OCA will submit the triennial Actuarial Report on the Canada Pension Plan (CPP) as at December 31, 2021 to the Minister of Finance for tabling before Parliament in 2022-23. This triennial report projects CPP revenues and expenditures over a 75 year period to assess the future impact of historical and projected demographic and economic trends. The OCA will be commissioning an independent peer review of this report, the results of which are expected to be released early in the 2023-24 fiscal year.

In 2022-23, the OCA will also begin work on the triennial Actuarial Report on the Old Age Security as at December 31, 2021. Further, the OCA will prepare the Actuarial Report on the Canada Student Financial Assistance Program as at July 31, 2021, the Actuarial Report on the Government Annuities as at March 31, 2022, and the Actuarial Report on the Civil Service Insurance Program as at March 31, 2022. The OCA will also submit various actuarial reports for the purpose of Public Accounts of Canada, presenting the obligations and costs, as at March 31, 2022, associated with federal public sector pension and benefit plans including future benefits to veterans.

As part of its ongoing provision of sound actuarial advice, the OCA will assist several government departments in the design, funding and administration of the plans and programs for which they are responsible. Client departments include the federal and provincial Departments of Finance, Employment and Social Development Canada, Treasury Board Secretariat, Veterans Affairs Canada, National Defense, Royal Canadian Mounted Police, the Department of Justice, and Public Services and Procurement Canada.

Experimentation

Through its transformation, OSFI will foster a culture that embraces experimentation, innovation, and continuous learning, supporting the Government of Canada's commitments to experimentation. Given that the OCA's primary responsibility is to provide actuarial advice, including the preparation of actuarial reports for federal government organizations, continuous improvement is generally sought through consultations and lessons learned exercises rather than experimental projects.

Planned results for Actuarial Services to Federal Government Organizations

The following table shows, for Actuarial Services to Federal Government Organizations, the planned results, the result indicators, the targets and the target dates for 2022–23, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result |

Departmental result indicator |

Target | Date to achieve target |

2018‑19 actual result |

2019‑20 actual result |

2020‑21 actual result |

|---|---|---|---|---|---|---|

| Stakeholders receive accurate and high quality actuarial information on the cost of public programs and government pension and benefit plans. | % of members of a panel of Canadian peer actuaries that deem the Canada Pension Plan actuarial valuation accurate and of high quality. | 100% Agreement among all three members of peer review panel | March 31, 2024 | N/A | N/A | 100% |

| % of public pension and insurance plan valuations that are deemed accurate and high quality. | 100% | March 31, 2023 | 100% | 100% | 100% |

Financial, human resources and performance information for Office of the Superintendent of Financial Institution’s program inventory is available on GC InfoBase.

Planned budgetary spending for Actuarial Services to Federal Government Organizations

The following table shows, for Financial Institution and Pension Plan Regulation, budgetary spending for 2022–23, as well as planned spending for that year and for each of the next two fiscal years.

| 2022–23 budgetary spending (as indicated in Main Estimates) |

2022-23 planned spending |

2023-24 planned spending |

2024-25 planned spending |

|---|---|---|---|

| 8,838,537 | 8,838,537 | 8,934,999 | 9,133,877 |

Financial, human resources and performance information for Office of the Superintendent of Financial Institution’s program inventory is available on GC InfoBase.

Planned human resources for Actuarial Services to Federal Government Organizations

The following table shows, in full time equivalents, the human resources the department will need to fulfill this core responsibility for 2022–23 and for each of the next two fiscal years.

| 2022-23 planned full-time equivalents |

2023-24 planned full-time equivalents |

2024-25 planned full-time equivalents |

|---|---|---|

| 43 | 43 | 43 |

The planned spending and full-time equivalents presented in the two tables above reflect the 2022-23 Main Estimates, and do not include incremental spending requirements to enable the OCA to deliver on its core responsibilities. The mandate of the OCA has expanded significantly over the last few years and resources have not kept up to deliver on its obligations. The complexity of the programs and sophistication of stakeholder needs have also increased. Apart from a small appropriation, the OCA is on a full cost recovery model. To this end, the OCA is currently working with its partners to ensure that there are adequate resources available to meet the demand for its services. The planned increase in spending will be reflected in next year's Departmental Plan.

Additional details are provided under the "Planned spending and human resources" section of the report.

Financial, human resources and performance information for Office of the Superintendent of Financial Institution's program inventory is available on GC InfoBase.

Internal Services: planned results

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Planning highlights

Refocusing the delivery of OSFI's mandate and core responsibilities will require the expansion of OSFI's internal capabilities regarding risk management and data analytics, enabled by a strong foundation in OSFI's people and culture capabilities. The following three transformation initiatives will be launched in 2022-23 to build a stronger foundation for how OSFI delivers in 2022-23 to 2024-25.

Culture Initiatives: OSFI is a workplace where curious, diverse, high integrity colleagues are safe to bring their true and best selves to work everyday and are safe to fail and then adapt.

Culture is the critical success factor for any transformation. Through the implementation of the Blueprint, OSFI will place culture change management at the centre of its efforts and investments. Achieving this outcome in 2022-23 to 2024-25 will involve:

- Implementing ongoing monitoring of OSFI's fidelity to cultural promises and commitments, including the use of state-of-the-art culture shift tools in addition to 360 feedback loops and regular surveys to ensure alignment and accountability across all levels of the organization.

- Reviewing competency models and performance assessment methods to hone accountability to focus on 'the how' as much as 'the what'.

- Implementing the requisite training and support for leaders and staff to nurture the fulfillment of OSFI's transformational goals, promises and commitments.

- Developing and executing an updated Human Capital Strategy that embeds OSFI's values in how it operates, identifies promises and commitments by people leaders and staff, and includes the implementation of DEI efforts.

Risk, Strategy and Governance: OSFI makes risk-intelligent decisions every day that reflect its transparent and revealed risk appetite via leadership and governance that delegates out decision-making, from the top to the leaders best positioned to make decisions.

Informed and timely decision-making requires a reliable view of OSFI's risk posture with suitable governance structures to reinforce alignment and accountability. To do so, OSFI will adjust its structure by embedding risk management practices to drive strategy and operations. Achieving this outcome in 2022-23 to 2024-25 will involve:

- Establishing a new Enterprise Risk and Strategy function, headed by a new Chief Risk Officer (CRO) with direct reporting to the Superintendent. This new function will leverage existing planning, risk management and governance capabilities, and will be accountable for building and embedding Enterprise Risk Management (ERM) practices at OSFI. This will drive strategic insights and advice, including the associated expectations for internal (risk) governance.

- Designing and implementing an enterprise-wide risk appetite framework with supporting ERM practices.

- Embracing the three lines of defense model by implementing a true second line of defense that provides effective challenge to the operation of the first line – the OSFI sectors and OCA – and reflects the expectations OSFI has for regulated entities, with Internal Audit continuing to provide independent assurance, as the third line of defense.

- Leveraging OSFI's governance structure to support an agile risk response, including the implementation of a new internal governance and decision-making structure that supports the delegation of decision-making authority and taking action within OSFI's risk appetite.

Data Management and Analytics: OSFI's data platform enables the vast majority of analytical research and insight-generation while simultaneously eliminating the necessity of most ad-hoc data requests made to regulated entities.

Good data is essential to ensure strong regulation and supervision; it is also critical for operating OSFI effectively and efficiently. OSFI has made progress on executing against its enterprise data strategy, though there is much work remaining to truly embed digitalization at OSFI. To support exceptional analysis and risk analytics insights, OSFI aims to improve the usability, timeliness, credibility, and granularity of data, while improving digital literacy and improving data infrastructure. Achieving this outcome in 2022-23 to 2024-25 will involve:

- Executing a medium-term strategy to restructure OSFI's data environment, including in the areas of data quality, data engineering, and advanced analytics.

- Further promoting analytical innovation and user cases across sectors, assisting with analytics governance, while also creating a centre for analytical expertise and learning for staff.

- Supporting all OSFI enterprise functions with improved data and analytics capabilities.

- Providing training and support for all staff to enhance general data literacy skills.

Other Internal Service Priorities

In parallel with the planned transformational efforts, OSFI will continue to deliver expected results supporting its enabling infrastructure and corporate obligations.

OSFI is engaging in a comprehensive strategic and operational planning exercise that accounts for the changing risk environment and builds on the realizations of the 2019-2022 Strategic Plan. OSFI's 2022-25 Strategic Plan, which will articulate the roadmap for the delivery of OSFI's renewed vision and transformation initiatives, will be published in early 2022-23.

Notable investments will be required following the establishment of OSFI's post-pandemic accommodations strategy and in continuing OSFI's cloud adoption journey. In 2022-23, OSFI's accommodations activities will be focused on project management, accommodations design, and some preparatory construction work. Work will also continue in evolving OSFI's security and risk management frameworks in support of OSFI's digital transformation and cloud adoption roadmap. In particular, OSFI will develop new capabilities for critical case management and risk assessment tools, as well as expand cloud-based analytics applications. OSFI will also implement the foundational infrastructure necessary to support a hybrid work model.

In 2022-23, the implementation of OSFI's DEI Strategy includes : conducting a review of human resource policies to determine alignment with DEI objectives, conducting a GBA Plus review and strategy pilot, and providing foundational DEI-related training to all employees.

2030 Agenda for Sustainable Development

OSFI supports UN SDG 12.7 by embedding environmental considerations in public procurement in accordance with the federal Policy on Green Procurement. OSFI will continue to ensure that its decision-making process includes consideration of Federal Sustainable Development Strategy goals and targets through its Strategic Environmental Assessment process. In 2022-23, work will be undertaken to develop OSFI's next Departmental Sustainable Development Strategy.

Experimentation

To thrive in increasingly uncertain times, OSFI will pursue broad cultural shifts in various areas. In particular, OSFI seeks to prioritize innovation over the status quo, nurture a culture of curiosity that fosters acceptance of diverse mindsets where it is safe to be different and safe to fail, and shift towards greater risk-taking informed by a robust analysis of risk trade-offs. Through its transformation, OSFI will foster a culture that embraces experimentation and innovation and will assess whether tools, techniques, and practices remain fit for purpose.

OSFI relies on data analysis to measure risk, identify trends and make evidence-based decisions. OSFI launched the Technology Exploration Space (TES) platform with an initial set of trial use cases to examine these technologies and look for further opportunities to maximize the value extracted from OSFI data. The discoveries have subsequently led to TES 2.0 and deployment of additional advanced analytics such as machine learning and natural language processing and plans for continued development of internal data science competencies. This work will continue in 2022-23. In addition, for the accommodations strategy, OSFI will test concepts defined by its hybrid operating model playbook, including unassigned spaces and balancing remote and office work.

Planned budgetary spending for internal services

The following table shows, for internal services, budgetary spending for 2022–23, as well as planned spending for that year and for each of the next two fiscal years.

| 2022-23 budgetary spending (as indicated in Main Estimates) |

2022-23 planned spending |

2023-24 planned spending |

2024-25 planned spending |

|---|---|---|---|

| 93,877,033 | 93,877,033 | 91,601,110 | 90,178,858 |

Planned human resources for internal services

The following table shows, in full time equivalents, the human resources the department will need to carry out its internal services for 2022–23 and for each of the next two fiscal years.

| 2022-23 planned full-time equivalents |

2023-24 planned full-time equivalents |

2024-25 planned full-time equivalents |

|---|---|---|

| 296 | 286 | 286 |

The planned spending and full-time equivalents presented in the two tables above reflect 2022-23 Main Estimates, which were based on OSFI's prior outlook before development of the Blueprint. Incremental spending requirements to deliver on OSFI's transformation agenda will only be known following completion of its strategic, operational, and financial planning exercises towards the end of the fourth quarter of 2021-22. The expected budget increases will not impact OSFI's appropriations given its full recovery funding model.

Additional details are provided under the "Planned spending and human resources" section of the report

Planned spending and human resources

This section provides an overview of the department's planned spending and human resources for the next three fiscal years and compares planned spending for 2022–23 with actual spending for the current year and the previous year.

As noted in the "Plans at a glance" section, OSFI is embarking on a transformational journey defined in A Blueprint for OSFI's Transformation, 2022-25. At the time of drafting of this plan, a strategic planning exercise is in progress that will articulate the roadmap for the delivery of the Blueprint. In parallel, the budget planning exercise is underway and will inform the level of investment required (i.e., incremental spending and full-time equivalents) to effectively deliver on OSFI's transformation agenda and address key emerging risks.

In addition to the transformational initiatives outlined in the Blueprint, notable investments will be undertaken in establishing OSFI's post-pandemic accommodations strategy and transitioning OSFI's technology infrastructure to the cloud. Consequently, there will be a meaningful increase in planned spending over the next three years, which is not reflected in the sections below (pending completion of its planning processes in the fourth quarter of 2021-22). This planned growth, affecting all core responsibilities and Internal Services, will be incorporated in next year's Departmental Plan and Future-Oriented Statement of Operations.

It is important to note that OSFI fully recovers its costs from the financial institutions and private pension plans that it regulates and supervises, and receives only a very small parliamentary appropriation representing approximately 0.6% of its revenues for actuarial and other services provided to various public sector pension and benefit plans.

Planned spending

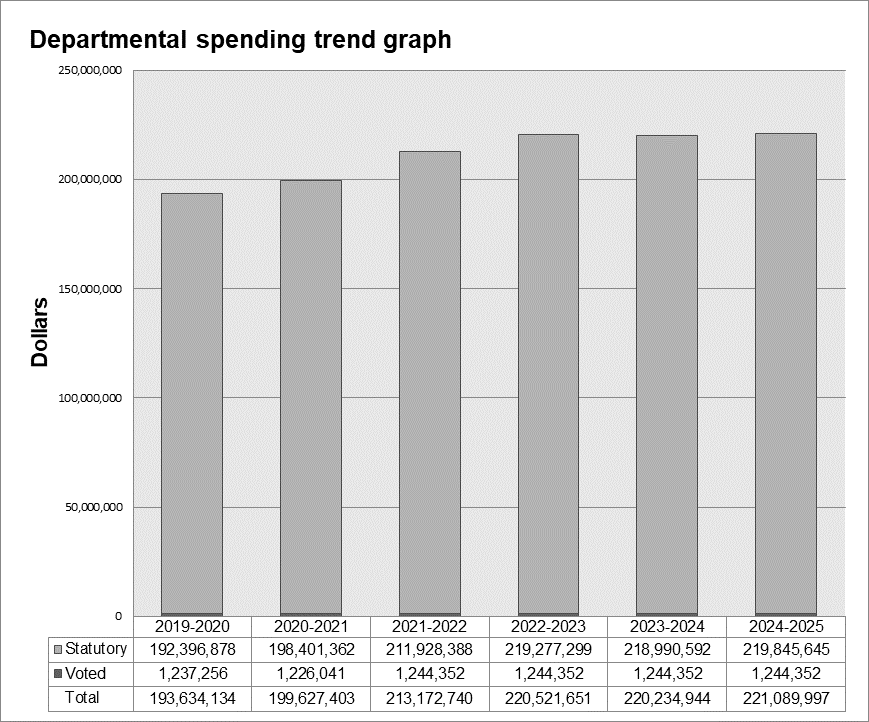

Departmental spending 2019–20 to 2024–25

The following graph presents planned spending (voted and statutory expenditures) over time.

Text Version

| 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 | 2023-2024 | 2024-2025 | |

|---|---|---|---|---|---|---|

| Statutory | 192,396,878 | 198,401,362 | 211,928,388 | 219,277,299 | 218,990,592 | 219,845,645 |

| Voted | 1,237,256 | 1,226,041 | 1,244,352 | 1,244,352 | 1,244,352 | 1,244,352 |

| Total | 193,634,134 | 199,627,403 | 213,172,740 | 220,521,651 | 220,234,944 | 221,089,997 |

The graph above represents OSFI's actual spending for 2019-20 and 2020-21, and current planned spending thereafter (i.e. before investments for the Blueprint as noted on the previous page). Statutory expenditures, which are recovered from respendable revenue, represent over 99% of total expenditures. The remainder of OSFI's spending is funded from a parliamentary appropriation for actuarial services related to federal public sector pension and benefit plans.

The increase in OSFI's total authorities (voted and statutory) in 2021-22 and onwards reflect investments for IM/IT modernization, centred around the move to cloud, modernizing OSFI's website to improve accessibility standards, augmenting the translation team, advancing DEI and strengthening OSFI's internal audit function.

Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of Office of the Superintendent of Financial Institution's core responsibilities and for its internal services for 2022–23 and other relevant fiscal years.

| Core responsibilities and internal services |

2019-20 actual expenditures |

2020-21 actual expenditures |

2021-22 forecast spending |

2022-23 budgetary spending (as indicated in Main Estimates) |

2022-23 planned spending |

2023-24 planned spending |

2024-25 planned spending |

|---|---|---|---|---|---|---|---|

| Financial Institution and Pension Plan Regulation and Supervision | 112,600,222 | 115,090,074 | 115,506,880 | 117,806,081 | 117,806,081 | 119,698,835 | 121,777,262 |

| Actuarial Services to Federal Government Organizations | 6,696,671 | 7,156,778 | 8,230,712 | 8,838,537 | 8,838,537 | 8,934,999 | 9,133,877 |

| Subtotal | 119,296,893 | 122,246,852 | 123,737,592 | 126,644,618 | 126,644,618 | 128,633,834 | 130,911,139 |

| Internal Services | 74,337,241 | 77,380,551 | 89,435,148 | 93,877,033 | 93,877,033 | 91,601,110 | 90,178,858 |

| Total | 193,634,134 | 199,627,403 | 213,172,740 | 220,521,651 | 220,521,651 | 220,234,944 | 221,089,997 |

| Planned spending figures presented in this table reflect 2022-23 Main Estimates, which are based on OSFI's prior outlook, and does not include incremental spending requirements to deliver on its transformation agenda, pending completion of its strategic, operational, and financial planning exercises towards the end of the fourth quarter of 2021-22. | |||||||

OSFI's total spending increased by 3.1% in 2020-21, largely driven by the COVID-19 pandemic, accelerated investments in technology and home office equipment to allow more efficient remote work, and costs related to unused vacation leave.

Overall spending increases of 6.8% in 2021-22 and 3.4% in 2022-23 are driven by the aggregate impact of the following:

- Planned spending under Financial Institution and Pension Plan Regulation and Supervision in 2022-23 onwards reflect regular economic and merit increases.

- Planned spending in Actuarial Services to Federal Government Organizations will increase by 6.9% in 2021-22 and by 15% in 2022-23. This is mainly due to the filling of previously approved vacant positions and two new positions to align the workforce with client demands. Planned spending in 2023-24 onwards reflect regular economic and merit increases.

- Internal services costs increased by 4% in 2020-21 driven by unplanned COVID-19 related costs and implementation of cloud-based technology. Planned spending increased by 16% in 2021-22 and will go up by 5% in 2022-23 mainly due to further investments to accelerate OSFI's move to cloud and spending on other initiatives such as DEI. The reduction in 2023-24 and onwards is due to the completion of technology projects.

Planned human resources

The following table shows information on human resources, in full-time equivalents (FTEs), for each of Office of the Superintendent of Financial Institution's core responsibilities and for its internal services for 2022–23 and the other relevant years.

| Core responsibilities and internal services |

2019-20 actual full‑time equivalents |

2020-21 actual full‑time equivalents |

2021-22 forecast full‑time equivalents |

2022-23 planned full‑time equivalents |

2023-24 planned full‑time equivalents |

2024-25 planned full‑time equivalents |

|---|---|---|---|---|---|---|

| Financial Institution and Pension Plan Regulation and Supervision | 519 | 555 | 591 | 577 | 576 | 579 |

| Actuarial Services to Federal Government Organizations | 34 | 37 | 40 | 43 | 43 | 43 |

| Subtotal | 553 | 592 | 631 | 620 | 619 | 622 |

| Internal services | 240 | 275 | 297 | 296 | 286 | 286 |

| Total | 793 | 867 | 928 | 916 | 905 | 908 |

| Planned full-time equivalents presented in this table does not include the incremental resources required to deliver on OSFI's transformation agenda, pending completion of its strategic, operational, and financial planning exercises towards the end of the fourth quarter. | ||||||

The increase of 74 FTEs in 2020-21 and the forecasted increase of 61 FTEs in 2021-22, largely under Financial Institution and Pension Plan Regulation and Supervision and Internal Services, are mainly due to the staffing of vacant positions and new positions approved in last year's budget (regarding the acceleration of other work such as technology projects due to the COVID-19 pandemic). The reduction of 12 FTEs in 2022-23 is largely attributed to a higher FTE count in 2021-22 due to lower turnover than planned as a result of the pandemic.

Estimates by vote

Information on Office of the Superintendent of Financial Institution's organizational appropriations is available in the 2022–23 Main Estimates.

Future-oriented condensed statement of operations

The future oriented condensed statement of operations provides an overview of OSFI's operations for 2021–22 to 2022–23.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future‑oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available on OSFI's website.

| Financial information | 2021-22 forecast results |

2022-23 planned results |

Difference (2022-23 planned results minus 2021–22 forecast results) |

|---|---|---|---|

| Total expenses | 216,727,538 | 220,500,000 | 3,772,462 |

| Total revenues | 215,483,186 | 219,255,648 | 3,772,462 |

| Net cost of operations before government funding and transfers | 1,244,352 | 1,244,352 | 0 |

OSFI fully recovers its costs through collection of revenues. The difference between the figures presented in the table above and the planned spending amounts provided in other sections of the Departmental Plan is due to a different basis of accounting and relates to non-respendable revenues, amortization of capital and intangible assets, and severance and sick leave liability adjustments.

As mentioned in the Planned spending and human resources section, the planned expenses for 2022-23 represent current planned spending. This amount will be increased when OSFI completes its strategic, operational, and budget planning exercises for 2022-25 towards the end of the fourth quarter of 2021-22.

Corporate information

Organizational profile

- Appropriate minister(s): Chrystia Alexandra Freeland

- Institutional head: Peter Routledge

- Ministerial portfolio: Finance

- Enabling instrument(s): Office of the Superintendent of Financial Institutions Act (OSFI Act)

- Year of incorporation / commencement: 1987

Raison d'être, mandate and role: who we are and what we do

Information on the Office of the Superintendent of Financial Institution's raison d'être, mandate and role is available on OSFI's website.

Operating context

Information on the operating context is available on Office of the Superintendent of Financial Institution's website.

Reporting framework

The Office of the Superintendent of Financial Institution's approved departmental results framework and program inventory for 2022–23 are as follows.

| Departmental Results Framework | Core Responsibility 1 Financial Institution and Pension Plan Regulation and Supervision |

Core Responsibility 2 Actuarial Services to Federal Government Organizations |

Internal Services | ||

|---|---|---|---|---|---|

| Departmental Result: Federally regulated financial institutions and private pensions plans are in sound financial condition | Indicator: % of financial institutions with a Composite Risk Rating of low or moderate | Departmental Result: Stakeholders receive accurate and high quality actuarial information on the cost of public programs and government pension and benefit plans | Indicator: % of members of a panel of Canadian peer actuaries that deem the Canada Pension Plan actuarial valuation accurate and of high quality | ||

| Indicator: Number of financial institutions for which the supervisory rating (i.e. risk level) has increased by two or more levels within a three month period | Indicator: % of public pension and insurance plan valuations that are deemed accurate and high quality. | ||||

| Indicator: Number of pension plans for which the supervisory rating (i.e. risk level) has increased by two or more levels within a three month period | |||||

| Departmental Result: Regulatory and supervisory frameworks contribute to the safety and soundness of the Canadian financial system | Indicator: The Office of the Superintendent of Financial Institutions' level of compliance with the International Monetary Fund's Financial Sector Assessment Program core principles | ||||

| Indicator: The Office of the Superintendent of Financial Institutions' level of compliance with Basel standards as assessed by the Regulatory Consistency Assessment Programme of the Bank for International Settlements | |||||

| Program Inventory | Program: Risk Assessment and Intervention – Federally Regulated Financial Institutions | Program: Actuarial Valuation and Advice | |||

| Program: Regulation and Guidance of Federally Regulated Financial Institutions | |||||

| Program: Regulatory Approvals and Legislative Precedents | |||||

| Program: Federally Regulated Private Pension Plans | |||||

Supporting information on the program inventory

Supporting information on planned expenditures, human resources, and results related to Office of the Superintendent of Financial Institution's program inventory is available on GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on Office of the Superintendent of Financial Institution's website:

Federal tax expenditures

Office of the Superintendent of Financial Institution's Departmental Plan does not include information on tax expenditures that relate to its planned results for 2022-23.

Tax expenditures are the responsibility of the Minister of Finance. The Department of Finance Canada publishes cost estimates and projections for government-wide tax expenditures each year in the Report on Federal Tax Expenditures. This report provides detailed information on tax expenditures, including objectives, historical background and references to related federal spending programs, as well as evaluations, research papers and gender-based analysis plus.

Organizational contact information

Mailing address

Office of the Superintendent of Financial Institutions

255 Albert Street

Ottawa, Ontario K1A 0H2

Telephone: 1-800-385-8647

Fax: 1-613-952-8219

E-mail: webmaster@osfi-bsif.gc.ca

Website: http://www.osfi-bsif.gc.ca/Eng/Pages/default.aspx

Appendix: definitions

- appropriation (crédit)

-

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

-

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

-

An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

-

A document that sets out a department's priorities, programs, expected results and associated resource requirements, covering a three year period beginning with the year indicated in the title of the report. Departmental Plans are tabled in Parliament each spring.

- departmental result (résultat ministériel)

-

A change that a department seeks to influence. A departmental result is often outside departments' immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

-

A factor or variable that provides a valid and reliable means to measure or describe progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

-

A framework that consists of the department's core responsibilities, departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

-

A report on a department's actual performance in a fiscal year against its plans, priorities and expected results set out in its Departmental Plan for that year. Departmental Results Reports are usually tabled in Parliament each fall.

- experimentation (expérimentation)

-

The conducting of activities that explore, test and compare the effects and impacts of policies and interventions in order to inform decision-making and improve outcomes for Canadians. Experimentation is related to, but distinct from, innovation. Innovation is the trying of something new; experimentation involves a rigorous comparison of results. For example, introducing a new mobile application to communicate with Canadians can be an innovation; systematically testing the new application and comparing it against an existing website or other tools to see which one reaches more people, is experimentation.

- full time equivalent (équivalent temps plein)

-

A measure of the extent to which an employee represents a full person year charge against a departmental budget. Full time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

-

An analytical process used to assess how diverse groups of women, men and gender-diverse people experience policies, programs and services based on multiple factors including race, ethnicity, religion, age, and mental or physical disability.

- government-wide priorities (priorités pangouvernementales)

-

For the purpose of the 2022–23 Departmental Plan, government-wide priorities are the high-level themes outlining the government's agenda in the 2021 Speech from the Throne: protecting Canadians from COVID-19; helping Canadians through the pandemic; building back better – a resiliency agenda for the middle class; the Canada we're fighting for.

- horizontal initiative (initiative horizontale)

-

An initiative in which two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non budgetary expenditures (dépenses non budgétaires)

-

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

-

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- plan (plan)

-

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

- planned spending (dépenses prévues)

-

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- program (programme)

-

Individual or groups of services, activities or combinations thereof that are managed together within a department and that focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

-

An inventory of a department's programs that describes how resources are organized to carry out the department's core responsibilities and achieve its planned results.

- result (résultat)

-

An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead, they are within the area of the organization's influence.

- statutory expenditures (dépenses législatives)

-

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

-

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

-

Expenditures that Parliament approves annually through an Appropriation Act. The vote wording becomes the governing conditions under which these expenditures may be made.