Domestic Stability Buffer

The Domestic Stability Buffer (DSB) is a proactive, risk-based tool that helps ensure capital levels at Canada’s largest banks, known as domestic systemically important banks, remain appropriate for system-wide risks. It supports continued stability and public confidence in the Canadian financial system.

Current level: 3.50% of total risk-weighted assets

Why the Domestic Stability Buffer is important

The DSB is part of OSFI’s capital framework for federally regulated financial institutions. It strengthens confidence in the banking system by ensuring capital levels remain aligned with the risks present in the financial environment.By adjusting the DSB as conditions evolve, OSFI helps maintain stability and strengthen resilience across Canada’s financial system. The DSB supports banks’ ability to continue lending and contributing to economic growth as conditions change.

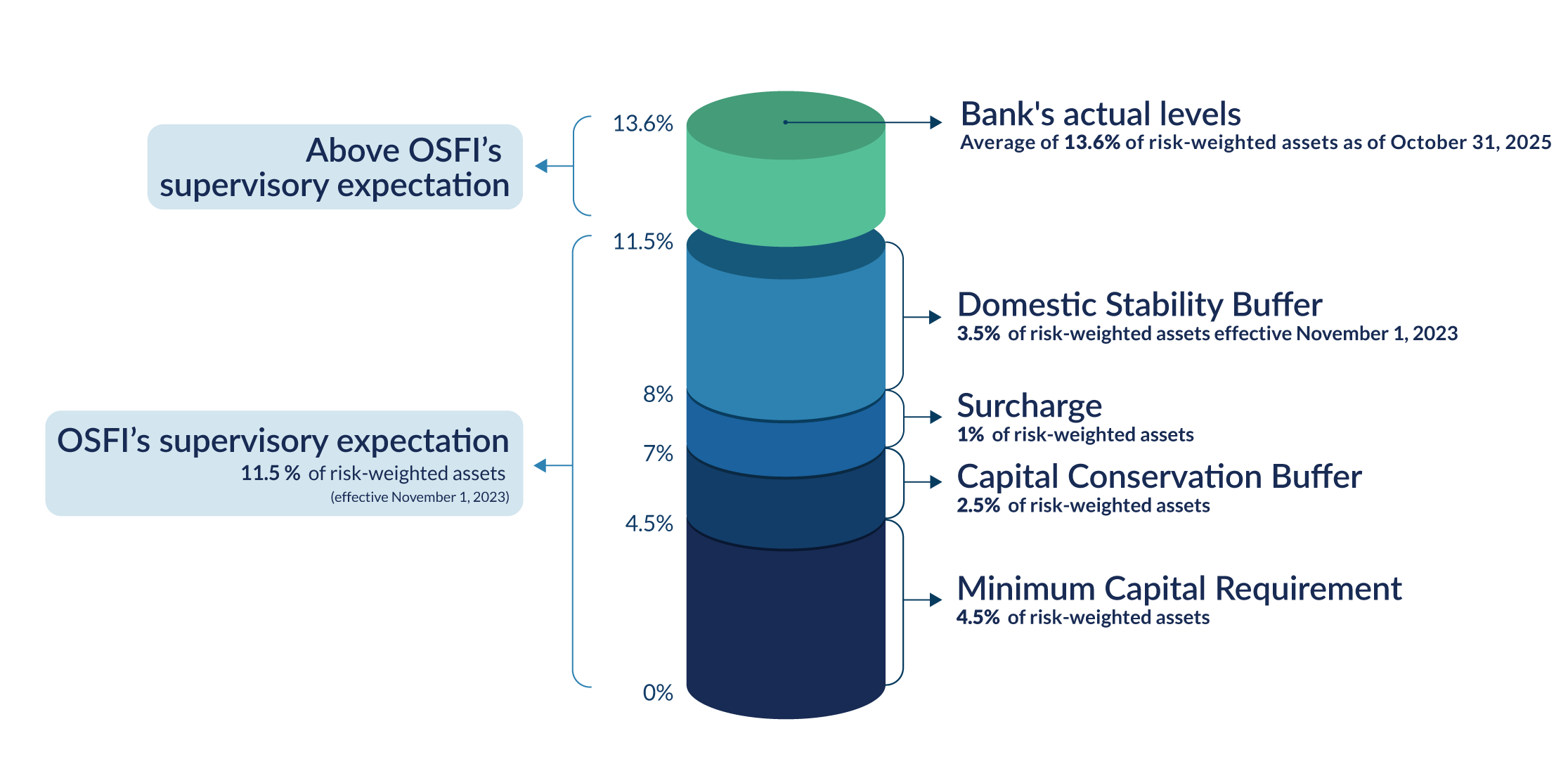

Big Banks Capital CET1 Requirements - Text version

Effective November 1, 2023, OSFI’s supervisory expectation is 11.5% of risk-weighted assets, composed of:

- Minimum Capital Requirement (4.5% of risk-weighted assets)

- Capital Conservation Buffer (2.5% of risk-weighted assets)

- Surcharge (1% of risk-weighted assets)

- Domestic Stability Buffer (3.5% of risk-weighted assets)

As of October 31, 2025, banks reported an average capital level of 13.6% of risk-weighted assets, exceeding this expectation.

How we set the Domestic Stability Buffer

We set the DSB level in consultation with our federal financial regulatory partners. The level is set twice a year, in June and December, but it can be adjusted at any time if conditions warrant. For example, on March 13, 2020, we lowered the buffer from 2.25% to 1% in response to the COVID-19 pandemic.

We determine the buffer level based on financial trends, risks and key vulnerabilities. The types of vulnerabilities include:

- Canadian household indebtedness

- High household debt levels can make it hard for households to manage financial stress. This can lead to consumers reducing spending and cause a recession. A recession, in turn, can expose banks to loan defaults and losses.

- Canadian asset imbalances

- Sharp increases in the value or price of assets such as houses can make the economy vulnerable should those values or prices drop. This can trigger reduced spending and investment and reduce the value of banks’ loan collateral.

- Canadian institutional indebtedness

- Elevated institutional or corporate debt can limit the ability of businesses and governments to withstand periods of economic stress. If those businesses and governments reduce spending and investment as a result, it can bring prices down and cause a recession. A recession, in turn, can expose banks to loan defaults and losses.

- External systemic vulnerabilities

- External systematic vulnerabilities are global developments such as pandemics, conflict or political unrest that make the Canadian economy and the domestic systemically important banks more vulnerable to an economic downturn. This includes measurable vulnerabilities as well as vulnerabilities that are more difficult to measure but could contribute to global macro-economic risk.

When and how we review the Domestic Stability Buffer

We review the buffer periodically to assess whether it continues to reflect the risks and vulnerabilities facing the financial system.

Adjusting the DSB is one of several tools OSFI uses to support confidence and stability in the financial system. OSFI may increase, decrease, or maintain the DSB level depending on its overall risk assessment.

Latest review of the Domestic Stability Buffer design and range

We periodically review the design and range of the DSB to ensure it remains effective and forward-looking. These reviews consider changes in the global financial landscape, advances in risk measurement, and lessons from supervisory experience.

For details on the latest review, see: