Legislative Framework for Foreign Banks

Information

Table of contents

Introduction: This Advisory provides an overview of how the Office of the Superintendent of Financial Institutions (OSFI) administers and interprets Parts XII and XII.01 of the Bank Act (the Act), which set out the framework for the branches, activities and investments in Canada of certain foreign banks and entities associated with a foreign bank.

In this Advisory, unless otherwise stated, references to parts or provisions are to those of the Act.

In this Advisory:

CRE stands for "Canadian regulated entity", which is an entity referred to in any of paragraphs 468(1)(a) to (i) (i.e., an FRE or a PRFI).

EAFB stands for "entity associated with a foreign bank" within the meaning of subsection 507(2), which is a Canadian or foreign entity that controls an FB, is controlled

FB stands for "foreign bank" within the meaning of section 2, which is a foreign entity that, among other things:

- is a bank according to the laws of a foreign jurisdiction,

- carries on a business in any foreign country that, if carried on in Canada, would be, wholly or to a significant extent, the business of banking,

- provides financial services and employs a name that includes the word "bank", "banque", "banking", or "bancaire", either alone or in combination with other words, or any corresponding words in another language,

- provides financial services and is affiliated

Within the meaning of section 6. with another FB, or - controls an FB

A foreign entity can be both an FB and an EAFB. A Canadian entity, however, can be an EAFB but, by definition, cannot be an FB. .

Subsection 1.5 of this Advisory lists certain entities that are exempted from the status of being FBs.

FB Conglomerate is comprised of an FB and all entities associated with that FB.

FRE stands for "federally regulated entity", which is an entity referred to in any of paragraphs 468(1)(a) to (f) (i.e., a federally regulated financial institution, a bank holding company or an insurance holding company).

FSE stands for "financial services entity", which is a Canadian entity, other than a CRE or a leasing entity

Material Banking Group refers to an FB Conglomerate with a Material Percentage of its revenues or assets attributable to Real FBs.

Material Percentage is a benchmark for determining whether an FB Conglomerate is materially engaged in the business of banking outside Canada. It assesses the extent to which the assets and revenues of an FB Conglomerate relate to the operations of Real FBs. The Material Banking Group Percentage Regulations set that benchmark at 35%. Subsection 1.4 of the Advisory provides guidance on completing this calculation.

Part XII Entity refers to an FB or EAFB to which Part XII applies by virtue of section 508. Section 1 of this Advisory provide guidance on this concept.

PRFI stands for "provincially regulated financial institution", which is an entity referred to in paragraphs 468(1)(g) to (i) (i.e., a provincially established trust, loan or insurance corporation, a provincially established and regulated cooperative credit society, or a federally or provincially established securities dealer).

Real FB refers to an FB described in paragraph 508(1)(a), which is an FB that:

- is a bank according to the laws of a foreign jurisdiction under which the FB was incorporated or in which the FB carries on business;

- engages in the business of providing financial services and employs, to identify or describe its business, a name that includes the word "bank", "banque", "banking", or "bancaire", either alone or in combination with other words, or any corresponding words in another language; or

- is regulated as a bank or as a deposit-taking institution according to the jurisdiction under whose laws it was incorporated or in any jurisdiction in which it carries on business.

Legislative References:

Part XII – Foreign Banks, sections 507 to 522.33

Part XII.01 – Non-Application of the Investment Canada Act, section 522.34

Entity Associated with a Foreign Bank Regulations

Exempt Classes of Foreign Banks Regulations

Exemption from Approval for Certain Investments in Intragroup Service Entities (Bank Act) Regulations

Exemption from Restrictions on Investments (Banks, Bank Holding Companies and Foreign Banks) Regulations

Foreign Bank Representative Offices Regulations

Information Technology Activities (Foreign Banks) Regulations

Manner of Calculation (Foreign Banks) Regulations

Material Banking Group Percentage Regulations

Prohibited Activities Respecting Real Property (Foreign Banks) Regulations

Specialized Financing (Foreign Banks) Regulations

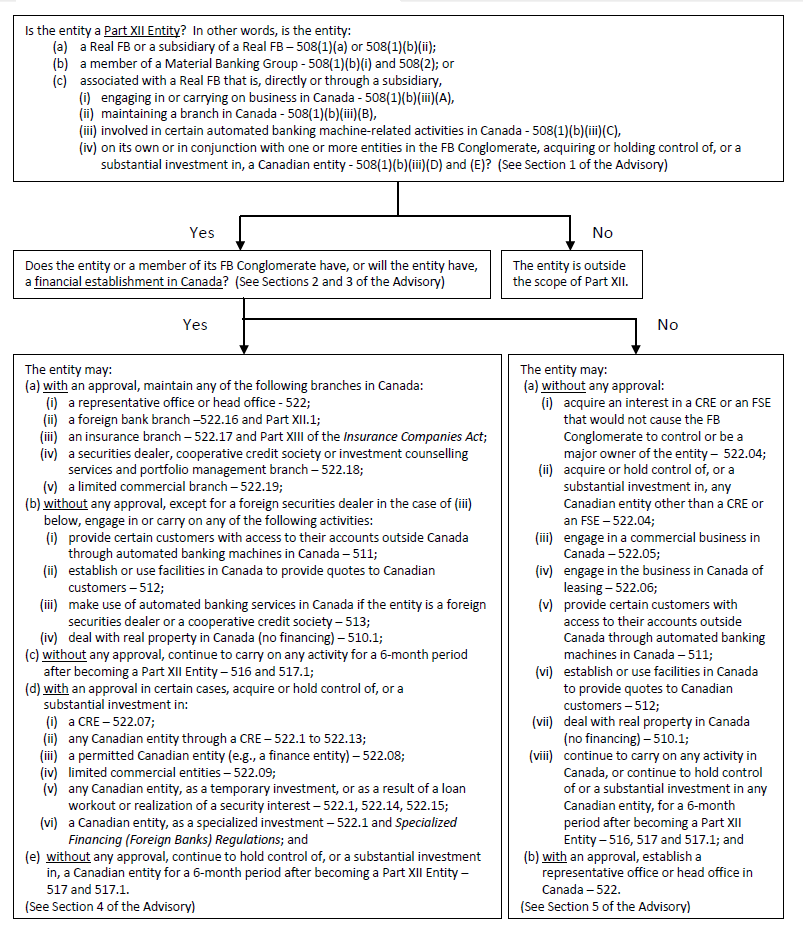

Flowchart – How OSFI Generally Assesses the Application of Part XII

In the following flowchart, "entity" refers to an FB or EAFB that seeks to engage in or carry on business in Canada (510(1)(a)), maintain a branch in Canada (510(1)(b)), undertake certain automated services in Canada (510(1)(c)), or acquire or hold control of, or a substantial investment in, a Canadian entity (510(1)(d)).

Text description of Flowchart – How OSFI Generally Assesses the Application of Part XII

- Is the entity a Part XII Entity? In other words, is the entity:

- a Real FB or a subsidiary of a Real FB – 508(1)(a) or 508(1)(b)(ii);

- a member of a Material Banking Group - 508(1)(b)(i) and 508(2); or

- associated with a Real FB that is, directly or through a subsidiary,

- engaging in or carrying on business in Canada - 508(1)(b)(iii)(A),

- maintaining a branch in Canada - 508(1)(b)(iii)(B),

- involved in certain automated banking machine-related activities in Canada - 508(1)(b)(iii)(C),

- on its own or in conjunction with one or more entities in the FB Conglomerate, acquiring or holding control of, or a substantial investment in, a Canadian entity - 508(1)(b)(iii)(D) and (E)? (See Section 1 of the Advisory)

- If no,

- The entity is outside the scope of Part XII.

- If yes,

- Does the entity or a member of its FB Conglomerate have, or will the entity have, a financial establishment in Canada? (See Sections 2 and 3 of the Advisory)

- If yes,

- The entity may:

- with an approval, maintain any of the following branches in Canada:

- a representative office or head office - 522;

- a foreign bank branch –522.16 and Part XII.1;

- an insurance branch – 522.17 and Part XIII of the Insurance Companies Act;

- a securities dealer, cooperative credit society or investment counselling services and portfolio management branch – 522.18;

- a limited commercial branch – 522.19;

- without any approval, except for a foreign securities dealer in the case of (iii)

below, engage in or carry on any of the following activities:- provide certain customers with access to their accounts outside Canada through automated banking machines in Canada – 511;

- establish or use facilities in Canada to provide quotes to Canadian customers – 512;

- make use of automated banking services in Canada if the entity is a foreign securities dealer or a cooperative credit society – 513;

- deal with real property in Canada (no financing) – 510.1;

- without any approval, continue to carry on any activity for a 6-month period

after becoming a Part XII Entity – 516 and 517.1; - with an approval in certain cases, acquire or hold control of, or a

substantial investment in:- a CRE – 522.07;

- any Canadian entity through a CRE – 522.1 to 522.13;

- a permitted Canadian entity (e.g., a finance entity) – 522.08;

- limited commercial entities – 522.09;

- any Canadian entity, as a temporary investment, or as a result of a loan workout or realization of a security interest – 522.1, 522.14, 522.15;

- a Canadian entity, as a specialized investment – 522.1 and Specialized Financing (Foreign Banks) Regulations; and

- without any approval, continue to hold control of, or a substantial investment in, a Canadian entity for a 6-month period after becoming a Part XII Entity – 517 and 517.1.

- with an approval, maintain any of the following branches in Canada:

- (See Section 4 of the Advisory)

- The entity may:

- If no,

- The entity may:

- without any approval:

- acquire an interest in a CRE or an FSE that would not cause the FB Conglomerate to control or be a major owner of the entity – 522.04;

- acquire or hold control of, or a substantial investment in, any Canadian entity other than a CRE or an FSE – 522.04;

- engage in a commercial business in Canada – 522.05;

- engage in the business in Canada of leasing – 522.06;

- provide certain customers with access to their accounts outside Canada through automated banking machines in Canada – 511;

- establish or use facilities in Canada to provide quotes to Canadian customers – 512;

- deal with real property in Canada (no financing) – 510.1;

- continue to carry on any activity in Canada, or continue to hold control of or a substantial investment in any Canadian entity, for a 6-month period after becoming a Part XII Entity – 516, 517 and 517.1; and

- with an approval, establish a representative office or head office in Canada – 522.

- without any approval:

- (See Section 5 of the Advisory)

- The entity may:

Context and overview: Part XII is designed to foster greater competition in the Canadian financial sector by encouraging the entry of FBs. The framework provides flexibility to FB Conglomerates that seek to invest or operate in Canada, while ensuring that the rules applicable to Part XII Entities that have a financial establishment in Canada

The concepts of "Part XII Entity" and "financial establishment in Canada" are key to the application of the Part XII framework. These concepts are discussed in Sections 1 and 2 of the Advisory, respectively. A requirement to obtain an approval may apply prior to a Part XII Entity having a financial establishment in Canada. This is discussed in Section 3 of the Advisory.

The branch establishment, activities and investment rules that apply to a Part XII Entity depend in large part on whether such entity has, or will have, a financial establishment in Canada. The rules that apply to a Part XII Entity that has, or whose prospective branch, activity or investment in Canada will cause it to have, a financial establishment in Canada are discussed in Section 4 of the Advisory. The rules that apply to a Part XII Entity that does not, and will not, have a financial establishment in Canada (the so called "commercial path" into Canada) are discussed in Section 5.

Appendix A to this Advisory sets out the permitted branches, activities and investments in Canada of Part XII Entities and whether they result in a financial establishment in Canada.

Pursuant to sections 510 and 518, a Part XII Entity need only consider Part XII where it seeks to (a) engage in or carry on business in Canada,

The circumstance-based rules in Part XII (e.g., the Material Percentage calculation) require FB Conglomerates to consider their compliance with Part XII, on an ongoing basis, where they have a branch, carry on activities or hold investments in Canada, or are proposing to do so.

Section 1. Identifying Part XII Entities (section 508)

Part XII applies only to FBs and EAFBs that are Part XII Entities. This section discusses the different types of Part XII Entities.

1.1 Real FBs (paragraph 508(1)(a))

Real FBs are Part XII Entities. While subparagraphs 508(1)(a)(i) and (ii) are self-explanatory, subparagraph (iii) merits some discussion. Pursuant to subparagraph (iii), a Real FB includes an FB that is regulated as a bank or as a deposit-taking institution according to the jurisdiction under whose laws it was incorporated or in any jurisdiction in which it carries on business.

OSFI is generally of the view that an FB is regulated as a bank or a deposit-taking institution if its core business comprises banking-type activities, such as deposit-taking and/or lending, and it is subject to a regulatory framework aimed at protecting the FB's depositors and/or other creditors. This would generally be the case, for example, for credit unions and savings and loan companies.

1.2 Real FB subsidiaries (508(1)(b)(ii))

Entities controlled by a Real FB are Part XII Entities.

1.3 FB Conglomerate members where a Real FB member of that conglomerate, or its subsidiary, has a presence in Canada or certain investments in Canada (508(1)(b)(iii))

An entity associated with a Real FB is a Part XII Entity where the Real FB, or one of the Real FB's subsidiaries, is:

- engaging in or carrying on business in Canada, other than holding, managing or otherwise dealing with real property;

- maintaining a branch in Canada, other than an FB representative office or head office (head office activities in Canada are limited to the conduct of business outside Canada);

- establishing, maintaining or acquiring for use in Canada an automated banking machine, a remote service unit or a similar automated service, or in Canada accepting data from such a machine, unit or service other than as described in section 511 or 512;

- acquiring or holding control of, or a substantial investment in, a Canadian entity;

- acquiring or holding any share or ownership interest in a Canadian entity that is controlled by another member of the FB Conglomerate, or in which that member has a substantial investment; or

- where the FB Conglomerate is controlled by an individual, acquiring or holding any share or ownership interest in a Canadian entity that two or more members of the FB Conglomerate would, if they were one person, control or have a substantial investment in.

In other words, the moment a Real FB in an FB Conglomerate directly or via a subsidiary carries out one of the activities listed above, all entities in the FB Conglomerate become Part XII Entities. This will be the case regardless of whether or not the FB Conglomerate is a Material Banking Group as discussed in the next section.

1.4 Members of Material Banking Groups (subparagraph 508(1)(b)(i) and subsection (508(2))

An entity that does not fit in any of the categories above will nonetheless be a Part XII Entity if it is a member of a Material Banking Group. Pursuant to subsection 508(2), the Material Percentage is calculated via the formula below. In the context of the formula, pursuant to subsection 508(5), an entity's "total revenue" and the value of its "total assets" are those reported on a consolidated basis:

- in its most recently completed financial statements that were prepared in accordance with generally accepted accounting principles in

- the jurisdiction in which the entity was formed or incorporated,

- a jurisdiction in which it carries on business, or

- a country or territory that is a WTO Member as defined in subsection 2(1) of the World Trade Organization Agreement Implementation Act; or

- in accordance with generally accepted accounting principles in Canada, where the entity's most recently completed financial statements were not prepared in the manner described in paragraph (a).

Material Percentage = greater of A/B or C/D

In the above formula:

A is the sum of the total assets of all Real FBs in the FB Conglomerate other than the total assets of a Real FB that are consolidated into the total assets of another Real FB in the conglomerate.

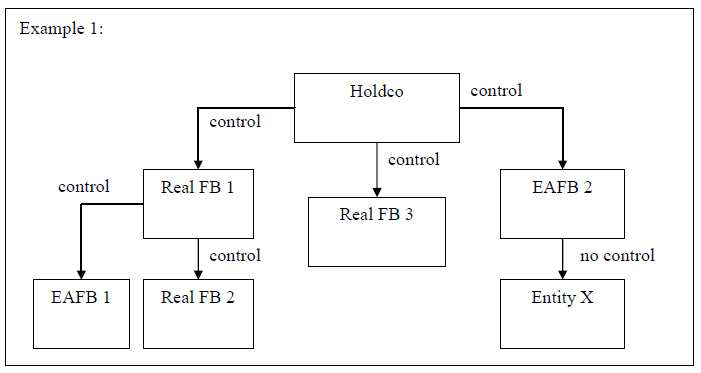

Text description of Example 1

- Holdco

- control

- Real FB 1

- control

- EAFB 1

- Real FB 2

- control

- Real FB 3

- EAFB 2

- no control

- Entity X

- no control

- Real FB 1

- control

Assume that in this scenario, the assets of EAFB 1 and Real FB 2 are consolidated in those of Real FB 1. To determine "A", one would add the assets of Real FB 1 to those of Real FB 3.

B is the value of the total assets of the entity that is at the top of the FB Conglomerate's ownership chain, and where an individual controls the FB Conglomerate, B is the sum of the total assets of all entities in the FB Conglomerate other than entities whose assets are consolidated into the total assets of another entity in the conglomerate.

Going back to Example 1 above, B would equal the total assets of Holdco. Note that this figure would likely not include the assets of Entity X as those assets would not likely be consolidated into the assets of EAFB 2 because EAFB 2 does not control Entity X.

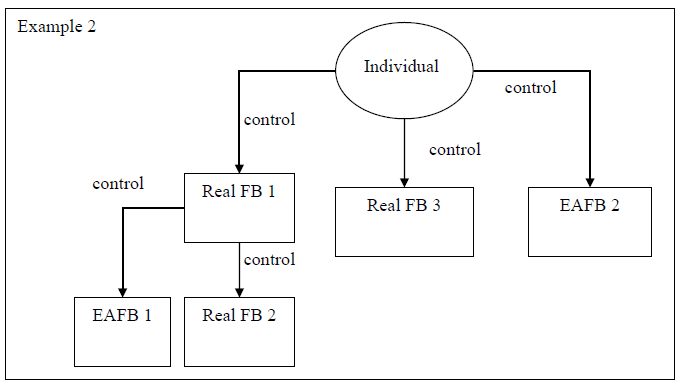

Now take another scenario where an individual is at the top of the FB Conglomerate.

Text description of Example 2

- Individual

- control

- Real FB 1

- control

- EAFB 1

- Real FB 2

- control

- Real FB 3

- EAFB 2

- Real FB 1

- control

Also assume that in this scenario, the assets of EAFB 1 and Real FB 2 are consolidated in those of Real FB 1. To determine "B", one would add the total assets of Real FB 1, Real FB 3 and EAFB 2.

C is the sum of the total revenue of all Real FBs in the FB Conglomerate other than the total revenue of a Real FB that is consolidated into the total revenue of another Real FB in the conglomerate.

D is the value of the total revenue of the entity at the top of the FB Conglomerate's ownership chain, and where an individual controls an FB Conglomerate, D is the sum of the total revenue of all entities in the FB Conglomerate other than entities whose total revenue are consolidated into the total revenue of another entity in the conglomerate.

Examples of total asset Material Percentage calculations (A/B calculations only):

Assume that in previous Example 1, unconsolidated assets are as follows:

EAFB 1 = 11

EAFB 2 = 12

Real FB 1 = 6

Real FB 2 = 13

Real FB 3 = 14

Holdco = 14

Entity X = 8

On a consolidated basis, the assets of the entities are as follows:

Real FB 1 = 30 (Real FB 1 + EAFB 1 + Real FB 2 = 6 + 11 + 13)

EAFB 2 = 12 Note: The assets of entity X are not consolidated as EAFB 2 does not control it

Holdco = 70 (Holdco + Real FB 1 consolidated + Real FB 3 + EAFB 2 = 14 + 30 + 14 + 12)

A = Real FB 1 + Real FB 3 = 30 + 14 = 44

B = Holdco = 70

Material Percentage = 44/70 = 62.9%

Assume that in previous Example 2, unconsolidated assets are as follows:

EAFB 1 = 11

EAFB 2 = 80

Real FB 1 = 14

Real FB 2 = 15

Real FB 3 = 5

On a consolidated basis, the assets of the entities are as follows:

Real FB 1 = 40 (Real FB 1 + EAFB 1 + Real FB 2 = 14 + 11 + 15)

Real FB 3 = 5

EAFB 2 = 80

A = 45 (Real FB 1 + Real FB 3 = 40 + 5)

B = 125 (Real FB 1 + Real FB 3 + EAFB 2 = 40 + 5 + 80)

Material Percentage = 45/125 = 36%

Where the Material Percentage is equal to or greater than 35%, all entities in the FB Conglomerate are Part XII Entities. However, where the Material Percentage is less than 50%

1.5 Certain exceptions from being a Part XII Entity

The following entities are exempted from the FB and/or EAFB status, and therefore from being Part XII Entities.

- In certain cases, the government of a foreign country or a political subdivision of a foreign country (e.g., a state or province) could be an FB or EAFB (e.g., where the government controls an FB). However, these governments and political subdivisions are exempt from FB and EAFB status, and certain entities controlled by them are exempt from EAFB status, so long as they do not carry on in Canada a business that includes an activity referred to in any of paragraphs (a) to (g) of the definition of "financial services entity" in subsection 507(1).

See section 1 of the Exempt Classes of Foreign Banks Regulations and paragraphs 2(a) and (b) of the Entity Associated with a Foreign Bank Regulations. This exempt status, however, does not extend to FBs controlled by these persons or to entities controlled by these FBs. - A subsidiary of a bank named in Schedule I of the Act, as that Schedule read on October 23, 2001, is not an FB, due to the exclusion in the definition of "foreign bank" in section 2.

- Where a Canadian entity is an EAFB only because it controls an FB, the Canadian entity and entities controlled by that Canadian entity are exempt from EAFB status if the conditions set out in any of paragraphs 2(c) to (f) of the Entity Associated with a Foreign Bank Regulations are met. For example, the following entities are not EAFBs:

- an FRE and its subsidiaries, other than subsidiaries that are Real FBs or are subsidiaries of Real FBs;

- any other Canadian entity that controls a Real FB so long as the Real FB or entities controlled by the Real FB do not have investments or a presence in Canada of a type described in subparagraph 2(e)(ii) of the regulations referred to above; and

- any subsidiary of the Canadian entity referred to in (ii) above, other than subsidiaries that are Real FBs or are subsidiaries of Real FBs.

While an FRE controlled by a Part XII Entity, and a Canadian entity controlled by that FRE, are not exempted from EAFB status, subsection 510(4) exempts them from the restrictions contained in subsection 510(1).

Section 2: Determining whether a Part XII Entity has a financial establishment in Canada (subsections 507(15) and (16))

A Part XII Entity has a financial establishment in Canada if the Part XII Entity or a member of its FB Conglomerate:

- is an authorized foreign bank (i.e., an FB that has obtained an order under subsection 524(1) permitting it to establish a branch in Canada to carry on business);

- is a foreign insurance company (i.e., an entity that has obtained an order under subsection 574(1) of the Insurance Companies Act permitting it to insure in Canada risks);

- has obtained an approval under paragraph 522.22(1)(f) to maintain a branch in Canada to engage in the business of a cooperative credit society or in the business of dealing in securities or providing investment counselling or portfolio management services;

- controls a CRE or a body corporate that is an FSE, or owns more than 20% of a class of voting shares or 30% of a class of non-voting shares of a CRE or a body corporate that is an FSE; or

- controls an unincorporated entity that is an FSE or owns more than 35% of the ownership interests of that entity.

Section 3: Determining whether an approval to have a financial establishment in Canada is required (sections 522.21 and 522.211)

A Part XII Entity must generally obtain an "entry approval" from the Minister under sections 522.21 or 522.211 prior to having a financial establishment in Canada.

- is an authorized foreign bank (i.e., an FB that has obtained an order under subsection 524(1) permitting it to establish a branch in Canada to carry on business);

- is a foreign insurance company (i.e., an entity that has obtained an order under subsection 574(1) of the Insurance Companies Act permitting it to insure in Canada risks);

- controls an FRE or beneficially owns more than 20% of its voting shares or 30% of its non-voting shares; or

- has already received the approval of the Minister to have a financial establishment in Canada. (subsections 522.21(2) and 522.211(2))

Prior to March 8, 2008, the Part XII "entry approval" was in the form a designation order from the Minister under subsection 508(1). Entities that were the subject of such a designation order are deemed to have received the approval of the Minister to have a financial establishment in Canada. (subsections 522.21(3) and 522.211(3))

When preparing an application for an approval to have a financial establishment in Canada, a Part XII Entity should refer to Transaction Instruction A No. 3.0 – Approval to have a financial establishment in Canada.

Section 4: Framework for Part XII Entities with a financial establishment in Canada (Divisions 2 and 4 of Part XII)

The activities and investment rules applicable to Part XII Entities that have, or whose prospective branch, activities or investments in Canada will cause them to have, a financial establishment in Canada are substantially similar to the rules applicable to Canadian banks.

Section 5: Framework for Part XII Entities without a financial establishment in Canada (Divisions 2 and 3 of Part XII)

The branch establishment, activities and investment rules applicable to Part XII Entities that do not have, and whose prospective branch, activities or investments will not cause them to have, a financial establishment in Canada are light. A Part XII Entity without a financial establishment in Canada may, without any approval under Part XII:

-

acquire control of, or a substantial investment in, any Canadian entity so long as, by virtue of the acquisition, neither the Part XII Entity nor any member of its FB Conglomerate,

-

controls a CRE or a body corporate that is an FSE, or owns more than 20% of a class of voting shares or 30% of a class of non-voting shares of a CRE or a body corporate that is a FSE, or

-

controls an unincorporated entity that is an FSE or owns more than 35% of the ownership interest of that entity;

(sections 522.04 and 522.2)

-

-

maintain a branch in Canada or engage in or carry on business in Canada that is predominantly commercial so long as:

-

no more than 10% of the Part XII Entity's business in Canada (total assets or revenue

The value of the entity's assets or revenue are to be determined in accordance with the Manner of Calculation (Foreign Banks) Regulations, which provide that the value of the assets and revenues are those reported on the entity's most recent financial statements that were prepared in accordance with generally accepted accounting principles in Canada, or in the jurisdiction in which the entity was formed or incorporated. ) are in respect of activities referred to in any of paragraph (a) to (g) of the definition of "financial services entity" in subsection 507(1), and -

no more than 10% of the Part XII Entity's business outside Canada (total assets or revenue) are in respect of activities referred to in any of paragraph (a) to (h) of the definition of "financial services entity" in subsection 507(1);

(sections 522.05 and 522.2, and sections 3 and 4 of the Manner of Calculation (Foreign Banks) Regulations)

-

-

maintain a branch in Canada or engage in or carry on business in Canada that is limited to "leasing activities" within the meaning of subsection 507(1), which include financial leasing activities, provided that outside Canada, the Part XII Entity engages only in

-

"leasing activities", and/or

-

activities other than those referred to in any of paragraphs (a) to (h) of the definition of "financial services entity" in subsection 507(1);

(sections 522.06 and 522.2)

-

-

provide customers who are natural persons not ordinarily resident in Canada with access to their accounts located outside Canada through automated banking machines in Canada;

(section 511)

-

establish, maintain or use a private telephone service or similar facility to provide quotes to customers in Canada or to enter into verbal agreements with customers in Canada relating to, foreign exchange, deposit or loan rates, if there is no accounting or information processing involved in the private telephone service or similar facility; and

(section 512)

-

hold, manage or deal with real property in Canada, provided this does not involve the making or acquiring of loans or advances on the security of real property.

(section 510.1 and the Prohibited Activities Respecting Real Property (Foreign Banks) Regulations)

In addition, under section 522, a Part XII Entity that is an FB may, with the approval of the Superintendent, establish a representative office in Canada and, with the approval of the Governor in Council, locate its head office in Canada. For certainty, neither such offices nor any other branch, activity or investment listed in (a) to (f) above will cause the Part XII Entity or members of its FB Conglomerate to have a financial establishment in Canada.

Where an entity becomes a Part XII Entity and maintains a branch, carries on an activity or holds an investment in Canada that results in a financial establishment in Canada for itself and its FB Conglomerate, the Part XII Entity and its FB Conglomerate have up to 6 months to take measures to comply with Part XII (sections 516, 517 and 517.1).

Section 6: Reporting (section 522.27)

A Part XII Entity must, at the times and in the form specified by the Superintendent, provide the Superintendent with the information that he or she may require.

Section 7: Investment Canada Act (Part XII.01)

Part XII.01 exempts the following investments and activities of FBs and EAFBs from the application of the Investment Canada Act:

- the acquisition of control of an FRE;

- the establishment of an insurance business in Canada under Part XIII of the Insurance Companies Act by an FB or EAFB that is not a Part XII Entity;

- the acquisition of control of a Canadian entity by an FRE that is a subsidiary of an FB or EAFB;

- the establishment of a new Canadian business that is authorized by Division 4 of Part XII (any of items 1, 3 and 4 of Table I of Appendix A, as well as item 6 of that table where the FB Conglomerate has a financial establishment in Canada); and

- the acquisition of control of a Canadian entity in accordance with Division 4 of Part XII (see Table II of Appendix A where the acquiring Part XII Entity has, or would have by virtue of the acquisition, a financial establishment in Canada).

Note: In this Section, "control" means control as defined in the Investment Canada Act.

Advisories describe how OSFI administers and interprets provisions of existing legislation, regulations or guidelines, or provide OSFI's position regarding certain policy issues. Advisories are not law; readers should refer to the relevant provisions of the legislation, regulation or guideline, including any amendments that came into effect subsequent to the Advisory's publication, when considering the relevance of the Advisory.

Appendix A

Part XII Entities

Permitted Types of Branches, Activities and Investments in Canada

This document has been prepared for convenience of reference only and has no official sanction. For all purposes of interpreting and applying the law, users should consult the BA and relevant regulations.

| Permitted Types of Branches and Activities in Canada | Results in a Financial Establishment in Canada? | Approval to have a Financial Establishment in Canada? | Other Approvals/Orders under the Act? | Comments |

|---|---|---|---|---|

| 1. Bank branch and business – authorized foreign bank [522.16] |

Yes, where the FB Conglomerate does not already have a financial establishment in Canada. |

Not required. [522.21(2)(a) and 522.211(2)(a)] |

Minister's order required under Part XII.1. No approval/order under Part XII. |

An FB must be a bank in the jurisdiction under whose laws it was incorporated in order for the Minister to make an order under Part XII.1. An authorized foreign bank is not subject to the subsection 520(1) restrictions on deposit-taking [520(2)] or the restrictions on borrowing from the public [520.1(4)(a)]. However, an authorized foreign bank may be subject to the Part XII.1 restrictions on deposit-taking and borrowing [524(2) and 540]. An authorized foreign bank's business in Canada is subject to Part XII.1 [523(1)] and that FB's substantial investments in Canadian entities are subject to Part XII. |

| 2. Representative office or head office [522] | No. | Not applicable. |

|

The Foreign Bank Representative Offices Regulations prescribe the types of activities that an FB may carry on in a representative office. OSFI has published Rulings on the scope of these activities. |

| 3. Insurance branch and business – foreign insurance company [522.17] | Yes, where the FB Conglomerate does not already have a financial establishment in Canada. [507(15)(b) and 507(16)(b)] |

Not required. [522.21(2)(b) and 522.211(2)(b)] |

No, but Superintendent's order required under Part XIII of the Insurance Companies Act. | The insurance business in Canada of a foreign insurance company is subject to Part XIII of the Insurance Companies Act. A foreign insurance company is subject to the restrictions on deposit-taking [520(1)], but not on borrowing from the public [520.1(4)(c)]. |

| 4. Cooperative credit society, securities dealer, investment counselling or portfolio management branch and business [522.18] |

Yes, where the FB Conglomerate does not already have a financial establishment in Canada. [507(15)(c) and (16)(c)] |

Required unless a member of the FB Conglomerate has received, or is deemed to have received, such an approval. [522.21(2)(d) and (3), and 522.211(2)(d) and (3)] |

Minister's approval required. [522.22(1)(f)] In addition, a foreign securities dealer that wishes to establish, maintain or acquire automated banking machines related to its business in Canada, would require another Minister's approval. |

A foreign cooperative credit society that has received an approval under paragraph 522.22(1)(f) is not subject to the restrictions on deposit-taking [520(2)] or on borrowing from the public [520.1(4)(b)]. A foreign securities dealer that has received an approval under paragraph 522.22(1)(f) is subject to the restrictions on deposit-taking [520(1)], but not on borrowing from the public [520.1(4)(d)]. In each case, the business in Canada must be carried on in accordance with applicable provincial law. |

| 5. Leasing branch and business [522.06] |

No. | Not applicable. | No. | Leasing branches and businesses are permitted provided that the Part XII Entity:

|

| 6. Commercial branch and business [522.05 or 522.19] |

No. | Not applicable. | Minister's approval required if the FB Conglomerate has a financial establishment in Canada. [522.22(1)(h)] |

A Part XII Entity may carry out these activities provided that: a. no more than 10% of its business in Canada (total assets or revenue) is in respect of activities referred to in any of paragraphs (a) to (g) of the definition of "financial services entity" in subsection 507(1); b. no more than 10% of its business outside Canada (total assets or revenue) is in respect of activities referred to in any of paragraphs (a) to (h) of the definition of "financial services entity" in subsection 507(1); c. if the FB Conglomerate has a financial establishment in Canada,

[522.05 or 522.19 and sections 3 and 4, or 6 and 7, of the Manner of Calculation (Foreign Banks) Regulations] An FB or EAFB with such a branch or business in Canada may be subject to the restrictions on deposit-taking [520(1)] and the disclosure requirements on borrowing from the public [520.1(1)(b) and (2)]. |

| 7. Establish, maintain or acquire for use in Canada an automated banking machine [513] |

No. | Not applicable. | Minister's approval required if the entity is a foreign securities dealer that has received the Minister's approval under 522.22(1)(f). [522.22(1)(i)] |

These activities are permitted to foreign securities dealers and cooperative credit society branches so long as they relate to their Canadian activities as permitted by subsection 522.18(1). Furthermore, authorized foreign banks are permitted by subsection 538(1) to engage in such activities. |

| 8. Provide certain customers with access to their accounts outside Canada through automated banking machines in Canada [511] |

No. | Not applicable. | No. | The customers must be natural persons who are not ordinarily resident in Canada. |

| 9. Establish, maintain or use a private telephone service or similar facility in Canada to provide quotes to customers in Canada, or to enter with customers in Canada into verbal agreements relating to, foreign exchange, deposit or loan rates [512] |

No. | Not applicable. | No. | These activities are only permitted if there is no accounting or information processing involved in the private telephone service or similar facility. |

| 10. Real property branch and business [510.1 and Prohibited Activities Respecting Real Property (Foreign Banks) Regulations] | No. | Not applicable. | No. |

This permission does not extend to the making or acquiring of loans or advances on the security of real property in Canada. [section 1 of the Prohibited Activities Respecting Real Property (Foreign Banks) Regulations] An FB or EAFB with such a branch or business in Canada may be subject to the restrictions on deposit-taking [520(1)] and on borrowing from the public [520.1(1) and (2)]. |

|

11. Carry on any activity for a 6-month period, as a result of a change of status |

Depends on the nature of the Part XII Entity's branches or activities in Canada. | Not applicable during the 6-month period. | No approval/order to obtain the 6-month transitional relief. | This is a transitional provision that allows an entity that becomes a Part XII Entity to continue to engage in any activity in Canada for a period of up to 6 months while its FB Conglomerate is taking measures to comply with Part XII. |

| Permitted Types of Canadian Entities | Results in a Financial Establishment in Canada? | Approval to have a Financial Establishment in Canada? | Other Approvals/Orders under the Act? | Comments |

|---|---|---|---|---|

|

1. Federally regulated entities (FREs) (468(1)(a) to (f) entities, i.e., a federally regulated financial institution, a bank holding company or an insurance holding company) |

Yes, where:

|

Not required. [522.21(2)(c) and 522.211(2)(c)] |

No, but Minister's approval required under the ownership provisions of the relevant FRE statute. |

FREs that are EAFBs are not subject to the general prohibitions set out in subsection 510(1). Banks and federally incorporated trust and loan companies and cooperative credit associations are not subject to the subsection 519(1) restrictions on deposit-taking. [519(2)] FREs, other than cooperative credit associations, are not subject to the disclosure requirements on borrowing from the public. |

| 2. Entities acquired or held through an FRE or a Canadian entity controlled by an FRE [522.1(a) and 522.11] |

No. Where the FB or EAFB controls an FRE, it already caused its FB conglomerate to have a financial establishment in Canada (where its FB Conglomerate did not already have one). | Not required. [522.21(2)(c) and 522.211(2)(c)] |

No, but the FRE may require an approval under the investment provisions of the relevant FRE statute. [522.11(2)] |

These entities that are EAFBs are not subject to the general prohibitions set out in subsection 510(1). These entities, however, may be subject to the:

|

|

3. Provincially regulated financial institutions (PRFIs) (468(1)(g) to (i) entities, i.e., a provincially established trust, loan or insurance corporation, a provincially established and regulated cooperative credit society, or a federally or provincially established securities dealer) |

Yes, where:

|

Approval required prior to acquiring or holding control of, or a major ownership interest in, a PRFI unless a member of the FB Conglomerate has received, or is deemed to have received, the Minister's approval to have a financial establishment in Canada. [522.21(2)(d) and (3), and 522.211(2)(d) and (3)] |

Minister's approval required if control is acquired from a person who is not a member of the foreign bank's group, as defined in subsection 507(14). [522.22(1)(a)] |

PRFIs that are EAFBs are not subject to the restrictions on:

Provincially incorporated trust or loan corporations and cooperative credit societies are not subject to the subsection 519(1) restrictions on deposit-taking. [519(2)] PRFIs, other than cooperative credit societies, are not subject to the disclosure requirements on borrowing from the public. |

| 4. Entities acquired or held through a PRFI or a Canadian entity controlled by a PRFI [522.1(a), 522.12 and 522.13] |

No. Where the FB or EAFB controls a PRFI, it already caused its FB Conglomerate to have a financial establishment in Canada (where its FB Conglomerate did not already have one). | At the time of the acquisition of the PRFI, the FB Conglomerate may have had to obtain an approval to have a financial establishment in Canada. [see category 3 above] |

The PRFI and its Canadian subsidiary do not require an approval. [522.12] |

These entities that are EAFBs:

These entities may be subject to the:

[522.12 and 522.13] |

|

5. Other financial intermediaries This class comprises non-CREs engaging in financial intermediary activities that expose the entity to material material market or credit risk, including:

|

Yes, where:

|

Except where the entity is a leasing entity, approval required prior to acquiring or holding control of, or a major ownership interest in, these entities unless a member of the FB Conglomerate has received, or is deemed to have received, the approval of the Minister to have a financial establishment in Canada. [522.21(2)(d) and (3) and 522.211(2)(d) and (3)] |

Minister's approval generally required if:

Minister's approval, however, is not required where the financial intermediary activities of the entity are limited to providing services to the foreign bank or the foreign bank's group. [section 2 of the Exemption from Approval for Certain Investments in Intragroup Service Entities Regulations] |

Financial intermediaries that are EAFBs:

Financial intermediaries are subject to the disclosure requirements on borrowing from the public [519.1(1) and (2)] and restrictions on:

|

|

6. Financial agents This class includes entities whose business consists of:

This class also includes a mutual fund distribution entity (defined in 464(1)). [522.08(1)(e)] |

Yes, where:

|

Approval required prior to acquiring or holding control of, or a major ownership interest in, these entities unless a member of the FB Conglomerate has received, or is deemed to have received, the approval of the Minister to have a financial establishment in Canada. [522.21(2)(d) and (3) and 522.211(2)(d) and (3)] |

No. |

Financial agents that are EAFBs:

Financial agents are subject to the disclosure requirements on borrowing from the public [519.1(1) and (2)] and restrictions on:

|

|

7. Investment holding entities that are not investment funds This class includes:

|

No. However, the investments held or made by an investment holding entity may cause the FB Conglomerate to have a financial establishment in Canada. | Not applicable. However, the investments held or made by an investment holding entity controlled by an FB or EAFB may trigger an approval. | No, but the investments held or made by an investment holding entity controlled by an FB or EAFB may trigger an approval. |

Investment holding entities that are EAFBs:

Where the investment holding entity is a specialized financing entity, its ownership is subject to the Specialized Financing (Foreign Banks) Regulations. Where the investment holding entity is a limited commercial holding entity, its activities are limited to holding investments in limited commercial entities. Investment holding entities are subject to the disclosure requirements on borrowing from the public [519.1(1) and (2)] and restrictions on:

|

|

8. Non-financial services entities This class includes entities that:

|

No. | Not applicable. |

Minister's approval required if the entity:

|

Non-financial services entities that are EAFBs:

Non-financial services entities are subject to the disclosure requirements on borrowing from the public [519.1(1) and (2)] and restrictions on:

|

|

9. Prescribed entities A Part XII Entity may acquire or hold control of, or a substantial investment in, an entity that engages in prescribed activities. [522.08(1)(f)] The only prescribed activities are found in subsection 2(1) of the Information Technology Activities (Foreign Banks) Regulations (the "IT Activities") |

No. | Not applicable. |

Minister's approval required unless exempted by the Regulations. [522.22(1)(e)]. Where an entity limits its activities to IT Activities, no approval of the Minister is required under paragraph 522.22(1)(e). |

Prescribed entities that are EAFBs:

Prescribed entities are subject to the:

An entity that engages in IT Activities is also subject to restrictions on:

|

|

10. Limited commercial entities, as defined in subsection 507(1) [522.09(1) and (2)] Note: commercial entities are "limited commercial entities" where they are held by a Part XII Entity that has a financial establishment in Canada. Commercial entities held under section 522.04 are not "limited commercial entities". |

No. | Not applicable. | Minister's approval required. [522.22(1)(g)] |

Limited commercial entities that are EAFBs are not restricted from engaging in or carrying on business in Canada or maintaining branches in Canada. The following restrictions are imposed on a limited commercial entity:

In addition, a limited commercial entity is subject to the:

|

|

11. Any entity, as a temporary investment A Part XII Entity may, by way of a temporary investment, acquire or hold control of, or a substantial investment in, a Canadian entity. General holding period: 2 years, except where:

Note: A change in the business, affairs or activities of a Canadian entity controlled by a Part XII Entity, or in which a Part XII Entity holds a substantial investment, may cause the Part XII Entity to have been deemed to have acquired the Canadian entity as a temporary investment. [522.14(5)] |

Depends on:

|

Depends on:

|

The Part XII Entity may request the Minister's approval to extend the holding period:

|

The Part XII Entity must, within 90 days of the acquisition, notify the Minister in writing of the acquisition. [522.14(6)] EAFBs held as temporary investments:

|

|

12. Certain entities, by way of specialized financing activities [522.1(e)] A Part XII Entity may acquire or hold control of, or a substantial investment in, a Canadian entity by way of specialized financing activities, as permitted by the Specialized Financing (Foreign Banks) Regulations. (See also class 7 above regarding specialized financing entities) |

Depends on:

|

Depends on:

|

No approval. | The Specialized Financing (Foreign Banks) Regulations provide that a Part XII Entity may not, by way of specialized financing activities, hold an investment in:

The regulations also set limits on the holding period and size of investments. EAFBs held by way of specialized financing activities:

Entities held by way of specialized financing activities:

|

|

13. Any entity, as a result of a loan workout or realization of a security interest [522.1(c) and (d), and 522.15] A Part XII Entity may acquire or hold control of, or a substantial investment in, a Canadian entity:

General holding period: 5 years [522.15(1)] |

Depends on:

|

Depends on:

|

The Part XII Entity may request the Minister's approval to extend the holding period:

|

EAFBs that result from a loan workout or the realization of a security interest:

|

| 14. Any entity for a 6-month period, as a result of an owner's change in status [517 and 517.1] |

Depends on the nature of the Part XII Entity's investments in Canada. | Not applicable during the 6-month period. | No approval/order to obtain the 6-month transitional relief. | This is a transitional provision that allows an entity that becomes a Part XII Entity to continue to hold certain Canadian investments for a period of up to 6 months while the FB Conglomerate is taking measures to comply with Part XII. |