2020-21 Departmental Results Report

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

© Her Majesty the Queen in Right of Canada, as represented by the Minister of Finance, 2021

Catalogue No. IN3-32E-PDF

ISSN 2561-0716

Table of contents

From the Superintendent

On behalf of the Office of the Superintendent of Financial Institutions (OSFI), I am pleased to present OSFI's 2020-21 Departmental Results Report.

As I begin my seven-year term as Superintendent, I cannot overstate the enthusiasm I feel about joining OSFI. The results contained in this report demonstrate our organization's expertise, focus and commitment. Canadians can have confidence in our ability to deliver on strategic priorities and effectively oversee federally regulated financial institutions and private pension plans.

OSFI delivered on this mandate and its strategic goals throughout a very challenging 2020-21 fiscal year. The uncertainty and volatility created by the COVID‑19 pandemic required us to act quickly with a series of measures designed to help buffer the impacts to Canada's financial system. During this time, we followed a clear set of principles in introducing measures that were credible, consistent, necessary and fit-for-purpose. While the pandemic is not yet behind us, we have begun to unwind and phase out some of these measures.

Moving forward, OSFI will continue to remain vigilant to other challenges on the horizon that will continue to shape the lives of Canadians and the financial institutions, insurers and pension plans that they rely upon. We remain dedicated to exercise our important role as a prudential regulator as to build future resilience and stability in Canada's financial system.

Peter Routledge

Superintendent

Results at a glance

OSFI's total actual spending for 2020-21 was $199.6 million and the total number of full-time equivalents was 867. The 2019-22 OSFI Strategic Plan set the following four goals to guide OSFI's work.

Goal 1: Federally regulated financial institution and pension plan preparedness and resilience to financial risks is improved, both in normal conditions and in the next financial stress event.

The objective of this goal is to ensure that federally regulated financial institutions (FRFIs) are able to provide financial services to Canadians and maintain market confidence, both in normal conditions and in times of stress. Pension plans continue to enhance their awareness of emerging risks and related risk management processes. Under this goal, in 2020-21 OSFI:

- Announced a series of regulatory adjustments to support financial and operational resilience during COVID‑19, and intensified monitoring and vulnerability analysis to assess changing FRFI risk profiles in light of the pandemic

- Conducted stress testing and sensitivity analysis with a particular focus on pandemic related FRFI loan deferral programs to identify the financial impacts and potential "cliff" effects related to those portfolios

- Issued a discussion paper on prudential considerations regarding climate related risks and linked climate related risk to supervisory work

- Issued a draft Capital Adequacy Requirements (CAR) Guideline, Leverage Requirements Guideline and Liquidity Adequacy Requirements (LAR) Guideline

- Issued a draft Small and Medium Sized Banks Capital and Liquidity Requirements Guideline

- Issued a draft Pillar 3 Disclosure Guideline for Domestic Systemically Important Banks

- Issued draft Revised Guideline B-2, Property and Casualty Large Insurance Exposures and Investment Concentration

Goal 2: FRFIs and pension plans are better prepared to identify and develop resilience to non-financial risks before they negatively affect their financial condition.

Through this goal, OSFI is focused on the resiliency of FRFIs and pension plans to non-financial risks. Under this goal, in 2020-21 OSFI:

- Published a technology risk discussion paper focusing on risks arising from rapid technological advancement and digitalization and developing resilience to non-financial risks

- Contributed to two consultative documents on operational risk and resilience as a member of the Basel Committee on Banking Supervision's Operational Resilience Group

- Completed artificial intelligence/machine learning (AI/ML) modelling studies with selected banks and insurance companies to better understand model risk

- Released the 2020 Life Memorandum to the Appointed Actuary including Appointed Actuary's Report disclosure enhancements related to participating life insurance

- Completed a comparative study on insurers' compliance with Guideline E-16, Participating Account Management and Disclosure to Participating Policyholders and Adjustable Policyholders

- Completed initial culture-focused supervisory reviews targeting strategic decision making in banking and insurance industries

- Continued work with the Culture External Advisory Committee to provide practical guidance on OSFI's supervision of culture

Goal 3: OSFI's agility and operational effectiveness are improved.

The objective of this goal is to ensure that OSFI has the right people, skills, and infrastructure to meet the needs of the organization and that these can be leveraged in a timely and effective manner. Under this goal, in 2020-21 OSFI:

- Continued the build-out of data and analytics resources and processes to expand capabilities

- Established new data governance frameworks to manage users, use cases, and datasets

- Implemented new enterprise tools to modernize business intelligence, workflow automation, and sandbox analytics environments

- Advanced OSFI's Cloud Adoption Roadmap by implementing foundational infrastructure and cloud-based collaboration tools

- Rolled out Vu, a newly developed supervisory system for carrying out core supervisory work

- Continued to deliver on the multi-year Human Capital Strategy, including a review of hiring and promotion practices, the development of a talent management program for non-executives, and worked to establish a Diversity, Equity and Inclusion Framework

Goal 4: Support from Canadians and cooperation from the financial industry are preserved.

The objective of this goal is ensuring that Canadians have trust in the safety and soundness of financial institutions and pension plans. Under this goal, in 2020-21 OSFI:

- Released a near-term plan of prudential policy priorities for federally regulated entities

- Enhanced communication with industry stakeholders and the public during the COVID‑19 pandemic through analyst, industry and media briefings (alongside posting over 250 FAQs on the OSFI website)

- Implemented an internal cybersecurity training platform and initial wave of self-study courses

- Revised OSFI's consultations approach to include broader and more accessible discussion papers designed to collect feedback across industry

OSFI's COVID‑19 Response

OSFI proactively supported Canada's FRFIs and federally regulated pension plans (FRPPs) in weathering the risks posed by COVID‑19. Early in the pandemic, as part of a coordinated effort by federal agencies, OSFI took a number of actions to help build the resilience of federally regulated entities and improve the stability of the Canadian financial system in response to the challenges posed by the pandemic. In March 2020, OSFI reacted quickly and lowered the Domestic Stability Buffer (DSB) for domestic systemically important banks (D-SIBs) from 2.25% to 1% of total risk-weighted assets. As part of this, OSFI announced the expectation that FRFIs not increase regular dividends, undertake common share buybacks or raise executive compensation until further notice.

Throughout the pandemic, OSFI continued this coordinated effort as the Office announced a series of regulatory adjustments to support the financial and operational resilience of federally regulated banks, insurers and private pension plans.

In the latter half of 2020 through to spring 2021, as risks in the financial system lessened, OSFI began unwinding some of these measures, starting with a gradual phasing-out of the special capital treatment of loan and insurance premium payment deferrals. In June 2021, the DSB (which had been held at 1% since March 2020) was raised to 2.5% in recognition of the fact that while certain risks due to COVID‑19 had lessened, key vulnerabilities such as consumer indebtedness remain elevated.

For more information on the Office of the Superintendent of Financial Institutions' plans, priorities and results achieved, see the "Results: what we achieved" section of this report.

Results: what we achieved

Financial Institution and Pension Plan Regulation and Supervision

Description

The Office of the Superintendent of Financial Institutions advances a regulatory framework designed to control and manage risk to federally regulated financial institutions and private pension plans and evaluates system-wide or sectoral developments that may have a negative impact on their financial condition. It also supervises financial institutions and pension plans to determine whether they are in sound financial condition and meeting regulatory and supervisory requirements. The Office promptly advises financial institutions and pension plan administrators if there are material deficiencies, and takes corrective measures or requires that they be taken to expeditiously address the situation. It acts to protect the rights and interests of depositors, policyholders, financial institution creditors and pension plan beneficiaries, while having due regard for the need to allow financial institutions to compete effectively and take reasonable risks.

Results

To support the priorities in OSFI's Strategic Plan during the ongoing COVID‑19 pandemic, OSFI focused on a number of key initiatives in areas such as capital, accounting, reinsurance, governance, crisis management, and non-financial risks. Key results from the 2020-21 reporting period are organized by OSFI's regulatory and supervisory program areas.

Regulation and Guidance of Federally Regulated Financial Institutions

OSFI continued to enhance the effectiveness of its capital and liquidity regime by consulting with industry on specific elements. In March 2021, OSFI launched a public consultation on revisions to the Capital Adequacy Requirements (CAR) Guideline, Leverage Requirements (LR) Guideline and Liquidity Adequacy Requirements (LAR) Guideline. The proposed revisions to the CAR and LR guidelines reflect OSFI's domestic implementation of the final Basel III reforms. All three guidelines also include proposed revisions to reflect specific capital and liquidity requirements for small and medium-sized institutions as well as help stakeholders understand how the CAR, LR and LAR guidelines apply to these institutions.

In March 2021, OSFI issued a draft Pillar 3 Disclosure Guideline for D-SIBs for public consultation. The draft Guideline implements Phases II and III of the Pillar 3 Framework for D-SIBs. OSFI also launched a consultation on the applicability of the Pillar 3 Framework for Small and Medium Sized Banks (SMSBs) through its SMSB proportionality project.

Throughout 2020-21, OSFI continued to focus on the quality of external audits of financial institutions by chairing the Financial Stability Board (FSB) Roundtable on Audit Quality. In September 2020, the Superintendent co-hosted and chaired the FSB's Roundtable on External Audit, a forum for constructive dialogue on promoting financial stability by enhancing public confidence in the quality of external audits. The discussion touched on current challenges linked to the economic downturn and volatility in financial markets and the estimation of expected credit losses, as well as goodwill impairment and other complex components of banks' financial statements.

In 2020-21 OSFI continued to promote sound mortgage underwriting practices that preserve FRFI financial resilience and reduce risks to the financial system. Specifically, OSFI's supervisory reviews and enhanced surveillance of deposit-taking institutions ensured that institutions had appropriate standards and adequate controls to assess a borrower's ability to pay their loan under a variety of conditions, including instances where borrowers were granted mortgage deferrals and/or received relief through various government programs. After the end of the 2020-21 reporting period, OSFI published a new minimum floor for the qualifying rate applied to uninsured mortgages: the higher of the mortgage contract rate plus 2%, or 5.25%, effective June 1, 2021. OSFI further committed that the rate will be reviewed annually.

In October 2020, OSFI issued an industry letter on the ongoing relevance of OSFI's Guideline B-8, Deterring and Detecting Money Laundering and Terrorist Financing, given FINTRAC's role as the federal supervisor for anti-money laundering and anti-terrorist financing. In May 2021, in response to consultation feedback, OSFI announced the decision to rescind Guideline B-8 without the need for amendment to Guideline E-13, Regulatory Compliance Management. OSFI expects to review E-13 in 2022, which will focus on OSFI's compliance risk management approach more generally.

In November 2020, OSFI released an advisory to formally include in the Life Insurance Capital Adequacy Test (LICAT) framework a smoothing technique for determining interest rate risk requirements for participating business. OSFI released another quantitative impact study and revised draft capital guidelines (LICAT, Minimum Capital Test and Mortgage Insurer Capital Adequacy Test), updated for International Financial Reporting Standards - Insurance Contracts (IFRS 17), directly to insurers and other stakeholders. The quantitative impact study submissions and feedback on the draft guidelines helped inform further refinements to these guidelines.

OSFI also continued to develop a new approach for determining capital requirements for segregated fund guarantee risk, which will reflect IFRS 17. Once implemented, the new approach will replace the current Chapter 7 of the LICAT guideline. In November 2020, OSFI published a letter detailing key steps in the development process. To allow insurers to focus on a robust implementation of IFRS 17, OSFI subsequently extended the implementation date by two years to January 1, 2025.

In September 2020, OSFI issued an updated advisory for IFRS 17 to reflect the International Accounting Standards Board's new effective date of January 1, 2023 and requirements for additional progress reporting for insurance companies. An IFRS 17 Regulatory Return public consultation was also held. Throughout 2020-21, OSFI monitored progress made on implementing this new standard by insurance companies through OSFI's semi-annual progress reporting process.

Participating (par) business is a significant portion of the in-force life insurance business in Canada and the Insurance Companies Act places specific responsibility on OSFI for ensuring fairness in the treatment of par policyholders. OSFI released the 2020 Life Memorandum to the Appointed Actuary in September 2020, including Appointed Actuary Report disclosure enhancements related to participating life insurance. OSFI has gathered information on the practices of companies with participating business and has begun the analysis of potential policy responses. The management of par business is an increasing area of focus for OSFI due to recent initiatives by insurers with respect to their in force par business as well as increased interest in offering par policies in the continuing low interest rate environment.

A comprehensive review of reinsurance practices has been a key OSFI initiative over the past few years. In June 2019, OSFI issued a draft revised Guideline B-3, Sound Reinsurance Practices and Procedures, for consultation. Building on this work, in November 2020, OSFI issued a draft Guideline B-2, Property & Casualty Large Exposures and Investment Limits, for consultation. Final Guidelines B-2 and B-3 will be released in December 2021.

OSFI launched an internal working group, the Aging Population Project, to study the risks stemming from this demographic trend on the Canadian insurance industry, including impacts on asset prices, industry product offerings, and risks. This working group interviewed life insurers and reinsurance firms, and sought input from non-insurers, civil society groups, and the Japanese Financial Services Authority. Presentations to stakeholders will take place in 2021-22.

Risk Assessment and Intervention - Federally Regulated Financial Institutions

Building on the industry culture scan conducted in 2019-20, OSFI conducted culture-focused supervisory reviews targeting FRFI strategic decisions in 2020-21. These reviews provided insights into behavioural indicators such as transparency and communication, diversity of thought, ability to provide effective challenge and reflective learning. OSFI will continue to incorporate culture within the scope of supervisory reviews.

OSFI views compensation, incentives and rewards as key drivers of organizational behaviour and culture. As a member of the FSB's Compensation Monitoring Contact Group (CMCG), OSFI collected information in late 2020-21 regarding compensation practices, including non-financial measures and impacts related to COVID‑19, across select banking and insurance institutions. Insights from this information will be aggregated to contribute to a CMCG report on the implementation of FSB Principles and Standards for Sound Compensation Practices in 2021-22.

The onset of COVID‑19 saw financial institutions rapidly move to remote working, which placed pressure on their operations, technology, staff, processes, controls and suppliers, leading many FRFIs to invoke their crisis management plans. OSFI gathered information about how FRFIs manage through disruption, including the need for up-to-date, well-tested business continuity plans and crisis playbooks that consider a wide range of possible scenarios and action plans. OSFI has now shifted its focus to monitoring the development and comprehensiveness of FRFI scenario testing and how the post-pandemic environment may affect operational resilience.

Climate continues to garner increased attention from prudential regulators, in Canada and internationally. In November 2020, OSFI launched a pilot project on climate-related risks with the Bank of Canada and six participating financial institutions (comprised of banks and insurers). Through this initiative, OSFI aims to gain a better understanding of the risks to the financial system posed by the transition to a low-carbon economy. This pilot project will also help build: the climate scenario analysis capability of authorities and financial institutions, which supports enhancing the Canadian financial sector disclosure of climate-related risks; increase the understanding of transition risks for the financial sector; and, improve the understanding of governance and risk-management practices around relevant climate-related risks and opportunities.

In January 2021, OSFI launched a three-month consultation on the potential impact of climate-related risks on FRFIs and FRPPs with the publication of a discussion paper. This paper, titled Navigating Uncertainty in Climate Change: Promoting Preparedness and Resilience to Climate-Related Risks outlined the possible risks stemming from climate change that could affect the safety and soundness of the entities OSFI regulates, in particular physical risk, transition risk, and liability risk. OSFI continues to gather comments and insights into how FRFIs and FRPPs define, identify, measure and build resilience to climate-related risks, and the role OSFI might play in fostering preparedness for, and resilience to, these risks.

OSFI also co-chaired the FSB Working Group on Climate Risks and participated in the FSB's Work Stream on Climate Disclosures, the Basel Committee on Banking Supervision's high-level task force on climate-related financial risks, the Sustainable Insurance Forum, the International Association of Insurance Supervisors, and the Network for Greening the Financial System.

Working in the context of the Government of Canada's National Cyber Security Strategy, OSFI continued to enhance its capabilities and expectations related to technology and cyber risks. The pandemic highlighted issues related to outdated technology, authentication, vulnerability and patch management, and technology change management at FRFIs. Further, trends towards the accelerated adoption of cloud computing and an advancement in digital innovation add complexity and urgency to technology and cyber risks. These technology-related issues and trends have an impact on existing business models. In addition to increased and focused monitoring throughout the pandemic, OSFI shared technology risk bulletins focusing on Multi Factor Authentication, and more recently on Application Programming Interface (API) security and risks, with FRFIs.

In 2020-21, OSFI noted increases in ransomware attacks and supply chain attacks. While FRFIs themselves performed relatively well against direct ransomware attacks, this threat affected their third and fourth party partners, causing disruptions to and impacts on FRFIs. There has also been an increase in phishing and malware, increasing the overall cyber threat level. In September 2020, OSFI issued a discussion paper, titled Developing Financial Sector Resilience in a Digital World: Selected Themes in Technology and Related Risks. This paper discussed broad topics beyond technology risk, spanning operational risk and resilience, cyber security, advanced analytics, data, and the third-party ecosystem, and invited feedback for consideration in the development of new guidance and supervisory approaches in these areas. Feedback received will help OSFI draft a technology and cyber risk guideline, to be issued for consultation in 2021-22.

The COVID‑19 pandemic demonstrated the potential limitations of models FRFIs use across a number of business areas including challenges related to model responsiveness and appropriateness of model outputs. In response, OSFI focused on assessing FRFI actions taken to address model weaknesses in the short term such as the application of model overlays, interim model recalibrations and tightening conditions for model use. With further deterioration expected in model performance as government relief programs come to an end, OSFI has shifted its focus towards assessing FRFIs' ability to effectively adapt their model risk management frameworks to different environments. OSFI continues to strengthen its understanding of the risks and challenges posed by FRFIs' use of advanced analytics and artificial intelligence. To that end, in 2020-21, OSFI completed artificial intelligence/machine learning (AI/ML) modelling studies with selected banks and insurance companies. Expectations around model risk management and regulatory expectations around the use of AI are evolving and will be reflected in an upcoming industry letter on advanced analytics, model risk and revised model risk guidelines.

Regulatory Approvals and Legislative Precedents

FRFIs are required to seek regulatory approval for certain types of transactions. OSFI evaluates and processes applications for regulatory consent, establishes positions on the interpretation and application of relevant legislation, identifies precedential transactions, and develops recommendations. In order to enhance transparency and efficiency in the approval process, OSFI published a webpage in December 2020 that provides an application form for approval requests related to the use of restricted words in company and business names as well as responses to frequently asked questions on this subject.

In 2020-21, OSFI processed 123 applications from FRFIs, 111 of which were approved and 12 of which were withdrawn. The majority of approved applications are related to banks (40%) and Property & Casualty insurers (35%). OSFI also provided advance capital confirmations on the eligibility of proposed regulatory capital instruments. OSFI provided a total of 20 such opinions and validations in 2020-21, compared to 21 in the previous year.

Federally Regulated Private Pension Plans

In response to COVID‑19, OSFI adjusted its policies to continue to protect the interests of pension plan members and beneficiaries, and to allow plan administrators to focus on addressing challenges posed by the pandemic. In addition to extending filing deadlines and suspending a number of consultations and policy development initiatives, OSFI implemented a temporary freeze on portability transfers and annuity purchases relating to defined benefit provisions of pension plans.

In September 2020, OSFI lifted the temporary portability freeze subject to certain conditions. Previously suspended work on developing pension-related guidance had also resumed. In addition, OSFI increased its monitoring in the areas of risk management, employers' ability to make contributions, business continuity, and employers operating in sectors highly impacted by the crisis. From late March until the end of December 2020, OSFI frequently calculated the estimated solvency ratio of the defined benefit pension plans it regulates, allowing OSFI to stay on top of the impact of volatility in the financial and economic environment.

As part of OSFI's review of its supervision of pension plan investments, an analysis of data collected through a pension investment questionnaire permitted a deeper understanding of the nature and level of inherent pension investment risks, as well as the form and quality of risk management practices. Risk management gaps identified through this review will inform OSFI's supervisory approach to pension investments and regulatory expectations.

In 2020-21, OSFI assessed the supervision of plans with defined contribution provisions. The Financial Services Regulatory Authority of Ontario (FSRA) and OSFI together established a special purpose committee to review approaches to supervising defined contribution plans and, where possible, find opportunities for greater regulatory harmonization. Through this collaboration, FSRA and OSFI will work towards improving outcomes for plan members and enhancing regulatory efficiency and effectiveness.

OSFI also continued work on two additional initiatives related to emerging risks faced by pension plans: a review of the consideration of environmental, social and governance (ESG) factors in plan investment decisions, and the analysis of the potential risks associated with technology, including cyber and third-party risk. In the spirit of harmonization, OSFI will consider whether introducing coordinated guidance through the Canadian Association of Pension Supervisory Authorities is a more practical and effective approach.

Experimentation

OSFI continued to support the Government of Canada's commitment to innovation. While continuous improvement is generally sought through consultations and lessons learned exercises, where possible, OSFI explores new ways to enhance its efficiency and effectiveness. For example, OSFI examined how it communicates to better support transparency and effective messaging to its stakeholders. In addition, OSFI experimented with its processes to roll out new guidance faster in an effort to be more agile in regulatory development.

2030 Agenda for Sustainable Development

Through OSFI's work on climate change scenario planning and associated supervisory and regulatory responses to climate risks, the Office supports UN SDG 13 by: strengthening resilience and adaptive capacity in responding to climate-related hazards (13.1); integrating climate change measures into policies, strategies and planning (13.2); and improving awareness and institutional capacity on climate change mitigation, adaptation, impact reduction, and early warning (13.3).

Through the ongoing execution of its mandate as a prudential financial regulator, OSFI also supports SDG 8.10 by strengthening the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services and SDG 10.5 by improving the regulation and monitoring of global financial markets and institutions and strengthening the implementation of such regulations.

| Departmental results | Performance indicators | Target | Date to achieve target | 2018‑19 Actual results |

2019‑20 Actual results |

2020‑21 Actual results |

|---|---|---|---|---|---|---|

| Federally regulated financial institutions and private pensions plans are in sound financial condition. | % of financial institutions with a Composite Risk Rating of low or moderate. | At least 80% | March 31, 2021 | 94% | 96% | 96% |

| Number of financial institutions for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three month period. | 1 or less | March 31, 2021 | 5 | 0 | 0 | |

| Number of pension plans for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three month period. | 1 or less | March 31, 2021 | 0 | 0 | 0 | |

| Regulatory and supervisory frameworks contribute to the safety and soundness of the Canadian financial system. | The Office of the Superintendent of Financial Institutions' level of compliance with the International Monetary Fund's Financial Sector Assessment Program core principles. | 100% | March 31, 2021 | 100% | N/A | N/A Table 1 Footnote 1 |

| The Office of the Superintendent of Financial Institutions' level of compliance with Basel standards as assessed by the Regulatory Consistency Assessment Programme of the Bank for International Settlements. | 90% | March 31, 2021 | 100% | N/A | N/A Table 1 Footnote 2 | |

Table 1 Footnotes

|

||||||

| 2020‑21 Main Estimates |

2020‑21 Planned spending |

2020‑21 Total authorities available for use |

2020‑21 Actual spending (authorities used) |

2020‑21 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 116,299,648 | 116,299,648 | 116,299,648 | 115,090,074 | -1,209,574 |

| 2020‑21 Planned full-time equivalents |

2020‑21 Actual full-time equivalents |

2020‑21 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 574 | 555 | -19 |

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions' Program Inventory is available in GC InfoBase.

Actuarial Services to Federal Government Organizations

Description

The Office of the Chief Actuary (OCA) provides a range of actuarial services, including statutory actuarial valuations required by legislation and checks and balances on the future costs of programs for the Canada Pension Plan (CPP), Old Age Security, Employment Insurance and Canada Student Loans programs, as well as pension and benefits plans covering the Federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police, federally appointed judges, and Members of Parliament.

Results

In 2020-21, the OCA continued to provide independent, accurate, high quality and timely actuarial reports and professional actuarial services and advice. With the view of maintaining high quality services, the OCA continued to maintain its programs of research on subjects relevant to the preparation of future actuarial reports. The OCA completed four actuarial reports that were submitted to the President of the Treasury Board for tabling before Parliament:

- Actuarial Report on the Pension Plan for Members of Parliament as at March 31, 2019;

- Actuarial Report on the Regular Force Death Benefit Account as at March 31, 2019;

- Actuarial Report on the Pension Plan for the Federally Appointed Judges as at March 31, 2019; and

- Actuarial Report on the Pension Plans for the Canadian Forces Regular Force and Reserve Force as at March 31, 2019.

These reports provide actuarial information to decision-makers, parliamentarians and the public. These reports also reflect the expected impacts of the COVID‑19 pandemic on economic assumptions.

The Old Age Security (OAS) Program, including the basic OAS pension and the Guaranteed Income Supplement and Allowance, is an important pillar of Canada's retirement income system and is financed from Government of Canada general tax revenues. The 16th Actuarial Report on the OAS Program as at December 31, 2018 was tabled in Parliament on October 20, 2020. It provides information on the OAS program's future expenditures until 2060. This information facilitates a better understanding of the program and the factors that influence its costs. This report also reflects the expected impacts of the COVID‑19 pandemic on the economic assumptions regarding the program.

In 2020-21, the OCA presented to the Canada Employment Insurance Commission (CEIC) the 2021 Actuarial Report on the Employment Insurance Premium Rate, which was tabled in Parliament on October 6, 2020.

The OCA also prepared numerous reports for purposes of reporting and disclosure in the consolidated financial statements of the Government of Canada. The OCA submitted the Actuarial Report on the Canada Student Loans Program as at July 31, 2019, the Actuarial Report on the Government Annuities as at March 31, 2019, and the Actuarial Report on the Civil Service Insurance Program as at March 31, 2020. The OCA also submitted various actuarial reports as at March 31, 2020 associated with federal public sector pension and other employee benefits, and future benefits to Veterans.

In May 2020, the OCA released the findings of an independent peer review panel commissioned to review the 30th Actuarial Report on the CPP. The complete review report is available in the Office of the Chief Actuary section on the OSFI website. The peer review resulted in nine recommendations dealing with various aspects of the report, including data, methodology, communication of results and other actuarial issues.

As part of its ongoing research, the OCA published the Old Age Security (OAS) Mortality Fact Sheet, which notes there is a slowing trend in the pace of increases in life expectancy for both sexes between 2005 and 2019. Preliminary data for 2020, which were not included in this study, show a surge in the number of deaths as a result of the COVID‑19 pandemic. The OCA also published a fact sheet on Registered Pension Plans (RPP) and Other Types of Savings Plans in Canada, which showed that, despite an increase in number of active RPP members over the last 10 years, the number of active RPP members both as a percentage of the labour force and as a percentage of employees has slightly decreased.

Experimentation

OSFI continued to support the Government of Canada's commitment to innovation. Given the OCA's primary responsibility is to provide actuarial advice including the preparation of actuarial reports for federal government organizations, continuous improvement is generally sought through consultations and lessons learned exercises rather than experimental projects.

| Departmental results | Performance indicators | Target | Date to achieve target | 2018‑19 Actual results | 2019‑20 Actual results | 2020‑21 Actual results |

|---|---|---|---|---|---|---|

| Stakeholders receive accurate and high quality actuarial information on the cost of public programs and government pension and benefit plans. | % of members of a panel of Canadian peer actuaries that deem the Canada Pension Plan actuarial valuation accurate and of high quality. | 100% Agreement among all three members of peer review panel | March 31, 2021 | N/A | N/A | 100% |

| % of public pension and insurance plan valuations that are deemed accurate and high quality. | 100% | March 31, 2021 | 100% | 100% | 100% |

| 2020‑21 Main Estimates |

2020‑21 Planned spending |

2020‑21 Total authorities available for use |

2020‑21 Actual spending (authorities used) |

2020‑21 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 7,371,737 | 7,371,737 | 7,371,737 | 7,156,778 | -214,959 |

| 2020‑21 Planned full-time equivalents |

2020‑21 Actual full-time equivalents |

2020‑21 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 40 | 37 | -3 |

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions' Program Inventory is available in GC InfoBase.

Internal Services

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. The 10 service categories are:

- Acquisition Management Services

- Communication Services

- Financial Management Services

- Human Resources Management Services

- Information Management Services

- Information Technology Services

- Legal Services

- Material Management Services

- Management and Oversight Services

- Real Property Management Services

Results

The OSFI Strategic Plan and its four strategic goals guided OSFI's work throughout 2020-21. In July 2020, OSFI launched its "Year of ART". The Year of ART describes how OSFI conducted itself and advanced its work in 2020-21, and beyond, using the following principles:

- Agility - remaining flexible to adapt to new realities, issues, and ways of working;

- Resilience - the capacity to not only react but also thrive in new circumstances; and

- Teamwork - doing this together; one team, One Office.

In 2020-21, OSFI refreshed its corporate values: Respect, Curiosity, and Stewardship. These values guide OSFI's work in realizing its vision, which is "Building OSFI for today and tomorrow: Preserving Confidence, Ever Vigilant, Always Improving". Through these principles and values, OSFI delivered effective and efficient programs and internal services through the challenges of the COVID‑19 pandemic.

In February 2021, OSFI was named by Mediacorp Canada Inc. as one of the National Capital Region's Top 100 Employers in recognition of its One Office approach and employee supports throughout the pandemic.

In 2021, OSFI also launched PIVOT, the ongoing transformation agenda for OSFI's operating model. PIVOT encompasses how OSFI works now and how OSFI will work in the future, along with how this will enhance the organizational culture. PIVOT is OSFI's integrated approach to how all necessary components will work together to transform the operating model, including work location, work practices, technological solutions, evolving human resources and leadership practices, and greening operations and physical space.

Governance

OSFI's new senior governance structure continued to mature in 2020-21. 2020-21 was the inaugural year for the restructured Business Risk Committee (BRC), responsible for overseeing the development of holistic strategies to address horizontal, industry-wide risks. The BRC brings greater cohesion to OSFI's macro risk oversight function, its risk triage and response function, and its FRFI monitoring and planning activities. The BRC supports a comprehensive review of risks and aims to increase communication consistency, improve transparency and enhance decision-making across OSFI. In addition, in 2020-21, OSFI finalized its rollout plan for its new Enterprise Risk Management framework, which will better integrate risk considerations into planning, governance and decision-making.

Communications and Engagement

In 2020-21, OSFI effectively communicated its plans, programs and activities to Canadians through its website, media, social media, public events, speeches, and parliamentary appearances. Twenty-two events (17 external and five internal) were organized throughout 2020-21, and OSFI responded to over 5,700 inquiries and requests for information. Some highlights include the Life Risk Management Webcast in June 2020, the Property and Casualty Risk Management Webcast and the Deposit-Taking Institutions Risk Management Webcast in November 2020, and the Small and Medium Sized Banks Webcast in March 2021.

In October 2020, OSFI hosted the 21st International Conference for Banking Supervisors (ICBS) in collaboration with the Bank of Canada. Delegates discussed a wide range of issues related to the future of banking supervision in a changing world, including the digitalization of finance and the evolution of banking models, operational resilience, climate-related financial risks and remote working arrangements. This was the first ICBS hosted by Canada and the first completely virtual version of the event, the largest in the event's history, attracting more than 450 participants from close to 100 countries (enabled by the virtual format).

Work continued on the implementation of OSFI's 3-year Communication Strategy, which provides a roadmap of how the communications function supports OSFI's strategic goals internally and externally. In line with Goal 4, it aims to increase awareness and understanding of OSFI's work and assist ongoing reputation management. An example of this is expanding the suite of animated videos that explain in an easy to understand format the work that OSFI does.

To further support ongoing communications work during the pandemic, a COVID‑19 updates page was added to the OSFI website, which acted as a central source of information for institutions and the public for announcements, FAQs and regulatory guidance and expectations related to the COVID‑19 measures that OSFI put in place.

Human Resources

In 2020-21, OSFI continued to deliver on its multi-year Human Capital Strategy (HCS). The strategy provides a framework for people management and employee development. The HCS consists of six priority areas: leadership development; talent management; learning and development; culture and community; enterprise change management; and workforce planning, the newest pillar. This new priority guides OSFI's work in examining practices to mitigate against potential biases and remove any unintended barriers, with the goal of increasing transparency and employment equity representation.

OSFI piloted a talent management program for non-executives with plans to expand the program enterprise-wide, delivered its Management Essentials Program, continued to provide coaching services, and rolled-out a Managing Virtually Program to support effective virtual teams. The Leadership Development Program delivery for the executive group was completed and an OSFI-wide Learning and Development Strategy was developed to support the professional development and career paths of all employees.

OSFI continues to support and promote employee wellness, diversity and inclusion. A Diversity, Equity and Inclusion (DEI) unit was created, along with the development of a DEI Framework to support the development of an enterprise-wide DEI Strategy. Work has commenced on the design and development of a Wellbeing Strategy, to be implemented in 2021-22.

OSFI updated its Conflict of Interest Policy to add clarity around the requirement for employees to review their obligations under the Policy, and to include new measures when employees engage in the procurement and contracting process. In keeping with new regulations and requirements on the prevention of harassment and violence in the workplace (Bill-C-65), a new Workplace Harassment and Violence Prevention Policy and procedures were introduced.

Information Management and Information Technology

The COVID‑19 pandemic reinforced the need for robust and reliable information technology infrastructure and network connectivity. The adoption of multiple secure collaboration technologies (including Skype for Business, Microsoft Teams and Zoom) enabled OSFI staff to work effectively during OSFI's remote work posture. In 2020-21, OSFI made significant progress on its IM/IT Strategy with a Digital Focus, which provides a long-term plan for the modernization and evolution of internal operations. Key achievements in 2020-21 include the delivery of the Vu system and improved and more secure collaboration and data analytics capabilities; the advancement of OSFI's Cloud Adoption Roadmap; and the launch of the cybersecurity awareness program.

OSFI continues to implement its Enterprise Data Strategy. The importance of timely and accurate data was heightened throughout the pandemic and will continue to be an area of focus going forward. Key achievements in 2020-21 include the continued build-out of data and analytics resources to expand internal capabilities and new data governance frameworks to enhance how OSFI protects and processes its data assets. Specifically, OSFI's enhanced data and analytics approach focuses on data management and transformation, data engineering and analytics, advanced analytics, and data governance. OSFI also implemented new enterprise tools to modernize business intelligence reporting, data workflow automation and advanced analytics sandbox environments.

Experimentation

OSFI relies on data analysis to measure risk, identify trends and make evidence-based decisions. OSFI launched the Technology Exploration Space (TES) platform with an initial set of trial use cases to examine these technologies and look for further opportunities to maximize the value extracted from OSFI data. The discoveries have subsequently led to TES 2.0 and deployment of additional advanced analytics tools and plans for continued development of internal data science competencies.

2030 Agenda for Sustainable Development

OSFI supports UN SDG 12.7 by embedding environmental considerations in public procurement in accordance with the federal Policy on Green Procurement. OSFI will continue to ensure that its decision-making process includes consideration of Federal Sustainable Development Strategy goals and targets through its Strategic Environmental Assessment (SEA) process. For more information, please refer to the Green Procurement supplementary information table.

| 2020‑21 Main Estimates |

2020‑21 Planned spending |

2020‑21 Total authorities available for use |

2020‑21 Actual spending (authorities used) |

2020‑21 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 77,384,289 | 77,384,289 | 77,384,289 | 77,380,551 | -3,738 |

| 2020‑21 Planned full-time equivalents |

2020‑21 Actual full-time equivalents |

2020‑21 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 260 | 275 | 15 |

Analysis of trends in spending and human resources

Actual expenditures

Departmental spending trend graph

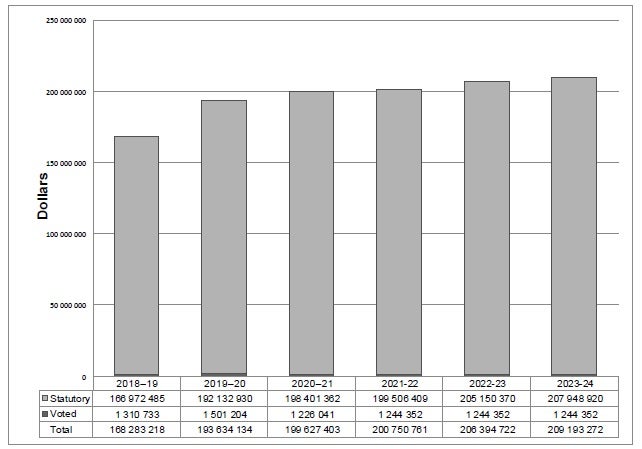

The following graph presents planned (voted and statutory spending) over time.

Graphic description - Departmental spending trend graph

| 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | |

|---|---|---|---|---|---|---|

| Statutory | 166,972,485 | 192,132,930 | 198,401,362 | 199,506,409 | 205,150,370 | 207,948,920 |

| Voted | 1,310,733 | 1,501,204 | 1,226,041 | 1,244,352 | 1,244,352 | 1,244,352 |

| Total | 168,283,218 | 193,634,134 | 199,627,403 | 200,750,761 | 206,394,722 | 209,193,272 |

The graph above presents OSFI's actual spending from 2018-19 to 2020-21 and planned spending from 2021-22 to 2023-24. Statutory expenditures, which are recovered from respendable revenue, represent over 99% of total expenditures. The remainder, representing less than 1% of OSFI's spending, is funded from a parliamentary appropriation for actuarial services related to federal public sector pension and benefits plans.

| Core responsibilities and Internal Services | 2020‑21 Main Estimates |

2020‑21 Planned spending |

2021‑22 Planned spending |

2022‑23 Planned spending |

2020‑21 Total authorities available for use |

2018‑19 Actual spending (authorities used) |

2019‑20 Actual spending (authorities used) |

2020‑21 Actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Financial Institution and Pension Plan Regulation and Supervision | 116,299,648 | 116,299,648 | 117,965,600 | 119,642,326 | 116,299,648 | 95,166,794 | 112,600,222 | 115,090,074 |

| Actuarial Services to Federal Government Organizations | 7,371,737 | 7,371,737 | 7,644,437 | 8,027,466 | 7,371,737 | 6,233,694 | 6,696,671 | 7,156,778 |

| Subtotal | 123,671,385 | 123,671,385 | 125,610,037 | 127,699,792 | 123,671,385 | 101,400,488 | 119,296,893 | 122,246,852 |

| Internal Services | 77,384,289 | 77,384,289 | 75,140,725 | 78,724,929 | 77,384,289 | 66,882,730 | 74,337,241 | 77,380,551 |

| Total | 201,055,674 | 201,055,674 | 200,750,762 | 206,394,722 | 201,055,674 | 168,283,218 | 193,634,134 | 199,627,403 |

OSFI's 2020-21 actual expenditures of $199.6 million were $1.5 million (or 0.7%) lower than planned. The variance versus the original plan was driven primarily by the COVID‑19 pandemic that resulted in some spending changes (e.g., reduced travel costs and increased / accelerated investments in technology and home office equipment to allow more efficient remote work). Compensation costs also exceeded those anticipated when the budget was established (e.g., the costs related to unused vacation leave and the impacts of new collective agreements).

Actual human resources

| Core responsibilities and Internal Services |

2018‑19 Actual full‑time equivalents |

2019‑20 Actual full‑time equivalents |

2020‑21 Planned full‑time equivalents |

2020‑21 Actual full‑time equivalents |

2021‑22 Planned full‑time equivalents |

2022‑23 Planned full‑time equivalents |

|---|---|---|---|---|---|---|

| Financial Institution and Pension Plan Regulation and Supervision | 480 | 519 | 574 | 555 | 574 | 575 |

| Actuarial Services to Federal Government Organizations | 36 | 34 | 40 | 37 | 41 | 41 |

| Subtotal | 516 | 553 | 614 | 592 | 615 | 616 |

| Internal Services | 225 | 240 | 260 | 275 | 280 | 276 |

| Total | 741 | 793 | 874 | 867 | 895 | 892 |

In 2020-21, OSFI's full-time equivalents (FTEs) was 7 FTEs or 0.8% lower than planned. This was due to delays in staffing some planned positions. The FTE total represents a growth of 9.3% over 2019-20. This is largely due to the staffing of vacant positions and new positions created to address the requirements of the three-year Strategic Plan for 2019-2022. OSFI's three-year strategic plan reflects and accounts for the continually evolving and increasingly complex environment within which OSFI operates.

Expenditures by vote

For information on the Office of the Superintendent of Financial Institutions' organizational voted and statutory expenditures, consult the Public Accounts of Canada 2020-2021.

Government of Canada spending and activities

Information on the alignment of the Office of the Superintendent of Financial Institutions' spending with the Government of Canada's spending and activities is available in GC InfoBase.

Financial statements and financial statements highlights

Financial statements

The Office of the Superintendent of Financial Institutions' financial statements (unaudited) for the year ended March 31, 2021, are available on the OSFI website.

Financial statement highlights

The tables below provide highlights from OSFI's Statement of Financial Position and Statement of Operations, as presented in its audited financial statements prepared in accordance with Public Sector Accounting Standards (PSAS). As such, there are differences between these tables and those presented in other sections of the Departmental Results Report, which are prepared on the appropriation (i.e., modified cash) basis of accounting, in accordance with the Guide to Preparation of Part III Estimates for 2020-21.

While OSFI is slightly under planned spending on the modified cash basis of accounting, total expenses in the financial statements prepared in accordance with PSAS are higher than planned. This is due to the different treatment of capital expenditures. Under the modified cash basis, unplanned personnel cost overspends were offset by underspending on capital expenditures whereas, under PSAS, expenses exclude capital expenditures.

| Financial information | 2020‑21 Planned results |

2020‑21 Actual results |

2019‑20 Actual results |

Difference (2020‑21 Actual results minus 2020‑21 Planned results) |

Difference (2020‑21 Actual results minus 2019‑20 Actual results) |

|---|---|---|---|---|---|

| Total expenses | 197,200,000 | 201,257,706 | 189,764,075 | 4,057,706 | 11,493,631 |

| Total revenues | 195,988,749 | 200,031,665 | 188,262,871 | 4,042,916 | 11,768,794 |

| Net cost of operations before government funding and transfers | 1,211,251 | 1,226,041 | 1,501,204 | 14,790 | -275,163 |

Note: Planned results as presented in OSFI's audited financial statements. OSFI's Future-Oriented Statement of Operations (FOSO) provides additional information on its planned results.

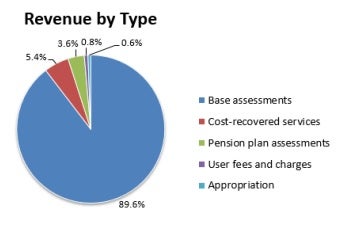

OSFI is mainly funded through assessments on the financial institutions and private pension plans that it regulates and supervises, and a user-pay program for legislative approvals and selected services. OSFI also receives revenues for cost-recovered services and a small parliamentary appropriation for actuarial services related to federal public sector pension and benefit plans. On an accrual basis of accounting, OSFI recovered all of its expenses for the year. The distribution of revenues by type did not change significantly compared to last year.

Graphic description - Revenue by Type

| Base assessments | Cost-recovered services | Pension plan assessments | User fees and charges | Appropriation |

|---|---|---|---|---|

| 89.6% | 5.4% | 3.6% | 0.8% | 0.6% |

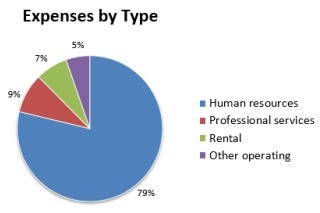

In 2020-21, total expenses were $201.3 million (calculated in accordance with PSAS), an increase of $11.5 million or 6.1% from the previous year, and $4.1 million higher than planned. The year-over-year increase is due to the creation of positions under OSFI's Strategic Plan, the staffing of vacant positions, normal escalation and merit increases and increases in accrued vacation liabilities resulting from lower than normal vacation usage during the pandemic. The distribution of expenses by type did not change significantly compared to last year.

Graphic description - Expenses by type

| Human resources | Professional services | Rental | Other operating |

|---|---|---|---|

| 79% | 9% | 7% | 5% |

| Financial information | 2020‑21 | 2019‑20 | Difference (2020‑21 minus 2019‑20) |

|---|---|---|---|

| Total financial assets | 62,001,000 | 57,787,000 | 4,214,000 |

| Total financial liabilities | 56,401,000 | 51,992,000 | 4,409,000 |

| Net financial assets | 5,600,000 | 5,795,000 | -195,000 |

| Total non-financial assets | 20,080,000 | 19,885,000 | 195,000 |

| Accumulated surplus | 25,680,000 | 25,680,000 | 0 |

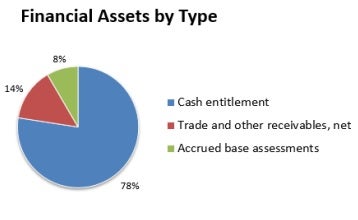

Total financial assets at the end of 2020-21 were $62.0 million, an increase of $4.2 million from the previous year. The increment is driven by an increase in the accrued base assessments as a result of final costs exceeding interim billings this year. Cash Entitlement represents the amount that OSFI is entitled to withdraw from the Consolidated Revenue Fund without further authority.

Graphic description - Financial assets by type

| Cash entitlement | Trade and other receivables, net | Accrued base assessment |

|---|---|---|

| 78% | 14% | 8% |

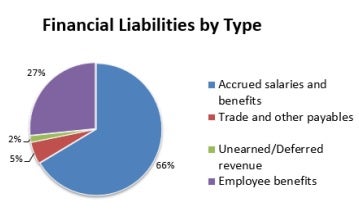

Total financial liabilities were $56.4 million, which was $4.4 million higher than the previous year. The increase is driven by higher accrued salaries and benefits, largely due to the growth in staff complement and increases in accrued vacation liabilities as a result of lower than normal vacation usage during the pandemic.

Graphic description - Financial Liabilities by Type

| Accrued salaries and benefits | Trade and other payables | Unearned / Deferred revenue | Employee benefits |

|---|---|---|---|

| 66% | 5% | 2% | 27% |

Corporate Information

Organizational profile

Appropriate minister[s]: Chrystia Alexandra Freeland

Institutional head: Peter Routledge

Ministerial portfolio: Finance

Enabling instrument[s]: Office of the Superintendent of Financial Institutions Act (OSFI Act)

Year of incorporation / commencement: 1987

Raison d'être, mandate and role: who we are and what we do

"Raison d'être, mandate and role: who we are and what we do" is available on the Office of the Superintendent of Financial Institutions' website.

Operating context

Information on the operating context is available on the Office of the Superintendent of Financial Institutions' website.

Reporting framework

OSFI's approved departmental results framework and program inventory for 2021-22 are as follows.

| Departmental Results Framework | Core Responsibility 1 Financial Institution and Pension Plan Regulation and Supervision |

Core Responsibility 2 Actuarial Services to Federal Government Organizations |

Internal Services | ||

|---|---|---|---|---|---|

| Departmental Result: Federally regulated financial institutions and private pensions plans are in sound financial condition | Indicator: % of financial institutions with a Composite Risk Rating of low or moderate | Departmental Result: Stakeholders receive accurate and high quality actuarial information on the cost of public programs and government pension and benefit plans | Indicator: % of members of a panel of Canadian peer actuaries that deem the Canada Pension Plan actuarial valuation accurate and of high quality | ||

| Indicator: Number of financial institutions for which the supervisory rating (i.e. risk level) has increased by two or more levels within a three month period | Indicator: % of public pension and insurance plan valuations that are deemed accurate and high quality. | ||||

| Indicator: Number of pension plans for which the supervisory rating (i.e. risk level) has increased by two or more levels within a three month period | |||||

| Departmental Result: Regulatory and supervisory frameworks contribute to the safety and soundness of the Canadian financial system | Indicator: The Office of the Superintendent of Financial Institutions' level of compliance with the International Monetary Fund's Financial Sector Assessment Program core principles | ||||

| Indicator: The Office of the Superintendent of Financial Institutions' level of compliance with Basel standards as assessed by the Regulatory Consistency Assessment Programme of the Bank for International Settlements | |||||

| Program Inventory | Program: Risk Assessment and Intervention - Federally Regulated Financial Institutions | Program: Actuarial Valuation and Advice | |||

| Program: Regulation and Guidance of Federally Regulated Financial Institutions | |||||

| Program: Regulatory Approvals and Legislative Precedents | |||||

| Program: Federally Regulated Private Pension Plans | |||||

Supporting information on the program inventory

Financial, human resources and performance information for Office of the Superintendent of Financial Institutions' Program Inventory is available in GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on Office of the Superintendent of Financial Institutions' website:

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA+ of tax expenditures.

Organizational contact information

Mailing address

Office of the Superintendent of Financial Institutions

255 Albert Street

Ottawa, Ontario K1A 0H2

Telephone: 1-800-385-8647

Fax: 1-613-952-8219

E-mail: webmaster@osfi-bsif.gc.ca

Website: http://www.osfi-bsif.gc.ca

Appendix: definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility(responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A report on the plans and expected performance of an appropriated department over a 3‑year period. Departmental Plans are usually tabled in Parliament each spring.

- departmental priority (priorité)

- A plan or project that a department has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired departmental results.

- departmental result (résultat ministériel)

- A consequence or outcome that a department seeks to achieve. A departmental result is often outside departments' immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

- A quantitative measure of progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

- A framework that connects the department's core responsibilities to its departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department's actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- experimentation (expérimentation)

- The conducting of activities that seek to first explore, then test and compare the effects and impacts of policies and interventions in order to inform evidence-based decision-making, and improve outcomes for Canadians, by learning what works, for whom and in what circumstances. Experimentation is related to, but distinct from innovation (the trying of new things), because it involves a rigorous comparison of results. For example, using a new website to communicate with Canadians can be an innovation; systematically testing the new website against existing outreach tools or an old website to see which one leads to more engagement, is experimentation.

- full‑time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person‑year charge against a departmental budget. For a particular position, the full‑time equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person's collective agreement.

- gender-based analysis plus (GBA+) (analyse comparative entre les sexes plus [ACS+])

- An analytical process used to assess how diverse groups of women, men and gender-diverse people experience policies, programs and services based on multiple factors including race ethnicity, religion, age, and mental or physical disability.

- government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2019-20 Departmental Results Report, those high-level themes outlining the government's agenda in the 2019 Speech from the Throne, namely: Fighting climate change; Strengthening the Middle Class; Walking the road of reconciliation; Keeping Canadians safe and healthy; and Positioning Canada for success in an uncertain world.

- horizontal initiative (initiative horizontale)

- An initiative where two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non‑budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- performance indicator (indicateur de rendement)

- A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

- performance reporting (production de rapports sur le rendement)

- The process of communicating evidence‑based performance information. Performance reporting supports decision making, accountability and transparency.

- plan (plan)

- The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

- planned spending (dépenses prévues)

- For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

- A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- program (programme)

- Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

- Identifies all the department's programs and describes how resources are organized to contribute to the department's core responsibilities and results.

- result (résultat)

- A consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization's influence.

- statutory expenditures (dépenses législatives)

- Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

- A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

- Expenditures that Parliament approves annually through an appropriation act. The vote wording becomes the governing conditions under which these expenditures may be made.