Canada Student Financial Assistance Program as at 31 July 2020

Accessibility statement

The Web Content Accessibility Guidelines (WCAG) defines requirements for designers and developers to improve accessibility for people with disabilities. It defines three levels of conformance: Level A, Level AA, and Level AAA. This report is partially conformant with WCAG 2.0 level AA. If you require a compliant version, please contact webmaster@osfi-bsif.gc.ca.

Office of the Chief Actuary

Office of the Superintendent of Financial Institutions Canada

12th Floor, Kent Square Building

255 Albert Street

Ottawa, Ontario

K1A 0H2

E-mail: oca-bac@osfi-bsif.gc.ca

Web site: www.osfi-bsif.gc.ca

© Her Majesty the Queen in Right of Canada, 2020

Cat. No. IN3-16/27E-PDF

ISSN 2564-1026

6 July 2021

The Honourable Carla Qualtrough

Minister of Employment, Workforce Development and Disability Inclusion

House of Commons

Ottawa, Canada

K1A 0A6

Dear Minister:

In accordance with section 19.1 of the Canada Student Financial Assistance Act, which provides that a report shall be prepared on financial assistance provided under this Act, I am pleased to submit the Actuarial Report on the Canada Student Financial Assistance Program (formerly referred to as Canada Student Loans Program), prepared as at 31 July 2020.

Yours sincerely,

Assia Billig, FCIA, FSA, PhD

Chief Actuary

Office of the Chief Actuary

Table of contents

Index of tables

- Table 1 Demographic and Labour Force Assumptions

- Table 2 Real Wage and Tuition Increases Assumptions

- Table 3 Borrowing Cost

- Table 4 Population and Post-secondary Enrolment of Participating Provinces

- Table 5 Loan Recipients

- Table 6 Student Need

- Table 7 Increase in New Loans Issued

- Table 8 Guaranteed and Risk-Shared Regimes Portfolio

- Table 9 Direct Loan Portfolio and Allowances

- Table 10 Defaulted Loans and Allowance for Bad Debt – Principal

- Table 11 Interest on Defaulted Loans and Allowance for Bad Debt – Interest

- Table 12 Allowance for Repayment Assistance Plan – Principal

- Table 13 Direct Loan Portfolio and Allowances (in millions of 2020 constant dollars)

- Table 14 Aggregate Amount of Outstanding Student Loans

- Table 15 Student Related Expenses

- Table 16 Risks to the Government

- Table 17 Summary of Expenses

- Table 18 Total Revenues

- Table 19 Net Annual Cost of the Program

- Table 20 Net Annual Cost of the Program (in millions of 2020 constant dollars)

- Table 21 Direct Loans Issued and Number of Students

- Table 22 Direct Loans Consolidated

- Table 23 Direct Loans Default Portfolio - Principal

- Table 24 Repayment Assistance Plan

- Table 25 Reconciliation of the Direct Loans Portfolio as at 31 July 2020

- Table 26 Full-time Post-Secondary Enrolment Rate by Labour Force Status

- Table 27 Short-term Increase of Tuition Expenses

- Table 28 Provision Rates for Bad Debt – Interest

- Table 29 RAP-Stage 1 Utilization Rates

- Table 30 RAP-Stage 2 Utilization Rates

- Table 31 RAP-PD Utilization Rates

- Table 32 Administrative Expense

- Table 33 Long-term Sensitivity Test Assumptions

- Table 34 Impact of Loan Limit on Loans Issued

- Table 35 Impact of Indexation of Loan Limit and Grants on Loans Issued

- Table 36 Impact of Indexation of Fixed Student Contribution on Loans Issued

- Table 37 Sensitivity Test Results for the 2044‑2045 Loan Year

Index of charts

1 Purpose and Summary

Main Findings

Grants

- $1,635M disbursed in 2019‑2020

- $3,206M expected in 2020‑2021

New Loans Issued

- $3,449M disbursed in 2019‑2020

- $3,879M expected in 2020‑2021

Direct Loan Portfolio

- $22.1B as at 31 July 2020

- $41.3B expected by 2044‑2045

- $34B limit projected to be reached in 2032‑2033

Program's Net Cost

- $2.6B in 2019‑2020

- $4.8B expected in 2044‑2045

- Grants represent 63% of net cost in 2019‑2020

Defaults (Bad Debt)

- Long-term net default rate is 8.1%

- $2,810M in allowance for bad debt – principal as at 31 July 2020

- $238M in allowance for bad debt – interest as at 31 July 2020

RAP (Repayment Assistance Plan)

- $1,717M in allowance for RAP – principal as at 31 July 2020

Effective 1 August 2000, the Government redesigned the delivery of the Canada Student Financial Assistance ProgramFootnote 1 (CSFA Program, formerly referred to as Canada Student Loans Program) from one delivered by chartered banks to one directly financed by the Government. As part of this redesign, the Office of the Chief Actuary was given the mandate to conduct an actuarial review of the program.

Section 19.1 of the Canada Student Financial Assistance Act defines the mandate given to the Chief Actuary; it states that the Chief Actuary of the Office of the Superintendent of Financial Institutions shall prepare a report on the financial assistance provided under this Act no later than three years apart. This is the seventh statutory Actuarial Report on the CSFA Program, prepared as at 31 July 2020. As provided in subsection 19.1(3), the report includes a forecast of the costs and revenues of the program for the next 25 years (through the 2044‑2045 loan year). The purpose of the actuarial review of the CSFA Program is to provide a valuation of the program's overall financial costs and increase the level of information provided to the Minister of Employment, Workforce Development and Disability Inclusion, Parliament and the public. The next triennial statutory report will be prepared as at 31 July 2023. Interim reports for Employment and Social Development Canada (ESDC) accounting purposes will be prepared as at 31 July 2021 and 31 July 2022.

The report shows estimates of:

- the number of students receiving a loan under the CSFA Program and the amount of new loans issued;

- the portfolio of loans in-study, loans in repayment and loans in default;

- the allowances under the direct loan regime in effect since August 2000; and

- the revenues, the expenses and the net resulting cost by type of regime.

COVID-19 Pandemic

More than one year has passed since the beginning of the COVID-19 pandemic. The situation remains fluid and will likely continue to evolve for some time. Several temporary measures were introduced by the Government within the CSFA Program during the 2019‑2020 and 2020‑2021 loan years to alleviate the impact of the pandemic on students and borrowers. Budget 2021 also proposed to extend some of these measures. These measures and their estimated impacts are reflected in the projections of this report. The final impacts of this health and economic crisis will likely generate some differences in the future.

This valuation report is based on the program provisions as described in Appendix A. The additional appendices provide information on the data used, a reconciliation of the portfolio, a description of assumptions and methodologies, sensitivity tests as well as information on concessionary terms.

2 Main Report

The Canada Student Financial Assistance Program (CSFA Program, formerly referred to as Canada Student Loans Program) has been in effect since 1964; it provides Canadians with financial assistance to pursue a post-secondary education. On 1 August 2000, the Government redesigned the delivery of the program to disburse loans directly to students. The Office of the Chief Actuary was given the mandate to provide an assessment of the current costs of the CSFA Program, a long-term (25 years) forecast of these costs, and a portfolio projection. The results are presented on a loan year basis from 1 August to 31 July.

The following items are considered to determine the net cost of the program:

Expenses

- Canada Student Grants (CSG)

- Interest subsidy on in-study loans and loans in the 6-month non-repayment period

- Interest relief from the Repayment Assitance Plan (RAP)

- Provisions for RAP (principal) and bad debt (principal and interest)

- Alternative payments

- Loan forgiveness expenses

- Administrative expenses

Reduced by Net Interest Revenues

- Interest accrued during the six-month non-repayment period (up to 31 October 2019)

- Student interest payments

- RAP interest payments covered by the Government

- Interest accrued on defaulted loans

2.1 Recent Program Changes

Over the last few years, several changes were made to the CSFA Program. This section summarizes recent changes that were implemented in loan year ending 31 July 2020 or will be implemented in future years. Unless stated otherwise, these measures have been reflected in the projections presented in this report.

| Implementation Date | Description | Source |

|---|---|---|

| 1 August 2019 | Increase the cap on the Canada Student Grant for Services and Equipment for Students with Permanent Disabilities, from $8,000 to $20,000 per year. | Budget 2019 / Approved |

| Expand eligibility for the Severe Permanent Disability Benefit to allow more student borrowers with severe permanent disabilities to qualify for loan forgiveness. | ||

| 1 November 2019 | Lower the floating interest rate, from prime plus 2.5 percentage points to prime. | Budget 2019 / Approved |

| Lower the fixed interest rate, from prime plus 5.0 percentage points to prime plus 2.0 percentage points. | ||

| Cease interest accrual during the six-month non-repayment period. | ||

| 1 January 2020 | Enhance the eligibility for loan rehabilitation for borrowers in default. | Budget 2019 / Approved |

| 1 August 2020 | Remove the restriction which prevent borrowers who have been out of study for five years and have used the RAP for Students with Permanent Disabilities (RAP-PD) to receive further loans and grants until their outstanding loans are fully paid. | Budget 2019 / Approved |

| 1 October 2020 | Implement interest-free and payment-free leave, for a maximum of 18 months, for borrowers taking temporary leave from their studies for medical or parental reasons, including mental health leave. | Budget 2019 / Approved |

| 1 August 2021 (expected) |

Flexibility to use current year's income instead of previous year's income to determine eligibility for Canada Student Grants (three-year pilot project introduced in 2018‑2019 made permanent). | Budget 2021 / Pending Regulatory Approval |

| 2022‑2023 (expected) |

Increase accessibility to the RAP by increasing RAP income thresholds and reducing the maximum affordable payment. | Budget 2021 / Pending Regulatory Approval |

| 2022‑2023 (expected) |

Expand access to supports for students and borrowers with persistent or prolonged disabilities that are not necessarily permanent. | Budget 2021 / Not considered in this report as details are not finalized |

| Start/End Date | Description | Source |

|---|---|---|

| 30 March 2020 to 30 September 2020 | Suspend student loan repayments and interest accrual. | Measures in response to COVID-19 |

| 1 August 2020 to 31 July 2021 | Double the amount for the following CSGs:

|

Measures in response to COVID-19 |

| Change the need assessment so that no fixed student contribution or spousal contribution are considered. This helps students qualify for more financial support. | ||

| Increase the weekly loan limit, from $210 to $350. | ||

| 1 April 2021 to 31 March 2022 | Waiver of interest accrual on student loans. | Bill C-14 / Approved |

| 1 August 2021 to 31 July 2023 (expected) |

Extend the doubling of the grants. | Budget 2021 / Pending Regulatory Approval |

| Extend the top-up grant of $200 per month for eligible adult learners returning to school full-time after being out of secondary school for at least 10 years (extension of the three-year pilot project introduced in loan year 2018‑2019). | ||

| 1 April 2022 to 31 March 2023 (expected) |

Extend the waiver of interest accrual on student loans. | Budget 2021 / Pending Budget Implementation Act Royal Ascent |

2.2 Best-Estimate Assumptions

Several economic and demographic assumptions are needed to determine the future long-term costs of the CSFA Program. The projections included in this report cover a period of 25 years and the assumptions are determined by putting as much emphasis on historical trends as on short-term experience. These assumptions reflect the actuary's best judgment and are referred to as "best-estimate" assumptions. Some of these assumptions are based on the most recent actuarial reports prepared by the Office of the Chief Actuary, adjusted to reflect loan year periods. The assumptions were chosen to be internally consistent.

2.2.1 Assumptions related to Total Loans Issued Projections

Several assumptions are needed to determine the total amount of loans issued. Tables 1 and 2 summarize the main assumptions used. Other economic assumptions used can be found in Table 3.

Table 1 presents the demographic and labour force assumptions while Table 2 presents the real wages and tuition fee increases assumptions. Assumptions shown in Table 1 and the ultimate real wage increase shown in Table 2 are based on the 30th Actuarial Report on the Canada Pension Plan as at 31 December 2018.

| 1 | Total fertility rate for Canada (ultimate) | 1.62 per woman (for 2027+) | |

|---|---|---|---|

| 2 | Mortality | Statistics Canada Life Tables with CPP 30th assumed future improvements | |

| 3 | Net migration rate for Canada (ultimate) | 0.62% of population (for 2021+) | |

| 4 | Youth labour force participation rate (participating provinces/territory, ages 15‑29)Table Footnote 1 |

69.2% | (2020‑2021) |

| 69.7% | (2021‑2022) | ||

| 70.7% | (2022‑2023) | ||

| • | |||

| • | |||

| • | |||

| 72.6% | (2044‑2045) | ||

Table 1 Footnotes

|

|||

| 5 | Real wage increasesTable Footnote 1 | 4.3%Table Footnote 2 | (2020‑2021) |

|---|---|---|---|

| -1.0%Table Footnote 3 | (2021‑2022) | ||

| -1.2% | (2022‑2023) | ||

| -0.7% | (2023‑2024) | ||

| 0.4% | (2024‑2025) | ||

| 1.0% | (2025‑2026)+ | ||

| 6 | Tuition fee increases | 1.8% | (2020‑2021) |

| 1.6% | (2021‑2022) | ||

| 4.1%Table Footnote 4 | (2022‑2023) | ||

| 4.1% | (2023‑2024) | ||

| • | |||

| • | |||

| • | |||

| Inflation + 1.75% | (2028‑2029)+ | ||

Table 2 Footnotes

|

|||

2.2.2 Cost of Borrowing

Table 3 presents the interest rates and inflation assumptions used to calculate the cost of borrowing for the Government and for borrowers. The inflation assumption is also used in the projection of total loans issued.

| Loan Year | Government's Cost of Borrowing (%) |

Inflation (%) |

Government's Real Cost of BorrowingTable Footnote 1 (%) |

Prime Rate (%) |

Student's Cost of Borrowing (%) |

|---|---|---|---|---|---|

| (1) | (2) | (1) - (2) | |||

| 2020‑2021 | 1.1 | 1.6 | -0.5 | 2.5 | 2.5 |

| 2021‑2022 | 1.7 | 2.0 | -0.3 | 2.5 | 2.5 |

| 2022‑2023 | 1.9 | 2.0 | -0.1 | 2.7 | 2.7 |

| 2023‑2024 | 2.2 | 2.0 | 0.2 | 3.0 | 3.0 |

| 2024‑2025 | 2.5 | 2.0 | 0.5 | 3.3 | 3.3 |

| 2025‑2026 | 2.7 | 2.0 | 0.7 | 3.5 | 3.5 |

| 2026‑2027 | 2.8 | 2.0 | 0.8 | 3.6 | 3.6 |

| 2027‑2028 | 3.0 | 2.0 | 1.0 | 3.7 | 3.7 |

| 2028‑2029 | 3.1 | 2.0 | 1.1 | 3.8 | 3.8 |

| 2029‑2030 | 3.3 | 2.0 | 1.3 | 3.9 | 3.9 |

| 2030‑2031 | 3.4 | 2.0 | 1.4 | 4.0 | 4.0 |

| 2031‑2032 | 3.5 | 2.0 | 1.5 | 4.1 | 4.1 |

| 2032‑2033 | 3.6 | 2.0 | 1.6 | 4.2 | 4.2 |

| 2033‑2034+ | 3.7 | 2.0 | 1.7 | 4.3 | 4.3 |

Table 3 Footnotes

|

|||||

The average prime rate for the 2020‑2021 loan year is 2.5%. It is obtained by adding the government's cost of borrowing and an interest rate spread. The short term government's cost of borrowing (until 2024‑2025) is based on the most recent Department of Finance Private Sector Survey and takes into account new actual data released after the publication of the survey. The government's cost of borrowing is expected to increase to reach an ultimate rate of 3.7% in 2033‑2034. The assumption on the interest rate spread is developed based on the analysis of historical data and the expected short term trajectory of interest rates. The spread is expected to decrease gradually from 1.4% in 2020‑2021 to an ultimate value of 0.6% in 2029‑2030, resulting in an ultimate prime rate of 4.3% in 2033‑2034.

2.2.3 Assumptions related to Allowances

Since August 2000, the CSFA Program has been delivered and financed directly by the Government. Three allowances exist to cover future costs: Bad debt – principal, Bad debt – interest and Repayment Assistance Plan (RAP) – principal.

A summary of the assumptions used to determine the allowances is provided below. Additional details can be found in Appendix D.

Long-Term Defaulted Principal Assumptions

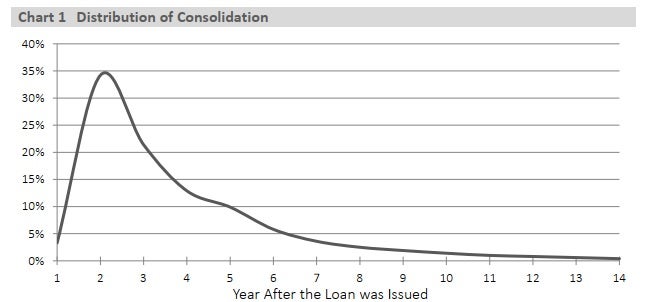

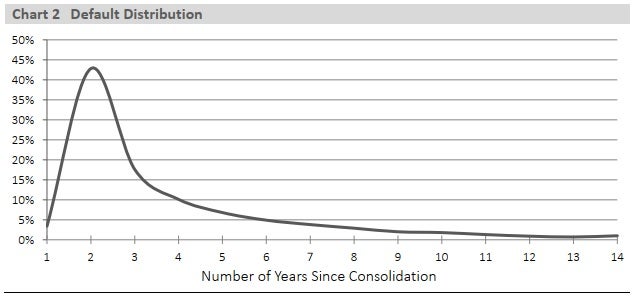

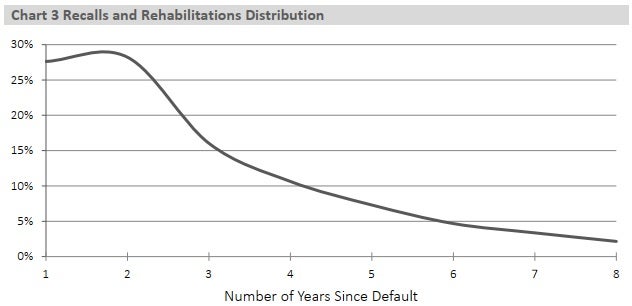

Several assumptions are used to determine the expected future amount of defaulted principal that will not be recovered. These assumptions are revised each year. The most recent experience, ending right before the start of the pandemic, shows a slight increase in gross defaults. Over the same period, higher than expected recalls and rehabilitations can also be observed, resulting in an ultimate net default rate that is comparable with the one in the previous actuarial report. The following ultimate assumptions are used:

| Gross Default |

|

|---|---|

| Recalls and Rehabilitations |

|

| Recoveries |

|

| Resulting Net Default |

|

Interest Recovery Assumption

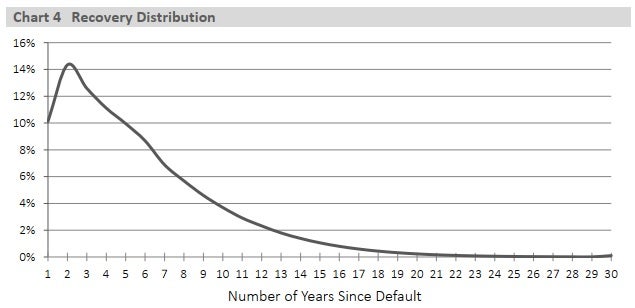

The interest recovery assumption is used to project the future expected non-recoverable interest. It is determined by a distribution that varies according to the time elapsed since the interest defaulted. The recovery rates are based on historical observations. Overall, the recovery rate for future accrued default interest is 56.4%.

Repayment Assistance Plan (RAP) Assumptions

Several assumptions are used to determine the dollar amount of loans that will ultimately be repaid by the Government through the RAP rather than by borrowers. These assumptions are reviewed each year based on new experience available:

| RAP-Stage 2 and RAP-PD Utilization |

|

|---|---|

| Required Payments |

|

| Affordable Payments |

|

2.3 Projection of Total Loans Issued

The following formula illustrates a simplification of the elements considered in the projection of the total amount of loans issued under the CSFA Program:

Total Amount of Loans Issued = Population × Post-Secondary Enrolment Rates × Loan Uptake Rates × Average Loan Size

2.3.1 Projection of the Population

Demographic projections are based on the population projected in the 30th Actuarial Report on the Canada Pension Plan as at 31 December 2018. Subsets of the population ineligible to participate in the CSFA Program are then removed, such that the "population" used corresponds to Canada less Quebec, Northwest Territories, Nunavut, and non-permanent residents.

As shown in Table 4, the population aged 15‑29 is expected to decrease from 4,975,000 in 2019‑2020 to 4,958,000 in 2020‑2021. It is expected to continue to decrease over the following year to reach 4,949,000. After that, it is expected to increase for the remainder of the projection period to reach 5,852,000 in 2044‑2045. Over the 25-year projection period, the population aged 15‑29 is expected to increase by 877,000.

2.3.2 Projection of Post-Secondary Enrolment

Projections of post-secondary enrolment are based on enrolment data from Statistics Canada's Labour Force Survey up to January 2021.

The enrolment rates vary according to the following:

Age Group

- 15 to 19

- 20 to 24

- 25 to 29

- 30 and over

Gender

- Male

- Female

Labour Force Status

- In labour force (individuals who are employed or looking for employment)

- Out of labour force

Educational Institution

- University

- Public college

- Private college

Overall, the aggregate enrolment rate for students aged 15 to 29 is expected to remain between 22% and 24% over the next 25 years.

Table 4 shows the evolution of the number of students enrolled full-time in a post-secondary institution (age group 15‑29 and total). The total number of enrolled students is expected to increase from its current level of 1,257,000 to 1,513,000 at the end of the projection period. Students aged 15‑29 are used for illustrative purposes as they represent more than 85% of the total post-secondary enrolment and better demonstrate the movement of this population across time.

| Loan Year | Population of Canada Less Quebec, Nunavut, and NWT (15‑29)Table Footnote 2 (thousands) |

Students Enrolled Full-Time (15‑29) Table Footnote 3 (thousands) |

All students Enrolled Full-Time (Total)Table Footnote 3 (thousands) |

Increase (thousands) |

Increase (%) |

|---|---|---|---|---|---|

| 2019‑2020 | 4,975 | 1,093 | 1,257Table Footnote 4 | ||

| 2020‑2021 | 4,958 | 1,140 | 1,289 | 32 | 2.5 |

| 2021‑2022 | 4,949 | 1,122 | 1,277 | -12 | -0.9 |

| 2022‑2023 | 4,957 | 1,123 | 1,280 | 3 | 0.2 |

| 2023‑2024 | 4,978 | 1,136 | 1,295 | 15 | 1.1 |

| 2024‑2025 | 5,001 | 1,145 | 1,305 | 10 | 0.8 |

| 2025‑2026 | 5,023 | 1,157 | 1,318 | 13 | 1.1 |

| 2026‑2027 | 5,045 | 1,164 | 1,324 | 6 | 0.4 |

| 2027‑2028 | 5,080 | 1,173 | 1,333 | 9 | 0.7 |

| 2028‑2029 | 5,116 | 1,183 | 1,343 | 10 | 0.7 |

| 2029‑2030 | 5,148 | 1,192 | 1,350 | 7 | 0.6 |

| 2030‑2031 | 5,177 | 1,200 | 1,359 | 9 | 0.6 |

| 2031‑2032 | 5,216 | 1,208 | 1,366 | 7 | 0.6 |

| 2032‑2033 | 5,260 | 1,214 | 1,372 | 6 | 0.4 |

| 2033‑2034 | 5,305 | 1,217 | 1,376 | 4 | 0.3 |

| 2034‑2035 | 5,347 | 1,221 | 1,380 | 4 | 0.3 |

| 2035‑2036 | 5,397 | 1,226 | 1,386 | 6 | 0.4 |

| 2036‑2037 | 5,448 | 1,236 | 1,397 | 11 | 0.8 |

| 2037‑2038 | 5,495 | 1,246 | 1,408 | 11 | 0.8 |

| 2038‑2039 | 5,537 | 1,257 | 1,419 | 11 | 0.8 |

| 2039‑2040 | 5,582 | 1,269 | 1,433 | 14 | 0.9 |

| 2040‑2041 | 5,631 | 1,282 | 1,448 | 15 | 1.0 |

| 2041‑2042 | 5,687 | 1,297 | 1,464 | 16 | 1.1 |

| 2042‑2043 | 5,742 | 1,312 | 1,481 | 17 | 1.1 |

| 2043‑2044 | 5,797 | 1,327 | 1,497 | 16 | 1.1 |

| 2044‑2045 | 5,852 | 1,342 | 1,513 | 16 | 1.1 |

Table 4 Footnotes

|

|||||

2.3.3 Projection of the Number of Students Receiving a Loan

The projection of the loan uptake rates is based on the historical number of students receiving a loan under the CSFA Program according to:

Educational Institution

- University

- Public college

- Private college

The product of the number of students enrolled full-time and the CSFA Program loan uptake rate gives the number of students receiving a loan under the CSFA Program. Table 5 shows that the increasing loan uptake rate, from 48.4% in 2019‑2020 to 54.2% in 2044‑2045, combined with the increase in students enrolled in post-secondary education, results in 212,000 more students in the program (from 608,000 students in 2019‑2020 to 820,000 in 2044‑2045).

The number of students in the CSFA Program shown in Table 5 does not include the small number of students who only receive a CSG since their entire need is covered by the grant (no loans are issued to them). According to the ESDC data file, the total number of students who received a grant in the 2019‑2020 loan year is 528,000. The majority of grant recipients (91%) received both a loan and a grant.

| Loan Year | Students Enrolled Full-Time (thousands) |

Loan Uptake Rate (%) |

Students in CSFATable Footnote 1 (thousands) |

Annual Increase in CSFA Students (thousands) |

Annual Increase in CSFA Students (%) |

|---|---|---|---|---|---|

| (1) | (2) | (1) x (2) | |||

| 2019‑2020 | 1,257 | 48.4 | 608 | ||

| 2020‑2021 | 1,289 | 44.1 | 568 | -40 | -6.5 |

| 2021‑2022 | 1,277 | 46.1 | 588 | 20 | 3.5 |

| 2022‑2023 | 1,280 | 46.2 | 592 | 4 | 0.6 |

| 2023‑2024 | 1,295 | 49.8 | 645 | 53 | 9.0 |

| 2024‑2025 | 1,305 | 50.0 | 653 | 8 | 1.2 |

| 2025‑2026 | 1,318 | 50.2 | 661 | 9 | 1.4 |

| 2026‑2027 | 1,324 | 50.4 | 667 | 6 | 0.8 |

| 2027‑2028 | 1,333 | 50.6 | 674 | 7 | 1.1 |

| 2028‑2029 | 1,343 | 50.8 | 682 | 7 | 1.1 |

| 2029‑2030 | 1,350 | 51.0 | 688 | 7 | 1.0 |

| 2030‑2031 | 1,359 | 51.2 | 695 | 7 | 1.0 |

| 2031‑2032 | 1,366 | 51.4 | 702 | 7 | 1.0 |

| 2032‑2033 | 1,372 | 51.6 | 708 | 6 | 0.9 |

| 2033‑2034 | 1,376 | 51.8 | 713 | 5 | 0.7 |

| 2034‑2035 | 1,380 | 52.0 | 718 | 5 | 0.7 |

| 2035‑2036 | 1,386 | 52.2 | 724 | 6 | 0.8 |

| 2036‑2037 | 1,397 | 52.5 | 733 | 9 | 1.2 |

| 2037‑2038 | 1,408 | 52.7 | 741 | 9 | 1.2 |

| 2038‑2039 | 1,419 | 52.9 | 751 | 9 | 1.3 |

| 2039‑2040 | 1,433 | 53.1 | 761 | 10 | 1.3 |

| 2040‑2041 | 1,448 | 53.3 | 772 | 11 | 1.4 |

| 2041‑2042 | 1,464 | 53.5 | 784 | 12 | 1.5 |

| 2042‑2043 | 1,481 | 53.7 | 796 | 12 | 1.5 |

| 2043‑2044 | 1,497 | 53.9 | 808 | 12 | 1.5 |

| 2044‑2045 | 1,513 | 54.2 | 820 | 12 | 1.5 |

Table 5 Footnotes

|

|||||

2.3.4 Projection of the Average Loan Issued per Borrower

The projection of the average loan issued is based on the projection of the student net need, capped at the maximum weekly loan limit:

Step 1: Determining the student net need

Student NeedFootnote 2 (excess of expenses over resources):

- Expenses: tuition and compulsory fees, books and supplies, living allowance, return transportation, child care and a few other allowable expenses depending on the student's situation.

- Resources: student contributionsFootnote 3 and, when applicable, parental or spousal contributions.

- Projected to increase using economic assumptions.

Grants reduction:

- Grants are the first component that reduce the student need, resulting in the student net need.

- Grants may fulfill the entire student need, in which case no loan is issued.

- Different grants are available (details can be found in Appendix A).

- Grants other than those for disability are projected using inflation indexed thresholds and expected gross annual family income.

Table 6 summarizes the main elements of the student net need calculation. All students who receive a loan are included.

| Loan Year | Resources ($) |

Tuition ($) |

Other Expenses ($) |

Total Expenses ($) |

Average Student Need ($) |

Average Grant for Net Need CalculationTable Footnote 2 ($) |

CSFA Average Student Net Need ($) |

CSFA Average Student Net Need Increase ($) |

|---|---|---|---|---|---|---|---|---|

| (A) | (B) | (C) | (D) = (B) + (C) | (E) = (D) - (A) | (F) | (G) = (E) × 60% - (F) | ||

| 2019‑2020 | 3,100 | 8,400 | 12,700 | 21,100 | 18,000 | 2,300 | 8,500 | |

| 2020‑2021 | 1,700Table Footnote 3 | 8,600 | 12,900 | 21,500 | 19,800 | 4,400Table Footnote 4 | 7,500 | -1,000 |

| 2021‑2022 | 3,300 | 8,700 | 13,100 | 21,800 | 18,500 | 4,400 | 6,700 | -800 |

| 2022‑2023 | 3,300 | 9,100 | 13,400 | 22,500 | 19,200 | 4,400 | 7,100 | 400 |

| 2023‑2024 | 3,300 | 9,500 | 13,700 | 23,200 | 19,900 | 2,100Table Footnote 5 | 9,800 | 2,700 |

| 2024‑2025 | 3,400 | 9,900 | 13,900 | 23,800 | 20,400 | 2,100 | 10,100 | 300 |

| 2025‑2026 | 3,500 | 10,300 | 14,200 | 24,500 | 21,000 | 2,100 | 10,500 | 400 |

| 2026‑2027 | 3,500 | 10,700 | 14,500 | 25,200 | 21,700 | 2,100 | 10,900 | 400 |

| 2027‑2028 | 3,600 | 11,100 | 14,800 | 25,900 | 22,300 | 2,100 | 11,300 | 400 |

| 2028‑2029 | 3,700 | 11,500 | 15,100 | 26,600 | 22,900 | 2,100 | 11,600 | 300 |

| 2029‑2030 | 3,800 | 12,000 | 15,400 | 27,400 | 23,600 | 2,100 | 12,100 | 500 |

| 2030‑2031 | 3,900 | 12,400 | 15,700 | 28,100 | 24,200 | 2,000 | 12,500 | 400 |

| 2031‑2032 | 4,000 | 12,900 | 16,000 | 28,900 | 24,900 | 2,000 | 12,900 | 400 |

| 2032‑2033 | 4,200 | 13,400 | 16,300 | 29,700 | 25,500 | 2,000 | 13,300 | 400 |

| 2033‑2034 | 4,300 | 13,900 | 16,600 | 30,500 | 26,200 | 2,000 | 13,700 | 400 |

| 2034‑2035 | 4,400 | 14,400 | 17,000 | 31,400 | 27,000 | 2,000 | 14,200 | 500 |

| 2035‑2036 | 4,500 | 15,000 | 17,300 | 32,300 | 27,800 | 2,000 | 14,700 | 500 |

| 2036‑2037 | 4,700 | 15,600 | 17,700 | 33,300 | 28,600 | 2,000 | 15,200 | 500 |

| 2037‑2038 | 4,800 | 16,200 | 18,000 | 34,200 | 29,400 | 1,900 | 15,700 | 500 |

| 2038‑2039 | 5,000 | 16,800 | 18,400 | 35,200 | 30,200 | 1,900 | 16,200 | 500 |

| 2039‑2040 | 5,100 | 17,400 | 18,700 | 36,100 | 31,000 | 1,900 | 16,700 | 500 |

| 2040‑2041 | 5,300 | 18,100 | 19,100 | 37,200 | 31,900 | 1,900 | 17,200 | 500 |

| 2041‑2042 | 5,400 | 18,800 | 19,500 | 38,300 | 32,900 | 1,900 | 17,800 | 600 |

| 2042‑2043 | 5,600 | 19,500 | 19,900 | 39,400 | 33,800 | 1,900 | 18,400 | 600 |

| 2043‑2044 | 5,800 | 20,300 | 20,300 | 40,600 | 34,800 | 1,900 | 19,000 | 600 |

| 2044‑2045 | 6,000 | 21,000 | 20,700 | 41,700 | 35,700 | 1,900 | 19,500 | 500 |

Table 6 Footnotes

|

||||||||

Step 2: Adjusting for the loan limit

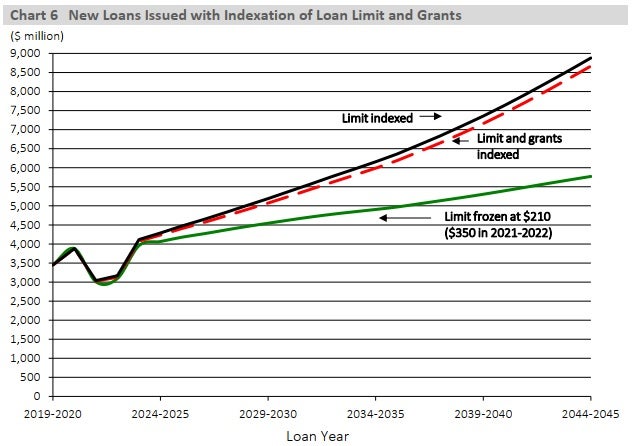

Loans are capped at a maximum of $210 per weekFootnote 4:

- Projected to remain fixed at $210

The constant loan limit restricts the growth of new loans issued. Over time, more students reach the loan limit without their needs being completely fulfilled. This is shown in Table 7 , where the percentage of students at the loan limit is projected to increase from 43.5% in 2019‑2020 to 87.9% in 2044‑2045.

2.3.5 Total Amount of Loans Issued

Table 7 presents the resulting projection of new amount of loans issued.

| Loan Year | Average Student Need ($) |

Increase (%) |

% of Students at LimitTable Footnote 1 |

New Loans Issued ($ million) |

Increase (%) |

Students in CSFA (thousands) |

Increase (%) |

Average Loan Size ($) |

Increase (%) |

|---|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (3) / (4) | |||||

| 2019‑2020 | 18,000 | 43.5 | 3,449 | 608 | 5,674 | ||||

| 2020‑2021 | 19,800 | 10.0Table Footnote 2 | 16.2Table Footnote 3 | 3,879 | 12.5Table Footnote 4 | 568 | -6.5 | 6,827 | 20.3 |

| 2021‑2022 | 18,500 | -6.6 | 33.2Table Footnote 5 | 3,006Table Footnote 6 | ‑22.5 | 588 | 3.5 | 5,110 | ‑25.1 |

| 2022‑2023 | 19,200 | 3.8 | 35.0Table Footnote 5 | 3,096 | 3.0 | 592 | 0.6 | 5,230 | 2.3 |

| 2023‑2024 | 19,900 | 3.6 | 52.2 | 3,956Table Footnote 7 | 27.8 | 645 | 9.0 | 6,133 | 17.3 |

| 2024‑2025 | 20,400 | 2.5 | 54.7 | 4,065 | 2.7 | 653 | 1.2 | 6,228 | 1.5 |

| 2025‑2026 | 21,000 | 2.9 | 57.2 | 4,178 | 2.8 | 661 | 1.4 | 6,316 | 1.4 |

| 2026‑2027 | 21,700 | 3.3 | 59.6 | 4,267 | 2.1 | 667 | 0.8 | 6,397 | 1.3 |

| 2027‑2028 | 22,300 | 2.8 | 62.1 | 4,364 | 2.3 | 674 | 1.1 | 6,472 | 1.2 |

| 2028‑2029 | 22,900 | 2.7 | 64.7 | 4,458 | 2.2 | 682 | 1.1 | 6,540 | 1.1 |

| 2029‑2030 | 23,600 | 3.1 | 67.0 | 4,544 | 1.9 | 688 | 1.0 | 6,602 | 1.0 |

| 2030‑2031 | 24,200 | 2.5 | 69.3 | 4,629 | 1.9 | 695 | 1.0 | 6,659 | 0.9 |

| 2031‑2032 | 24,900 | 2.9 | 72.0 | 4,709 | 1.7 | 702 | 1.0 | 6,710 | 0.8 |

| 2032‑2033 | 25,500 | 2.4 | 74.0 | 4,781 | 1.5 | 708 | 0.9 | 6,755 | 0.7 |

| 2033‑2034 | 26,200 | 2.7 | 75.6 | 4,845 | 1.3 | 713 | 0.7 | 6,795 | 0.6 |

| 2034‑2035 | 27,000 | 3.1 | 77.0 | 4,905 | 1.3 | 718 | 0.7 | 6,832 | 0.5 |

| 2035‑2036 | 27,800 | 3.0 | 78.4 | 4,971 | 1.3 | 724 | 0.8 | 6,865 | 0.5 |

| 2036‑2037 | 28,600 | 2.9 | 79.6 | 5,053 | 1.6 | 733 | 1.2 | 6,896 | 0.4 |

| 2037‑2038 | 29,400 | 2.8 | 80.9 | 5,134 | 1.6 | 741 | 1.2 | 6,924 | 0.4 |

| 2038‑2039 | 30,200 | 2.7 | 82.1 | 5,217 | 1.6 | 751 | 1.3 | 6,949 | 0.4 |

| 2039‑2040 | 31,000 | 2.6 | 83.3 | 5,305 | 1.7 | 761 | 1.3 | 6,972 | 0.3 |

| 2040‑2041 | 31,900 | 2.9 | 84.4 | 5,396 | 1.7 | 772 | 1.4 | 6,991 | 0.3 |

| 2041‑2042 | 32,900 | 3.1 | 85.6 | 5,491 | 1.8 | 784 | 1.5 | 7,008 | 0.2 |

| 2042‑2043 | 33,800 | 2.7 | 86.6 | 5,587 | 1.7 | 796 | 1.5 | 7,022 | 0.2 |

| 2043‑2044 | 34,800 | 3.0 | 87.3 | 5,680 | 1.7 | 808 | 1.5 | 7,034 | 0.2 |

| 2044‑2045 | 35,700 | 2.6 | 87.9 | 5,772 | 1.6 | 820 | 1.5 | 7,043 | 0.1 |

Table 7 Footnotes

|

|||||||||

Table 7 shows the annual increase in new loans issued over the 25-year projection period. Overall, the total new loans issued is expected to increase from $3,449 million in 2019‑2020 to $3,879 million in 2020‑2021. In 2044‑2045, projected new loans issued total $5,772 million, which corresponds to an average annual increase of 2.1%. This average annual increase can be attributed to two factors: an average annual increase in the number of students in the program of 1.2% and an average annual increase in the average loan size of 0.9% over the 25-year projection period. The average loan size is calculated as the ratio of new loans issued over the number of students receiving a loan under the CSFA Program. The growth rate of the average loan size is moderated due to the constant loan limit.

2.4 Portfolio Projections

This section presents projections of the portfolio for all three regimes described in Appendix A, as well as projections of the three allowances under the direct loan regime. The amounts for loans in-study represent loans issued to students who are still in the post-secondary educational system. Interest on loans in-study is fully subsidized by the Government for students in the CSFA Program. Loans in repayment consist of outstanding loans consolidated by students with financial institutions (or the Government).

2.4.1 Guaranteed and Risk-Shared Regimes

The guaranteed and risk-shared regimes apply to loans issued before August 2000. Some loans in these regimes are still outstanding since there are still students under these regimes attending post-secondary institutions or repaying their loans. Table 8 presents the projections of the guaranteed and risk-shared loans owned by financial institutions and by the GovernmentFootnote 5 as well as the loans returned to the Government because of default (principal only). The projection for defaulted loans is shown separately for guaranteed and risk-shared regimes as the latter is necessary to determine when the limit on the aggregate amount of outstanding loans prescribed through the Canada Student Financial Assistance Regulations will be reached, as presented in Table 14 . The guaranteed and risk-shared regimes are gradually being phased out.

At the end of the 2019‑2020 loan year, the sum of all loans coming from the guaranteed and risk-shared regimes that are owned by the Government amounts to approximately $160 million (principal and interest). The Government sets up a separate allowance in the Public Accounts for those loans. This allowance calculation is not included in this report. Expenses related to Guaranteed and Risk-Shared Loans are presented in Table 15 and Table 16 .

| As at July 31 | Loans in Study or Repayment | Loans in Default | Total ($ million) |

||

|---|---|---|---|---|---|

| (with financial institutions)Table Footnote 1 |

(bought back by the Government) |

(Returned to the Government) | |||

| Guaranteed and Risk-Shared ($ million) |

Guaranteed and Risk-Shared ($ million) |

Guaranteed ($ million) |

Risk-Shared ($ million) |

||

| 2020 | 752 | 0 | 50 | 33 | 835 |

| 2021 | 626 | 9 | 39 | 29 | 703 |

| 2022 | 499 | 7 | 28 | 26 | 561 |

| 2023 | 372 | 5 | 19 | 23 | 419 |

| 2024 | 258 | 3 | 12 | 20 | 294 |

| 2025 | 165 | 2 | 7 | 18 | 192 |

| 2026 | 106 | 1 | - | 15 | 123 |

| 2027 | 68 | 1 | - | 13 | 82 |

| 2028 | 44 | 1 | - | 10 | 54 |

| 2029 | 28 | - | - | 7 | 36 |

| 2030 | 18 | - | - | 3 | 22 |

| 2031 | 12 | - | - | 1 | 12 |

| 2032 | 7 | - | - | 0 | 8 |

| 2033 | 0 | - | - | - | 0 |

| 2034 | - | - | - | - | - |

| 2035 | - | - | - | - | - |

Table 8 Footnotes

|

|||||

2.4.2 Direct Loan Regime

The projection of the direct loan portfolio includes the balance of outstanding loans (in-study and in repayment separately) and the balance of loans in default. There are two allowances for bad debt (principal and interest) to cover the risk of future default, net of recoveries, and an allowance for the RAP (principal) to cover the future cost of students benefiting from this program. The projection of the direct loan portfolio and allowances is shown in Table 9 .

| As at July 31 |

Principal only | Allowance for | |||||

|---|---|---|---|---|---|---|---|

| Loans In-Study |

Loans in Repayment |

Defaulted Loans | Total | Bad Debt Principal | Bad Debt Interest | RAP - Principal | |

| ($ million) | ($ million) | ||||||

| 2020 | 8,201 | 11,638 | 2,213 Table Footnote 1 | 22,052 | 2,810 | 238 | 1,717 |

| 2021 | 8,800 | 11,842 | 2,276 | 22,918 | 2,984 | 216 | 2,237 Table Footnote 3 |

| 2022 | 8,299 | 11,878 | 2,649 Table Footnote 2 | 22,826 | 3,105 | 196 | 2,277 |

| 2023 | 8,317 | 11,789 | 2,688 | 22,794 | 3,129 | 153 | 2,300 |

| 2024 | 9,288 | 11,755 | 2,738 | 23,781 | 3,238 | 155 | 2,386 |

| 2025 | 10,068 | 12,033 | 2,778 | 24,879 | 3,351 | 161 | 2,476 |

| 2026 | 10,732 | 12,454 | 2,835 | 26,021 | 3,473 | 174 | 2,578 |

| 2027 | 11,273 | 12,975 | 2,909 | 27,157 | 3,603 | 191 | 2,681 |

| 2028 | 11,695 | 13,600 | 2,951 | 28,246 | 3,692 | 202 | 2,792 |

| 2029 | 12,058 | 14,232 | 2,986 | 29,276 | 3,763 | 210 | 2,890 |

| 2030 | 12,391 | 14,838 | 3,064 | 30,293 | 3,869 | 222 | 2,982 |

| 2031 | 12,683 | 15,418 | 3,154 | 31,255 | 3,980 | 236 | 3,076 |

| 2032 | 12,955 | 15,956 | 3,249 | 32,160 | 4,092 | 250 | 3,171 |

| 2033 | 13,206 | 16,468 | 3,342 | 33,016 | 4,198 | 264 | 3,264 |

| 2034 | 13,434 | 16,950 | 3,433 | 33,817 | 4,300 | 278 | 3,354 |

| 2035 | 13,645 | 17,395 | 3,527 | 34,567 | 4,401 | 292 | 3,441 |

| 2036 | 13,849 | 17,805 | 3,617 | 35,271 | 4,499 | 304 | 3,524 |

| 2037 | 14,062 | 18,189 | 3,704 | 35,955 | 4,594 | 314 | 3,604 |

| 2038 | 14,280 | 18,552 | 3,789 | 36,621 | 4,687 | 323 | 3,679 |

| 2039 | 14,505 | 18,899 | 3,875 | 37,279 | 4,783 | 332 | 3,750 |

| 2040 | 14,738 | 19,234 | 3,964 | 37,936 | 4,883 | 340 | 3,819 |

| 2041 | 14,980 | 19,563 | 4,050 | 38,593 | 4,981 | 348 | 3,886 |

| 2042 | 15,232 | 19,891 | 4,136 | 39,259 | 5,079 | 357 | 3,952 |

| 2043 | 15,492 | 20,223 | 4,219 | 39,934 | 5,176 | 365 | 4,019 |

| 2044 | 15,753 | 20,560 | 4,301 | 40,614 | 5,273 | 372 | 4,086 |

| 2045 | 16,015 | 20,903 | 4,390 | 41,308 | 5,377 | 381 | 4,154 |

Table 9 Footnotes

|

|||||||

The outstanding direct loans portfolio is projected to increase rapidly from $22.1 billion as at 31 July 2020 to $24.9 billion five years later. By the end of the 2044‑2045 loan year, the portfolio is projected to reach $41.3 billion.

As at 31 July 2020, the outstanding direct loan portfolio is $22.1 billion and is retrospectively derived from the experienceFootnote 6 during loan years 2000‑2001 to 2019‑2020 as follow:

| New loans issued | $46.4 billion |

|---|---|

| Plus the interest accrued during the non-repayment periodFootnote 7 | $1.4 billion |

| Minus repaymentsFootnote 8 | $23.6 billion |

| Minus loans forgiven and debt reductions in repaymentFootnote 9 | $0.8 billion |

| Minus defaulted loans written-off | $1.3 billion |

| $22.1 billion |

The remainder of subsection 2.4.2 provides detailed information on the three allowances.

Allowance for Bad Debt – Principal

Table 10 provides the calculation details for the projection of the defaulted loans portfolio and the allowance for bad debt – principal under the direct loan regime.

| Loan Year | Defaulted Loans Portfolio (Principal only) | Allowance for Bad Debt - Principal | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Balance 1 August |

New Defaulted LoansTable Footnote 1 |

Collected Loans | Write-offs | Balance 31 July |

Allowance 1 August |

Write-offs | Allowance 31 July |

Yearly Expense | |

| ($ million) | ($ million) | ||||||||

| (1) | (2) | (3) | (4) | (1+2) - (3+4) | (1) | (2) | (3) | (3) - (1 - 2) | |

| 2019‑2020 | 2,191 | 238 Table Footnote 2 | 78 | 138 | 2,213 | 2,731 | 138 | 2,810 | 217 |

| 2020‑2021 | 2,213 | 268 Table Footnote 2 | 58 | 146 | 2,277 | 2,810 | 146 | 2,984 Table Footnote 3 | 320 |

| 2021‑2022 | 2,276 | 576 Table Footnote 4 | 117 | 87 | 2,648 | 2,984 | 87 | 3,105 | 208 |

| 2022‑2023 | 2,649 | 357 | 129 | 189 | 2,688 | 3,105 | 189 | 3,129 | 213 |

| 2023‑2024 | 2,688 | 343 | 131 | 162 | 2,738 | 3,129 | 162 | 3,238 | 271 |

| 2024‑2025 | 2,738 | 337 | 131 | 165 | 2,779 | 3,238 | 165 | 3,351 | 278 |

| 2025‑2026 | 2,778 | 354 | 133 | 164 | 2,835 | 3,351 | 164 | 3,473 | 286 |

| 2026‑2027 | 2,835 | 370 | 134 | 162 | 2,909 | 3,473 | 162 | 3,603 | 292 |

| 2027‑2028 | 2,909 | 388 | 136 | 210 | 2,951 | 3,603 | 210 | 3,692 | 299 |

| 2028‑2029 | 2,951 | 407 | 138 | 233 | 2,987 | 3,692 | 233 | 3,763 | 304 |

| 2029‑2030 | 2,986 | 426 | 142 | 206 | 3,064 | 3,763 | 206 | 3,869 | 312 |

| 2030‑2031 | 3,064 | 440 | 145 | 205 | 3,154 | 3,869 | 205 | 3,980 | 316 |

| 2031‑2032 | 3,154 | 455 | 150 | 211 | 3,248 | 3,980 | 211 | 4,092 | 323 |

| 2032‑2033 | 3,249 | 468 | 154 | 220 | 3,343 | 4,092 | 220 | 4,198 | 326 |

| 2033‑2034 | 3,342 | 479 | 158 | 230 | 3,433 | 4,198 | 230 | 4,300 | 332 |

| 2034‑2035 | 3,433 | 490 | 163 | 234 | 3,526 | 4,300 | 234 | 4,401 | 335 |

| 2035‑2036 | 3,527 | 500 | 167 | 243 | 3,617 | 4,401 | 243 | 4,499 | 341 |

| 2036‑2037 | 3,617 | 509 | 172 | 250 | 3,704 | 4,499 | 250 | 4,594 | 345 |

| 2037‑2038 | 3,704 | 519 | 176 | 258 | 3,789 | 4,594 | 258 | 4,687 | 351 |

| 2038‑2039 | 3,789 | 528 | 180 | 261 | 3,876 | 4,687 | 261 | 4,783 | 357 |

| 2039‑2040 | 3,875 | 537 | 184 | 264 | 3,964 | 4,783 | 264 | 4,883 | 364 |

| 2040‑2041 | 3,964 | 546 | 188 | 271 | 4,051 | 4,883 | 271 | 4,981 | 369 |

| 2041‑2042 | 4,050 | 555 | 192 | 277 | 4,136 | 4,981 | 277 | 5,079 | 375 |

| 2042‑2043 | 4,136 | 564 | 196 | 286 | 4,218 | 5,079 | 286 | 5,176 | 383 |

| 2043‑2044 | 4,219 | 573 | 199 | 292 | 4,301 | 5,176 | 292 | 5,273 | 389 |

| 2044‑2045 | 4,301 | 583 | 203 | 291 | 4,390 | 5,273 | 291 | 5,377 | 395 |

Table 10 Footnotes

|

|||||||||

The balance of loans in default (principal only) was $2,213 million as at 31 July 2020. The defaulted loans portfolio is projected to reach $4,390 million by the end of the projection period.

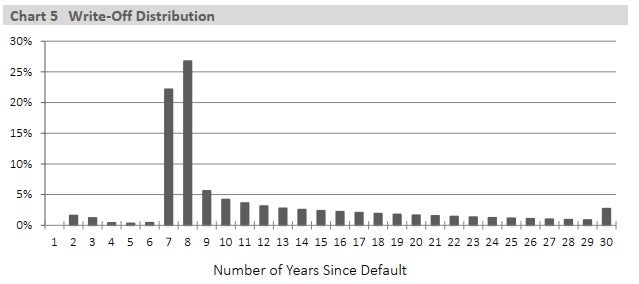

As shown in Table 10 , an amount of $138 million was written-off in 2019‑2020. The amount of write-offs in 2020‑2021 is $146 million and includes all the non-recoverable loans that were identified and approved for write-off by ESDC and CRA between July 2019 and June 2020. These write-offs were approved on 30 March 2021, via Royal Assent of Bill C‑26 (Appropriation Act No. 6, 2020‑2021). The decision to write off particular loans is part of a multi-step process inevitably resulting in some volatility in the actual amount written off from year to year.

The allowance for bad debt – principal covers the risk of future defaults, net of recoveries. It is estimated at $2,810 million as at 31 July 2020, which is lower than the $2,829 million projected in the previous report as at 31 July 2019. Projections of the previous report were adjusted to reflect the newest experience available. For the 2019‑2020 loan year, the yearly expense for the allowance for bad debt – principal is $217 million.

The provision rates used to determine the 2020‑2021 allowance are presented below. The ultimate provision rates are presented in Appendix D.

Provision Rates

Allowance as at 31 July 2021

- 6.9% of the outstanding balance of loans in-study;

- 5.2% of the outstanding balance of loans in repayment; and

- 77.4% of the outstanding balance of loans in default.

Allowance for Public Accounts: Provision rates used to determine the allowances for Public Accounts were based on the program's conditions as of 31 March 2021, i.e. without considering any measures announced in Budget 2021.

- 7.0% of the outstanding balance of loans in-study, which is $9,279 million as at 31 March 2021;

- 5.1% of the outstanding balance of loans in repayment, which is $11,958 million as at 31 March 2021; and

- 77.4% of the outstanding balance of loans in default, which is $2,142 million as at 31 March 2021.

- Total allowance as at 31 March 2021: $2,917 million.

Allowance for Bad Debt – Interest

In accordance with the collection practice, interest accrues on defaulted loans until they reach a "non-recoverable" status. A provision is set to cover the risk that such accrued interest will never be recovered. The methodology used is the same as in the previous report. Provision rates are modified to take into account recent experience. The allowance for bad debt – interest is determined using the outstanding interest and a variable provision rate for each year since default. The provision rates are presented in Appendix D (Table 28).

The projection of the balance of interest on defaulted loans is presented in Table 11 .

| Loan Year | Interest on Defaulted Loans | Allowance for Bad Debt - Interest | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Balance August 1 | Interest Transferred in DefaultTable Footnote 1 | Interest Accrued | Interest Collected | Write-offs | Balance July 31 | Allowance August 1 | Write-offs | Allowance July 31 | Yearly expense | |

| ($ million) | ($ million) | |||||||||

| (1) | (2) | (3) | (4) | (5) | (1+2+3) - (4+5) | (1) | (2) | (3) | (3) - (1‑2) | |

| 2019‑2020 | 362 | 10 | 73 Table Footnote 2 | 46 | 41 | 358 | 245 | 41 | 238 | 33 |

| 2020‑2021 | 358 | 5 | 27 Table Footnote 2Table Footnote 3 | 25 | 39 | 325 | 238 | 39 | 216 | 18 |

| 2021‑2022 | 325 | 3 | 0 Table Footnote 3 | 43 | 21 | 265 | 216 | 21 | 196 | 1 |

| 2022‑2023 | 265 | 1 | 21 Table Footnote 3 | 35 | 51 | 200 | 196 | 51 | 153 | 9 |

| 2023‑2024 | 200 | 7 | 72 | 38 | 30 | 212 | 153 | 30 | 155 | 31 |

| 2024‑2025 | 212 | 9 | 80 | 43 | 29 | 229 | 155 | 29 | 161 | 36 |

| 2025‑2026 | 229 | 10 | 87 | 47 | 28 | 251 | 161 | 28 | 174 | 41 |

| 2026‑2027 | 251 | 11 | 91 | 51 | 27 | 274 | 174 | 27 | 191 | 44 |

| 2027‑2028 | 274 | 12 | 94 | 54 | 34 | 292 | 191 | 34 | 202 | 45 |

| 2028‑2029 | 292 | 13 | 98 | 57 | 39 | 307 | 202 | 39 | 210 | 47 |

| 2029‑2030 | 307 | 14 | 104 | 61 | 37 | 327 | 210 | 37 | 222 | 50 |

| 2030‑2031 | 327 | 15 | 110 | 64 | 39 | 348 | 222 | 39 | 236 | 53 |

| 2031‑2032 | 348 | 16 | 117 | 68 | 42 | 370 | 236 | 42 | 250 | 56 |

| 2032‑2033 | 370 | 16 | 123 | 73 | 45 | 392 | 250 | 45 | 264 | 59 |

| 2033‑2034 | 392 | 17 | 130 | 77 | 49 | 413 | 264 | 49 | 278 | 62 |

| 2034‑2035 | 413 | 18 | 134 | 81 | 51 | 433 | 278 | 51 | 292 | 64 |

| 2035‑2036 | 433 | 18 | 137 | 84 | 54 | 450 | 292 | 54 | 304 | 66 |

| 2036‑2037 | 450 | 18 | 140 | 87 | 57 | 465 | 304 | 57 | 314 | 67 |

| 2037‑2038 | 465 | 19 | 144 | 90 | 59 | 479 | 314 | 59 | 323 | 68 |

| 2038‑2039 | 479 | 19 | 147 | 92 | 61 | 491 | 323 | 61 | 332 | 70 |

| 2039‑2040 | 491 | 19 | 150 | 94 | 63 | 503 | 332 | 63 | 340 | 71 |

| 2040‑2041 | 503 | 20 | 153 | 97 | 64 | 515 | 340 | 64 | 348 | 72 |

| 2041‑2042 | 515 | 20 | 156 | 99 | 65 | 527 | 348 | 65 | 357 | 74 |

| 2042‑2043 | 527 | 20 | 159 | 101 | 67 | 538 | 357 | 67 | 365 | 75 |

| 2043‑2044 | 538 | 21 | 162 | 103 | 69 | 549 | 365 | 69 | 372 | 77 |

| 2044‑2045 | 549 | 21 | 165 | 105 | 69 | 561 | 372 | 69 | 381 | 78 |

Table 11 Footnotes

|

||||||||||

When a loan is transferred to the Government after nine months without a payment, it comes with an interest portion that generally represents slightly more than nine months of interest accrued on the defaulted principal transferred. Table 11 shows that $10 million of interest was returned to the Government in the 2019‑2020 loan year, along with the newly defaulted principal portion of the loans. An additional amount of $73 million in interest was accrued during the 2019‑2020 loan year on the principal balance of the recoverable defaulted loans portfolio at the beginning of the loan year.

Once loans are in default, CRA collects money for their repayment on behalf of the program. These collections are first applied to the interest portion of defaulted loans. As such, an amount of $46 million was recovered in the 2019‑2020 loan year.

Finally, when a loan meets certain criteria and has exceeded the six-year limitation period, the interest amounts are also considered for write-off. In the 2019‑2020 loan year, $41 million in interest was written off. As shown in Table 11, the balance of interest in default was $362 million at the beginning of the 2019‑2020 loan year and it decreased to $358 million as at 31 July 2020. The balance of interest in default is projected to increase to $561 million by the end of the projection period.

The allowance for bad debt – interest is estimated at $238 million as at 31 July 2020, which is slightly lower than the $239 million projected in the previous report as at 31 July 2019. Projections of the previous report were adjusted to reflect the newest experience available. For the 2019‑2020 loan year, the yearly expense for the allowance for bad debt – interest is $33 million.

The allowances are determined using provision rates applied to their corresponding outstanding balances of accrued interest according to the year since default. The sets of provision rates for the 2020‑2021 allowances, as well as the ultimate provision rates, are presented in Appendix D. The provision rates used to determine the allowances for Public Accounts were based on the conditions of the program as of 31 March 2021, i.e. without considering any measures announced in Budget 2021. The resulting allowance for Public Accounts as at 31 March 2021 corresponds to $225 million.

Allowance for the Repayment Assistance Plan – Principal

Table 12 provides the calculation details for the projection of the allowance for the Repayment Assistance Plan (RAP) under the direct loan regime.

| Loan Year | Allowance 1 August ($ million) |

RAP Expenses ($ million) |

Allowance 31 July ($ million) |

Yearly Expense ($ million) |

|---|---|---|---|---|

| (1) | (2) | (3) | (3) - (1‑2) | |

| 2019‑2020 | 1,594 | 82 Table Footnote 1 | 1,717 | 205 |

| 2020‑2021 | 1,717 | 149 Table Footnote 1 | 2,237 Table Footnote 2 | 669 |

| 2021‑2022 | 2,237 | 175 | 2,277 | 215 |

| 2022‑2023 | 2,277 | 197 | 2,300 | 220 |

| 2023‑2024 | 2,300 | 193 | 2,386 | 279 |

| 2024‑2025 | 2,386 | 197 | 2,476 | 287 |

| 2025‑2026 | 2,476 | 200 | 2,578 | 302 |

| 2026‑2027 | 2,578 | 208 | 2,681 | 311 |

| 2027‑2028 | 2,681 | 216 | 2,792 | 327 |

| 2028‑2029 | 2,792 | 221 | 2,890 | 319 |

| 2029‑2030 | 2,890 | 226 | 2,982 | 318 |

| 2030‑2031 | 2,982 | 231 | 3,076 | 325 |

| 2031‑2032 | 3,076 | 237 | 3,171 | 332 |

| 2032‑2033 | 3,171 | 245 | 3,264 | 338 |

| 2033‑2034 | 3,264 | 252 | 3,354 | 342 |

| 2034‑2035 | 3,354 | 260 | 3,441 | 347 |

| 2035‑2036 | 3,441 | 269 | 3,524 | 352 |

| 2036‑2037 | 3,524 | 277 | 3,604 | 357 |

| 2037‑2038 | 3,604 | 287 | 3,679 | 362 |

| 2038‑2039 | 3,679 | 297 | 3,750 | 368 |

| 2039‑2040 | 3,750 | 306 | 3,819 | 375 |

| 2040‑2041 | 3,819 | 314 | 3,886 | 381 |

| 2041‑2042 | 3,886 | 321 | 3,952 | 387 |

| 2042‑2043 | 3,952 | 328 | 4,019 | 395 |

| 2043‑2044 | 4,019 | 334 | 4,086 | 401 |

| 2044‑2045 | 4,086 | 340 | 4,154 | 408 |

Table 12 Footnotes

|

||||

Table 12 shows the projection of the allowance for the principal portion of the required payment paid by the Government under Stage 2, including the RAP for borrowers with permanent disabilities (RAP-PD). For the RAP – interest, a provision is determined by ESDC for accounting purposes to take into account the timing of the interest accrued.

As shown in Table 12 , the allowance for the RAP – principal is estimated at $1,717 million as at 31 July 2020, which is higher than the $1,675 million projected in the previous report as at 31 July 2019. The projections of the last report were adjusted to reflect the newest experience available. For the 2019‑2020 loan year, the yearly expense for the allowance for RAP – principal allowance is $205 million.

Budget 2021 proposed to increase the RAP thresholds as well as to decrease the maximum affordable payment, both starting in loan year 2022‑2023. Future assumptions were adjusted to reflect these modifications, which result in more borrowers being eligible for RAP, in addition to a higher share of principal payments to be covered by the Government. Consequently, the 2020‑2021 allowance, which represents future expenses covered by the Government for borrowers in RAP, is projected to increase to $2,237 million as shown in Table 12.

The provision rates used to determine the 2020‑2021 allowance are presented below. The ultimate provision rates are presented in Appendix D.

Provision Rates

Allowance as at 31 July 2021

- 7.1% of the outstanding balance of loans in-study;

- 1.9% of the outstanding balance of loans in repayment (net of loans in the RAP); and

- 34.3% of the outstanding balance of loans in RAP (all stages combined).

Allowance for Public Accounts: Provision rates used to determine the allowances for Public Accounts were based on the program's conditions as of 31 March 2021, i.e. without considering any measures announced in Budget 2021.

- 5.5% of the outstanding balance of loans in-study, which is $9,279 million as at 31 March 2021;

- 1.4% of the outstanding balance of loans in repayment (reduced by loans in the RAP - all stages), which is $7,955 million as at 31 March 2021;

- 28.8% of the outstanding balance of loans in the RAP (all stages), which is $4,003 million as at 31 March 2021.

- Total allowance as at 31 March 2021: $1,775 million.

For comparison purposes, Table 13 shows the direct loan portfolio and allowances in 2020 constant dollars.

| As at July 31 |

Principal only | Allowance for | |||||

|---|---|---|---|---|---|---|---|

| Loans In-study |

Loans in Repayment |

Defaulted Loans | Total | Bad Debt Principal | Bad Debt Interest | RAP - Principal | |

| ($ million) | ($ million) | ||||||

| 2020 | 8,201 | 11,638 | 2,213 | 22,052 | 2,810 | 238 | 1,717 |

| 2021 | 8,664 | 11,658 | 2,241 | 22,563 | 2,938 | 213 | 2,202 |

| 2022 | 8,013 | 11,468 | 2,558 | 22,038 | 2,998 | 189 | 2,198 |

| 2023 | 7,878 | 11,166 | 2,546 | 21,590 | 2,964 | 145 | 2,179 |

| 2024 | 8,634 | 10,927 | 2,545 | 22,106 | 3,010 | 144 | 2,218 |

| 2025 | 9,188 | 10,982 | 2,535 | 22,705 | 3,058 | 147 | 2,260 |

| 2026 | 9,619 | 11,162 | 2,541 | 23,322 | 3,113 | 156 | 2,311 |

| 2027 | 9,926 | 11,424 | 2,561 | 23,911 | 3,172 | 168 | 2,361 |

| 2028 | 10,119 | 11,767 | 2,553 | 24,440 | 3,194 | 175 | 2,416 |

| 2029 | 10,256 | 12,105 | 2,540 | 24,900 | 3,201 | 179 | 2,458 |

| 2030 | 10,363 | 12,409 | 2,562 | 25,334 | 3,236 | 186 | 2,494 |

| 2031 | 10,432 | 12,682 | 2,594 | 25,708 | 3,274 | 194 | 2,530 |

| 2032 | 10,484 | 12,912 | 2,629 | 26,025 | 3,311 | 202 | 2,566 |

| 2033 | 10,516 | 13,114 | 2,661 | 26,292 | 3,343 | 210 | 2,599 |

| 2034 | 10,530 | 13,286 | 2,691 | 26,508 | 3,371 | 218 | 2,629 |

| 2035 | 10,531 | 13,425 | 2,722 | 26,677 | 3,396 | 225 | 2,656 |

| 2036 | 10,526 | 13,532 | 2,749 | 26,807 | 3,419 | 231 | 2,678 |

| 2037 | 10,527 | 13,617 | 2,773 | 26,917 | 3,439 | 235 | 2,698 |

| 2038 | 10,533 | 13,684 | 2,795 | 27,012 | 3,457 | 238 | 2,714 |

| 2039 | 10,543 | 13,737 | 2,817 | 27,097 | 3,477 | 241 | 2,726 |

| 2040 | 10,559 | 13,780 | 2,840 | 27,180 | 3,498 | 244 | 2,736 |

| 2041 | 10,581 | 13,818 | 2,861 | 27,260 | 3,518 | 246 | 2,745 |

| 2042 | 10,609 | 13,854 | 2,881 | 27,344 | 3,538 | 249 | 2,753 |

| 2043 | 10,642 | 13,892 | 2,898 | 27,432 | 3,556 | 251 | 2,761 |

| 2044 | 10,675 | 13,932 | 2,914 | 27,521 | 3,573 | 252 | 2,769 |

| 2045 | 10,707 | 13,975 | 2,935 | 27,617 | 3,595 | 255 | 2,777 |

|

|||||||

2.4.3 Limit on the Aggregate Amount of Outstanding Loans

The Canada Student Financial Assistance Regulations (CSFAR) imposes a limit on the aggregate amount of outstanding loans in the program. The limit was increased from $24 billion to $34 billion in June 2019.

Table 14 presents the projection of the aggregate amount of outstanding loans. It is the sum of :

- Total principal amount of direct loans in study, in repayment and in default;

- Total principal amount of defaulted risk-shared loans returnedFootnote 10 to the Government from financial institutions.

In comparison with Table 8 and Table 9 , which show the projection of the loan portfolio at the end of loan years, Table 14 presents the estimated peak of the portfolio during the loan year. Monthly fluctuations throughout the year cause the aggregate amount of loans to be lower both at the beginning and at the end of the loan year. The peak occurs in the middle of the loan year and is 3% to 5% higher than the aggregate amount at the end of the loan year. Table 9 shows an aggregate amount of outstanding direct loans of $22.1 billion as at 31 July 2020. Table 14 shows that the aggregate amount of outstanding direct loans reached $22.3 billion in January 2020 and $23.9 billion in January 2021.

The projection shows that the $34 billion limit is expected to be reached during the 2032‑2033 loan year if the program's provisions don't change and assumptions materialize.

| Loan Year | Estimated Peak During the Loan Year (January) | Total ($ million) |

|

|---|---|---|---|

| Direct Loans ($ million) |

Risk‑Shared Loans ($ million) |

||

| 2019‑2020 | 22,293 | 35 | 22,328 |

| 2020‑2021 | 23,830 | 31 | 23,861 |

| 2021‑2022 | 23,985 | 28 | 24,013 |

| 2022‑2023 | 24,005 | 24 | 24,029 |

| 2023‑2024 | 24,774 | 21 | 24,795 |

| 2024‑2025 | 25,857 | 19 | 25,876 |

| 2025‑2026 | 27,017 | 16 | 27,033 |

| 2026‑2027 | 28,186 | 14 | 28,200 |

| 2027‑2028 | 29,357 | 11 | 29,368 |

| 2028‑2029 | 30,462 | 8 | 30,470 |

| 2029‑2030 | 31,502 | 5 | 31,507 |

| 2030‑2031 | 32,521 | 2 | 32,523 |

| 2031‑2032 | 33,485 | 0 | 33,485 |

| 2032‑2033 | 34,395 | - | 34,395 |

| 2033‑2034 | 35,252 | - | 35,252 |

| 2034‑2035 | 36,050 | - | 36,050 |

| 2035‑2036 | 36,804 | - | 36,804 |

| 2036‑2037 | 37,531 | - | 37,531 |

| 2037‑2038 | 38,239 | - | 38,239 |

| 2038‑2039 | 38,932 | - | 38,932 |

| 2039‑2040 | 39,622 | - | 39,622 |

| 2040‑2041 | 40,315 | - | 40,315 |

| 2041‑2042 | 41,014 | - | 41,014 |

| 2042‑2043 | 41,722 | - | 41,722 |

| 2043‑2044 | 42,436 | - | 42,436 |

| 2044‑2045 | 43,155 | - | 43,155 |

2.5 Projection of the Net Cost of the Program

2.5.1 Student Related Expenses

The primary expense of the CSFA Program is the cost of supporting students during their study and repayment periods. The student related expenses are presented in Table 15.

| Loan Year | Direct Loan | Risk-Shared and Guaranteed Loans | Canada Student Grants | Total | |||

|---|---|---|---|---|---|---|---|

| Interest Subsidy | RAP - InterestTable Footnote 1 | Provision RAP - Principal | Interest SubsidyTable Footnote 2 | RAP - Interest and Principal | |||

| ($ million) | ($ million) | ($ million) | ($ million) | ||||

| 2019‑2020 | 94.0 | 124.3 | 205.3 | 0.0 | 2.8 | 1,634.8 | 2,061.2 |

| 2020‑2021 | 101.7 Table Footnote 3 | 48.9 Table Footnote 4 | 669.2 | 0.0 | 2.9 | 3,205.5 Table Footnote 5 | 4,028.2 |

| 2021‑2022 | 153.7 | 0.0 Table Footnote 4 | 214.6 | 0.0 | 0.8 | 3,206.7 Table Footnote 5 | 3,575.8 |

| 2022‑2023 | 168.9 | 44.2 Table Footnote 4 | 219.9 | - | 1.5 | 3,219.4 Table Footnote 5 | 3,653.9 |

| 2023‑2024 | 213.1 | 147.8 | 279.9 | - | 2.5 | 1,595.8 | 2,239.1 |

| 2024‑2025 | 263.8 | 164.1 | 287.2 | - | 1.7 | 1,609.0 | 2,325.8 |

| 2025‑2026 | 304.5 | 179.2 | 301.6 | - | 1.1 | 1,627.4 | 2,413.8 |

| 2026‑2027 | 332.7 | 191.1 | 311.6 | - | 0.7 | 1,636.1 | 2,472.2 |

| 2027‑2028 | 370.9 | 204.6 | 326.7 | - | 0.5 | 1,648.8 | 2,551.5 |

| 2028‑2029 | 395.7 | 218.7 | 319.6 | - | 0.3 | 1,661.4 | 2,595.7 |

| 2029‑2030 | 433.1 | 233.2 | 317.0 | - | 0.2 | 1,671.8 | 2,655.3 |

| 2030‑2031 | 457.2 | 248.0 | 324.9 | - | 0.1 | 1,682.9 | 2,713.1 |

| 2031‑2032 | 480.9 | 262.9 | 331.7 | - | 0.0 | 1,693.9 | 2,769.4 |

| 2032‑2033 | 504.4 | 277.8 | 337.4 | - | 0.0 | 1,702.4 | 2,822.0 |

| 2033‑2034 | 527.6 | 292.5 | 342.9 | - | 0.0 | 1,709.1 | 2,872.1 |

| 2034‑2035 | 536.1 | 300.1 | 347.1 | - | - | 1,715.0 | 2,898.3 |

| 2035‑2036 | 544.2 | 307.1 | 351.4 | - | - | 1,723.2 | 2,925.9 |

| 2036‑2037 | 552.5 | 313.8 | 356.9 | - | - | 1,738.2 | 2,961.4 |

| 2037‑2038 | 561.1 | 320.1 | 362.7 | - | - | 1,752.8 | 2,996.7 |

| 2038‑2039 | 569.9 | 326.2 | 368.7 | - | - | 1,768.6 | 3,033.4 |

| 2039‑2040 | 579.0 | 332.0 | 374.8 | - | - | 1,786.1 | 3,071.9 |

| 2040‑2041 | 588.5 | 337.7 | 381.2 | - | - | 1,805.6 | 3,113.0 |

| 2041‑2042 | 598.3 | 343.4 | 387.8 | - | - | 1,826.8 | 3,156.3 |

| 2042‑2043 | 608.5 | 349.1 | 394.5 | - | - | 1,849.3 | 3,201.4 |

| 2043‑2044 | 618.8 | 354.9 | 401.1 | - | - | 1,871.1 | 3,245.9 |

| 2044‑2045 | 629.1 | 360.8 | 407.5 | - | - | 1,893.4 | 3,290.8 |

Table 15 Footnotes

|

|||||||

In the 2019‑2020 loan year, a total of $1,635 million of CSGs were disbursed. It is projected to increase to approximately $3,200 million from 2020‑2021 and 2022‑2023 due to measures announced. Monthly grant amounts are set in the Canada Student Financial Assistance Regulations and are assumed to remain constant for the remaining projection period for the purpose of this evaluation.

2.5.2 Program Risk Expenses

Another expense for the Government corresponds to the risk that loans will never be repaid. This includes the risk of loan default and the risk of loans being forgiven upon a student's death or severe permanent disability. Loans forgiven for family physicians and nurses practicing in under-served rural or remote communities are also included in Table 16 below.

| Loan Year | Direct Loan | Risk-Shared | Guaranteed | Loans Forgiven |

Total | |

|---|---|---|---|---|---|---|

| Provision for Bad Debt | Risk Premium, Put-Backs & Refunds to FIs | Claims for Defaulted Loans | ||||

| Principal | Interest | |||||

| ($ million) | ($ million) | ($ million) | ($ million) | ($ million) | ||

| 2019‑2020 | 217.0 | 33.7 | 0.7 | 0.4 | 38.3 | 290.1 |

| 2020‑2021 | 319.9 | 18.2 | 0.7 | 0.0 | 42.7 | 381.5 |

| 2021‑2022 | 208.0 | 0.7 | 0.6 | 0.0 | 42.7 | 252.0 |

| 2022‑2023 | 213.2 | 8.6 | 0.6 | 0.0 | 40.6 | 263.0 |

| 2023‑2024 | 271.3 | 31.3 | 0.5 | 0.0 | 41.0 | 344.1 |

| 2024‑2025 | 278.1 | 36.3 | 0.4 | 0.0 | 41.8 | 356.6 |

| 2025‑2026 | 285.8 | 40.7 | 0.3 | - | 42.5 | 369.3 |

| 2026‑2027 | 291.9 | 44.3 | 0.3 | - | 43.5 | 380.0 |

| 2027‑2028 | 298.5 | 45.4 | 0.2 | - | 44.5 | 388.6 |

| 2028‑2029 | 305.0 | 47.1 | 0.2 | - | 45.7 | 398.0 |

| 2029‑2030 | 310.9 | 49.9 | 0.1 | - | 46.9 | 407.8 |

| 2030‑2031 | 316.7 | 53.0 | - | - | 48.0 | 417.8 |

| 2031‑2032 | 322.2 | 56.3 | - | - | 49.1 | 427.6 |

| 2032‑2033 | 327.1 | 59.4 | - | - | 50.1 | 436.6 |

| 2033‑2034 | 331.4 | 62.5 | - | - | 51.1 | 445.0 |

| 2034‑2035 | 335.6 | 64.1 | - | - | 52.1 | 451.8 |

| 2035‑2036 | 340.1 | 65.5 | - | - | 53.0 | 458.6 |

| 2036‑2037 | 345.7 | 66.9 | - | - | 53.9 | 466.5 |

| 2037‑2038 | 351.2 | 68.3 | - | - | 54.7 | 474.2 |

| 2038‑2039 | 356.9 | 69.6 | - | - | 55.5 | 482.0 |

| 2039‑2040 | 362.9 | 70.9 | - | - | 56.2 | 490.0 |

| 2040‑2041 | 369.2 | 72.4 | - | - | 57.0 | 498.6 |

| 2041‑2042 | 375.7 | 73.8 | - | - | 57.7 | 507.2 |

| 2042‑2043 | 382.2 | 75.2 | - | - | 58.5 | 515.9 |

| 2043‑2044 | 388.6 | 76.6 | - | - | 59.3 | 524.5 |

| 2044‑2045 | 394.9 | 78.0 | - | - | 60.1 | 533.0 |

Details on the risks to the Government are provided below:

| Direct Loans | Provision for bad debts (principal and interest): Cost of the default risk assumed by the Government in directly disbursing loans to students. |

|---|---|

| Risk-Shared | Risk premium: Amount paid to lending institutions by the Government based on the value of loans consolidating in a year. |

Put-backs and Refunds to financial institutions:

|

|

| Guaranteed | Claims for defaulted loans: the Government bears the entire risk of defaulted loans. |

| Loans Forgiven | Due to death: during the period of study, repayment or after the loan has defaulted. |

| Due to severe permanent disability: As of August 2009, limited to borrowers who, due to their severe permanent disability, are unable to pay their loans and will never be able to repay them. | |

| For doctors and nurses: Portion of loans for family physicians and nurses who practice in under-served rural or remote communities. |

2.5.3 Other Expenses

Alternative payments are made directly to Quebec, the Northwest Territories, and Nunavut, as they do not participate in the CSFA Program. The calculation of alternative payments is based on expenses and revenues for a given loan year and the payment is accounted for in the following loan year.

COVID-19 Pandemic

The alternative payments for loan years 2021‑2022 to 2023‑2024 are significantly higher compared to the prior year mostly due to the doubling of grants as the results of COVID-19 measures implemented to help students.

The administrative expenses include fees paid to the participating provinces and to the Yukon Territory as well as general administrative fees. Fees are paid to the participating provinces and to the Yukon Territory to administer certain aspects of the CSFA Program. Budget 2019 announced increased compensation to participating provinces and territory by $4.0 million per year, starting in 2019‑2020, to compensate for the partner's costs stemming from Budget 2019's proposed changes. The general administrative fees represent the expenses incurred by the departments involved and fees paid to the National Student Loans Service Centre (NSLSC), which is responsible for the administration of student loans and grants. The NSLSC is run by a private entity contracted by the Government. The short-term projection of the administrative fees were provided by ESDC. All collection activities on defaulted loans are fulfilled by CRA and a cost is included in the projected general administrative fees for this purpose.

As shown in Table 17, total expenses associated with the program increase from $3.0 billion in 2019‑2020 to $5.1 billion in 2044‑2045. On average, total expenses are projected to increase at an annual rate of 2.2%.

| Loan Year | Student Related Expenses | Risks to the Government | Alternative PaymentsTable Footnote 1 | Administrative Expenses | Total Expenses |

|

|---|---|---|---|---|---|---|

| Fees Paid to Provinces | General | |||||

| ($ million) | ($ million) | ($ million) | ($ million) | ($ million) | ||

| 2019‑2020 | 2,061.2 | 290.1 | 492.3 | 34.7 | 92.1 | 2,970.4 |

| 2020‑2021 | 4,028.2 | 381.5 | 487.2 | 36.5 | 92.1 | 5,025.5 |

| 2021‑2022 | 3,575.8 | 252.0 | 967.7 | 36.8 | 106.8 | 4,939.1 |

| 2022‑2023 | 3,653.9 | 263.0 | 1,084.6 | 37.1 | 117.9 | 5,156.5 |

| 2023‑2024 | 2,239.1 | 344.1 | 1,028.0 | 37.5 | 118.6 | 3,767.3 |

| 2024‑2025 | 2,325.8 | 356.6 | 600.3 | 38.4 | 120.0 | 3,441.1 |

| 2025‑2026 | 2,413.8 | 369.3 | 628.1 | 39.6 | 126.1 | 3,576.9 |

| 2026‑2027 | 2,472.2 | 380.0 | 661.0 | 40.8 | 136.6 | 3,690.6 |

| 2027‑2028 | 2,551.5 | 388.6 | 689.1 | 42.0 | 140.8 | 3,812.0 |

| 2028‑2029 | 2,595.7 | 398.0 | 725.6 | 43.3 | 145.0 | 3,907.6 |

| 2029‑2030 | 2,655.3 | 407.8 | 755.3 | 44.6 | 149.4 | 4,012.4 |

| 2030‑2031 | 2,713.1 | 417.8 | 792.1 | 45.9 | 153.9 | 4,122.8 |

| 2031‑2032 | 2,769.4 | 427.6 | 818.5 | 47.3 | 158.6 | 4,221.4 |

| 2032‑2033 | 2,822.0 | 436.6 | 843.2 | 48.7 | 163.3 | 4,313.8 |

| 2033‑2034 | 2,872.1 | 445.0 | 864.9 | 50.2 | 168.3 | 4,400.5 |

| 2034‑2035 | 2,898.3 | 451.8 | 883.7 | 51.7 | 173.4 | 4,458.9 |

| 2035‑2036 | 2,925.9 | 458.6 | 892.4 | 53.3 | 178.6 | 4,508.8 |

| 2036‑2037 | 2,961.4 | 466.5 | 897.9 | 54.9 | 184.0 | 4,564.7 |

| 2037‑2038 | 2,996.7 | 474.2 | 902.0 | 56.5 | 189.5 | 4,618.9 |

| 2038‑2039 | 3,033.4 | 482.0 | 907.7 | 58.3 | 195.3 | 4,676.7 |

| 2039‑2040 | 3,071.9 | 490.0 | 910.9 | 60.0 | 201.2 | 4,734.0 |

| 2040‑2041 | 3,113.0 | 498.6 | 913.0 | 61.8 | 207.2 | 4,793.6 |

| 2041‑2042 | 3,156.3 | 507.2 | 915.4 | 63.7 | 213.5 | 4,856.1 |

| 2042‑2043 | 3,201.4 | 515.9 | 918.4 | 65.6 | 219.9 | 4,921.2 |

| 2043‑2044 | 3,245.9 | 524.5 | 924.1 | 67.6 | 226.6 | 4,988.7 |

| 2044‑2045 | 3,290.8 | 533.0 | 930.8 | 69.6 | 233.4 | 5,057.6 |

Table 17 Footnotes

|

||||||

2.5.4 Total Revenue

Interest revenues from the direct loan regime (shown in Table 18 ) include:

- Interest earned from student loans in repayment;

- Interest accrued on defaulted loans; and

- Interest portion of the RAP.

These interest revenues are net of interest on loans forgiven. They are also reduced by the Government's cost of borrowing for loans in repayment and in default (only for the interest accrued expected to be recovered). The difference results in net interest revenues. It is worth noting that the interest on defaulted direct loans is accrued until the status of the loans becomes "non-recoverable".

Under the guaranteed and risk-shared regimes, revenues mainly come from recoveries of principal and interest from defaulted loans owned by the Government. A small portion of revenues are coming from good-standing loans in repayment that were bought back from financial institutions in loan year 2020‑2021.

Total revenues are projected to decrease at an average rate of 2.1% per year over the remaining 25 years of the projection.

| Loan Year | Direct Loan | Risk-SharedTable Footnote 1 | Guaranteed | Total Revenues | ||

|---|---|---|---|---|---|---|

| Interest Revenues | Borrowing Cost | Net Interest Revenues | Principal and Interest from Recovery | Principal and Interest from Recovery | ||

| ($ million) | ($ million) | ($ million) | ($ million) | ($ million) | ||

| 2019‑2020 | 483.1 Table Footnote 2 | -129.8 | 353.3 | 2.3 | 3.7 | 359.3 |

| 2020‑2021 | 188.3 Table Footnote 3,Table Footnote 4 | -149.1 | 39.2 | 2.9 | 3.0 | 45.1 |

| 2021‑2022 | 0.0 Table Footnote 4 | -241.6 | -241.6 | 2.5 | 1.6 | -237.5 |

| 2022‑2023 | 126.7 Table Footnote 4 | -300.3 | -173.6 | 2.2 | 1.1 | -170.3 |

| 2023‑2024 | 421.5 | -284.6 | 136.9 | 2.0 | 0.4 | 139.3 |

| 2024‑2025 | 470.3 | -327.7 | 142.7 | 1.8 | 0.2 | 144.7 |

| 2025‑2026 | 513.3 | -364.4 | 148.9 | 1.5 | 0.0 | 150.4 |

| 2026‑2027 | 547.4 | -392.2 | 155.2 | 1.3 | 0.0 | 156.5 |

| 2027‑2028 | 584.2 | -437.7 | 146.5 | 1.1 | 0.0 | 147.6 |

| 2028‑2029 | 624.7 | -472.3 | 152.4 | 0.8 | - | 153.2 |

| 2029‑2030 | 666.2 | -524.2 | 142.0 | 0.6 | - | 142.6 |

| 2030‑2031 | 711.9 | -561.4 | 150.5 | 0.3 | - | 150.8 |

| 2031‑2032 | 755.1 | -598.6 | 156.5 | 0.0 | - | 156.5 |

| 2032‑2033 | 799.5 | -636.1 | 163.4 | - | - | 163.4 |

| 2033‑2034 | 843.5 | -673.5 | 170.0 | - | - | 170.0 |

| 2034‑2035 | 866.6 | -692.0 | 174.6 | - | - | 174.6 |

| 2035‑2036 | 887.9 | -709.0 | 178.9 | - | - | 178.9 |

| 2036‑2037 | 907.9 | -724.9 | 183.0 | - | - | 183.0 |

| 2037‑2038 | 926.8 | -739.9 | 186.9 | - | - | 186.9 |

| 2038‑2039 | 945.0 | -754.3 | 190.7 | - | - | 190.7 |

| 2039‑2040 | 962.6 | -768.1 | 194.5 | - | - | 194.5 |

| 2040‑2041 | 979.4 | -781.6 | 197.8 | - | - | 197.8 |

| 2041‑2042 | 996.8 | -795.0 | 201.8 | - | - | 201.8 |

| 2042‑2043 | 1,014.0 | -808.5 | 205.4 | - | - | 205.4 |

| 2043‑2044 | 1,031.2 | -822.2 | 209.0 | - | - | 209.0 |

| 2044‑2045 | 1,048.7 | -836.0 | 212.7 | - | - | 212.7 |

Table 18 Footnotes

|

||||||

2.5.5 Net Cost of the Program

Table 19 shows projected total expenses, total revenues, and the total net cost of the program in current dollars for the 25-year projection period, while Table 20 shows the same information expressed in 2020 constant dollars. The expenses and revenues shown correspond to values presented earlier in this report.

| Loan Year | All Regimes | Net Cost of the Program | ||||

|---|---|---|---|---|---|---|

| Total Expenses | Total Revenues | Total Net Cost of the Program |

Changes | Direct Loan | Risk-Shared & Guaranteed | |

| ($ million) | ($ million) | (%) | ($ million) | |||

| 2019‑2020 | 2,970.4 | 359.3 | 2,611.1 | 2,612.3 | -1.3 | |

| 2020‑2021 | 5,025.5 | 45.1 | 4,980.4 | 90.7% | 4,982.3 | -1.8 |

| 2021‑2022 | 4,939.1 | -237.5 | 5,176.6 | 3.9% | 5,179.0 | -2.3 |

| 2022‑2023 | 5,156.5 | -170.3 | 5,326.8 | 2.9% | 5,327.6 | -1.1 |

| 2023‑2024 | 3,767.3 | 139.3 | 3,628.0 | -31.9% | 3,627.2 | 0.7 |

| 2024‑2025 | 3,441.1 | 144.7 | 3,296.4 | -9.1% | 3,296.2 | 0.2 |

| 2025‑2026 | 3,576.9 | 150.4 | 3,426.5 | 3.9% | 3,426.5 | 0.0 |

| 2026‑2027 | 3,690.6 | 156.5 | 3,534.1 | 3.1% | 3,534.4 | -0.3 |

| 2027‑2028 | 3,812.0 | 147.6 | 3,664.4 | 3.7% | 3,664.8 | -0.4 |

| 2028‑2029 | 3,907.6 | 153.2 | 3,754.4 | 2.5% | 3,754.8 | -0.4 |

| 2029‑2030 | 4,012.4 | 142.6 | 3,869.8 | 3.1% | 3,870.0 | -0.3 |

| 2030‑2031 | 4,122.8 | 150.8 | 3,972.0 | 2.6% | 3,972.1 | -0.1 |

| 2031‑2032 | 4,221.4 | 156.5 | 4,064.9 | 2.3% | 4,064.9 | 0.0 |

| 2032‑2033 | 4,313.8 | 163.4 | 4,150.4 | 2.1% | 4,150.4 | 0.0 |

| 2033‑2034 | 4,400.5 | 170.0 | 4,230.5 | 1.9% | 4,230.5 | 0.0 |

| 2034‑2035 | 4,458.9 | 174.6 | 4,284.3 | 1.3% | 4,284.2 | 0.0 |

| 2035‑2036 | 4,508.8 | 178.9 | 4,329.9 | 1.1% | 4,329.9 | - |

| 2036‑2037 | 4,564.7 | 183.0 | 4,381.7 | 1.2% | 4,381.6 | - |

| 2037‑2038 | 4,618.9 | 186.9 | 4,432.0 | 1.1% | 4,432.0 | - |

| 2038‑2039 | 4,676.7 | 190.7 | 4,486.0 | 1.2% | 4,485.8 | - |

| 2039‑2040 | 4,734.0 | 194.5 | 4,539.5 | 1.2% | 4,539.6 | - |

| 2040‑2041 | 4,793.6 | 197.8 | 4,595.8 | 1.2% | 4,595.9 | - |

| 2041‑2042 | 4,856.1 | 201.8 | 4,654.3 | 1.3% | 4,654.4 | - |

| 2042‑2043 | 4,921.2 | 205.4 | 4,715.8 | 1.3% | 4,715.9 | - |

| 2043‑2044 | 4,988.7 | 209.0 | 4,779.7 | 1.4% | 4,779.6 | - |

| 2044‑2045 | 5,057.6 | 212.7 | 4,844.9 | 1.4% | 4,845.0 | - |

As shown in Table 19 , the initial net annual cost for the direct loan regime is $2.6 billion for the 2019‑2020 loan year and is projected to increase to $4.8 billion in the 2044‑2045 loan year. This represents an annual average increase of 2.5% over the entire projection period.

It is important to specify that this net cost includes the amount of CSGs disbursed. The amount of grants disbursed is $1,635 million in 2019‑2020, representing 63% of the net cost in that loan year. It increases from 2020‑2021 to 2022‑2023 due to the doubling of the CSGs announced by the Government in response to COVID-19. Moreover, the net cost also includes yearly expenses to account for provisions that recognize in advance the risk of future losses associated with student loans.

In 2020 constant dollars (Table 20 ), the cost of the direct loan regime increases on average by 0.86% per year, from $2.6 billion at the beginning of the projection period to $3.2 billion at the end of it.

| Loan Year | All Regimes | Net Cost of the Program | |||

|---|---|---|---|---|---|

| Total Expenses | Total Revenues | Total Net Cost of the Program |

Direct Loan | Risk-Shared & Guaranteed | |

| ($ million) | ($ million) | ($ million) | |||

| 2019‑2020 | 2,970.4 | 359.3 | 2,611.1 | 2,612.3 | -1.3 |

| 2020‑2021 | 4,947.6 | 44.4 | 4,903.2 | 4,905.1 | -1.8 |

| 2021‑2022 | 4,768.6 | -229.3 | 4,997.9 | 5,000.2 | -2.2 |

| 2022‑2023 | 4,884.2 | -161.3 | 5,045.5 | 5,046.3 | -1.0 |

| 2023‑2024 | 3,502.0 | 129.5 | 3,372.5 | 3,371.8 | 0.7 |

| 2024‑2025 | 3,140.4 | 132.1 | 3,008.4 | 3,008.2 | 0.2 |

| 2025‑2026 | 3,205.8 | 134.8 | 3,071.0 | 3,071.0 | 0.0 |

| 2026‑2027 | 3,249.5 | 137.8 | 3,111.7 | 3,112.0 | -0.3 |

| 2027‑2028 | 3,298.3 | 127.7 | 3,170.6 | 3,170.9 | -0.3 |

| 2028‑2029 | 3,323.5 | 130.3 | 3,193.2 | 3,193.5 | -0.3 |

| 2029‑2030 | 3,355.6 | 119.3 | 3,236.3 | 3,236.5 | -0.3 |

| 2030‑2031 | 3,391.2 | 124.0 | 3,267.1 | 3,267.2 | -0.1 |

| 2031‑2032 | 3,416.1 | 126.6 | 3,289.4 | 3,289.4 | 0.0 |

| 2032‑2033 | 3,435.2 | 130.1 | 3,305.1 | 3,305.1 | 0.0 |

| 2033‑2034 | 3,449.3 | 133.3 | 3,316.1 | 3,316.1 | 0.0 |

| 2034‑2035 | 3,441.2 | 134.7 | 3,306.4 | 3,306.4 | 0.0 |

| 2035‑2036 | 3,426.8 | 136.0 | 3,290.8 | 3,290.8 | 0.0 |

| 2036‑2037 | 3,417.3 | 137.0 | 3,280.3 | 3,280.3 | - |

| 2037‑2038 | 3,406.9 | 137.9 | 3,269.0 | 3,269.0 | - |

| 2038‑2039 | 3,399.4 | 138.6 | 3,260.8 | 3,260.6 | - |

| 2039‑2040 | 3,391.7 | 139.4 | 3,252.4 | 3,252.4 | - |

| 2040‑2041 | 3,385.9 | 139.7 | 3,246.2 | 3,246.3 | - |

| 2041‑2042 | 3,382.3 | 140.6 | 3,241.7 | 3,241.8 | - |

| 2042‑2043 | 3,380.5 | 141.1 | 3,239.4 | 3,239.5 | - |

| 2043‑2044 | 3,380.5 | 141.6 | 3,238.8 | 3,238.8 | - |

| 2044‑2045 | 3,381.3 | 142.2 | 3,239.1 | 3,239.2 | - |

Table 20 Footnotes

|

|||||

3 Conclusion