2022-23 Departmental Results Report

Erratum

- The 2022-23 result posted in the ‘Contracts awarded to Indigenous businesses’ table for Internal Services indicator “total value of contracts awarded to Indigenous businesses” should read $2,611,781.18 instead of $2,502,659.90.

- The 2022-23 result posted in the ‘Contracts awarded to Indigenous businesses’ table for Internal Services indicator “total value of contracts awarded to Indigenous and non-Indigenous businesses” should read $44,415,741.28 instead of $40,566,939.00.

- The 2022-23 result posted in the ‘Contracts awarded to Indigenous businesses’ table for Internal Services indicator “proportion of contracts awarded to Indigenous businesses” should read 5.88% instead of 6.2%.

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

© His Majesty the King in Right of Canada, as represented by the Minister of Finance, 2023

Catalogue No. IN3-32E-PDF

ISSN 2561-0716

Table of contents

From the Superintendent

On behalf of the Office of the Superintendent of Financial Institutions (OSFI), I am proud to present our Departmental Results Report for fiscal year 2022-23.

This report describes the progress and work we have achieved over the past year to reinforce resilience in Canada’s financial system so as to contribute to Canadians’ confidence in it. We developed our Blueprint transformation plan in fall 2021 because OSFI’s risk environment had fundamentally shifted. The Blueprint’s underlying vision is to ensure that OSFI thrives in intensifying uncertainty and, in the face of risk, the values underlying our Blueprint compel us to act early to minimize the costs of being too slow to act.

We have made incredible progress on our ambitious transformation plan over the past year. Some of the great strides include developing a risk appetite statement and an enterprise risk management function to support strategic and operational management and launching a Data Collection Modernization initiative to improve data driven decision-making. We also started work to renew our approach to supervision and modernized how we develop our guidance.

In addition to this foundational work to implement our Blueprint, we continued our vigilant supervision in the face of intensifying external risks. This included taking swift and decisive action when confronted by crisis events such as the Silicon Valley Bank collapse and the near failure of Credit Suisse, a globally, systemically important bank. I am proud that we responded effectively through close collaboration with global regulators and Canada’s financial safety net partners during these crises.

I am confident the work described in this report will position us to deliver on our promise to Canadians: to contribute to public confidence in the Canadian financial system.

Peter Routledge

Superintendent

Results at a glance

In fiscal year 2022-23, our total actual spending was $239.7 million and the total number of full-time equivalent employees was 1,024. We regulated and supervised 373 federally regulated financial institutions (FRFIs) and 1,180 federally regulated pension plans (FRPPs) to determine whether they were in sound financial condition and complying with governing statute law and supervisory requirements under the law.

During 2022-23, we steered through a rapidly changing financial landscape marked by external risks and transformative forces. Global financial systems adjusted to inflationary pressures, a shifting interest rate environment, and disruptive technological innovations. We proactively addressed these challenges while also advancing climate-related risk initiatives, ensuring compliance with regulations, and lessening cyber security threats. We also embarked on a change journey outlined in A Blueprint for OSFI’s Transformation, 2022-2025 (Blueprint). This was followed by the release of the 2022-2025 Strategic Plan, which laid out initiatives aimed at enhancing public confidence in the Canadian financial system. The following provides an overview of the results achieved through the lenses of the six strategic initiatives outlined in the 2022-23 Departmental Plan. We report additional results under each core responsibility.

1. Culture and enabler initiatives

- Advanced the Human Capital Strategy, along with the development of a multi-year culture implementation plan and diversity, equity, and inclusion (DEI) initiatives.

- Led a series of consultations through a grassroots approach to craft our first Promises and Commitments. The approved Promises and Commitments lays the foundation of our culture.

- Updated competency models and performance assessment tools, which included training and support to fulfill our cultural priorities.

Result: implemented measures to achieve a workplace where curious, diverse, high integrity colleagues are safe to bring their true and best selves to work everyday, and are safe to fail and then adapt.

2. Risk, strategy and governance

- Established a new Strategy, Risk and Governance (SRG) Sector and Chief Strategy and Risk Officer (CSRO).

- Established a dedicated enterprise risk management (ERM) function that implemented an enterprise-wide risk appetite statement and a second line challenge function.

- Redesigned the corporate governance structure to better support transparent decision-making.

Result: a foundation to make risk-intelligent decisions everyday that reflect our transparent and revealed risk appetite via leadership and governance that delegates decision making from the top to the leaders best positioned to make decisions.

3. Strategic stakeholder and partner engagement

- Established a Stakeholder Affairs Framework and developed draft outreach strategies to expand the Superintendent’s and the Chief Actuary’s public presence.

- Utilized the Financial Institutions Supervisory Committee (FISC) more effectively as a communication and modernization mechanism.

- Developed a plan to prioritize stakeholder engagements.

Result: improved integration and alignment with key stakeholders and partners inside and outside of the federal financial safety net in a manner that maximizes its influence and preserves its integrity in fulfilling its purpose and mandate.

4. Policy innovation

- Advanced climate initiatives, conducted climate risk roundtables, and promoted climate risk management.

- Advanced analysis, insights, and skill sets with respect to digital innovation, social transformations, cyber risk, third-party risk management, and operational resilience.

- Started to build a policy architecture renewal team tasked with removing redundancy and duplication, re-organizing guidance in a more understandable manner, and increasing consistency in how information is written and presented.

Result: implemented activities and measures to support our role in becoming a global leader in prudential supervision by making policy to ensure operational and financial resilience of its regulated entities in the face of climate-related, digitalization, and other yet-to-be foreseen risks.

5. Supervision renewal

- Invested substantially in modernizing the Supervisory Framework to include more differentiated ratings and better reflect the assessment of business risk, financial resilience, operational resilience, and risk governance for FRFIs and FRPPs.

- Enhanced the use of data analytics across the Supervision Sector.

- Advanced a greater risk appetite for earlier corrective actions, where appropriate.

- Communicated our expectations to FRFIs and FRPPs that capital and liquidity regimes should remain appropriate through the business cycle.

Result: supervision renewal enables a work environment that guides supervisors to effectively and efficiently manage their portfolio of regulated entities, builds capacity, creates a collective responsibility for risk assessments and management, and utilizes data and analytics to meet our supervision mandate.

6. Data management and analytics

- Continued to apply the current data strategy and laid the foundation to support enterprise functions with improved data and analytics capabilities.

- Implemented analytical innovation, cloud technologies and improved analytical reporting and data accessibility.

- Advanced preparatory work for the Data Collection Modernization (DCM) initiative.

Result: a foundation for a data platform that enables the vast majority of analytical research and insight-generation while simultaneously eliminating the necessity of most ad-hoc data requests made to regulated entities.

For more information on OSFI’s plans, priorities, and results achieved, see the “Results: what we achieved” section of this report.

Results: what we achieved

Core responsibilities

Financial Institution and Pension Plan Regulation and Supervision

Description

The Office of the Superintendent of Financial Institutions advances a regulatory framework designed to control and manage risk to federally regulated financial institutions and private pension plans and evaluates system-wide or sectoral developments that may have a negative impact on their financial condition. It also supervises financial institutions and pension plans to determine whether they are in sound financial condition and meeting regulatory and supervisory requirements. The Office promptly advises financial institutions and pension plan administrators if there are material deficiencies and takes corrective measures or requires that they be taken to expeditiously address the situation. It acts to protect the rights and interests of depositors, policyholders, financial institution creditors and pension plan beneficiaries, while having due regard for the need to allow financial institutions to compete effectively and take reasonable risks.

Results

As part of our mandate as a prudential financial regulator, our regulatory and supervisory frameworks provide guidance to FRFIs and FRPPs to ensure the safety and soundness of the Canadian financial system. The key achievements supporting our core mandate and addressing the evolving risks in the financial sector are summarized below.

-

Ensuring that risk measures for FRFIs, and our capital and liquidity regimes, remained appropriate even in stress scenarios. To that effect, we:

- Published in July 2022, the revised final insurance capital guidelines 2023, which included the Life Insurance Capital Adequacy Test, the Minimum Capital Test for federally regulated property and casualty insurers, and the Mortgage Insurer Capital Adequacy Test, to reflect the new international accounting standard, International Financial Reporting Standard 17: Insurance Contracts (IFRS 17).

- Outlined our expectations for capital and liquidity regarding crypto-assets held by Canadian banks and insurers, providing interim guidance on their management, setting limits on their use, and offering further guidance on the capital and liquidity treatment of crypto-asset holdings.

- Published in November 2022, the final guideline on Assurance on Capital, Leverage, and Liquidity returns, and issued the Final IFRS 17 Memoranda to The Appointed Actuary for Federally Regulated Insurers.

- Released in January 2023, the final guideline E-16, which establishes expectations for applying requirements in the Insurance Companies Act and the Policyholders Disclosure Regulations to participating and adjustable policies.

-

Continuing to regularly supervise FRFIs and FRPPs by reviewing, assessing, and responding to risks. As part of this work, we:

- Focused on assessing areas of higher risk to ensure financial institutions were well capitalized and resilient.

- Advanced work on liquidity risk reporting, assessments, and monitoring of asset and liability management.

- Advanced supervisory capabilities related to the use of data and analytics to foster greater consistency, efficiency, and focus using standardized, high quality, and replicable analytical tools to support the supervisory work.

- Approved several applications related to acquisitions and new entrants, allowing financial institutions to compete effectively and to take reasonable risks while protecting the rights and interests of depositors, policyholders, and creditors of financial institutions.

-

Ensuring that the regulatory approach for identifying, assessing, and monitoring non-financial risks (NFRs) is clear and transparent, particularly as it relates to FRFI and FRPP risk management practices for technology, cyber, and third-party risk. To that end, we:

- Developed supervisory expectations for NFR guidelines and published Guideline B-13 – Technology and Cyber Risk Management in July 2022.

- Introduced the Intelligence-Led Cyber Resilience Testing Framework to enhance cyber resilience practices in April 2022.

- Released a draft Culture and Behaviour Risk Guideline, which is currently under review, to address the crucial aspect of fostering appropriate organizational culture and behavior in February 2023.

-

Increasing engagements with industry, to enhance risk management practices in FRFIs through the following activities:

- Held 12 information sessions in 2022-23 to keep FRFIs and the federal pension sector informed of our plans and priorities.

- Hosted an industry session to clarify residential mortgage underwriting practices in line with Guideline B-20 to reinforce prudent practices.

- Conducted a review of Guideline B-20 and assessed stakeholder feedback to inform proposed changes, which will be issued as a draft guideline for further public consultation.

- Completed a cross-sector review of residential mortgage lenders’ compliance with Guideline B-20 underwriting expectations and assessed suitability of near-term maturities and variable rate mortgage products in light of changing market conditions.

- Published the advisory to clarify the treatment of innovative real estate secured lending (RESL) products, which provided guidance on underwriting practices and procedures for reverse residential mortgages, shared equity features, and combined loan plans.

- Assessed the implementation plans of FRFIs with material combined loan plan exposure to ensure compliance with proposed transitional arrangements, account management practices, and timelines.

- Issued an industry letter emphasizing sound RESL risk governance and practices to promote a risk-aware culture and resilience in an environment of increasing interest rates.

-

Supporting the adoption of IFRS 17, the most significant accounting change for insurers in decades, which became effective on January 1, 2023. To that end, we:

- Published and updated OSFI IFRS-17 development items and rationale.

- Finalized regulatory returns and issued supporting instructions to aid in implementing the new standard.

- Ensured a smooth transition by requiring insurers to participate in a Transition Readiness Test and submit semi-annual progress reports to monitor the progress of insurers.

- Developed key supervisory performance metrics, tools, and methods to evaluate compliance with IFRS 17.

- Evaluated the Insurance Companies Act concentration limits leading to a temporary increase of regulatory prudential limits for investment, lending, and borrowing by 25% for a transition period of two years for Canadian property and casualty federally regulated insurers.

- Developing a supervision crisis readiness team to strengthen our ability to plan for potential systemic stress events. Doing so will ensure that we manage crises in an effective and agile way so that the public’s confidence in our financial system remains unwavering. As a result of this diligent work, we acted on March 15, 2023, to protect creditors of Silicon Valley Bank’s (SVB’s) Canadian branch. We took legal control of its assets after the California Department of Financial Protection and Innovation shut down SVB in the United States. As well, the amendment to the crisis playbook enabled the quick support of SVB’s Canadian branch.

- Advancing the development of a new approach for determining capital requirements for segregated fund guarantee (SFG) risk in the life insurance industry for implementation in January 2025. We conducted industry consultations over several months and launched the sixth Quantitative Impact Study (QIS #6). We also invited life insurers with SFG businesses to provide feedback on a draft of the proposed capital requirements for SFG risk.

-

Contributing to the stability of the financial system by reviewing two important measures set by us: the minimum qualifying rate (MQR) and the domestic stability buffer (DSB). We implemented the following measures, announced in December 2022:

- The MQR for uninsured mortgages would remain the greater of either the mortgage contract rate plus 2% or 5.25%. This measure ensures that borrowers meet a minimum standard when applying for mortgages without insurance coverage.

- The range of the DSB increased from 0% to 2.5% to 0% to 4% in response to a comprehensive design review. The purpose of this adjustment was to ensure that domestic systemically important banks (D-SIBs) are capable of absorbing potential losses under various economic conditions, while still maintaining their lending activities.

- The DSB level was raised by 50 basis points, effective February 1, 2023, reaching 3% of D-SIBs’ total risk-weighted assets in response to elevated systemic vulnerabilities and higher economic uncertainty.

- Conducting ongoing assessment and processing of applications and transactions for regulatory approval. All service standards and pension benchmarks required by FRFIs and FRPPs were successfully met during the 2022-23 period.

- Working closely with the Canadian Association of Pension Supervisory Authorities (CAPSA) to develop comprehensive guidance on establishing principles for managing investment risk, thereby enhancing regulatory oversight and supervision of FRPPs. We also partnered with CAPSA to create a preliminary guideline on Environmental, Social and Governance (ESG) Considerations in Pension Plan Management. This draft guideline was released for public consultation in June 2022.

- Updating the 2022-23 plan of policy releases for FRFIs and FRPPs and including it within the annex of our Annual Risk Outlook (ARO). We published our ARO with a forward-looking view of the most material risks facing FRFIs and FRPPs. The timelines indicated in the annex reflect the Strategic Plan and current risk priorities, with priorities divided into three streams for simplicity of guidance initiatives.

Strategic initiatives

During the period of 2022-23, we implemented several strategic initiatives as part of the 2022-2025 Strategic Plan. We designed these initiatives to support the first year of the plan and they encompassed various actions such as restructuring the organization, increasing capacity, developing essential frameworks, and empowering employees in their respective roles.

A primary objective driving our work during this period was to contribute to strengthening public confidence in Canada’s financial system, which is our mandate and part of our core responsibility. This objective aligned with the prevailing risk environment and was supported by our internal capabilities, as described in the internal services section. As a result, our focus in 2022-23 revolved around the launch of the following transformational initiatives aimed at enhancing the fulfillment of this core responsibility.

Strategic stakeholder and partner engagement

OSFI integrates and aligns with key stakeholders and partners inside and outside of the federal financial safety net in a manner that maximizes its influence and preserves its integrity in fulfilling our mandate.

Our aim was to maximize our influence in all areas within our mandate. To achieve this, we employed various strategies to address risks, exerted our influence on public policy, and capitalized on our credibility and impact. In 2022-23, the key results achieved are:

- Developed a Stakeholder Affairs Framework to lay the groundwork for a new approach to engaging with stakeholders.

- Established a dedicated central stakeholder affairs function and an enterprise-wide Stakeholder Affairs Community of Practice to foster collaboration and knowledge sharing.

- Created a new stakeholder engagement tracking and reporting tool to improve transparency and accountability in the engagement process.

- Initiated brand development strategies for the Superintendent and the Chief Actuary to strengthen their positions and enhance their visibility.

- Agreed with FISCFootnote 1 peers to directly lead the modernization of the data environment.

- Leveraged FISC and special sub-FISC meetings to share critical supervisory issues affecting FRFIs and to ensure optimal information sharing with FISC agencies in a timely manner.

- Remained an active participant on many national and international committees and regularly contributed to international journals and papers.

- Developed strategies informed by public opinion research to ensure effective engagement with internal and external partners.

- Developed an engagement plan to prioritize stakeholder engagements for a more targeted and impactful approach.

These results helped to enhance our influence by fostering stakeholder engagement and driving effective practices in the financial institution and pension plan regulation and supervision domains.

Policy innovation

OSFI becomes a global leader in prudential supervision by making policy to support the operational and financial resilience of its regulated entities in the face of climate-related, digitalization, and other yet-to-be foreseen risks.

We made significant progress in the context of climate-related risks and their impact on the safety and soundness of Canada’s financial institutions, private pension plans, and the broader financial system. We undertook several activities to reinforce our policy function. One of these activities was refining our policy innovation and regulatory function to address emerging risks outlined in the ARO 2022-23. The key results achieved are:

- Created the Climate Risk Hub and developed a comprehensive plan for our climate risk response, including policy, climate scenario analysis, regulatory capital, data, and regulatory returns.

-

Published Guideline B-15, which is our first prudential framework on climate risk management. This was in response to the threats that climate change poses to the safety and soundness of FRFIs and the financial system more broadly. The Guideline details our foundational expectations for FRFIs to:

- Enhance their readiness to manage the climate-related risks inherent in business plans and strategies.

- Adopt appropriate climate-related governance, risk management, and disclosure practices.

- Ensure they remain operationally and financially resilient to climate-related risks.

- Established the Digital Innovation and Impact Hub to help develop policy and supervisory tools.

- Developed several policy and supervisory tools that leverage data, analytics, and publications of guidelines to assess NFRs effectively.

- Designed a regulatory strategic response framework for emerging risk based on four key pillars: governance, policy architecture renewal, engagement, and dedicated organizational structures.

- Supported and issued various reports, guidelines, and bulletins on topics such as third-party and operational risks to FRFIs.

- Developed and rolled out a third-party assessment diagnostic tool to support the assessment of FRFI risk management programs.

- Piloted first third-party data call to provide insights into risk trends and start the process of assessing systemic concentration risk.

These activities resulted in policy innovation, effective supervision, and proactive responses to emerging risks, chiefly in the context of climate-related risks and the impact of technology and other NFRs on the financial sector.

Supervision renewal

Supervision Renewal enables a work environment that guides supervisors to effectively and efficiently manage their portfolio of regulated entities, builds capacity, creates a collective responsibility for risk assessments and management, and utilizes data and analytics to meet our supervision mandate.

We focused on modernizing our Supervisory Framework to ensure our success in assessing and responding to risks in FRFIs and FRPPs. This approach to supervision is strategic, guided by our risk appetite, and driven by data and analytics. The following activities took place to advance Supervision Renewal, which included developing a new Supervisory Framework with an effective date of April 1, 2024:

- Updated the governance structures and mechanisms to enhance early detection as well as the ability to address risks of FRFIs and FRPPs promptly.

- Enhanced collaboration of front-line supervisors with financial risk specialists by bringing teams together in the Supervision Sector.

- Strengthened regular operational reporting and supervision key performance indicators to further improve supervisory practices.

- Progressed significantly on the development of the new Supervisory Framework, including details as to the greater differentiation in risk ratings, particularly with those institutions at Stage 0 in the current system.

Overall, these activities resulted in enhancing risk assessment practices and contributed to improving the stability and resilience of the regulated financial sector. By staying proactive, responsive, and adaptable, we can better fulfill our mandate.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

We pursued sustainable development in accordance with our prudential mandate to contribute to public confidence in the Canadian financial system. Climate-related risks are drivers of traditional financial and non-financial risks for FRFIs. The contributions to the Federal Sustainable Development Strategy (FSDS) and specific United Nations (UN) Sustainable Development Goals (SDGs) stem from the prudential policy making and supervisory activities captured in the recent publication of Guideline B-15: Climate Risk Management.

We supported UN SDG 13 by strengthening resilience in responding to climate-related hazards (13.1), integrating climate change measures into policies, strategies, and planning (13.2), and improving early warning detection (13.3). This was the result of supervisory responses to climate risks, scenario analysis with the Bank of Canada, and stakeholder engagements, including with Canada’s Sustainable Finance Action Council, the Basel Committee on Banking Supervision, the Financial Stability Board, the International Association of Insurance Supervisors, the Sustainable Insurance Forum, and the Network for Greening the Financial System. Additionally, to illustrate the potential risk for the Canada Pension Plan (CPP), the Actuarial Report (31st) on the Canada Pension Plan detailed three intentionally adverse hypothetical climate change scenarios based on publicly available information. The scenarios focused on differences in gross domestic product growth rates from different transition pathways.

We also supported SDG 10.5 by improving the regulation and monitoring of global financial markets and institutions and strengthening the implementation of such regulations.

We supported UN SDG 12.7 by embedding environmental considerations in public procurement in accordance with the federal Policy on Green Procurement. We continued to ensure that our decision-making process included the consideration of Federal Sustainable Development Strategy goals and targets through our Strategic Environmental Assessment process.

Innovation

Innovations have been at the forefront of our transformation. The key high-impact innovations under this core responsibility relate to:

- Modernizing the Supervisory Framework to ensure it remains fit for purpose, today and tomorrow.

- Evolving the policy response to strategic risks based on our risk appetite and embracing innovation through our policy tools. These include experimentation and an iterative ‘test and learn’ policy development.

Still early in our transformation journey, we are exploring the development of outcome indicators to better understand the extent of our transformation through the lenses of efficiency and effectiveness. The objective will be to better understand the outcomes of the projects that enable the strategic plan.

Key risks

We continued to monitor evolving and emerging risks to the financial system such as cyber attacks, digital innovation, housing-related considerations, and climate change, among others. In April 2022, we released our first ARO, followed by an update in October 2022 detailing key risks faced by Canada’s financial system at that time and our supervisory and regulatory response.

Results achieved

The following table shows, for Financial Institution and Pension Plan Regulation and Supervision, the results achieved, the performance indicators, the targets and the target dates for 2022–23, and the actual results for the three most recent fiscal years for which actual results are available.

| Performance indicators | Target | Date to achieve target | 2020–21 actual results | 2021–22 actual results | 2022–23 actual results | |

|---|---|---|---|---|---|---|

| % of financial institutions with a Composite Risk Rating of low or moderate. | At least 80% | March 31, 2023 | 96% | 96% | 96% | |

| Number of financial institutions for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three-month period. | 1 or less | March 31, 2023 | 0 | 0 | 2Table A footnote 2 | |

| Number of pension plans for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three-month period. | 1 or less | March 31, 2023 | 0 | 1 | 2 Table A footnote 3 | |

|

Table A - Footnotes

|

||||||

| Performance indicators | Target | Date to achieve target | 2020–21 actual results | 2021–22 actual results | 2022–23 actual results | |

|---|---|---|---|---|---|---|

| The Office of the Superintendent of Financial Institutions’ level of compliance with the International Monetary Fund’s Financial Sector Assessment Program core principles. | 100% | March 31, 2024 | N/A | N/A | N/ATable B footnote 1 | |

| The Office of the Superintendent of Financial Institutions’ level of compliance with Basel standards as assessed by the Regulatory Consistency Assessment Programme of the Bank for International Settlements. | 90% | March 31, 2023 | N/A | N/A | N/ATable B footnote 2 | |

|

Table B - Footnotes

|

||||||

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions’ program inventory is available in GC InfoBase.

Budgetary financial resources (dollars)

The following table shows, for Financial Institution and Pension Plan Regulation and Supervision, budgetary spending for 2022–23, as well as actual spending for that year.

| 2022–23 main estimates | 2022–23 planned spending | 2022–23 total authorities available for use | 2022–23 actual spending (authorities used) |

2022–23 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 117,806,081 | 117,806,081 | 137,027,710 | 125,838,034 | 8,031,953 |

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions’ program inventory is available in GC InfoBase.

Human resources (full-time equivalents)

The following table shows, in full‑time equivalents, the human resources the department needed to fulfill this core responsibility for 2022–23.

| 2022–23 planned full-time equivalents | 2022–23 actual full-time equivalents | 2022–23 difference (actual full‑time equivalents minus planned full‑time equivalents) |

|---|---|---|

| 577 | 621 | 44 |

Financial, human resources, and performance information for the Office of the Superintendent of Financial Institutions’ program inventory is available in GC InfoBase.

Actuarial services to federal government organizations

Description

The Office of the Chief Actuary (OCA) provides a range of actuarial services, including statutory actuarial valuations required by legislation and checks and balances on the future costs of programs for the Canada Pension Plan, Old Age Security, Employment Insurance and Canada Student Loans programs, as well as pension and benefits plans covering the Federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police, federally appointed judges, and Members of Parliament.

Results

The OCA contributed to strengthening confidence in the financial system by helping to ensure the stability and sustainability of social programs, public sector pension plans, and insurance arrangements in Canada. During fiscal year 2022-23, the OCA provided independent, accurate, and high-quality actuarial reports, as well as professional actuarial services and advice. The key achievements for this period are:

- Completion of the Actuarial Report on the Pension Plan for the Royal Canadian Mounted Police (RCMP) as at March 31, 2021. This report, submitted to the President of the Treasury Board and tabled in Parliament on November 18, 2022, offered actuarial information to decision-makers, parliamentarians, and the public. By increasing transparency and confidence in Canada’s retirement income system, the RCMP report facilitated informed decision-making.

- Presentation of the 2023 Actuarial Report on the Employment Insurance Premium Rate to the Canada Employment Insurance Commission. This report, tabled in Parliament on September 29, 2022, provided a forecast of the break-even premium rate for the upcoming year, accompanied by a detailed analysis. This information supported the Commission in making informed decisions about employment insurance premiums, ensuring the financial sustainability of the program.

- Completion of the triennial CPP Actuarial Report as at December 31, 2021, being the 31st Report, which was submitted to the Minister of Finance and tabled in Parliament on December 14, 2022. This triennial report projected CPP revenues and expenditures over a 75-year period to assess the future impact of historical and projected demographic and economic trends.

- In addition, the OCA commissioned an independent peer review of this report, being the ninth review of this kind, with results released early in fiscal year 2023-24. The independent panel’s findings confirm that the work performed by the OCA on the report meets professional standards of practice and statutory requirements, and that the assumptions and methods used are reasonable. The panel also stated that the report fairly communicates the results of the work performed by the Chief Actuary and their staff.

- Initiation of work on the triennial Actuarial Report on the Old Age Security Program as at December 31, 2021.

- Preparation of the Actuarial Report on the Canada Student Financial Assistance Program as at 31 July 2021, the Actuarial Report on the Government Annuities as at 31 March 2022, and the Actuarial Report on the Civil Service Insurance Program as at March 31, 2022.

- Submission of various actuarial reports supporting the Public Accounts of Canada, presenting the obligations and costs, as at March 31, 2022, associated with federal public sector pension and benefit plans including future benefits to veterans.

- Assisting Health Canada with preliminary analysis related to the federal government’s National Strategy for Drugs for Rare Diseases.

- Publication of the Old Age Security (OAS) Mortality Fact Sheet, which focused on comparing 2019 and 2020 data to highlight the impacts of the pandemic on OAS beneficiaries. The Fact Sheet showed that there were an estimated 20,000 extra deaths caused by the pandemic during 2020.

-

Presentations at different events, including:

- Employment Insurance Premium Reduction and Sickness Benefits presentation at the Canadian Institute of Actuaries 2022 Annual Conference, held in June 2022.

- Mortality Projection from a Social Security Panel presentation at the Society of Actuaries Living to 100 Symposium.

- Towards financially sustainable, green and resilient social security presentation at the International Social Security Association World Social Security Forum, held in October 2022.

Innovation

The OCA continued to support the Government of Canada’s commitment to innovation by fostering a culture that embraces continuous learning. Ongoing improvement is generally sought through internal research, consultations, and lessons learned exercises. Some important research took place and can be viewed from an experimentation lens: the Risk Assessment of the OCA Funding Model. The work began for conducting a risk assessment of the current funding model. This assessment aimed to enhance the understanding of the risks associated with the OCA funding methodology and is aimed at enabling better-informed decision-making. Another area of innovation is the first-ever inclusion of impacts of climate-related scenarios on the financial state of the CPP in the 31st CPP Actuarial Report.

Results achieved

The following table shows, for Actuarial Services to Federal Government Organizations, the results achieved, the performance indicators, the targets and the target dates for 2022–23, and the actual results for the three most recent fiscal years for which actual results are available.

| Performance indicators | Target | Date to achieve target | 2020–21 actual results | 2021–22 actual results | 2022–23 actual results | |

|---|---|---|---|---|---|---|

| % of members of a panel of Canadian peer actuaries that deem the Canada Pension Plan actuarial valuation accurate and of high quality. | 100% Agreement among all three members of peer review panel | March 31, 2024 | 100% | N/A | N/ATable C footnote 1 | |

| % of public pension and insurance plan valuations that are deemed accurate and high quality. | 100% | March 31, 2023 | 100% | 100% | 100% | |

|

Table C - Footnotes

|

||||||

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions’ program inventory is available in GC InfoBase.

Budgetary financial resources (dollars)

The following table shows, for Actuarial Services to Federal Government Organizations, budgetary spending for 2022–23, as well as actual spending for that year.

| 2022–23 main estimates | 2022–23 planned spending | 2022–23 total authorities available for use | 2022–23 actual spending (authorities used) |

2022–23 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 8,838,537 | 8,838,537 | 8,838,537 | 10,042,756 | 1,204,219 |

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions’ program inventory is available in GC InfoBase.

Human resources (full-time equivalents)

The following table shows, in full‑time equivalents, the human resources the department needed to fulfill this core responsibility for 2022–23.

| 2022–23 planned full-time equivalents | 2022–23 actual full-time equivalents | 2022–23 difference (actual full‑time equivalents minus planned full‑time equivalents) |

|---|---|---|

| 43 | 45 | 2 |

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions’ program inventory is available in GC InfoBase.

Internal services

Description

Internal services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal services refers to the activities and resources of the 10 distinct service categories that support program delivery in the organization, regardless of the internal services delivery model in a department. The 10 service categories are:

- acquisition management services

- communication services

- financial management services

- human resources management services

- information management services

- information technology services

- legal services

- material management services

- management and oversight services

- real property management services

Internal services provide the infrastructure for us to fulfill our mandate. These activities ensure that we can effectively operate within the Canadian financial system, and that our employees can positively contribute and benefit from the work environment. This work includes implementing technological enhancements, establishing and integrating initiatives that improve overall culture, and undertaking key projects that support the development and growth of our organization. The key results achieved in 2022-23 are:

- Continued migration to the cloud and the establishment of foundational infrastructure, such as configuring Microsoft Teams and Channels, to facilitate a hybrid work environment.

- Continued to prepare to migrate information management software (eSpace) to the cloud, including the migration of foundational information architecture and all eSpace legacy libraries to SharePoint Online.

- Strengthened security measures and risk management frameworks, including additional security monitoring and alerting technology and services, as well as data loss prevention capabilities, to enhance the cyber security posture.

- Developed a new Information Management/Information Technology (IM/IT) strategy to ensure adaptability with the evolving environment, business context, risks, and principles that are crucial for both us and Canadians, along with a proposal of an IM/IT operating model and organization structure.

- Promoted transparency and enhanced the understanding of our operations. This includes advancing the internet renewal project to align with our accessibility plan, ensuring that users can access content barrier-free. We also increased executive speaking engagements and enhanced our social media presence on platforms such as Twitter, LinkedIn, and YouTube.

- Engaged employees on topics relating to developing a hybrid charter, redesigning office spaces and equipment across all four office locations and issuing a playbook that describes our hybrid work environment.

-

Continued to embed diversity, equity, and inclusion (DEI) into all culture initiatives. Key accomplishments in 2022-23 are:

- Developed a DEI Measurement Framework and associated logic model, which includes key indicators that track progress throughout the implementation of the multi-year DEI Strategy.

- Held 20-plus organization-wide events that served as platforms for employee engagement, dialogue, and raising awareness on DEI issues. These included unconscious bias, diversity of thought, multiculturalism, mental health, and family responsibilities.

- Organized anti-racism learning events tailored to executive leaders, equipping them with the necessary knowledge and tools to support and effect change.

- Launched "SponsorMe" to support employees from equity seeking groups, and "MentorMe" to facilitate employee growth and development.

- Published the Accessibility Plan 2023-2026, which outlines expectations for improved accessibility, including adopting accessible technologies and products.

Strategic initiatives

In fiscal year 2022-23, the internal services continued to support our programs and achieved important transformational results, focusing on the launch of the following transformational initiatives.

Culture and Enabler Initiatives

OSFI is a workplace where curious, diverse, high integrity colleagues are safe to bring their true and best selves to work everyday and are safe to fail and then adapt.

During year one of our transformation, we focused on culture change management. In 2022-23, the key results in this area are:

- Concluded workplace culture consultations across the organization, creating the Promises and Commitments initiative. This established the foundation for how we as an organization lead, make decisions, and serve Canada, so that every employee feels they can bring their best self to work every day. Under the Promises and Commitments initiative, we developed a plan to implement behavioural work objectives related to shaping our desired culture.

- Offered 360-degree feedback assessments to people leaders.

- Continued to implement our multi-year DEI Strategy, which included relevant learning sessions.

- Launched the new Leadership Competency Model that supports our vision and desired culture, allowing the delivery of transformational goals and ongoing excellence. We offered training and reinforcement activities to employees, along with guidance on applying and living the competencies.

- Enhanced the performance management process to increase the focus on skills through redesigned forms and requiring a more thorough self-assessment of behaviours and competencies relative to objectives.

- Evolved the Human Capital Strategy to align operations with values supported by a three-year implementation plan focused on cultural change.

- Continued enactment of a risk-based approach for procurement by clarifying risk appetite and working on triage, assignment, quality assurance, and approval of procurement and contracts.

Risk, Strategy and Governance

OSFI makes risk-intelligent decisions every day via leadership and governance that delegates decision-making from the top to the leaders best positioned to make decisions.

The key results in this area are:

- Established a new Strategy, Risk and Governance (SRG) Sector, headed by a new Chief Strategy and Risk Officer reporting directly to the Superintendent.

- Established a dedicated enterprise risk management (ERM) function and an implementation plan to embed risk management practices across our organization.

- Developed an enterprise-wide risk appetite statement with supporting risk categories and communicated broadly across the organization along with risk tolerances.

- Established and communicated the SRG Sector’s role as the enterprise wide second line function, which provides expertise, support, monitoring, and objective oversight and challenge on risk-related matters.

- Redesigned internal governance to support strategic decision-making, including launching new governance committees.

- Established a dedicated group for environment scanning of emerging risks, regulatory developments, and trends, by drawing on enhanced stress testing and advanced analytics capabilities to aid in the reporting, assessing, and prioritizing our response to the risk environment.

Data Management and Analytics

OSFI’s data platform enables the vast majority of analytical research and insight-generation while simultaneously eliminating the necessity of most ad-hoc data requests made to regulated entities.

The key results in this area are:

- Continued execution of the existing data strategy, while laying the foundation for a new phase in data and analytics growth to support enterprise functions with improved capabilities across the organization.

- Advanced data management, data governance, data engineering, and analytics through the integration of cloud technologies, enterprise governance processes, and the implementation of use cases.

- Developed advanced analytical methodologies, such as text and predictive analytics, enabling the extraction of valuable insights from both structured and unstructured datasets.

- Implemented the Business Intelligence (BI) Modernization project, which facilitated the creation of Enterprise datasets and self-service analytics using regulatory returns data.

- Developed data literacy personas and associated competencies to advance our data literacy strategy.

- Established a Data Analytics Community of Practice, providing a resource and learning space for users of our data.

- Agreed on the hosting location of new data collection technology by Tri-Agency executives, with OSFI to host a new solution as part of the Data Collection Modernization initiative that will aim to improve the type of data we collect and how we collect it.

Innovation

We prioritize innovation, foster curiosity, and encourage risk-taking. In our transformation, we embraced experimentation and innovation, evaluated tools, and improved practices. The key high-impact innovations under internal services were:

- Enhanced the Technology Exploration Space platform and established a production environment for approved data science workloads.

- Tested the hybrid operating model, created individual and collaborative work points, delivered knowledge sessions, and improved booking tools for all of our locations.

Contracts awarded to Indigenous businesses

OSFI is a Phase 1 department and as such must ensure that a minimum 5% of the total value of the contracts it awards is to Indigenous businesses by the end of 2022-23. In our 2023-24 Departmental Plan, we forecasted that, by the end of 2022-23, we would award 5% of the total value of our contracts to Indigenous businesses.

As shown in the following table, OSFI awarded 6.2% of the total value of our contracts to Indigenous businesses in 2022-23.

| Contracting performance indicators | 2022-23 Results | |||||

|---|---|---|---|---|---|---|

| Total value of contractsTable D footnote 1 awarded to Indigenous businessesTable D footnote 2 (A) | $2,502,659.90 | |||||

| Total value of contracts awarded to Indigenous and non‑Indigenous businessesTable D footnote 3 (B) | $40,566,939.00 | |||||

| Value of exceptions approved by deputy head (C) | $0.00 | |||||

| Proportion of contracts awarded to Indigenous businesses [A / (B−C)×100] | 6.2% | |||||

|

Table D - Footnotes

|

||||||

We exceeded the minimum 5% target through a combination of contracts voluntarily set aside for office furniture and Information Technology (IT) professional services; and contracts for IT hardware, moving services, and professional services that were awarded to Indigenous businesses. We track our performance against the minimum 5% target on a quarterly basis to ensure there is an opportunity to adjust procurement plans as required to continue our performance against the target.

As reported in the Department Plan, our practice is to invite a minimum of one (1) Indigenous supplier to bid on all professional services requests for proposals. We recently increased this practice to a minimum of two (2) Indigenous suppliers.

All our procurement and contracting staff have completed the mandatory course Indigenous Considerations in Procurement (COR409) from the Canada School of Public Service.

Budgetary financial resources (dollars)

The following table shows, for internal services, budgetary spending for 2022–23, as well as spending for that year.

| 2022–23 main estimates | 2022–23 planned spending | 2022–23 total authorities available for use | 2022–23 actual spending (authorities used) |

2022–23 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 93,877,033 | 93,877,033 | 93,879,893 | 103,865,350 | 9,988,317 |

Human resources (full-time equivalents)

The following table shows, in full time equivalents, the human resources the department needed to carry out our internal services for 2022–23.

| 2022–23 planned full‑time equivalents | 2022–23 actual full‑time equivalents | 2022–23 difference (actual full‑time equivalents minus planned full‑time equivalents) |

|---|---|---|

| 296 | 358 | 62 |

Spending and human resources

Spending

Spending 2020–21 to 2025–26

Spending 2020–21 to 2025–26 - text description

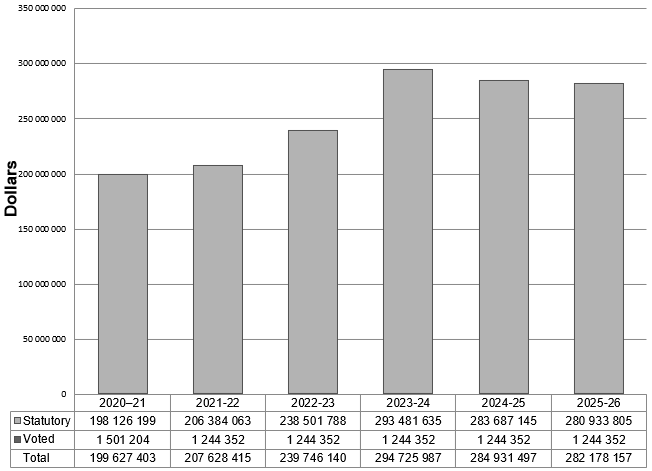

| Spending | 2020–21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | 2025-26 |

|---|---|---|---|---|---|---|

| Statutory | 198,126,199 | 206,384,063 | 238,501,788 | 293,481,635 | 283,687,145 | 280,933,805 |

| Voted | 1,501,204 | 1,244,352 | 1,244,352 | 1,244,352 | 1,244,352 | 1,244,352 |

| Total | 199,627,403 | 207,628,415 | 239,746,140 | 294,725,987 | 284,931,497 | 282,178,157 |

The graph above presents our actual spending from 2020-21 to 2022-23, and planned spending from 2023-24 to 2025-26. The planned spending is based on our 2023-24 Departmental Plan.

Since publishing the 2023-24 Departmental Plan, Parliament amended OSFI’s mandate. Accordingly, this plan does not reflect the budgetary implications of OSFI’s mandate change.

Statutory expenditures, which are recovered from respendable revenue, represent over 99% of total expenditures. The remainder, representing less than 1% of our spending, is funded from a parliamentary appropriation for actuarial services related to federal public sector pension and benefits plans.

Budgetary performance summary for core responsibilities and internal services (dollars)

The “Budgetary performance summary for core responsibilities and internal services” table presents the budgetary financial resources allocated for the Office of the Superintendent of Financial Institutions’ core responsibilities and for internal services.

| Core responsibilities and internal services | 2022–23 Main Estimates | 2022–23 planned spending | 2023–24 planned spending | 2024–25 planned spending | 2022–23 total authorities available for use | 2020–21 actual spending (authorities used) |

2021–22 actual spending (authorities used) |

2022–23 actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Financial Institution and Pension Plan Regulation and Supervision | 117,806,081 | 117,806,081 | 142,174,356 | 153,453,821 | 137,027,710 | 115,090,074 | 115,971,511 | 125,838,034 |

| Actuarial Services to Federal Government Organizations | 8,838,537 | 8,838,537 | 11,891,119 | 12,339,612 | 8,838,537 | 7,156,778 | 8,054,564 | 10,042,756 |

| Subtotal | 126,644,618 | 126,644,618 | 154,065,475 | 165,793,433 | 145,866,247 | 122,246,852 | 124,026,076 | 135,880,790 |

| Internal services | 93,877,033 | 93,877,033 | 140,660,512 | 119,138,064 | 93,879,893 | 77,380,551 | 83,602,340 | 103,865,350 |

| Total | 220,521,651 | 220,521,651 | 294,725,987 | 284,931,497 | 239,746,140 | 199,627,403 | 207,628,415 | 239,746,140 |

OSFI’s 2022-23 planned spending, as presented in the 2022-23 Departmental Plan, was $220.5 million. Following the release of the 2022-2025 Strategic Plan (subsequent to the 2022-23 Departmental Plan), the budget was increased by $21.2 million (or 9.6%) (i.e., from $220.5 million to $241.7 million) and was largely driven by the addition of resources to implement the six strategic transformation initiatives outlined and detailed in the 2022-23 Departmental Plan and in the Results at a Glance section above.

Our 2022-23 actual expenditures of $239.7 million were $2.0 million (or 0.8%) lower than our revised plan of $241.7 million and was largely driven by delays in some of the initiatives added during the 2022-2025 strategic planning exercise. These variances primarily impacted internal services.

The planned spending for 2023-24 and 2024-25 are based on our 2023-24 Departmental Plan that incorporates the Blueprint and the 2022-2025 Strategic Plan.

Human resources

The “Human resources summary for core responsibilities and internal services” table presents the full-time equivalents (FTEs) allocated to each of the Office of the Superintendent of Financial Institutions’ core responsibilities and to internal services.

Human resources summary for core responsibilities and internal services

| Core responsibilities and internal services | 2020–21 actual full‑time equivalents | 2021–22 actual full‑time equivalents | 2022–23 planned full‑time equivalents | 2022–23 actual full‑time equivalents | 2023–24 planned full‑time equivalents | 2024–25 planned full‑time equivalents |

|---|---|---|---|---|---|---|

| Financial Institution and Pension Plan Regulation and Supervision | 555 | 583 | 577 | 621 | 696 | 748 |

| Actuarial Services to Federal Government Organizations | 37 | 40 | 43 | 45 | 56 | 56 |

| Subtotal | 592 | 623 | 620 | 666 | 752 | 804 |

| Internal services | 275 | 297 | 296 | 358 | 369 | 396 |

| Total | 867 | 920 | 916 | 1,024 | 1,121 | 1,200 |

OSFI’s 2022-23 planned full-time equivalents (FTEs), as presented in the 2022-23 Departmental Plan, was 916. Following the release of the 2022-2025 Strategic Plan (subsequent to the 2022-23 Departmental Plan), planned FTEs were increased by 122 (or 13.3%) (i.e., from 916 FTEs to 1,038 FTEs) and was largely driven by the addition of resources to implement the six strategic transformation initiatives outlined and detailed in the 2022-23 Departmental Plan.

In 2022-23, our FTEs were 1,024, which is 12 (or 1.2%) lower than the revised plan of 1,038 and was largely driven by delays in some of the initiatives added during the 2022-2025 strategic planning exercise.

The planned FTEs for 2023-24 and 2024-25 are based on our 2023-24 Departmental Plan that incorporates the Blueprint and the 2022-2025 Strategic Plan.

Expenditures by vote

For information on Office of the Superintendent of Financial Institutions’ organizational voted and statutory expenditures, consult the Public Accounts of Canada.

Government of Canada spending and activities

Information on the alignment of Office of the Superintendent of Financial Institutions’ spending with Government of Canada’s spending and activities is available in GC InfoBase.

Financial statements and financial statement highlights

Financial statements

The Office of the Superintendent of Financial Institutions’ financial statements (unaudited) for the year ended March 31, 2023, are available on the department’s website.

Financial statement highlights

| Financial information | 2022–23 planned results | 2022–23 actual results | 2021–22 actual results | Difference (2022–23 actual results minus 2022–23 planned results) |

Difference (2022–23 actual results minus 2021–22 actual results) |

|---|---|---|---|---|---|

| Total expenses | 220,500,000 | 242,795,705 | 212,501,582 | 22,295,705 | 30,294,123 |

| Total revenues | 219,255,648 | 241,551,353 | 211,257,230 | 22,295,705 | 30,294,123 |

| Net cost of operations before government funding and transfers | 1,244,352 | 1,244,352 | 1,244,352 | 0 | 0 |

The 2022–23 planned results information is provided in the Office of the Superintendent of Financial Institutions Future-Oriented Statement of Operations and Notes for 2022–23.

We are mainly funded through assessments on the financial institutions and private pension plans that we regulate and supervise, and a user-pay program for legislative approvals and selected services. We also receive revenues for cost-recovered services and a small parliamentary appropriation for actuarial services related to federal public sector pension and benefit plans. On an accrual basis of accounting, we recovered all our expenses for the year.

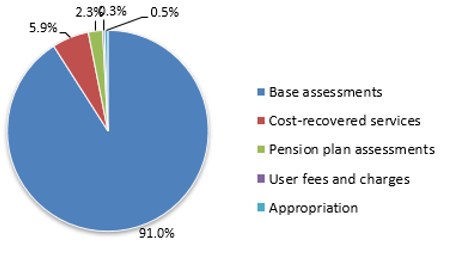

Revenue by type

Revenue by type - text description

| Revenue | % |

|---|---|

| Base assessments | 91.0% |

| Cost-recovered services | 5.9% |

| Pension plan assessments | 2.3% |

| Appropriation | 0.5% |

| User fees and charges | 0.3% |

In 2022-23, total expenses were $242.8 million (calculated in accordance with the Public Sector Accounting Standards), an increase of $30.3 million or 14.3% from the previous year, and $22.3 million higher than initial plan. The year-over-year increase is primarily driven by the addition of resources to implement the six strategic transformation initiatives outlined and detailed in the 2022-2025 Strategic Plan, the staffing of vacant positions, and normal escalation and merit increases.

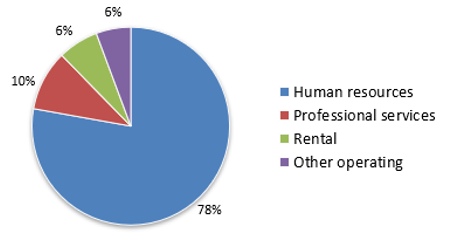

Expense by type

Expense by type - text description

| Expenses | % |

|---|---|

| Human resources | 78% |

| Professional services | 10% |

| Rental | 6% |

| Other operating | 6% |

| Financial information | 2022–23 | 2021–22 | Difference (2022–23 minus 2021–22) |

|---|---|---|---|

| Total net liabilities | 73,319,000 | 62,213,000 | 8,106,000 |

| Total net financial assets | 82,989,000 | 74,052,000 | 8,937,000 |

| Departmental net assets | 9,670,000 | 8,839,000 | 831,000 |

| Total non-financial assets | 16,010,000 | 16,841,000 | -831,000 |

| Departmental net financial position | 25,680,000 | 25,680,000 | 0 |

The 2022–23 planned results information is provided in the Office of the Superintendent of Financial Institutions’ Future-Oriented Statement of Operations and Notes for 2022–23.

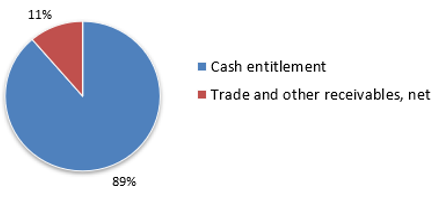

Total financial assets at the end of 2022-23 were $83.0 million, an increase of $8.9 million from the previous year. The change is largely driven by an increase in our cash entitlement (due to increased financial liabilities). Cash entitlement represents the amount that we are entitled to withdraw from the Consolidated Revenue Fund without further authority.

Financial assets by type

Financial assets by type - text description

| Financial assets | % |

|---|---|

| Cash entitlement | 89% |

| Trade and other receivables, net | 11% |

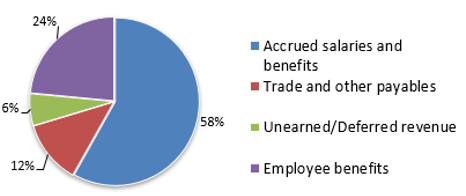

Total financial liabilities were $73.3 million, which was $8.1 million higher than the previous year. The increase is driven by higher accrued salaries and benefits (largely due to the growth in staff complement and accrued economic increases) and an increase in trade and other payables (largely due to growth in overall expenditures).

Financial liabilities by type

Financial liabilities by type - text description

| Financial liabilities | % |

|---|---|

| Accrued salaries and benefits | 58% |

| Employee benefits | 24% |

| Trade and other payables | 12% |

| Unearned/Deferred revenue | 6% |

Corporate information

Organizational profile

Appropriate minister[s]: Chrystia Alexandra Freeland

Institutional head: Peter Routledge

Ministerial portfolio: Finance

Enabling instrument[s]:Office of the Superintendent of Financial Institutions Act (OSFI Act)

Year of incorporation / commencement: 1987

Raison d’être, mandate and role: who we are and what we do

“Raison d’être, mandate and role: who we are and what we do” is available on OSFI’s website.

Operating context

Information on the operating context is available on OSFI’s website.

Reporting framework

OSFI’s departmental results framework and program inventory of record for 2022–23 are shown below.

Departmental Results Framework

Core Responsibility 1 - Financial Institution and Pension Plan Regulation and Supervision

- Departmental Result: Federally regulated financial institutions and private pensions plans are in sound financial condition

- Indicator: % of financial institutions with a Composite Risk Rating of low or moderate

- Indicator: Number of financial institutions for which the supervisory rating (i.e. risk level) has increased by two or more levels within a three month period

- Indicator: Number of pension plans for which the supervisory rating (i.e. risk level) has increased by two or more levels within a three month period

- Departmental Result: Regulatory and supervisory frameworks contribute to the safety and soundness of the Canadian financial system

- Indicator: The Office of the Superintendent of Financial Institutions’ level of compliance with the International Monetary Fund’s Financial Sector Assessment Program core principles

- Indicator: The Office of the Superintendent of Financial Institutions’ level of compliance with Basel standards as assessed by the Regulatory Consistency Assessment Programme of the Bank for International Settlements

Program Inventory

- Risk Assessment and Intervention – Federally Regulated Financial Institutions

- Regulation and Guidance of Federally Regulated Financial Institutions

- Regulatory Approvals and Legislative Precedents

- Federally Regulated Private Pension Plans

Core Responsibility 2 – Actuarial Services to Federal Government Organizations

- Departmental Result: Stakeholders receive accurate and high quality actuarial information on the cost of public programs and government pension and benefit plans

- Indicator: % of members of a panel of Canadian peer actuaries that deem the Canada Pension Plan actuarial valuation accurate and of high quality

- Indicator: % of public pension and insurance plan valuations that are deemed accurate and high quality.

Program Inventory

- Actuarial Valuation and Advice

Core Responsibility 3 – Internal Services

Supporting information on the program inventory

Financial, human resources and performance information for OSFI’s program inventory is available in GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on OSFI’s website:

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA Plus of tax expenditures.

Organizational contact information

Mailing addressOffice of the Superintendent of Financial Institutions

255 Albert Street

Ottawa, Ontario K1A 0H2

Telephone: 1-800-385-8647

TTY: 1-800-465-7735

Fax: 1-613-990-5591

Email: webmaster@osfi-bsif.gc.ca

Website(s):https://www.osfi-bsif.gc.ca

Appendix: definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A report on the plans and expected performance of an appropriated department over a 3‑year period. Departmental Plans are usually tabled in Parliament each spring.

- departmental priority (priorité)

- A plan or project that a department has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired departmental results.

- departmental result (résultat ministériel)

- A consequence or outcome that a department seeks to achieve. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

- A quantitative measure of progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

- A framework that connects the department’s core responsibilities to its departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- full‑time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person‑year charge against a departmental budget. For a particular position, the full‑time equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person’s collective agreement.

- gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

- An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives; and understand how factors such as sex, race, national and ethnic origin, Indigenous origin or identity, age, sexual orientation, socio-economic conditions, geography, culture and disability, impact experiences and outcomes, and can affect access to and experience of government programs.

- government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2022–23 Departmental Results Report, government-wide priorities are the high-level themes outlining the government’s agenda in the November 23, 2021, Speech from the Throne: building a healthier today and tomorrow; growing a more resilient economy; bolder climate action; fighter harder for safer communities; standing up for diversity and inclusion; moving faster on the path to reconciliation; and fighting for a secure, just and equitable world.

- horizontal initiative (initiative horizontale)

- An initiative where two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- Indigenous business (enterprise autochtones)

- For the purpose of the Directive on the Management of Procurement Appendix E: Mandatory Procedures for Contracts Awarded to Indigenous Businesses and the Government of Canada’s commitment that a mandatory minimum target of 5% of the total value of contracts is awarded to Indigenous businesses, an organization that meets the definition and requirements as defined by the Indigenous Business Directory.

- non‑budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- performance indicator (indicateur de rendement)

- A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

- performance reporting (production de rapports sur le rendement)

- The process of communicating evidence‑based performance information. Performance reporting supports decision making, accountability and transparency.

- plan (plan)

- The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

- planned spending (dépenses prévues)

- For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

- A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- program (programme)

- Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

- Identifies all the department’s programs and describes how resources are organized to contribute to the department’s core responsibilities and results.

- result (résultat)

- A consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

- statutory expenditures (dépenses législatives)

- Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

- A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

- Expenditures that Parliament approves annually through an appropriation act. The vote wording becomes the governing conditions under which these expenditures may be made.

Footnotes

- Footnote 1

-

Financial Institutions Supervisory Committee (FISC) is comprised of five federal government organizations, which are the Department of Finance Canada, Bank of Canada, Financial Consumer Agency of Canada, Canada Deposit Insurance Corporation, and OSFI.