General Guidelines for Use of Letters of Credit (LOC’s)

Background

This document provides Federally Regulated Insurance Institutions with guidance on OSFI’s requirements relating to letters of credit (LOC) approvals.

OSFI will recognize an approved LOC as security for the purposes of:

- reducing the reserve and required coverage for unregistered reinsurance, and

- admitting Self Insured Retention (SIR) recoverable for the capital test.

Guidelines

- Letters of Credit must adhere strictly to OSFI’s standard wording.

- There are two different LOCs that may be used – one for Unregistered Reinsurance and one for Self-Insured Retention (“SIR”). Applicants should instruct the issuing bank which type of LOC is required. Templates are posted on OSFI’s website.

- For the Insurance Company to obtain a capital credit for an LOC, the LOC must be approved by the Superintendent.

- Any change in the amount of this LOC must be approved by the Superintendent.

- LOCs from foreign banks must have a separate confirming letter from a Canadian bank. If the LOC is issued by a foreign bank, the bank address shown in the body of the LOC can be either that of issuing bank or of the Canadian confirming bank (in practice the Canadian bank’s address is usually used).

- The letter of credit must be irrevocable and be subject to International Standby Practices (ISP98).

- LOCs must be for a fixed term of at least one year.

- LOCs must be for a stipulated dollar amount.

- LOCs must be evergreen, unconditional and be in the currency of the business reinsured, issued or confirmed by a Canadian financial institution.

- LOCs must be irrevocable except with at least three months’ notice to the Office of the Superintendent of Financial Institutions. This condition can be satisfied either by a provision in the letter of credit or by confirmation from the issuing bank.

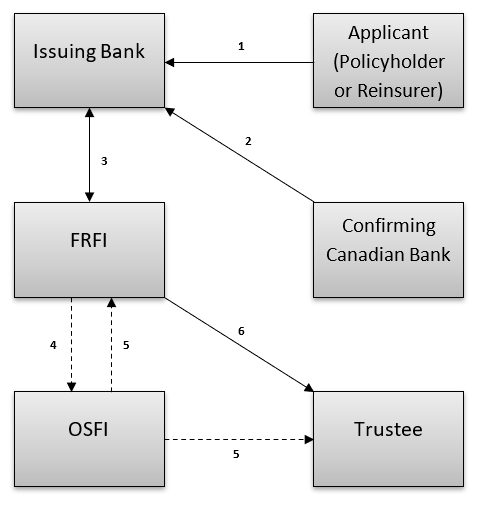

Process

- The applicant requests an LOC from the issuing bank.

- If the issuing bank is a foreign bank, the LOC requires confirmation of a Canadian bank.

- Issuer (bank) sends original (or amendment) to the Insurance Company (Canadian or Foreign Company) for review. The Insurance Company will ensure details are correct and that the LOC meets OSFI Guidelines.

- Insurance Company forwards a soft copy of LOC or amendment to OSFI via email for review.

- Once approved, OSFI will notify the Insurance Company and Trustee (if applicable) via email.

- Foreign Insurance Company forwards original documentation to the trustee for safekeeping.

If the FRFI is a Canadian Insurance Company, the LOC is kept for safekeeping.

Of note, OSFI cannot demand that the issuer comply with our requests. Further instruction must come from the applicant and/or the beneficiary, who should also follow up to ensure OSFI requests are complied with. If required changes are not submitted, the LOC and/or amendment remain outstanding and unapproved.

Overview of the process