Actuarial Report (32nd) on the Canada Pension Plan

Accessibility statement

The Web Content Accessibility Guidelines (WCAG) defines requirements for designers and developers to improve accessibility for people with disabilities. It defines three levels of conformance: Level A, Level AA, and Level AAA. This report is partially conformant with WCAG 2.0 level AA. If you require a compliant version, please contact webmaster@osfi-bsif.gc.ca.

14 November 2025

The Honourable François-Philippe Champagne, P.C., M.P.

Minister of Finance and National Revenue

Ottawa, Canada

K1A 0A6

Dear Minister:

In accordance with section 115 of the Canada Pension Plan, which provides that an actuarial report shall be prepared every three years for purposes of the financial state review by the Minister of Finance and the ministers of the Crown from the provinces, I am pleased to submit the Thirty-Second Actuarial Report on the Canada Pension Plan, prepared as at 31 December 2024.

Yours sincerely,

Assia Billig, FCIA, FSA, PhD

Chief Actuary

Table of content

- 1 Highlights of the report

- 2 Introduction

- 3 Methodology

- 4 Best‑estimate assumptions

- 5 Results - base CPP

- 6 Results – additional CPP

- 7 Reconciliation with previous triennial report

- 8 Actuarial opinion

- Appendix A - Summary of plan provisions

- Appendix B - Data, assumptions and methodology

- Appendix C - Financing the Canada Pension Plan

- Appendix D - Detailed reconciliation with previous triennial report

- Appendix E - Uncertainty of results

- Appendix F - Adjustment factors

List of tables

- Table 1 Best-estimate assumptions from 32nd report compared with 31st report - Canada

- Table 2 Population of Canada less Quebec

- Table 3 Economic assumptions

- Table 4 Contributions - base CPP

- Table 5 Beneficiaries - base CPP

- Table 6 Beneficiaries by sex - base CPP

- Table 7 Expenditures - base CPP

- Table 8 Expenditures - base CPP, year 2025 constant dollars

- Table 9 Expenditures as percentage of contributory earnings - base CPP

- Table 10 Historical results - base CPP

- Table 11 Financial projections - base CPP, statutory contribution rate of 9.9%

- Table 12 Financial projections - base CPP, statutory contribution rate of 9.9%, year 2025 constant dollars

- Table 13 Sources of revenues and funding of expenditures - base CPP, statutory contribution rate of 9.9%

- Table 14 Financial projections - base CPP, minimum contribution rate of 9.21% for 2028 to 2033, 9.19% for 2034+

- Table 15 Progression of minimum contribution rate over time – base CPP

- Table 16 Contributions - additional CPP

- Table 17 Beneficiaries - additional CPP

- Table 18 Beneficiaries by sex – additional CPP

- Table 19 Expenditures - additional CPP

- Table 20 Expenditures – additional CPP, year 2025 constant dollars

- Table 21 Historical results - additional CPP

- Table 22 Financial projections - additional CPP, statutory first and second additional contribution rates of 2.0% and 8.0%

- Table 23 Financial projections - statutory first and second additional contribution rates of 2.0% and 8.0%, year 2025 constant dollars

- Table 24 Sources of revenues - additional CPP, statutory first and second additional contribution rates of 2.0% and 8.0%

- Table 25 Financial projections - additional CPP, first and second additional minimum contribution rates of 2.01% and 8.04%

- Table 26 Progression of additional minimum contribution rates over time

- Table 27 Change in assets - 31 December 2021 to 31 December 2024 - base CPP

- Table 28 Summary of expenditures – 2022 to 2024 – base CPP

- Table 29 Reconciliation of changes in minimum contribution rate

- Table 30 Change in assets - 31 December 2021 to 31 December 2024 - additional CPP

- Table 31 Summary of expenditures – 2022 to 2024 – additional CPP

- Table 32 Reconciliation of changes in additional minimum contribution rates

- Table 33 Scheduled contribution rates as per legislation

- Table 34 Projected maximum additional CPP retirement benefit

- Table 35 Projected maximum additional CPP disability benefit

- Table 36 Projected maximum additional CPP survivor's benefit, survivor under age 65

- Table 37 Projected maximum additional CPP survivor's benefit, survivor age 65 or over

- Table 38 Data Sources

- Table 39 Cohort fertility rates by age and year of birth

- Table 40 Annual fertility rates by age group

- Table 41 Assumed annual mortality improvement rates for Canada

- Table 42 Mortality rates for Canada

- Table 43 Life expectancies for Canada, without mortality improvements after the year shown

- Table 44 Life expectancies for Canada, with mortality improvements after the year shown

- Table 45 Population of Canada by age

- Table 46 Population of Canada less Quebec by age

- Table 47 Analysis of population of Canada less Quebec by age

- Table 48 Births, net migrants, and deaths for Canada less Quebec

- Table 49 Active and employed populations (Canada, ages 15 and over)

- Table 50 Labour force participation, employment, and unemployment rates (Canada, ages 15 and over)

- Table 51 Labour force participation rates (Canada)

- Table 52 Employment of population (Canada, ages 18 to 69)

- Table 53 Active and employed populations (Canada less Quebec, ages 15 and over)

- Table 54 Labour force participation rates (Canada less Quebec)

- Table 55 Employment of population and proportion of earners (Canada less Quebec, ages 18 to 69)

- Table 56 Real wage increase and related components

- Table 57 Average annual earnings (Canada less Quebec, by age group)

- Table 58 Total earnings (Canada less Quebec, ages 18 to 69)

- Table 59 Average pensionable earnings up to YMPE (Canada less Quebec)

- Table 60 Average pensionable earnings up to YAMPE (Canada less Quebec)

- Table 61 Proportion of contributors to the CPP, by age group

- Table 62 Total adjusted contributory earnings for pensionable earnings up to YMPE

- Table 63 Total adjusted contributory earnings for pensionable earnings up to YAMPE

- Table 64 Net assets as at 31 December 2024

- Table 65 Initial asset mix as at 31 December 2024 for base and additional CPP

- Table 66 Real rates of return by asset type (before investment expenses and allocation for rebalancing and diversification)

- Table 67 Asset mix, portfolio risk, and expected rates of return (before investment expenses)

- Table 68 Additional CPP pool structure

- Table 69 Asset mix, portfolio risk, and expected rates of return (before investment expenses)

- Table 70 Ultimate rates of return on base and additional CPP assets (2042+)

- Table 71 Annual rates of return on CPP assets

- Table 72 Benefits payable as at 31 December 2024 – base and additional CPP

- Table 73 Benefit eligibility rates by type of benefit

- Table 74 Average earnings-related benefit as percentage of maximum benefit - base CPP

- Table 75 Average additional earnings-related benefit as percentage of maximum additional benefit - additional CPP

- Table 76 Retirement pension take-up rates (cohort aged 65 in 2031+)

- Table 77 New retirement beneficiaries and pensions - base CPP

- Table 78 New retirement beneficiaries and pensions - additional CPP

- Table 79 Mortality rates of retirement beneficiaries

- Table 80 Life expectancies of retirement beneficiaries, with improvements after the year shown

- Table 81 CPP working beneficiaries who are contributors as a proportion of retirement beneficiaries (2025+)

- Table 82 Average contributory earnings of working beneficiaries with pensionable earnings up to the YMPE

- Table 83 Average contributory earnings of working beneficiaries with pensionable earnings up to the YAMPE

- Table 84 Working beneficiaries - contributors, contributions, and post-retirement benefits

- Table 85 Ultimate disability incidence rates (2029+)

- Table 86 Number of new disability beneficiaries

- Table 87 New disability pensions and post-retirement disability benefits

- Table 88 Disability termination rates in 2025 and 2035 (ultimate), by age, sex, and duration of disability

- Table 89 Assumed proportion of contributors married or in a common-law relationship at time of death (2026+)

- Table 90 Number of new survivor beneficiaries - base CPP

- Table 91 Number of new survivor beneficiaries - additional CPP

- Table 92 Average new monthly survivor's pension - base CPP

- Table 93 Average new survivor pension - additional CPP

- Table 94 Mortality rates of survivor beneficiaries

- Table 95 Life expectancies of survivor beneficiaries, with improvements after the year shown

- Table 96 Number of death benefits

- Table 97 New children's benefits

- Table 98 Operating expenses – base CPP

- Table 99 Operating expenses - additional CPP

- Table 100 Full funding rates in respect of the amendments to the base CPP

- Table 101 Additional CPP balance sheet (open group basis)

- Table 102 Base CPP balance sheet (open group basis)

- Table 103 Additional CPP balance sheet (open group basis)

- Table 104 Reconciliation of changes in minimum contribution rate - base CPP

- Table 105 Reconciliation of changes in additional minimum contribution rates

- Table 106 Base CPP MCR as at December 31, 2024 based on different levels of starting assets

- Table 107 Probability distribution of MCR as at 31 December 2027 based on 2025-2027 intervaluation investment experience

- Table 108 Additional CPP FAMCR as at December 31, 2045 based on different levels of starting assets

- Table 109 Probability distribution of FAMCR as at 31 December 2048 based on 2046-2048 investment returns experience

- Table 110 Individual sensitivity test assumptions - Canada

- Table 111 Sensitivity of base CPP minimum contribution rate

- Table 112 Sensitivity of additional CPP minimum contribution rates

- Table 113 Higher and lower economic growth sensitivity scenarios

- Table 114 Assumed annual nominal wage increase by category of earners and scenario (2025-2055)

- Table 115 Impact on the base CPP MCR of different earners and earnings distributions

- Table 116 Climate change impact on economic and investment assumptions

- Table 117 Climate change impact on base CPP MCR

- Table 118 Alternative assumptions – Changes relative to CPP32 best-estimate assumptions

- Table 119 Adjustment factors

- Table 120 Cumulative adjustments from adjustment factors on the retirement pension by age

List of charts

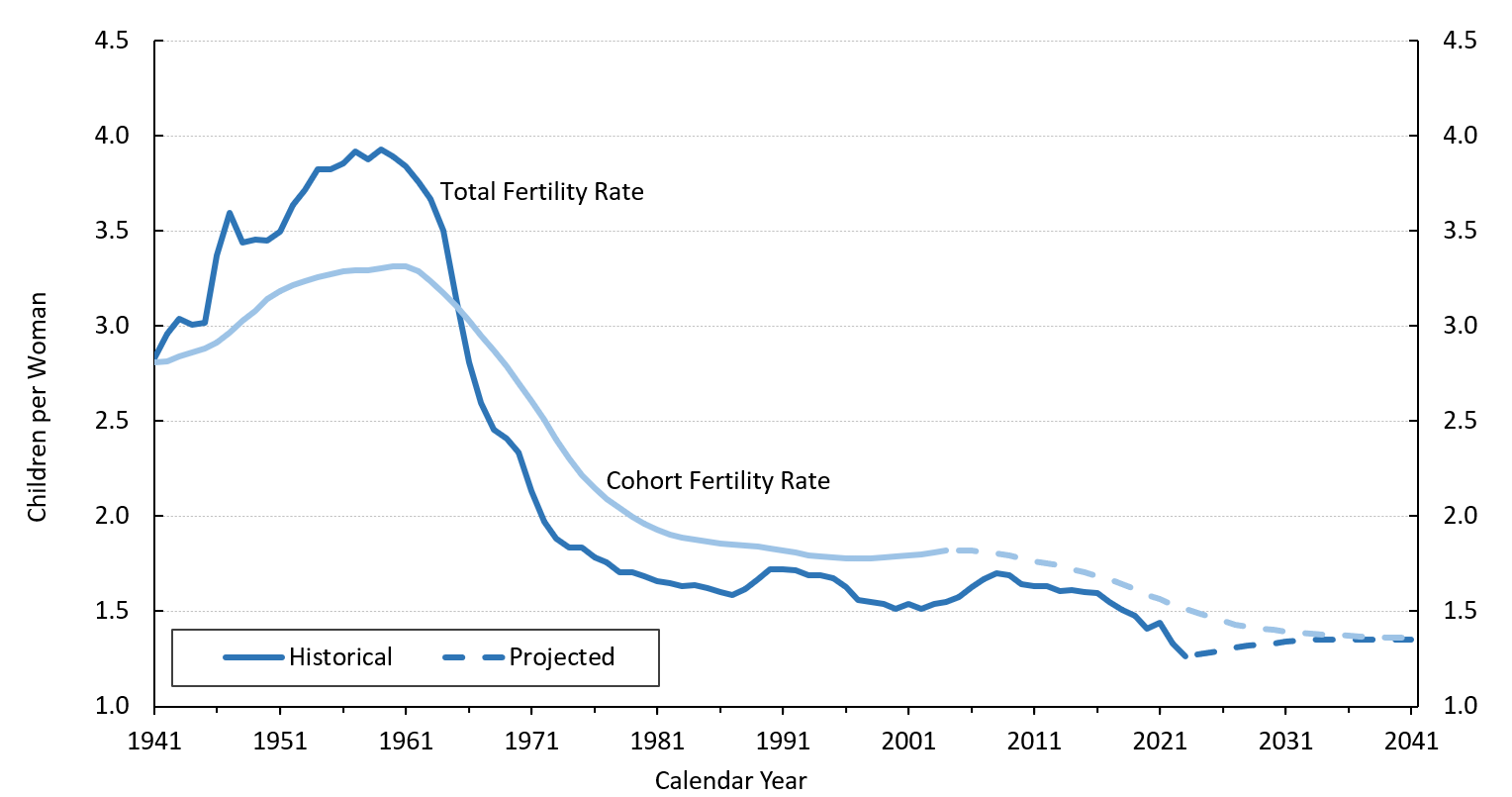

- Chart 1 Historical and projected total and cohort fertility rates for Canada

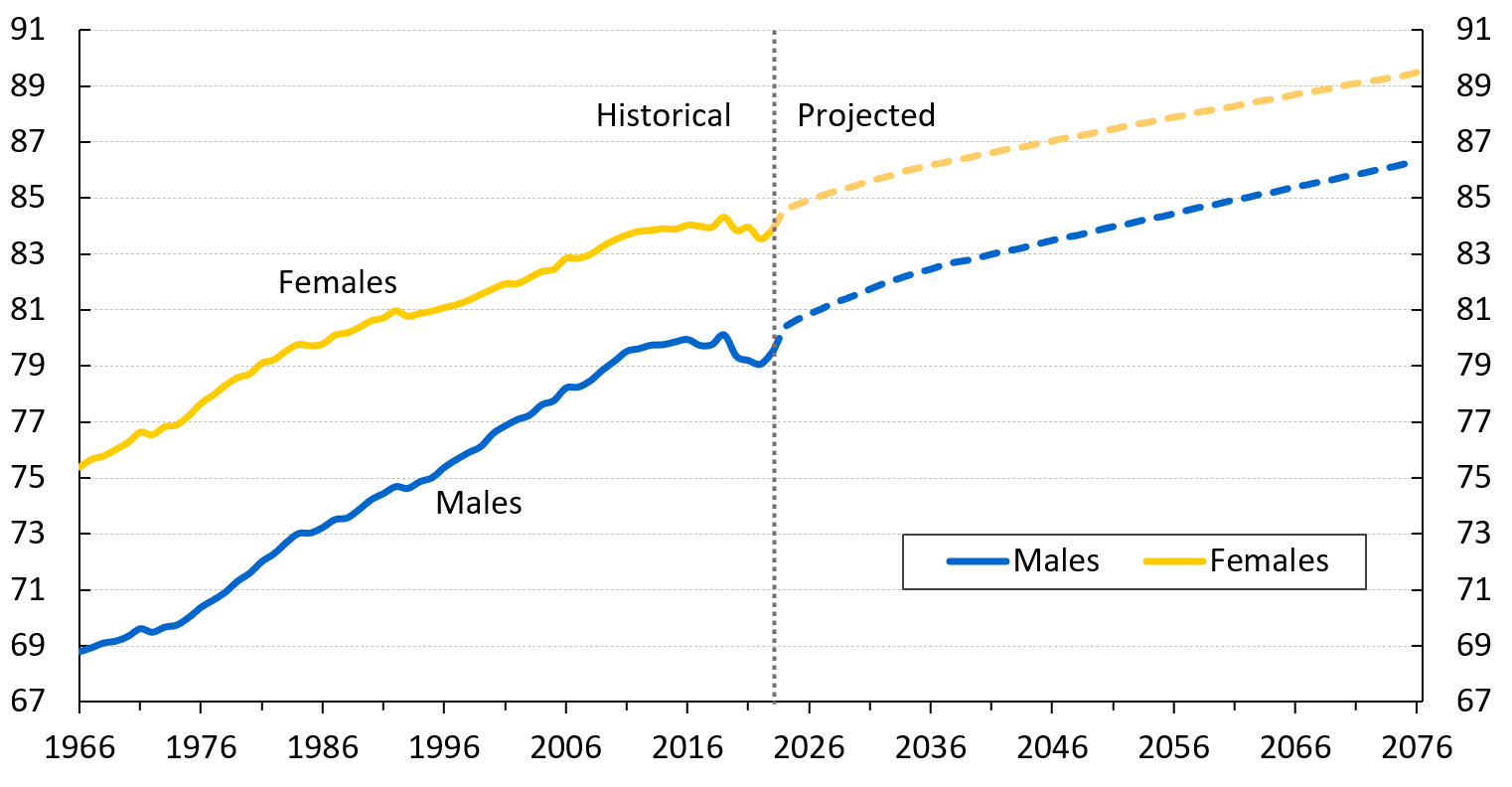

- Chart 2 Life expectancies at birth for Canada, without mortality improvements after the year shown

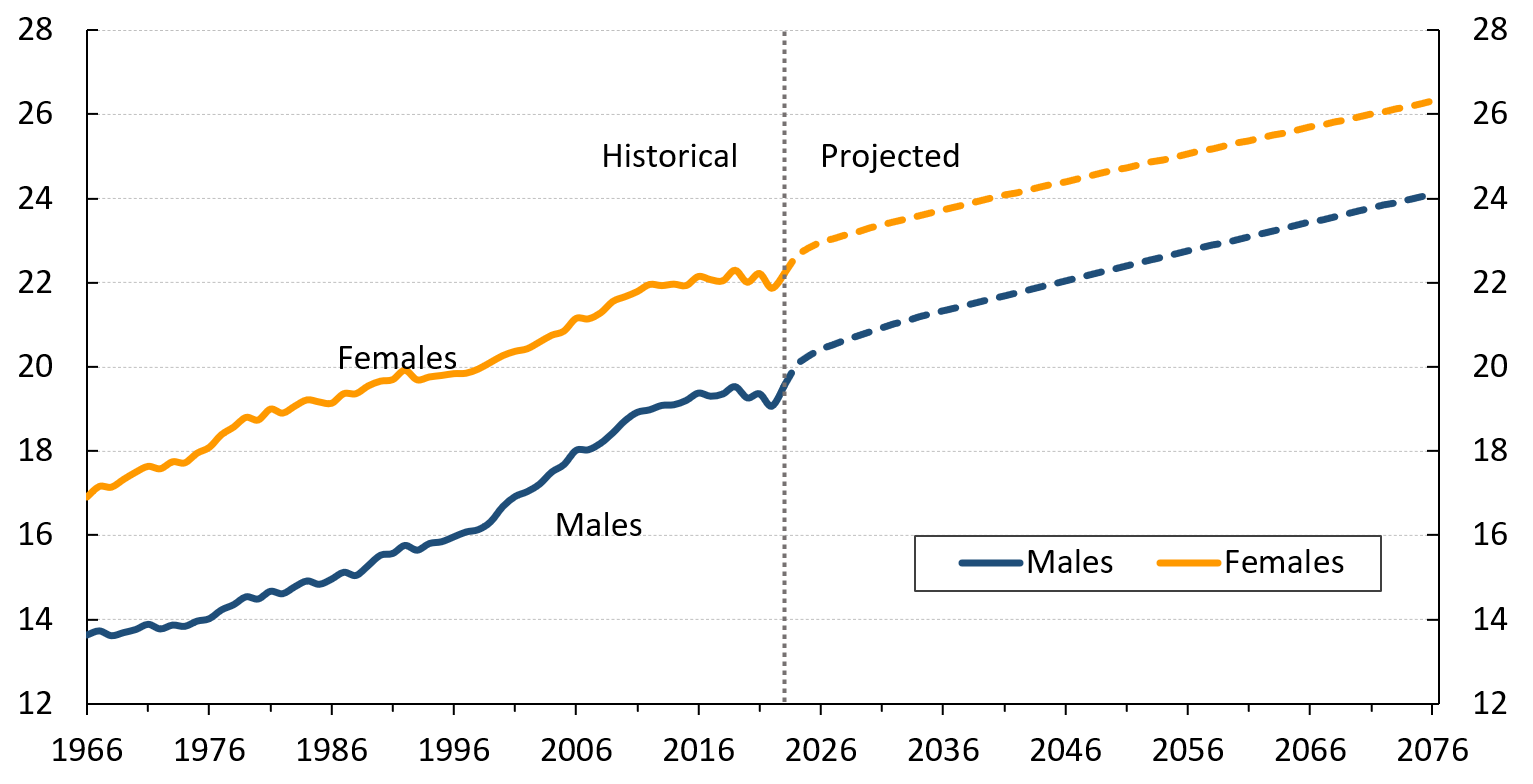

- Chart 3 Life expectancies at Age 65 for Canada, without mortality improvements after the year shown

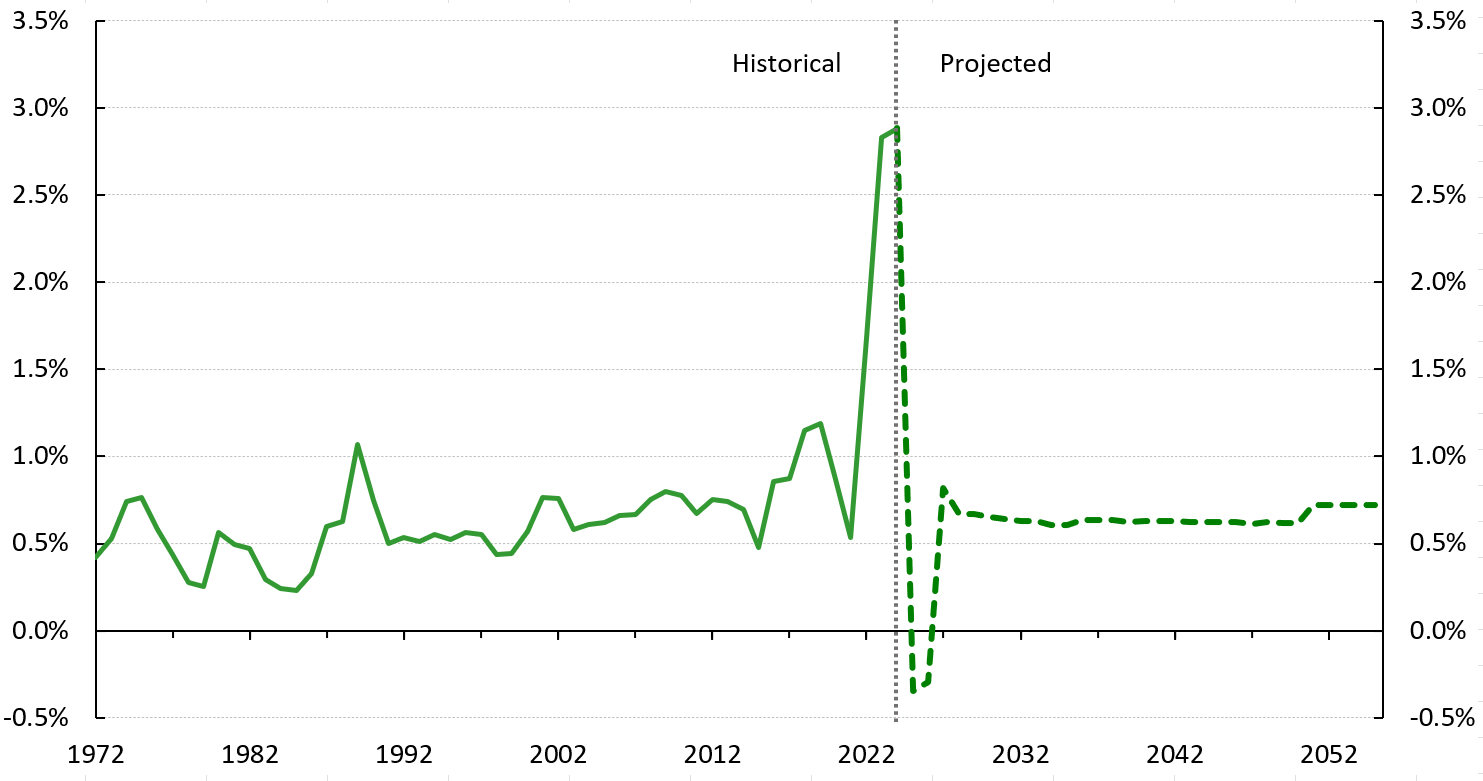

- Chart 4 Net migration rate (Canada)

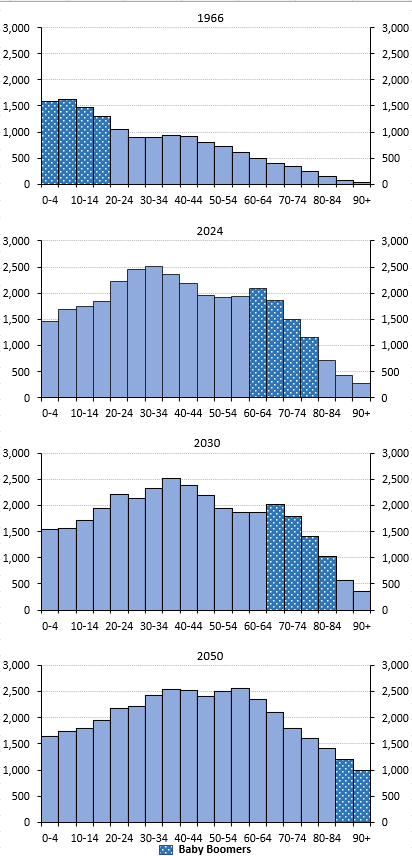

- Chart 5 Age distribution of the population of Canada less Quebec

- Chart 6 Population of Canada less Quebec

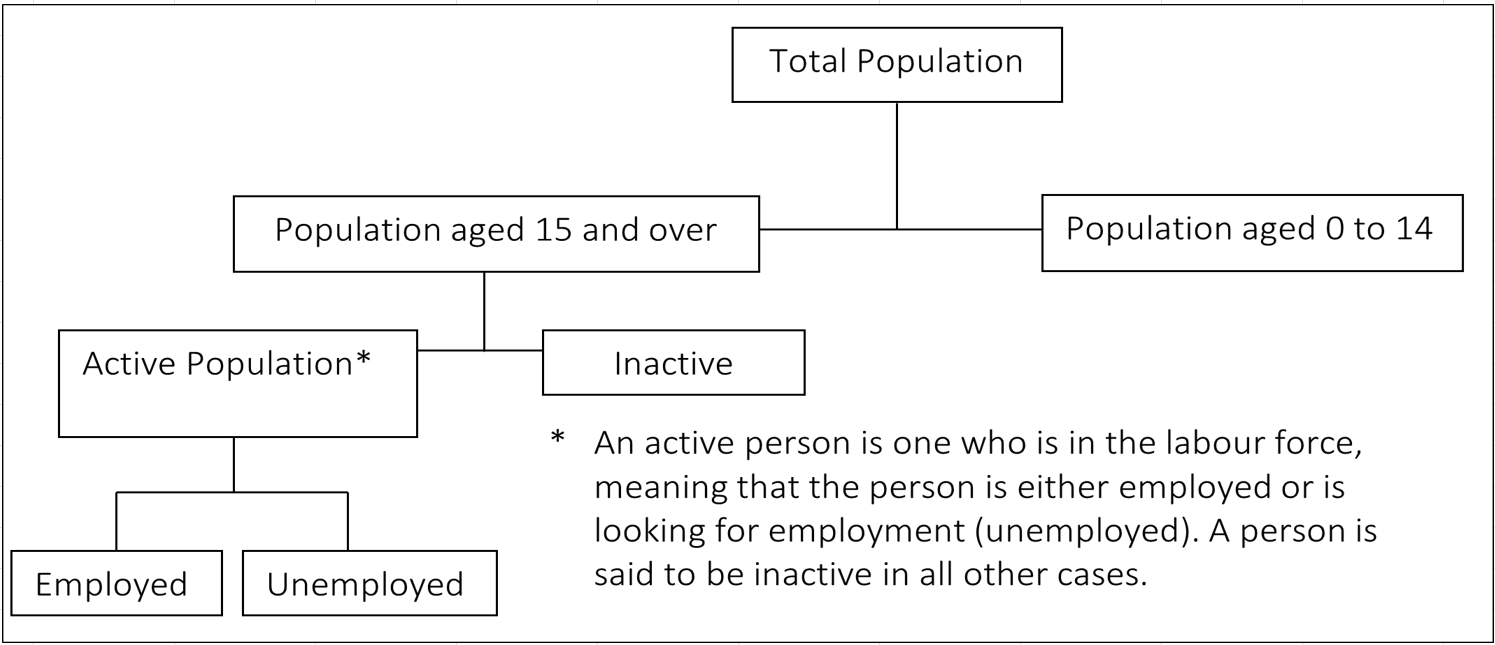

- Chart 7 Components of the labour market

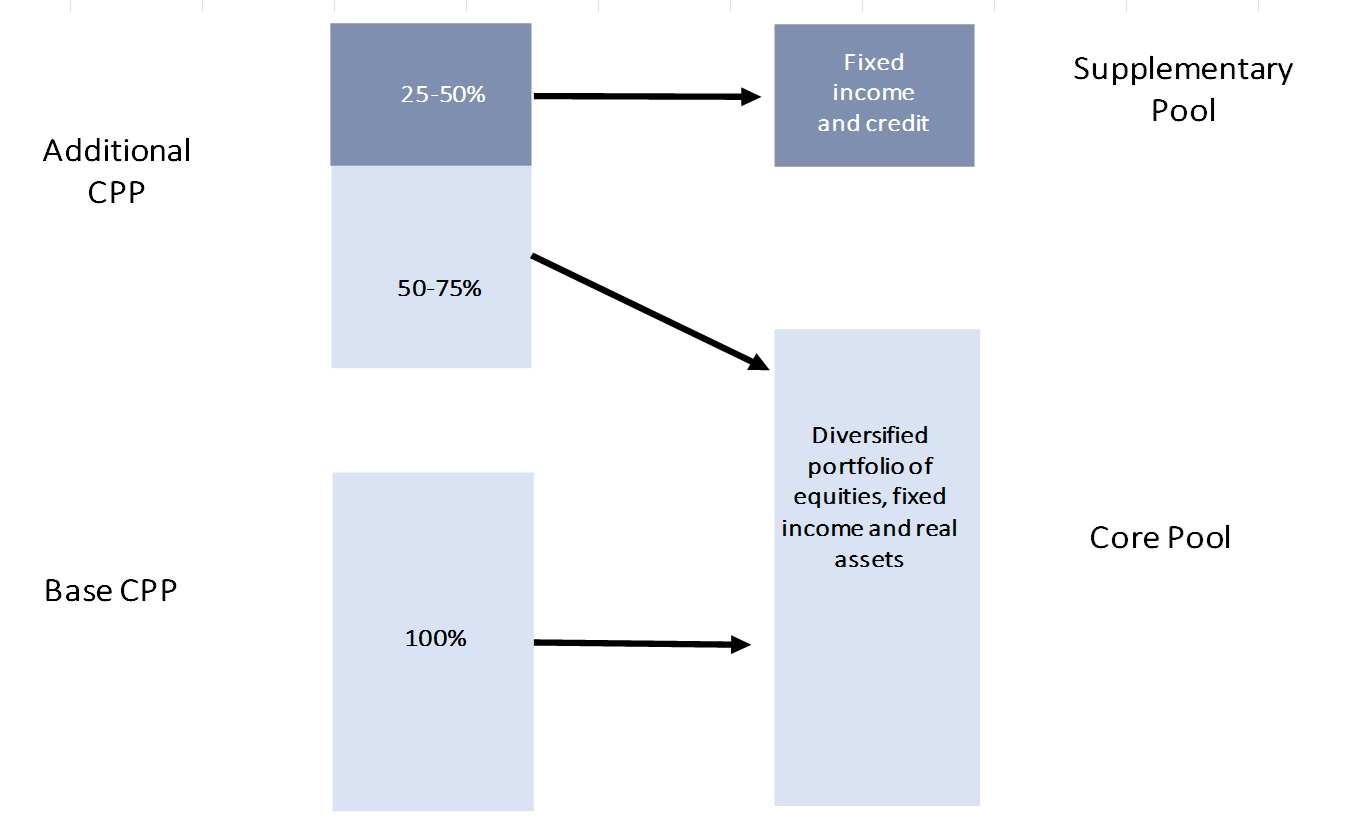

- Chart 8 Illustrative two-pool investment structure of the CPPIB

- Chart 9 Historical and projected retirement pension take-up rates for males at ages 60, 65 and 70

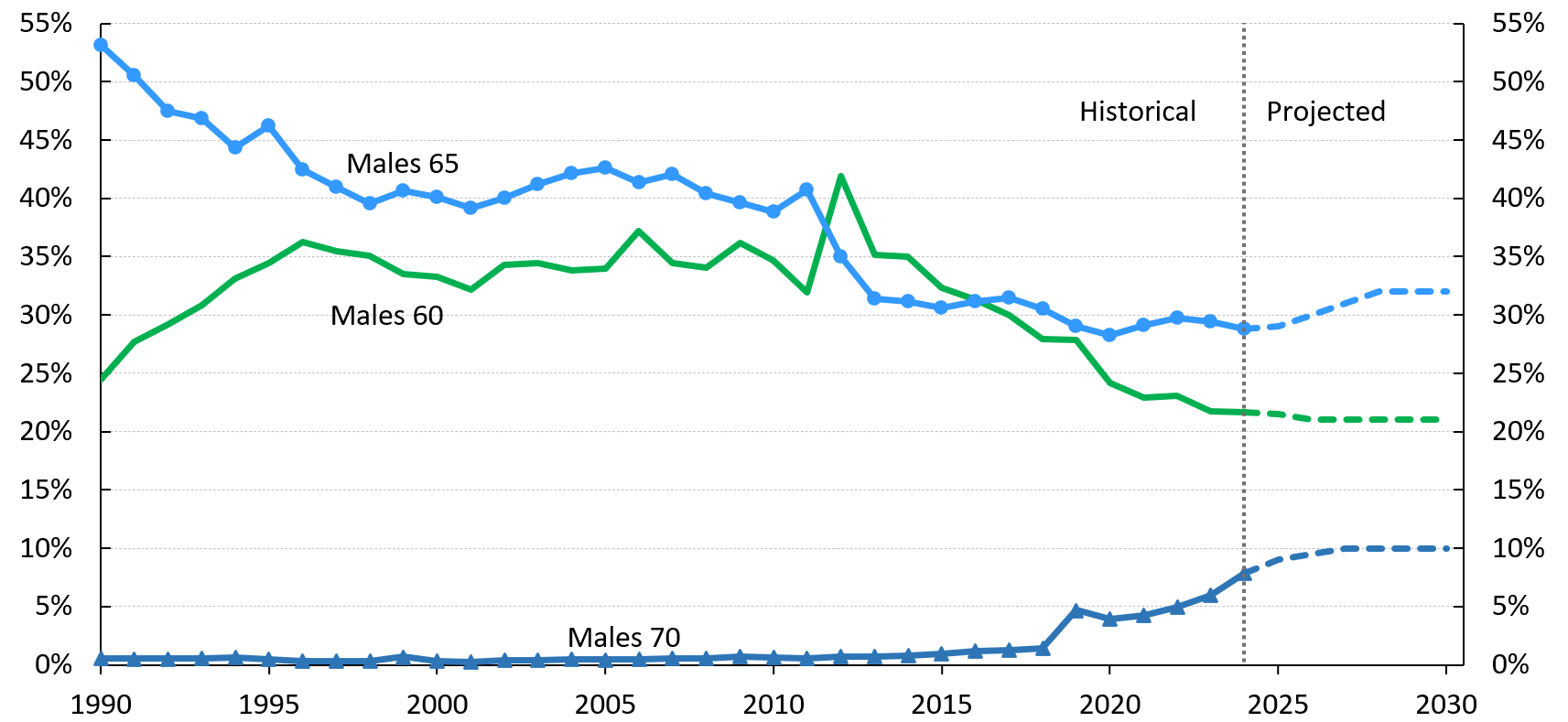

- Chart 10 Historical and projected retirement pension take-up rates for females at ages 60, 65 and 70

- Chart 11 Historical disability incidence rates

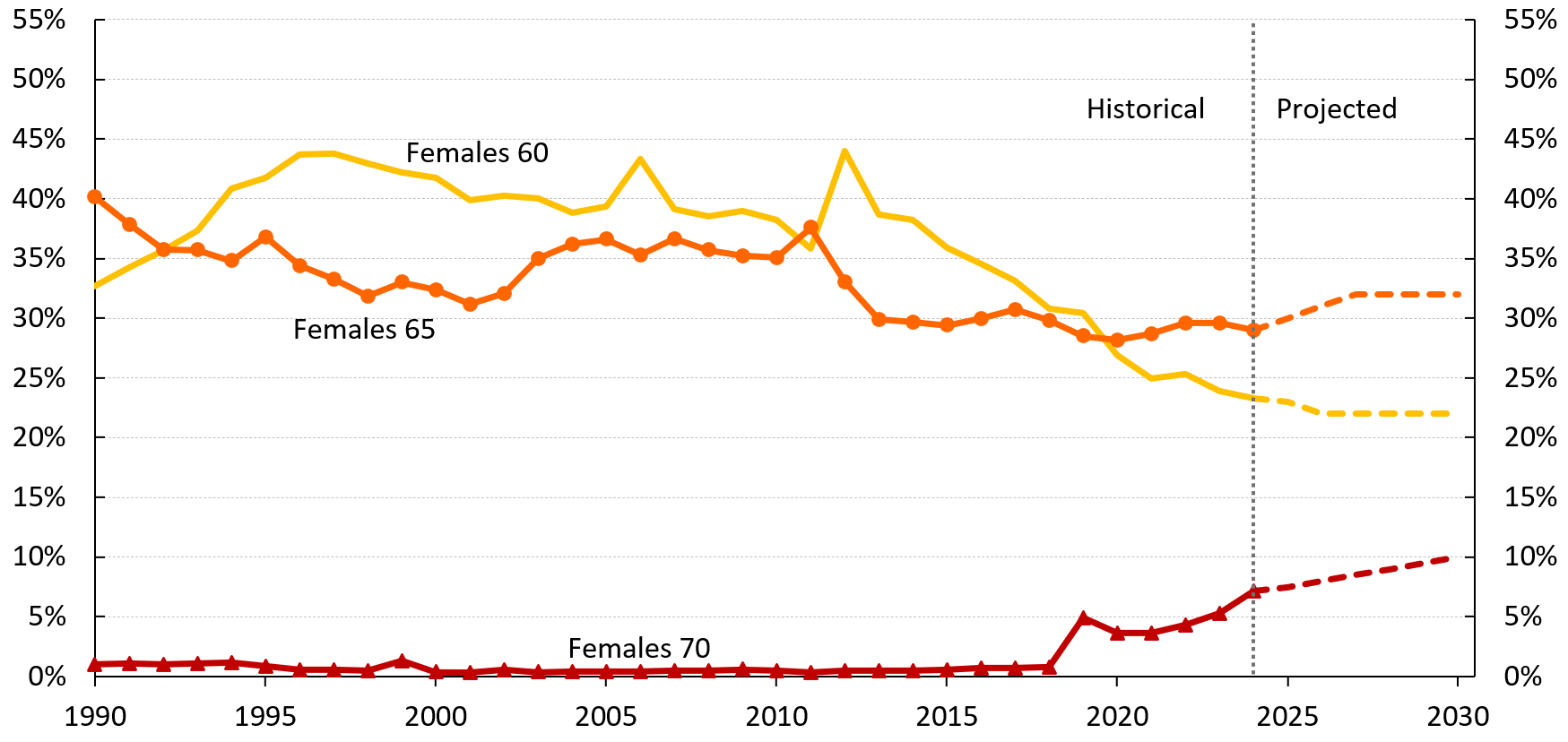

- Chart 12 Assets/Expenditures ratio – base CPP (statutory and minimum contribution rates)

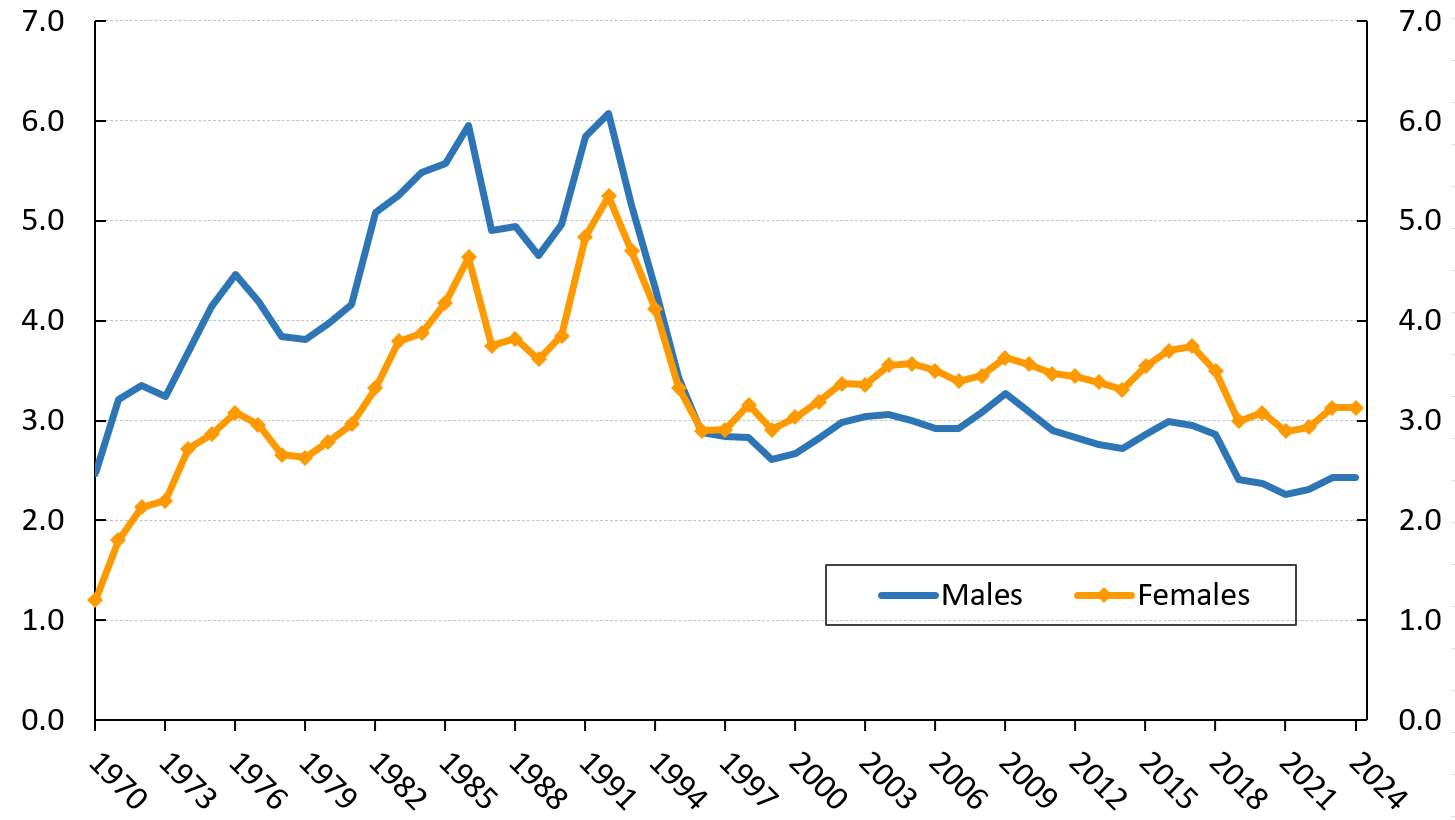

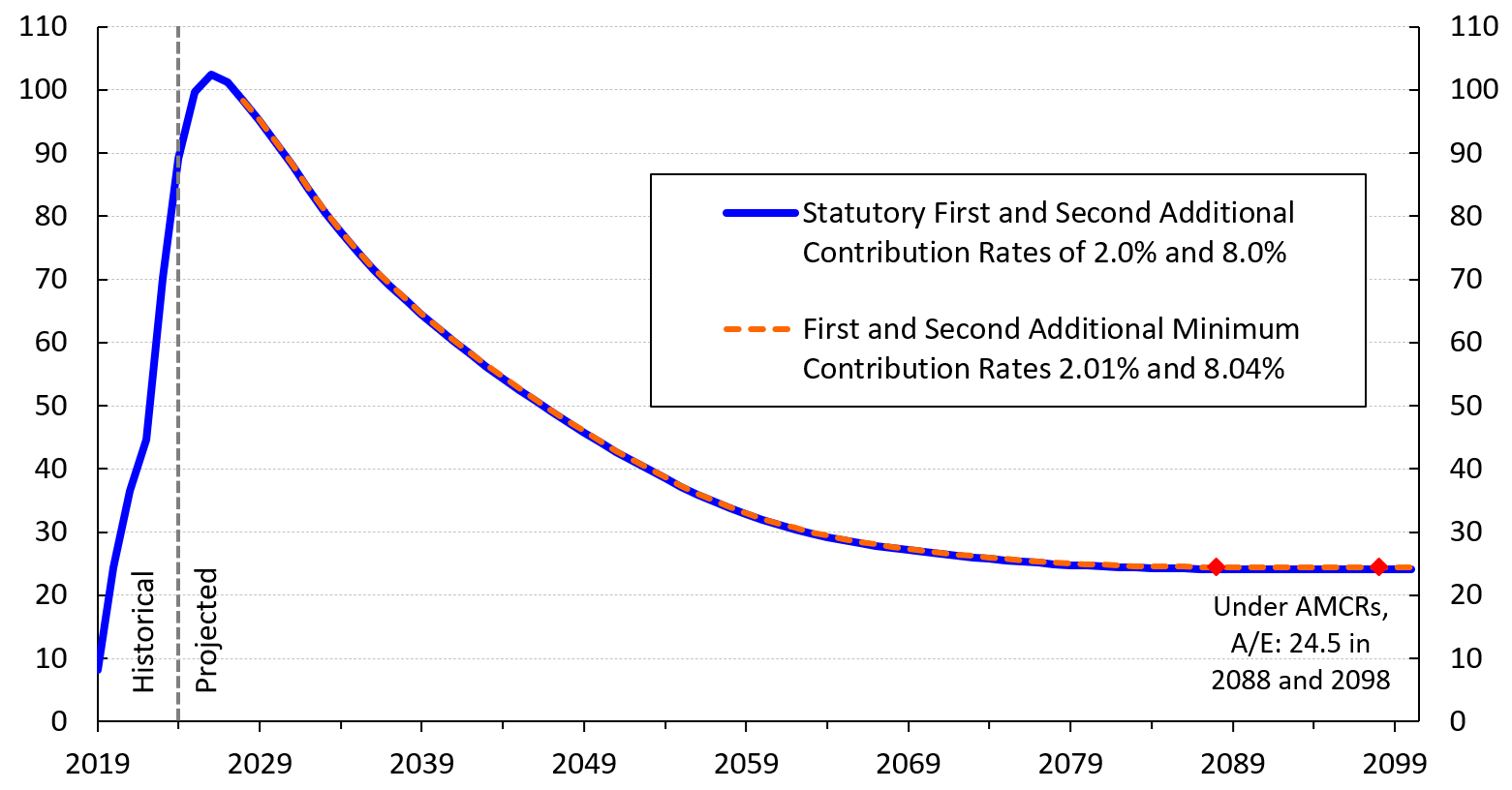

- Chart 13 Assets/Expenditures ratio – additional CPP (statutory and additional minimum contribution rates)

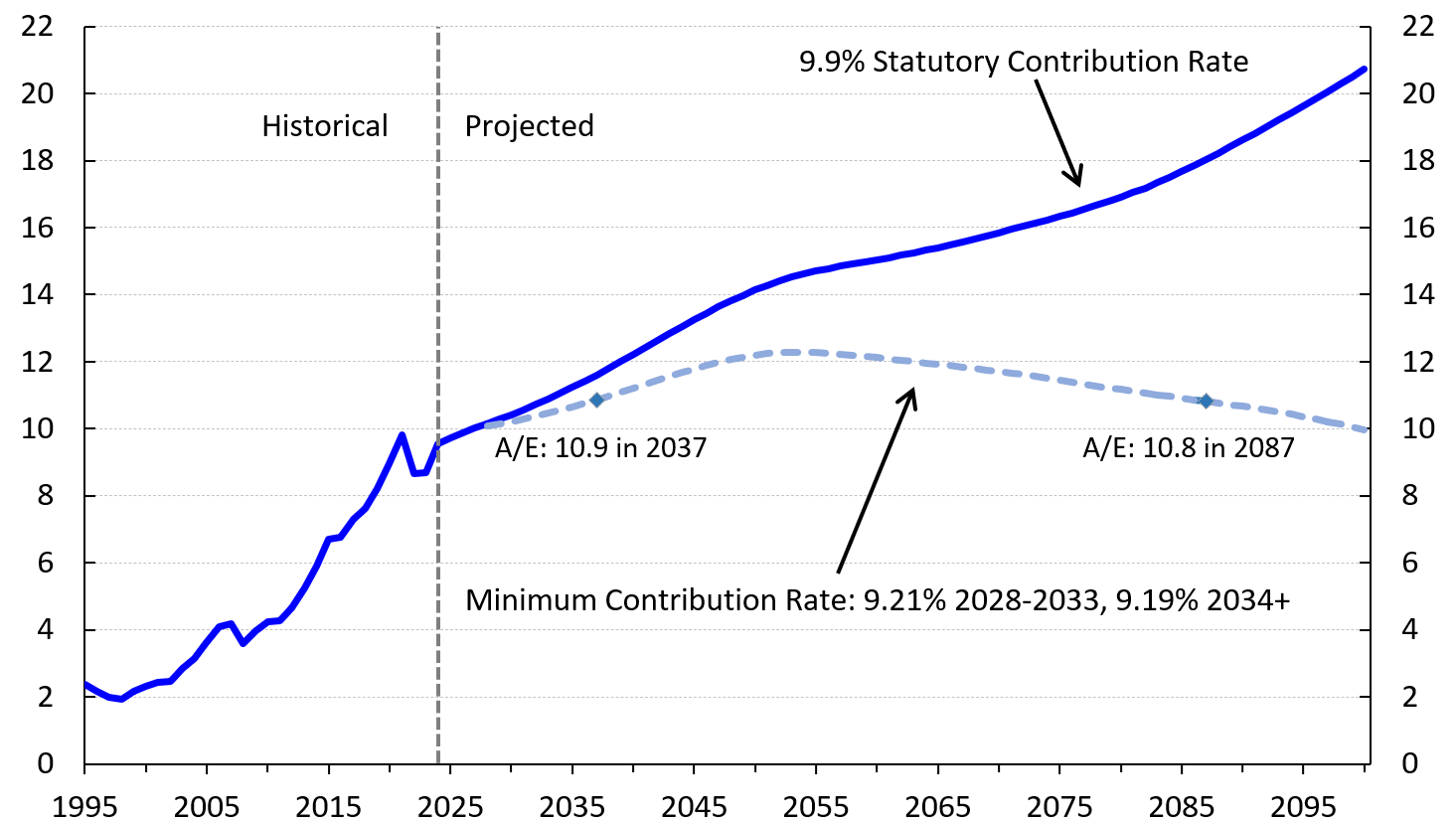

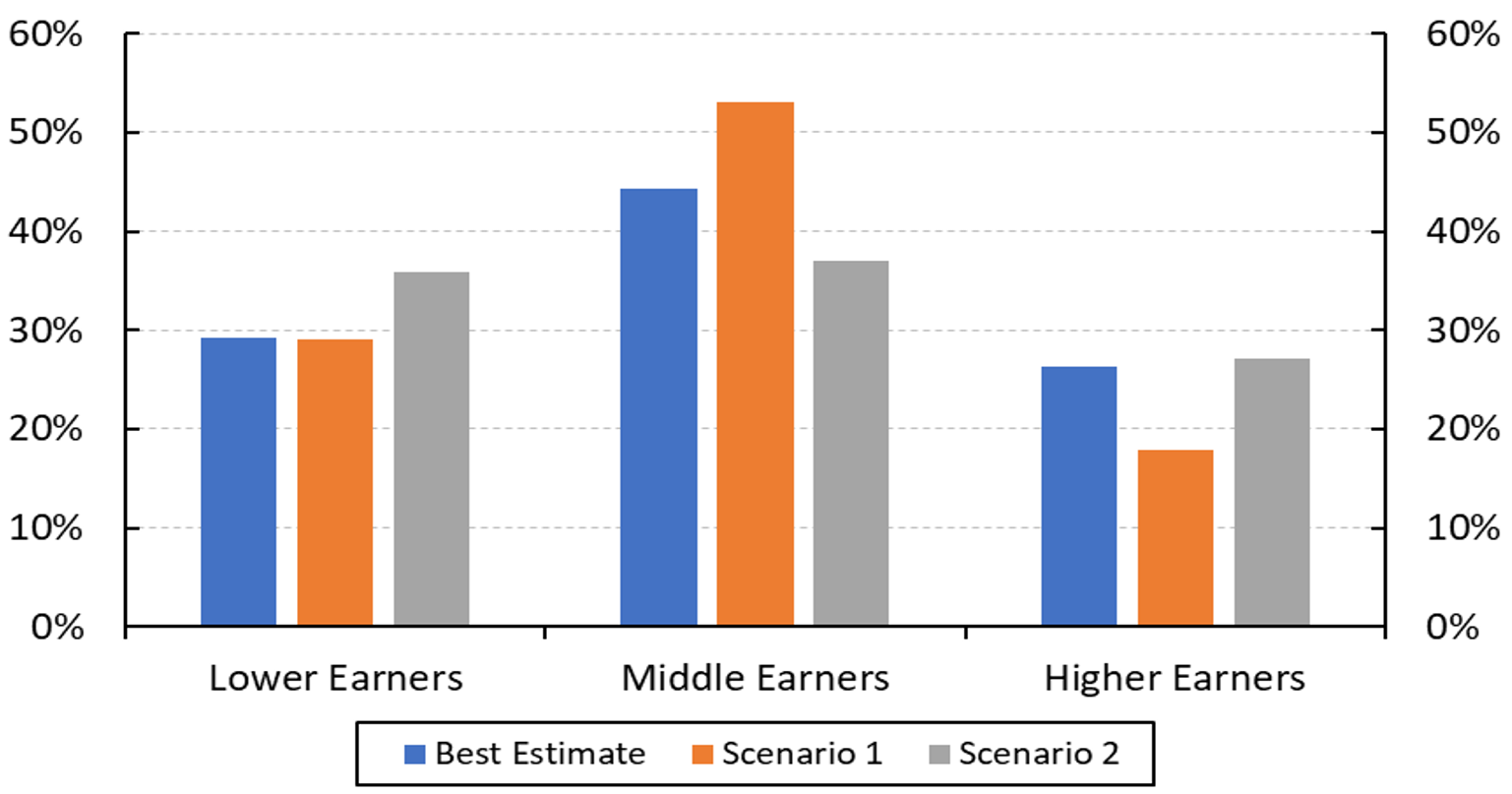

- Chart 14 Scenario impact on distribution of earners categories relative to best estimate

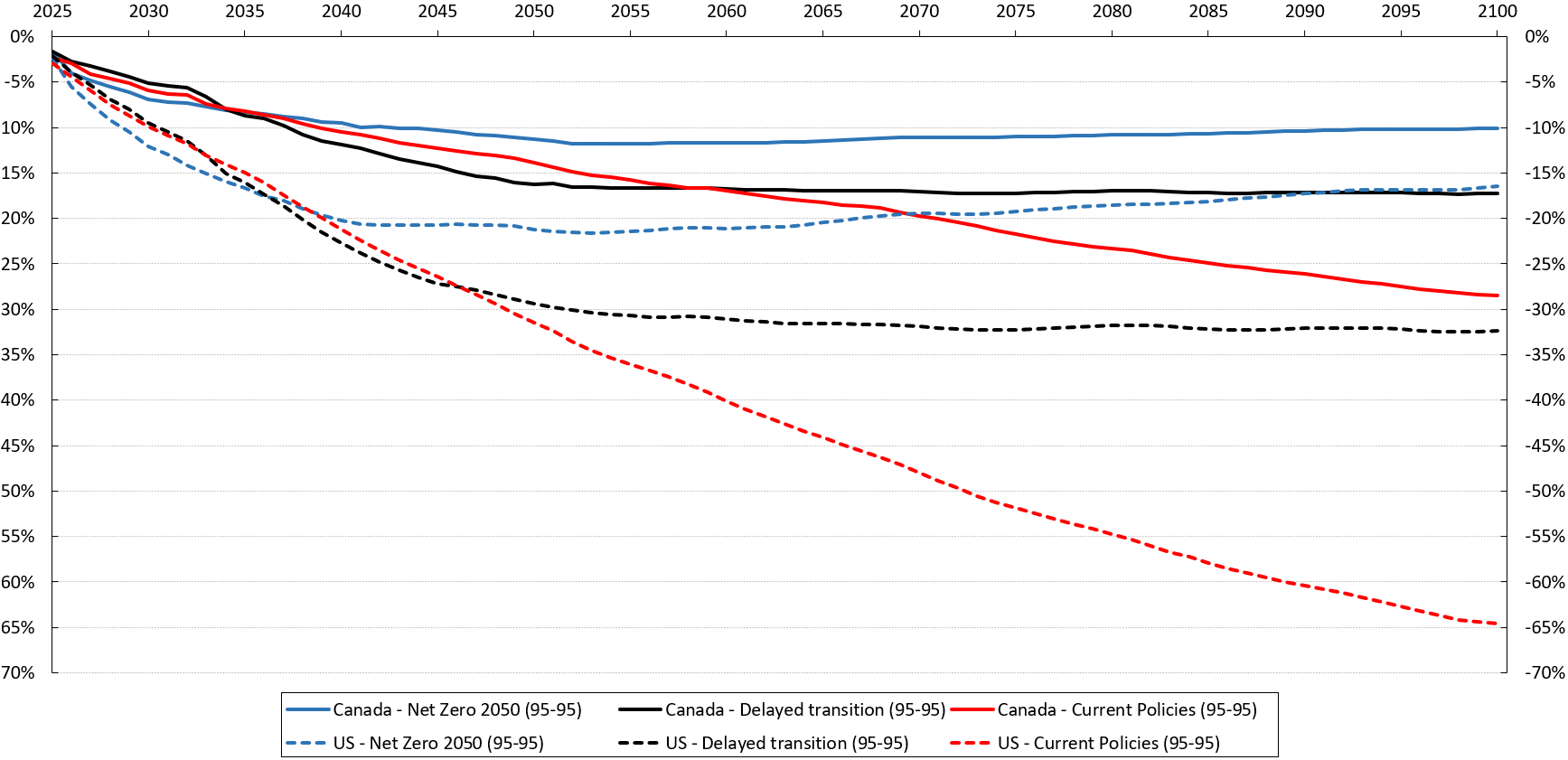

- Chart 15 Downside risk scenarios – cumulative real GDP impact for Canada and the U.S. relative to NGFS baseline scenario (physical and transition risks)

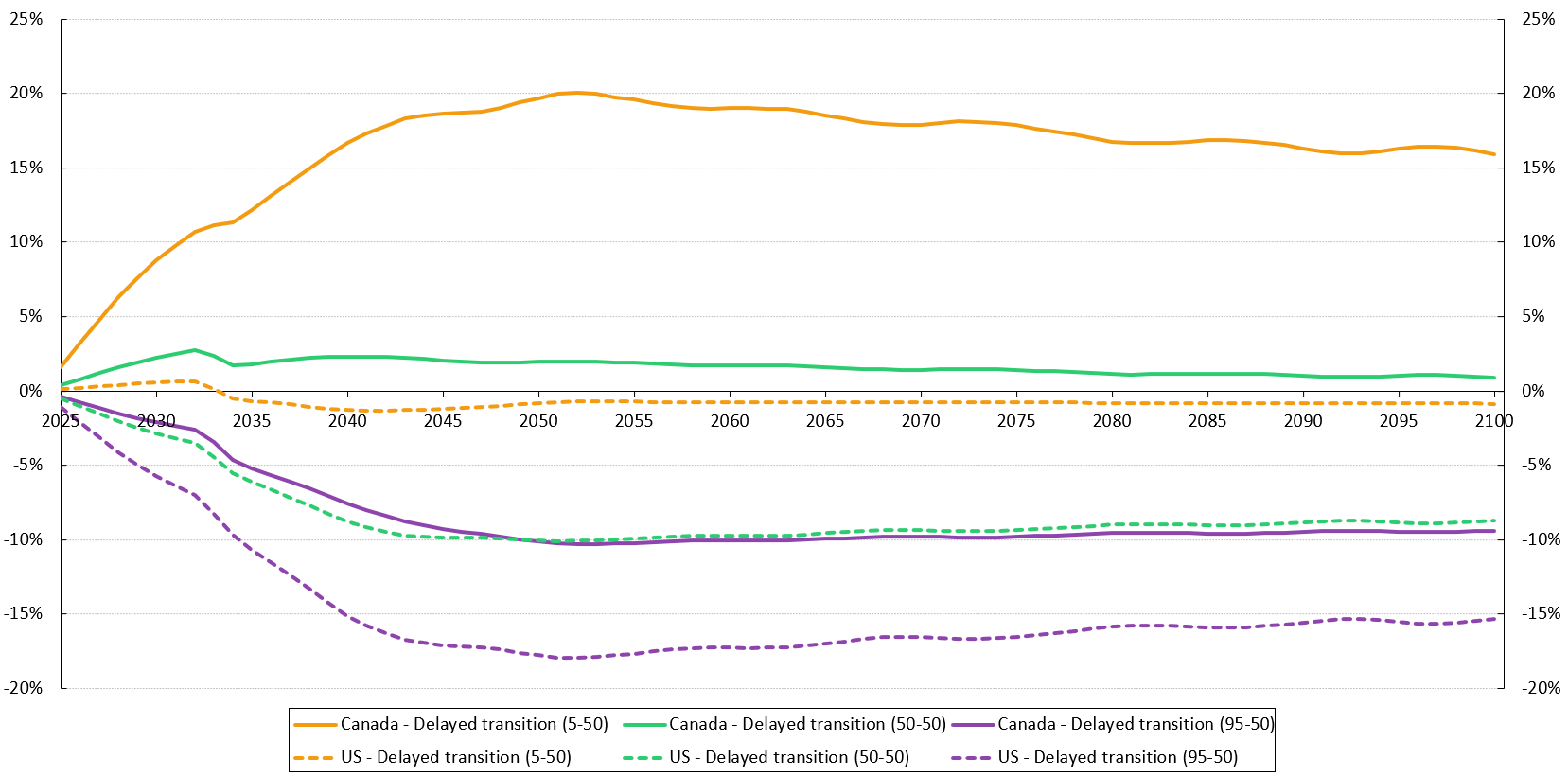

- Chart 16 Delayed transition scenarios – cumulative real GDP impact for Canada and the U.S. relative to NGFS baseline scenario (physical and transition risks)

- Chart 17 Annual impact on Canada real policy rates relative to NGFS baseline scenario (transition risk only)

1 Highlights of the report

| Base CPP | Additional CPP | |

|---|---|---|

| Contributions |

|

|

Under the statutory contribution rate of 9.9% for year 2025 and thereafter:

|

Under the statutory first and second additional contribution rates of 2.0% and 8.0% respectively for year 2025 and thereafter:

|

|

| Expenditures |

|

|

| Assets |

|

|

| Minimum contribution rates needed to sustain the CPP |

|

|

|

||

| Base CPP | Additional CPP | |

|---|---|---|

| Real rate of return assumption | The 32nd CPP Actuarial Report is based on an assumed 75-year average annual real rate of return of 4.05% for the base CPP and 3.53% for the additional CPP. | |

| If lower average returns are assumed (2.45% for the base CPP and 2.33% for the additional CPP), this would result in: | ||

|

|

|

| If higher average returns are assumed (5.65% for the base CPP and 4.73% for the additional CPP), this would result in: | ||

|

|

|

| Mortality assumption | The 32nd CPP Actuarial Report is based on the assumption that mortality will continue to improve but at a slower pace than over the last few decades. | |

| If longevity were to improve faster than assumed (projected life expectancies at age 65 in 2050 that are approximately 2.5 years higher), this would result in: | ||

|

|

|

| If longevity were to improve slower than assumed (projected life expectancies at age 65 in 2050 that are approximately 2.5 years lower), this would result in: | ||

|

|

|

| Economic growth | The 32nd CPP Actuarial Report is based on the assumption of moderate and sustained economic growth. | |

| If lower economic growth is assumed with total employment earnings in 2035 being 11% lower, this would result in: | ||

|

|

|

| If higher economic growth is assumed with total employment earnings in 2035 being 16% higher, this would result in: | ||

|

|

|

| The impacts are in the opposite direction for the base and additional Plans due to the different financing approaches of the two components of the CPP. | ||

|

Table B Footnotes

|

||

The 32nd CPP Actuarial Report includes a section that uses scenario analysis to assess and illustrate relevant risks to the funding of the base CPP. Since the additional CPP is still at its early stages, it is not included in this section. The scenarios presented are not meant to represent forecasts or predictions and should be interpreted with caution.

| Earnings distribution |

The 32nd CPP Actuarial Report assumes the same increase in earnings at each earnings level. The pattern of increase in earnings by earnings level may change as new technologies, automatization, immigration patterns, population aging and skills requirements evolve. These changes could affect the future funding of the CPP. Two scenarios were analyzed and their impacts on the MCR relative to the best estimate are as follows:

|

|---|---|

| Acute economic event |

The 32nd CPP Actuarial Report is based on the assumption of sustained moderate economic growth. A scenario was developed to illustrate the impact of an acute, relatively short-term economic event that unfolds over a period of 4 years starting in 2026. This scenario results in higher inflation and unemployment, and lower growth in real wages and real rates of return. This hypothetical acute economic event scenario would result in:

|

| Climate scenarios |

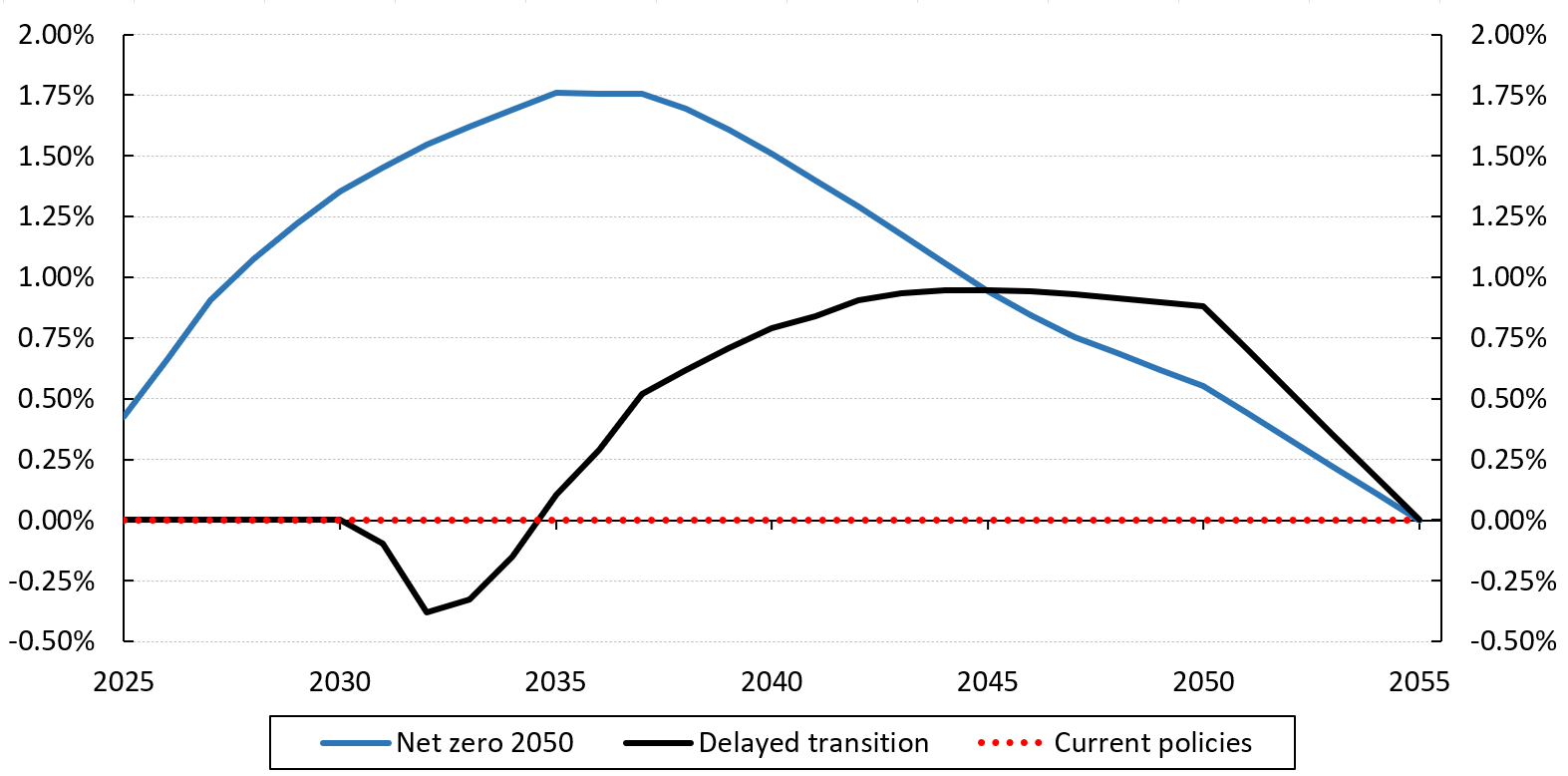

Climate change can affect the CPP through various channels given its potential impact on the future demographic, economic, and investment environments. However, there is a lot of uncertainty on the direction and magnitude of these potential impacts, and the risk is evolving constantly. Two sets of scenarios from the Network of Central Banks and Supervisors for Greening the Financial System were used to illustrate potential climate risk and outcomes. The first set consists of downside risk scenarios (most severe risk levels for damage and temperature functions) for three different scenario narratives: net zero 2050, delayed transition, and current policies. The second set focuses on the delayed transition scenario narrative and illustrates a range of potential outcomes by varying risk levels for the damage function.

|

|

Table C Footnotes

|

|

2 Introduction

2.1 Purpose of the report

This is the 32nd Actuarial Report on the Canada Pension Plan since the inception of the Canada Pension Plan (CPP or the Plan) in 1966. The valuation date is 31 December 2024. This report has been prepared in compliance with the timing and information requirements of the Canada Pension Plan. Section 113.1 of the Canada Pension Plan provides that the Minister of Finance and ministers of the Crown from the provinces shall review the financial state of the CPP once every three years and may consequently make recommendations to change the benefits or contribution rates, or both. Section 113.1 identifies the factors the ministers consider in their review, including information to be provided by the Chief Actuary.

The CPP retirement pension is subject to adjustment factors for early (pre-65) or late (post-65) commencement. In accordance with subsection 115(1.11) of the Canada Pension Plan, in the first actuarial report prepared after 2015 and in every third report that follows, the Chief Actuary is required to specify the adjustment factors as calculated according to a methodology that they deem appropriate. The relevant material is presented in Appendix - F. The Minister of Finance and ministers of the Crown from the provinces shall, as part of their triennial review, review the adjustment factors specified by the Chief Actuary and may make recommendations as to whether the scheduled adjustment factors should be changed. This 32nd CPP Actuarial Report as at 31 December 2024 is the second report for which the Chief Actuary is required to specify the factors in accordance with the legislation.

Since 1 January 2019, the CPP has two components: the base and additional Plans. The CPP consisted only of the base Plan (or base CPP) prior to 2019, and this component continues. The additional Plan (or additional CPP) is the enhancement to the CPP as of 2019. When not qualified, the term "CPP" or the "Plan" used in this report refers to the entire CPP, that is, to both its components.

An important purpose of the report is to inform contributors and beneficiaries of the current and projected financial states of the base and additional CPP. The report provides information to evaluate the financial sustainability of the base and additional Plans over a long period, assuming that the legislation remains unchanged. Such information facilitates a better understanding of the financial states of the base and additional Plans and the factors that influence costs, and thus contributes to an informed public discussion of issues related to the finances of the two components of the CPP.

The previous triennial report was the 31st Actuarial Report on the Canada Pension Plan as at 31 December 2021, which was tabled in the House of Commons on 14 December 2022.

This 32nd CPP Actuarial Report takes into account all amendments to date regarding the CPP statute, with the most recent changes listed in the following section. It also takes into account recent demographic, economic, and investment experience data as described in section B.2 of Appendix - B. Additionally, the report is based on the Chief Actuary's best-estimate assumptions, which consider various forecasts from experts in these areas.

This report presents projections of CPP revenues and expenditures for both of its components, the base and additional CPP, over a long period of time. Given the length of the projection period and the number of assumptions required, it is unlikely that actual future experience will develop precisely in accordance with the best-estimate projections.

This 32nd CPP Actuarial Report is intended solely for the above purposes. It was prepared to meet those specific objectives and may not be suitable for any other purposes prior to obtaining approval from the Office of the Chief Actuary (OCA).

For any questions regarding the proper use of this report, please contact the OCA.

2.2 Recent amendments

The Canada Pension Plan was subject to amendments after 31 December 2021 as followsFootnote 1:

- Under the Budget Implementation Act, 2024, No. 1, which received Royal Assent on 20 June 2024, a top-up to the death benefit is provided for certain individuals, a new children's benefit for part-time students is created for dependent children of disabled or deceased contributors, eligibility is extended for the disabled contributors' child's benefit after the disabled parent reaches ages 65, and entitlement to a survivor's pension is ended following a credit split. The amendments are all effective 1 January 2025 and are taken into account in this 32nd CPP Actuarial Report.

2.3 Subsequent events

For this 32nd CPP Actuarial Report, there were no subsequent events, i.e. events which became known to the Chief Actuary after the valuation date, but before the report date, and that were deemed to have an effect on the financial states of the base or additional CPP as at the valuation date or during the projection period.

The Canadian and global economies are going through a period of heightened uncertainty, due in part to escalating trade tensions, environmental risks, and geopolitical conflicts. The future impacts of these issues and risks on the financial state of the CPP are still uncertain and evolving, and as such, they have not been recognized as subsequent events for the purpose of this report.

2.4 Independent peer review process

As part of its policy of ensuring that it provides sound and relevant actuarial advice to Members of Parliament and to the Canadian population, and as was done for previous reports, the OCA has commissioned an external peer review of this actuarial report on the CPP.Footnote 2

The external peer review is intended to ensure that the actuarial reports meet high professional standards and are based on reasonable methods and assumptions. Over the years, peer review recommendations have been carefully considered and many of them implemented.

2.5 Scope of the report

Section 3 presents a general overview of the methodology used in preparing the actuarial estimates included in this report, which are based on the best-estimate assumptions described in section 4. The results for the base Plan and additional Plan are presented separately in sections 5 and 6, respectively, and include for each component the projections of the revenues, expenditures, and assets over the next 75 years. Section 7 provides the reconciliation of the results for the base and additional Plans with those of the 31st CPP Actuarial Report, while section 8 provides the actuarial opinion.

The various appendices provide a summary of the Plan provisions, a description of the data, assumptions and methodology employed, supplemental information on the financing of the CPP, detailed reconciliations of the results with the previous report, and the uncertainty of results. In addition, Appendix F provides the adjustment factors for pre-65 and post-65 retirement pension take-up as calculated on the basis of this report and in accordance with subsection 115(1.11) of the Canada Pension Plan.

3 Methodology

The actuarial examination of the CPP involves projections of the revenues and expenditures of both components (base CPP and additional CPP) over a long period of time, so that the future impacts of historical and projected trends in demographic, economic, and investment factors can be properly assessed. The actuarial estimates in this report are based on the provisions of the Canada Pension Plan as at 31 December 2024,Footnote 3 historical experience data used for the starting point of the projections, and best‑estimate assumptions regarding future demographic, economic and investment experience.

The revenues of the base and additional Plans include both contributions and investment income. The projection of contributions begins with a projection of the working-age population. This requires assumptions regarding demographic factors such as fertility, migration, and mortality. Total contributory earnings for each component of the Plan are derived by applying labour force participation and job creation rates to the projected population and by projecting future average employment earnings. This requires assumptions about various factors such as wage increases, earnings distributions, and unemployment rates. Contributions for each of the components of the CPP are obtained by applying the respective component's contribution rate(s) to the respective contributory earnings. Investment income is projected on the basis of the existing portfolios of assets for the base and additional CPP, the respective projected net cash flows (contributions less expenditures), and the respective assumptions regarding the future asset mix and rates of return on investments net of investment expenses. Since the assumptions regarding the future asset mix differ between the base and additional Plans, the resulting assumptions regarding investment returns differ as well.

Expenditures for each component of the Plan consist of the benefits paid out and operating expenses. Newly emerging benefits are projected by applying assumptions regarding retirement, disability, and death to the populations eligible for benefits, together with the benefit provisions and the earnings histories of cohorts (actual and projected). The projection of total benefits, which includes the continuation of benefits already in pay at the valuation date, requires further assumptions such as assumptions regarding the mortality rates of retirement beneficiaries. Operating expenses, excluding operating expenses relating to professional management of the CPP Fund by the Canada Pension Plan Investment Board (CPPIB), are projected by considering the historical and projected relationship between expenses and total employment earnings, while CPPIB operating expenses are considered in the determination of the rates of return.

The assumptions and results presented in the following sections make it possible to measure the financial states of the base and additional CPP separately in each projection year and to calculate the minimum contribution rates. The minimum contribution rates are determined separately for each component based on prescribed methodologies.

For the base Plan, the minimum contribution rate (MCR) is the sum of two types of rates. The first rate is referred to as the "steady‑state" contribution rate. The second type of rate that makes up the MCR is the full funding rate for increased or new benefits.

For the additional CPP, there are two additional minimum contribution rates (AMCRs), the first additional minimum contribution rate (FAMCR) and the second additional minimum contribution rate (SAMCR). The FAMCR is applicable to contributory earnings below the Year's Maximum Pensionable Earnings (YMPE) and the SAMCR is applicable to contributory earnings between the YMPE and the Year's Additional Maximum Pensionable Earnings (YAMPE).

Details of the methodologies used to determine the MCR and AMCRs are presented in Appendix - C.

A wide variety of factors influence both the current and projected financial states of the components of the CPP. Accordingly, the results shown in this report differ from those shown in previous reports. Likewise, future actuarial examinations will likely reveal results that differ from the projections included in this report.

4 Best‑estimate assumptions

4.1 Introduction

The information required by statute, which is presented in sections 5 and 6 of this report, necessitates making numerous assumptions regarding future demographic, economic, and investment trends. The projections included in this report cover a long period of time (75 years).

The assumptions selected reflect the long projection period and the expectation that the CPP will continue indefinitely. The assumptions are determined by examining historical short- to long-term trends and applying judgment as to the extent these trends will continue in the future. These assumptions, which do not include any margins for adverse deviations, reflect the Chief Actuary's best judgment and are referred to in this report as the best-estimate assumptions. The assumptions were selected to be independently reasonable and appropriate in the aggregate, taking into account certain interrelationships between them.

The use of best-estimate assumptions is considered to be the most appropriate choice for projecting the long-term financial state of the CPP given the Plan's legislation. Under section 113.1 of the Canada Pension Plan, the Chief Actuary must determine the lowest constant contribution rates that, if maintained over the foreseeable future, achieve certain measures for the base and additional Plans. References to the 'lowest constant rate(s)' in section 113.1 justify using best-estimate assumptions without any adjustments for adverse deviations.

For this 32nd CPP Actuarial Report, there were no subsequent events, i.e. events which became known to the Chief Actuary after the valuation date, but before the report date, and that were deemed to have an effect on the financial states of the base or additional CPP as at the valuation date or during the projection period.

The Chief Actuary held a virtual seminar in September 2024 on the long-term demographic, economic, and investment outlook for Canada to obtain opinions from a wide range of individuals with relevant expertise. Experts in the fields of demographics, economics, and investments were invited to present their views. The topics discussed included short- to long-term perspectives on capital markets and risks, the labour market and the economy, as well as population projections with a separate session on immigration.

Among the participants at the seminar were representatives from the OCA, federal departments including Statistics Canada, Employment and Social Development Canada (ESDC), and the Department of Finance, representatives from provincial and territorial governments, as well as representatives from Retraite Québec, the CPPIB, the U.S. Office of the Chief Actuary of the Social Security Administration, and other organizations. Representatives of the OCA also attended workshops hosted by Retraite Québec in October 2024 to launch the actuarial valuation of the Quebec Pension Plan.

OCA staff also sought expert perspectives on demographic, economic, and investment-related topics by attending various webinars, consulting numerous publications, and consulting with other experts. These expert perspectives were all considered in developing the best-estimate assumptions for this 32nd CPP Actuarial Report.

Table 1 presents a summary of the most important assumptions used in this report compared with those used in the previous triennial report. The assumptions are described in more detail in Appendix - B of this report.

| Assumptions | 32nd report (as at 31 December 2024) | 31st report (as at 31 December 2021) |

|---|---|---|

| Total fertility rate | 1.35 (2033+) | 1.54 (2029+) |

| Mortality | Statistics Canada Life Tables (CLT 1-year table: 2019) with assumed future improvementsTable 1 Footnote 1,Table 1 Footnote 2 | Statistics Canada Life Tables (CLT 1-year table: 2019) with assumed future improvementsTable 1 Footnote 2 |

| Canadian life expectancy for male at birth in 2025Table 1 Footnote 3 | 87.8 years | 86.9 years |

| Canadian life expectancy for female at birth in 2025Table 1 Footnote 3 | 91.0 years | 90.2 years |

| Canadian life expectancy for male at age 65 in 2025Table 1 Footnote 3 | 21.6 years | 21.5 years |

| Canadian life expectancy for female at age 65 in 2025Table 1 Footnote 3 | 24.1 years | 24.0 years |

| Net migration rate (including changes in non-permanent residents) | 0.72% of population (for 2051+) | 0.64% of population (for 2031+) |

| Non-permanent residents level | 2.5% of population (for 2050+)Table 1 Footnote 4 | N/A Not applicableTable 1 Footnote 5 |

| Participation rate (age group 18-69) | 80.0% (2035) | 80.0% (2035) |

| Employment rate (age group 18-69) | 75.3% (2035) | 75.3% (2035) |

| Unemployment rate (age group 18-69) | 5.9% (2028+) | 5.9% (2027+) |

| Rate of increase in prices | 2.0% (2027+) | 2.0% (2026+) |

| Real wage increase | 0.8% (2025+) | 0.9% (2026+) |

| Real rate of return (average 2025-2099) - base CPP assets | 4.05% | 4.01% |

| Real rate of return (average 2025-2099) - additional CPP assets | 3.53% | 3.57% |

| Retirement rates for cohort at age 60 - males | 21.0% (2026+) | 26.0% (2022+) |

| Retirement rates for cohort at age 60 - females | 22.0% (2026+) | 28.0% (2022+) |

| CPP disability incidence rates (per 1,000 eligible) - males | 2.70 (2029+) | 2.76 (2026+)Table 1 Footnote 6 |

| CPP disability incidence rates (per 1,000 eligible) - females | 3.40 (2029+) | 3.48 (2026+)Table 1 Footnote 6 |

|

Table 1 Footnotes

|

||

4.2 Demographic assumptions

The population projections start with the Canada and Quebec populations on 1 July 2024, to which are applied fertility, migration, and mortality assumptions. The relevant population for the Canada Pension Plan is the population of Canada less that of Quebec and is obtained by subtracting the projected results for Quebec from those for Canada. The population projections are essential in determining the future number of CPP contributors and beneficiaries.

The age distribution of the population has changed significantly since the inception of the Plan in 1966. The proportion of the Canadian population aged 65 and above has increased from 7.6% in 1966 to 12.1% in 1996, and reached 18.9% in 2024, which indicates an aging population. It is assumed that the population aging will continue in the future, albeit to a more modest extent.

4.2.1 Fertility

One of the causes of the aging of the Canadian population is the decline in the total fertility rate that has occurred since the late 1950s. The total fertility rate in Canada decreased rapidly from a level of about 4.0 children per woman in the late 1950s to 1.6 by the mid-1980s. The total fertility rate then hovered between 1.5 and 1.7 until 2008. Similar to the experience in other industrialized countries, Canada's total fertility rate has decreased since 2008, with steeper decreases since 2020. Canada, once in the middle of the pack amongst industrialized countries, is now positioned with Italy and Japan as one of the countries with lower fertility rates.

The total fertility rate for Canada stood at 1.41 in 2020, and decreased further to 1.26 in 2023, the lowest rate ever recorded. Although not identical, the total fertility rate in Quebec followed a similar pattern to that of Canada. In 2020, the Quebec fertility rate was 1.53 and then declined further to 1.39 in 2023.

The rapid decrease in the total fertility rate between the late 1950s and mid-1980s occurred as a result of changes in a variety of social, medical, economic, and environmental-related factors. It is unlikely that the rate will return to historical levels in the absence of significant societal changes. Decreases in the fertility rate since 2008 could be largely attributable to the 2008 economic downturn and continuing economic uncertainty. The housing crisis, the increase in the number of non-permanent residents which tend to have lower fertility, as well as increased anxiety and mental health issues can also help explain the steep decreases in recent years.

To project the fertility rates in Canada for most age groups, a 20-year period of data ending in 2023 was used to establish a trending model that provides the best fit using historical patterns and anticipated future movements. Some adjustments were made for age groups 25-29 and 30-34. Fertility rates for certain age groups were also adjusted upwards to account for expected effects from the Canada-Wide Early Learning and Child Care plan (CWELCC).

The assumed age-specific fertility rates lead to an assumed total fertility rate for Canada that will increase from its 2023 level of 1.26 children per woman to an ultimate level of 1.35 in 2033. It is assumed that the increase from 2023 levels will result from the positive impact of the CWELCC, as well as a renewed rise in fertility rates among the 30–39 age group, driven by delayed childbearing decisions.

For Quebec, the fertility rate for each age group is based on an analysis of historical differences with the Canada fertility rate. The assumed age-specific fertility rates for Quebec lead to a total fertility rate for the province that will slightly increase from its 2023 level of 1.39 to an ultimate level of 1.40 in 2033.

4.2.2 Mortality

Another element that has contributed to the aging of the population is the significant reduction in the age-specific mortality rates, especially at older ages. This can be measured by the increase in life expectancy at age 65, which directly affects how long retirement benefits will be paid to beneficiaries. Calendar year male life expectancy (without future mortality improvements) at age 65 increased by 43% between 1966 and 2023, rising from 13.6 to 19.5 years. For women, it increased by 31%, from 16.9 to 22.2 years over the same period. Although the overall gains in life expectancy at age 65 since 1966 are similar for males and females, 67% of the increase occurred after 1991 for males, while for females, 47% of the increase occurred during that period.

Although Statistics Canada life tables were available up to 2023, data for calendar years 2020 to 2023 were excluded from the analysis for purposes of setting long-term mortality rates. Mortality tables for these years reflect significant mortality increases related to COVID-19 and opioid-related deaths, which are assumed to be temporary. Long-term future mortality rates are therefore determined by applying assumed mortality improvement rates to Statistics Canada's 2019 life tables. The projected mortality improvement rates are assumed to gradually reduce from their 15-year average ending in 2019 to ultimate levels in 2039, which are for both sexes 1.0% per year for ages below 90, 0.6% per year for ages 90 to 94, and 0.2% per year for ages 95 and above.

The assumed ultimate mortality improvement rates are based on an analysis of the Canadian experience over the period 1954 to 2019 and the possible drivers of future mortality improvements. Consideration was also given to benchmarks from peers as well as educational notes and research published by the Canadian Institute of Actuaries, including the most recent Mortality Improvements Research paper published in April 2024.

Short-term adjustments are then applied to projected mortality rates to match historical data available (2020 to 2023) and to reflect the temporary continuing impacts of the COVID-19 pandemic and opioid crisis. The COVID-19 pandemic is assumed to have a residual effect on mortality in 2024 and 2025, followed by an assumed full recovery and reversion to the projected unadjusted mortality rates for year 2026 and onward. The short-term adjustments also reflect the expectation that the opioid crisis will be temporary, and that mortality for affected age groups will revert to unadjusted mortality rates by 2039.

Considering the above, cohort life expectancy (with assumed future mortality improvements) at age 65 in 2025 is projected to be 21.6 years for males, and 24.1 years for females.

The mortality improvement rates for Quebec were developed using a similar methodology as for Canada. However, given that Quebec is not as affected by the opioid crisis, no corresponding short-term adjustments were applied. Quebec's cohort life expectancy (with future improvements) at age 65 in 2025 is projected to be 21.9 years for males and 23.9 years for females.

To project CPP benefits, the mortality rates for CPP retirement, survivor, and disability beneficiaries reflect actual experience for those segments of the population. Specific mortality experience for CPP beneficiaries is discussed further in Appendix - B of this report.

4.2.3 Net migration

Net migration corresponds to the number of immigrants less the net number of emigrants (i.e. the number of emigrants less the number of returning Canadians) plus the net increase in the number of non-permanent residents (NPR).

To select the assumptions regarding the short-term and ultimate rates, the components of net migration were analyzed separately by considering trends in the historical data as well as qualitative factors that could influence future trends. Consideration was also given to the federal government's short-term immigration targets and to long-term perspectives of various experts regarding levels of future immigration and non-permanent residents. For this valuation, a new methodology was developed to estimate the annual levels of NPR as a proportion of the population, from which the net increase in NPR is then derived.

In line with the government's short-term immigration targets, the immigration rate is expected to decrease from 1.12% of the population in 2024 to 0.96% in 2025, 0.92% in 2026, and 0.88% in 2027. After that, it is projected to gradually decrease to an ultimate rate of 0.82% by 2034. The ultimate rate of 0.82% corresponds to the 20-year average ending in 2024, which was selected to give some weight to generally higher levels of immigration observed since 2016 while still reflecting longer term historical trends.

The historical net emigration rate has been relatively stable. The net emigration rate is expected to decrease slightly from 0.12% of the population in 2024 to 0.11% by 2026 and remain at that level thereafter.

In recent years, there has been a significant increase in the number of NPR. By the end of 2024, the number of NPR reached an unprecedented level, representing 7.3% of the population. By contrast, based on the 20-year average ending in 2024, NPR represented 2.7% of the population. In addition, for the first time ever, the government announced short-term target for NPR, which is set at 5% of the population by the end of 2026.

To address the higher levels and volatility of the number of NPR in recent years, a new method was developed for this report to project the number of NPR separately from the rest of the population. For this purpose, an assumption is made for each year of the projection period regarding the level of NPR as a percentage of the population. The resulting annual changes in NPR can then be determined and flow through the overall net migration rate.

Based on the new NPR method, the number of NPR as a percentage of the population is expected to decrease from 7.3% of the population in 2024 to 5% of the population by 2026 as per the government's short-term targets. It is further assumed that this proportion will decrease to 4% by 2035 and to an ultimate rate of 2.5% by 2050. The ultimate rate of 2.5% was selected to give some weight to recent higher levels of NPR, while still reflecting longer-term historical trends.

As a result of the above, the net migration rate for Canada, including net changes in the level of NPR, is projected to decrease from its 2024 level of 2.88% of the populationFootnote 4 to -0.34% in 2025 and -0.29% in 2026, and is then assumed to increase to 0.82% in 2027. Thereafter, the net migration rate is assumed to gradually transition to an ultimate level of 0.72% of the population in 2051. The assumed short-term net migration rate varies from the ultimate rate of 0.72% due to the Government of Canada's short-term targets and the assumed changes in the net migration components as percentages of the population.

For the Quebec population, the ultimate net migration rate assumption is set at 0.45% in 2051 and thereafter. The net migration assumption varies in the short term like for Canada.

4.2.4 Population projections

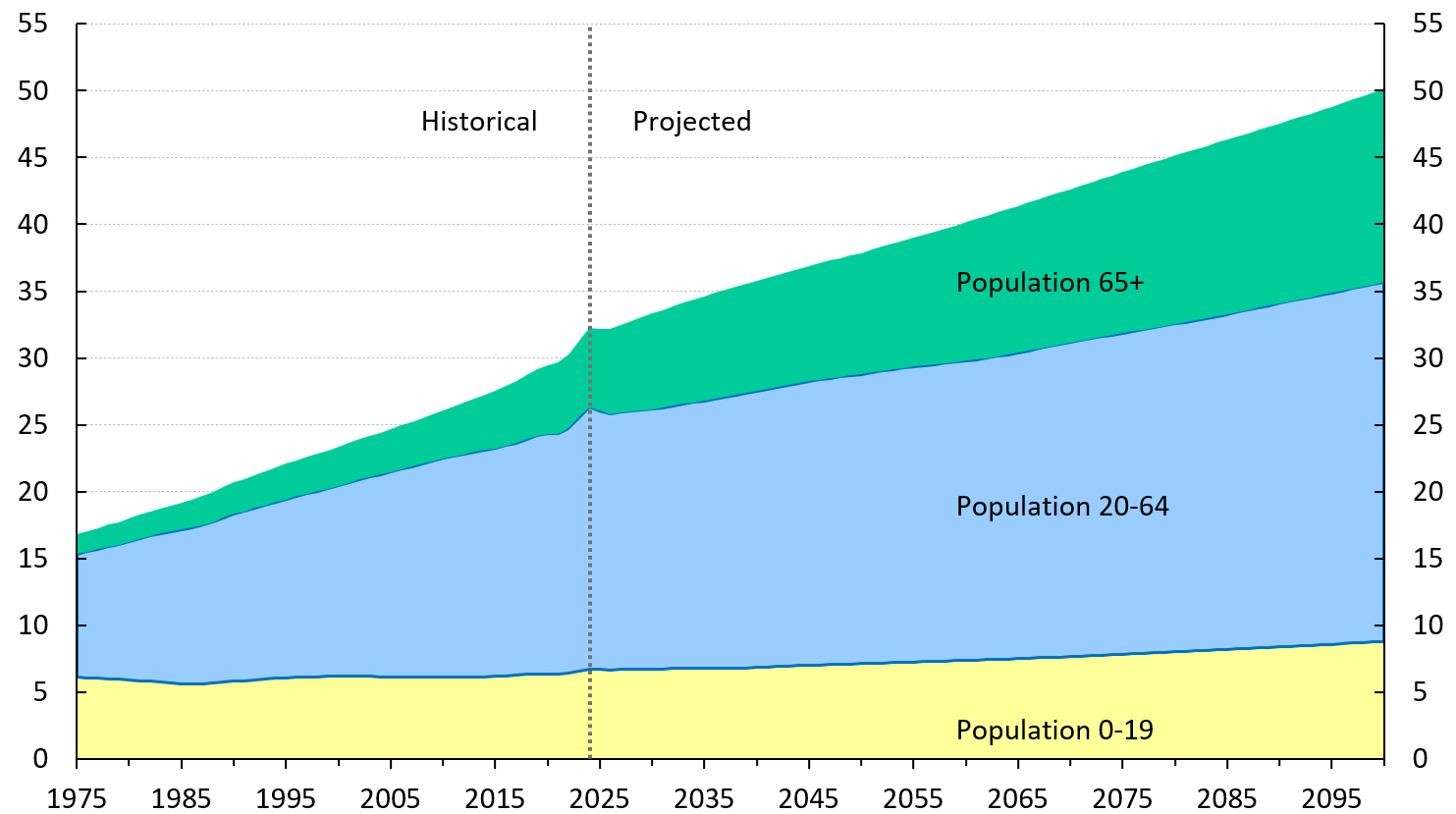

Table 2 shows the population of Canada less Quebec for three age groups (0-19, 20-64, and 65 and over) throughout the projection period. The ratio of the number of people aged 20-64 to those aged 65 and over is a measure that approximates the ratio of the number of working-age people to retirees. Because of the aging population, this ratio is projected to drop from an estimated value of 3.2 in 2025 to 1.9 by 2080.

| Year | Total | Age 0-19 | Age 20-64 | Age 65 and over | Ratio of 20-64 to 65 and over |

|---|---|---|---|---|---|

| 2025 | 32,182 | 6,698 | 19,368 | 6,116 | 3.2 |

| 2026 | 32,149 | 6,677 | 19,139 | 6,333 | 3.0 |

| 2027 | 32,483 | 6,705 | 19,234 | 6,544 | 2.9 |

| 2028 | 32,768 | 6,718 | 19,292 | 6,758 | 2.9 |

| 2029 | 33,054 | 6,731 | 19,359 | 6,963 | 2.8 |

| 2030 | 33,330 | 6,743 | 19,437 | 7,150 | 2.7 |

| 2031 | 33,600 | 6,757 | 19,535 | 7,307 | 2.7 |

| 2032 | 33,863 | 6,768 | 19,655 | 7,440 | 2.6 |

| 2033 | 34,123 | 6,777 | 19,780 | 7,567 | 2.6 |

| 2034 | 34,372 | 6,785 | 19,896 | 7,692 | 2.6 |

| 2035 | 34,615 | 6,788 | 20,013 | 7,815 | 2.6 |

| 2040 | 35,799 | 6,854 | 20,665 | 8,280 | 2.5 |

| 2045 | 36,878 | 7,022 | 21,227 | 8,628 | 2.5 |

| 2050 | 37,863 | 7,129 | 21,657 | 9,077 | 2.4 |

| 2055 | 38,997 | 7,247 | 22,103 | 9,647 | 2.3 |

| 2060 | 40,154 | 7,379 | 22,420 | 10,355 | 2.2 |

| 2065 | 41,374 | 7,514 | 22,883 | 10,976 | 2.1 |

| 2070 | 42,639 | 7,665 | 23,509 | 11,466 | 2.1 |

| 2075 | 43,907 | 7,843 | 24,020 | 12,044 | 2.0 |

| 2080 | 45,144 | 8,033 | 24,507 | 12,604 | 1.9 |

| 2085 | 46,347 | 8,221 | 25,040 | 13,087 | 1.9 |

| 2090 | 47,549 | 8,406 | 25,677 | 13,467 | 1.9 |

| 2095 | 48,803 | 8,594 | 26,276 | 13,933 | 1.9 |

| 2100 | 50,125 | 8,789 | 26,890 | 14,446 | 1.9 |

|

Table 2 Footnotes

|

|||||

4.3 Economic and investment assumptions

The main economic assumptions to project the CPP cash flows are labour force participation rates, job creation rates, unemployment rates, the rate of increase in prices, and real increases in average employment earnings. Real rates of return by asset class as well as other investment assumptions are used to project the assets.

The economic assumptions selected in this report are based on the overall expectation of sustained moderate economic growth. Furthermore, a key element underlying the best‑estimate economic assumptions relates to the continued trend toward longer working lives. Older workers are expected to exit the workforce at a later age, which could alleviate the impact of the aging of the population on future labour force growth. However, despite the expected later exit ages, labour force growth is projected to weaken as the working-age population expands at a slower pace and baby boomers continue to exit the labour force.

4.3.1 Labour force

Employment levels vary with the rate of unemployment and reflect trends in increased workforce participation by women, longer periods of formal education among young adults, changes in the age structure of the working-age population, as well as changing retirement patterns of older workers.

As the population ages, older age groups with lower labour force participation increase in size. As a result, the labour force participation rate for Canadians aged 15 and over is expected to decline from an estimated value of 65.2% in 2025 to 64.4% in 2035. A more useful measure of the working-age population is the participation rate of those aged 18 to 69, which is expected to increase from an estimated 77.3% in 2025 to 80.0% in 2035. The increase in the participation rate for those aged 18 to 69 reflects several trends.

For example, it is assumed that female participation rates will continue to grow at a faster pace than male participation rates until 2035, thereby continuing to reduce the gap in participation rates between males and females, albeit at a slower pace than in the past. A part of this projected reduction can be attributed to the continuing impact of the Canada-Wide Early Learning and Child Care plan on female labour force participation.

It is also assumed that participation rates for age groups 55 and over for both sexes will increase as a result of an expected continued trend toward longer working lives.

It is expected that the projected aging of the population will create upward pressure on future participation rates as a larger proportion of the population no longer in the workforce will require services from a relatively smaller working-aged population. The participation rates for all age groups are thus expected to increase in response to this demographic shift.

Overall, the male participation rate of those aged 18 to 69 is expected to be 81.0% in 2025 and to increase to 83.1% by 2035, while the female participation rate for the same age group is expected to be 73.5% in 2025 and to increase to 76.9% by 2035. As such, the difference between male and female participation rates for the age group 18 to 69 is projected to be 7.5% in 2025 and decrease to 6.2% by 2035. Thereafter, the gap between participation rates for males and females, age group 18 to 69, is projected to vary between 6.1 and 6.2 percentage points.

The job creation rate, measured by the annual change in employment, was on average 1.6% from 1976 to 2024. Future job creation rates will depend on changes in the unemployment rates and the rate of labour force growth.

The unemployment rate (ages 15+) is projected to rise from 6.3% in 2024 to 7.0% in 2025, and then gradually decline to 6.1% by 2028.

In 2025 and 2026, the labour force is expected to contract mainly due to a decline in the NPR population. This will contribute to negative job creation during those years. Stronger job creation rates are expected in 2027 and 2028 at rates of 1.2% and 1.0% respectively, as labour force growth resumes and unemployment falls. Starting in 2029, job creation rates are assumed to align with labour force growth, averaging 0.8% annually until 2035 and 0.4% thereafter. The aging population is the primary factor behind this slower long-term growth.

4.3.2 Price increases

On December 13, 2021, the Bank of Canada and the federal Government renewed their commitment to keep inflation between 1% and 3% with a target at the mid-point of 2% until the end of 2026. They further noted that the Bank of Canada will use the flexibility of the 1% to 3% range to actively seek the maximum sustainable level of employment to an extent that is consistent with keeping medium-term inflation expectations at 2%.

Despite the mid-point target of 2%, price increases (inflation), as measured by changes in the Consumer Price Index (CPI), will fluctuate from year to year. For instance, global imbalances in supply and demand during the COVID-19 outbreak, pent-up demand following the lifting of restrictions in 2021 and 2022, as well as the war in Ukraine that commenced in February 2022, contributed to upward pressure on prices, resulting in inflation peaking at 8.1% in June 2022. As the pandemic became more manageable, fiscal stimulus wound down. This, combined with demand and supply returning to equilibrium, allowed the inflation rate to gradually align with the Bank's 2% target, which it hit in August 2024. On an annual basis, the average inflation rate in 2024 was 2.4%.

In this report, the inflation rate in Canada is assumed to be 2.2% for 2025, decreasing to 2.1% in 2026, and returning to the 2.0% target for 2027 and thereafter. These assumed price increases are based on short-term forecasts from various economistsFootnote 5 as well as the expectation that the Bank of Canada and federal Government will continue to renew the inflation target of 2.0%, and that the Bank of Canada will be successful in keeping inflation at its mid-point target in the long term.

4.3.3 Real wage increases

Wage increases affect the financial state of the CPP in two ways. In the short term, an increase in the average wage translates into higher contribution income, with little immediate impact on benefits. Over the long term, higher average wages produce higher benefits. The difference between nominal wage increases and inflation represents increases in the real wage, which is also referred to in this report as the real wage increase.

Two wage measures are used in this report: the average annual earnings (AAE) and the average weekly earnings (AWE). The assumed increase in AAE is used to project the total employment earnings of CPP contributors, while the assumed increase in the AWE is used to project the increase in the YMPE from one year to the next. The two measures are assumed to grow at the same pace over the projection period.

Real AAE and real AWE are projected to increase by 0.8% in 2025 and for every year thereafter. This assumption is developed taking into account historical trends and future views on labour productivity, average hours worked and other contributing factors. The ultimate real AAE and real AWE increase assumption combined with the ultimate price increase assumption results in an assumed increase in nominal AAE and nominal AWE of 2.8% in 2027 and thereafter.

4.3.4 Real rates of return on investments

Real rates of return on investments are the excess of the nominal rates of return over price increases and are required for the projection of revenue arising from investment income. A real rate of return is assumed for each year in the projection period and for each of the main asset categories in which the base and additional CPP assets are invested. The assumption for each asset class is based on a combination of analysis of historical data (yields, returns, spreads, premiums, etc.) and potential future drivers, as well as judgment on the extent to which past trends will continue in the future. Consideration is also given to forecasts from relevant experts.

The assumed long-term real rates of return on base and additional CPP assets take into account the assumed asset mixes of investments of each CPP component. The real rates of return on investments are net of all investment expenses, including the CPPIB operating expenses.

The ultimate annual real rates of return for the base and additional CPP are respectively 4.02% and 3.53%, and these are reached in 2042.

For the period 2025 to 2041, the projected annual real rates of return for the base CPP are higher than the assumed ultimate long-term rates beginning in 2042, mainly due to a greater allocation to equities and the use of leverage. The average real rates of return for the 10-year period 2025-2034 for the base and additional CPP are respectively 4.23% and 3.47%.

The 75-year average real rate of return on the assets over the 2025-2099 projection period is assumed to be 4.05% for the base CPP and 3.53% for the additional CPP.

Table 3 summarizes the main economic assumptions over the projection period.

| Year | Real increase average annual earnings | Real increase average weekly earnings (YMPE) | Price increase | Labour force (Canada, 15+) | Real rates of return on investments | ||||

|---|---|---|---|---|---|---|---|---|---|

| Participation rate | Job creation rate | Unemployment rate | Labour force annual increase | Base CPP | Additional CPP | ||||

| 2025 | 0.8 | 0.8 | 2.2 | 65.2 | (0.7) | 7.0 | 0.0 | 4.2 | 3.3 |

| 2026 | 0.8 | 0.8 | 2.1 | 64.8 | (0.4) | 6.7 | (0.7) | 4.3 | 3.4 |

| 2027 | 0.8 | 0.8 | 2.0 | 64.7 | 1.2 | 6.4 | 0.9 | 4.3 | 3.5 |

| 2028 | 0.8 | 0.8 | 2.0 | 64.6 | 1.0 | 6.1 | 0.7 | 4.3 | 3.5 |

| 2029 | 0.8 | 0.8 | 2.0 | 64.5 | 0.7 | 6.1 | 0.7 | 4.3 | 3.5 |

| 2030 | 0.8 | 0.8 | 2.0 | 64.4 | 0.7 | 6.1 | 0.7 | 4.2 | 3.5 |

| 2031 | 0.8 | 0.8 | 2.0 | 64.3 | 0.8 | 6.1 | 0.8 | 4.2 | 3.5 |

| 2032 | 0.8 | 0.8 | 2.0 | 64.3 | 0.8 | 6.1 | 0.8 | 4.2 | 3.5 |

| 2033 | 0.8 | 0.8 | 2.0 | 64.3 | 0.8 | 6.1 | 0.8 | 4.2 | 3.5 |

| 2034 | 0.8 | 0.8 | 2.0 | 64.4 | 0.7 | 6.1 | 0.7 | 4.1 | 3.5 |

| 2035 | 0.8 | 0.8 | 2.0 | 64.4 | 0.7 | 6.1 | 0.7 | 4.1 | 3.5 |

| 2040 | 0.8 | 0.8 | 2.0 | 64.0 | 0.4 | 6.1 | 0.4 | 4.1 | 3.5 |

| 2045 | 0.8 | 0.8 | 2.0 | 63.7 | 0.4 | 6.1 | 0.4 | 4.0 | 3.5 |

| 2050 | 0.8 | 0.8 | 2.0 | 63.2 | 0.2 | 6.1 | 0.2 | 4.0 | 3.5 |

| 2055 | 0.8 | 0.8 | 2.0 | 62.7 | 0.3 | 6.1 | 0.3 | 4.0 | 3.5 |

| 2060 | 0.8 | 0.8 | 2.0 | 62.1 | 0.3 | 6.1 | 0.3 | 4.0 | 3.5 |

| 2065 | 0.8 | 0.8 | 2.0 | 61.6 | 0.4 | 6.1 | 0.4 | 4.0 | 3.5 |

| 2070 | 0.8 | 0.8 | 2.0 | 61.2 | 0.4 | 6.1 | 0.4 | 4.0 | 3.5 |

| 2075 | 0.8 | 0.8 | 2.0 | 60.8 | 0.4 | 6.1 | 0.4 | 4.0 | 3.5 |

| 2080 | 0.8 | 0.8 | 2.0 | 60.4 | 0.4 | 6.1 | 0.4 | 4.0 | 3.5 |

| 2085 | 0.8 | 0.8 | 2.0 | 60.2 | 0.4 | 6.1 | 0.4 | 4.0 | 3.5 |

| 2090 | 0.8 | 0.8 | 2.0 | 60.0 | 0.4 | 6.1 | 0.4 | 4.0 | 3.5 |

| 2095 | 0.8 | 0.8 | 2.0 | 59.8 | 0.4 | 6.1 | 0.4 | 4.0 | 3.5 |

| 2100 | 0.8 | 0.8 | 2.0 | 59.6 | 0.4 | 6.1 | 0.4 | 4.0 | 3.5 |

4.4 Other assumptions

This report is based on several other key assumptions, such as retirement pension take-up rates and disability incidence rates.

4.4.1 Retirement pension take-up rates

The retirement pension take-up rates are determined on a cohort basis and reflect the distribution of the age at which individuals are expected to take their retirement benefits, from ages 60 through 70. The sex-distinct take-up rate for a given age and year corresponds to the number of emerging (new) retirement beneficiaries divided by the total number of people eligible for retirement benefits.

Under the CPP, the unreduced pension age is 65. In 1987, the flexible retirement age provision became effective such that a person can choose to receive a reduced retirement pension as early as age 60, or an increased pension if deferred beyond age 65 up to age 70. This provision had the overall effect of lowering the average age at pension take-up to below age 65. In 1986, the average age at pension take-up was 65.2, compared to an average age of 62.7 over the decade ending in 2019. However, recent data suggest a reversal of this trend, with individuals increasingly opting to retire later. In 2024, the average age at benefit take-up was 64.0 for males and 63.8 for females.

The age 60 retirement pension take-up rates have decreased over the past decade. The take-up rates at age 60 in 2024 were 21.7% for males and 23.3% for females – the lowest levels observed since the introduction of the flexible retirement provisions in 1987. The trends of decreasing rates at lower ages are offset by increasing rates at higher ages. These trends will continue to be monitored for the next CPP valuation.

The assumption reflects the historical experience including recent trends. From 2030, the retirement benefit take-up rates at age 60 are assumed to be 21% for males and 22% for females. The rates are assumed to be 32% for both sexes at age 65 and 10% for both sexes at age 70. These assumptions result in a projected average retirement pension take-up age of 64.3 for both males and females. The same retirement pension take-up rate assumptions for the base CPP apply to the additional CPP.

4.4.2 Disability incidence rates - disability pension

The sex-distinct disability incidence rate in respect of the disability benefit at any given age is the number of new disability beneficiaries divided by the total number of people eligible for the disability benefit at that age. The disability incidence rates for the base Plan are the same as for the additional Plan.

Due to administrative changes to the disability program, disability incidence rates decreased significantly in the mid-1990s, and they have remained relatively stable until the late 2010s. However, the disability incidence rates have been decreasing overall since 2018.

The ultimate disability incidence rate assumptions of 2.70 per thousand eligible for males and 3.40 per thousand eligible for females were selected taking into account long-term historical trends, more recent trends, the consistent gap between female and male rates observed since 1996, and trends by causes of disability. The assumed ultimate disability incidence rates are reached gradually by 2029.

5 Results - base CPP

5.1 Overview

The key observations and findings of the actuarial projections of the financial state of the base CPP presented in this report are as follows.

- With the statutory contribution rate of 9.9%, contributions to the base CPP are projected to be more than sufficient to cover the expenditures over the period 2025 to 2030. Thereafter, a portion of investment income is required to make up the difference between contributions and expenditures. In 2031, about 1.0% of investment income will be required to pay for expenditures. This is expected to gradually increase to about 12% by 2050 and about 26% by 2070, after which it is expected to be fairly stable.

- With the statutory contribution rate of 9.9%, total assets of the base Plan are expected to grow over the projection period. The pace of growth is expected to gradually slow as positive net cash flows diminish and eventually turn negative, requiring an increasing share of investment income to pay for expenditures. Total assets are expected to increase from $651 billion at the end of 2024 to $963 billion by the end of 2030. Assets are then projected to reach $2.9 trillion by 2050 and $27.3trillion by 2100. The ratio of assets to the following year's expenditures is projected to increase slightly from 9.7 to 10.4 between 2025 and 2030 and to continue to grow thereafter to values of 14.1 in 2050 and 20.7 in 2100.

- With the statutory contribution rate of 9.9%, investment income of the base Plan, which is expected to represent 37% of revenues (i.e. contributions and investment income) in 2025, is further projected to represent 39% of revenues in 2030, 48% of revenues in 2050, and 63% of revenues by 2100. This illustrates the importance of investment income as a source of revenues for the base Plan.

- The minimum contribution rate (MCR) to sustain the base Plan is 9.21% of contributory earnings for years 2028 to 2033 and 9.19% for the year 2034 and thereafter. The statutory contribution rate of 9.9% applies to the first three years after the valuation year, that is, to the current triennial review period of 2025-2027.

- The MCR consists of two separate components. First, the steady-state contribution rate, which is the lowest rate that results in the projected ratio of the assets to the following year's expenditures of the base Plan remaining generally constant over the long term, before consideration of any full funding of increased or new benefits, is 9.18% for the year 2028 and thereafter. The second component is the full funding rate that is required to fully fund the amendments made to the Canada Pension Plan under the Budget Implementation Act, 2018, No. 1. The full funding rate is 0.03% for years 2028 to 2033 and 0.01% for the year 2034 and thereafter. The amendments made to the Canada Pension Plan under the Budget Implementation Act, 2024, No. 1 were determined not to require separate full funding and thus are financed entirely by the steady-state contribution rate.

- Under the MCR, the ratio of assets to the following year's expenditures is projected to increase from 10.1 in 2028 to 10.9 in 2037 and to be about the same fifty years later in 2087.

- The MCR determined for this report is lower than the MCR of 9.54% for year 2034 and thereafter determined under the 31st CPP Actuarial Report. Experience over the period 2022 to 2024 was better than expected overall, leading to a decrease in the MCR. The main contributing factor for this was better than expected investment experience, which lowers the MCR by 0.21 percentage points. Methodology changes, mainly to better reflect non-permanent residents, also led to a decrease in the MCR of 0.11 percentage points. The net result of all changes since the 31st CPP Actuarial Report is a decrease in the MCR of 0.35 percentage points for the year 2034 and thereafter.

- The MCR is less than the statutory rate of 9.9%, and thus the insufficient rates provisions do not apply. Therefore, in the absence of specific action by the federal and provincial Ministers of Finance, the statutory contribution rate will remain at 9.9% for the year 2025 and thereafter.

- Although the pay-as-you-go rate is expected to increase over time from 9.3% in 2025 to 13.9% by 2100 due to the retirement of the baby boom generation and the projected continued aging of the population, the statutory contribution rate of 9.9% is sufficient to finance the base Plan over the long term. The pay-as-you-go rate is the contribution rate that would need to be paid if there were no assets.

- The number of contributors to the CPP is expected to grow from 16.1 million in 2025 to 19.3 million in 2050 and 24.5 million by 2100. Under the statutory contribution rate of 9.9%, base CPP contributions are expected to increase from $73 billion in 2025 to $177 billion in 2050 and $905 billion by 2100.

- The number of base CPP retirement beneficiaries is expected to increase from 6.4 million in 2025 to 9.5 million in 2050 and 15.5 million by 2100.

- Total expenditures of the base Plan are expected to grow from approximately $68 billion in 2025 to $88 billion in 2030. Thereafter, total expenditures are projected to grow at a slower pace, reaching $197 billion in 2050 and $1.3 trillion by 2100.

- For the base CPP, as described in Appendix F, the adjustment factors calculated on the basis of this report and in accordance with subsection 115(1.11) of the Canada Pension Plan are 0.6% per month for pre-65 retirement pension take-up and 0.7% per month for post-65 retirement pension take-up. These adjustment factors are the same as the current legislated factors for pre-65 and post-65 retirement pension take-up.

5.2 Contributions

Projected contributions are the product of the contribution rate, the number of contributors, and the average contributory earnings. The contribution rate for the base CPP is set by law and is 9.9%. As of 1 January 2019, all contributors to the base CPP also contribute to the additional CPP.

Table 4 presents the projected number of CPP contributors, including CPP retirement beneficiaries who are working (i.e. "working beneficiaries"), their base CPP contributory earnings and contributions. The total number of contributors are directly linked to the assumed labour force participation rates applied to the projected working-age population and the job creation rates. Within this total, the number of working beneficiaries who are contributors is based on the number of retirement beneficiaries in pay. Hence, the demographic, economic, and retirement-related assumptions all have an influence on the expected level of contributions.

In this report, the number of CPP contributors is expected to increase continuously throughout the projection period, from an estimated 16.1 million in 2025 to 17.0 million in 2030, 19.3 million in 2050, and 24.5 million by 2100. The future increase in the number of contributors is limited by the projected lower growth in the working-age population and labour force.

The growth in base CPP contributory earnings, which are derived by subtracting the Year's Basic Exemption (YBE) from pensionable earnings (up to the YMPE) is linked to the growth in average employment earnings through the assumption regarding annual increases in wages and is affected by the freeze on the YBE since 1998.

Contributions to the base CPP are expected to increase from an estimated $73 billion in 2025 to $88 billion in 2030, $177 billion in 2050, and to continue increasing thereafter, reaching $905 billion in 2100 as shown in Table 4. The projected YMPE is also shown, which is assumed to increase according to the increases in the average weekly earnings assumption. The YMPE is projected to increase from $71,300 in 2025 to $82,100 in 2030, $142,700 in 2050, and $567,600 by 2100.

Since the statutory contribution rate for the base CPP is constant at 9.9%, contributions to the base CPP increase at the same rate as total contributory earnings over the projection period.

| Year | Contribution rate (%) | YMPE ($) | Number of contributors (thousands) | Contributory earnings ($ million) | Contributions ($ million) |

|---|---|---|---|---|---|

| 2025 | 9.9 | 71,300 | 16,114 | 733,218 | 72,589 |

| 2026 | 9.9 | 73,400 | 16,121 | 756,595 | 74,903 |

| 2027 | 9.9 | 75,600 | 16,424 | 794,101 | 78,616 |

| 2028 | 9.9 | 77,700 | 16,683 | 829,989 | 82,169 |

| 2029 | 9.9 | 79,900 | 16,825 | 861,449 | 85,283 |

| 2030 | 9.9 | 82,100 | 16,960 | 893,245 | 88,431 |

| 2031 | 9.9 | 84,400 | 17,108 | 927,034 | 91,776 |

| 2032 | 9.9 | 86,800 | 17,267 | 962,880 | 95,325 |

| 2033 | 9.9 | 89,200 | 17,429 | 999,736 | 98,974 |

| 2034 | 9.9 | 91,700 | 17,584 | 1,037,774 | 102,740 |

| 2035 | 9.9 | 94,300 | 17,740 | 1,077,475 | 106,670 |

| 2040 | 9.9 | 108,200 | 18,316 | 1,282,894 | 127,007 |

| 2045 | 9.9 | 124,300 | 18,843 | 1,521,171 | 150,596 |

| 2050 | 9.9 | 142,700 | 19,280 | 1,790,525 | 177,262 |

| 2055 | 9.9 | 163,800 | 19,749 | 2,108,774 | 208,769 |

| 2060 | 9.9 | 188,000 | 20,159 | 2,475,330 | 245,058 |

| 2065 | 9.9 | 215,900 | 20,626 | 2,912,278 | 288,316 |

| 2070 | 9.9 | 247,900 | 21,166 | 3,435,340 | 340,099 |

| 2075 | 9.9 | 284,600 | 21,698 | 4,047,374 | 400,690 |

| 2080 | 9.9 | 326,700 | 22,206 | 4,759,241 | 471,165 |

| 2085 | 9.9 | 375,100 | 22,738 | 5,599,158 | 554,317 |

| 2090 | 9.9 | 430,600 | 23,313 | 6,594,010 | 652,807 |

| 2095 | 9.9 | 494,400 | 23,904 | 7,766,468 | 768,880 |

| 2100 | 9.9 | 567,600 | 24,486 | 9,137,861 | 904,648 |

5.3 Expenditures

The projected number of base CPP beneficiaries by type of benefit is presented in Table 5, while Table 6 presents information for male and female beneficiaries separately. The number of retirement, disability, and survivor beneficiaries increases throughout the projection period. In particular, the number of retirement beneficiaries is expected to increase from an estimated 6.4 million in 2025 to 7.3 million by 2030, a 14% increase, due to the aging of the population and continued retirement of the baby boomers. By 2050, the number of retirement beneficiaries is projected to be 9.5 million and to then further increase to 15.5 million by 2100.

| Year | RetirementTable 5 Footnote 2,Table 5 Footnote 3,Table 5 Footnote 4,Table 5 Footnote 5 | DisabilityTable 5 Footnote 4,Table 5 Footnote 6 | SurvivorTable 5 Footnote 5,Table 5 Footnote 6 | Children | DeathTable 5 Footnote 7 |

|---|---|---|---|---|---|

| 2025 | 6,433 | 350 | 1,476 | 235 | 185 |

| 2026 | 6,615 | 352 | 1,501 | 241 | 189 |

| 2027 | 6,804 | 357 | 1,528 | 245 | 195 |

| 2028 | 6,991 | 360 | 1,555 | 250 | 201 |

| 2029 | 7,172 | 362 | 1,583 | 255 | 207 |

| 2030 | 7,343 | 366 | 1,611 | 260 | 212 |

| 2031 | 7,500 | 371 | 1,639 | 264 | 218 |

| 2032 | 7,641 | 377 | 1,668 | 267 | 224 |

| 2033 | 7,774 | 384 | 1,696 | 270 | 230 |

| 2034 | 7,900 | 391 | 1,724 | 272 | 237 |

| 2035 | 8,020 | 397 | 1,752 | 274 | 243 |

| 2040 | 8,499 | 436 | 1,878 | 280 | 275 |

| 2045 | 8,926 | 479 | 1,975 | 288 | 300 |

| 2050 | 9,458 | 512 | 2,036 | 296 | 318 |

| 2055 | 10,192 | 531 | 2,070 | 300 | 328 |

| 2060 | 11,033 | 535 | 2,091 | 303 | 333 |

| 2065 | 11,772 | 547 | 2,120 | 307 | 339 |

| 2070 | 12,434 | 573 | 2,173 | 310 | 351 |

| 2075 | 13,087 | 591 | 2,249 | 313 | 370 |

| 2080 | 13,674 | 603 | 2,330 | 316 | 391 |

| 2085 | 14,131 | 618 | 2,396 | 320 | 410 |

| 2090 | 14,519 | 640 | 2,433 | 324 | 421 |

| 2095 | 14,958 | 659 | 2,447 | 329 | 426 |

| 2100 | 15,464 | 677 | 2,458 | 333 | 433 |

|

Table 5 Footnotes

|

|||||

| Year | Males | Females | ||||||

|---|---|---|---|---|---|---|---|---|

| RetirementTable 6 Footnote 2,Table 6 Footnote 3,Table 6 Footnote 4,Table 6 Footnote 5 | DisabilityTable 6 Footnote 4,Table 6 Footnote 6 | SurvivorTable 6 Footnote 5,Table 6 Footnote 6 | DeathTable 6 Footnote 7 | RetirementTable 6 Footnote 2,Table 6 Footnote 3,Table 6 Footnote 4,Table 6 Footnote 5 | DisabilityTable 6 Footnote 4,Table 6 Footnote 6 | SurvivorTable 6 Footnote 5,Table 6 Footnote 6 | DeathTable 6 Footnote 7 | |

| 2025 | 3,063 | 154 | 310 | 107 | 3,369 | 196 | 1,165 | 78 |

| 2026 | 3,147 | 154 | 320 | 109 | 3,468 | 198 | 1,182 | 80 |

| 2027 | 3,233 | 156 | 329 | 112 | 3,570 | 201 | 1,199 | 83 |

| 2028 | 3,319 | 157 | 338 | 115 | 3,672 | 203 | 1,217 | 86 |

| 2029 | 3,400 | 158 | 347 | 117 | 3,772 | 204 | 1,236 | 89 |

| 2030 | 3,475 | 159 | 356 | 120 | 3,868 | 206 | 1,255 | 92 |

| 2031 | 3,543 | 162 | 365 | 123 | 3,957 | 209 | 1,275 | 96 |

| 2032 | 3,603 | 164 | 373 | 125 | 4,038 | 213 | 1,295 | 99 |

| 2033 | 3,659 | 167 | 381 | 128 | 4,115 | 216 | 1,315 | 102 |

| 2034 | 3,710 | 170 | 389 | 131 | 4,189 | 220 | 1,335 | 106 |

| 2035 | 3,759 | 173 | 397 | 134 | 4,260 | 224 | 1,355 | 109 |

| 2040 | 3,949 | 190 | 428 | 147 | 4,550 | 246 | 1,451 | 127 |

| 2045 | 4,125 | 210 | 447 | 157 | 4,801 | 269 | 1,528 | 143 |

| 2050 | 4,370 | 225 | 456 | 163 | 5,088 | 287 | 1,580 | 154 |

| 2055 | 4,731 | 233 | 460 | 167 | 5,461 | 298 | 1,610 | 161 |

| 2060 | 5,156 | 233 | 464 | 169 | 5,878 | 302 | 1,627 | 165 |

| 2065 | 5,522 | 237 | 472 | 172 | 6,250 | 309 | 1,648 | 167 |

| 2070 | 5,839 | 249 | 484 | 179 | 6,595 | 324 | 1,689 | 172 |

| 2075 | 6,145 | 257 | 497 | 189 | 6,942 | 334 | 1,752 | 181 |

| 2080 | 6,414 | 262 | 506 | 199 | 7,260 | 341 | 1,825 | 192 |

| 2085 | 6,619 | 269 | 509 | 208 | 7,513 | 349 | 1,886 | 202 |

| 2090 | 6,796 | 279 | 509 | 213 | 7,723 | 361 | 1,924 | 208 |

| 2095 | 7,007 | 287 | 509 | 215 | 7,951 | 371 | 1,938 | 211 |

| 2100 | 7,253 | 296 | 509 | 218 | 8,211 | 381 | 1,949 | 215 |

|

Table 6 Footnotes

|

||||||||

Table 7 shows the amount of projected base CPP expenditures by type. Total expenditures of the base Plan are expected to grow from approximately $68 billion in 2025 to $88 billion in 2030. Thereafter, total expenditures are projected to grow at a slower pace, reaching $197 billion in 2050 and $1.3 trillion by 2100. Table 8 shows the same information but in millions of year 2025 constant dollars.

Table 9 shows the projected base CPP expenditures by type expressed as a percentage of contributory earnings. These are referred to as the pay-as-you-go (or "PayGo") rates. A pay-as-you-go rate corresponds to the contribution rate that would need to be paid to cover expenditures if there were no assets. Although the total pay-as-you-go rate is expected to increase significantly from approximately 9.3% in 2025 to 13.9% by the end of the projection period in 2100, the statutory contribution rate of 9.9% is sufficient to finance the base Plan over the projection period.

| Year | RetirementTable 7 Footnote 1 | DisabilityTable 7 Footnote 2 | Survivor | Children | Death | Operating expensesTable 7 Footnote 3 | Total |

|---|---|---|---|---|---|---|---|

| 2025 | 55,700 | 4,829 | 5,664 | 673 | 500 | 754 | 68,119 |

| 2026 | 58,951 | 4,953 | 5,810 | 706 | 510 | 750 | 71,679 |

| 2027 | 62,432 | 5,077 | 5,967 | 737 | 523 | 784 | 75,521 |

| 2028 | 66,079 | 5,197 | 6,133 | 768 | 537 | 818 | 79,532 |

| 2029 | 69,877 | 5,328 | 6,318 | 799 | 552 | 847 | 83,720 |

| 2030 | 73,728 | 5,484 | 6,521 | 830 | 566 | 877 | 88,006 |

| 2031 | 77,592 | 5,682 | 6,743 | 860 | 580 | 908 | 92,365 |

| 2032 | 81,436 | 5,905 | 6,983 | 888 | 594 | 941 | 96,747 |

| 2033 | 85,290 | 6,153 | 7,239 | 914 | 609 | 974 | 101,179 |

| 2034 | 89,184 | 6,403 | 7,509 | 939 | 625 | 1,009 | 105,669 |

| 2035 | 93,129 | 6,670 | 7,795 | 965 | 641 | 1,045 | 110,244 |

| 2036 | 97,121 | 6,938 | 8,094 | 990 | 656 | 1,080 | 114,878 |

| 2037 | 101,131 | 7,236 | 8,407 | 1,014 | 671 | 1,117 | 119,576 |

| 2038 | 105,177 | 7,561 | 8,732 | 1,039 | 687 | 1,154 | 124,350 |

| 2039 | 109,304 | 7,909 | 9,070 | 1,063 | 704 | 1,192 | 129,242 |

| 2040 | 113,559 | 8,264 | 9,418 | 1,091 | 719 | 1,232 | 134,283 |

| 2041 | 117,955 | 8,640 | 9,776 | 1,121 | 733 | 1,273 | 139,497 |

| 2042 | 122,484 | 9,034 | 10,141 | 1,149 | 746 | 1,315 | 144,869 |

| 2043 | 127,167 | 9,439 | 10,513 | 1,178 | 759 | 1,358 | 150,414 |

| 2044 | 132,052 | 9,853 | 10,892 | 1,209 | 772 | 1,403 | 156,181 |

| 2045 | 137,187 | 10,274 | 11,277 | 1,240 | 783 | 1,450 | 162,211 |

| 2046 | 142,601 | 10,699 | 11,666 | 1,271 | 793 | 1,497 | 168,526 |

| 2047 | 148,303 | 11,126 | 12,057 | 1,303 | 802 | 1,546 | 175,137 |

| 2048 | 154,325 | 11,555 | 12,452 | 1,336 | 811 | 1,596 | 182,074 |

| 2049 | 160,713 | 11,990 | 12,849 | 1,370 | 819 | 1,647 | 189,387 |

| 2050 | 167,546 | 12,421 | 13,249 | 1,402 | 826 | 1,699 | 197,144 |

| 2051 | 174,872 | 12,858 | 13,651 | 1,434 | 833 | 1,755 | 205,403 |

| 2052 | 182,649 | 13,302 | 14,054 | 1,467 | 838 | 1,813 | 214,122 |

| 2053 | 190,857 | 13,752 | 14,458 | 1,501 | 843 | 1,872 | 223,283 |

| 2054 | 199,574 | 14,189 | 14,865 | 1,535 | 848 | 1,933 | 232,943 |

| 2055 | 208,917 | 14,593 | 15,276 | 1,569 | 851 | 1,994 | 243,200 |

| 2060 | 263,009 | 16,633 | 17,439 | 1,752 | 862 | 2,334 | 302,028 |

| 2065 | 325,973 | 19,223 | 20,043 | 1,959 | 876 | 2,731 | 370,805 |

| 2070 | 397,355 | 22,763 | 23,358 | 2,184 | 905 | 3,207 | 449,772 |

| 2075 | 481,077 | 26,534 | 27,605 | 2,429 | 952 | 3,769 | 542,366 |

| 2080 | 578,548 | 30,604 | 32,718 | 2,709 | 1,005 | 4,421 | 650,004 |