InfoPensions – Issue 32 – May 2025

InfoPensions includes announcements and reminders on matters relevant to federally regulated pension plans including pooled registered pension plans. To receive email notifications of new items posted to our website, including this newsletter and other pension-related documents, please subscribe using Email notifications.

If you have any questions about the articles you read in InfoPensions or if you have suggestions for future articles, please contact us at Pension-Retraite@osfi-bsif.gc.ca. We expect to publish the next issue of InfoPensions in November 2025.

For general enquiries, including pension-related questions, please contact us at information@osfi-bsif.gc.ca. If you prefer to contact us by telephone, by fax, or by mail, please refer to the contact information on our website.

Table of contents

Guidance and legislative matters

Guidance posted on our website

The following documents were posted to our website since the last edition of InfoPensions:

- February 2025 – final Instruction guide for completing the Actuarial Information Summary (AIS) and the related AIS form (PDF)

- February 2025 – final Instruction guide for Completing the Annual Information Returns (AIR) and forms: OSFI 49 (PDF), OSFI 49A (PDF), and PPACC (PDF)

- February 2025 – final Instruction guide for Completing the Certified Financial Statements (OSFI 60) and the related OSFI 60 form (PDF)

- February 2025 – Amendment forms: OSFI 593 (PDF) and OSFI 594 (PDF)

- January 2025 – Unlocking funds from a pension plan or from a locked-in retirement savings plan

- January 2025 – Form 1 and Instructions – Attestation regarding withdrawal based on financial hardship

- December 2024 – 2025 Maximum Annual amount of Life Income Funds, Restricted Life Income Funds, and Variable Benefits Accounts

Actuarial

Estimated solvency ratio results

We regularly estimate the solvency ratio for federally regulated pension plans with defined benefit provisions. The estimated solvency ratio (ESR) exercise assists us in identifying solvency issues that could affect the security of pension benefits promised to members and beneficiaries before a pension plan files their actuarial report. The ESR results also help identify broader trends.

We calculate the ESR using the most recent actuarial, financial, and membership information filed with us for each plan before the analysis date. Assets are projected based on either the rate of return provided on the Solvency Information Return (SIR) or an assumed rate of return for the plan when no SIR has been filed. Solvency liabilities are projected using relevant interest rates. Expected contributions, benefit payments, and expenses are considered and an ESR based on the estimated adjusted market value of the fund and estimated liabilities is then calculated for each plan.

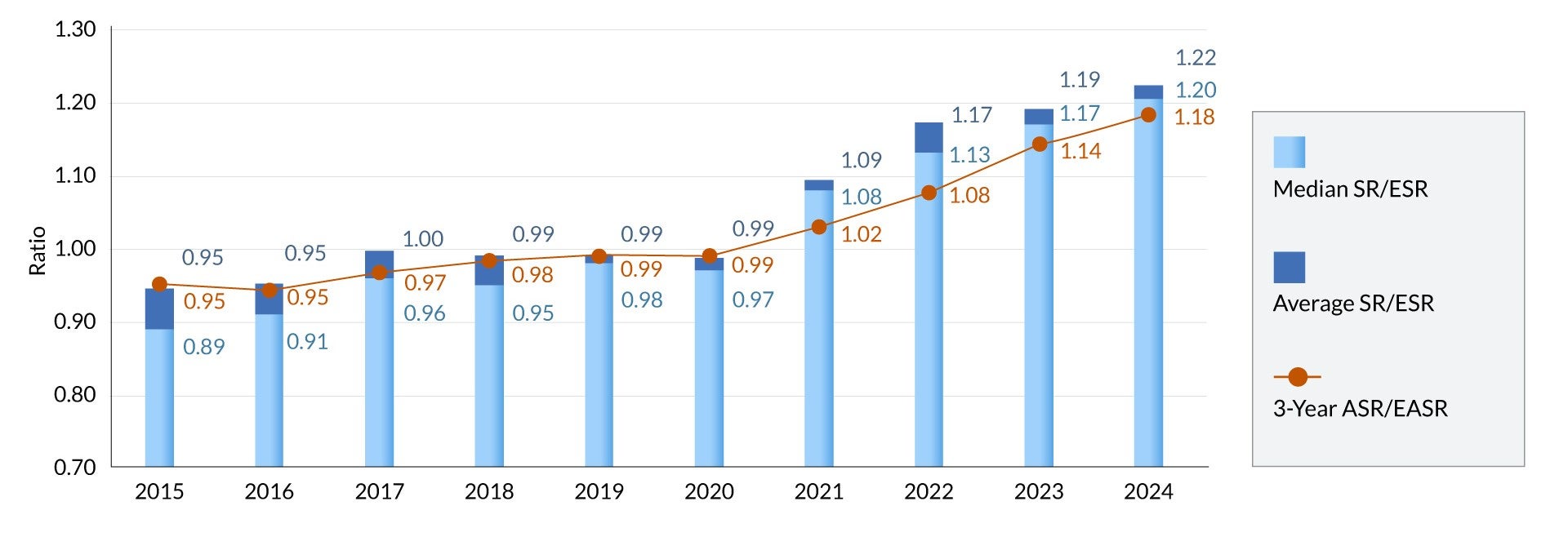

The solvency position of federally regulated pension plans with defined benefit provisions improved in 2024. The median ESR for the 303 plans included in the exercise (down from 308 last year) increased to 1.20 as at December 31, 2024, up from 1.17 at the end of 2023. The liability weighted average ESR for all plans is 1.22 as at December 31, 2024, up from 1.19 at the end of 2023. The main drivers of the variation from the SR at the end of 2023 to the ESR at the end of 2024 are the positive investment returns that offset any fluctuations in liabilities associated with minimal changes in solvency discount rates. The three-year estimated average solvency ratio (EASR), on which funding requirements are based, has increased to 1.18 as at December 31, 2024, up from a three-year average solvency ratio (ASR) of 1.14 at the end of 2023.

Graph 1 below shows the reported SRs, median SRs, and ASRs from December 2015 to December 2023. It also shows the ESR, median ESR, and the three-year EASR for December 2024.

Graph 1: Solvency position of federally regulated pension plans as at December 31

Graph 1 - Text version

| Year | Median SR/ESR | Average SR/ESR | 3-Year ASR/EASR |

|---|---|---|---|

| 2015 | 0.89 | 0.95 | 0.95 |

| 2016 | 0.91 | 0.95 | 0.95 |

| 2017 | 0.96 | 1.00 | 0.97 |

| 2018 | 0.95 | 0.99 | 0.98 |

| 2019 | 0.98 | 0.99 | 0.99 |

| 2020 | 0.97 | 0.99 | 0.99 |

| 2021 | 1.08 | 1.09 | 1.02 |

| 2022 | 1.13 | 1.17 | 1.08 |

| 2023 | 1.17 | 1.19 | 1.14 |

| 2024 | 1.20 | 1.22 | 1.18 |

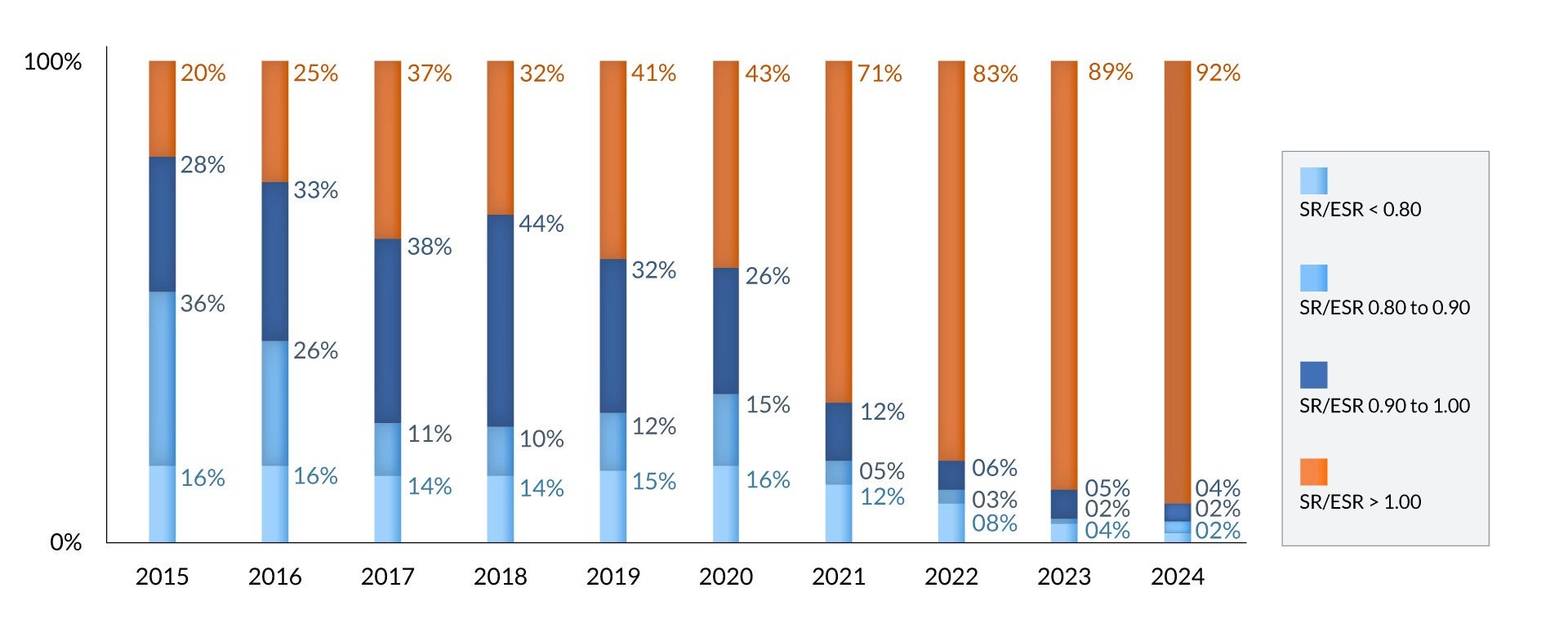

The most recent ESR results show that over 90% of pension plans with defined benefit provisions are fully funded. There was a reduction in the percentage of plans that were underfunded (8% in 2024 versus 11% in 2023). The number of plans that were significantly underfunded (SRs or ESRs below 0.80) also decreased (2% in 2024 down from 4% in 2023). It should be noted that all significantly underfunded plans are designated plans and therefore their funding is limited by the Income Tax Regulations. Graph 2 below illustrates the distribution of the SR/ESR results as at December 31 of each year since 2015.

Graph 2: Percentage distribution of the estimated solvency ratio of federally regulated pension plans as at December 31

Graph 2 - Text version

| Year | SR/ESR < 0.80 | SR/ESR 0.80-0.90 | SR/ESR 0.90-1.00 | SR/ESR > 1.00 |

|---|---|---|---|---|

| 2015 | 16 % | 36 % | 28 % | 20 % |

| 2016 | 16 % | 26 % | 33 % | 25 % |

| 2017 | 14 % | 11 % | 38 % | 37 % |

| 2018 | 14 % | 10 % | 44 % | 32 % |

| 2019 | 15 % | 12 % | 32 % | 41 % |

| 2020 | 16 % | 15 % | 26 % | 43 % |

| 2021 | 12 % | 05 % | 12 % | 71 % |

| 2022 | 08 % | 03 % | 06 % | 83 % |

| 2023 | 04 % | 02 % | 05 % | 89 % |

| 2024 | 02 % | 02 % | 04 % | 92 % |

The first quarter of 2025 was marked with interest rate and market volatility. Solvency discount rates decreased since the beginning of 2025. Overall, the solvency situation of FRPPs is expected to decrease due to recent market developments.

Regulatory filings and important dates

Important reminders and dates

Annual filings and plan amendments must be filed using the Regulatory Reporting System (RRS).

Under the Pension Benefits Standards Act, 1985:

| Action or Required Filing | Deadline |

|---|---|

| Annual Information Return (OSFI 49) and Schedule A – Canada Revenue Agency Information Requirements (OSFI 49A) | 6 months after plan year end |

| Pension Plan Annual Corporate Certification (PPACC) | 6 months after plan year end |

| Certified Financial Statements (OSFI 60), Auditor’s Report Filing Confirmation (ARFC) and, if required, an Auditor's Report | 6 months after plan year end |

| Payment of Plan Assessment | Upon receipt of the OSFI-issued invoice |

| Annual statements to members and former members and their spouses or common-law partners | 6 months after plan year end |

| Amendments to documents that create or support the plan or pension fund | Within 60 days after the amendment is made |

| Action or Required Filing | Deadline |

|---|---|

| Actuarial Report and Actuarial Information Summary and, if required, Replicating Portfolio Information Summary | 6 months after plan year end |

| Solvency Information Return (OSFI 575) | The later of 45 days after the plan year end or February 15 |

Documents in support of an application for plan registration can be submitted by email to Approvals-Approbations@osfi-bsif.gc.ca. All other documents in support of an application that requires the Superintendent’s authorization must be filed using RRS. For additional information including instruction guides for filing an application using RRS, please visit the Amendments, Applications and Approvals section of our website.

Under the Pooled Registered Pension Plans Act:

| Action or Required Filing | Deadline |

|---|---|

| Pooled Registered Pension Plan Annual Information Return (includes financial statements) | April 30 (4 months after the end of the year to which the document relates) |

| Auditor’s Report | April 30 (4 months after the end of the year to which the document relates) |

| Pension Plan Annual Corporate Certification (PPACC) | April 30 (4 months after the end of the year) |

| Payment of Plan Assessments | Upon receipt of the OSFI-issued invoice |

| Annual statements to members and their spouses or common-law partners | February 14 (45 days after the end of the year) |