Data Collection Modernization Initiative Progress Update and Upcoming Priorities

Information

Table of contents

The Office of Superintendent of Financial Institutions (OSFI) is leading the Data Collection Modernization (DCM) project in partnership with the Bank of Canada and the Canada Deposit Insurance Corporation. The DCM project is a multiyear initiative running from May 2023 to April 2028 with two key objectives:

- modernize the regulatory data collection technology platform

- advance prioritized data initiatives and enhance data quality

Over time, both the technology and data initiatives aim to better manage regulatory reporting burden.

Progress update and upcoming priorities

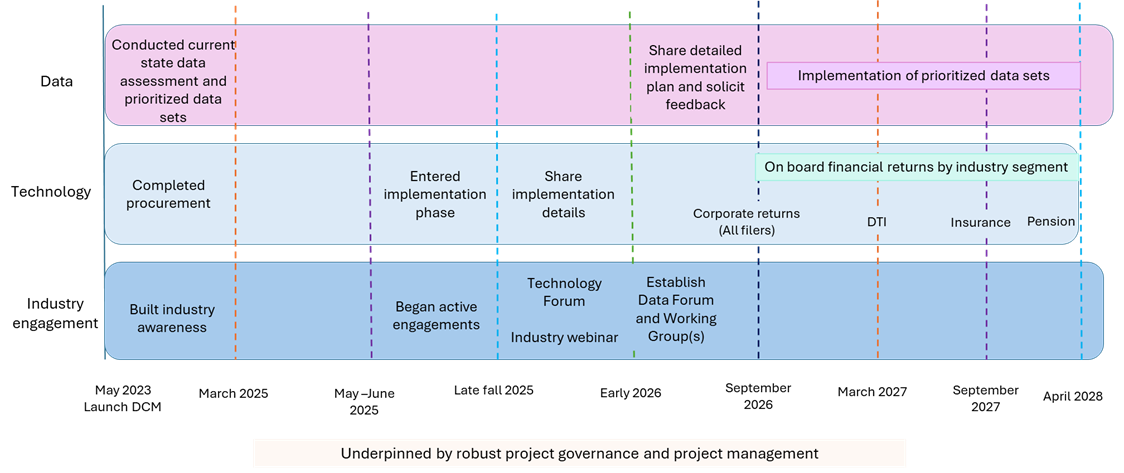

During the planning phase between May 2023 to April 2025, we created a foundation for implementing the technology and data initiatives through active industry engagements. Figure 1 below highlights key achievements and the next phase of project implementation.

Figure 1: DCM Project Timeline (2023 – 2028)

Figure 1 - Text version

May 2023 Launch DCM

- Data – Conducted current state data assessment and prioritized data sets

- Technology – Completed procurement

- Industry engagement – Built industry awareness

May-June 2025

- Technology – Entered implementation phase

- Industry engagement – Began active engagements

Late fall 2025

- Technology – Share implementation details

- Industry engagement – Technology Forum / Industry webinar

Early 2026

- Data – Share detailed implementation plan and solicit feedback

- Industry engagement – Establish Data Forum and Working Group(s)

September 2026

- Data – Implementation of prioritized data sets

- Technology – On board financial returns by industry segment

- Corporate returns (All filers)

- DTI

- Insurance

- Pensions

Underpinned by robust project governance and project management

In May 2025, the DCM implementation phase began. During this phase, we will establish a Technology Forum to rollout the new Regnology data collection platform by industry segment. In parallel, we will establish a new Data Forum as well as working groups to initiate work on prioritized data initiatives. Detailed implementation plans will be shared first through the forums and then broadly with all industry stakeholders via webinars.

We will establish a regular cadence for touchpoints to actively engage with the industry and invite their participation (see Table 1 below). Industry associations and federally regulated financial institutions and pension plans support this approach.

| Active Engagement Stream | Membership | Launch date | Frequency | Objectives | |||||

|---|---|---|---|---|---|---|---|---|---|

| Coordinate efforts on key initiatives | Enable industry internal readiness | Advance data quality | Coordinate operational needs | Invite tactical advice | Coordinate industry-wide action for implementation | ||||

| Strategic Council | Senior leaders of key institutions |

Banking - June 2025 |

Annually or as needed | True ✓ | True ✓ | True ✓ | not applicable | not applicable | not applicable |

| Technology Forum | Management leaders across 3 sectors |

Late fall 2025 |

Quarterly for project duration | True ✓ | True ✓ | True ✓ | True ✓ | True ✓ | not applicable |

| Data Forum | Management leaders of key institutions |

Early 2026 |

Quarterly | True ✓ | True ✓ | True ✓ | True ✓ | True ✓ | not applicable |

|

Data Working |

Subject matter experts |

Early 2026 |

Monthly or as required | not applicable | not applicable | not applicable | True ✓ | True ✓ | not applicable |

| Industry webinars | All regulated institutions | TBD Banking, Insurance and Private Pension Plans | As required | not applicable | not applicable | not applicable | not applicable | not applicable | True ✓ |

Technology

The technology implementation plan will address change management strategies for data migration, sequential industry onboarding, and filer support. The new technology platform, once implemented, will provide a centralized channel for filers to efficiently submit all regulatory data. It will process large amounts of data in a variety of formats and structures, including during peak filing periods

Data

In addition to migrating existing regulatory returns to the new technology platform, three data priorities were identified as critical to supporting risk-intelligent decision-making in the banking sector:

- real estate secured lending (RESL)

- non-retail lending (corporate and commercial real estate)

- securities holdings

Internal regulatory data assessments and the current risk landscape informed these priorities. We will leverage existing RESL and non-retail regulatory data collections to inform project work and manage regulatory burden. For securities holdings, data collection efforts are already underway via the Bank of Canada with test runs beginning shortly.

We look forward to collaborating with you and your teams on this critical initiative through various engagement streams. For comments or questions, contact Shaheena Mukhi at dcm-mcd@osfi-bsif.gc.ca.

Regards,

Andrew Miller, Chief Data Officer