Chapter 3: OSFI’s legislated reporting requirements

We have various legislated reporting expectations set out in the OSFI Act, the Bank Act, the Insurance Companies Act, the Trust and Loan Companies Act, the Cooperative Credit Associations Act, the Pension Benefits Standards Act, 1985 (PBSA) and the Pooled Registered Pension Plans Act (PRPP Act).

Disclosure Footnote 1

As the regulator for financial institutions, we are responsible for establishing the expectations for operating within Canada’s financial industry. To promote active disclosure, we routinely publish financial information and provide advice to guide disclosures by financial institutions that we regulate.

Notable actions we took to strengthen disclosure in our financial services industry in 2024-2025 include the following:

-

We released Crypto-asset disclosures for banks (Domestically systematically important banks and Small and Medium-Sized Deposit-Taking Institutions) in August 2024, and consulted stakeholders for feedback.

-

To address climate change and the global response on the safety and soundness of financial institutions and the financial system, we updated our disclosure requirements for financial institutions on B-15: Climate Risk Management so they remain consistent with the Canadian Sustainability Standards Board’s final standards.

Approvals

The Bank Act, the Trust and Loan Companies Act, and the Insurance Companies Act require financial institutions to obtain regulatory approval from the Superintendent or the Minister of Finance before engaging in certain transactions. Additionally, individuals seeking to incorporate an institution, as well as foreign banks or insurers aiming to establish a presence or to make specific investments in Canada, must also secure regulatory approval.

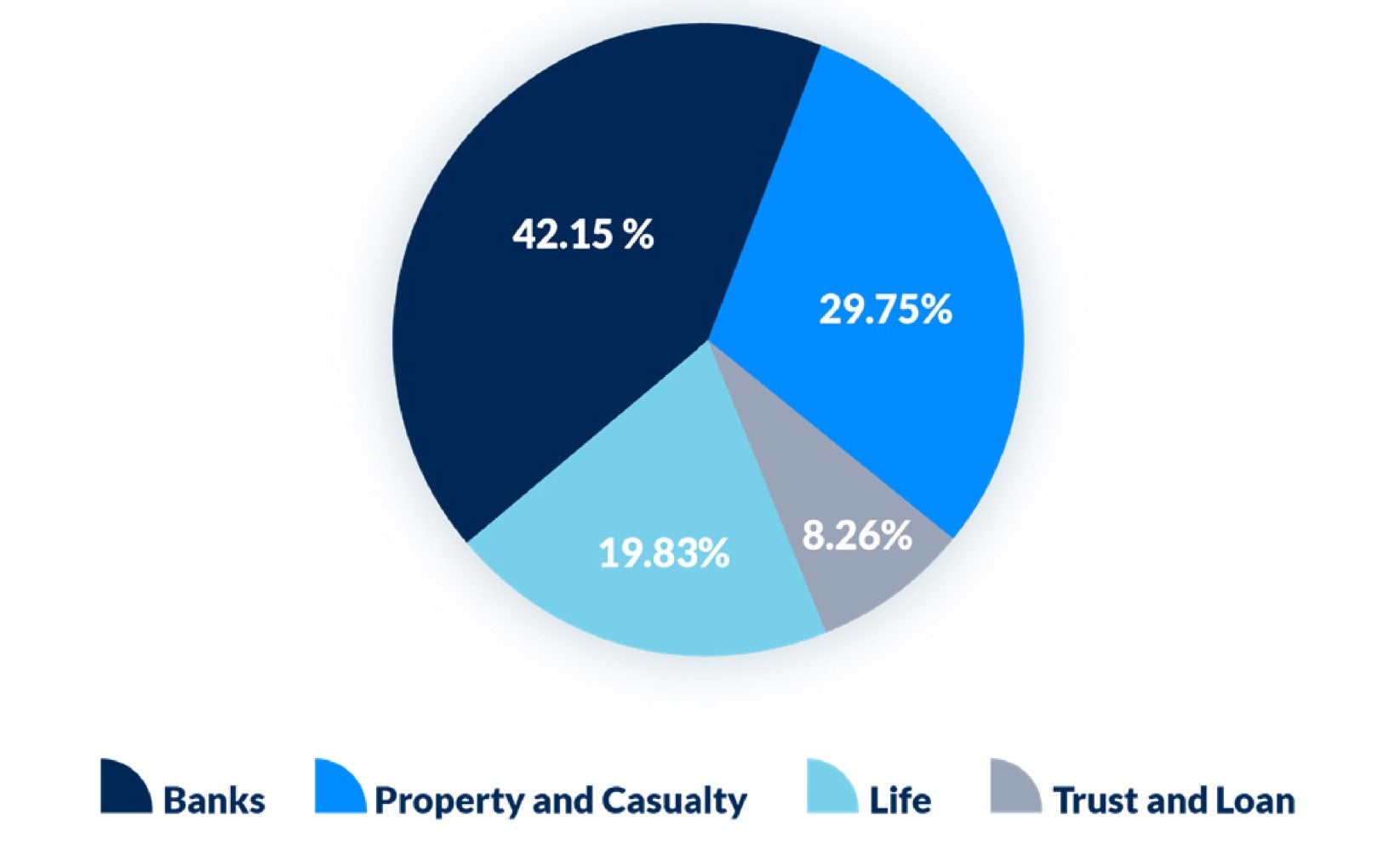

For the 2024-25 fiscal year, there were 241 approval requests granted. Of these, 82 requests were approved by the Minister and 159 were approved by the Superintendent.

Figure 1 - text description

| Industry | % of approvals granted |

|---|---|

| Banks | 42.15 |

| Trust and Loan | 8.26 |

| Life | 19.83 |

| Property and Casualty | 29.75 |

Pension Benefits Standards Act, 1985

40 (1) The Superintendent shall, after consultation with the Chief Actuary of the Office of the Superintendent of Financial Institutions and as soon as possible after the end of each fiscal year, submit to the Minister a report on (a) the operation of this Act during that year; and (b) the success of pension plans in meeting the funding requirements, determined in accordance with section 9, and the corrective measures taken or directed to be taken to deal with any pension plans that are not meeting the funding requirements.

(2) The Minister shall cause the report to be tabled in each House of Parliament on any of the first 15 days on which that House is sitting after the day the Minister receives it.

(3) As soon as possible after the tabling of the report in Parliament, the Superintendent shall transmit the report to the relevant provincial ministers responsible for finance and provincial securities commissions.

| Indicators | Type | As at March 31, 2024 | As at March 31, 2025 |

|---|---|---|---|

| Number of Plans | Defined BenefitTable 2 Footnote 1 | 239 | 233 |

| CombinationTable 2 Footnote 2 | 115 | 120 | |

| Defined ContributionTable 2 Footnote 3 | 830 | 838 | |

| Total | 1,184 | 1,191 | |

| Active Membership | Defined Benefit | 166,200 | 164,904 |

| Combination | 378,400 | 387,486 | |

| Defined Contribution | 180,700 | 180,872 | |

| Total | 725,300 | 733,262 | |

| Other Beneficiaries | Defined Benefit | 230,100 | 228,305 |

| Combination | 314,500 | 323,277 | |

| Defined Contribution | 29,000 | 33,035 | |

| Total | 573,600 | 584,617 | |

| Assets ($ millions) | Defined Benefit | 104,044 | 107,809 |

| Combination | 130,456 | 144,161 | |

| Defined Contribution | 11,227 | 13,695 | |

| Total | 245,727 | 265,665 | |

|

Table 2 Footnotes

|

|||

Our supervisory activities for pension plans—including assessing compliance with minimum funding requirements and relevant legislative and supervisory requirements—enhance transparency and bolster confidence in Canada’s retirement income system and its long-term sustainability. We prioritize protecting members’ benefits by clearly communicating our expectations directly to plan administrators and employers, and, if necessary, exercising our enforcement powers to ensure compliance with legislative requirements.

We develop guidance on risk management and mitigation, assess whether pension plans are meeting their funding requirements and managing risks effectively, and intervene promptly when corrective action is necessary. Ultimately, pension plan administrators bear the responsibility for the sound and prudent management of their pension plans.

Interventions

In 2024-25, 324 pension plans failed to meet the minimum funding requirements under the PBSA due to either insufficient negotiated contributions or contributions remained outstanding for over 30 days. We issued letters to employers who did not remit contributions on time, reminding them of their obligation to make the required contributions. In five cases, despite these efforts, contributions remained unpaid for an extended period. We intervened by issuing a notice of intent to issue a direction of compliance or an actual direction of compliance. Following these interventions, three pension plans have fully remitted their outstanding contributions along with interest, while we continue to work closely with the other two pension plans to ensure they meet the minimum funding requirements.

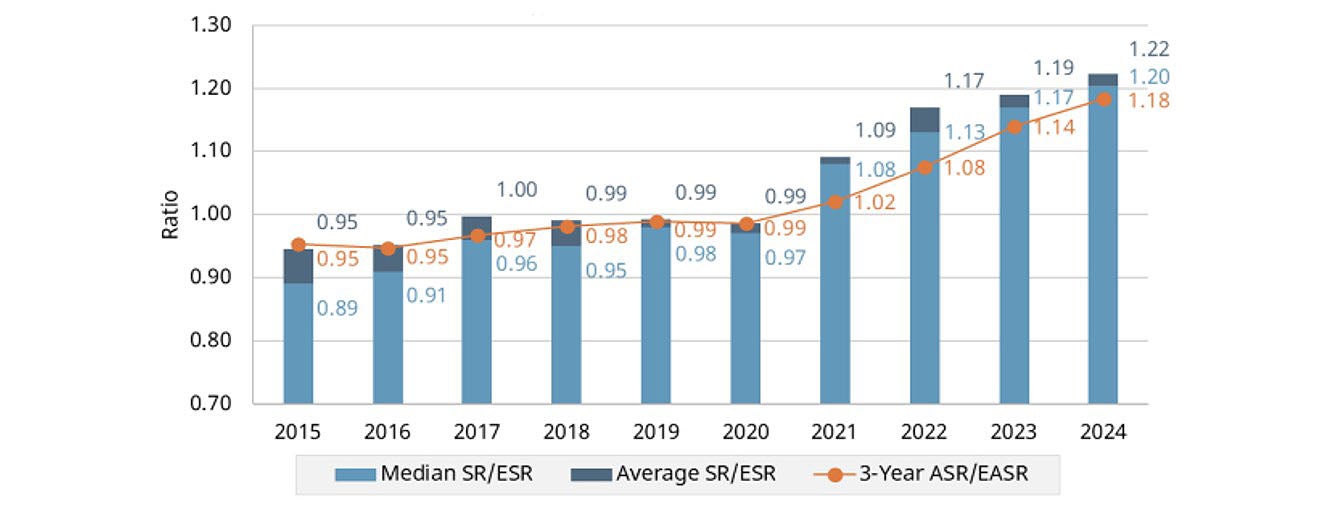

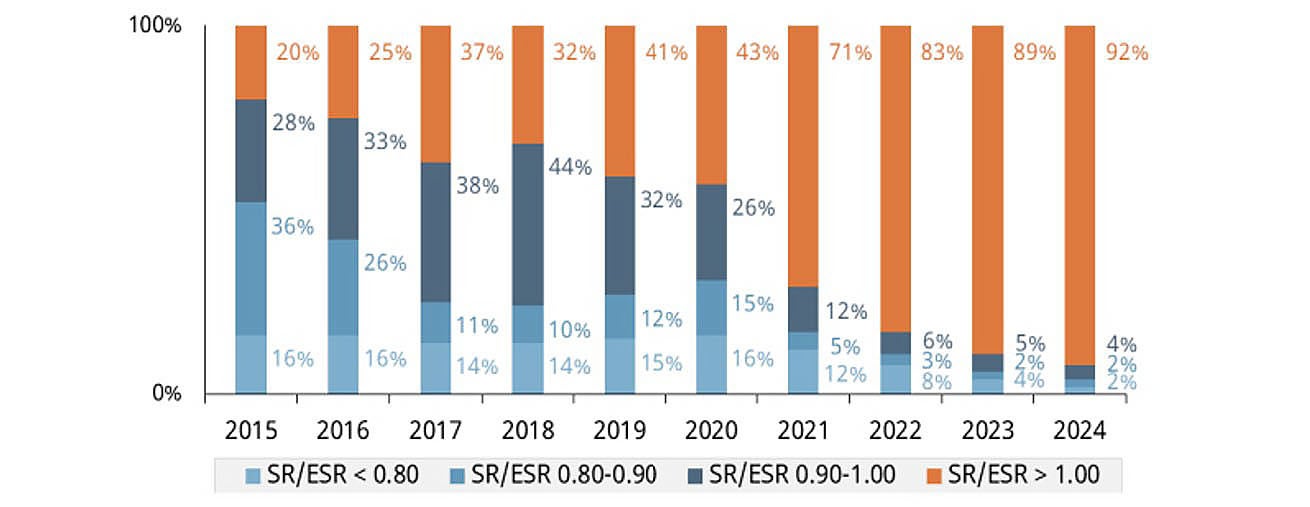

At the end of 2024, the median solvency ratio of pension plans increased to 1.20, compared 1.17 in 2023. Figure 2 below shows the evolution of the solvency position since 2015. As of December 31, 2024, 92% of pension plans with defined benefit provisions are fully funded on a solvency basis. There was a reduction in the percentage of underfunded plans (8% in 2024 versus 11% in 2023). All significantly underfunded plans are designated plans, for which funding is limited by the Income Tax Regulations. The graph “Distribution in % of the Solvency Ratio” illustrates the distribution of the solvency ratios as at December 31 of each year since 2015.

Figure 2 - text description

| December 31 (Year) | Average SR/ESR | Median SR/ESR | 3-Year ASR/EASR |

|---|---|---|---|

| 2015 | 0.95 | 0.89 | 0.95 |

| 2016 | 0.95 | 0.91 | 0.95 |

| 2017 | 1.00 | 0.96 | 0.97 |

| 2018 | 0.99 | 0.95 | 0.98 |

| 2019 | 0.99 | 0.98 | 0.99 |

| 2020 | 0.99 | 0.97 | 0.99 |

| 2021 | 1.09 | 1.08 | 1.02 |

| 2022 | 1.17 | 1.13 | 1.08 |

| 2023 | 1.19 | 1.17 | 1.14 |

| 2024 | 1.22 | 1.20 | 1.18 |

Figure 3 - text description

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|---|---|---|---|

| SR/ESR < 0.80 | 16% | 16% | 14% | 14% | 15% | 16% | 12% | 8% | 4% | 2% |

| SR/ESR 0.80-0.90 | 36% | 26% | 11% | 10% | 12% | 15% | 5% | 3% | 2% | 2% |

| SR/ESR 0.90-1.00 | 28% | 33% | 38% | 44% | 32% | 26% | 12% | 6% | 5% | 4% |

| SR/ESR > 1.00 | 20% | 25% | 37% | 32% | 41% | 43% | 71% | 83% | 89% | 92% |

Actuarial reports

In 2024-25, 216 actuarial reports were filed with us. In-depth reviews of selected reports prompted questions regarding certain actuarial assumptions and facilitated enforcement of compliance with relevant legislation and guidance. We communicated any issues identified during in-depth reviews to pension plan actuaries, especially when the concerns affect current or future funding requirements. As a result of our interventions, some pension plans amended their actuarial reports.

Reviews

During 2024-25, we completed a thematic review on investment risk management for seven pension plans. The findings and observations indicate that these pension plans have effective mechanisms in place to manage investment risks, appropriate governance structures overseeing their investment functions, and asset mixes that correspond with their plans’ demographics and liabilities. Our recommendations included completing a governance self-assessment, ensuring adherence to the Statement of Investment Policies and Procedures, and providing accurate data reporting in the Certified Financial Statements.

Pension plan approvals

Pension plans are required to obtain the approval of the Superintendent for various types of transactions, including registrations, terminations, asset transfers, surplus refunds, and accrued benefits reductions.

In 2024-25, we successfully:

-

Registered 23 new pension plans of which 16 were defined contribution plans.

-

Approved 10 plan termination reports.

-

Authorized one accrued benefit reduction for a designated plan.

In total, 44 pension plan transactions were submitted for approval in 2024-25, compared to 26 in the previous fiscal year. We processed 39 applications and successfully met our service standard for pension plan approvals.

Pension guidance and newsletters

During the fiscal year 2024-25 reporting period, we released two editions of our newsletter called InfoPensions in May and November 2024. These newsletters serve as a valuable communication tool, providing important announcements, reminders, and descriptions of how we apply pension legislation and its guidance.

We also published a Guide for the Administration of Negotiated Contribution Plans, reflecting changes made in spring 2024 to the legislative framework for these plans and setting our expectations regarding managing the funding limitations of these plans.

The Canadian Association of Pension Supervisory Authorities released its Guideline for Risk Management for Plan Administrators in fall 2024, and we published a letter to plan administrators communicating that we expect them to follow this guideline as part of their efforts to meet their fiduciary duties in the administration of their pension plans and their pension funds or plan assets.

For more information on guidance to administer pension plans, see OSFI’s Pension Guidance library.

Pooled Registered Pension Plans Act

78 The Superintendent must, as soon as feasible after the end of each fiscal year, submit to the Minister a report on the operation of this Act during that year, and the Minister must cause the report to be laid before each House of Parliament on any of the first 15 days on which that House is sitting after the day the Minister receives it.

Under the Pooled Registered Pension Plans Act, the Superintendent is responsible for licensing pooled registered pension plans (PRPP) administrators, registering PRPPs, and conducting ongoing supervision of these plans. At the end of 2024, there were five federally registered PRPPs, covering 20 employers and 195 members. The total value of investments was $1.9 million.

Auriel Cordeiro, Director, Enterprise Risk Management

Francois Lemire, Director, Public Pensions

Tanisha Salakoh, Principal Analyst, Insurance

Lilly Sheng, Manager, Data Collection Modernization