2023-24 Departmental Plan

Office of the Superintendent of Financial Institutions

2023–24 Departmental Plan

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

© His Majesty the King in Right of Canada, as represented by the Minister of Finance, 2023

Catalogue No. IN3-31E-PDF

ISSN 2371-7343

Table of contents

From the Superintendent

I am pleased to present the 2023-24 Departmental Plan for the Office of the Superintendent of Financial Institutions (OSFI). This report presents what we plan to do during the upcoming year and the results we expect to achieve.

What we do

OSFI is an independent federal government agency that regulates and supervises federally regulated financial institutions, including banks, insurance companies and pension plans. By doing so, we maintain public confidence in the Canadian financial system and contribute to a marketplace where banks can continue to make loans and take deposits, insurance companies can pay policyholders, and pension plans can continue to make payments to beneficiaries.

We also house the Office of the Chief Actuary (OCA), which provides a range of actuarial valuation and advisory services to the federal government. The OCA helps ensure that social programs and public sector pension and insurance arrangements remain sound and sustainable for Canadians.

What we are trying to achieve

Canada has a strong reputation of managing financial sector uncertainty in a manner that contributes to financial stability. However, we at OSFI do not infer from this track record a reason for complacency.

In the year ahead, the current risk environment will continue to test the resiliency of our financial institutions in new and dynamic ways. OSFI will continue to adapt and evolve our structures, strategies, and practices to meet these challenges head-on.

As we make our way through the second year of the Blueprint for Transformation, OSFI’s work will be guided by the six priority initiatives outlined in our 2022-25 Strategic Plan. They include:

- Culture and enabler initiatives

- Risk, strategy and governance

- Strategic stakeholder and partner engagement

- Policy innovation

- Supervision renewal

- Data management and analytics

Our plans and activities in each of these priority areas are described in detail in this report. Pursuing these priorities will support us in positioning OSFI as an organization that thrives in uncertainty.

We will continue to support Diversity, Equity, and Inclusion in all its forms, so that our employees feel supported and confident in bringing their very best to work every day. This is more than just smart business practice – it is a moral imperative for institutions that serve the Canadian public.

Looking ahead

The global economy and the Canadian financial system are facing challenges in the coming year.

Persistently high inflation and the corresponding response by global central bank actions to raise interest rates lead us to expect a slowdown in economic activity globally and in Canada. Combined with other macroeconomic headwinds and market risk events, financial institutions and pension plans we oversee would face increased risks and may experience financial stress.

As we enter these uncertain times, OSFI will rely on our regulatory frameworks to ensure regulated entities ably manage their risk. We are also confident that the changes we have already made under our Blueprint for Transformation and the 2022-2025 Strategic Plan are positioning our organization to anticipate and manage risks in the financial sector.

We stand ready to protect Canadians’ confidence in their financial system while at the same time adapting our practices at OSFI to remain an agile organization.

Peter Routledge

Superintendent

Plans at a glance

In 2023-24, OSFI will focus on its second year of delivering on the six priority initiatives outlined in its Blueprint for OSFI’s Transformation and 2022-25 Strategic Plan. If severer vulnerabilities materialize in the Canadian financial system, some initiatives may be re-prioritized to meet operational needs.

01 Culture and Enabler Initiatives: OSFI is a workplace where curious, diverse, high integrity colleagues are safe to bring their true and best selves to work everyday and are safe to fail and then adapt.

To achieve this initiative, OSFI will:

- nurture a workplace where our desired values and culture thrive;

- modernize how we work, hire, promote and incentivize our people; and

- empower leaders to support our transformation and take decisions.

In 2023-24, key activities will include:

- finalizing and implementing a three-year Culture Change Action Plan;

- developing and implementing a new multi-year Human Capital Strategy;

- enhancing OSFI’s hybrid work environment to offer flexibility and modernized improvements; and

- implementing IM/IT initiatives to promote and enhance collaboration, data and analytics, and office productivity.

02 Risk, Strategy and Governance: OSFI makes risk-intelligent decisions every day that reflect its transparent and revealed risk appetite via leadership and governance that delegates out decision-making, from the top to the leaders best positioned to make decisions.

To achieve this initiative, OSFI will:

- make bold and courageous risk-intelligent decisions driven by our expanded risk program and risk appetite;

- proactively influence policymaking and supervision to strengthen public confidence in the Canadian financial system by accelerating our understanding and risk response to macro risks and trends; and

- fully leverage our governance structure to support an agile risk response, delegation of decision-making authority, and taking action within our risk appetite.

In 2023-24, key activities will include:

- enhancing environmental scanning tools to advance OSFI’s assessment of risks and trends;

- implementing a risk appetite and framework to ensure risk-based decision making; and

- implementing an enhanced governance structure to enable timely, transparent, and risk-intelligent decision making.

03 Strategic Stakeholder and Partner Engagement: OSFI integrates and aligns with key stakeholders and partners inside and outside of the federal financial safety net in a manner that maximizes its influence and preserves its integrity in fulfilling its purpose and mandate.

To achieve this initiative, OSFI will:

- develop a deliberate and coordinated approach to strategic stakeholder management;

- use partner and stakeholder engagement plans as part of our strategic risk response; and

- leverage the public role of the Superintendent and the Chief Actuary.

In 2023-24, key activities will include:

- continuing to build the Stakeholder Affairs function;

- continuing the implementation of OSFI’s stakeholder affairs framework to coordinate key stakeholder and partner engagement and build strategic relationships; and

- exploring increased opportunities for the Superintendent and the Chief Actuary to enhance public confidence in Canada’s financial system.

04 Policy Innovation: OSFI becomes a global leader in prudential supervision by making policy to support operational and financial resilience of its regulated entities in the face of climate-related, digitalization, and other yet-to-be foreseen risks.

To achieve this initiative, OSFI will:

- continue to build the Climate Risk Hub, the Digital Innovation Impact Hub, the Non-Financial Risk Division, and the Policy Architecture Renewal Team; and

- establish new structures, processes, and relationships to facilitate collaboration with internal and external partners.

In 2023-24, key activities will include:

- implementing a multi-year roadmap for Policy Architecture Renewal;

- developing policy instruments on stablecoin and starting to build the Digital Regulatory Incubator; and

- reviewing publications and releasing new guidelines and frameworks for key risk principles.

05 Supervision Renewal: OSFI’s Supervision Renewal enables a work environment that guides supervisors to effectively and efficiently manage their portfolio of regulated entities, builds capacity, creates a collective responsibility for risk assessments and management, and utilizes data and analytics to meet our supervision mandate.

To achieve this initiative, OSFI will:

- build the Risk Assessment and Intervention Hub, Risk Advisory Hub, Supervision Institute, Supervision Quality Assurance Division, and the Supervision Central Office; and

- modernize our Supervisory Framework to build greater risk appetite for earlier corrective actions and ensure it is always fit for purpose and achieves simplicity, standardization, and greater use of data.

In 2023-24, key activities will include:

- building up new teams to further OSFI’s supervision capabilities and expertise;

- redesigning the Supervisory Framework to reflect OSFI’s new risk appetite, create functionality, and increase the flexibility of decision-making; and

- enhancing OSFI’s supervision functions in connection with non-financial risk policy expectations.

06 Data Management and Analytics: OSFI’s data platform enables the vast majority of analytical research and insight-generation while simultaneously eliminating the necessity of most ad-hoc data requests made to regulated entities.

To achieve this initiative, OSFI will:

- become a leading data and analytics driven regulator that makes well-informed decisions to supervise and regulate pro-actively to changes in the risk environment;

- continuously improve our data technology infrastructure to support leading-edge data and analytical capabilities; and

- make investments to build, support, and promote the development of leaders and staff in becoming agile, proficient, and forward-looking in data trends and analytics.

In 2023-24, key activities will include:

- establishing OSFI’s next generation data strategy, named “Vision 2030”, which will transform the use of data and analytics to encompass its business activities and provide new opportunities;

- furthering the Data Collection Modernization initiative, which aims to modernize the definition, collection, transformation and use of regulatory data; and

- developing and executing an enterprise data literacy strategy to make data and analytics an integral part of OSFI’s operations and decision making.

For more information on OSFI’s plans, see the “Core responsibilities: planned results and resources” section of this plan.

Core responsibilities: planned results and resources

This section contains information on the OSFI's planned results and resources for each of its core responsibilities.

Financial Institution and Pension Plan Regulation and Supervision

Description

The Office of the Superintendent of Financial Institutions (OSFI) advances a regulatory framework designed to control and manage risk to federally regulated financial institutions (FRFIs) and private pension plans (FRPPs) and evaluates system-wide or sectoral developments that may have a negative impact on their financial condition. It also supervises financial institutions and pension plans to determine whether they are in sound financial condition and meeting regulatory and supervisory requirements. The Office promptly advises financial institutions and pension plan administrators if there are material deficiencies, and takes corrective measures or requires that they be taken to expeditiously address the situation. It acts to protect the rights and interests of depositors, policyholders, financial institution creditors and pension plan beneficiaries, while having due regard for the need to allow financial institutions to compete effectively and take reasonable risks.

Planning highlights

In 2023-24, OSFI will continue to execute on priority transformation initiatives included in its Strategic Plan 2022-25. These and other regulation and supervision priorities highlighted below support the delivery of OSFI’s two departmental results under its first core responsibility:

- ensuring that FRFIs and FRPPs are in sound financial condition; and

- ensuring that OSFI’s regulatory and supervisory frameworks contribute to the safety and soundness of the Canadian financial system.

Strategic Stakeholder and Partner Engagement: OSFI integrates and aligns with key stakeholders and partners inside and outside of the federal financial safety net in a manner that maximizes its influence and preserves its integrity in fulfilling its purpose and mandate.

Achieving this outcome in 2023-24 will involve advancing the following plans:

- refining OSFI’s stakeholder affairs framework, building standard messaging content, and beginning to acquire tools;

- implementing a strategy for internal and external partner engagement through public opinion research; and

- exploring options to build on OSFI’s existing feedback system to improve opportunities for measurement.

To increase opportunities for the Superintendent and the Chief Actuary to contribute to public confidence in the Canadian financial system, OSFI will explore opportunities to leverage new stakeholder tools and strategies. Further, OSFI will identify and collaborate on stakeholder speaking opportunities with members of the Financial Institutions Supervisory Committee (FISC).

Policy Innovation: OSFI becomes a global leader in prudential supervision by making policy to support operational and financial resilience of its regulated entities in the face of climate-related, digitalization, and other yet-to-be foreseen risks.

In 2023-24, OSFI will initiate the implementation of a multi-year roadmap for policy architecture renewal, which will include:

- taking stock of OSFI guidance to identify potential gaps, duplication and inconsistencies, and retiring any redundant guidance;

- streamlining guidance, including developing new foundational guidelines that simplify OSFI’s expectations in key areas and reduce unnecessary overlap and duplication;

- improving internal policy processes to effectively prioritize, sequence and monitor policy work, and to properly balance OSFI’s regulatory objectives; and

- engaging stakeholders, including public communication on the new proposed policy architecture to build broad awareness and seek input from the industry.

In 2023-24, OSFI will be:

- issuing draft updates to Guideline B-20 - Residential Mortgage Underwriting Practices and Procedures to address mounting risks in the housing sector;

- issuing a Digital Innovation Roadmap, risk management clarification on stablecoin, and initiating a Financial Innovation Sandbox;

- issuing final Guideline B-10 - Third Party Risk Management and Guideline B-13 - Technology and Cyber Risk Management;

- publishing and initiating the Intelligence-led Cyber Resilience Testing (I-CRT) framework;

- publishing updated draft E-21 - Operational Risk and Resilience, shifting focus to operational resilience while maintaining key principles of operational risk;

- publishing final Guideline B-15 - Climate Risk Management, along with results of climate risk scenario exercises; and

- publishing draft Culture & Behaviour Risk Guideline, establishing key principles and proposed outcomes, along with a related self-assessment tool.

Supervision Renewal: OSFI’s supervision renewal enables a work environment that guides supervisors to effectively and efficiently manage their portfolio of regulated entities, builds capacity, creates a collective responsibility for risk assessments and management, and utilizes data and analytics to meet our supervision mandate.

In 2023-24, OSFI will advance its supervision capabilities and expertise. Leveraging the new organizational structure for supervision, key priorities will include:

- advancing an interaction model between internal partners across all OSFI sectors;

- delivering a training program for supervision and the revised Supervisory Framework;

- developing and implementing Supervisory Technology capabilities;

- enhancing supervisory key performance indicator reporting; and

- continuing to build and execute on plans for quality assurance across OSFI’s supervision functions.

In 2023-24, the Supervisory Framework redesign will strengthen OSFI’s ability to aggregate thematic analytics from entity to system level and identify interconnectedness across industry sectors. The redesign will include:

- ensuring key risk drivers (both financial and non-financial) are prominent;

- developing a process for rating non-financial risks;

- increasing the use of data analytics to inform risk-based decisions;

- reflecting OSFI’s new risk appetite; and

- developing new processes for approving and supervising new entrants.

In 2023-24, OSFI will simplify and standardize the supervisory system, Vu, to align with the revised Supervisory Framework. Updated guidance will be provided to users and the modernization will reduce the administrative burden on supervisors.

Other regulation and supervision priorities

In parallel with the planned transformational efforts, OSFI will continue to deliver expected results supporting its core mandate. Highlights of OSFI’s regulation and supervision priorities for the 2023-24 reporting period are as follows:

- To ensure FRFI financial and risk measures, including OSFI’s capital and liquidity regimes remain appropriate in stress scenarios, OSFI will continue to focus on:

- monitoring FRFIs for robust implementation and application of key accounting, auditing and disclosure policies and practices for consistency with international standards and domestic modifications. With this, OSFI will also oversee the effective implementation of enhanced assurance expectations over key regulatory returns;

- monitoring its insurance capital tests, post implementation of International Financial Reporting Standard (IFRS 17), to ensure that they are functioning as intended; and

- advancing key policy reviews, which are aimed at ensuring that OSFI’s capital tests remain fit-for-purpose and risk based.

- In addition, OSFI will focus on monitoring and supporting the January 2023 transition of IFRS 17 - Insurance Contracts. This includes continued training for OSFI supervisors and monitoring industry results.

- Overall risk management practices at FRFIs will be assessed to determine if they are aligned to the evolving risk environment that they operate in, particularly as it relates to residential mortgage activities, commercial real estate, and corporate lending.

- OSFI will continue to assess vulnerabilities to ensure that mortgage underwriting standards, including the Minimum Qualifying Rate (MQR), remain appropriately calibrated for the risk environment. The next planned MQR announcement date will be in December 2023.

- OSFI will continue to make progress on the draft framework for determining capital requirements for segregated fund guarantee risk for life insurers. As part of this work, OSFI will review results of the Quantitative Impact Study (QIS) 6 that launched in February 2023, as well as comments received from a public consultation on the draft framework. The draft framework is expected to be finalized in mid-2024 and is expected to come into effect in January 2025.

- To ensure that OSFI’s regulatory approach for the identification, assessment, and monitoring of technology and non-financial risks is clear and transparent, OSFI will develop supervisory expectations and tools that align with new or revised non-financial risk guidelines including technology and cyber, third party, operational resilience, culture and behaviour, and compliance.

- OSFI will complete semi-annual reviews of the Domestic Stability Buffer and will make public announcements in June and December 2023.

- OSFI will ensure that its expectations and supervisory processes support effective regulation and supervision of FRPPs by working with the Canadian Association of Pension Supervisory Authorities to develop a Risk Management Guideline that includes guidance on investments, cyber risk, and Environmental, Social and Governance (ESG) considerations.

- OSFI will continue to monitor evolving and emerging risks to the financial system ranging from cyber attacks and digital innovation to housing-related considerations and climate change. In summer 2023, OSFI will release its Annual Risk Outlook. This will provide details about the risks facing Canada’s financial system and OSFI’s plans to address them.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

In 2023-24, OSFI will be developing and tabling its Departmental Sustainable Development Strategy (DSDS) that will be aligned with the 2022-26 Federal Sustainable Development Strategy (FSDS). The DSDS will discuss strategies to support UN Sustainable Development Goals (SDGs) as applicable.

OSFI pursues sustainable development in accordance with its prudential mandate in order to contribute to public confidence in the Canadian financial system. Climate-related risks are drivers of traditional financial and non-financial risks for federally regulated financial institutions. Our contributions to the FSDS and specific UN SDGs stem from our prudential policy making and supervisory activities, and changes in our internal operations.

OSFI supports UN SDG 13 on Climate Action through its regulatory and supervisory responses to climate risks and stakeholder engagement, both domestically and internationally. Notably, OSFI actively participates in Canada’s Sustainable Finance Action Council, the Basel Committee on Banking Supervision, Financial Stability Board, International Association of Insurance Supervisors, and the Network for Greening the Financial System. Specifically, OSFI’s activities will focus on strengthening resilience and adaptive capacity in responding to climate-related hazards (13.1); integrating climate change measures into national policies, strategies, and planning (13.2); and improving awareness and institutional capacity on climate change mitigation, adaptation, impact reduction, and early warning (13.3).

OSFI supports UN SDG 8.10 on Decent Work and Economic Growth by strengthening the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services. OSFI also supports UN SDG 10.5 on Reduced Inequalities by improving the regulation and monitoring of global financial markets and institutions and strengthening the implementation of such regulations.

OSFI supports UN SDG 12.7 on Responsible Consumption and Production by embedding environmental considerations in public procurement in accordance with the federal Policy on Green Procurement. In addition, under UN SDG 12 and UN SDG 13, there are several targets, milestones and implementation strategies within the FSDS that OSFI would directly contribute to through changes to our internal operations and implementing efforts, such as the Greening Government Strategy. More specifically, OSFI will support goals related to responsible consumption, greenhouse gas emissions and climate resilience. By doing so, OSFI will contribute to efforts in decreasing the carbon footprint and increasing the climate resilience of our internal operations, committing to a greener economy.

Innovation

To continue thriving in increasingly uncertain times, OSFI will continue to pursue broad cultural shifts in various areas. OSFI seeks to prioritize innovation over the status quo, nurture a culture of curiosity that fosters acceptance of diverse mindsets where it is safe to be different and safe to fail (within our risk framework), and shift towards greater risk-taking that is informed by a robust analysis of risk trade-offs.

In 2023-24, OSFI will be agile and prepared to shift activities to account for changing priorities and operational needs should financial system conditions change. A Stop-Rethink-Reimagine exercise is ongoing, which aims to stop activities that are no longer fit for purpose and to rethink and reimagine work to drive innovation and efficiencies. For example, OSFI’s work on data analytics and experimentation with new technologies, outlined under the Internal Services section of this plan, will support effective regulation and supervision of financial institutions as well as the execution of the policy innovation and supervision renewal initiatives.

Planned results for Financial Institution and Pension Plan Regulation and Supervision

The following table shows, for Financial Institution and Pension Plan Regulation and Supervision, the planned results, the result indicators, the targets and the target dates for 2023–24, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result |

Departmental result indicator |

Target | Date to achieve target |

2019‑20 actual result |

2020‑21 actual result |

2021‑22 actual result |

|---|---|---|---|---|---|---|

| Federally regulated financial institutions and private pensions plans are in sound financial condition. | % of financial institutions with a Composite Risk Rating of low or moderate. | At least 80% | March 31, 2024 | 96% | 96% | 96% |

| Number of financial institutions for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three-month period. | 1 or less | March 31, 2024 | 0 | 0 | 0 | |

| Number of pension plans for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three-month period. | 1 or less | March 31, 2024 | 0 | 0 | 1 | |

| Regulatory and supervisory frameworks contribute to the safety and soundness of the Canadian financial system. | The Office of the Superintendent of Financial Institutions’ level of compliance with the International Monetary Fund’s Financial Sector Assessment Program core principles. | 100% | March 31, 2024 | N/A | N/A | N/ATable 1 footnote* |

| The Office of the Superintendent of Financial Institutions’ level of compliance with Basel standards as assessed by the Regulatory Consistency Assessment Programme of the Bank for International Settlements. | 90% | March 31, 2024 | N/A | N/A | N/ATable 1 footnote** | |

|

Table 1 footnotes

|

||||||

The financial, human resources and performance information for OSFI’s program inventory is available on GC InfoBase.

Planned budgetary spending for Financial Institution and Pension Plan Regulation and Supervision

The following table shows, for Financial Institution and Pension Plan Regulation, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023‑24 budgetary spending (as indicated in Main Estimates) |

2023‑24 planned spending |

2024‑25 planned spending |

2025‑26 planned spending |

|---|---|---|---|

| 142,174,356 | 142,174,356 | 153,453,821 | 153,197,095 |

Financial, human resources and performance information for OSFI’s program inventory is available on GC InfoBase.

Planned human resources for Financial Institution and Pension Plan Regulation and Supervision

The following table shows, in full-time equivalents, the human resources the department will need to fulfill this core responsibility for 2023–24 and for each of the next two fiscal years.

| 2023‑24 planned full-time equivalents |

2024‑25 planned full-time equivalents |

2025‑26 planned full-time equivalents |

|---|---|---|

| 696 | 748 | 747 |

Financial, human resources and performance information for OSFI’s program inventory is available on GC InfoBase.

Actuarial Services to Federal Government Organizations

Description

The Office of the Chief Actuary (OCA) provides a range of actuarial services, including statutory actuarial valuations required by legislation and checks and balances on the future costs of programs for the Canada Pension Plan, Old Age Security, Employment Insurance and Canada Student Loans programs, as well as pension and benefits plans covering the Federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police, federally appointed judges, and Members of Parliament.

Planning highlights

The OCA contributes to financial system oversight by helping to ensure that social programs and public sector pension and insurance arrangements remain sound and sustainable for Canadians.

To support OSFI’s ongoing transformation in 2023-24, the OCA will focus on developing a coordinated approach towards strategic stakeholder management. In particular, the OCA will perform an assessment of its current financing model to identify the risks associated with the model and recommend next steps.

In 2023-24, the OCA will continue to meet its mandate by ensuring the provision of high-quality actuarial information on the cost of public programs and government pension and benefit plans. As a result, the following actuarial reports will be submitted to the President of Treasury Board for tabling before Parliament in 2023-24:

- Actuarial Report on the Pension Plan for the Federally Appointed Judges as at 31 March 2022

- Actuarial Report on the Pension Plan for the Members of Parliament as at 31 March 2022

- Actuarial Report on the Pension Plans for the Canadian Armed Forces (Regular Force and Reserve Force) as at 31 March 2022

- Actuarial Report on the Regular Force Death Benefit Account as at 31 March 2022

In addition, the 2024 Actuarial Report on the Employment Insurance Premium Rate will be submitted to the Canada Employment Insurance Commission and the triennial Actuarial Report on the Old Age Security as at 31 December 2021 will be submitted to the Minister of Seniors, both to be tabled before Parliament in 2023-24.

Following the release of the triennial Actuarial Report on the Canada Pension Plan (CPP) as at 31 December 2021, which involved the projection of demographic and economic trends based on CPP revenues and expenditures over a 75-year period, the results of the independent peer review are scheduled to be released in early 2023-24.

In 2023-24, the OCA will prepare the Actuarial Report on the Canada Student Financial Assistance Program as at 31 July 2022. Further, the OCA will also submit various actuarial reports for the purpose of Public Accounts of Canada, presenting the obligations and costs, as at March 31, 2023, associated with federal public sector pension and benefit plans including future benefits to veterans.

Moreover, the OCA will publish two actuarial studies in 2023-24 on climate change and how it may affect the plans and programs under the OCA’s responsibility, as well as on CPP beneficiaries' mortality.

As part of its ongoing provision of sound actuarial advice, the OCA will assist several government departments in the design, funding and administration of the plans and programs for which they are responsible. Client departments include the federal and provincial Departments of Finance, Employment and Social Development Canada, Treasury Board Secretariat, Veterans Affairs Canada, National Defense, Royal Canadian Mounted Police, the Department of Justice, and Public Services and Procurement Canada.

Innovation

Given that the OCA’s primary responsibility is to provide actuarial advice, including the preparation of actuarial reports for federal government organizations, continuous improvement is generally sought through consultations and lessons learned exercises rather than experimental projects.

Planned results for Actuarial Services to Federal Government Organizations

The following table shows, for Actuarial Services to Federal Government Organizations, the planned results, the result indicators, the targets and the target dates for 2023–24, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result |

Departmental result indicator |

Target | Date to achieve target |

2019‑20 actual result |

2020‑21 actual result |

2021‑22 actual result |

|---|---|---|---|---|---|---|

| Stakeholders receive accurate and high quality actuarial information on the cost of public programs and government pension and benefit plans. | % of members of a panel of Canadian peer actuaries that deem the Canada Pension Plan actuarial valuation accurate and of high quality. | 100% Agreement among all three members of peer review panel |

March 31, 2024 | N/A | 100% | N/ATable 4 footnote* |

| % of public pension and insurance plan valuations that are deemed accurate and high quality. | 100% | March 31, 2024 | 100% | 100% | 100% | |

|

Table 4 footnotes

|

||||||

The financial, human resources and performance information for OSFI’s program inventory is available on GC InfoBase.

Planned budgetary spending for Actuarial Services to Federal Government Organizations

The following table shows, for Actuarial Services to Federal Government Organizations, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023‑24 budgetary spending (as indicated in Main Estimates) |

2023‑24 planned spending |

2024‑25 planned spending |

2025‑26 planned spending |

|---|---|---|---|

| 11,891,119 | 11,891,119 | 12,339,612 | 12,996,051 |

Financial, human resources and performance information for OSFI’s program inventory is available on GC InfoBase.

Planned human resources for Actuarial Services to Federal Government Organizations

The following table shows, in full-time equivalents, the human resources the department will need to fulfill this core responsibility for 2023–24 and for each of the next two fiscal years.

| 2023‑24 planned full-time equivalents |

2024‑25 planned full-time equivalents |

2025‑26 planned full-time equivalents |

|---|---|---|

| 56 | 56 | 56 |

Financial, human resources and performance information for OSFI’s program inventory is available on GC InfoBase.

Internal services: planned results

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Planning highlights

In 2023-24, OSFI will continue to execute on priority transformation initiatives included in its Strategic Plan 2022-25. These and other internal service priorities highlighted below support the advancement of OSFI’s internal capabilities.

Culture and Enabler Initiatives: OSFI is a workplace where curious, diverse, high integrity colleagues are safe to bring their true and best selves to work everyday and are safe to fail and then adapt.

In 2023-24, OSFI will advance its work to nurture a workplace where its desired values and culture thrive through:

- completing and implementing a three-year Culture Change Action Plan;

- developing and implementing a new multi-year Human Capital Strategy;

- reviewing management and leadership development programs;

- embedding OSFI’s cultural Promises and Commitments in OSFI’s annual Performance Management Cycle;

- developing program improvements for the talent management program of all employees;

- implementing OSFI’s Official Languages (OL) Strategy, aiming to promote and support linguistic duality in keeping with the Official Languages Act; and

- advancing initiatives focused on diversity, equity and inclusion through the implementation of its 2022-2025 Diversity, Equity and Inclusion (DEI) Action Plan.

OSFI will continue to implement strategies to support transformation efforts, prioritizing efficiency over process and promoting a change mindset, including:

- continuing to implement a Stop-Rethink-Reimagine exercise, with a focus on determining which activities are no longer fit-for-purpose or need to be adjusted;

- clarifying the risk appetite for procurement and implementing a risk-based approach to triage, assignment, quality assurance and approval of procurement and contracts;

- continuing to implement a fully dedicated enterprise change management function; and

- ensuring OSFI’s transformation initiatives have continued access to change management advisory support.

OSFI will also continue advancing information management/information technology (IM/IT) initiatives, including:

- commencing the Human Capital Management (HCM) system project and Approvals Case Management Renewal; and

- developing a new IM/IT strategy aligned to the 2022-25 Strategic Plan, with a focus on improving and building forward-looking IM/IT capabilities, and agility and efficiency through process optimization.

Risk, Strategy and Governance: OSFI makes risk-intelligent decisions every day that reflect its transparent and revealed risk appetite via leadership and governance that delegates out decision-making, from the top to the leaders best positioned to make decisions.

In 2023-24, OSFI will make progress on risk management practices to enable risk-based decisions. This will be achieved through:

- developing and implementing an enterprise-wide risk appetite framework (RAF);

- developing an Enterprise Risk Management (ERM) Framework;

- implementing a plan to mature OSFI’s strategic planning framework and capabilities;

- continuing to evolve OSFI’s integrated risk reporting and analytics framework;

- implementing a redesigned governance structure to enable the organization to make timely and risk-based decisions;

- advancing stress testing capabilities by continuing to build new and enhanced processes, and continuing industry outreach to stay ahead of the latest advances in financial modeling;

- providing forward-looking applied horizon risk research and evolving regular risk reports in key areas of industry surveillance;

- completing the build and roll-out of risk-related dashboards; and

- implementing additional scanning tools to continuously monitor and report on risks across multiple sources.

Data Management and Analytics: OSFI’s data platform enables the vast majority of analytical research and insight-generation while simultaneously eliminating the necessity of most ad-hoc data requests made to regulated entities.

In 2023-24, OSFI will build on its current data strategy to establish its “Vision 2030” Data Strategy, a medium to long-term plan for transforming the use of data and analytics. This work will involve:

- initiating the development of a technology infrastructure roadmap;

- further leveraging new tools for both data management and advanced analytics, including establishing an advanced data and analytics platform and applications; and

- planning and executing on the Data Collection Modernization (DCM) initiative, along with Financial Information Committee (FIC)Footnote 1 partners, including defining detailed requirements and initiating a procurement process for a new technology solution to replace the legacy Regulatory Return System (RRS).

Work will continue on an analytics alignment framework and the development of an interaction model with stakeholders across OSFI. Further, OSFI will develop and execute on an enterprise data literacy strategy in collaboration with key internal partners to help make data and analytics part of OSFI’s culture DNA.

Additionally, OSFI will stand up an external Analytics Advisory Committee to support the implementation and continuous improvement of OSFI’s Vision 2030 Data Strategy.

Hybrid work environment

In parallel with the ongoing transformational efforts, OSFI will continue to deliver expected results supporting its enabling infrastructure and corporate obligations.

OSFI will complete renovations in the Ottawa and Toronto offices. It will monitor the Montreal and Vancouver offices, which underwent upgrades in 2022-23, for any required adjustments. OSFI continues to integrate new technologies to build and support a hybrid workplace. Additionally, OSFI aims to implement a measurement strategy to monitor the effectiveness of its hybrid work model.

OSFI will introduce new technology to enable a hybrid environment. It will continue to roll out the Cloud Adoption Roadmap, which focuses on modernizing work practices and moving applications to the cloud. This includes applications in areas to improve collaboration, data and analytics, and office productivity, as well as making investments in OSFI’s fundamental infrastructure, service desk, processes, and services. OSFI will carry on with enhancing its IM/IT Risk Management Framework to capture, analyze, and respond to risks in its environment to ensure the rollout of technological capabilities that will enable OSFI’s strategic objectives.

To support these and other priorities, communications will play a significant role to ensure that innovative tactics are used to reach key audiences and adapt to the ever-changing financial risk environment. Externally, OSFI’s Public Affairs team will provide timely and accurate information to ensure transparency on key issues that impact Canadians and their confidence in our financial system. The team will focus on plain language descriptions of the complex OSFI policies and guidelines, opportunities for the Superintendent, the Chief Actuary and other senior leaders to address key audiences, and social media and web content that helps all stakeholders understand how OSFI’s role and actions contribute to the safety and stability of Canada’s financial system.

OSFI’s internal communications will ensure there are strong connections between our leadership and our employees. It will ensure employees are aware of and support the transition to the hybrid work model and the larger transformation agenda. It will also help the organization transition to a new, modern website and adhere to web best practices.

Innovation

OSFI relies on data analysis to measure risk, identify trends, and make evidence-based decisions. As a result, IM/IT continues to design, release, and support new iterations of the Technology Exploration Space and Advanced Data Analytics Platform and Technology.

Planning for contracts awarded to Indigenous Businesses

OSFI plans to support the Government of Canada’s commitment that a mandatory minimum target of 5% of the total value of contracts is awarded to Indigenous Businesses annually by achieving the minimum targets set out below. OSFI plans to achieve these minimum targets using a combination of voluntary set asides for planned office furniture and IT hardware expenditures related to OSFI’s return to office initiative, and IT professional services expenditures related to OSFI’s web renewal and cloud projects. OSFI plans to supplement these with regular contracts (“incidentals”) awarded to Indigenous Businesses. OSFI’s standard practice is to invite a minimum of one Indigenous supplier to bid on all professional services requests for proposal to provide ongoing opportunities to Indigenous Businesses.

In the past, OSFI has consistently achieved or surpassed its annual targets for contracts awarded to Indigenous Businesses by relying on furniture and IT purchases; however, OSFI recognizes that the planned procurement value for those areas is not sufficient to achieve the mandatory minimum 5% target in the longer term. As such, OSFI plans to pilot the use of the conditional set aside process in 2023-2024, and will also explore other strategies to sustain or increase the value of contracts awarded to Indigenous Businesses relative to the total value of contracts OSFI awards each fiscal year.

| 5% reporting field description | 2021‑22 actual % achieved |

2022‑23 forecasted % target |

2023‑24 planned % target |

|---|---|---|---|

| Total percentage of contracts with Indigenous businesses | N/A | 5% | 7.5% |

Planned budgetary spending for internal services

The following table shows, for internal services, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023‑24 budgetary spending (as indicated in Main Estimates) |

2023‑24 planned spending |

2024‑25 planned spending |

2025‑26 planned spending |

|---|---|---|---|

| 140,660,512 | 140,660,512 | 119,138,064 | 115,985,010 |

The reduction in 2024-25 planned spending is due to the completion of renovations in the Ottawa and Toronto offices to support OSFI’s hybrid work model. Additional details are provided under the “Planned spending and human resources” section of the report.

Planned human resources for internal services

The following table shows, in full-time equivalents, the human resources the department will need to carry out its internal services for 2023–24 and for each of the next two fiscal years.

| 2023‑24 planned full-time equivalents |

2024‑25 planned full-time equivalents |

2025‑26 planned full-time equivalents |

|---|---|---|

| 369 | 396 | 387 |

Financial, human resources and performance information for OSFI’s program inventory is available on GC InfoBase.

Planned spending and human resources

This section provides an overview of the department’s planned spending and human resources for the next three fiscal years and compares planned spending for 2023–24 with actual spending for the current year and the previous year.

Planned spending

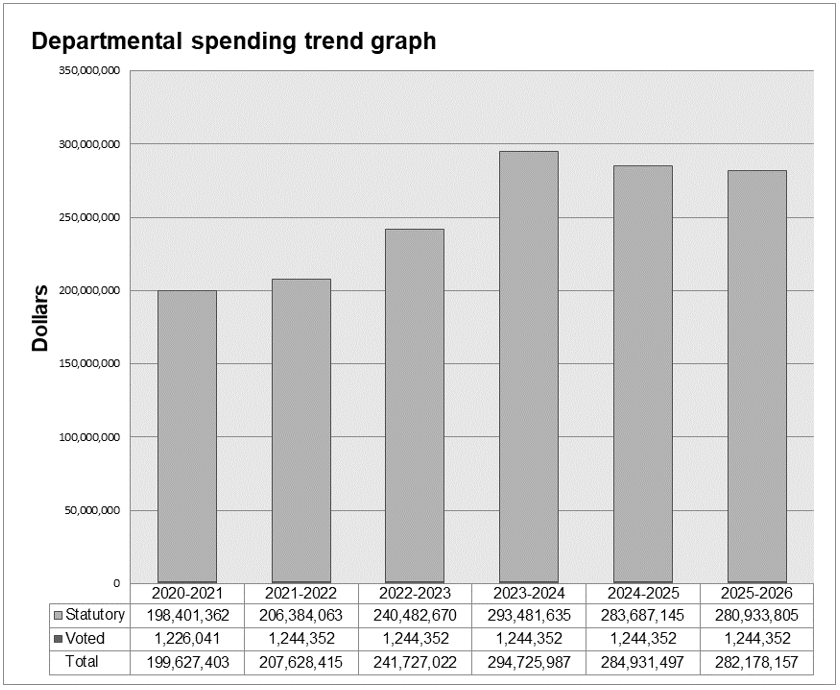

Departmental spending 2020–21 to 2025–26

The following graph presents planned spending (voted and statutory expenditures) over time.

Text version

| 2020-2021 | 2021-2022 | 2022-2023 | 2023-2024 | 2024-2025 | 2025-2026 | |

|---|---|---|---|---|---|---|

| Statutory | 198,401,362 | 206,384,063 | 240,482,670 | 293,481,635 | 283,687,145 | 280,933,805 |

| Voted | 1,226,041 | 1,244,352 | 1,244,352 | 1,244,352 | 1,244,352 | 1,244,352 |

| Total | 199,627,403 | 207,628,415 | 241,727,022 | 294,725,987 | 284,931,497 | 282,178,157 |

The graph above represents OSFI’s actual spending for 2020-21 and 2021-22, and current planned spending thereafter. Statutory expenditures, which are recovered from respendable revenue, represent over 99% of total expenditures. The remainder of OSFI’s spending is funded from a parliamentary appropriation for actuarial services related to federal public sector pension and benefit plans.

OSFI’s total authorities (voted and statutory) increased in 2021-22 due to the addition of resources to implement OSFI’s DEI strategy, as well as the acceleration of some initiatives such as the move to cloud-based technology and continued investments in data and analytics. The significant increase in 2022-23 and onwards is due to the implementation of OSFI’s 2022-25 Strategic Plan, which will allow OSFI to effectively address its intensifying risk environment by focusing on the six priorities noted in the “Plans at a glance” section of this document. This increase was not included in the 2022-23 Departmental Plan because the three-year strategic planning exercise was completed after the submission of the Departmental Plan was completed.

Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of OSFI’s core responsibilities and for its internal services for 2023–24 and other relevant fiscal years.

| Core responsibilities and internal services |

2020‑21 actual expenditures |

2021‑22 actual expenditures |

2022‑23 forecast spending |

2023‑24 budgetary spending (as indicated in Main Estimates) |

2023‑24 planned spending |

2024‑25 planned spending |

2025‑26 planned spending |

|---|---|---|---|---|---|---|---|

| Financial Institution and Pension Plan Regulation and Supervision | 115,090,074 | 115,971,511 | 125,624,166 | 142,174,356 | 142,174,356 | 153,453,821 | 153,197,095 |

| Actuarial Services to Federal Government Organizations | 7,156,778 | 8,054,564 | 10,210,746 | 11,891,119 | 11,891,119 | 12,339,612 | 12,996,051 |

| Subtotal | 122,246,852 | 124,026,075 | 135,834,912 | 154,065,475 | 154,065,475 | 165,793,433 | 166,193,146 |

| Internal services | 77,380,551 | 83,602,340 | 105,892,110 | 140,660,512 | 140,660,512 | 119,138,064 | 115,985,010 |

| Total | 199,627,403 | 207,628,415 | 241,727,022 | 294,725,987 | 294,725,987 | 284,931,497 | 282,178,156 |

OSFI’s total spending increased by 4% in 2021-22, largely driven by staffing of vacant positions, normal escalation / merit increases, the addition of resources to implement OSFI’s DEI strategy, as well as the acceleration of some initiatives such as the move to cloud-based technology and continued investments in data and analytics.

Overall spending increases of 16.4% in 2022-23 and 21.9% in 2023-24 are driven by the aggregate impact of the following:

- Planned spending under Financial Institution and Pension Plan Regulation and Supervision will increase by 8.3% in 2022-23 and by 13.2% in 2023-24. This is mainly due to investments in climate risk vision, digital innovation, and multi-year projects to renew the Supervisory Framework and Approvals Case Management.

- Actuarial Services to Federal Government Organizations’ planned spending will increase by 26.8% in 2022-23 and by 16.5% in 2023-24. This is mainly to develop an agile workforce consisting of subject matter experts to advise clients on current and emerging risks such as climate change, automation, labour markets, etc. The increase in 2024-25 and onwards reflect regular economic and merit increases.

- Internal Services costs will increase by 26.7% in 2022-23 and by 32.8% in 2023-24, mainly due to investments to continue OSFI’s move to the cloud, renovations of the Ottawa and Toronto offices to support a hybrid workplace, commencing of the HCM system, creation of an ERM function and the Transformation Office, and additional resources to support OSFI’s transformation journey. The reduction in 2024-25 and onwards is due to the completion of technology projects and office renovations.

Planned human resources

The following table shows information on human resources, in full-time equivalents (FTEs), for each of OSFI’s core responsibilities and for its internal services for 2023–24 and the other relevant years.

Human resources planning summary for core responsibilities and internal services

| Core responsibilities and internal services |

2020‑21 actual full-time equivalents |

2021‑22 actual full-time equivalents |

2022‑23 forecast full-time equivalents |

2023‑24 planned full-time equivalents |

2024‑25 planned full-time equivalents |

2025‑26 planned full-time equivalents |

|---|---|---|---|---|---|---|

| Financial Institution and Pension Plan Regulation and Supervision | 555 | 583 | 637 | 696 | 748 | 747 |

| Actuarial Services to Federal Government Organizations | 37 | 40 | 47 | 56 | 56 | 56 |

| Subtotal | 592 | 623 | 684 | 752 | 804 | 803 |

| Internal services | 275 | 297 | 354 | 369 | 396 | 387 |

| Total | 867 | 920 | 1038 | 1121 | 1200 | 1190 |

The increase of 53 FTEs in 2021-22 was largely due to the staffing of vacant positions under the Financial Institution and Pension Plan Regulation and Supervision core responsibility and Internal Services. The forecasted increase of 118 FTEs in 2022-23 and 83 FTEs in 2023-24 are mainly due to the implementation of OSFI’s 2022-25 Strategic Plan, which entails FTE increases across OSFI. The number of FTEs is expected to stabilize in 2025-26 once the transformation office, the HCM system, the Approvals Case Management Renewal, and IM/IT’s cloud projects are completed.

Estimates by vote

Information on OSFI’s organizational appropriations is available in the 2023–24 Main Estimates.

Future-oriented condensed statement of operations

The future-oriented condensed statement of operations provides an overview of OSFI’s operations for 2022–23 to 2023–24.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future-oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available on OSFI’s website.

| Financial information | 2022‑23 forecast results |

2023‑24 planned results |

Difference (2023‑24 planned results minus 2022‑23 forecast results) |

|---|---|---|---|

| Total expenses | 243,621,034 | 275,195,717 | 31,574,683 |

| Total revenues | 242,376,682 | 273,951,365 | 31,574,683 |

| Net cost of operations before government funding and transfers | 1,244,352 | 1,244,352 | 0 |

OSFI fully recovers its costs through collection of revenues. The difference between the figures presented in the table above and the planned spending amounts provided in other sections of the Departmental Plan is due to a different basis of accounting and relates to non-respendable revenues, amortization of capital and intangible assets, and severance and sick leave liability adjustments.

Corporate information

Organizational profile

- Appropriate minister(s): Chrystia Alexandra Freeland

- Institutional head: Peter Routledge

- Ministerial portfolio: Finance

- Enabling instrument(s):Office of the Superintendent of Financial Institutions Act (OSFI Act)

- Year of incorporation / commencement: 1987

Raison d'être, mandate and role: who we are and what we do

Information on the OSFI’s raison d'être, mandate and role is available on OSFI's website.

Operating context

Information on the operating context is available on OSFI's website.

Reporting framework

OSFI’s approved departmental results framework and program inventory for 2023–24 are as follows.

Departmental results framework

Core responsibility 1 - Financial Institution and Pension Plan Regulation and Supervision

- Departmental Result: Federally regulated financial institutions and private pensions plans are in sound financial condition

- Indicator: % of financial institutions with a Composite Risk Rating of low or moderate

- Indicator: Number of financial institutions for which the supervisory rating (i.e. risk level) has increased by two or more levels within a three month period

- Indicator: Number of pension plans for which the supervisory rating (i.e. risk level) has increased by two or more levels within a three month period

- Departmental Result: Regulatory and supervisory frameworks contribute to the safety and soundness of the Canadian financial system

- Indicator: The Office of the Superintendent of Financial Institutions’ level of compliance with the International Monetary Fund’s Financial Sector Assessment Program core principles

- Indicator: The Office of the Superintendent of Financial Institutions’ level of compliance with Basel standards as assessed by the Regulatory Consistency Assessment Programme of the Bank for International Settlements

Program inventory

- Risk Assessment and Intervention – Federally Regulated Financial Institutions

- Regulation and Guidance of Federally Regulated Financial Institutions

- Regulatory Approvals and Legislative Precedents

- Federally Regulated Private Pension Plans

Core responsibility 2 – Actuarial Services to Federal Government Organizations

- Departmental Result: Stakeholders receive accurate and high quality actuarial information on the cost of public programs and government pension and benefit plans

- Indicator: % of members of a panel of Canadian peer actuaries that deem the Canada Pension Plan actuarial valuation accurate and of high quality

- Indicator: % of public pension and insurance plan valuations that are deemed accurate and high quality.

Program inventory

- Actuarial Valuation and Advice

Core responsibility 3 – Internal Services

Supporting information on the program inventory

Supporting information on planned expenditures, human resources, and results related to OSFI's program inventory is available on GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on OSFI's website:

Federal tax expenditures

OSFI’s Departmental Plan does not include information on tax expenditures.

Tax expenditures are the responsibility of the Minister of Finance. The Department of Finance Canada publishes cost estimates and projections for government-wide tax expenditures each year in the Report on Federal Tax Expenditures. This report provides detailed information on tax expenditures, including objectives, historical background and references to related federal spending programs, as well as evaluations, research papers and gender-based analysis plus.

Organizational contact information

Mailing address

Office of the Superintendent of Financial Institutions

255 Albert Street

Ottawa, Ontario K1A 0H2

Telephone: 1-800-385-8647

Fax: 1-613-990-5591

Email:webmaster@osfi-bsif.gc.ca

Website: http://www.osfi-bsif.gc.ca/Eng/Pages/default.aspx

Appendix: Definitions

- appropriation (crédit)

-

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

-

Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

-

An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

-

A document that sets out a department's priorities, programs, expected results and associated resource requirements, covering a three-year period beginning with the year indicated in the title of the report. Departmental Plans are tabled in Parliament each spring.

- departmental result (résultat ministériel)

-

A change that a department seeks to influence. A departmental result is often outside departments' immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

-

A factor or variable that provides a valid and reliable means to measure or describe progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

-

A framework that consists of the department's core responsibilities, departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

-

A report on a department's actual performance in a fiscal year against its plans, priorities and expected results set out in its Departmental Plan for that year. Departmental Results Reports are usually tabled in Parliament each fall.

- full-time equivalent (équivalent temps plein)

-

A measure of the extent to which an employee represents a full person-year charge against a departmental budget. Full-time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

-

An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives. GBA Plus is a process for understanding who is impacted by the issue or opportunity being addressed by the initiative; identifying how the initiative could be tailored to meet diverse needs of the people most impacted; and anticipating and mitigating any barriers to accessing or benefitting from the initiative. GBA Plus is an intersectional analysis that goes beyond biological (sex) and socio-cultural (gender) differences to consider other factors, such as age, disability, education, ethnicity, economic status, geography, language, race, religion, and sexual orientation.

- government-wide priorities (priorités pangouvernementales)

-

For the purpose of the 2023–24 Departmental Plan, government-wide priorities are the high-level themes outlining the Government's agenda in the 2021 Speech from the Throne: building a healthier today and tomorrow; growing a more resilient economy; bolder climate action; fighter harder for safer communities; standing up for diversity and inclusion; moving faster on the path to reconciliation and fighting for a secure, just, and equitable world.

- high impact innovation (innovation à impact élevé)

-

High impact innovation varies per organizational context. In some cases, it could mean trying something significantly new or different from the status quo. In other cases, it might mean making incremental improvements that relate to a high-spending area or addressing problems faced by a significant number of Canadians or public servants.

- horizontal initiative (initiative horizontale)

-

An initiative in which two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non-budgetary expenditures (dépenses non budgétaires)

-

Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

-

What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- plan (plan)

-

The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

- planned spending (dépenses prévues)

-

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- program (programme)

-

Individual or groups of services, activities or combinations thereof that are managed together within a department and that focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

-

An inventory of a department's programs that describes how resources are organized to carry out the department's core responsibilities and achieve its planned results.

- result (résultat)

-

An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead, they are within the area of the organization's influence.

- statutory expenditures (dépenses législatives)

-

Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

-

A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

-

Expenditures that Parliament approves annually through an Appropriation Act. The vote wording becomes the governing conditions under which these expenditures may be made.

Footnotes

- Footnote 1

-

Financial Information Committee (FIC) is comprised of OSFI (Chair), the Bank of Canada and the Canada Deposit Insurance Corporation (CDIC). FIC was created under the auspices of FISC to govern the collection and sharing of regulatory data.