Data Collection Modernization Initiative: Get Ready for Implementation

Information

Table of contents

The Data Collection Modernization (DCM) project (May 2023 to April 2028) aims to:

- modernize the regulatory data collection technology platform

- advance key data initiatives and improve data quality

Together these efforts will help better manage regulatory reporting workload over time.

The information below will help federally regulated financial institutions (institutions) and federally regulated pension plans (pension plans) prepare for the implementation of DCM.

Industry engagement to get ready

Industry engagement is critical to the success of DCM. We met with 34 senior leaders in the banking and insurance sectors in June 2025 to begin implementation planning and in November 2025 to discuss details of technology implementation plan.

Throughout 2026 (see Table 1), we will share the technology implementation plan details via small group discussions (with a diverse size of institutions) as well as industry-wide forums. This approach supports a smooth transition.

In early 2026, we will begin to engage with relevant federally regulated banks on data initiatives.

| When | Active Engagements | Engagement size | Who | Banking | Insurance | Private Pension Plans |

|---|---|---|---|---|---|---|

| November 2025 | Survey | 1200 private pension plans | Plan administrators | not applicable | not applicable | True✓ |

| November 2025 | Strategic Council Forums (virtual) | 34 participantsTable 1 Footnote * |

Senior Leaders Industry associations |

True✓ | True✓ | not applicable |

| December 2025 | Technology Forum (virtual) | 46 participantsTable 1 Footnote ** | Technology leaders | True✓ | True✓ | not applicable |

| February 2026 |

Industry Day |

Interested regulatory reporting team membersTable 1 Footnote *** | Self-identified regulatory reporting team members | True✓ | True✓ | True✓ |

| February 2026 | Open Door Forums (virtual) | All interestedTable 1 Footnote *** | Self-identified subject matter experts | True✓ | True✓ | True✓ |

| Spring 2026 | Industry webinar (virtual) | All |

Filers and plan administrators Vendors Others |

True✓ | True✓ | True✓ |

| Summer 2026 | Training to support Step 1 (virtual) | TBC | Filers and plan administrators | True✓ | True✓ | True✓ |

|

Table 1 Footnotes

|

||||||

Technology transition

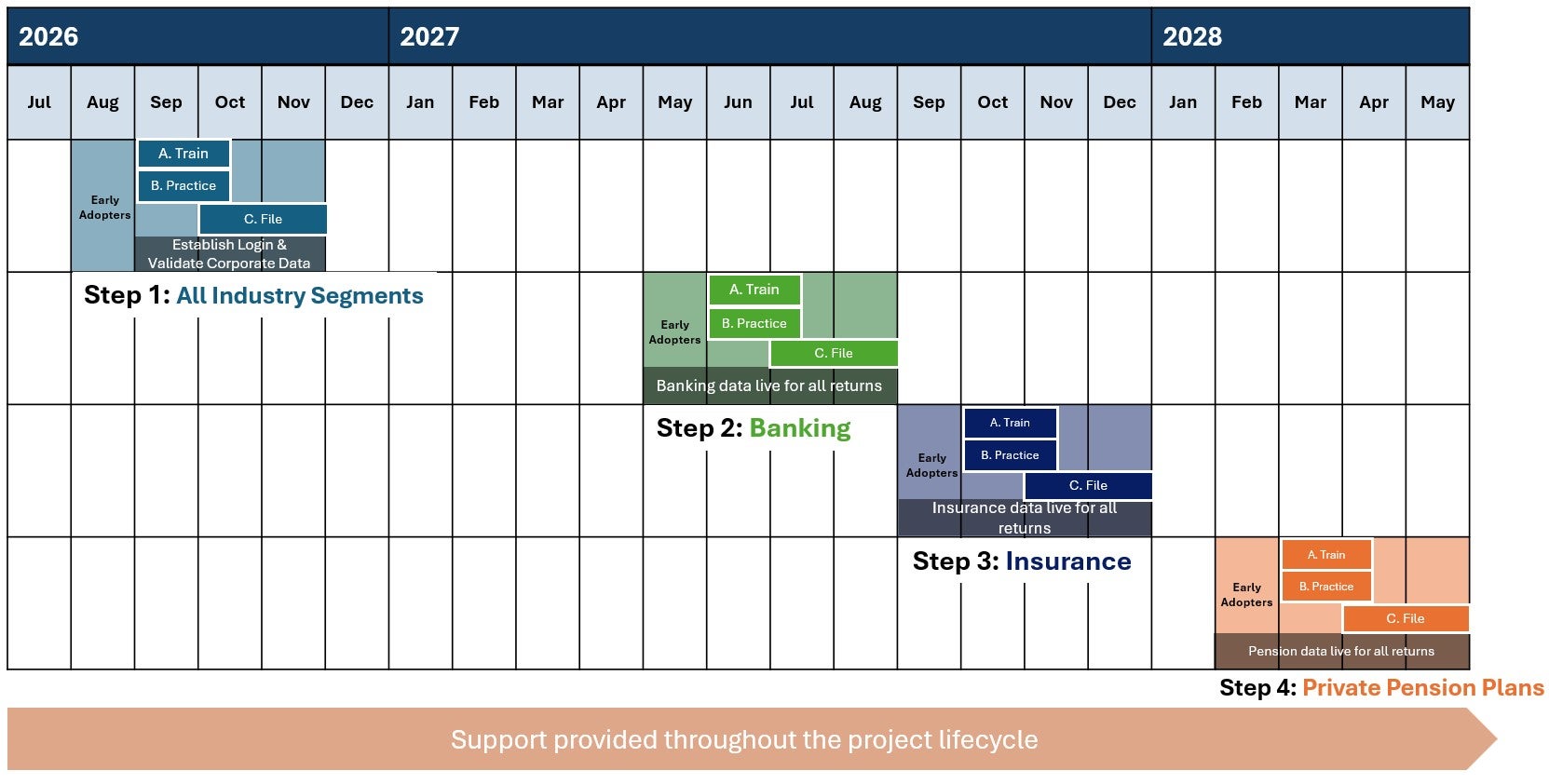

The new platform is designed for ease of use, including during peak filing periods. While institutions and pension plans will need to learn how to use the new platform, they can continue to use legacy file format to file returns. We are taking a phased approach to onboard the industry between fall 2026 to spring 2028 (see Figure 1):

- step 1 (fall 2026 system is live): establish credentials, validate corporate profile, and file corporate data (all sectors)

- steps 2 to 4: begin filing regulatory returns starting with banks, followed by insurers then pension plans

Ahead of each step, we will communicate and train. The step 1 training schedule will be available by late spring 2026.

Figure 1 - Text version

Data

We are taking a thoughtful, balanced, and collaborative approach to advance data priorities. In collaboration with the industry, we can drive fit-for-purpose datasets, higher data quality, and enhance processes.

We previously identified three strategic priorities to:

- transition securities holdings to structured data collection return

- transition real estate secured lending to structured data collection return

- refine the collection and quality of non-retail credit risk data

Once these strategic initiatives are implemented, we will identify future areas to streamline data requests.

In 2026, we will launch the Data Forum and share a roadmap, outlining timelines for industry engagements on strategic data initiatives, and refining potential existing returns.

Visit the DCM webpage or email Shaheena Mukhi (email: dcm-mcd@osfi-bsif.gc.ca) to stay connected.

Wishing you a healthy and safe holiday season!

We look forward to collaborating with you and your teams.

Regards,

Andrew Miller, Chief Data Officer