2021-22 Departmental Results Report

The Honourable Chrystia Freeland, P.C., M.P.

Deputy Prime Minister and Minister of Finance

© His Majesty the King in Right of Canada, as represented by the Minister of Finance, 2022

Catalogue No. IN3-32E-PDF

ISSN 2561-0716

Table of contents

From the Superintendent

On behalf of the Office of the Superintendent of Financial Institutions (OSFI), I present our 2021-22 Departmental Results Report. In this report, we account for the successful completion of OSFI’s 2019-2022 Strategic Plan.

Highlights include ensuring our guidance and activites remained balanced in weathering the risks posed by COVID-19, including, most importantly, the issuance of effective capital and liquidity guidelines. We also advanced a wide range of regulatory and supervisory expectations and expanded our outreach to external stakeholders.

Internally, we worked on getting the right people, skills, and infrastructure in place to meet the needs of our organization. Our Human Capital Strategy helped to promote a culture of high performance and reinforced OSFI’s Blueprint for Transformation 2022-2025 of transparency, innovation, efficiency, and intelligent risk-taking.

Most importantly, this accomplishment affords OSFI the opportunity to shift our focus towards the financial system risks on our horizon.

In the past, OSFI has indirectly contributed to public confidence in the Canadian financial system by focusing its efforts on protecting depositors, policyholders, financial institution creditors and pension plan members, while allowing financial institutions to compete and take reasonable risks. In other words, our contribution to public confidence – via the regulation and supervision of individual federally regulated financial institutions (FRFIs) and federally regulated pension plans (FRPPs) – was a result, but not the driver, of what we do.

Going forward, maintaining and strengthening public confidence in the financial system will drive all our work, every day. This means transforming our strategy for adapting to financial system risks – a strategy that will include prudential regulation and supervisory actions.

I urge readers of this report to join us at OSFI in focusing on the forward risks on our horizon by reading our new Blueprint for Transformation 2022-2025 and 2022-2025 Strategic Plan. OSFI has placed itself a bold, responsible new path that will prepare us to thrive in an intensifying and threatening risk environment.

Peter Routledge

Superintendent

Results at a glance

OSFI’s total actual spending for 2021-22 was $207.6 million and the total number of full-time equivalents was 920. In December 2021, OSFI released its Blueprint for Transformation, 2022-25, which was followed in April of 2022 by the release of a new Strategic Plan for 2022-25. The results at a glance below provide an overview of OSFI’s work during 2021-22, in support of the third and final year of its 2019-2022 Strategic Plan.

Goal 1: Federally regulated financial institution and pension plan preparedness and resilience to financial risks is improved, both in normal conditions and in the next financial stress event.

The objective of this goal is to ensure that federally regulated financial institutions (FRFIs) and pension plans (FRPPs) are able to continue to provide financial services to Canadians and maintain market confidence, both in normal conditions and in times of stress. The objective is also to ensure that FRPPs continue to enhance their awareness of emerging risks and related risk management processes. Under this goal, in 2021-22 OSFI:

- Raised the Domestic Stability Buffer (DSB) from 1.00% to 2.50% of risk weighted assets.

- Confirmed that the minimum qualifying rate (MQR) for uninsured mortgages will remain the greater of the mortgage contract rate plus 2 percent or 5.25 percent.

- Continued to adapt its work, regulatory returns, and monitoring metrics to prepare for the implementation of the new International Standards for Insurance (IFRS 17), which will take effect January 1, 2023.

- Enhanced its understanding of climate-related financial risks through consulting with the industry, working collaboratively with the Bank of Canada on a scenario analysis pilot project, and expanding its international presence.

- Issued capital and liquidity guidelines and a discussion paper on the assurance of capital, leverage, and liquidity returns for deposit taking institutions and insurers.

- Collaborated with the Financial Services Regulatory Authority of Ontario to enhance regulatory efficiency and effectiveness for defined contribution pension plans.

- Continued to work towards ensuring that guidance remained credible, consistent, necessary, and fit-for-purpose for FRFIs and FRPPs in weathering the risks posed by COVID-19.

Goal 2: FRFIs and pension plans are better prepared to identify and develop resilience to non-financial risks before they negatively affect their financial condition.

Through this goal, OSFI is focused on the resiliency of FRFIs and FRPPs to non-financial risks. Under this goal, in 2021-22, OSFI:

- Issued draft Guideline B-13 (Technology and Cyber Risk Management) for public consultation. OSFI is piloting the Intelligence-Led Cyber Resilience Testing Framework. OSFI also updated its Cyber Self-Assessment tool and refreshed its Technology and Cyber Incident Reporting Advisory.

- Advanced regulatory and supervisory expectations for third party risk, by updating Guideline B-10 (Outsourcing).

- Enhanced its supervisory expectations to include the use of advanced analytical techniques, leading to the enhancement of model risk guidelines.

- Advanced regulatory and supervisory expectations on operational risk and resilience.

Goal 3: OSFI’s agility and operational effectiveness are improved.

The objective of this goal is to ensure that OSFI has the right people, skills and infrastructure in place to meet the needs of the organization and that these can be leveraged in a timely and effective manner. Under this goal, in 2021-22 OSFI:

- Concluded the delivery of the multi-year Human Capital Strategy through various initiatives promoting a culture of high performance, and reinforcing OSFI’s corporate values of Respect, Curiosity and Stewardship.

- Developed a Crisis Preparedness Framework, process and tools to strengthen operational readiness for a one-office response to a FRFI crisis.

- Continued to implement an enterprise Data Strategy strengthening data management, data governance, and advanced analytic capabilities.

- Continued to evolve and deliver on the OSFI Cloud Strategy and Cloud Adoption Framework, facilitating a successful migration to the cloud.

Goal 4: Support from Canadians and cooperation from the financial industry are preserved.

The objective of this goal is ensuring that Canadians have trust in the safety and soundness of financial institutions and pension plans. Under this goal, in 2021-22 OSFI:

- Expanded outreach to external stakeholders to support an increased understanding of key risk issues, including OSFI’s role and perspective, and engaged with industry to provide risk management training.

- Continued to promote transparency and understanding of what it does through a variety of means including speaking engagements, publication of the Domestic Stability Buffer and Minimum Qualifying Rate (under Guideline B-20), and the release of OSFI’s Blueprint for Transformation, 2022-25.

- Implemented mandatory cyber security training to improve OSFI’s security posture.

For more information on OSFI’s plans, priorities and results achieved, see the “Results: what we achieved” section of this report.

Results: what we achieved

Financial Institution and Pension Plan Regulation and Supervision

Description

The Office of the Superintendent of Financial Institutions advances a regulatory framework designed to control and manage risk to federally regulated financial institutions and private pension plans and evaluates system-wide or sectoral developments that may have a negative impact on their financial condition. It also supervises financial institutions and pension plans to determine whether they are in sound financial condition and meeting regulatory and supervisory requirements. The Office promptly advises financial institutions and pension plan administrators if there are material deficiencies and takes corrective measures or requires that they be taken to expeditiously address the situation. It acts to protect the rights and interests of depositors, policyholders, financial institution creditors and pension plan beneficiaries, while having due regard for the need to allow financial institutions to compete effectively and take reasonable risks.

Results

During 2021-22, in support of the third and final year of its 2019-2022 Strategic Plan, OSFI focused on several key initiatives in areas such as capital, accounting, reinsurance, non-financial risks, crisis preparedness and pensions. OSFI also participated in various fora to advance the development of international capital, accounting and auditing standards.

Regulation and Guidance of Federally Regulated Financial Institutions

Following public consultation in 2021, OSFI released final revisions to its capital (including credit, operational and market risks), leverage, liquidity, and related disclosure guidelines for deposit taking institutions (DTIs). The guidelines incorporated the latest and final round of the internationally agreed-upon Basel III reforms. OSFI also advanced the proportionality of its capital and liquidity frameworks for smaller, less-complex DTIs to make them more effective and thereby fit for purpose. This was done by finalizing enhancements that strike a balance between improving the risk sensitivity of the requirements for smaller institutions and helping to address the rising complexity of the frameworks.

OSFI continued to prepare for the January 2023 implementation of the International Financial Reporting Standard - Insurance Contracts (IFRS 17) by:

- Conducting a third quantitative impact study (QIS) for life insurance companies, to assess insurers’ capital ratios using the IFRS 17 draft frameworks. This consultation and quantitative testing resulted in enhancements to the draft capital guidelines that were made public in summer 2022.

- Continued monitoring of the industry’s implementation progress through semi-annual progress reports.

- Finalizing new supervisory IFRS 17 metrics in collaboration with industry and issuing final regulatory reporting forms and instructions.

- Implementing training for supervisors to equip them for IFRS 17 reporting in 2023.

- Continuing development of a new approach for determining capital requirements for segregated fund guarantee (SFG) risk which will reflect IFRS 17. In June 2021, OSFI announced the deferral of the implementation of this new approach to January 1, 2025 (from January 1, 2023) to allow insurers time to focus on a robust implementation of IFRS 17. As part of the process, in February 2022 OSFI launched a consultation of the draft approach, a quantitative impact study and sensitivity tests.

A separate project to use an OSFI segregated fund model to benchmark IFRS 17 segregated fund liabilities to support supervisory assessments of related risks continued, with a IFRS 17 compliant valuation model for segregated fund guarantees expected to be completed in 2022-23.

For DTIs, OSFI continued to monitor the integration of the expected credit loss framework (IFRS 9) with the regulatory capital framework and impacts from the COVID-19 environment.

With the publication of final Guidelines B-2 (Property & Casualty Large Exposures Investments and Limits) and B-3 (Reinsurance) in February 2022, OSFI’s reinsurance review was completed.

Risk Assessment and Intervention of Federally Regulated Financial Institutions

The DTI Crisis Preparedness initiative was completed with the development of an updated crisis preparedness framework and strategy, including a refined crisis communication strategy and updated playbooks. To ensure operational readiness for a one office response to a FRFI crisis, a training program was delivered to staff to introduce the new processes and tools, and processes were developed for standing emergency contracts. Lead Supervisor Teams for the domestic systemically important banks (D-SIBs) also reviewed the June 2021 Recovery Plans for inclusion of COVID-19 lessons learned, and then provided feedback to the banks.

OSFI requires D-SIBs to hold a Domestic Stability Buffer (DSB). This buffer contributes to D-SIBs’ resilience to key vulnerabilities and system-wide risks by allowing banks to absorb losses while continuing to provide loans to Canadian households and businesses. OSFI maintained its commitment to setting the DSB level in a transparent manner via its semi-annual planned DSB announcements in June and December of 2021. In 2021-22, OSFI raised the level of the DSB to 2.5% of risk-weighted assets, in response to elevated vulnerabilities related to household indebtedness, asset imbalances and non-financial corporate indebtedness. These vulnerabilities are not new but at elevated levels make borrowers and banks more susceptible to losses in the event of economic shocks. As part of the December 2021 DSB announcement, OSFI also indicated that it would undertake a review of the design and range of the DSB in order to ensure it continues to support the long-term effectiveness of the capital regime.

In April 2021, OSFI published a letter proposing a new qualifying rate for uninsured mortgages (i.e., loan-to-value less than 80 percent) and reinforcing the principles of sound mortgage underwriting in Guideline B‑20 (Residential Mortgage Underwriting Practices and Procedures). OSFI received over 170 stakeholder submissions in response to its letter.

Effective June 1, 2021, OSFI confirmed the MQR for all uninsured mortgages should be the greater of the mortgage contract rate plus 2 percent or 5.25 percent, and updated Guideline B-20.

OSFI issued a discussion paper on the Assurance on Capital, Leverage and Liquidity Returns for DTIs and insurers in April 2021 and incorporated the feedback received in a draft Guideline issued in March 2022.

OSFI continued to monitor evolving and emerging risks to the financial system ranging from cyber attacks and digital innovation to housing-related considerations and climate change. In April 2022, OSFI released its first Annual Risk Outlook , which provides details of the risks facing Canada’s financial system and OSFI’s plans to address them in the coming year.

OSFI’s focus remained on ensuring financial institutions are well capitalized and resilient. As such in 2021-22 OSFI:

- Conducted enhanced monitoring on regulatory capital models and sensitivity analysis assessing the availability of capital buffers under various stress conditions.

- Completed its Integrated Credit Risk Plan (ICRP) that encompassed real estate secured lending, commercial real estate and commercial/corporate workstreams. Key findings and observations were shared with the respective FRFIs.

- Continued to produce its credit quality enhanced monitoring for systemically important banks and large and mid-size insurance companies and completed planned Significant Activity Reviews. As well, OSFI worked with the industry to ensure that OSFI’s supervisory expectations around combined loan products (CLPs) were clarified.

- Undertook stress testing for DTIs, to assess the resiliency of capital positions under adverse scenarios and provided feedback on areas for improvement in their stress testing programs.

- Conducted various reviews focused on credit risk management practices.

- Leveraged appointed actuaries’ financial condition testing reports for insurance companies to understand how the risk of inflation was being managed by insurers and conducted sensitivity testing of the impact of a significant drop in equity markets on P&C insurers. For life insurers, enterprise-wide stress testing was reviewed, and reviews were conducted to support capital management assessments.

Work to enhance OSFI’s approach to the identification, assessment and monitoring of technology and cyber security risks at FRFIs continued through updates to the Cyber Self-Assessment tool and the completion of a Technology and Cyber Incident Reporting Advisory. An intelligence bulletin on ransomware was also completed. Draft Guideline B-13 (Technology and Cyber Risk Management) was developed, and industry consultation was completed. As a result of an assessment of the results from the Third-Party Risk Analysis Exercise Industry Report and Technology Risk Discussion Paper, OSFI refined Guideline B-10 (Outsourcing) to expand the scope from outsourcing to all third-party arrangements.

A pilot third-party data call involving 16 FRFIs was initiated. This pilot will provide insights into systemic concentration risk, trends and robustness of FRFI third-party data.

OSFI also completed deep dive studies with selected institutions on artificial intelligence and machine learning and two roundtable discussions with the insurance industry to gain better insights into current practices and challenges. OSFI continued to exchange insights and share information with peer regulators and began drafting an industry letter on artificial intelligence and model risk to be released in early 2022-23.

In the area of culture and compliance risk management in financial institutions, OSFI continued to develop new supervisory approaches and tools for supervision. The Supervisory Framework will incorporate relevant elements beginning in April 2024. Through 2021-22, OSFI:

- Formed a more comprehensive view of the adequacy and effectiveness of FRFI culture risk management by incorporating culture risks in supervisory reviews and piloting new approaches for culture risk monitoring.

- Issued a letter in March 2021 on culture risks, outlining desired outcomes of effective culture risk management, including on dimensions of group dynamics and decision-making and leadership, compensation, people management and incentives, accountability and ownership, risk mindsets and behaviours, group dynamics and decision-making, and resilience. This will form the basis of a principles-based, outcomes-focused culture risk management guideline for consultation in late 2022.

OSFI rescinded Guideline B-8 (Deterring and Detecting Money Laundering and Terrorist Financing) as of July 26, 2021. This supported an initiative by OSFI and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) to eliminate duplication and redundancy in how Anti-Money Laundering and Anti-Terrorist Financing (AML/ATF) regulatory requirements are applied to FRFIs. A joint agency information session on AML/ATF supervision was held for industry in October 2021 to clarify how OSFI and FINTRAC will work together. OSFI will continue to coordinate and share relevant information with FINTRAC, the federal AML/ATF supervisor.

Work continued regarding climate change and how climate-related risks may challenge the safety and soundness of Canada's financial institutions, private pension plans, and the broader financial system. In January 2022, the Bank of Canada and OSFI published the results of a pilot project on climate scenario analysis. This pilot was an important step in helping Canada’s financial sector improve its ability to analyze economic and financial risks affecting financial institutions that could arise from climate change.

OSFI issued a letter to industry outlining the prudential outcomes that it plans to integrate into draft climate risk management guidance. The letter is based on feedback received from over 70 respondents on a discussion paper entitled “Navigating Uncertainty in Climate Change” which was released for comment in January 2021. OSFI plans to release the draft guideline for consultation in 2022-23.

OSFI continued to implement its enterprise Data Strategy. Access to granular, timely and high-quality data to support OSFI’s supervisory and regulatory mandate continued to be an area of focus. Key achievements in 2021-22 included further operationalization of data and analytics governance frameworks, tools and processes and exploring opportunities for data collection modernization. OSFI also continued its efforts related to organizational data literacy through internal training and information sessions.

OSFI continued to support supervisory work in a work-from-anywhere environment by maintaining an evergreen document entitled the “Virtual Supervisory Guide”. In support of OSFI’s supervisory work, the implementation of streamlined assessment topics was completed for its Vu platform. Planned work was also reviewed in preparation for OSFI’s upcoming Supervisory Framework review.

In Q2 2021-22, a final determination was made on the applicability of Guideline E-16 (Participating Account Management and Disclosure to Participating Policyholders and Adjustable Policyholders) to fraternal benefit societies. Enhanced monitoring of participating business came into effect at the end of Q3 2021-22. In addition, meetings were held with relevant FRFIs to communicate individual findings from OSFI’s Comparative Study of insurers’ participating business practices. Broader findings from the Comparative Study resulted in proposed changes to Guideline E-16.

OSFI chaired the Financial Stability Board’s Roundtable on External Audit in May 2021. OSFI also co-hosted an audit quality roundtable in October 2021 with the Canadian Public Accountability Board. Both roundtables provided a forum to discuss ways to continue promoting financial stability by enhancing public confidence in the quality of external audits.

Federally Regulated Private Pension Plans

With regards to FRPPs, in March 2021, OSFI released a consultation paper on Pension Investment Risk Management. Stakeholder feedback received during the consultation period will inform the development of OSFI guidance and may also inform guidance produced by the Canadian Association of Pension Supervisory Authorities (CAPSA).

OSFI consulted with plan administrators and third-party service providers to better understand the potential risks associated with pension technology, including cyber and third-party risk. Analysis of data collected through a pension technology questionnaire provided a deeper understanding of the nature and level of inherent pension technology risks and of current practices used to mitigate these risks. This information will inform OSFI’s supervisory approach to cyber and third-party risk. In addition, OSFI is collaborating with CAPSA to address identified gaps in pension technology risk management.

During 2021-22, OSFI collaborated with the Financial Services Regulatory Authority of Ontario (FSRA) and a Technical Advisory Committee on the review of defined contribution (DC) pension plans. In October 2021, the Committee issued a Summary of Outcomes and Recommendations and developed a member-focused guide for DC plans which was endorsed by CAPSA and published on their website. In November 2021, OSFI and FSRA hosted a webinar to share these outcomes and recommendations with the pension industry.

In 2021-22, OSFI advanced work with CAPSA on a principles-based guideline on Environmental, Social and Governance (ESG) Considerations in Pension Plan Management. OSFI chaired CAPSA’s ESG Committee and with input from an industry working group, the ESG Committee made significant progress on this initiative.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

Through OSFI's work on climate change scenario planning and associated supervisory and regulatory responses to climate risks, the Office supports UN SDG 13 by: strengthening resilience and adaptive capacity in responding to climate-related hazards (13.1); integrating climate change measures into policies, strategies and planning (13.2); and improving awareness and institutional capacity on climate change mitigation, adaptation, impact reduction, and early warning (13.3).

Through the ongoing execution of its mandate as a prudential financial regulator, OSFI also supports SDG 8.10 by strengthening the capacity of domestic financial institutions to encourage and expand access to banking, insurance and financial services and SDG 10.5 by improving the regulation and monitoring of global financial markets and institutions and strengthening the implementation of such regulations.

Experimentation

OSFI continued to support the Government of Canada’s commitment to innovation. While continuous improvement is generally sought through consultations and lessons learned exercises, where possible, OSFI explores new ways to enhance its efficiency and effectiveness. For example, OSFI examined how it communicates to better support transparency and effective messaging to its stakeholders. This led to the public release of the OSFI Blueprint and new strategic plan and a greater social media presence overall. In addition, OSFI experimented with its processes to roll out new guidance faster in an effort to be more agile in regulatory development.

Results achieved

The following table shows, for Financial Institution and Pension Plan Regulation and Supervision, the results achieved, the performance indicators, the targets and the target dates for 2021–22, and the actual results for the three most recent fiscal years for which actual results are available.

| Performance indicators | Target | Date to achieve target | 2019‑20 actual results |

2020‑21 actual results |

2021‑22 actual results |

|---|---|---|---|---|---|

| % of financial institutions with a Composite Risk Rating of low or moderate. | At least 80% | March 31, 2022 | 96% | 96% | 96% |

| Number of financial institutions for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three month period. | 1 or less | March 31, 2022 | 0 | 0 | 0 |

| Number of pension plans for which the supervisory rating (i.e., risk level) has increased by two or more levels within a three month period. | 1 or less | March 31, 2022 | 0 | 0 | 1 |

| Performance indicators | Target | Date to achieve target | 2019‑20 actual results |

2020‑21 actual results |

2021‑22 actual results |

|---|---|---|---|---|---|

| The Office of the Superintendent of Financial Institutions’ level of compliance with the International Monetary Fund’s Financial Sector Assessment Program core principles. | 100% | March 31, 2022 | N/A | N/A | N/A Table 2 Footnote 1 |

| The Office of the Superintendent of Financial Institutions’ level of compliance with Basel standards as assessed by the Regulatory Consistency Assessment Programme of the Bank for International Settlements. | 90% | March 31, 2022 | N/A | N/A | N/A Table 2 Footnote 2 |

Table 2 Footnotes

|

|||||

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions’ Program Inventory is available in GC InfoBase.

Budgetary financial resources (dollars)

The following table shows, for Financial Institution and Pension Plan Regulation and Supervision, budgetary spending for 2021–22, as well as actual spending for that year.

| 2021‑22 Main Estimates |

2021‑22 planned spending |

2021‑22 total authorities available for use |

2021‑22 actual spending (authorities used) |

2021‑22 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 117,965,600 | 117,965,600 | 117,965,600 | 115,971,511 | -1,994,089 |

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions’ Program Inventory is available in GC InfoBase.

Human resources (full-time equivalents)

The following table shows, in full time equivalents, the human resources the department needed to fulfill this core responsibility for 2021–22.

| 2021‑22 planned full-time equivalents |

2021‑22 actual full-time equivalents |

2021‑22 difference (actual full-time equivalents minus planned full time equivalents) |

|---|---|---|

| 574 | 583 | 9 |

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions’ Program Inventory is available in GC InfoBase.

Actuarial Services to Federal Government Organizations

Description

The Office of the Chief Actuary (OCA) provides a range of actuarial services, including statutory actuarial valuations required by legislation and checks and balances on the future costs of programs for the Canada Pension Plan (CPP), Old Age Security, Employment Insurance and Canada Student Financial Assistance programs, as well as pension and benefits plans covering the Federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police, federally appointed judges, and Members of Parliament.

Results

In 2021-22, the OCA began work on the triennial Actuarial Report on the Canada Pension Plan (CPP) as at December 31, 2021. This triennial report, which covers both the base CPP and the additional CPP, projects CPP revenues and expenditures over a 75-year period in order to assess the future impact of historical and projected demographic and economic trends. In September 2021, the OCA hosted a Virtual Seminar on Demographic, Economic, and Investment Perspectives for Canada. The purpose of the seminar is to consult with experts in the fields of demography, economics, and investments before setting the assumptions for the CPP actuarial report. The seminar was attended by representatives from federal, provincial and territorial governments and other government departments.

During 2021-22, the OCA continued to provide independent, accurate, high quality and timely actuarial reports and professional actuarial services and advice. With the view of maintaining high quality services, the OCA continued to maintain its programs of research on subjects relevant to the preparation of future actuarial reports. The OCA tabled in Parliament three actuarial reports on public sector insurance and pension plans:

- Actuarial Report on the Pension Plan for the Public Service of Canada as at March 31, 2020;

- Actuarial Report on the Public Service Death Benefit Account as at March 31, 2020; and

- Actuarial Report on the Benefit Plan Financed Through the Royal Canadian Mounted Police (Dependents) Pension Fund as at March 31, 2019.

These reports provide actuarial information to decision-makers, parliamentarians and the public. Most importantly, the Actuarial Report on the Pension Plan for the Public Service of Canada provides advice to the Government of Canada for setting pension employee contribution rates for federal public servants, and members of the Canadian Armed Forces (Regular Force) and the Royal Canadian Mounted Police. These reports also reflect the expected impacts of the COVID-19 pandemic on economic assumptions.

The OCA also submitted to the Minister of Employment, Workforce Development and Disability Inclusion the Actuarial Report on the Canada Student Financial Assistance Program as at July 31, 2020. This report, which was tabled in Parliament on December 7, 2021, presents a valuation of the program’s overall financial costs and increases the level of information available to decision makers, parliamentarians and the public. This report is also used for purposes of reporting and disclosure in the consolidated financial statements of the Government of Canada.

In 2021-22, the OCA presented to the Canada Employment Insurance Commission (CEIC) the 2022 Actuarial Report on the Employment Insurance Premium Rate, which was tabled in Parliament on December 3, 2021.

The OCA submitted the Actuarial Report on the Government Annuities as at March 31, 2021, and the Actuarial Report on the Civil Service Insurance Program as at March 31, 2021. The OCA also submitted various actuarial reports for the purpose of Public Accounts of Canada presenting the obligations and costs as at March 31, 2021 which are associated with federal public sector pension and benefit plans including future benefits to Veterans.

The 17th Actuarial Report supplementing the Actuarial Report on the Old Age Security (OAS) program as at December 31, 2018 was tabled in Parliament on February 4, 2022. It provides information on the OAS program’s future expenditures until 2060. This information facilitates a better understanding of the program and the factors that influence its costs. The 17th Actuarial Report has been prepared to show the effect of increasing the OAS pension payable to individuals aged 75 or older by 10%, effective July 1, 2022, on the long‑term financial status of the OAS program.

In 2021-22, the OCA also published a fact sheet on Registered Pension Plans (RPP) and Other Types of Savings Plans in Canada which showed that, in 1989, only 37% of active registered pension plan members were women. Fast forward to 2019, they accounted for 51% of the 6.5 million active members.

Experimentation

OSFI continued to support the Government of Canada’s commitment to innovation. Given the OCA’s primary responsibility is to provide actuarial advice including the preparation of actuarial reports for federal government organizations, continuous improvement is generally sought through consultations and lessons learned exercises rather than experimental projects.

Results achieved

The following table shows, for Actuarial Services to Federal Government Organizations, the results achieved, the performance indicators, the targets and the target dates for 2021–22, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental results | Performance indicators | Target | Date to achieve target | 2019–20 actual results | 2020–21 actual results | 2021–22 actual results |

|---|---|---|---|---|---|---|

| Stakeholders receive accurate and high quality actuarial information on the cost of public programs and government pension and benefit plans. | % of members of a panel of Canadian peer actuaries that deem the Canada Pension Plan actuarial valuation accurate and of high quality. | 100% Agreement among all three members of peer review panel | March 31, 2022 | N/A | 100% | N/A Table 5 Footnote 1 |

| % of public pension and insurance plan valuations that are deemed accurate and high quality | 100% | March 31, 2022 | 100% | 100% | 100% | |

Table 5 Footnotes

|

||||||

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions’ Program Inventory is available in GC InfoBase.

Budgetary financial resources (dollars)

The following table shows, for Actuarial Services to Federal Government Organizations, budgetary spending for 2021–22, as well as actual spending for that year.

| 2021‑22 Main Estimates |

2021‑22 planned spending |

2021‑22 total authorities available for use |

2021‑22 actual spending (authorities used) |

2021‑22 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 7,644,437 | 7,644,437 | 7,644,437 | 8,054,564 | 410,127 |

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions’ Program Inventory is available in GC InfoBase.

Human resources (full-time equivalents)

The following table shows, in full time equivalents, the human resources the department needed to fulfill this core responsibility for 2021–22.

| 2021‑22 planned full-time equivalents |

2021‑22 actual full-time equivalents |

2021‑22 difference (actual full-time equivalents minus planned full time equivalents) |

|---|---|---|

| 41 | 40 | -1 |

Financial, human resources and performance information for the Office of the Superintendent of Financial Institutions’ Program Inventory is available in GC InfoBase.

Internal services

Description

Internal services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal services refers to the activities and resources of the 10 distinct service categories that support program delivery in the organization, regardless of the internal services delivery model in a department. The 10 service categories are:

- acquisition management services

- communication services

- financial management services

- human resources management services

- information management services

- information technology services

- legal services

- material management services

- management and oversight services

- real property management services

Results

In December 2021, OSFI released its Blueprint for Transformation, 2022-25, which will guide OSFI’s overall direction through to 2025. It sets the foundation for how the organization intends to go about preparing for fundamental changes in the risk environment within which OSFI operates.

The work started by the Blueprint continued through the remainder of 2021-22, culminating in the release of 2022-25 Strategic Plan in April 2022. This new Strategic Plan sets out the goals and priorities for the next three years and outlines the concrete actions OSFI will take to implement the Blueprint.

With the Blueprint and accompanying Strategic Plan in hand, OSFI announced in March 2022 changes to the organizational structure to better align with the new strategy. This new structure, which involved significant planning and numerous staffing actions, will position OSFI to fulfill its mandate, contributing to confidence in Canada’s financial system.

Communnications and Engagement

OSFI continued to use innovative approaches to communicate in 2021-22. The internet renewal project commenced and OSFI produced its first digital Strategic Plan. OSFI also continued to promote transparency and understanding of what it does through a variety of means, including by increasing the number of speaking engagements by OSFI executives, publishing changes such as the DSB and MQR (under Guideline B-20), publicly releasing the OSFI Blueprint and new Strategic Plan, and increasing its social media presence on Twitter, LinkedIn, and YouTube. OSFI also made improvements to its forward-looking agenda on policy priorities.

Information Management and Information Technology

OSFI’s internal governance structure continued to ensure strategic and integrated decision-making on enterprise-wide files. Examples include cloud adoption, data collection modernization, and employee wellbeing, and operational files such as corporate performance metrics and internal controls over financial reporting.

OSFI moved forward with its PIVOT program, an integrated approach to responding to the evolution of its workplace, engaging employees across the organization and re-designing its office space and equipment as appropriate across all four offices. Throughout the COVID-19 pandemic waves in 2021-22, OSFI supported all employees who were working from home and ensured those performing essential functions onsite were equipped to do their jobs safely.

OSFI ensured its employees were able to work productively with the implementation, upgrade and modernization of technology-powered tools and services. This included the continued distribution of new equipment such as laptops, headsets etc., implementation of automated VPN to enable secure connection to OSFI internal network assets and continued modernization and transition of systems (e.g., business intelligence (BI)) to the cloud in support of remote work for all OSFI employees.

OSFI continued its journey while ensuring security and compliance. Examples include:

- Implementation of virtual meeting platforms and features.

- E-signature capability to facilitate internal and external approvals (e.g., for external stakeholders GlobalSign was enabled).

- Implementation of OSFI’s Vaccine Attestation Tracking System for employees.

- Rolling out Office 365 applications in the cloud, migrating email services to the cloud and launching mandatory cyber security training to improve OSFI’s security posture.

- Implementing an organizational change management strategy/program to better support employees in the adoption of newly deployed cloud productivity tools, and

- Expanding the security infrastructure to better protect OSFI’s digital assets in a hybrid work model.

OSFI continued to make significant progress on advancing its Information Management/ Information Technology (IM/IT) Strategy with a Digital Focus. In 2021-22, OSFI expanded its strategy by developing a number of sub-strategies in the areas of case management, collaboration technology, cloud information governance, and cyber security. OSFI also implemented a modern IM/IT operating model providing dedicated support to critical line-of-business programs, a technology exploration space (TES), and launched the FInsight tool for users of financial information.

Human Resources

In 2021-22, OSFI completed the roll out of the initiatives originally identified in the 2017 launch of its five-year Human Capital Strategy (HCS). These initiatives were dedicated to advancing diversity and inclusion; hiring and promotion processes and practices; employee wellbeing, talent management and leadership development. Work to further these initiatives continues. In 2021-22, OSFI:

- Released the 2022-2025 Diversity, Equity and Inclusion (DE&I) Strategy to advance OSFI’s commitment to become a more representative and inclusive organization.

- Launched a Self-Identification Campaign and its first-ever Inclusion Award which recognizes contributions to a healthy, inclusive, and respectful environment.

- Completed the examination of hiring and promotion processes and practices and implemented an action plan.

- Launched a Wellbeing Strategy and Wellbeing Hub, which supports employees with services, resources, and tools.

- Implemented the new Workplace Harassment and Violence Prevention Policy and accompanying procedure, conducted a workplace assessment and developed mitigation strategies.

- Supported the professional and leadership development of its employees.

- Launched the Leadership Development program for Aspiring and New Directors and the OSFI leaders’ program for Senior leaders.

- Updated the Leadership Competency Model, which is a cornerstone of OSFI’s culture transformation.

- Offered increased accessibility to language training and developed the new Directive on Official Languages for Workplace Communications.

- Concluded the Talent Management pilot program for non-executives. This exercise allowed employees to have in-depth reflections and meaningful conversations with their managers on their professional development.

Budgetary financial resources (dollars)

The following table shows, for internal services, budgetary spending for 2021–22, as well as spending for that year.

| 2021‑22 Main Estimates |

2021‑22 planned spending |

2021‑22 total authorities available for use |

2021‑22 actual spending (authorities used) |

2021‑22 difference (actual spending minus planned spending) |

|---|---|---|---|---|

| 75,140,725 | 75,140,725 | 75,140,725 | 83,602,340 | 8,461,615 |

Human resources (full-time equivalents)

The following table shows, in full time equivalents, the human resources the department needed to carry out its internal services for 2021–22.

| 2021‑22 planned full-time equivalents |

2021‑22 actual full-time equivalents |

2021‑22 difference (actual full-time equivalents minus planned full time equivalents) |

|---|---|---|

| 280 | 297 | 17 |

Spending and human resources

Spending

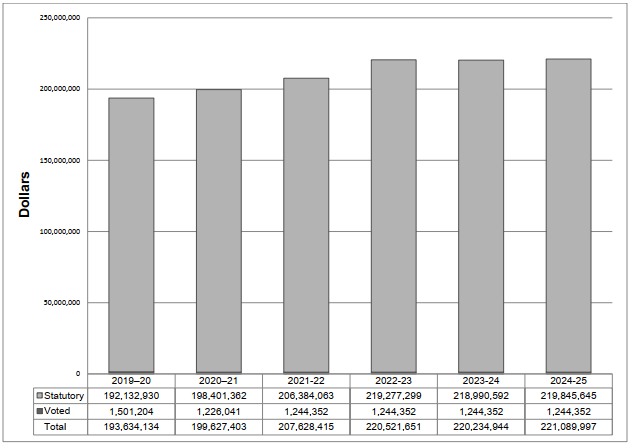

Spending 2019–20 to 2024–25

The following graph presents planned (voted and statutory spending) over time.

Graphic description - Departmental spending trend graph

| blank | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 |

|---|---|---|---|---|---|---|

| Statutory | 192,132,930 | 198,401,362 | 206,384,063 | 219,277,299 | 218,990,592 | 219,845,645 |

| Voted | 1,501,204 | 1,226,041 | 1,244,352 | 1,244,352 | 1,244,352 | 1,244,352 |

| Total | 193,634,134 | 199,627,403 | 207,628,415 | 220,521,651 | 220,234,944 | 221,089,997 |

The graph above presents OSFI’s actual spending from 2019-20 to 2021-22 and planned spending from 2022-23 to 2024-25. The planned spending is based on OSFI’s 2022-23 Departmental Plan, and reflects OSFI’s prior outlook before the development of OSFI’s Blueprint for Transformation, 2022-25. As per the resulting three-year Strategic Plan, statutory spending will grow meaningfully over the 2022-2025 horizon. Planned spending for 2022-23 will increase to $263.0M (from $220.5M), rising to $284.1M by 2024-2025; these revised spending plans will be reflected in the 2023-24 Departmental Plan.

Statutory expenditures, which are recovered from respendable revenue, represent over 99% of total expenditures. The remainder, representing less than 1% of OSFI’s spending, is funded from a parliamentary appropriation for actuarial services related to federal public sector pension and benefits plans. The budget increases outlined above will not impact OSFI’s appropriations given its full recovery funding model.

Budgetary performance summary for core responsibilities and internal services (dollars)

The “Budgetary performance summary for core responsibilities and internal services” table presents the budgetary financial resources allocated for the Office of the Superintendent of Financial Institutions’ core responsibilities and for internal services.

| Core responsibilities and internal services | 2021‑22 Main Estimates |

2021‑22 planned spending |

2022‑23 planned spending |

2023‑24 planned spending |

2021‑22 total authorities available for use |

2019‑20 actual spending (authorities used) |

2020‑21 actual spending (authorities used) |

2021‑22 actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Financial Institution and Pension Plan Regulation and Supervision | 117,965,600 | 117,965,600 | 117,806,081 | 119,698,835 | 117,965,600 | 112,600,222 | 115,090,074 | 115,971,511 |

| Actuarial Services to Federal Government Organizations | 7,644,437 | 7,644,437 | 8,838,537 | 8,934,999 | 7,644,437 | 6,696,671 | 7,156,778 | 8,054,564 |

| Subtotal | 125,610,037 | 125,610,037 | 126,644,618 | 128,633,834 | 125,610,037 | 119,296,893 | 122,246,852 | 124,026,075 |

| Internal services | 75,140,725 | 75,140,725 | 93,877,033 | 91,601,110 | 75,140,725 | 74,337,241 | 77,380,551 | 83,602,340 |

| Total | 200,750,762 | 200,750,762 | 220,521,651 | 220,234,944 | 200,750,762 | 193,634,134 | 199,627,403 | 207,628,415 |

OSFI’s 2021-22 planned spending, as presented in the 2021-22 Departmental Plan, was $200.8 million. However, following OSFI’s 2021-22 planning exercise (completed after the 2021-22 Departmental Plan), the budget was increased by $12.4 million (or 6.2%) (i.e., from $200.8 million to $213.2 million) and was largely driven by the addition of resources to implement OSFI’s DE&I strategy as well as the acceleration of some initiatives such as the move to cloud based technology.

OSFI’s 2021-22 actual expenditures of $207.6 million were $5.6 million (or 2.6%) lower than its revised plan and was largely driven by delays in some of the initiatives added during the 2021-22 planning exercise. These variances primarily impacted Internal Services.

Human resources

The “Human resources summary for core responsibilities and internal services” table presents the full-time equivalents (FTEs) allocated to each of the Office of the Superintendent of Financial Institutions’ core responsibilities and to internal services.

| Core responsibilities and internal services |

2019‑20 actual full-time equivalents |

2020‑21 actual full-time equivalents |

2021‑22 planned full-time equivalents |

2021‑22 actual full-time equivalents |

2022‑23 planned full-time equivalents |

2023‑24 planned full-time equivalents |

|---|---|---|---|---|---|---|

| Financial Institution and Pension Plan Regulation and Supervision | 519 | 555 | 574 | 583 | 577 | 576 |

| Actuarial Services to Federal Government Organizations | 34 | 37 | 41 | 40 | 43 | 43 |

| Subtotal | 553 | 592 | 615 | 623 | 620 | 619 |

| Internal services | 240 | 275 | 280 | 297 | 296 | 286 |

| Total | 793 | 867 | 895 | 920 | 916 | 905 |

OSFI’s 2021-22 planned full-time equivalents (FTEs), as presented in the 2021-22 Departmental Plan, was 895. However, following OSFI’s 2021-22 planning exercise (completed after the 2021-22 Departmental Plan), planned FTEs were increased by 33 (or 3.7%) (i.e., from 895 FTEs to 928 FTEs) and was largely driven by the addition of resources to implement OSFI’s DE&I strategy as well as the acceleration of some initiatives such as the move to cloud based technology.

In 2021-22, OSFI’s FTEs were 920, which is 8 (or 0.9%) lower than the revised plan. The FTE total represents a growth of 6.1% over 2020-21. The increase is largely due to the staffing of vacant positions and new positions created to address the requirements of the 2021-22 planning exercise, which was completed after the 2021-22 Departmental Plan was produced.

Similarly, the planned FTEs for 2022-23 and 2023-24 are based on OSFI’s 2022-23 Departmental Plan, which reflects OSFI’s prior outlook before the development of the OSFI’s Blueprint for Transformation 2022-25. As per the resulting three-year Strategic Plan, FTEs will grow meaningfully over the 2022-2025 horizon. Planned FTEs for 2022-23 will increase to 1,085 (from 916) rising to 1,194 by 2024-25; these revised FTEs will be reflected in the 2023-24 Departmental Plan.

Expenditures by vote

For information on Office of the Superintendent of Financial Institutions’ organizational voted and statutory expenditures, consult the Public Accounts of Canada 2021.

Government of Canada spending and activities

Information on the alignment of Office of the Superintendent of Financial Institutions’ spending with Government of Canada’s spending and activities is available in GC InfoBase.

Financial statements and financial statements highlights

Financial statements

The Office of the Superintendent of Financial Institutions’ financial statements (unaudited) for the year ended March 31, 2022, are available on OSFI’s website.

Financial statement highlights

| Financial information | 2021‑22 planned results |

2021‑22 actual results |

2020‑21 actual results |

Difference (2021–22 actual results minus 2021–22 planned results) |

Difference (2021–22 actual results minus 2020–21 actual results) |

|---|---|---|---|---|---|

| Total expenses | 216,500,000 | 212,501,582 | 201,257,706 | -3,998,418 | 11,243,876 |

| Total revenues | 215,255,648 | 211,257,230 | 200,031,665 | -3,998,418 | 11,225,565 |

| Net cost of operations before government funding and transfers | 1,244,352 | 1,244,352 | 1,226,041 | 0 | 18,311 |

*Note: Planned results based on the 2021-22 planning exercise as presented in OSFI’s audited financial statements. OSFI’s Future-Oriented Statement of Operations (FOSO) provides additional information on its planned results.

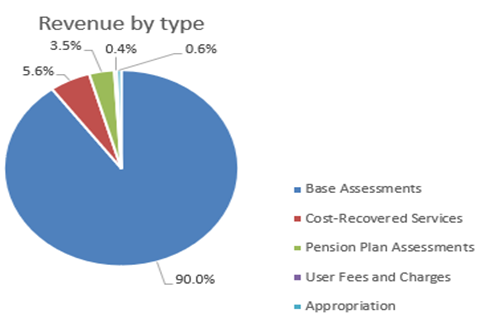

OSFI is mainly funded through assessments on the financial institutions and private pension plans that it regulates and supervises, and a user-pay program for legislative approvals and selected services. OSFI also receives revenues for cost-recovered services and a small parliamentary appropriation for actuarial services related to federal public sector pension and benefit plans. On an accrual basis of accounting, OSFI recovered all of its expenses for the year.

Graphic description - Revenue by type

| Base assessments | Cost-Recovered Services | Pension Plan Assessments | User Fees and Charges | Appropriation |

|---|---|---|---|---|

| 90.0% | 5.6% | 3.5% | 0.4% | 0.6% |

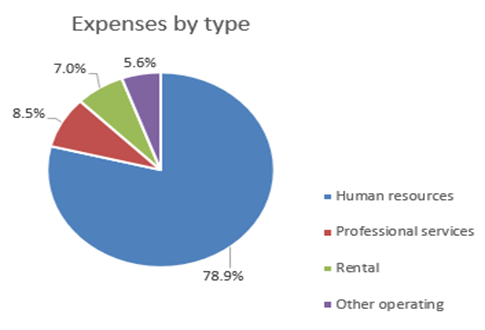

In 2021-22, total expenses were $212.5 million (calculated in accordance with PSAS), an increase of $11.2 million or 5.6% from the previous year, and $4.0 million lower than final plan. The year-over-year increase is primarily due to the creation of positions under OSFI’s Strategic Plan, the staffing of vacant positions, and normal escalation and merit increases. The acceleration of cloud investments in response to the COVID-19 pandemic (e.g., more remote work) also contributed to the increase.

Graphic description - Expenses by type

| Human resources | Professional services | Rental | Other operating |

|---|---|---|---|

| 78.9% | 8.5% | 7.0% | 5.6% |

| Financial information | 2021–22 | 2020–21 | Difference (2021–22 minus 2020–21) |

|---|---|---|---|

| Total financial assets | 74,052,000 | 62,001,000 | 12,051,000 |

| Total financial liabilities | 65,213,000 | 56,401,000 | 8,812,000 |

| Net financial assets | 8,839,000 | 5,600,000 | 3,239,000 |

| Total non-financial assets | 16,841,000 | 20,080,000 | -3,239,000 |

| Accumulated surplus | 25,680,000 | 25,680,000 | 0 |

The 2021–22 planned results information is provided in OSFI’s Future-Oriented Statement of Operations and Notes 2021–22.

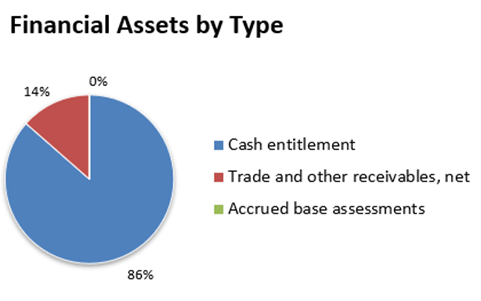

Total financial assets at the end of 2021-22 were $74.0 million, an increase of $12.1 million from the previous year. The change is driven by an increase in OSFI’s cash entitlement (due to increased financial liabilities), offset by a reduction in accrued base assessments. Cash entitlement represents the amount that OSFI is entitled to withdraw from the Consolidated Revenue Fund without further authority.

Graphic description - Financial Assets by type

| Cash entitlement | Trade and other receivables, net | Accrued base assessment |

|---|---|---|

| 86% | 14% | 0% |

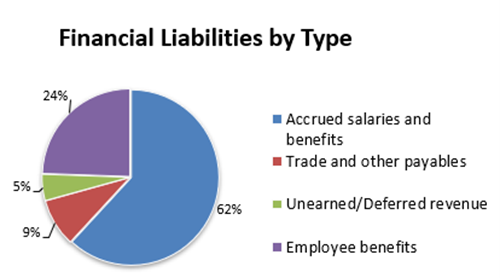

Total financial liabilities were $65.2 million, which was $8.8 million higher than the previous year. The increase is driven by higher accrued salaries and benefits (largely due to the growth in staff complement and accrued economic increases for executive level employees) and an increase in unearned base assessments (largely due to lower than planned operating costs this year).

Graphic description - Financial Liabilities by Type

| Accrued salaries and benefits | Trade and other payables | Unearned / Deferred revenue | Employee benefits |

|---|---|---|---|

| 62% | 9% | 5% | 24% |

Corporate information

Organizational profile

Appropriate minister[s]: Chrystia Alexandra Freeland

Institutional head: Peter Routledge

Ministerial portfolio: Finance

Enabling instrument[s]: Office of the Superintendent of Financial Institutions Act (OSFI Act)

Year of incorporation / commencement: 1987

Raison d’être, mandate and role: who we are and what we do

“Raison d’être, mandate and role: who we are and what we do” is available on OSFI’s website.

Operating context

Information on the operating context is available on OSFI’s website.

Reporting framework

OSFI’s Departmental Results Framework and Program Inventory of record for 2021–22 are shown below.

Departmental Results Framework

Core Responsibility 1 - Financial Institution and Pension Plan Regulation and Supervision

- Departmental Result: Federally regulated financial institutions and private pensions plans are in sound financial condition

- Indicator: % of financial institutions with a Composite Risk Rating of low or moderate

- Indicator: Number of financial institutions for which the supervisory rating (i.e. risk level) has increased by two or more levels within a three month period

- Indicator: Number of pension plans for which the supervisory rating (i.e. risk level) has increased by two or more levels within a three month period

- Departmental Result: Regulatory and supervisory frameworks contribute to the safety and soundness of the Canadian financial system

- Indicator: The Office of the Superintendent of Financial Institutions’ level of compliance with the International Monetary Fund’s Financial Sector Assessment Program core principles

- Indicator: The Office of the Superintendent of Financial Institutions’ level of compliance with Basel standards as assessed by the Regulatory Consistency Assessment Programme of the Bank for International Settlements

Program Inventory

- Risk Assessment and Intervention – Federally Regulated Financial Institutions

- Regulation and Guidance of Federally Regulated Financial Institutions

- Regulatory Approvals and Legislative Precedents

- Federally Regulated Private Pension Plans

Core Responsibility 2 – Actuarial Services to Federal Government Organizations

- Departmental Result: Stakeholders receive accurate and high quality actuarial information on the cost of public programs and government pension and benefit plans

- Indicator: % of members of a panel of Canadian peer actuaries that deem the Canada Pension Plan actuarial valuation accurate and of high quality

- Indicator: % of public pension and insurance plan valuations that are deemed accurate and high quality.

Program Inventory

- Actuarial Valuation and Advice

Core Responsibility 3 – Internal Services

Supporting information on the program inventory

Financial, human resources and performance information for OSFI’s Program Inventory is available in GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on OSFI’s website:

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA Plus of tax expenditures.

Organizational contact information

Mailing address:

Office of the Superintendent of Financial Institutions

255 Albert Street

Ottawa, Ontario K1A 0H2

Telephone: 1-800-385-8647

Fax: 1-613-952-8219

Email: webmaster@osfi-bsif.gc.ca

Website: http://www.osfi-bsif.gc.ca

Appendix: definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A report on the plans and expected performance of an appropriated department over a 3 year period. Departmental Plans are usually tabled in Parliament each spring.

- departmental priority (priorité)

- A plan or project that a department has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired departmental results.

- departmental result (résultat ministériel)

- A consequence or outcome that a department seeks to achieve. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

- A quantitative measure of progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

- A framework that connects the department’s core responsibilities to its departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- experimentation (expérimentation)

- The conducting of activities that seek to first explore, then test and compare the effects and impacts of policies and interventions in order to inform evidence-based decision-making, and improve outcomes for Canadians, by learning what works, for whom and in what circumstances. Experimentation is related to, but distinct from innovation (the trying of new things), because it involves a rigorous comparison of results. For example, using a new website to communicate with Canadians can be an innovation; systematically testing the new website against existing outreach tools or an old website to see which one leads to more engagement, is experimentation.

- full-time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person year charge against a departmental budget. For a particular position, the full time equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person’s collective agreement.

- gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

- An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives; and understand how factors such as sex, race, national and ethnic origin, Indigenous origin or identity, age, sexual orientation, socio-economic conditions, geography, culture and disability, impact experiences and outcomes, and can affect access to and experience of government programs.

- government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2021–22 Departmental Results Report, government-wide priorities refers to those high-level themes outlining the government’s agenda in the 2020 Speech from the Throne, namely: Protecting Canadians from COVID-19; Helping Canadians through the pandemic; Building back better – a resiliency agenda for the middle class; The Canada we’re fighting for.

- horizontal initiative (initiative horizontale)

- An initiative where two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non-budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- performance indicator (indicateur de rendement)

- A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

- performance reporting (production de rapports sur le rendement)

- The process of communicating evidence based performance information. Performance reporting supports decision making, accountability and transparency.

- plan (plan)

- The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

- planned spending (dépenses prévues)

- For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

- A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- program (programme)

- Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

- Identifies all the department’s programs and describes how resources are organized to contribute to the department’s core responsibilities and results.

- result (résultat)

- A consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

- statutory expenditures (dépenses législatives)

- Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

- A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

- Expenditures that Parliament approves annually through an appropriation act. The vote wording becomes the governing conditions under which these expenditures may be made.