Modernizing how we collect data from institutions

OSFI is leading the Data Collection Modernization (DCM) project in partnership with the Bank of Canada and the Canada Deposit Insurance Corporation.

The Data Collection Modernization initiative

The DCM project (May 2023 to April 2028) aims to:

- modernize the regulatory data collection technology platform

- advance key data initiatives and improve data quality

Together these efforts will help better manage regulatory reporting workload over time.

Industry engagement with a diverse group of stakeholders is critical to the success of DCM. Initially, we built awareness. Now, we are preparing and enabling federally regulated institutions (institutions) and pension plans to implement DCM initiatives.

Modernizing technology platform

The new platform will be live in 2026. Institutions and pension plans will find it easy to use, even during peaking filing periods. Their user experience will be better.

Click here to see our phased approach to onboard institutions and pension plans between fall 2026 to spring 2028.

Modernizing data collection

We are taking a thoughtful, balanced, and collaborative approach to advance data priorities. By early 2026, we will share a roadmap, outlining timelines for industry engagements on strategic data initiatives, refining potential existing returns.

The three strategic priorities are:

- transition securities holdings to structured data collection return

- transition real estate secured lending to structured data collection return

- refine the collection and quality of non -retail credit risk

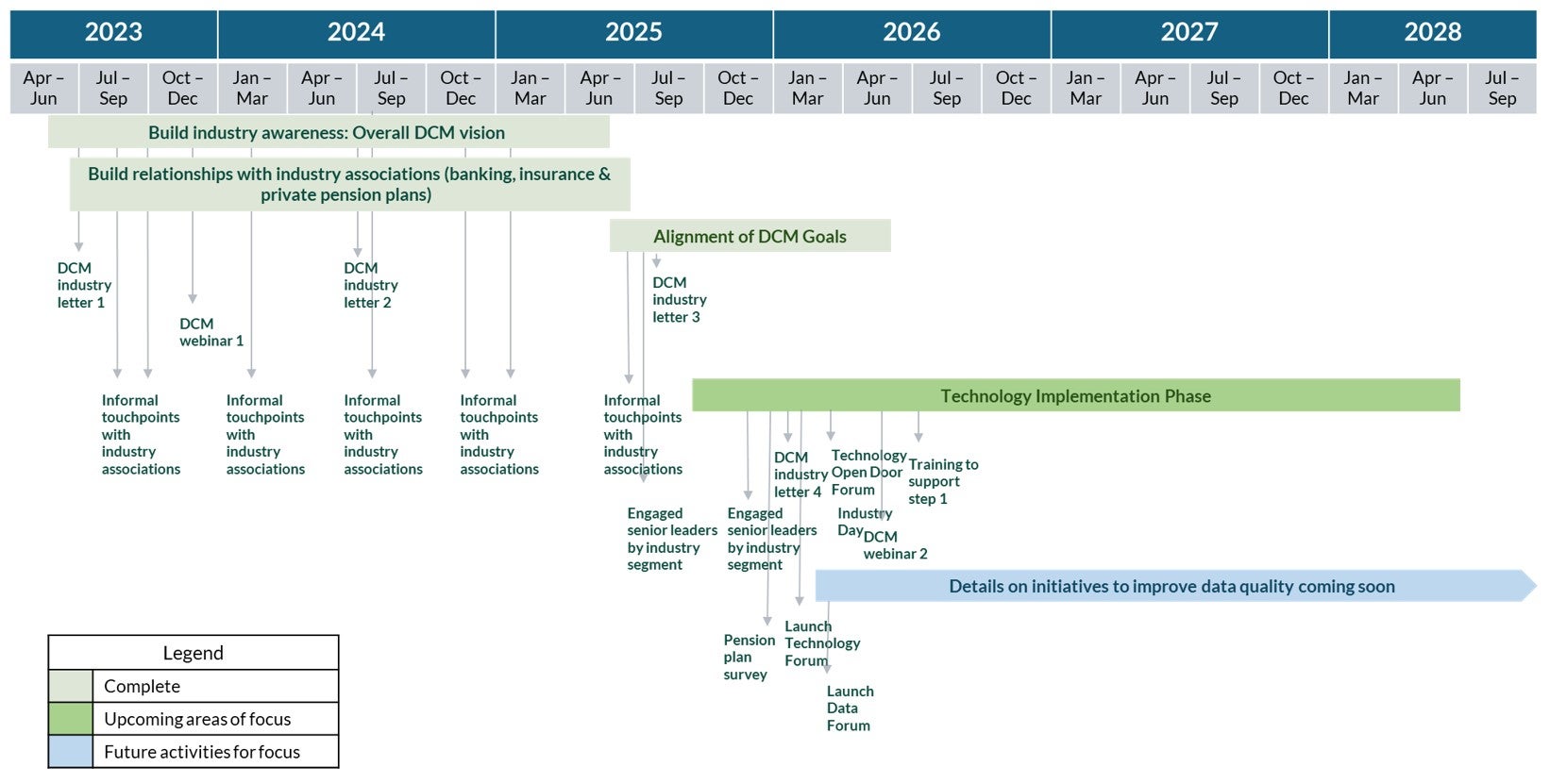

DCM Industry Engagement progress and coming up next

We are working with stakeholders at senior and working levels in a thoughtful, balanced and collaborative manner. Figure 1 displays our touchpoints with the industry associations, institutions and pension plans. Initially (2023- early 2025), we built awareness and relationships. Between now and April 2028, we are preparing and supporting stakeholders to participate in the implementation of the DCM initiatives.

Figure 1 - Text version

We use a variety of communication tactics to engage with a variety of stakeholders. Our journey includes:

- raising industry awareness about the DCM project and building relationships (this took place between summer of 2023 and 2025)

- driving alignment on DCM goals with senior leaders of key institutions (this occurred between June and December of 2025)

- involving stakeholders to gather their feedback on the implementation plans (this will continue throughout 2026)

Mark your calendars

- February 12, 2026: At Industry Day, we will provide an overview of DCM technology and data initiatives. This session will provide an orientation for filers and Local Registration Authorities. Register here to participate in Industry Day.

- February 23, 2026: At the DCM Technology Open Door Forum we will review key details to assist institutions to transition smoothly to the new technology platform. Register here to participate in the Technology Open Door Forum.

- Spring 2026: we will host a DCM webinar. Further details will be shared in advance.

We invite institutions and pension plans to email us to express their interest in joining the technology small working groups.

The Ledger – DCM bulletin

The DCM bulletin, the Ledger, provides institutions with timely information that will help them plan, prepare, and participate in DCM initiatives.

Read issue 1, January 19, 2026

Subscribe to the bulletin

Subscribe to receive updates about the Data Collection Modernization initiative.

Letters to institutions and pension plans

Stay connected

If you have questions about the DCM initiative, please email dcm-mcd@osfi-bsif.gc.ca.