Auditor’s Report Filing Confirmation

Information

Table of contents

Introduction

The purpose of this Instruction Guide is to assist administrators of pension plans registered, or having filed an application for registration, under the Pension Benefits Standards Act, 1985 (PBSA) in completing the Auditor's Report Filing Confirmation (ARFC) that is required to be filed with the Office of the Superintendent of Financial Institutions (OSFI). The Instruction Guide also assists administrators with submitting, if required, an Auditor’s Report.

Please note that a separate guide exists for completing the OSFI 60 - Certified Financial Statements.

The Instruction Guide does not supersede the requirements of the PBSA, the Pension Benefits Standards Regulations, 1985 (PBSR), the Directives of the Superintendent Pursuant to the Pension Benefits Standards Act, 1985 or any guidelines that OSFI has issued or may issue regarding the administration of pension plans subject to the PBSA.

A glossary of some of the terms used in this Instruction Guide is provided in Appendix A.

Who must file

The administrator of a pension plan registered, or having filed an application for registration, under the PBSA, or its agent, must file the ARFC and, if required, an Auditor’s Report.

Filing due date

The ARFC and, if required, an Auditor's Report must be filed within six months after the end of the plan year to which they relate

Filing requirements

The administrator must submit the ARFC and, if required, an Auditor’s Report using the Regulatory Reporting System (RRS).

For further information on how to file using RRS, please consult the Manage Financial Returns User Guide for Insurance Companies and Private Pension Plans (PDF) and other RRS training material available on the OSFI website. RRS training material can also be found in RRS in the Documents folder under Training and Support.

Auditor's Report Filing Confirmation

To determine if an Auditor’s Report is required to be filed, the filer must complete the ARFC by answering the four questions below:

-

Are all assets of the pension fund held by one insurance company in any type of account?

-

Are all assets of the pension fund held in the pooled funds of one trust company?

-

Are all assets of the pension fund held by one trust company but not in its pooled funds, and the fair market value of the total assets of the pension fund is less than $5,000,000?

-

Is the plan a fully insured plan (i.e., all benefits are paid by means of an annuity or insurance contract)?

If the answer is "yes" to any of questions 1 to 4, then an Auditor's Report is not required to be submitted with the ARFC. You may submit the ARFC return with no files uploaded.

All other plans (i.e., if the answer is “no” to all questions), including plans funded through a Pension Fund Society, are required to submit an Auditor’s Report by uploading a copy of the document within the ARFC return. If an Auditor’s Report is required, submitting the ARFC with no files uploaded, will return an error message.

The following types of Auditor's Reports may be filed with OSFI:

-

An Auditor's Report filed on the pension fund – OSFI will accept a statement in the Auditor's Report indicating that the financial statements have been prepared for filing with the regulator and are not appropriate for any other purpose.

-

An Auditor's Report filed on the financial statements of the pension plan – OSFI will accept an Auditor's Report on the financial statements of the pension plan that is prepared in accordance with Section 4600 of the Chartered Professional Accountants (CPA) Canada Handbook – Accounting (the Handbook). Section 4600 of the Handbook is the primary accounting standard for pension plans.

When required, please follow the steps below to upload the Auditor’s Report by completing questions 5.a) and 5.b):

-

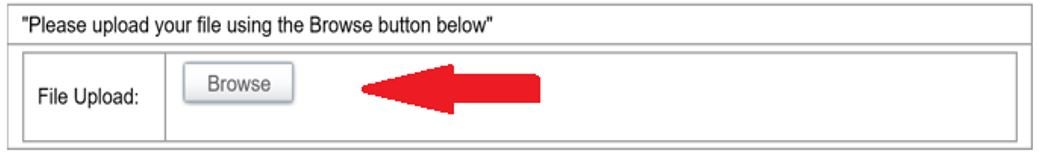

Click the "Browse" button provided in the ARFC to find the Auditor's Report you would like to upload

-

Find the Auditor's Report within your computer and select it;

-

Click "Upload" once the file is selected; and

-

Follow the remaining instructions to upload the Auditor's Report into RRS.

-

Indicate if the Auditor’s opinion is qualified by answering “yes” or “no”.

The ARFC can be submitted once the Auditor’s Report, if required, has been uploaded to the ARFC return under question 5.a) and question 5.b) has been answered.

Contact details

For further information, please visit the OSFI website or contact us at:

Telephone: (613) 991-0609 or 1-800-385-8647

Email: ReturnsAdmin@osfi-bsif.gc.ca

Appendix A – Glossary

- Auditor's Report

- Also known as the auditor’s opinion, is the opinion of the auditor with respect to the financial statements that have been prepared for the pension fund or pension plan.

- Insured plan

- Is a pension plan for which all benefits are paid by means of an annuity or insurance contract issued by an organization authorized to carry on a life insurance business in Canada and under which the organization is obligated to pay all the benefits set out in the plan.

- Mutual fund or Pooled fund

Amendments to the PBSR replaced references to “Mutual Fund” and “Pooled Fund” with “Investment Fund”. - Is a fund that includes several securities or categories of securities (shares, bonds, mortgages, etc.) established by a corporation that is duly authorized to operate a fund in which moneys from two or more depositors are accepted for investment and where units allocated to each depositor serve to establish at any time the proportionate interest of each depositor in the assets of the fund.

- Pension fund

- In relation to a pension plan, means a fund maintained to provide benefits under or related to the pension plan.